What is NetSuite Financial Close Management?

With NetSuite, finance teams can accelerate the financial close by automating inefficient manual tasks, such as journal entries, account reconciliations, variance analysis and intercompany transactions, and reducing their reliance on spreadsheets to ensure financial statements are timely and accurate. NetSuite puts all of your financial information in one place, providing convenient, permission-based access for your accounting staff. This increases efficiency by making it easier to obtain all the financial information needed quickly, generate reports and close the books faster and more accurately.

Close the books faster, with greater accuracy

Support a Continuous Close

With automation and access to real-time financial information, you can implement a continuous or “rolling” close process, allowing accounting teams to keep accounts up to date on a daily basis and provide financial information at any time during the monthly reporting cycle.

NetSuite Financial Close Management Features

By standardizing and embedding controls in the reconciliation and period-end close processes, organizations can eliminate labor-intensive activities that don’t add business value. They can simplify decentralized and disjointed workflows that lengthen cycle times, minimize the risk of control failure and better ensure the integrity of financial statements.

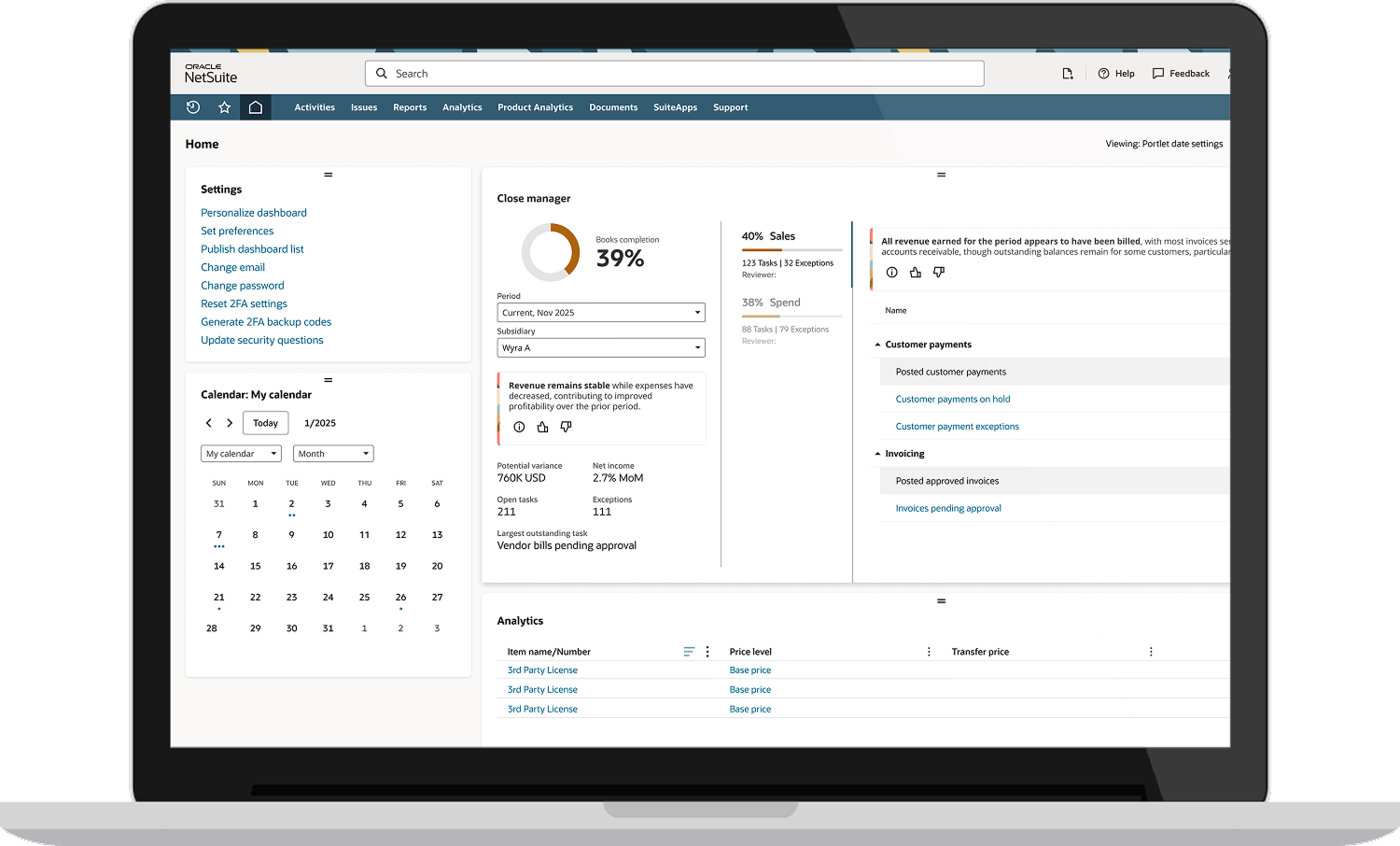

Continuous close management

NetSuite Intelligent Close Manager provides users with AI-powered, data-driven monitoring to help keep teams on track for a timely close. Finance teams can gauge progress at a glance while hyperlinked tasks minimize task switching friction and direct users to take action. Built-in AI insights highlight trends, errors, projected activities, and areas to focus on, helping accounting teams close their books with confidence and speed.

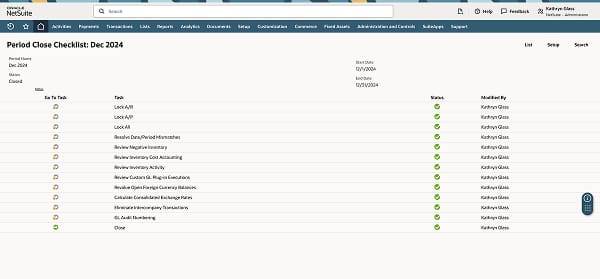

Period close checklist

NetSuite provides a standardized close checklist to help ensure the financial close process runs smoothly and that closing tasks are completed in the correct order. Accounting staff quickly gain a better understanding of the close cycle, and department managers are better able to track progress.

Bank reconciliation

NetSuite's account reconciliation and banking integration features work together to save time and improve the accuracy of financial records. NetSuite automatically imports bank statement data, matches completed transactions to existing accounting records, creates journal entries for missing transactions and flags any discrepancies for review by accounting personnel.

Bank transaction matching

Delays in reconciling bank transactions can affect financial accuracy and cash flow visibility. NetSuite automates the bank transaction matching process by identifying and pairing bank transactions with the appropriate general ledger entries. Generative AI is used to extract richer transaction data and enhance the auto-match engine. This increases successful auto-matches, reduces manual effort, and speeds up reconciliation.

Financial consolidation

For companies with subsidiaries, preparing consolidated financial statements is one of the most difficult steps in the close process. NetSuite automatically posts and consolidates subsidiary level accounts, saving time and improving compliance with accounting standards and reporting requirements.

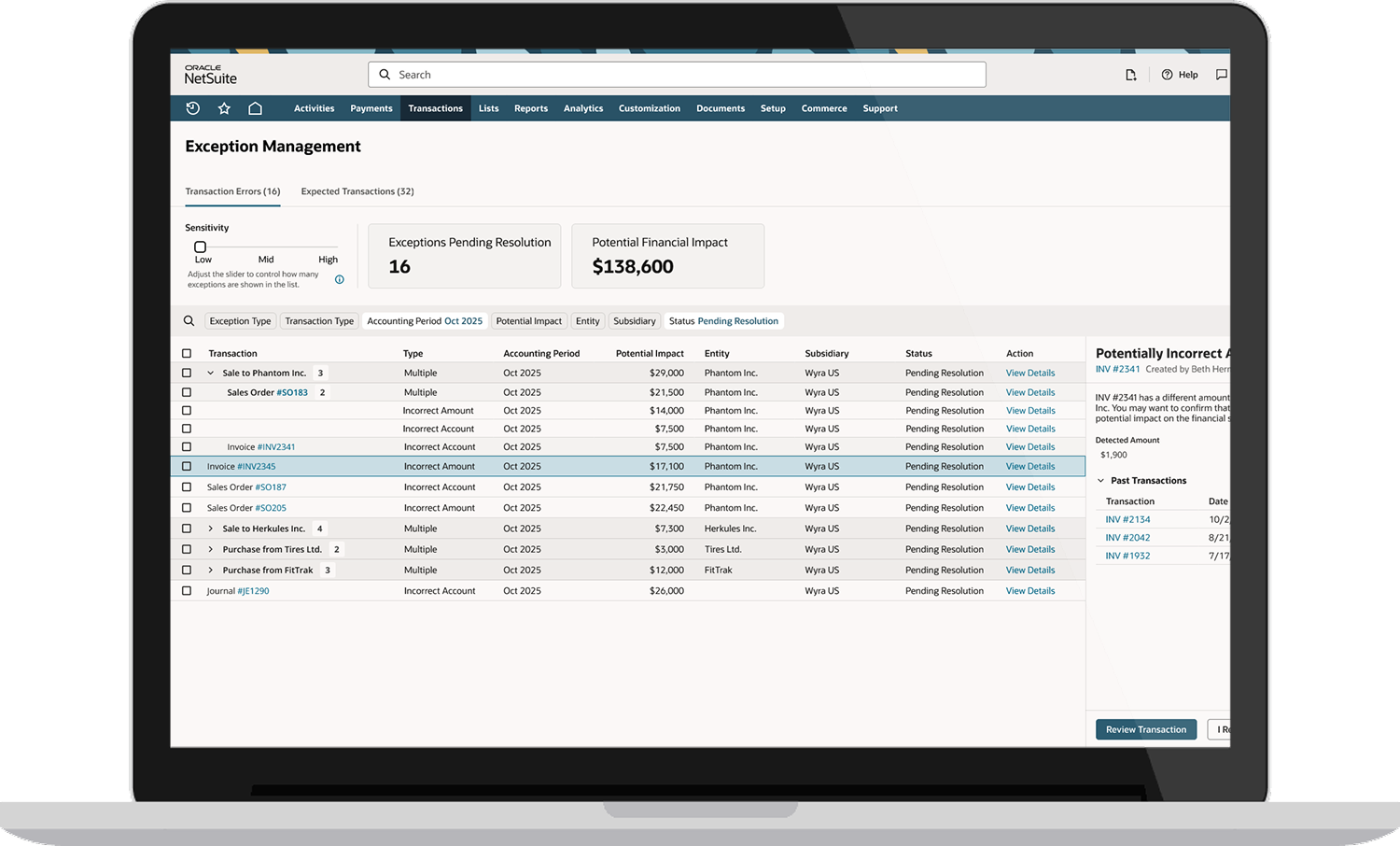

Exception detection

NetSuite Exception Management leverages AI to continuously monitor financial data, such as journal entries, invoices, sales orders, purchase orders, and payments, to automatically detect financial exceptions. Proactively identify transactions that fall outside your usual data pattern and get actionable insights to help resolve issues ahead of the period end time crunch.

Learn How ERP Can Streamline Your Business

Free Product Tour(opens in a new tab)

Cutting out the manual time and energy that goes into the QuickBooks system has really saved us on payroll.

NetSuite Financial Close Management Benefits

See How NetSuite Can Help You With Your Role

Business Guide

Business Guide

Challenges NetSuite Financial Close Management Solves

How Much Does NetSuite Financial Close Management Cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for initial setup. As your business grows, you can easily activate new modules and add users – that’s the beauty of cloud software.

NetSuite financial close management capabilities are included with the NetSuite platform license.

Contact NetSuite Now(opens in new tab)Resources

Data sheets

Access specifications, features and benefits of the NetSuite close management process.

Guides & blogs

Go deep into topics around the NetSuite close management process.

Essential learning

Discover best practices and learn more about close management from beginner to advanced levels.