Paying employees and contractors accurately and on time is a critical task for any small business. But it’s also a time-consuming and detail-oriented job—and errors can have serious consequences, including tax penalties. In fact, poor tax compliance is a top small-business financial challenge that can end up costing big bucks.

While you may not be able to dedicate a team to managing payroll, that doesn’t mean you’re on your own. Many small firms have found success with online services that handle a variety of payroll tasks, such as calculating wages and taxes and paying employees by direct deposit or check, for a monthly fee.

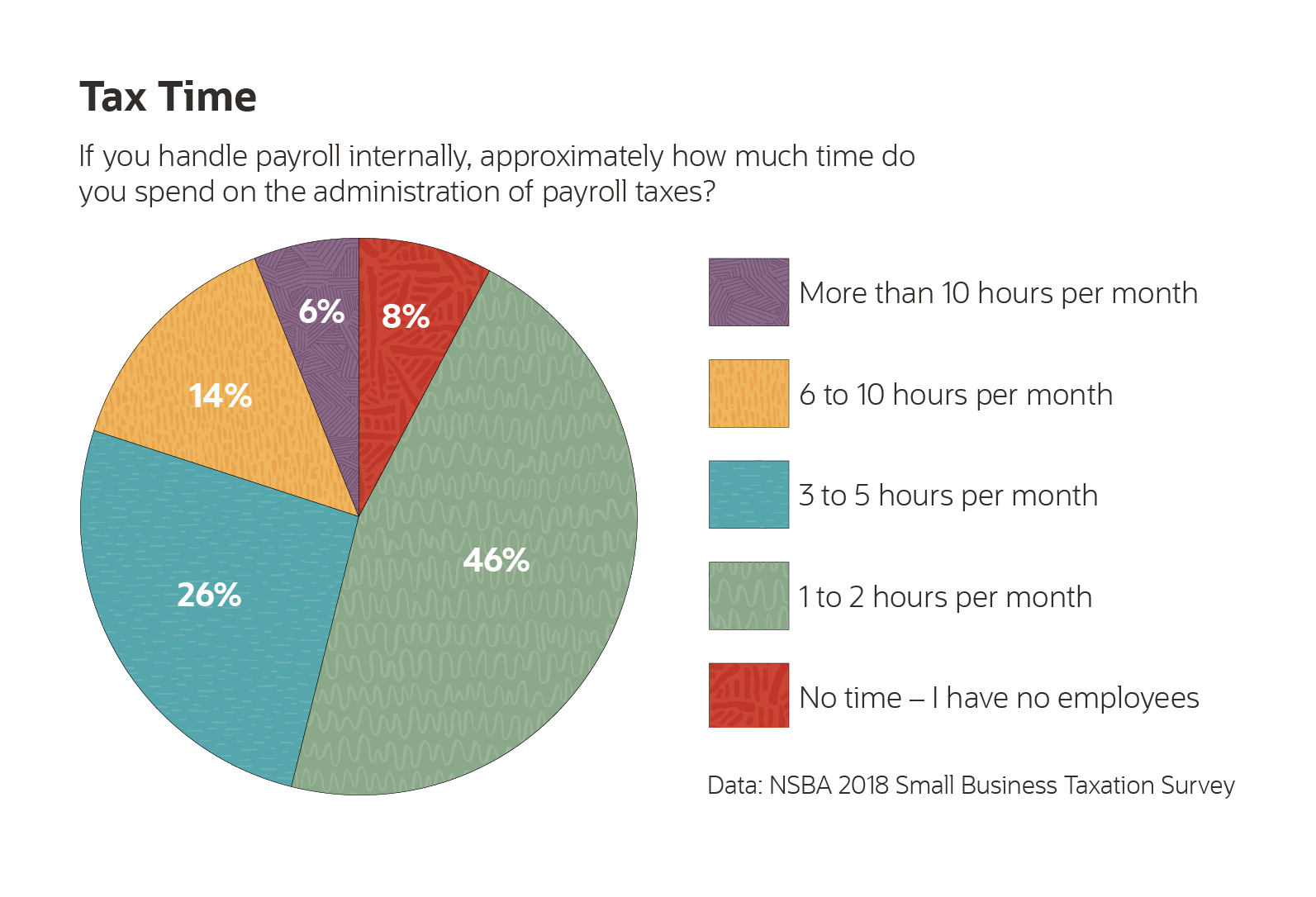

In the National Small Business Association’s 2018 Small Business Taxation Survey, 45% of small businesses use payroll services, and 42% spend between $101 and $500 per month. Twenty-three percent spend more than $500.

Here’s a rundown of these software-based services, some factors that will influence what you pay and suggestions for getting the most value from your provider.

What Is the Average Cost to Outsource Payroll?

The cost of using a software-based payroll service varies widely, in part because these providers often offer several service tiers.

A starter-level small-business payroll package may be very inexpensive, starting at roughly $20 per month plus a per-employee fee. These packages offer basic functions, such as calculating wages and depositing payments directly into employees’ bank accounts. They also typically calculate local, state and federal taxes and file relevant forms. Some services enable employees to access their financial information online from a browser or a mobile app.

Higher-level tiers may include access to human-resources information and specialists, for a base fee that’s typically several times the cost of the entry-level service. HR support can range from a knowledge base with standard forms and templates, such as for employee handbooks, to access to HR advisers for one-on-one consultations. This saves small businesses the expense of hiring a specialist, and potentially adding an HR management system, by providing expertise on an as-needed basis.

Factors That Affect the Cost of Payroll

Other factors that can affect small-business payroll costs include your company’s pay frequency, total number of employees, how many use direct deposit, whether you have teams dispersed across multiple states and the complexity of your local, state and federal taxes.

Payroll frequency

Some payroll services charge based on each payroll run, while others include an unlimited number of payroll runs per month, including off-cycle runs. If a service charges per payroll run, be mindful that while employees generally prefer a weekly paycheck, the more frequently you pay your employees, the more it may cost.

Payroll frequency can have less-obvious cost implications for your business and its employees as well. For example, if your payroll service provider charges by the run, paying monthly may be the least expensive option for the company—but it may not be legal in your state, or for some classes of workers.

Paying semi-monthly—on a fixed date each month, such as the 15th and 30th —can be more complicated to administer because each pay period has a different number of days and will often end in the middle of a workweek.

Total number of employees on payroll

Payroll processing services typically charge a per-employee monthly fee in addition to the basic subscription cost. The per-employee fee can range from $2 to $15 per employee per payroll run or per month. The per-employee cost may be greater for smaller companies because larger firms often qualify for volume discounts from providers.

Direct deposit

In general, fees for payroll services include direct deposit to employees’ bank accounts. Direct deposit eliminates the potential cost of replacing paper checks that get lost in the mail and ensures that employees’ pay always reaches their bank accounts on a specific date, even if they’re traveling on business or on vacation.

Using a payroll service that includes direct deposit can also save money compared with the cost of managing your own payroll and setting up direct deposit with your bank. According to the National Federation of Independent Business, direct deposit setup fees range from $50 to $149, depending on factors such as the size of the employer and the type of bank account. In addition, banks may impose a flat fee for each pay period plus a charge for each employee payment.

Dispersed teams across states

Payroll processing may cost more if you have employees in multiple states simply because the accounting is more complicated. In fact, having workers in multiple tax jurisdictions may have major implications beyond just payroll.

If you have a geographically dispersed workforce, ask the provider about support before subscribing because some basic packages won’t be able to provide the nuanced insights needed when employees are residents of different states. Generally, local and state taxes are withheld for the state where the employee performed the work, and your business must register with each state revenue agency. For example, say you have employees who live in Connecticut and work full-time at your business in New York. You would withhold New York taxes. But if that employee works full time at your Connecticut facility, you’d withhold Connecticut taxes.

If another employee lives and works remotely from a tax-free state, no tax would be collected.

Any additional tax services

Employers have to contribute local, state and federal taxes for employees on their payrolls. For all permanent employees, businesses must pay the employer’s share of Social Security and Medicare taxes, which together add up to 7.65% of wages. Employers are also responsible for paying into Federal and state unemployment taxes, which vary by state.

Other Potential Payroll Fees

Depending on the service tier and provider you choose, there may be additional fees to cover functions such as:

Employee benefits: Some payroll providers offer additional employee benefits, either in basic packages or in higher tiers. For example, they may automatically calculate, deduct and pay for workers compensation insurance. Some companies also partner with external providers to offer medical, dental and vision insurance. Note that you still need to pay close attention to spending on worker’s comp and healthcare because these are two areas experts say many small businesses overpay.

Adding or dropping employees: Because there’s a cost of adding your employee and business tax data to the system, some providers charge a fee when you add or remove employees from your payroll.

Direct deposit: Direct deposit fees aren’t always included in payroll service providers, which can add on to costs.

User-based security: A configurable security model will let you grant specific users access to selected functions and information based on their roles in the company. For example, a hiring manager should be able to review pay rates for all employees. Some providers charge extra for this functionality.

Employee self-service: Employee self-service functionality allow employees to make changes to elective deductions, direct deposit accounts and tax withholdings and retrieve copies of earning statements without HR assistance—but some providers charge extra for this feature.

Printing and mailing checks: Though direct deposit is the preferred method for most payroll services, some employers and employees still prefer paper checks. Payroll services generally enable companies to print their own checks on standard templates, but if you want the service to print and mail checks for you, delivery charges may apply.

A Third Option: Payroll Cards

Employees who prefer paper checks because they lack bank accounts now have another option: Reloadable payroll debit cards that are automatically funded each pay period.

Pros |

Cons |

|||

|---|---|---|---|---|

|

Security and convenience: Employees no longer need to worry about checks being lost in the mail or getting to a bank during business hours. Cards have unique PINs for each employee. Lost cards can be deactivated and replaced with a phone call. Savings: Employers avoid the cost of printing and mailing checks, while unbanked employees avoid check-cashing fees. Wide acceptance: These cards are issued by Visa and MasterCard, meaning they’re usable anywhere credit cards are accepted and carry the same FDIC insurance and fraud protection. Employees may also withdraw their pay from an ATM. |

Fees: Potential added costs that can eat into wages include inactivity, ATM and overdraft fees. Employers should investigate the card issuer’s fee structure and educate employees on how to avoid charges. Regulations: Some states regulate the use of payroll cards, including placing limits on what fees may be imposed. The National Council of State Legislatures has a guide to state and federal laws. Pay stubs: Employers must still ensure workers have access to their pay statements, so work with your service provider to decide the best way to provide stubs—after all, printing and mailing paper eliminates much of the convenience and security upside of the card. |

|||

W-2 and 1099 processing: Some services charge extra for completing and filing year-end tax forms for your workers—W-2 forms for employees and 1099 forms for independent contractors. However, that fee may be well worth it for some companies that lack in-house or contract bookkeepers.

How Is It Different When Payroll is Done in House or Via Software?

It’s possible for small businesses to handle payroll themselves instead of using a software-based service, especially if they have only a handful of employees. However, that requires a considerable amount of work and knowledge, both to set up the process and to run it on an ongoing basis. In addition, someone must continually track changing tax laws.

Businesses that lack in-house financial expertise may consider enlisting the services of a bookkeeper or certified public accountant (CPA). A bookkeeper will have the most affordable rates; you will generally pay much more for a CPA who can offer tax planning services, maintain financial records and provide business consulting advice.

Regardless of whether you hire an accountant, someone within the company will have responsibility for managing payroll duties, so factor in the cost of that person’s time when deciding whether to manage payroll manually or use a service. Tasks involved in handling payroll include calculating wages, deductions and tax withholding amounts; creating Federal, state and local tax forms; setting up direct deposit; and paying the employer’s share of payroll taxes.

Saving Money and Time with Payroll Automation Software

For many small businesses, it’s more efficient to use a software service to automate payroll rather than tackle the time-consuming chore of managing payroll calculations in-house or paying an accountant to do it.

Payroll automation frees you and your staff to focus on growing the business. Automation also reduces the likelihood of errors due to manual input and calculations, which can have costly implications. For example, payroll automation can make sure you’re paying your federal and local taxes correctly—that alone can be enormously complex, because there are thousands of U.S. tax jurisdictions. For example, small businesses with gross receipts of $5 million or less can face penalties of more than $1 million for unintentionally failing to file W-2 or 1099 forms.

Some payroll services also save businesses money by including access to HR information and specialists within the monthly fee.

When it comes to timesheet management software, you need to make it simple and easy for employees to enter hours worked and supporting timesheet information. The more manageable the process, the more likely timesheets will be accurate and entered on time.