Running your business costs money. You have to pay your employees, buy raw materials for products you sell and market your services. Keeping track of your expenses not only helps you see the financial health of your business and plan for the future, many business expenses can be written off for tax purposes. But not all expenses are treated the same.

Expense vs. Expenditure: What’s the Difference?

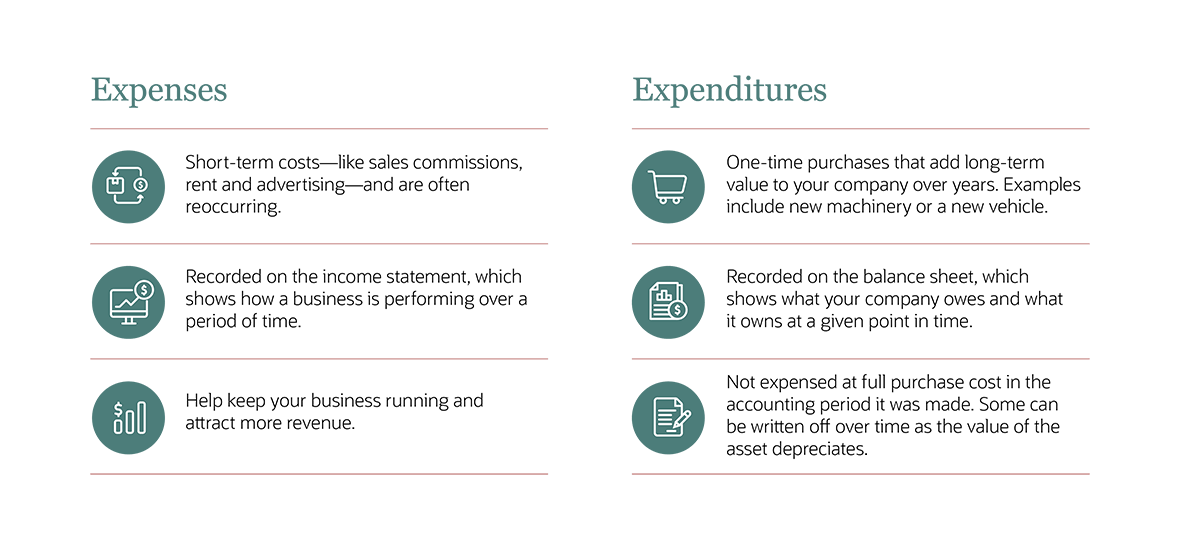

Understanding the differences between expenses and expenditures can help you accurately list information on your financial statements and maximize your tax deductions. Simply put, expenses revolve around what delivers revenue and allows your company to operate day to day. Expenditures help create long-term value around your business.

What is an Expense?

An expense is what you spend on the goods and services to keep your company running. Expenses can be for physical items, such as a furniture maker buying wood to make chairs. Or they can be other efforts that help drive your company toward revenue, like the commission you pay a salesperson.

Many expenses are tax deductible, or costs that can be subtracted from your overall gross income, reducing your tax liability at the end of the year. For an expense to be tax deductible it needs to be “ordinary and necessary.” To be considered ordinary, the expense needs to help your company generate revenue. And to be necessary, it must be something that is commonly accepted in your particular industry.

On an income statement, expenses are offset by revenue or other forms of income. By seeing your expenses and your revenue over a period of time, you get a snapshot of the financial health of your company.

What is an Expenditure?

Where expenses are purchases to increase revenue, expenditures are made to improve the long-term value of the company. There are two types of expenditures: revenue and capital.

Capital expenditures are one-time purchases like vehicles, machinery or real estate that add value to your business. These are also sometimes known as fixed assets. For example, Bill’s Printing buys a new building to accommodate growth and house new printers. This costs money, but also adds long-term value in the form of real estate to the business. So, it’s treated differently than a business expense like advertising a weekend sale on paint. This purchase will not be an expense on the print shop’s income statement. Instead, it will appear on the company balance sheet, which essentially is a list of what your company owns and what it owes.

Another way of looking at it is after expenses are paid, the purchase no longer delivers value to the company. But after capital expenditures are paid for, they continue to deliver value to the company. For example, after Bill’s Printing bought a new truck, they continued to use that truck for many years after the accounting year it was purchased.

Let’s take a look at another type of expenditure. Bill’s Printing buys a new printer for $100,000. The initial cost is adding long-term value to his business and is a capital expenditure. However, this new printer has to be serviced once a quarter and it costs $1,000 to do so. Additionally, the new printer loses value over time. For example, if Bill wanted to sell the printer after 10 years of owning it, he would not be able to recoup all $100,000. He might get half that. The value lost, along with the maintenance of this piece of equipment, is known as a revenue expenditure and can be written off over the lifetime of the printer.

Key Differences Between Expenses and Expenditures

The bottom line is:

- Not all expenditures are expenses.

- Some examples of expenses are rent, utilities and salaries.

- Expenses generate revenue and keep the day-to-day operations of your business running.

- Capital expenditures are used to increase the long-term value of your company. Some examples include equipment and buildings.

- The maintenance and depreciation of some capital expenditures can be expensed—or written off. This is called a revenue expenditure.

- Expenses appear on income statements. And capital expenditures show on balance sheets.

Expenses and Expenditures in Financial Reporting: Income statements, also known as a profit and loss statement, look at revenue and expenses over a specific accounting period—usually three months. These financial reports help you better see how your business is performing and whether you need to make changes to meet important financial benchmarks. And the income statement is where expenses are reported. Each income statement will have a few features.

Cost of Goods Sold (COGS): This is how much it takes to produce the items your company sells, including materials, labor, freight costs, etc. There are various ways to calculate this, depending on your industry.

Operating Expenses: This is where you track everything that goes into the day-to-day running of the business. It also includes expenses associated with maintaining and running physical assets. Fixed operating expenses include things like rent and salaries. There are also variable operating expenses, such as sales commissions or the costs of marketing.

Depreciation & Amortization: While capital expenditures do not appear on the company’s income statement, some can be depreciated or amortized as expenses on the income statement over time. Rather than write-off a large expense in one year, depreciation is the process of deducting the value over multiple years during the life of the purchase, giving you more control of your expenses. Straight-line depreciation takes the total cost of the item and divides it by its lifespan to expense part of the asset on the income statement.

The new truck Bill’s Printing bought cost $40,000. Bill expects to use that truck for four years, which means he will expense $10,000 per year on his income statement and remove that same amount from his balance sheet. Depreciation applies only to physical assets, and amortization is the same concept that applies to intangible assets like trademarks and permits. You calculate the depreciation expense based on a variety of factors, including what the IRS permits based on the type of expenditure.

Non-operating Expenses: These are expenses associated with a peripheral business activity that you have to make, but don’t directly drive revenue, such as taxes and interest paid on loans.

Business accounting software can help you efficiently track your expenses and expenditures, as well as generate your income statement and balance sheet. This software is used at every skill level—and there are even training programs to learn how to better utilize the applications.

Managing Expense and Expenditures with Accounting Software

Keeping track of everything manually can be overwhelming, even for small businesses and startups. Going paperless and buying accounting software should be one of the first steps you take when starting your business, or when you’re looking for ways to make it more efficient. In fact, the U.S. Small Business Administration says the first bookkeeping step you should take when launching a company is to get business accounting software. They even list that before opening a business checking account and tracking sales. Financial management software is essential for tracking revenue and expenses, and generating financial reports, and tracking the financial health of the business. And as your business matures, managerial accounting software can scale with your growth and even provide forward-looking analyses and reports.

Learn more about financial and accounting for modern companies.