Companies that take payroll for granted may end up spending too much, alienating employees, and even getting hit with hefty fines or lawsuits. While there are a lot of moving pieces—timekeeping, releasing funds to your financial institution, remitting taxes, managing benefits and other deductions—companies with formalized processes in place will find it easier and more cost-effective to pay workers properly and on time.

What Is Payroll?

The word “payroll” can mean several things, all related to employees and their pay. This article will focus on the processes involved in paying employees for their work. These payroll-related tasks include tracking hours, calculating wages, paying and withholding taxes, managing deductions and benefit contributions, and then getting accurate checks or direct deposits to employees on time.

In midsize and large companies, responsibility for payroll typically belongs to the finance or human resources department. In smaller firms, an accountant or even the owner may be in charge of the process. Regardless of company size, payroll can be challenging because salaries, tax withholding, and benefit profiles must be individualized for each staff member. In addition, the company must accurately withhold income and other taxes from each check and pay it to the relevant local, state, or federal government.

Key Takeaways

- Payroll is one of the most important aspects of running a business. It’s also one of a company’s largest expenses.

- Errors in payments, whether to employees or the government, can have costly consequences. Software can help automate the process.

- Payroll responsibilities involve more than issuing paychecks. They include withholding income and other taxes, deducting for employee benefits, and issuing payments on time.

Payroll Explained

The employee payroll process typically starts when a new hire fills out a W-4 form, which determines how much tax will be withheld. Then, for each pay period, the company calculates how much is owed to each employee—a complicated process because tax withholding and other deductions, such as benefits, may be different for each worker.

The company then determines if it’s eligible for any payroll tax credits and remits the withheld employee taxes to federal, state, and local authorities as appropriate, along with the employer’s share of taxes, and issues a check or direct deposit for the amount due the worker.

What Are Payroll Taxes?

Payroll taxes are taxes imposed on wages to fund government programs. Each pay period, they’re withheld from workers’ paychecks to cover employee contributions to federal income taxes, Social Security taxes, and Medicare taxes—collectively known as FICA (short for the Federal Insurance Contributions Act). Both employers and employees pay payroll taxes. For Social Security and Medicare, employers match the amount withheld from employees’ wages to effectively double the contribution.

In addition to contributing to FICA, employers are solely responsible for paying FUTA (Federal Unemployment Tax Act) taxes. These funds are used by state agencies to pay unemployment benefits to eligible workers. Employers that operate in California, Hawaii, New Jersey, New York, and Rhode Island must also pay disability insurance taxes.

What Are Payroll Deductions?

A payroll deduction is any amount subtracted from an employee’s gross pay—such as payroll taxes—thereby reducing net pay. Deductions fall into two categories: mandatory and voluntary. Mandatory payroll deductions are required by law and include:

- Federal income tax: Withholding is based on IRS guidelines and information provided on an employee’s W-4 form.

- State income taxes: Applicable in states that impose income taxes; rates and rules vary by state.

- Local taxes: These may include city, county, or school district taxes, depending on the employee’s location.

- Social Security tax: Withheld at a rate of 6.2% on wages up to the annual limit ($176,100 for 2025).

- Medicare tax: Withheld at 1.45%, plus an additional 0.9% on wages over $200,000.

If relevant, court-ordered garnishments, such as child support payments, are also compulsory.

Voluntary deductions, meanwhile, are elected by the employee. These can include contributions to retirement plans, health insurance premiums, or life insurance.

How Does Payroll Work?

If you pay employees, you need a process to manage payroll. What does that entail? The details vary, but essentially, an implementation plan consists of three main stages: The company gathers information from each employee, calculates pay and deductions each period, and files and pays the worker and governments as required:

Step 1: Gather information: The company collects a W-4 form for employees or a W-9 form for independent contractors as well as state withholding certificates as required; a Form I-9 (to verify employment eligibility); bank information (for direct deposit); and any forms related to medical insurance and retirement benefits. Every company with employees also needs to apply for a federal Employer Identification Number (EIN), which can be obtained online from the IRS.

Step 2: Pay employees: For each pay period, the company calculates each employee’s gross wages and deductions, such as tax withholding, health insurance, and/or retirement plan contributions. The result, net pay, is then delivered to an employee on payday, either electronically or by check.

Step 3: Remit payroll taxes: The business pays the withheld employee taxes as well as its own share of payroll taxes to the IRS and appropriate local authorities. It also keeps records in compliance with IRS and Department of Labor rules and reports taxes per federal, state, and local requirements.

What Is Payroll Frequency?

Businesses can choose how often they pay employees. Options include:

- Weekly (52 paychecks per year): Employees are paid once a week, typically on the same day. This option offers consistent cash flow for workers, but the cost can quickly add up for businesses. Payroll costs include fees paid to software or service providers, banking charges for direct deposits, and any mailing costs.

- Biweekly (26 paychecks per year): Employees are paid every other week on the same day. This is the most common pay frequency according to the U.S. Bureau of Labor Statistics. It’s the sweet spot for many businesses—cost-effective, simple to administer, and reasonably consistent cash flow for employees.

- Semi-monthly (24 paychecks per year): Employees are paid twice a month on fixed dates, such as the 15th and last day of the month. This schedule may be more difficult to administer because each pay period has a different number of days.

- Monthly (12 paychecks per year): Employees receive one paycheck per month. While simple to process, this option can cause cash-flow problems for employees.

Note that some states set a minimum permitted frequency; you can find payday requirements for each state (opens in new tab) on the Department of Labor website. If employees work in different states, an employer will need to align with the relevant state law for each employee.

5 Employer Payroll Responsibilities

Employers are generally responsible for ensuring that payroll calculations are correct and that employees are paid in a timely way. This includes accurately calculating tax withholding and benefit contributions, and filing and paying federal, state, and local taxes. Here are five key employer responsibilities:

- Accurately calculate taxes. Employers must calculate their share of federal and any applicable state and local taxes. In addition, they must account for FICA taxes and FUTA taxes. Employers are responsible for calculating and withholding employee income taxes based on the employee’s W-4 and state withholding forms.

- Deduct employment tax. Each pay period, employers are required to deduct tax and any voluntary deductions from employees’ wages.

- Deposit employee and employer taxes using the Electronic Federal Tax Payment System (EFTPS). Employers need to enroll in EFTPS, a system set up so taxpayers can make tax payments and deposit withholdings promptly. Otherwise, an employer could face significant penalties.

- Keep payroll records. This should include worked hours, wages, tax expenditures, and receipts of the funds used to pay the taxes.

- Provide employees with payment summaries. This includes the annual rundown of earnings and taxes that workers need to file their own tax returns.

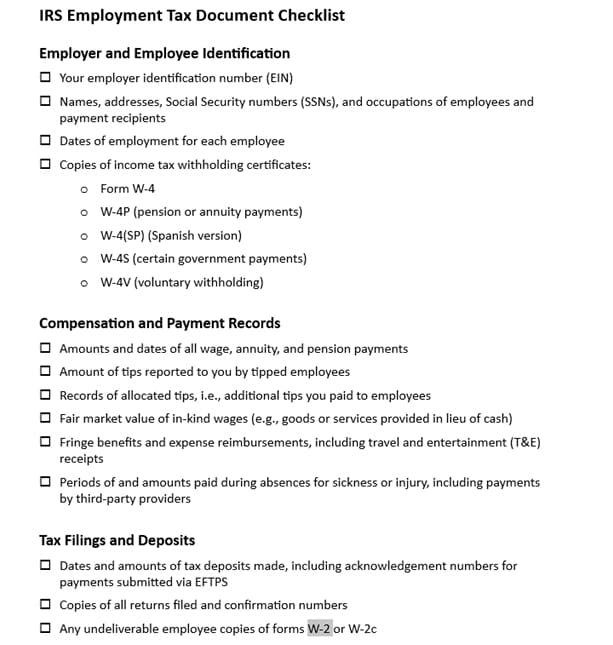

IRS Employment Tax Documents Checklist

Here’s a handy, downloadable checklist (opens in new tab) for employers to follow when submitting employee payroll deductions to the IRS:

Payroll Processing Methods

Businesses have several options to run payroll. Small companies often start by managing payroll manually. But as they grow and that task takes correspondingly more time, it generally makes more financial sense to automate the process using payroll software or an outsourced service. Automating payroll is key to simplifying payroll, cutting the time and effort required and reduce errors.

Let’s look at the three main options:

- In-house, manual: Companies calculate employees’ pay using spreadsheets and/or online payroll calculators, which determine tax withholding and other deductions. This process can easily become complex given that employees have different salaries and tax withholding preferences. This approach is also vulnerable to human error, mainly because of its complexity. A staff member must closely track changes to tax and labor regulations to ensure employees’ pay is correctly calculated. Manually running payroll is also the slowest and most labor-intensive method, partly because of the paper trail that must be maintained to protect a company in the event of an audit.

- Outsource: Businesses can hire an external payroll company or an accountant to handle payroll. Outsourcing often means a hands-off process for a business after the initial payroll setup, although certain information, such as employee time cards, must be provided if the payroll company doesn’t offer a time-tracking app or another way to track hours. The provider handles all payroll calculations and distributes paychecks. The outsourcing provider is also responsible for compliance with tax and labor laws, so an employer is not held liable for penalties if paychecks or tax filings are incorrect.

- Software: Software solutions provide freedom from some of the more grueling aspects of running payroll while allowing an employer to retain control over the process. A good payroll software solution stays current with legal requirements in every jurisdiction and saves customers time by performing tasks such as automated calculation of earnings and deductions, real-time payroll review and editing, payroll tax filings, and distribution of end-of-year tax forms.

How to Process Payroll

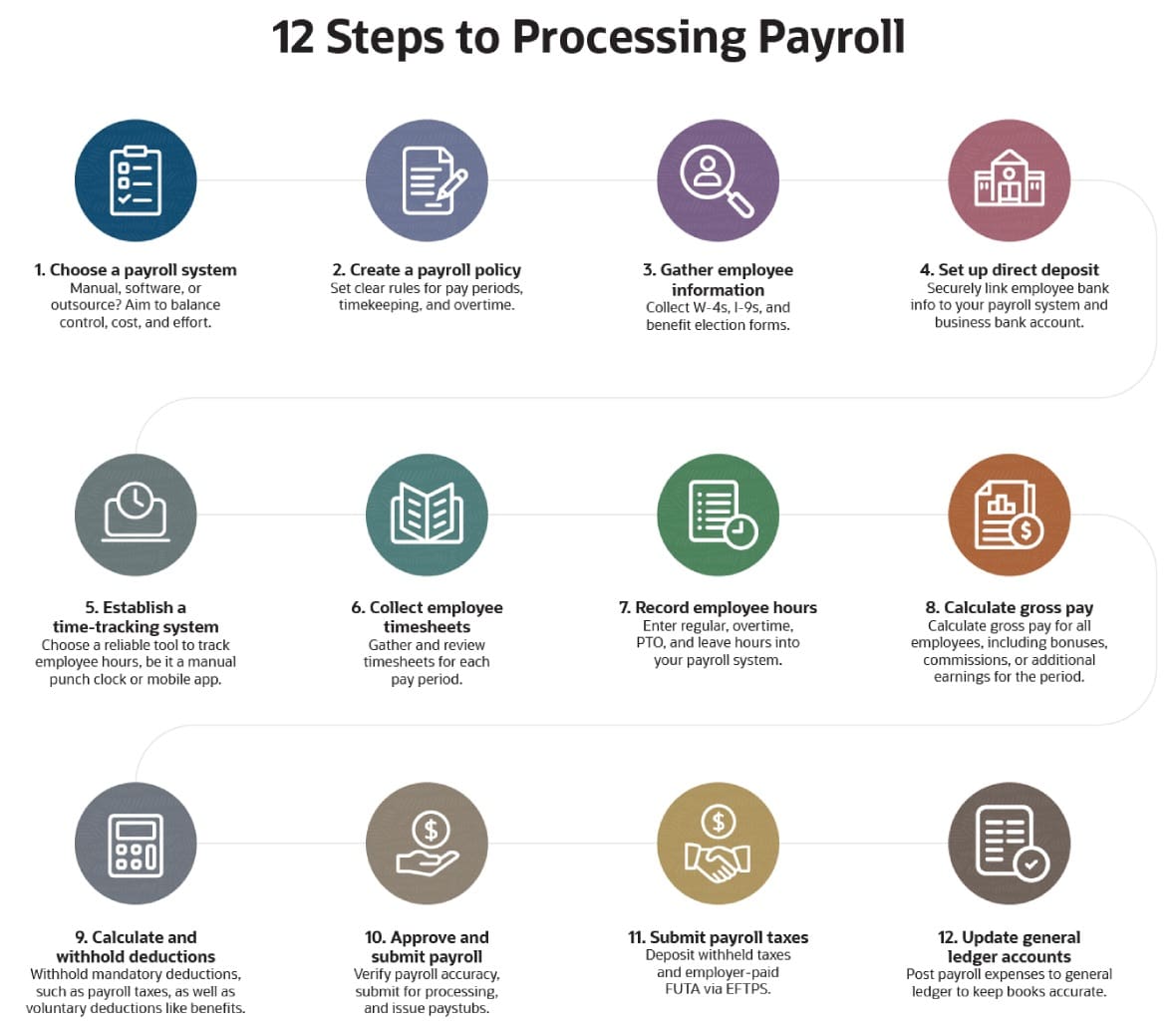

Once you’ve collected the required documents, set a payroll cadence, and determined how you’ll manage the process, there are 12 steps to processing payroll.

-

Choose a Payroll System

Decide whether you’ll process payroll manually, use software, or outsource to a payroll provider. Consider the size of your team, your budget, and compliance needs. Each option has trade-offs in terms of control, cost, and effort. Manual offers control but is time-consuming; software balances cost and effort; outsourcing saves time but costs more and limits flexibility.

-

Create a Payroll Policy

Draft a formal payroll policy that outlines how and when employees are paid, timekeeping expectations, overtime rules, and how issues like forgetting to clock in are handled. Share it with employees so expectations are clear from day one.

-

Gather Employee Information

Collect all necessary employee documents, including tax forms (e.g., W-4s), I-9s, and any benefit election forms. Keep this information secure and up to date to avoid paycheck errors and maintain compliance.

-

Set Up Direct Deposit

Direct deposit is faster and more secure than issuing paper checks. Work with your bank or payroll provider to connect employee bank accounts to your business bank account and payroll system. You’ll need each employee’s bank name, account number, and routing number.

-

Establish a Time-Tracking System

For hourly employees, choose a reliable method to track hours worked—whether it’s a manual punch clock, a digital time clock, or a mobile app connected to payroll software. The system should be easy to use and reliable enough to support accurate pay and labor law compliance.

-

Collect Employee Timesheets

At the end of each pay period, gather and review all timesheets for completeness and accuracy. Missing or incorrect timesheets can delay payroll and cause compliance issues.

-

Record Employee Hours

Log employee hours worked in your payroll system, making sure to include regular time, overtime, paid time off, and any unpaid leave. Accuracy here ensures employees are paid correctly and legal requirements are met.

-

Calculate Gross Pay

For hourly employees, multiply their hourly rate by the total hours worked in a given pay period. Overtime hours generally must be paid at time-and-a-half. For salaried employees, gross pay is calculated as the year’s salary divided by the number of pay periods. Include any bonuses, commissions, or additional earnings due that period.

-

Calculate and Withhold Deductions

Calculate and withhold mandatory federal, state, local, Medicare, and Social Security taxes. Factor in any voluntary deductions, such as 401(k) contributions or health insurance premiums. Double check calculations to avoid penalties and payroll disputes. Remember: While FUTA is typically calculated at this stage, it’s not deducted from employee pay and is instead paid separately by the employer.

-

Approve and Submit Payroll

Review payroll for accuracy, approve it, and submit it for processing. Employees should receive their net pay, along with a pay stub that breaks down gross pay, deductions, and net pay. Thorough, accurate recordkeeping is a must here. As mandated by the Fair Labor Standards Act, businesses must be able to supply payroll records within 72 hours to the Department of Labor upon request.

-

Submit Payroll Taxes

Submit withheld federal income taxes, FICA (Social Security and Medicare), and the employer-paid portion of payroll taxes—including FUTA—using EFTPS. Your deposit schedule is determined by your “lookback period,” which is usually the previous four quarters. If you owed $50,000 or less in your lookback period, you deposit monthly. If you reported more than $50,000, you deposit semiweekly (not literally twice per week, but rather based on when your payday falls). FUTA taxes are deposited quarterly if your liability exceeds $500 for the quarter. Missing deadlines can result in IRS penalties.

-

Update General Ledger Accounts

Since payroll is one of the largest expenses for a company, it’s important to update your general ledger accounts after each pay period to keep financial reports accurate and up-to-date. Accurate payroll accounting and reconciliation support financial reporting, budgeting, tax preparation, and compliance.

Essential Payroll System Components

Whether you pay employees manually or by using an outsourcing service or software, you’ll need to create a system for managing payroll. For example, you generally need a point person within the company who’s responsible for payroll, and you need to define payroll policies and communicate them to employees.

Typical components of a company’s payroll system include:

- Payroll manager: A dedicated point of contact can help payroll run smoothly. The payroll manager is responsible for issuing paychecks and/or electronic transfers to bank accounts; summarizing earnings, taxes, deductions, leave, disability, and nontaxable wages; and balancing payroll accounts.

- Payroll policy: The policy should include information on paycheck frequency, timesheet submission, over/underpayments, mandatory deductions, and benefits. This helps to set expectations for employees and resolve problems.

- Payroll processing method: You’ll need to decide whether to run payroll manually or use software or an outsourcing service and figure out other day-to day aspects of payroll processing, such as how you’ll track employee time.

- Payroll register: A payroll register is an accounting summary of employee earnings and deductions for each pay period. It includes hours worked, gross pay, net pay, deductions, and payroll date. It maintains a record of payroll expenses and helps the company analyze costs.

How Is Payroll Calculated?

An employee’s pay is calculated each pay period in a series of steps that start by calculating gross pay and end up with the amount employees see in their paychecks:

- Determine an employee’s gross pay: Multiply their hourly rate by the total hours worked in the pay period, plus overtime. For salaried workers, gross pay for each pay period is calculated by dividing yearly salary by the number of pay periods in a year. If someone earns an annual salary of $104,000 and is paid weekly, the gross pay for each pay period is $2,000 ($104,000 / 52 = $2,000).

- Figure federal income taxes: Employees are taxed individually at rates based on their incomes and withholding allowances.

-

Calculate FICA taxes: Multiply each employee’s gross pay for the pay period by 6.2%, which is the worker’s portion of the Social Security tax liability, to calculate their contribution. In the example above, the employee would pay $124 per paycheck for Social Security taxes ($2,000 x .062 = $124).

FICA taxes = Gross pay for pay period x 6.2%

Note that the Social Security tax liability is based on a taxable wage base of $176,100 for 2025; employees who make more than that are taxed for only the first $176,100 earned annually. In addition, FICA taxes are a shared liability between employer and employee. That means an employer has to match the amount an employee remits to the government.

For the Medicare portion of FICA, multiply the employee’s gross pay for the pay period by 1.45%, which is their portion of the Medicare tax liability. In our example, the employee’s Medicare tax liability for each weekly pay period is $29 ($2,000 x .0145 = $29).

Medicare tax = Gross pay for pay period x 1.45%

The total FICA contribution is the sum of Social Security and Medicare, or $153 in our example.

FICA contribution = Social Security + Medicare

- Compute any applicable state or local taxes: Payroll tax laws and tax rates differ from state to state, so verify with relevant state and local government agencies to accurately determine necessary taxes. If some employees went from working in an office to working from home, potentially in a different state from your headquarters, those remote workers could create an economic nexus—and unanticipated filing responsibilities for the business.

- Calculate other deductions. Calculate voluntary deductions, such as contributions to retirement funds and medical insurance, plus any involuntary deductions, such as court-ordered garnishment of wages.

Subtracting the amounts calculated in these steps yields the employee’s net pay, also referred to as take-home pay.

7 Payroll Best Practices

Employees and the government expect to be paid accurately and on time. Failure to meet those responsibilities can result in significant penalties, lawsuits, low employee morale, and reputational damage. Here are seven ways to help ensure that payroll rolls smoothly:

- Adopt up-to-date payroll management software: Payroll management software can improve payroll efficiency. By automating processes and connecting accounting and HR information, payroll solutions can save time and prevent costly mistakes.

- Check employee classifications: Incorrectly classifying employees as independent contractors can lead to fines and potentially other problems, such as employee lawsuits. Employees may be entitled to company benefits and unemployment compensation, while contractors generally are not. There are also tax liability differences; for example, you need to withhold income and FICA tax contributions for employees, but not for contractors. For employees, you also need to pay the employer’s share of FICA and other applicable taxes. So be sure you understand and comply with up-to-date classification guidelines.

- Maintain a calendar of important tax dates and deadlines: This information should be shared with the payroll team, too. Missing a deadline could result in penalties.

- Maintain a policy and procedures document: Create a payroll policy if you don’t have one, and update it at least annually if you do. Store it online where it’s accessible to workers and direct them to your policy for questions about pay periods, tax forms, deductions, and personal time off. Keep downloadable copies of important forms online as well.

- Promote direct deposit: Paper checks cost money to print and mail. Encourage staff to enroll in direct deposit. This also ensures that employees’ pay is available in their bank accounts on payday and eliminates the possibility of checks being lost or stolen and the cost of putting a stop and reissuing a check.

- Keep open lines of communication with staff: Employees should feel comfortable about sharing any payroll-related problems with their employers so that possible issues can be addressed. Encouraging input in shaping payroll policies may boost employee morale.

- Distribute the payroll workload: Delegating payroll tasks, such as calculating payable hours, commissions, bonuses, taxes, and deductions, among staff can help ease the load. With training, even employees outside the payroll department can take on non-core tasks, such as collecting forms during the onboarding process, thus freeing up payroll experts to focus on more time-intensive tasks. Consider adopting payroll self-service applications so employees can securely keep critical payroll information, like addresses, up to date.

Automate Your Payroll Process With NetSuite

Payroll can be a complicated and laborious process, but it’s also one of the most important aspects of running a business. It’s critical to understand the ins and outs of payroll, from onboarding to pay periods, worker classifications, and tax law. NetSuite’s SuitePeople Payroll software can help streamline these processes by unifying payroll with core business operations, making it easier to pay employees accurately and on time, every time—while reducing manual effort and minimizing risk.

Built to support growing businesses, SuitePeople Payroll automates payroll tax calculations, helps maintain compliance with federal and state regulations, and accommodates multistate workforces. And because it’s part of the NetSuite suite of applications, payroll data flows directly into your general ledger and financial reports to reduce reconciliation headaches.

Payroll may seem simple from an employee’s perspective, but it’s a multifaceted process with legal, financial, and operational implications. Every step matters: Collecting employee information, setting pay frequency, submitting taxes, and staying compliant with labor laws all require attention to detail to pay employees accurately and on time while staying compliant with labor laws and regulations. The right processes and tools can make the process more straightforward, less time-consuming, and less risky.

Payroll FAQs

What is the difference between payroll and paycheck?

Payroll is the process of calculating and distributing employee wages, including withholding taxes and filing reports. A paycheck is the actual payment an employee receives for their work.

Who pays payroll?

Employers are responsible for running payroll, paying employees, and remitting payroll taxes to the appropriate government agencies.

Why do I need payroll?

Any business with employees—even just one employee—needs payroll to make sure workers are paid accurately and on time, and to comply with tax and labor laws.

Can I do payroll myself?

It depends. Many small business owners can manage payroll in-house, but as they add employees, offer benefits, or hire in multiple jurisdictions, outsourcing the payroll function or using payroll software can save time and reduce errors.