Business might seem to be progressing as planned, but outward appearance is not enough. Retailers need quantitative proof to fully understand whether they’re heading toward their business goals and can stay ahead of the competition. Key performance indicators (KPIs) provide them with objective data to assess their performance, optimize their operations and, ultimately, succeed. By tracking and analyzing inventory turnover, net profit, customer lifetime value and many more KPIs, retail leaders can make more informed decisions and plan more effective omnichannel strategies. The question is: Which KPIs are the most helpful? While there’s no one-size-fits-all answer, the 25 KPIs presented in this article cover all of the important retail bases.

What Is a Retail KPI?

Retail KPIs are quantifiable measurements that demonstrate a retailer’s progress toward specific business goals. Tracked over time, KPIs alert decision-makers to important trends, opportunities and trouble spots regarding their inventory, sales and sales channels, ecommerce, customers and employees. KPIs are also helpful when compared with previous periods, competitors and benchmarks to add context and set realistic goals for future strategies. By tracking multiple KPIs, retailers can more effectively allocate resources, forecast future sales, create more accurate budgets and drive long-term growth and success.

Key Takeaways

- KPIs help retailers identify trends, measure their performance and gauge whether their strategies are working.

- Retail KPIs fall into the categories of inventory, sales, ecommerce, customer behavior and employee performance.

- Collecting and organizing the necessary data for effective KPI analysis is often accomplished via sophisticated technology, including point-of-sale (POS) and enterprise resource planning (ERP) systems.

Retail KPIs Explained

Retail success is contingent on many moving pieces that, without proper monitoring, can lead a business astray. By tracking performance using KPIs, a retailer can concretely see how it’s doing from a multitude of perspectives: financial, operational, workforce and customer-based. Armed with this information, it can adjust or optimize its strategies and tactics to meet, for example, changing demand for its products and improve its bottom line. Similarly, analysis of inventory-related KPIs, such as inventory turnover and return rates, can lead to more effective inventory control that optimizes order fulfillment rates or reveals a glitch in the product production process.

Given the popularity of online shopping, ecommerce KPIs are especially important to scrutinize. Analysis of a traffic boost, for example, may support a recent effort to optimize site content for search engines, underscoring that it’s an effort worth continuing. On the other hand, an increase in customers abandoning their shopping carts could prove to be the catalyst for a special promotion to entice shoppers to complete their purchases.

By using KPIs to develop an accurate and holistic view of a company’s performance, retailers can ensure that they’re operating efficiently and that customers are satisfied. As retailers make changes, the same KPIs that informed those adjustments can be used to track results and inform future adjustments.

Retail Inventory KPIs

Inventory is at the heart of every retailer’s business. Customers expect their desired goods to be in stock and readily available either in-store or online, with fast delivery. Otherwise, they’ll take their business elsewhere. But effective inventory management is tricky, at best, without KPIs to serve as a guide. Order too little inventory and the retailer will be unable to meet demand, leading to lost revenue. But order too much and the retailer will increase its carrying costs, which cuts into profits and ties up funds that could otherwise be used to purchase other items or grow the business.

By tracking inventory KPIs, retailers can identify wastefulness, better allocate inventory and strike the right balance between satisfying customers and minimizing on-site storage. The following are five critical inventory KPIs worth tracking.

-

Inventory Turnover

The inventory turnover rate calculates how many times a retailer sells and replaces its stock. Also known as the inventory turnover ratio, inventory turn or stock turn, this KPI is calculated for a set period of time, depending on type of goods and seasonal fluctuations. Generally speaking, a high inventory turnover indicates strong sales, while a low turnover rate points to the opposite; but mitigating factors, such as the type of goods sold — for example, a commodity product versus a luxury product — can influence interpretation. Regardless, by tracking inventory turnover, the retailer can take better control of its stock, reducing the carrying costs associated with having too many products, while limiting the risk of sales lost due to not having enough.

The inventory turnover formula requires two variables: the cost of goods sold (COGS), which accounts for all expenses related to inventory acquisition, and average inventory, based on a comparison of the amount of inventory on hand at the beginning and end of a period. The formula for inventory turnover is:

Inventory turnover rate = COGS / Average inventory

If a clothing retailer has $90,000 in annual COGS for carrying a jacket that has an average inventory value of $7,500, the inventory turnover rate is 12 ($90,000 / $7,500). This means that the retailer typically sells and replaces its stock 12 times a year, or once a month, on average. This KPI can be used to set production schedules, forecast sales closer to demand and plan discounts to increase turnover rates.

-

GMROI

Gross margin return on investment (GMROI) measures the return on every dollar spent on inventory by dividing the retailer’s gross margin — the profit left over after direct costs are paid — by the average cost of inventory.

The formula for GMROI is:

Gross margin return on investment = Gross margin / Average inventory cost

A GMROI above 1 indicates that the retailer is selling its merchandise for more than it cost to purchase it; anything less than 1 means the retailer is losing money. If this KPI starts to drop, it might be a sign of rising inventory costs, in which case the retailer may decide to increase its prices to compensate. This KPI is also helpful for determining which goods are worth carrying and which should be retired. A furniture retailer that sells sofas and tables, for example, can compare the products’ GMROIs to determine where to focus its marketing. If sofas have a GMROI of 4 and tables have a GMROI of 2, the retailer would likely choose to promote its sofas because they have a higher ROI.

However, it is important to remember that gross margins without context do not paint the whole picture: Lower return on inventory with a high sales volume may be worth maintaining if it meets customer demand.

-

Sell-Through

The sell-through rate shows the amount of a specific type of inventory sold as a percentage of the total amount of that inventory received within a specific period. This KPI helps quantify the sales performance of specific goods and pinpoints how well sales are matching supply.

The formula for sell-through rate is:

Sell-through rate = (Number of units sold / Number of units received) x 100

A sell-through rate close to 100% means inventory is close to selling out. A decrease in the sell-through rate can indicate fewer sales or that the level of inventory coming into the business outpaced sales. Either way, the retailer should investigate before ordering more inventory, as COGS are not recouped until goods are sold.

Consider a hardware store that starts the quarter with 200 hammers in stock but sells only 50. The sell-through rate is 25% (50 / 200), which leaves 150 hammers taking up precious shelf space and not producing revenue. The retailer might consider running a promotion to ignite sales or moving half of the hammers to the back room to free up space for a product with a higher sell-through. That said, a retailer building up stock before a busy construction season might not be concerned.

-

Shrinkage

Shrinkage measures the difference between the amount of inventory recorded and the amount that goes missing or is unsellable due to damage, miscounts, theft or other reason.

The formula for shrinkage is:

Inventory shrinkage = Ending inventory value – Physically counted inventory value

Shrinkage is a valuable KPI because it tracks how many goods are “wasted,” and it informs cost analysis and pricing strategies, especially for inventory with some expected shrinkage, such as delicate products shipped over great distances. Shrinkage can also help a retailer identify poor quality-control measures and stores with high levels of theft. If a home goods retailer orders 5,000 bowls but sells out after only 4,500 sales, shrinkage is 500 (5,000 – 4,500). Upon investigation, the seller notes insufficient packaging on the supplier side, causing too many bowls to arrive damaged and unsellable. By providing this feedback, the retailer can potentially reduce shrinkage and realize higher revenue per order — or, of course, switch to a new supplier.

-

Spoilage

Spoilage refers to inventory that customers can’t purchase because it went bad (as is the case with perishable items), became obsolete (such as technology) or is no longer in demand (like the end of a clothing fad). Before calculating the percentage of stock that has succumbed to spoilage, often called “dead stock,” a retailer must first set the criteria for when a good is considered dead. No-longer-trendy items may still earn some sales, but spoiled food cannot be sold and must be discarded.

The formula for spoilage is:

Spoilage = (Amount of unsellable stock in period / Amount of available stock in period) x 100

Spoilage is especially significant for retailers of perishable goods. If a grocery store sees spoilage rates increasing, it could be a sign of overordering that needs to be addressed. To recoup some of their costs, many retailers begin discounting the price of goods approaching their expiration dates.

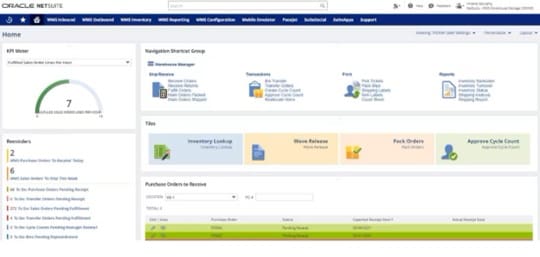

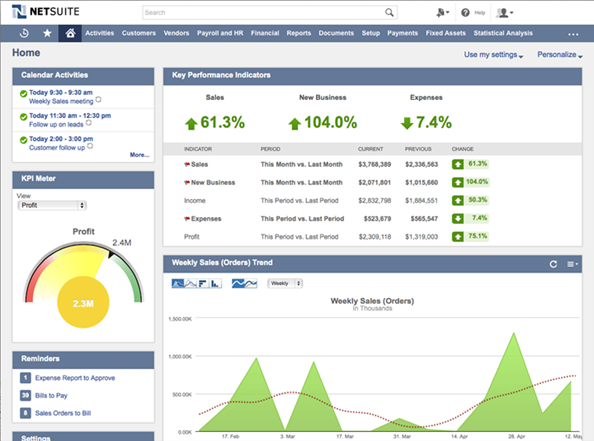

Tracking inventory KPIs is a critical part of order management. Leading business software platforms organize this data into easy-to-read and customizable dashboards to help inform retailers’ inventory decisions and improve operations.

Retail Sales KPIs

Sales is the name of the retail game. When analyzing their sales KPIs, retailers should view them in the context of customer behavior and industry norms, as some comparisons among different types of retailers may not reveal much about success. For example, grocery store customers are likely to purchase many items at once and do so more frequently than customers in the market for diamond jewelry. By comparing KPIs with previous internal results, with direct competitors or against benchmarks, retailers can gain a better sense of their sales strengths and where they can make improvements. The following are eight important retail sales KPIs.

-

Sales per Square Foot

Sales per square foot (or meter) measures how effectively a brick-and-mortar store uses its space to generate sales. It is usually calculated by location, enabling retailers with multiple locations to compare stores’ performance. Both available space and store layout can impact this KPI.

To calculate sales per square foot, a retailer must first figure out its net sales (total sales revenue minus discounts, allowances and returns). The formula for sales per square foot is:

Sales per square foot = Net sales / Store floor area

Let’s use the example of a clothing retailer that has two storefronts with similar inventory layouts. One occupies 750 square feet and makes $255,000 in monthly sales, while the other occupies 500 square feet and brings in $140,000. As such, sales per square foot for the larger store is $340 ($255,000 / 750), and for the smaller store it is $280 ($140,000 / 500). In other words, the larger store is using its space more efficiently. Reasons for the disparity could include customers not having enough room to browse in the smaller store or a wider inventory selection at the larger store. This insight could lead the retailer to double down on promoting its smaller store, expand it or, perhaps, shutter it.

-

Conversion Rate

Conversion rate tracks the percentage of prospective customers who turn into paying customers. A higher conversion rate translates to more sales. Ecommerce retailers typically have an easier time collecting this data, as web traffic can be more reliably captured than foot traffic, especially for stores in busy locations, such as a shopping mall. (More on this soon.)

The formula for conversion rate is:

Conversion rate = (Number of sales / Number of visitors) x 100

The conversion rate is a useful KPI for determining how effectively a retailer turns browsers into customers. It can also demonstrate the effectiveness of store layouts or whether a marketing campaign was successful. For example, a wine tasting at a liquor store could prompt prospects to purchase a few bottles, while a barbecue cookout at a car dealership might attract hungry passersby with no interest in purchasing a vehicle.

-

Gross Profit

Gross profit is the revenue earned from product sales once COGS is deducted. This KPI, which appears on the company’s income statement, shows the overall profitability of the retailer’s sales operations and contextualizes the ROI from direct sales.

The formula to calculate gross profits is:

Gross profit = Net sales revenue - COGS

Gross profit goes toward paying indirect expenses — those not directly linked to the purchase and sale of goods — such as rent, utilities, administrative costs and insurance. A drop in gross profit may signify that the retailer needs to raise prices or find places to cut costs, such as by sourcing products from a less-expensive vendor.

-

Net Profit

Net profit is the amount of total revenue that remains after a retailer has paid all of its expenses. If expenses exceed revenue, it’s called a net loss.

The net profit KPI can be calculated in a variety of ways. The two primary formulas are:

Net profit = Gross profit – Operating and other non-COGS expenses

Net profit = Total revenue – Total expensesNet profit — also known as the “bottom line” because it appears at the end of the income statement — illustrates overall business success over a given financial period. Profit can be paid out to owners and stakeholders or reinvested to grow the business, whether in the form of purchasing new equipment, adding new product lines or opening additional locations. It’s important to note that occasional periods of negative net profit do not necessarily signify a problem; they may be caused by high investment expenses, such as building up inventory before a busy season. But continuous negative net profit can put a business at risk of being unable to pay its debts and obligations. If net profit is dropping and gross profit is staying steady, retailers can look at their operational costs to find areas to improve.

-

Average Transaction Value

Average transaction value (ATV), or average order value, measures how much a customer will typically spend on a purchase.

The formula for ATV is:

Average transaction value = Revenue / Number of transactions

Studying ATV over time can reinforce marketing strategies and promotions aimed at raising the amount the average customer spends every time they make a purchase. Ecommerce retailers frequently do this by offering free shipping when orders exceed their designated ATVs, such as once the customer spends $50. In cases where the customer’s total purchase value is only a few dollars away from free shipping, there’s a strong chance they can be nudged to find another item not originally on their shopping list to push the total into the free-shipping zone. Indeed, 85% of consumers said they were willing to spend extra money to meet free shipping minimums, according to Flexe Institute’s “2022 Omnichannel Retail Report.” This KPI can also inform price-change decisions.

-

Items per Transaction

Items per transaction, also known as “basket size,” tracks the number of goods typically purchased in a single order.

The formula to find items per transaction is:

Items per transaction = Total items sold / Total sale transactions

This KPI is helpful in determining seasonal sales trends; the effectiveness of store layouts, product placement and marketing strategies; and evaluating employee performance. If a retailer notes a decline in items per transaction, it might decide to rearrange its displays so as to bundle related or complementary goods. For example, a beauty shop could cross-promote its products by placing shampoo and conditioner displays alongside related hair products, such as hairspray and headbands, to increase the likelihood of a customer picking up multiple items at once. A consistently high item per transaction KPI indicates that a business is properly aligning inventory with demand and satisfying its customers’ needs.

-

Online vs. In-Person Sales

Omnichannel retailers can learn much about their customers’ purchasing behavior — and align their sales strategies and resources accordingly— by monitoring online vs. in-person sales. This sales KPI doesn’t require a formula; rather, it is a direct comparison between the total revenue generated from each area of the business. It also reflects only the point at which the actual sale occurs. For example, a shopper who buys a bathroom vanity online may have first visited several showrooms to ensure that the drawers opened smoothly and the color was the “right” shade of blue.

To that point, research shows that customers increasingly prefer having both in-person and online options when shopping. In Bazaarevoice’s 2022 omnichannel shopping survey of 6,000 consumers and 400 businesses, 66% of respondents indicated they preferred hybrid shopping, compared with 8% who chose online only and 25% who chose in-store only.

YoY Growth

Year-over-year (YoY) growth compares total sales revenue from one 12-month period to the one before it. Revenue can fluctuate throughout the year for a multitude of reasons, such as a spike in sales before major holidays. The YoY growth KPI, presented as a percentage, accounts for all of the hills and valleys.

The formula for YoY growth is:

Year-over-year growth = (Current year’s sales – Previous year’s sales) / Previous year’s sales x 100

Startup retailers with little or no historical data may want to begin by tracking month-over-month growth. Regardless, this KPI can point to a slowdown in growth that a retailer will want to investigate to make any necessary adjustments to turn results around. For example, if a brick-and-mortar bookstore experiences declining sales growth for two years in a row, it might host a book club or invite local authors to speak to attract more customers. Or, it might decide to move to a smaller space to cut back on its expenses.

Retail Ecommerce KPIs

Retail ecommerce sales are predicted to reach $6.15 trillion by the end of 2023, representing 21.5% of total retail sales, according to eMarketer, which also forecasts more growth ahead. Retailers that intend to grow their share of that revenue will want to measure their online sales performance and effectiveness at acquiring and retaining customers. They can do so by monitoring the following KPIs.

-

Cost per Acquisition (CPA)

Cost per acquisition (CPA) tracks how much it costs, on average, for a retailer to earn one new customer. Granted, this can be challenging to calculate with 100% certainty, because word of mouth and personal recommendations are difficult to quantify. As a result, this KPI is often based on ad campaigns with trackable click-through rates.

The CPA formula is:

Cost per acquisition = Total investment / Number of new customers

Retailers must weigh the revenue that new customers bring in against CPA to determine the effectiveness of an ad campaign. For example, if a shoe store makes $200 in profit from sales to a new customer — the upshot of a marketing campaign that cost $25,000 and brought in 500 new customers — the campaign could be considered successful because its cost per acquisition was $50 ($25,000 / 500). Of course, net profit includes other indirect costs, so the level of campaign success will depend on other business factors that make the “break-even point” for new customers difficult to estimate accurately.

-

Cart Abandonment Rate

Cart abandonment rate shows the percentage of ecommerce customers who place products in their online shopping carts — and leave them there. This KPI can help valuate customer experience by putting the spotlight on bottlenecks, a complicated checkout experience or high shipping costs that might have prompted customers to abandon their orders.

The cart abandonment rate formula, as a percentage, is:

Cart abandonment rate = (Completed transactions / Started transactions) x 100

There is no set benchmark for a “good” or “bad” cart abandonment rate, though research generally shows that seven out of 10 shoppers leave their carts without checking out. An ecommerce business might consider sending follow-up emails to remind potential buyers that their products are waiting for them in their carts and, perhaps, offer an incentive to see the purchase through.

-

Customer Lifetime Value (CLV)

Customer lifetime value (CLV) is the average total revenue a retailer can expect to receive from a customer, based on average transaction value (ATV) and how long the average customer stays with a business.

There are many ways to calculate CLV, depending on how often a customer buys from a retailer. A simple version of the formula is:

Customer lifetime value = ATV x average purchase frequency x average customer life span

Understanding CLV can inform changes to products/services offered and marketing strategies to improve customer retention and increase revenue from repeat customers. CLV is also important for subscription-based businesses. For example, a beauty products retailer whose customers subscribe to receive monthly makeup goody bags can take the average order cost, shipment frequency and average length of subscription to calculate CLV. If a monthly goody bag costs $50 and the average customer subscribes for three-and-a-half years, the CLV would be $2,100 ($50 x [12 monthly purchases per year x 3.5 years]).

To increase CLV, retailers could offer incentives, like discounts, to returning customers to increase the frequency and size of their regular orders. CLV can also help retailers evaluate their costs per acquisition and determine the effectiveness of marketing strategies.

Retail Customer KPIs

As the link between customers and goods, retailers must take special care to track and better meet their customers’ needs. Customer KPIs focus on the direct ways in which customers interact with retailers, whether in-store or online. Here are some important customer KPIs retailers can track to better understand and serve their customers.

-

Foot Traffic

Foot traffic measures the number of people who enter a store, regardless of whether they buy anything. This KPI can be used to compare multiple locations, gauge brand awareness and assess the performance of marketing campaigns.

The formula for foot traffic is:

Foot traffic = number of visitors / unit of time

Foot traffic can be difficult to measure manually, though some retailers still use manual counters to track the number of incoming customers. Nowadays, many modern retailers rely on electronic trackers, such as motion sensors or cameras with built-in counting technology. Retailers can improve their foot traffic through advertising or aesthetic improvements that boost its “curb appeal.” For example, if a retailer in a busy shopping mall updates its logo and window displays, it can compare foot traffic before and after the change to see whether it made a difference in the number of walk-in customers. However, it is important to track foot traffic KPIs alongside sales; promotions may bring in curious shoppers but not translate into revenue.

-

Retention

Retention is a prime KPI for growing retailers, as it measures repeat business from customers who have completed an initial purchase.

Retention is typically calculated as a percentage. The formula is:

Customer retention = (Customers at the end of a period – New customers during the period) x 100

Customers at the start of the period

This KPI tracks how well retailers are bringing customers back, an effort that costs businesses less than acquiring new ones. To improve retention, retailers can create loyalty programs that, for example, offer some type of bonus after a certain number of purchases. Of course, they need to be mindful about not letting incentives cut into their profit margins.

-

Return Rate

The return rate KPI measures how many goods customers bring back to the retailer, for reasons including defects and damages, incorrect orders, or items no longer wanted or needed. Return rates are important to track because of their impact on revenue, especially when returned goods can’t be resold.

The formula for return rate is:

Return rate = (Total returns / Total goods sold) x 100

Returns can be costly for retailers, but a high return rate isn’t necessarily indicative of low customer satisfaction or poor quality control. Many clothing shoppers, for example, order merchandise online in multiple sizes and colors to try on at home and then return what doesn’t fit or appeal to a local storefront. This system combines the convenience of online shopping with in-person returns, increasing the likelihood that these customers will purchase more than they would have if they were browsing through a limited in-store inventory. In such cases, a high return rate points to high customer engagement, not dissatisfaction, and should be contextualized with customer behavior and transaction values before making any conclusions.

However, retailers that employ this tactic must be sure to track margins and return rates carefully to avoid incurring losses, especially if the business pays for shipping costs on returns. Return rates can also be evaluated against customer feedback and viewed over time to catch return rate upticks that demand investigation.

-

Online Traffic

Online traffic measures how many people visit an ecommerce shop. This KPI is typically monitored in a web analytics platform that tracks individual visitors or through a larger business platform, such as an enterprise resource planning (ERP) system that integrates this data with other important ecommerce metrics.

Like physical foot traffic, online traffic can be a raw number or averaged over a given period. The formula for online traffic is:

Online traffic = Number of website visitors / Unit of time

Online traffic is an increasingly important KPI, as more customers prefer to shop online. Traffic can be assessed in a number of ways. For example, a retailer that wants to know how many new people (meaning, potential customers) visited its site during a specific time period will look at unique visitor traffic.

Online traffic KPIs are also helpful when reviewing the success of digital marketing campaigns. When products go viral, websites will likely experience an uptick in “organic” traffic from search engine results generated by curious customers. By comparing organic traffic with paid, ad-driven traffic, retailers can improve their search engine optimization (SEO) strategies and track the effectiveness and ROI of their digital advertising, for both reaching potential customers and increasing revenue.

-

Customer Satisfaction

Tracking customer satisfaction can be challenging, as customers with anything but an exceptional — or exceptionally bad — experience may not feel inclined to voice their opinions. While there is no precise formula for customer satisfaction, many retailers use the Net Promoter Score (NPS), where customers are asked to rank the likelihood of recommending the retailer to friends and family on a scale from 0 to 10. Respondents are grouped into three categories — detractors (0 to 6), passives (7 to 8) and promoters (9 to 10) — and then converted to percentages.

This formula is used to calculate an overall Net Promoter Score:

Net Promoter Score = Percentage of promoters – Percentage of detractors

A positive NPS signifies more promoters than detractors, while a negative NPS indicates the opposite. For example, an electronics retailer with an NPS of 60% has significantly more promoters than detractors and will likely have high customer satisfaction. NPS surveys typically include free-response sections to give customers a chance to explain their scores and add context, providing valuable insight that can guide retailers toward improvement.

-

Shopper Dwell Time

Shopper dwell time measures how much time the average customer spends in a store, whether physical or online.

The formula for shopper dwell time is:

Shopper Dwell Time = Total Minutes in Store for All Shoppers (In-person or Digital) / Total Traffic

This KPI often requires additional analysis because a high dwell time may point to one of two opposing outcomes. High dwell time can lead to higher sales, the logic being that the longer customers browse, the more items they will purchase. Conversely, it could also mean that customers are struggling to find what they need, which can lead to frustration, hurt customer retention and culminate in lost sales. As a result, retailers often view dwell time in conjunction with other KPIs, especially foot/online traffic and conversion rates, to better understand what is happening and make any necessary adjustments. For example, a shop that sells board games that wants to improve shopper dwell time may decide to rearrange the store’s layout in a way that guides customers through more aisles. Or, it might let them play the latest new games in-store.

Retail Employee KPIs

Retail employees are on the front lines, working with customers to answer their questions, help them find exactly what they need — which can decrease the number of returns — and suggest better versions of what they’re buying (upselling), along with complementary goods (cross-selling), as a way to increase revenue. But all of those pressures can also lead to employee dissatisfaction and burnout, resulting in high turnover or subpar performance. The following three KPIs can aid retailers in evaluating the strength of their workforce.

-

Sales per Employee

Sales per employee calculates the average value of a sale per worker. This KPI can inform many decisions, including scheduling, budgeting for payroll, forecasting seasonal staffing needs and determining compensation, or risk, when increasing or decreasing staff sizes.

The sales per employee formula is:

Sales per employee = Net sales / Number of employees

A high or increasing sales-per-employee ratio for a given period is typically a good indicator of strong sales and a productive staff. However, if, over time, this KPI flatlines or, conversely, is high enough to justify bringing in another employee without dinging a healthy profit, it could signal that the current staff is overworked, and it is time to add new members. For example, if a retail store has four employees who bring in a total of $32,000 in sales per month, the sales per employee ratio would be $8,000 ($32,000 / 4). But if customers begin to complain about long wait times, it may be time for a new hire who, if they bring in a proportional increase in sales, would not cut into the retailer’s profit margin.

-

Employee Turnover Rate

The employee turnover rate calculates the rate at which workers leave a company over a given period. A high turnover rate means that many workers are exiting, whether voluntarily, such as for a higher-paying job with better benefits or because they’re unhappy with management, or involuntarily, due to layoffs or terminations.

The formula to calculate employee turnover rate (as a percentage) is:

Employee turnover rate = (Number of employees who left / Average number of employees) x 100

Not only will a retailer with a high employee turnover rate be left understaffed, but it will also have to spend time and resources on recruitment and training new hires. Indeed, the average cost to hire a new employee is $4,683, according to the Society for Human Resource Management. The retailer also loses valuable institutional knowledge. For example, an electronics retail team comprising mostly new hires won’t initially have the same knowledge of products or how to troubleshoot problems when customers come in for assistance, which could cause frustration. Tracking the rate of employee turnover can potentially help a retailer avoid these scenarios, providing it takes the time to look into the underlying causes.

-

Employee Satisfaction Rate

Employee satisfaction rate measures how happy employees are with their jobs, in terms of their responsibilities, compensation, work environment and other factors. This KPI can be difficult to quantify, as there is no widely used formula for employee satisfaction; but many retailers use employee performance reviews or surveys — similar to the NPS surveys for customer satisfaction — to collect feedback from staff to ensure that they feel heard and that problems are addressed before they push talented staff to competitors. Happy and engaged employees also tend to be better workers, according to Gallup’s “State of the Global Workforce 2022” survey, which determined that there was “a strong link between engagement and performance outcomes, such as retention, productivity, safety and profitability.”

How to Decide Which KPIs Matter to Your Business?

Retailers should choose the KPIs that best align with their business models and goals; track different facets of the business, such as inventory management and customer satisfaction; and, importantly, are actionable — meaning, they inform decision-making. Otherwise, they’re just a static vanity metric that can mislead a retailer about its performance. A retailer that earns 90% of its revenue online and runs just a handful of small retail locations specializing in returns and customer service would benefit more from focusing on ecommerce KPIs, such as click-through rates and abandoned carts, while it would be more appropriate for a chain of hardware stores with a website akin to a product catalog to focus more on in-person metrics, like foot traffic and sales-per-square-foot analysis.

Of note, retailers will want to incorporate two categories of KPIs — leading and lagging — in their decision-making. Each type offers a different perspective. Leading KPIs look ahead to what might happen, such as potential revenue growth following the introduction of a new product line, and help retailers prepare. Lagging KPIs look back on what has already happened, identifying trends and tracking performance. Both types can influence how a retailer moves forward.

Technology in KPI Tracking: Retail Analytics and POS

KPI analysis requires robust data collection from every corner of a retail organization. Many modern retailers integrate their point-of-sale (POS) systems with a larger business platform, such as ERP, to gather and organize data as sales are made. These POS systems can track sales by products, employees, departments, customers and more. Sophisticated retail dashboards present this information visually, providing retailers with real-time information about operations to help them quickly identify and address any problems that arise. This information also helps in developing forecasts, allowing retailers to more accurately predict customer demand, allocate inventory and stay ahead of the competition.

Manage Your Retail KPIs in One Place With NetSuite

Retailers need to maximize every possible advantage to retain a lead in the ever-changing world of retail. With NetSuite for Retail, retailers can provide customers with a unified, omnichannel experience across multiple platforms. NetSuite Retail also gives retailers a comprehensive management platform, with detailed, accurate and real-time insights into business performance, so they can meet customer demand, allocate inventory, optimize processes, track sales, monitor important KPIs and more.

NetSuite Financial Management is a cloud-based management solution that centralizes retailers’ financial information in a secure platform that is available wherever and whenever business leaders need access. Through detailed KPI reporting and analysis, NetSuite lets retailers see how changes and trends in their operations are impacting profitability, revenue and long-term growth, and where improvements can be made. With NetSuite, retailers can gain the visibility they need to effectively plan for the future and ensure that their customers are well served as the company grows.

Retailers can’t rely on intuition to gauge performance. They require concrete data to fine-tune their operations. Key performance indicators provide this information. Through KPI tracking and analysis, retailers can enhance decision-making and devise actionable strategies that capitalize on successes and preempt potential pitfalls. By focusing on the right metrics, retailers can spend less time putting out fires and more time on what they do best: delivering for their customers and growing the business.

Retail KPI FAQs

Why are KPIs important in retail business?

KPIs help retailers identify trends and find areas for improvement before inefficiencies begin to affect their performance. They also help retailers make more informed decisions about allocating resources, planning inventory and driving long-term growth and success. KPIs are typically viewed either as trends over time or in comparison to prior periods, rather than as standalone numbers.

What is the Net Promoter Score (NPS) and why is it important?

The Net Promoter Score (NPS) measures how likely customers will be to recommend a product or service to friends and family. It categorizes customers into three categories: promoters, passives and detractors. Promoters actively speak positively about a business; passives offer recommendations, if the topic comes up; and detractors warn their friends and family against interacting with a business. NPS can help predict growth, give the company an edge over competitors and help customers feel valued through solicited feedback.

How can technology help with retail KPI tracking?

Many KPIs require large amounts of data to paint an accurate picture of a business’s performance, and data must be collected in near- or real-time to serve as a foundation for actionable strategies that address problems before they become major headaches. An enterprise resource planning (ERP) system with easy-to-understand dashboards enables business leaders to access the data they need to resolve problems as they arise and create a streamlined operation capable of meeting customer demand.

What are some common mistakes to avoid while tracking retail KPIs?

KPIs don’t always tell the entire story and should be contextualized within a larger narrative. For example, low sales in one quarter may not be indicative of a problem; it could just be a normal seasonal fluctuation. By analyzing KPIs side by side and with prior periods’ data, businesses can get a better sense of where the business is going and what can be done to improve operations, as well as an understanding of when something doesn’t need action and will likely improve on its own due to natural market conditions.

How can tracking KPIs improve a store’s overall performance?

KPI tracking helps retailers understand their performance through clear and quantifiable measurements. This allows decision-makers to better replicate successes and avoid repeating failures. By closely monitoring KPIs related to inventory management, sales, staff performance and customers, a retailer can proactively address challenges, capitalize on opportunities and improve customer experiences, in turn driving profitability and growth.

What are the KPIs in retail?

There are many KPIs retailers can use to gain insights into their operations and business strengths. Different types of retailers will benefit from KPIs catered to their businesses, such as an ecommerce retailer tracking web traffic and cart abandonment rates or a brick-and-mortar retailer tracking foot traffic and sales per square foot. All retailers, however, can benefit from tracking KPIs, such as gross profit, inventory turnover rate, customer retention and employee turnover rate.

What are the top five key performance indicators in retail?

There is no one-size-fits-all list of “best” KPIs. The five primary categories of retail KPIs are inventory, sales, ecommerce, customer behavior and employee performance. By closely monitoring KPIs in all five categories, retailers can optimize processes, reduce costs and better serve their customers.

What are KPIs for retail customer service?

Some primary KPIs for customer service include customer retention, return rates and traffic, both in-store and online. By monitoring and learning from these metrics, retailers can create a more enjoyable customer experience and increase customer satisfaction.