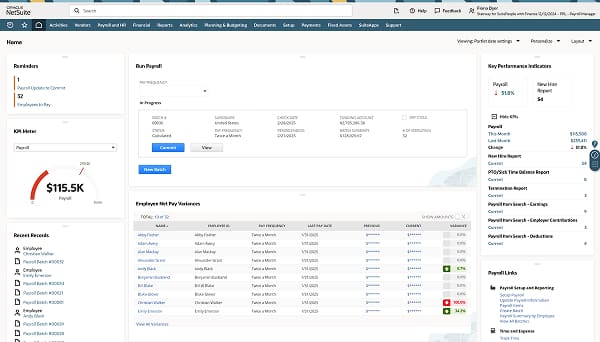

What is NetSuite Payroll?

NetSuite’s SuitePeople Payroll is a full-service payroll solution for employees in the United States that automates payroll processes, including calculating gross-to-net earnings, withholding mandatory taxes, deducting benefits and scheduling and issuing payments. Payroll batch previews help HR spot variances before payroll is run to reduce errors. Real-time general ledger (GL) postings keep GL accounts up-to-date and in balance. Finance leaders can drill down from payroll summary costs in financial reports to individual paychecks to gain insights and make more informed decisions.

Simplify payroll processes

Payroll and Financials

No more importing payroll data to your accounting software. Detailed payroll data is available, in real-time, in other NetSuite applications, including accounting, professional services automation, planning and budgeting and SuitePeople HR.

We can have payroll done in 10 minutes. Before it was over an hour. It's definitely changed my weekly payroll responsibilities.

Learn How ERP Can Streamline Your Business

Free Product Tour(opens in a new tab)

NetSuite Payroll Benefits

NetSuite Payroll Features

With dashboards, analytics, reports, self-service capabilities, up-to-date gross-to-net calculations and the ability to automatically update the general ledger in real time, NetSuite SuitePeople Payroll takes the pain out of running scheduled or off-cycle payrolls. Our customer success team — certified by the American Payroll Association — provides expert support and keeps you up-to-date on evolving payroll laws and regulations.

Pay Methods

Employees can set up direct deposits of their paychecks for up to 10 bank accounts and be paid with a check or have their earnings directly deposited into their accounts. And, employees can set up and edit their own bank account information for direct deposit.

Filing and Deposits

NetSuite automates deposits for federal, state and local taxes plus all quarterly and annual federal, state and local tax form filings. In addition to handling all tax filings and deposits, ACA forms 1095c and 1094c can be populated and provided to your employees. Prepare, print and file W-2 and 1099 MISC forms for employees and contractors at year’s end.

Flexible Payment Schedules

Pay hourly or salaried employees weekly, semi-monthly, monthly, annually and more. Run off-cycle payrolls whenever the need arises.

Employee Self Service

Employees can securely view and change their own information to keep their records up-to-date. The ability to view as many as five previous paychecks and their W-4 information and expense reports mean questions get answered fast — without help from HR. Additionally, employees can access digital W2 forms via the employee center.

Variable Pay

Include variable payments, like bonuses, commissions and other incentive compensation or expense payments, in paychecks. Flexible options allow you to include or exclude these variable payments in your payroll.

Dashboards and Reports

More than 100 standard reports and key performance indicators (KPIs) are included to customize, or build your own. Monitor payroll trends while comparing actual results to other periods. Dashboards break down payroll expenses by location, department or subsidiary. Authorized users can drill down from summary-level financial information, such as trial balance reports, to detailed payroll transactions for faster troubleshooting.

Challenges NetSuite Payroll Solves

SuiteSuccess – Your proven path to success

Leveraging more than 25 years of experience working with tens of thousands of organizations, across all industries and business sizes, our SuiteSuccess customer lifecycle methodology helps customers transform their business. It starts by building an AI-powered, integrated business suite with industry-specific solutions. Then we engage with your business to ensure that we’re addressing your specific needs and guiding you along the way on how to best consume and optimize NetSuite to solve challenges of today and the future. This approach helps ensure customers experience faster time-to-value, better ROI, and greater employee adoption.

Learn more

How Much Does NetSuite Payroll Cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for initial setup. As your business grows, you can easily activate new modules and add users – that’s the beauty of cloud software.

NetSuite SuitePeople Payroll is available as an add-on module.

Contact NetSuite Now(opens in new tab)Resources

Data Sheets

Access specifications, features and benefits of NetSuite SuitePeople Payroll.

Customer Stories

Spark ideas with success stories from NetSuite customers.

Product Demos

See NetSuite SuitePeople Payroll in action.

NetSuite Webinars

View our on-demand webinars, which deliver insights from NetSuite and industry experts.

Guides & Blogs

Go deep into topics around NetSuite SuitePeople Payroll.

- How Professional Services Organizations Can Simplify Billing and Payroll With NetSuite (Guide)(opens in a new tab)

- A Buyer’s Guide to Payroll Software (Guide)(opens in a new tab)

- Stop Payroll Pains Before They Start (Blog)

- 5 Payroll Problems Too Many Companies Ignore–and How to Overcome Them (Guide)(opens in a new tab)

Essential Learning

Discover best practices and learn more about payroll from beginner to advanced levels.

- How to Manage Payroll for a Small Business (Article)

- Small Business Payroll Tax Credits: 13 Credits Every Business Owner Should Know (Article)

- Understanding the Costs Behind Small-Business Payroll (Article)

- 16 Top Payroll Challenges for Small Businesses and How to Solve Them (Article)

- Small Business Payroll: From Expenses to Deductions and Reporting—Everything You Need to Know (Article)