When starting, a new business must select a business structure, which will have both legal and tax implications. And, the choice of business structure is a monumental step for a new company. It can affect ongoing costs, liability and how your business team can be configured. This topic becomes particularly timely during tax season, as your business’ structure has direct tax implications.

Have no fear: Below, we outline the most common types of business structures and their respective tax ramifications.

What Is a Business Structure?

A business structure is a type of legal organization of a business. When starting a new business, it’s important to take time to decide on the right type of business entity. The business structure you choose doesn’t have a lot of impact on the day-to-day operation of your business, but it is extremely important in defining ownership, limiting personal liability, managing business taxes, and preparing for future growth.

At a basic level, business entities establish the business as a legal entity that can have bank accounts, enter into contracts, and conduct business without putting everything in your own name. For some very small businesses, working under your own name may be okay, but if you plan to earn a full-time income from the business, sign contracts, or hire employees, it’s likely in your best interest to choose a business structure and register with your state.

Key Takeaways

- A business structure is a form of legal organization for a business.

- The right business structure may offer personal liability protection and other benefits.

- Most businesses should choose a business structure and register with their state.

- There are unique pros and cons of each type of business structures for every business.

Business Structures Explained

If you’ve ever had a job, rented a home, or bought a car, you likely signed a contract where you were acting as yourself. However, on the other side of the contract, the signature lines may show someone signing on behalf of a business. For that business to enter into a contract, it must use a recognized business structure and maintain an active registration with the state government.

When you sign a contract or do business as yourself, which is the default if you start a business and don’t register, you are personally liable for anything that goes wrong. If you make a mistake with a client or someone is injured by your product or service, you could be personally liable for any financial damages. That means they can sue you and go after your personal bank accounts, investments, home, and other assets in the suit. When you operate a registered business and follow best practices, your personal assets are protected.

By default, your business is considered a sole proprietorship, where you are the business and transact under your own name. When you create an LLC, corporation, or partnership, that new entity takes your place on contracts. Once you reach a certain income level, if you’re running the business full-time, there are additional tax benefits as well.

However, business entities are not free. Every state requires different fees to start and maintain a business. You may be able to file the registration paperwork on your own, but many people choose to hire a lawyer to ensure the business is created correctly and stays in compliance with local, state, and federal laws. Because every business and business owner is unique, it may be worthwhile to consult with a legal or tax professional for advice on choosing the best business structure for your long-term goals.

What Are the Four Types of Business Structures?

1. Sole proprietorship

A sole proprietorship is the most common type of business structure. As defined by the IRS(opens in new tab), a sole proprietor “is someone who owns an unincorporated business by himself or herself.” The key advantage in a sole proprietorship lies in its simplicity. Here, there is no distinction between the business and the individual who owns it — which means that the owner is entitled to all profits. However, it also means that the sole proprietor is responsible for all the business’s debts, losses and liabilities. This means that creditors or lawsuit claimants may have access to the business owner’s personal accounts and assets if the business accounts cannot cover the debt. Examples of sole proprietorship include freelance writers, independent consultants, tutors and caterers.

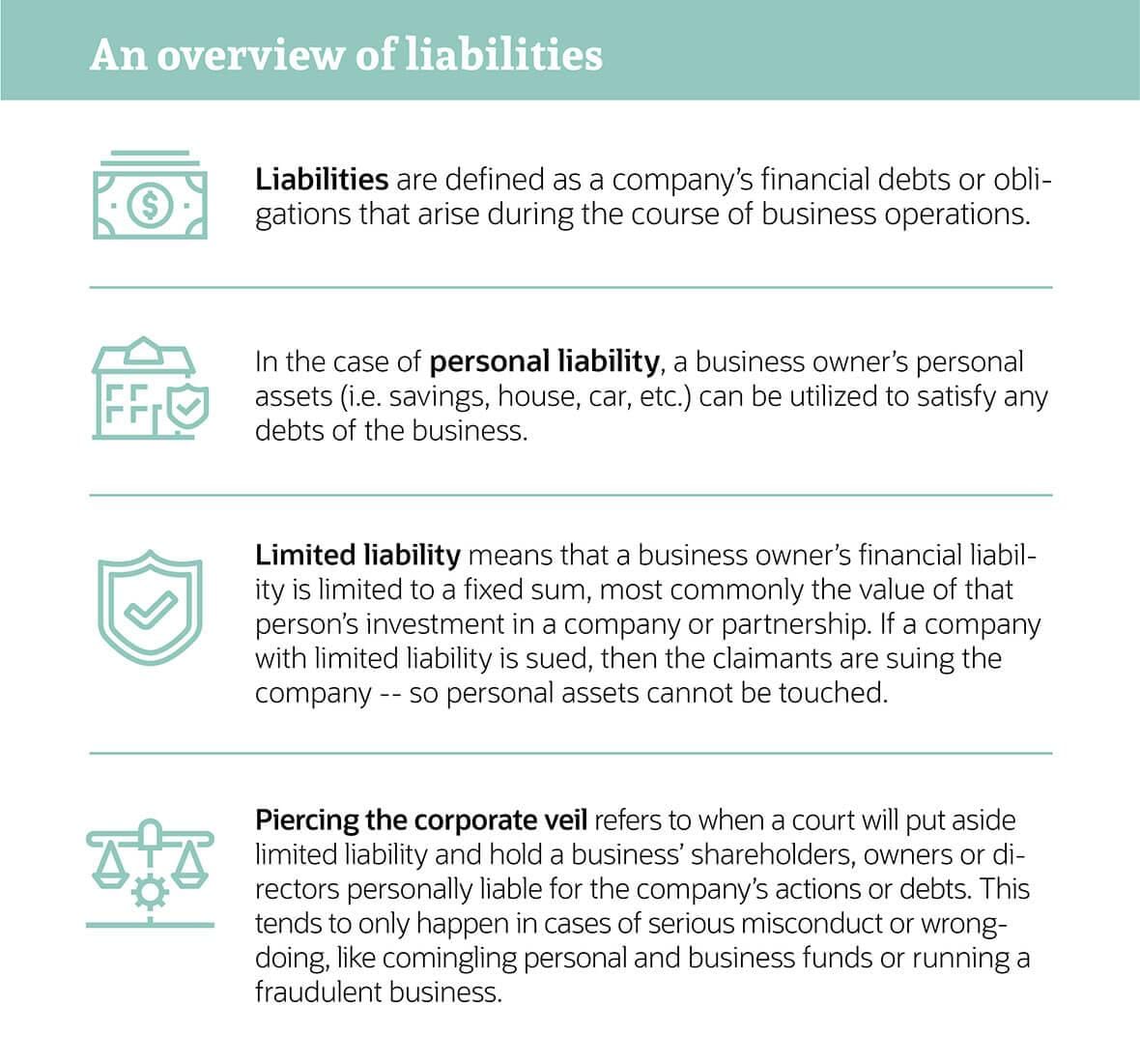

Overview of liabilities

Liabilities are defined as a company’s financial debts or obligations that arise during business operations.

Limited liability is a type of legal structure where a corporate loss will not exceed the amount invested in a partnership or LLC. In other words, investors’ and owners’ private assets are not at risk if the company fails. So, if a company with limited liability is sued, then the claimants are suing the company; personal assets can’t be touched.

Whereas personal liability is when a business owner’s assets can be used to satisfy any business debts.

However, "piercing the corporate veil" is the most common in close corporations to settle debts and can occur when serious misconduct takes place. This is when courts put aside limited liability and hold a company’s shareholders personally liable for the corporation’s actions or debts.

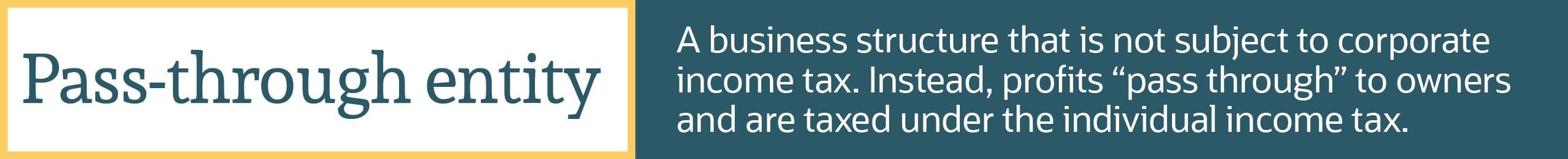

Pass-through entity

In terms of tax implications, sole proprietorships are considered a “pass-through entity.” Also known as a “flow-through entity” or “fiscally transparent entity,” this means that the business itself pays no taxes. Instead, taxes are “passed through” to the owner. Pass-through entities are not subject to corporate income tax. Profits pass through to owners who pay them in their personal returns under ordinary income tax rates on the typical Tax Day, usually April 15.

Pros:

- No cost to start — You are a sole proprietor by default.

- Easy to maintain — There are no ongoing registration or legal requirements to start, maintain, or shut down a sole proprietorship.

Cons:

- Personal liability: You are personally liable for anything that goes wrong related to the business.

- No tax benefits: You must pay self-employment tax on all earnings and include business earnings on your personal tax return using Schedule C.

- Less professional: Clients and customers may find you to be unprofessional unless you operate a legally registered business. You may also struggle to get business financing.

2. Partnership

In business structure, a partnership is(opens in new tab) “the relationship existing between two or more persons who join to carry on a trade or business.” Partnerships have three common types of classifications: a general partnership(opens in new tab), limited partnership(opens in new tab) or a limited liability partnership(opens in new tab).

- General partnership: Consists of two or more partners who share all liability and responsibility equally. This means the partners both take part in the day-to-day operations of the business. It also means that the partners are equally liable for any debts generated by the business. All partners are considered “general partners.”

- Limited partnership (LP): Has at least one “general partner” and one “limited partner.” A general partner assumes ownership of the business operations and unlimited liability. A limited partner, also known as a silent partner, invests capital in the business. However, limited partners are not involved in the day-to-day operations and don’t have voting rights(opens in new tab) and therefore have limited liability.

- Limited liability partnership (LLP): In this arrangement, all partners have limited personal liability, which means they are not liable for wrongdoings (i.e. acts of malpractice or negligence) committed by other partners. All partners in an LLP can be involved in the management of the business. It tends to be more flexible than the previous partnership forms because partners can determine their own management structure.

Like a sole proprietorship, partnerships are considered a pass-through entity when it comes to taxation. In many ways, a partnership is like an expanded sole proprietorship — but with the advantages and disadvantages that comes with a partner. A partner can provide expertise, skills and capital for the business. But while they can affect the business positively, they can also impact it negatively. You should be comfortable with whomever you enter into business with.

Partnership tax returns are due the fifteenth day of the third month after the end of the entity’s tax year, which is typically March 15 (or March 16 in 2020). However, while the taxes are filed in March, partners don’t tend to pay taxes on the business until the April deadline (July 15 in 2020) since it passes through to their personal tax return.

Pros:

- Relatively easy to create: Creating a partnership with your state is a relatively simple process.

- May offer liability protections: Limited Partnerships and Limited Liability Partnerships may offer personal financial and legal liability protection.

Cons:

- May not protect from all liabilities: Partnerships may not shield all personal liability depending on the specific business structure and operations.

- More complex tax requirements: Partnerships must file their own tax returns and supply additional forms to partners for personal taxes.

3. Limited liability company

Now, a limited liability company (LLC) is where things start to get a little dicey. The IRS states that an LLC is a “business structure allowed by state statute.” That means it is formed under state law and the regulations surrounding LLCs vary from state to state. Depending on elections made by the LLC and its characteristics, the IRS will treat an LLC as either a corporation, partnership or as part of the LLC’s owner’s tax return (i.e. a “disregarded entity(opens in new tab)” with many of the characteristics of a sole proprietorship).

An LLC is considered a hybrid legal entity because it has traits of numerous other business structures, depending on the elections made by the owners. This lends it more protections and flexibility than some of its business structure counterparts. From a protections perspective, members of an LLC are not personally liable. Because the LLC is an entity created by state statute, it has flexibility in regards to federal tax treatment. For instance, a single-member LLC(opens in new tab) can be taxed as a sole proprietorship or a corporation. A multi-member LLC(opens in new tab) can be taxed as a partnership or a corporation.

The aforementioned flexibility causes some discrepancies when it comes to the federal tax due date.

- An LLC that chooses to be viewed federally as a sole proprietorship or C corporation (find more on C corporations types below) will typically have a federal tax filing and payment due date of April 15.

- However, an LLC being taxed as an S corporation or partnership will typically have a federal tax filing due date of March 15 and a payment deadline in line with their individual income return.

Pros:

- Liability protection for one or more owners: When established and operated correctly, an LLC offers liability protection for owners, including a single owner.

- Choose between two taxation methods: Choose between pass-through taxation or S Corp taxation depending on which is more beneficial to owner finances.

- Potential for major tax savings: Owners who work in the business full-time may save on self-employment taxes with S Corp taxation.

Cons:

- Costs to establish and maintain: LLCs require government forms and fees to establish and maintain.

- More complex tax requirements: Tax preparation may be more complex, particularly if you opt for S Corp taxation.

4. Corporation

Corporations are a company or group of people authorized to act as a single legal entity. This means that the company is considered separate and distinct from its owners (i.e. there’s no personal liability here). However, a corporation is eligible for many of the rights that individuals possess, hence why it is sometimes referred to as a “legal person.”(opens in new tab) For instance, a corporation can sue or be sued, enter into contracts and is entitled to free speech.

The IRS splits corporations into two separate classifications: the “C corporation” and the “S corporation.”

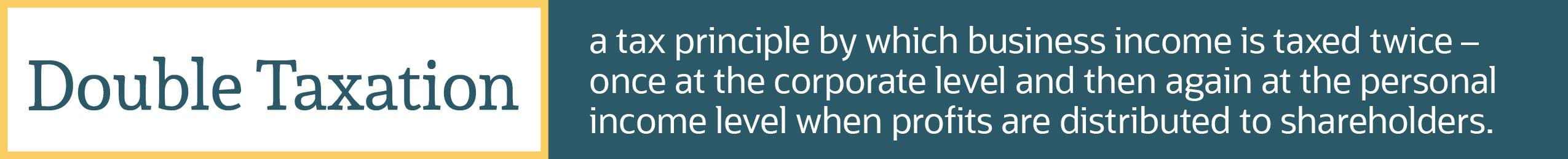

- C corporation (C corp): A C corporation is considered the default designation for corporations. All corporations start in the “C” classification when filing articles of incorporation with the state’s business filing agency. Unlike our preceding business structures, C corporations are not a pass-through entity. They are taxed twice at a corporate and personal income level, which is referred to as double taxation.

- S corporation (S corp): An S corporation is distinctively different from a C corporation because it is a pass-through entity, allowing it to avoid double taxation. However, the IRS institutes strict standards(opens in new tab) for companies looking to qualify for S corporation status, particularly around shareholders. For instance, an S corporation can only have 100 shareholders, and they must be U.S. citizens/residents. (It’s not unusual for startups to issue 100,000 shares of stock(opens in new tab) at their outset.)

Like partnerships, an S corporation must always file its annual federal tax return by the fifteenth day of the third month following the end of the tax year, generally March 15. The income is then passed down to its members individual returns, which adhere to the normal April Tax Day.

Corporations are the only business tax structure allowing for perpetual existence. This means that its continuance is not affected by the coming and going of shareholders, officers and directors.

Pros:

- Extensive liability protections: S Corp and C Corp owners are shareholders and receive more extensive legal protection if the business operates correctly.

- Corporation acts as a legal person: The corporation can enter contracts and transact as its own legal entity.

- Can have unlimited shareholders: S Corporations may have up to 100 shareholders. C Corporations can have unlimited shareholders.

Cons:

- More costly to establish and maintain: Corporations typically require more work and higher fees to establish and maintain.

- Detailed ongoing requirements: Corporations have requirements such as annual meetings, appointing a board of directors, and other state-imposed regulations.

What Are the Tax Pros and Cons of Each Business Structure?

| Business structure | Tax pros | Tax cons |

|---|---|---|

| Sole proprietorship |

|

|

| Partnership |

|

|

| Limited liability company (LLC) |

|

|

| C corporation |

|

|

| S corporation |

|

|

Choosing a Business Structure

The best business structure for your company depends on your long-term goals, ownership, plans to hire employees, and legal risk. While some very small businesses and side hustles may operate safely as a sole proprietorship, most businesses are better off registering a business with their state.

The best business structure for businesses that don’t plan to bring in outside investments is often an LLC, as it works for one or more owners with lower startup and maintenance requirements than a full corporation. If your business employs one or more owner full-time, it could make sense to register as an LLC and opt for taxation as an S Corporation.

If you plan to bring in outside investment rounds and may grow into a publicly traded company in the future, the best business structure is a C Corporation, as that structure allows for 100 or more shareholders.

Because of the important tax and legal implications, it’s often well worth the cost to consult with an attorney or tax expert for advice on the best business structure for your needs and goals.

Conclusion

Choosing a legal business structure is a critical step in your business's lifecycle. It affects everything from the ability to attract investors to personal liability and government paperwork.

Businesses owners should weigh their own personal circumstances and long-term business goals against the costs to pick the best possible legal structures. Once you have that important decision locked in, it's back to focusing on what's most important: running your day-to-day operation for maximum business profits.