What is NetSuite Account Reconciliation Software?

NetSuite Account Reconciliation software automates general ledger reconciliations—including bank, credit card, intercompany, AR/AP, and invoice-to-PO matching—in one centralized workspace. With embedded AI that streamlines reconciliation setup, enhances transaction matching, and automatically drafts flux explanations, teams eliminate manual effort and focus on high-risk items and strategic work.

Close faster by automating account reconciliations and transaction matching

Automate and Standardize Your Reconciliation Process

Eliminate time spent downloading data from source systems, aggregating details in spreadsheets, manually reviewing account balances, and using complex formulas to match and reconcile.

Learn How ERP Lets You Manage Your Business Better

Free Product Tour

With NetSuite Account Reconciliation, we will no longer have to do manual balance sheet recons in Excel which often cause delays, errors and headaches in our close process.

NetSuite Account Reconciliation Software Benefits

NetSuite Account Reconciliation Software Features

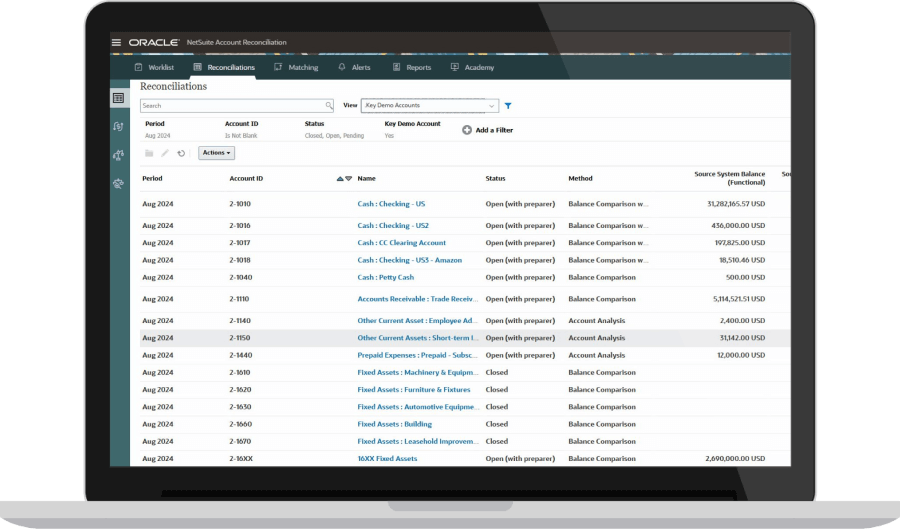

Work directly with NetSuite general ledger (GL) entries to automatically match transactions and reconcile line items, with AI-driven assistance that automates setup and improves match accuracy.

Reconciliation Compliance

Ensure accounts are properly reconciled using the correct format, with complete justification and clear logic behind any adjustments. Keep teams on track with approval workflows that capture evidence of signoffs and send automated notifications.

- AI-assisted reconciliation setup. The AI assistant automates this setup by identifying newly created accounts, assigning them to the appropriate preparers, applying the correct formats and attributes, and continuously learning from prior cycles to streamline future periods.

- Automated reconciliations. Direct integration with NetSuite transactions further automates reconciliations for bank, credit card, intercompany, AP, AR, and similar accounts.

- Flexible formats and templates. Start quickly with prebuilt, best-practice reconciliation formats or create custom templates tailored to your organization’s requirements.

- Audit support and compliance. A secure document repository ensures reconciliations and supporting evidence are never altered or lost, providing global auditability and a complete, time-stamped audit trail.

- Flux analysis. Identify and explain balance changes across any period—month-over-month, quarter-over-quarter, or year-over-year—with built-in flux analysis.

Transaction Matching

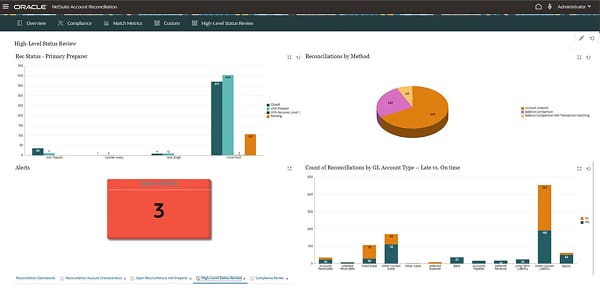

Automate high-volume transaction matching to support balance comparison reconciliation processes, including intercompany, subledger, credit card, and bank reconciliations. Operational and compliance dashboards show which reconciliations are complete, open, or late and list the responsible party, variance details, and commentary.

- AI-powered matching assistance. The AI-powered matching assistant supplements rules with machine learning that uncovers hidden relationships, suggests likely matches with predictive confidence scoring, and improves accuracy over time as it learns from approved matches.

- High-volume transactional reconciliations. The auto-match engine processes millions of transactions in minutes and integrates directly with period-end reconciliations.

- Matching rules. Create flexible rules for individual or grouped transactions—one-to-one, many-to-one, and many-to-many to automate structured matching scenarios.

- Complex reconciliations. Unlimited data sources and unlimited attributes per source can be configured to support even the most complex reconciliation needs.

Task Management

Close your books faster and with more accuracy by managing and monitoring every aspect of the close process.

- Schedule. Assign tasks and ensure they are executed in the proper sequence.

- Monitor. Access the status of every close task and its dependencies from a single dashboard, with the ability to drill down by user to identify any potential bottlenecks.

- Workflow. Prebuilt customizable workflows simplify the close process, automating tasks such as task assignments, data validation, approval routing, and notifications.

- Automated Calendars. Calendars automatically roll forward from the prior-year reporting, eliminating the need for manual adjustments.

Challenges NetSuite Account Reconciliation Software Solves

How Much Does NetSuite Account Reconciliation Cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual license fee. Your license is made up of three main components: core platform, optional modules and the number of users. There is also a one-time implementation fee for initial setup. As your business grows, you can easily activate new modules and add users – that’s the beauty of cloud software.

NetSuite Account Reconciliation software is available as an add-on module.

Contact NetSuite Now(opens in new tab)Resources

Data Sheets

Access specifications, features, and benefits of NetSuite Account Reconciliation.

Customer Stories

Spark ideas with success stories from NetSuite customers.

Product Demos

See NetSuite Account Reconciliation in action.

Webinars

View our on-demand webinars, which deliver insights from NetSuite and industry experts.

Guides & Blogs

Go deep into topics around account reconciliation.

Essential Insights

Discover best practices and learn more about account reconciliation from beginner to advanced levels.