What is NetSuite Accounts Receivable?

NetSuite accounts receivable (AR) enables businesses to easily and quickly generate and send invoices, define credit terms, manage collections — and gain the liquidity needed to fund growth, shorten the credit-to-cash cycle and seize new investment opportunities as they arise. With real-time visibility throughout the entire AR process, finance teams can check the status of receivables anytime, at the macro level as well as down to each individual customer and invoice.

Optimize receivables, accelerate cash flow

Simplify and Automate

Automatically post order transactions to general and AR ledgers, with accurate tax calculations on each invoice, for rapid, precise tax processing and billing. NetSuite automates manual accounts receivable processes and empowers finance teams to issue digital invoices and offer multiple payment options to speed collections.

NetSuite Accounts Receivable Features

NetSuite accounts receivable offers real-time insights and robust automation capabilities. The system is readily configurable, with AR-specific dashboards that put you in total control of your company’s AR process.

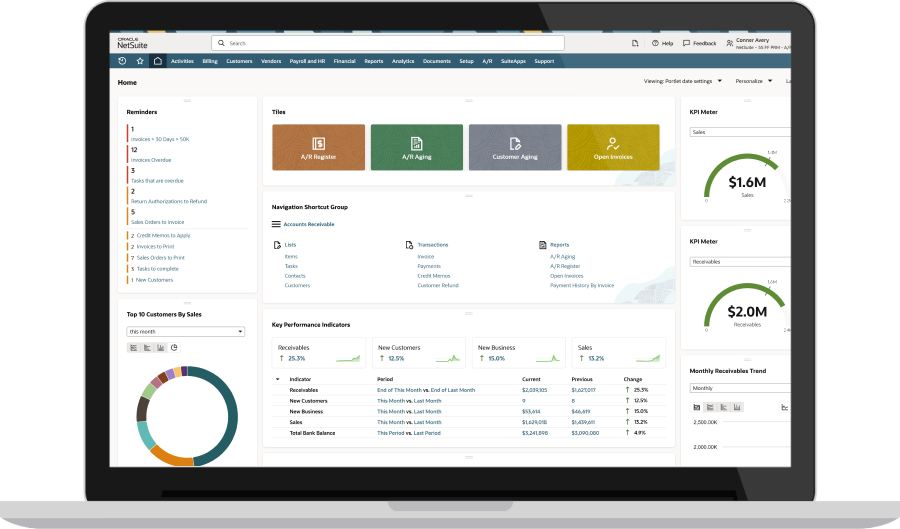

Accounts Receivable Dashboard

Role-based dashboards can be personalized with reminders and links to commonly used actions and reports. NetSuite’s “at-a-glance” format helps finance teams zero in on important information and activities to accelerate collections and minimize days sales outstanding (DSO).

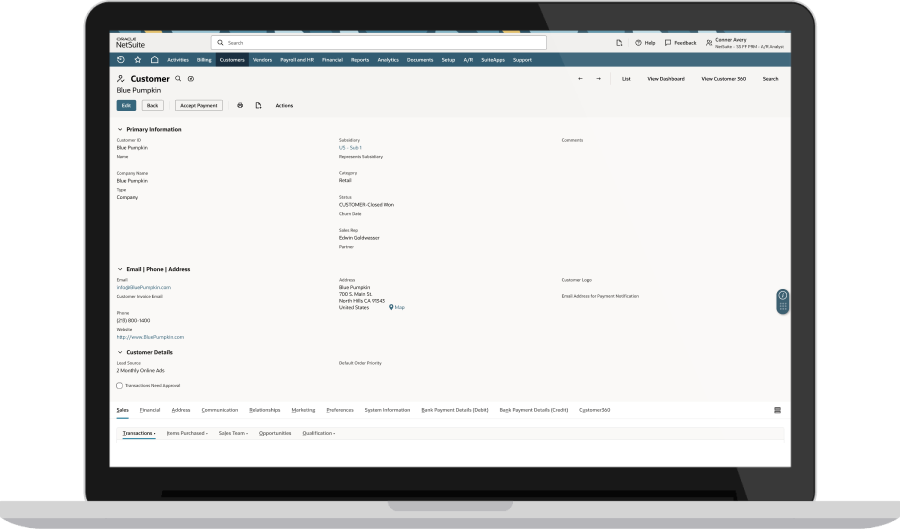

Customer Records

Maintain accurate customer data, including contacts, transaction history, items purchased, open invoices, communications history and more. Configurable user roles and privileges enable finance teams to specify who can access accounts and modify records, helping keep customer information secure.

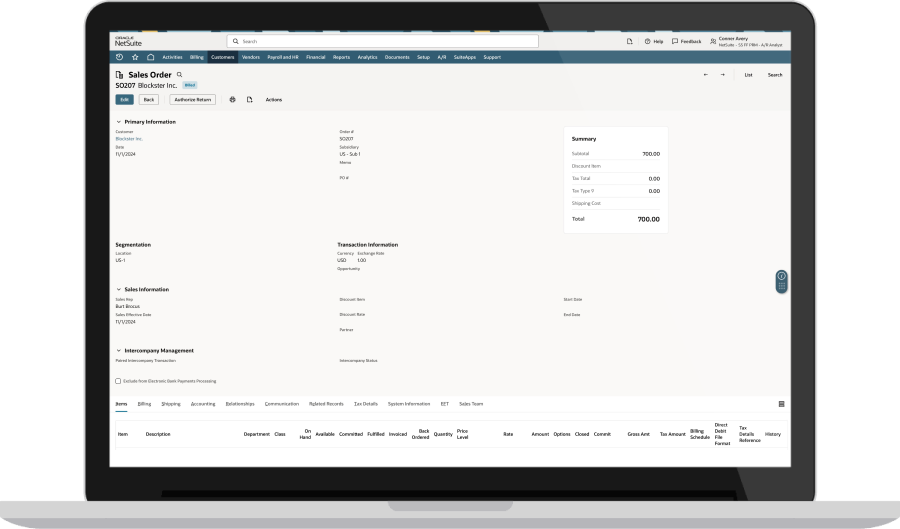

Automated Invoicing

Automatically convert sales orders to invoices as orders are fulfilled. Easily customize invoice templates to meet customers’ unique billing needs. Bill by mail, email, fax or electronically. Easily calculate VAT, sales and other taxes. Posting transactions to the general ledger automatically saves time, avoids error-prone manual data entry and ensures accounts receivable data is always up to date.

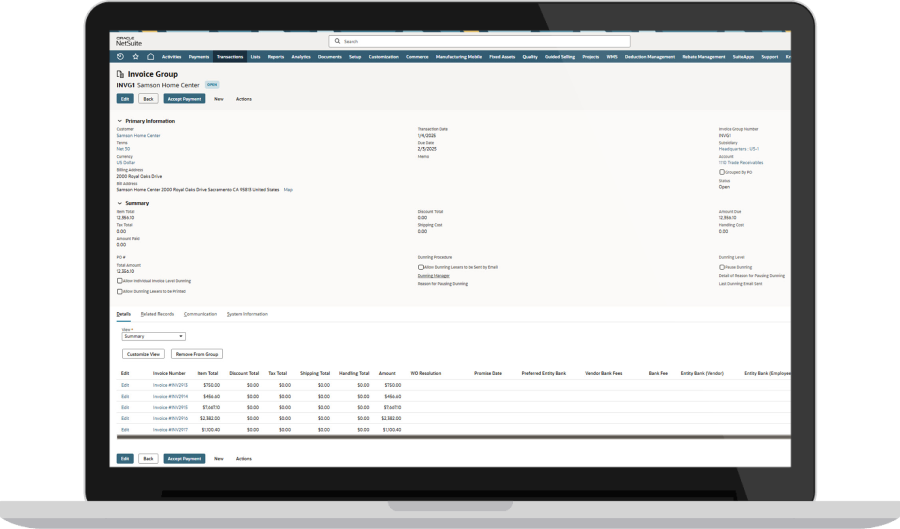

Invoice Grouping

Streamline the billing process with invoice grouping. When customers place multiple orders within a single billing period, NetSuite can consolidate multiple invoices into a single invoice. When payment is made, it is allocated to each order. Finance teams get faster billing and more efficient invoice processing. Customers pay once, increasing convenience while reducing days sales outstanding (DSO).

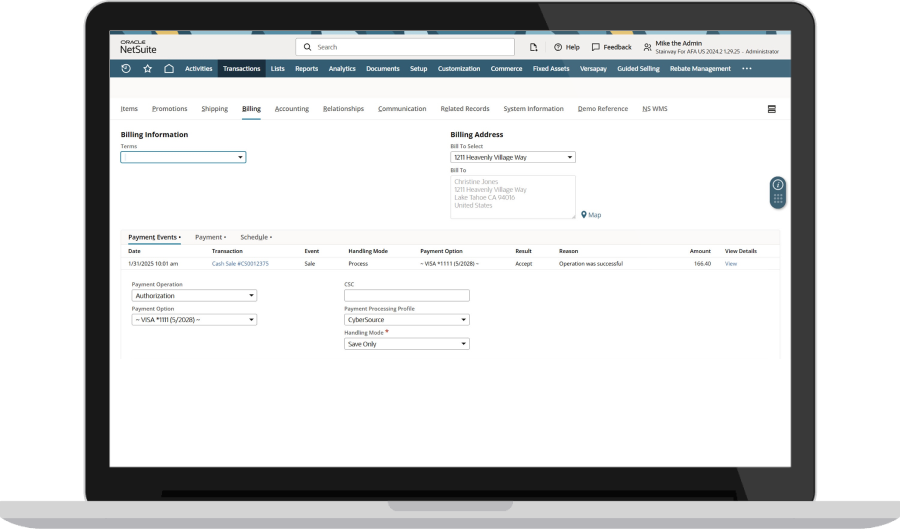

Payment Management

Accept payments via cash, credit card, check, bank transfer, electronic funds transfer (EFT) or another electronic format. Automatically match customer payments to open invoices, or apply a single payment to multiple bills. Track customer deposits against performance milestones for accurate billing, apply credits automatically and manage refunds with ease.

NetSuite Payment Link makes it easier for businesses to receive payment by including a “pay now” option on electronic and printed invoices.

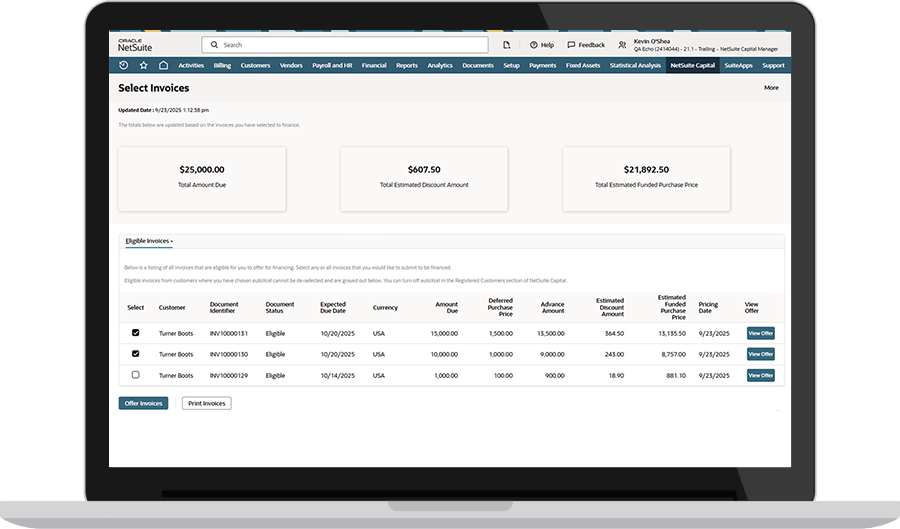

Working Capital

Accelerate invoice payments and convert receivables into immediate cash to lower DSO, stabilize liquidity, and keep operations and growth on track.

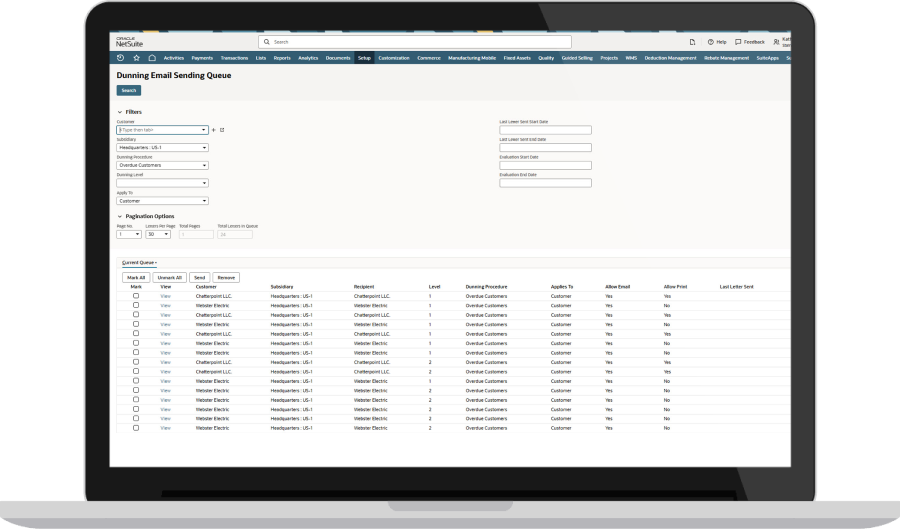

Dunning and Collections

Proactive, consistent customer outreach speeds accounts receivable collections. With NetSuite, companies can automatically send reminders in multiple languages and currencies before or after payment is due. Finance teams gain the flexibility to administer company policies while customizing communications to white-glove customers.

Reporting

Configurable AR reports, easy-to-use tools and custom segments allow for multidimensional analysis of receivables data. Report unpaid balances by region, salesperson, distributor or other criteria, and track payment history to identify customers that routinely pay late to improve collections forecasts.

Learn How ERP Can Streamline Your Business

Free Product Tour

Cutting out the manual time and energy that goes into the QuickBooks system has really saved us on payroll.

NetSuite Accounts Receivable Benefits

See How NetSuite Can Help You With Your Role

Business Guide

Business Guide

Challenges NetSuite Accounts Receivable Solves

How Much Does NetSuite Accounts Receivable Cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for initial setup. As your business grows, you can easily activate new modules and add users – that’s the beauty of cloud software.

Accounts receivable capabilities are included with the NetSuite platform license.

Contact NetSuite Now(opens in new tab)Resources

Data Sheets

Access specifications, features and benefits of the NetSuite accounts receivable solution.

Customer Stories

Spark ideas with success stories from NetSuite customers.

Product Demos

See NetSuite accounts receivable in action.

Guides & Blogs

Go deep into topics around NetSuite accounts receivable.

- Managing Accounts Receivable for Greater Liquidity (Blog)(opens in new tab)

- Accelerating the Order-to-Cash Cycle (Blog)(opens in new tab)

- Guide to Continuous Accounting (Guide)(opens in new tab)

- Looking Beyond QuickBooks (Paper)(opens in new tab)

- The CFO’s Guide to AR/AP Automation (Guide)(opens in new tab)

Essential Learning

Discover best practices and learn more about NetSuite Accounts Receivable from beginner to advanced levels.