What is NetSuite Tax Management?

NetSuite’s indirect tax management solution, SuiteTax, is a configurable tax engine that delivers end-to-end global tax management. Finance teams can effortlessly generate detailed reports, analyzing transactions down to line-item tax details in real-time. SuiteTax simplifies global tax compliance, saving time, reducing costs and eliminating manual calculations. NetSuite’s built-in tax logic automates determinations of taxability and calculations on every transaction, down to the individual item level.

Automated global tax determination and compliance

Any Tax, Anywhere

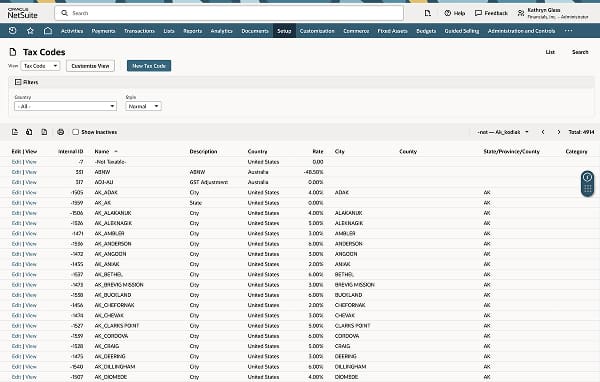

NetSuite provides monthly tax rate updates for 110 countries and retains historical rate changes. That means SuiteTax automatically applies the right rate to every transaction, every time.

NetSuite Tax Management Features

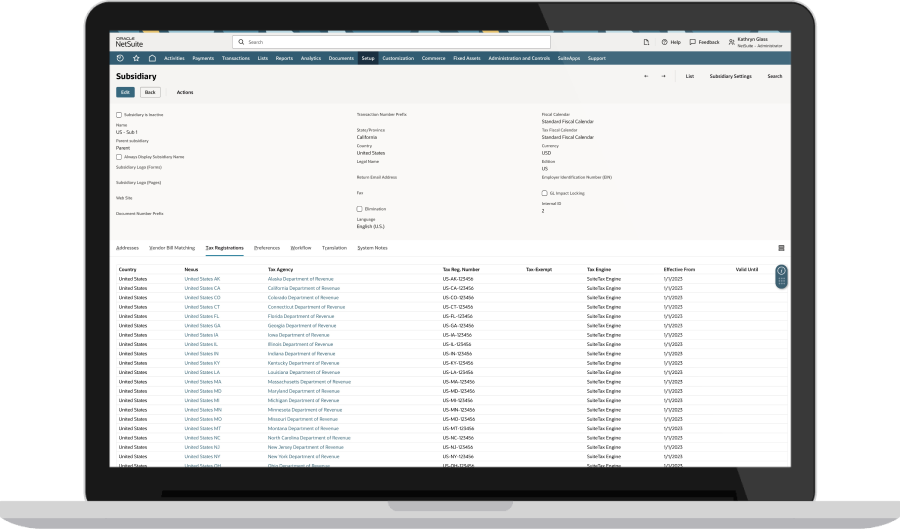

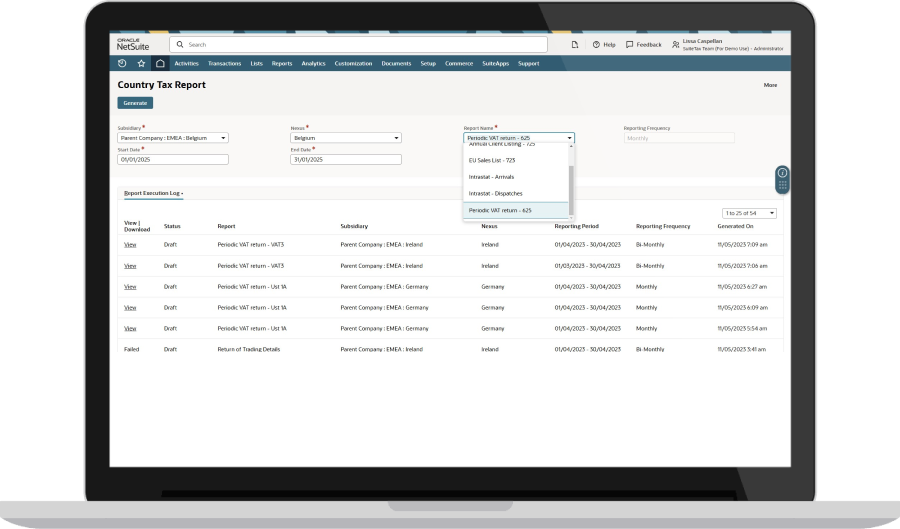

SuiteTax provides the flexibility to support specific country needs and stays up to date on legislation changes regarding tax calculations and reporting. Finance teams can easily manage in-country transactions — sales tax, VAT or GST — and navigate special tax situations and rules on, for example, intra-EU transactions, 3PL, reverse charges and more. Use the right tax calculation engines for nexuses comprising U.S. sales and use taxes, and override tax details on transactions. And, real-time visibility into your indirect tax position improves cash flow.

Automated VAT/GST Calculation

Say goodbye to manual calculations: NetSuite’s built-in tax logic automatically determines taxability and runs calculations on every transaction, on every item in your account, for every tax jurisdiction. NetSuite validates all your customer and vendor VAT registration numbers, thus calculating the correct taxes for all cross-border goods and services within the EU.

U.S. Sales Tax

Complying with sales taxes across the United States often demands full-time attention from the entire tax team. SuiteTax reduces the massive costs associated with monitoring compliance by delivering automated monthly tax rates for all jurisdictions. You get Zip+4 for greater accuracy along with exemption certificate management. You can even set your own item taxability rules, making it simple to accommodate, for example, sales tax holidays.

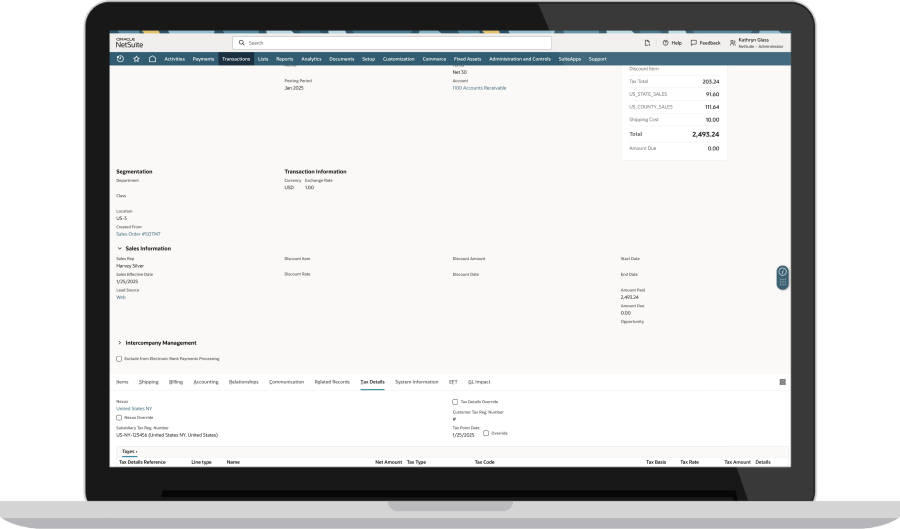

Audit Capabilities

Details matter to auditors. Tax calculations by line item, showing each rationale and country-specific compliance text, in any language, are included on invoices. Configurable roles and permissions throughout NetSuite ensure that only authorized users can make changes, such as overriding the tax jurisdiction. Rate change histories are recorded, as are all customer and vendor detail changes.

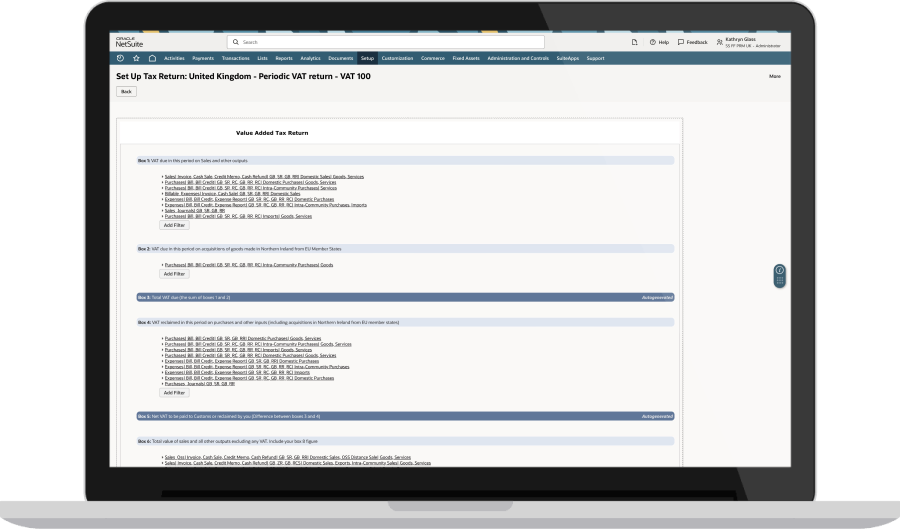

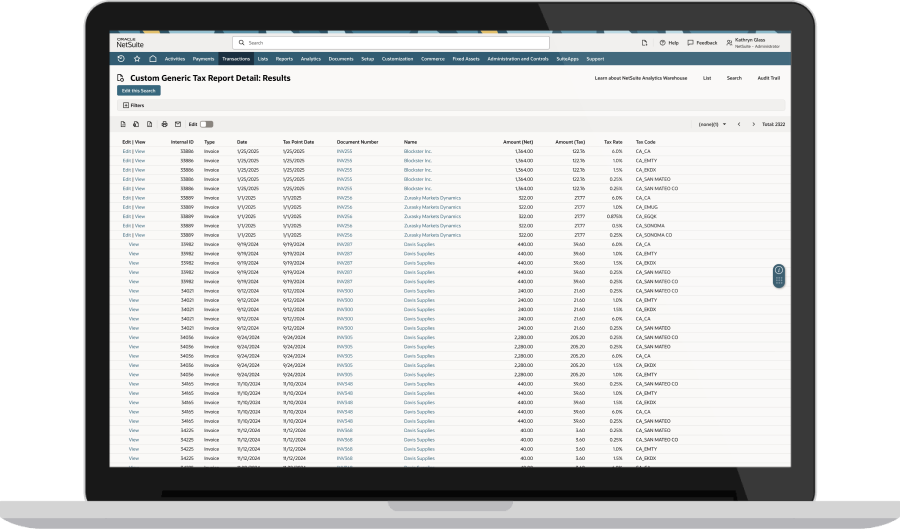

Flexible Reporting

Gain real-time visibility into your sales tax and VAT position. Automated summaries, transaction-level subsidiary rollups and out-of-the-box localized reports for many countries translate to faster, easier tax reporting. Define and apply each tax code and transaction type to any box on the tax form with NetSuite’s configurable reports, and take advantage of a framework for creating your own report for any country.

Tax Service Partners

The SuiteTax API provides the ability to connect with best-of-breed tax service partners. And you’re not limited — SuiteTax provides the option to connect with multiple tax service providers, allowing finance teams to select the best partner for each geography, even within a single subsidiary.

Learn How ERP Can Streamline Your Business

Free Product Tour

The company could have handled the growth without an ERP system, but we would have been forced to hire a lot more people.

NetSuite Tax Management Benefits

Challenges NetSuite Tax Management Solves

How Much Does NetSuite Tax Management Cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for initial setup. As your business grows, you can easily activate new modules and add users – that’s the beauty of cloud software.

SuiteTax is included with the NetSuite platform license.

Contact NetSuite Now(opens in new tab)Resources

Data Sheets

Access specifications, features and benefits of NetSuite tax management solution.

Guides & Blogs

Go deep into topics around NetSuite SuiteTax.

Essential Learning

Discover best practices and learn more about tax management from beginner to advanced levels.