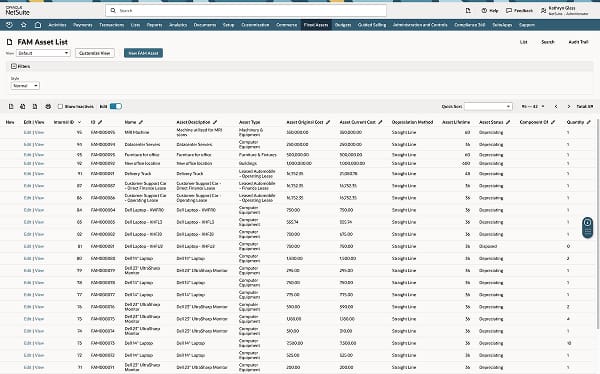

What Is NetSuite Fixed Assets Management?

NetSuite Fixed Assets Management makes financial reporting more timely and accurate by automating fixed-asset depreciation and lease accounting. Develop a comprehensive list of existing assets, including relevant data like acquisition cost, in-service date, estimated useful life and more, and track lease agreement details like contract value, duration and discount rate. Fixed Assets Management lets you manage the entire asset lifecycle, from acquisition to retirement, with ease — and without spreadsheets and time-consuming manual processes.

Manage fixed assets and lease accounting

More Accurate Records

Out-of-date information can lead to overvaluation of fixed assets and overpaying for insurance. Fixed Assets Management makes it easy to maintain accurate records of depreciating and non-depreciating assets.

NetSuite Fixed Assets Management Features

NetSuite Fixed Assets Management covers the entire asset lifecycle, from procurement to disposal, helping companies maintain up-to-date records, accurately record depreciation data and comply with lease accounting standards. Fixed Assets Management works seamlessly with NetSuite Procurement and Advanced Financial Management to automate the creation of new assets and posting of depreciation and lease expenses.

Asset Tracking

Develop an accurate listing of depreciating and non-depreciating fixed assets, and maintain detailed records over the entire asset lifecycle. Assign and track assets by region, facility, department or other reporting segment. Transfer assets from one subsidiary or business unit to another while retaining the complete history without manually reentering data.

Depreciation

Fixed Assets Management automatically calculates depreciation expenses using standard or custom methods and schedules and lets finance teams choose how and when to apply depreciation. With usage-based methods, for instance, NetSuite gives you the option to not depreciate an asset during seasonal downtime, when equipment is offline.

Lease Accounting

Standardize lease accounting and ensure compliance with financial reporting requirements. Capture key lease details, including start and stop dates, total cost and discount rate, and amortize lease expense over the duration of each agreement. NetSuite automatically posts separate journal entries for lease and interest expense and updates remaining lease liability.

Reporting

Produce accurate financial statements that meet tax and accounting requirements, generate standard fixed-asset reports or leverage SuiteAnalytics to slice and dice asset data by location, subsidiary or other criteria.

Learn How ERP Can Streamline Your Business

Free Product Tour

Before NetSuite, company leaders had to pull monthly depreciation and amortization reports from Excel spreadsheets. Now, it’s just a one-button push for the month-end process.

NetSuite Fixed Assets Management Benefits

See How NetSuite Can Help You With Your Role

Business Guide

Business Guide

Business Guide

Business Guide

Challenges NetSuite Fixed Assets Management Solves

How Much Does NetSuite Fixed Assets Management Cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for initial setup. As your business grows, you can easily activate new modules and add users – that’s the beauty of cloud software.

NetSuite Fixed Assets Management is available as an add-on module.

Contact NetSuite Now(opens in new tab)Resources

Data Sheets

Access specifications, features and benefits of NetSuite Fixed Assets Management.

Customer Stories

Spark ideas with success stories from NetSuite customers.

Guides & Blogs

Go deep into topics around NetSuite Fixed Assets Management.

Essential Learning

Discover best practices and learn more about NetSuite Fixed Assets Management from beginner to advanced levels.