Managing business expenses is a key concern for all companies — one that’s difficult to orchestrate with manual processes, paper receipts and handwritten notes. By using software to track and monitor employee spending, companies can speed up the expense management process, reduce errors and distribute reimbursements faster.

What Is Expense Management?

Expense management tracks employee spending as well as determines how the organization will reimburse the costs incurred. It also applies the procedures and policies used to control this type of spending. For example, if employees are given daily allowances for meals when traveling, then the expense management process accounts for those limits when generating reimbursements for workers.

Why Is Expense Management Important?

All companies must be able to pay their bills on time to stay in business, and employee expenses are one of those bills. For any company with employees who conduct business outside of the office, expense management will always be vital. Even something as simple as a client lunch paid for by an outside sales manager needs to be documented, approved and reimbursed.

With effective expense management processes in place, companies can issue those reimbursements quickly and accurately. Employees don’t like waiting months after they cover an expense to get reimbursed.

Key Takeaways

- Expense management is a core business process required for controlling and gaining visibility into employee-initiated business expenses.

- Many companies still use manual expense management processes via paper or spreadsheets, but this approach is time-consuming, error-prone and difficult to scale.

- Automated expense management software streamlines the entire process, from expense submission to reimbursement.

- Expense management systems offer features like automated receipt capture, policy enforcement and approval workflows.

- Integrating expense management solutions with enterprise resource planning (ERP) or accounting systems can provide additional benefits, such as reduced data entry and real-time spending insights.

Expense Management Explained

At its core, expense management is the system organizations use to process, pay and audit employee-initiated business expenses. These costs include everything from travel and entertainment to office supplies, software subscriptions and client entertainment. The goal of expense management is to establish control and visibility over these costs, while enforcing company policies and maintaining accurate records for accounting, tax and regulatory purposes.

The process of expense management involves multiple steps, stakeholders and systems. Employees who incur expenses on behalf of the company must document, categorize and submit their costs. Based on predefined expense management policies, managers review reports to validate expenses before issuing reimbursement. Finally, expense data is recorded in the company’s accounting system and analyzed to identify spending trends, optimize budgets and inform future expense policies

Types of Expense Management

Companies have different ways of managing expenses, including:

- Paper tracking: This is the traditional — and outdated — way to manage expenses, with employees collecting paper receipts and submitting them to the accounting department for approval on a monthly or quarterly basis.

- Spreadsheets: This is a popular choice among companies trying to reduce their reliance on paper but have yet to move over to a dedicated, automated expense management system.

- Expense management software: This approach simplifies the expense management process. The software alerts managers to expense reports needing review, letting them accept or reject the claim. Approved expenses are then automatically routed to accounting for reimbursement.

Expense Management Process

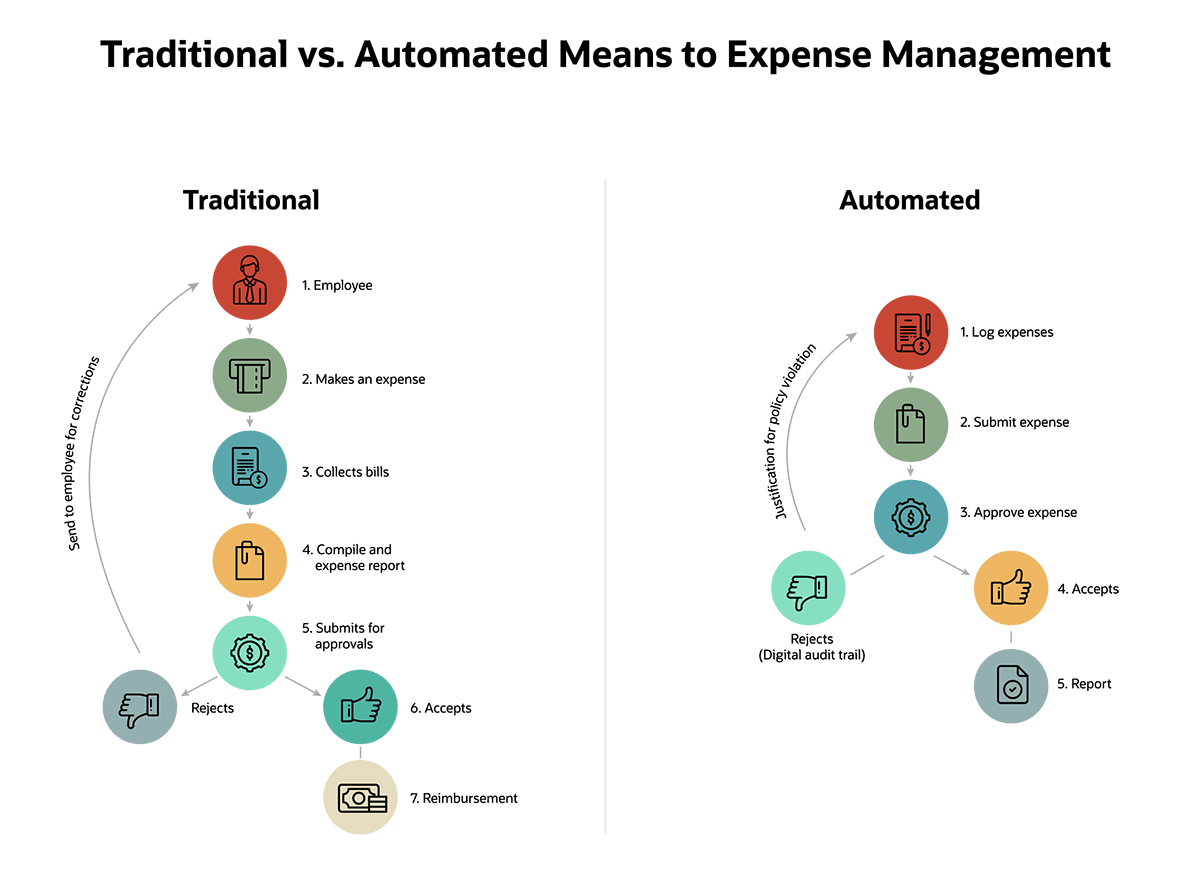

Expense management is a multistep process that includes capturing and submitting expenses, approving those expenses, and, finally, reimbursing the employee. The exact process, however, depends not only on the business and its needs, but whether it’s using a traditional manual expense management process or an automated one.

- Manual expense tracking begins when an employee makes a business-related expense. This could be for travel, meals, office supplies, client entertainment or anything else approved by the company. For every expense, the employee must collect and keep relevant receipts or bills. For each period established by the business’s expense policy, the employee gathers all receipts related to the expenses. This information is used to file an expense report, either via a paper form or a digital template. The report is then submitted for approval and manually reviewed. If approved, the employee is reimbursed via check or direct deposit. If rejected, usually due to errors or noncompliance with the expense policy, the employee must make necessary corrections and resubmit the report.

- Automated expense tracking, though essentially the same as manual tracking, is streamlined for greater accuracy, efficiency and transparency. It begins with an employee making a business-related purchase. But in an automated system, the employee often uses a company credit card or mobile app that instantly logs expenses — no need to keep receipts unless required by the business’s expense policy. Expense management software then automatically compiles expenses into a report and submits them for approval on a preset schedule. Approvals are also automated, but a human reviewer may still need to check any flagged expenses or collect random samples for audit purposes. If approved, reimbursement is automatically initiated and payment is typically deposited into the employee’s bank account. If denied, the software will notify the employee, who can make corrections and resubmit as needed.

Benefits and Challenges of Expense Management

- Monitor their spending.

- Ensure employees aren’t abusing the system and take quick corrective action if they are (e.g., letting individual employees know that they’re spending more than they should be in specific areas). If, for example, a salesperson has been flying first class without prior approval to do so, a quick check of their receipts will reveal the violation.

- Gain real-time insights into spending, assuming the company is using automated expense management software.

However, expense management is not without its challenges, especially for companies using manual systems. Manual systems can make it difficult to:

- Identify issues, such as missing information, typos or other errors.

- Scale up, especially amid a growing team of field workers.

- Quickly approve reports, which can wastes employees’ time and leave them wondering when they’ll be reimbursed for their expenses.

Despite the disadvantages of manual expense management, a recent survey(opens in new tab) found a sizable percentage of companies are still doing it — and not reaping the benefits of automated expense management: About 33% use manual processes, such as spreadsheets or paper, for expense reporting. That figure includes 38% of large companies, which the survey defines as over 1,000 employees.

What Is an Expense Management System?

An expense management system is software that simplifies the employee expense reimbursement process by automating much of it. The software reduces the need for paper, lowers the amount of time spent handling expenses and minimizes errors.

What Does an Expense Management System Do?

This system automates the recording, tracking, approval and payment of reimbursable expenses incurred by employees. Expense management software aligns with the company’s expense management policy to ensure the business doesn’t overspend on approved (or unapproved) expenses.

An expense management system also provides analytical tools that help the organization make better decisions about future spending and inform any necessary adjustments to its policy. Finally, the system helps organizations maintain compliance and accountability by accurately reporting on all expenses.

Integrating expense management software with an ERP or accounting system provides additional benefits. For one, it eliminates the need for accounting staff to upload or manually enter expense report data, saving time and reducing the risk of errors. Once approved, expenses are then automatically scheduled for payment, resulting in faster employee reimbursement.

Combining expense report data with ERP data also leads to a richer analysis across all spend categories, as well as by region, brand or other business segment. For instance, integration allows services companies to more easily tie expenses to individual projects, eliminating questions about how expenses should be allocated or which customer they should be billed to.

Expense Management Software Features & Capabilities

Here are some of the key features and capabilities of expense management software:

- Track all employee receipts.

- Allow employees to use their smartphones to capture receipts.

- Put the receipts on a centralized dashboard.

- Document spending limits and company policies.

- Allow companies to change these limits and policies as necessary.

- Integrate with corporate credit cards (if applicable).

- Route the receipts to the appropriate approvers.

- Manage those approvals or flag those that need more attention.

- Check for policy violations.

- Schedule reimbursement checks for payment.

Why Use an Expense Management System?

Manual expense report management is both expensive and time-consuming. According to the Global Business Travel Association(opens in new tab), it takes an average:

- 20 minutes to complete one expense report.

- 18 minutes to correct an expense report.

- $58 to process one expense report.

- $52 to correct one expense report.

Companies that automate the expense management process can dramatically cut down on the amount of time and money spent on this important task. At the same time, they gain better insights into the spending habits of individual employees, making it easier to pinpoint unusually high expenses so they can be addressed.

Expense Management Software Advantages

Expense management software makes life easier for companies and employees in a variety of ways. Specifically, it can help:

- Save time: By automating the expense reporting process, software minimizes the need for manual data entry. This speeds up the entire expense management life cycle.

- Boost expense control: Software makes it easier to precisely track and manage individual employee expenditures. This gives managers better granular control over individual employee expenditures and spending limits.

- Reduce errors: Expense management software minimizes human error by automating receipt tracking, expense reporting and approvals. Automation prevents employees from making data entry mistakes while reducing the risk of supervisors misinterpreting entries.

- Compile expense reports faster: Automation streamlines the creation and submission of expense reports. Employees can generally compile and submit with just a few clicks.

- Improve compliance: Software automatically helps companies better adhere to their spending policies by automatically verifying each expense against established rules and guidelines.

- Simplify approvals Using custom workflows, software simplifies the expense approval process by automatically routing those tasks to the right people.

- Make smarter decisions These solutions incorporate built-in analytics that can quickly identify spending trends, detect potential problems, flag outliers and provide actionable insights that improve decision-making.

Choosing an Expense Management System

Many different expense management systems are available today, but not all of them are created equal. As with any technology purchase, you’ll want to make sure the solution offers the right level of functionality, can accommodate your company’s specific needs and comes with a high level of post-sale support.

Common functionalities to look for and compare among vendors include:

- Document management to create audit trails.

- Easy, customizable approval processes.

- Customizable expense policies, with real-time checks for employee compliance.

- Mobile accessibility on many kinds of devices.

- Analytics and reporting.

- Integration with other software systems.

Once you’ve identified your company’s needs, explore your options and request demonstrations. Talk to other companies (preferably within your industry) that are successfully using an expense management system, and be sure to evaluate multiple options before making your final decision.

Enable Effortless, Efficient Expense Management with NetSuite

NetSuite SuiteProjects expense management offers a comprehensive expense management solution that both simplifies and automates the entire expense cycle, from reporting and submission to approval. For example, customized workflows and approval processes can be designed to align with specific business needs, enhancing overall expense management efficiency and accuracy. By seamlessly integrating with the broader NetSuite ERP platform, companies can effectively eliminate redundant data entry to guarantee expense reports are submitted quickly and with precision.

NetSuite’s expense management solution also supports direct credit card integration with American Express, saving employees’ time and energy while reducing human error. And, whether employees are completing a job on-site or working remotely, the NetSuite mobile app makes it easy to manage expenses on any device, anywhere, preventing receipts from piling up and streamlining the submission process — a convenient way to maximize productivity.

Any company that allows its employees to make purchases on behalf of the business needs an expense management policy. But traditional methods of managing expenses — manually, with paper or spreadsheets — are costly, time-consuming and error-prone. In turn, many companies are wising up to the benefits of expense management software. These solutions leverage automation to simplify the employee expense management process, reducing the need for paper, minimizing errors and significantly cutting the amount of time spent submitting, tracking and approving expenses.

Expense Management FAQs

What is an expense management policy?

An expense management policy is a set of guidelines that control employee spending by clearly defining reimbursable and non-reimbursable expenses. Key components of an effective policy typically include:

- A complete list of expenses that the company will pay for.

- A complete list of expenses that the company will not pay for.

- Clear and concise language (so there are no questions about what is/isn’t admissible).

- Regular updates to accommodate company growth and changes.

- Clearly defined steps of the approval process.

- A list of best practices, such as requiring preapprovals for certain expenses.

How does expense management software reduce fraud?

Expense management software automates policy enforcement, creates an audit trail, and flags suspicious expenses. Modern systems also use AI to find patterns of fraud, like duplicate claims or expenses that go beyond the typical limits.