The reality of payroll extends far beyond delivering paychecks. It’s also about safeguarding employee trust, complying with tax regulations, managing cash flow and upholding the company’s financial integrity. Within this intricate process lies the critical task of payroll reconciliation, which, when done correctly, guarantees that every aspect of payroll is accurate and accounted for. While time-consuming when handled manually, its role is fundamental to any business setting, as payroll errors can lead to employee dissatisfaction and financial repercussions. Simply put, payroll reconciliation plays a pivotal role in keeping the financial wheels of a business turning smoothly.

What Is Payroll Reconciliation?

Payroll reconciliation is the process of verifying that the amounts a business pays to its employees and that are deducted for taxes and other withholdings are reflected in its financial records. It not only ensures that employees will be paid correctly, but that every payroll penny — be it for wages, deductions or contributions — is accurately recorded and accounted for. This detail-oriented process involves comparing payroll data with bank statements and other key financial documents, such as the general ledger. The ultimate goal of payroll reconciliation is to help businesses identify and rectify any discrepancies to maintain financial integrity, ensure compliance and support employee satisfaction.

Key Takeaways

- Payroll reconciliation is the process of verifying the accuracy of a company’s records regarding employee compensation, from gross pay to net pay and everything in between.

- Payroll inaccuracies can lead to IRS penalties, labor law issues and employee dissatisfaction.

- Businesses should aim to reconcile their payrolls before every pay period, as well as quarterly and annually.

- The act of reconciliation is rooted in accounting principles and requires close collaboration between payroll management teams and financial teams.

- Payroll software can be a useful upgrade for growing businesses looking to streamline their payroll and reconciliation processes.

Payroll Reconciliation Explained

Payroll reconciliation is an integral part of payroll management, yet its implications and requirements are deeply rooted in accounting principles. Indeed, payroll reconciliation is essentially a small subset of payroll accounting.

The payroll reconciliation process begins by collecting and verifying detailed payroll data, including hours worked, wage rates and deductions, and comparing these details to what’s listed in the company’s payroll register. The data is then meticulously cross-checked against bank transactions and accounting entries in the general ledger to confirm consistency and accuracy across the board.

Employees who reconcile payroll are tasked with identifying any discrepancies — from minor calculation errors to significant payroll fraud — and forging a path to correct them. Regular payroll reconciliation supports sound financial practices, with accurate records benefiting tax filings, audits and financial assessments. Furthermore, data from payroll reconciliation can inform broader business decisions, such as whether to adopt automated payroll software and integrated accounting software solutions.

Benefits of Payroll Reconciliation

Average payroll accuracy hovers around 80% for U.S. companies with between 250 and 10,000 employees, according to a 2022 EY study. Addressing inaccuracies is essential yet costly, averaging about $300 per error to rectify. Payroll reconciliation is a great way to not only enhance accuracy but also confirm compliance with regulations, detect fraud and streamline financial reporting — all of which can save a business additional money. What’s more, consistently accurate payroll increases employee satisfaction.

Ensures Accuracy and Compliance With Tax Regulations

Payroll reconciliation plays a pivotal role in complying with tax regulations at federal, state, local and international levels. This process is particularly important for companies with a diverse workforce spread across different states, jurisdictions or countries. For example, businesses with international remote workers will likely need to manage various tax and regulatory schemes, necessitating meticulous payroll management to maintain compliance in each applicable area.

Companies with a robust and proactive payroll reconciliation process — especially ones that use automated payroll software designed to stay up to date with regulations — are better fit to stay abreast of any tax law changes. They will find it easier to correctly adjust deduction requirements, as needed, and prevent miscalculations, while reducing the risk of noncompliance penalties and safeguarding the business’s legal standing.

Detects and Prevents Fraudulent Activities

Payroll fraud made up 9% of all recent occupational fraud schemes, according to a 2022 global study by the Association of Certified Fraud Examiners. Nine percent may not seem like a lot, but with a median loss of $45,000 per case, the cost of fraud can be devastating for many businesses. Systematically reviewing payroll transactions can uncover irregularities, including unauthorized payments, unauthorized changes to payroll records, timesheet fraud and the existence of “ghost employees,” who are fictitious workers on a company’s payroll for whom a salary is drawn, though no such actual person works for the company. The meticulous process of payroll reconciliation, by nature, is essentially a payroll fraud detector. It enables companies to quickly spot and address fraudulent activities — which is critical, given that the same study found that payroll fraud typically takes about 18 months to detect. Furthermore, this level of scrutiny and oversight helps maintain the integrity of the payroll process, while supporting strong internal controls and ethical practices.

Streamlines Financial Reporting

The core goal of payroll reconciliation is to ensure data accuracy, a cornerstone of streamlined financial reporting. Payroll reconciliation maintains the precision of important financial records and documents, including the general ledger, by making sure that wage and deduction records are precise and current. In turn, this accuracy can save time and effort when it comes to quarterly and annual tax obligations. And, when payroll records consistently align with financial records, it facilitates smoother audits and financial reviews because auditors and reviewers will be working with verified, reliable data. This also helps companies comply with accounting standards, furthering the link between payroll management and accounting.

Enhances Employee Trust and Satisfaction

Employees rely on their paychecks. But issues like back wages can create a significant problem. In 2022, for instance, the U.S. Department of Labor disbursed $9.1 million in back wages, at an average of $1,393 for each employee. That’s equivalent to several weeks of groceries, utilities or child care — and it doesn’t factor in issues like late pay. Problems, such as back wages, late paychecks or payroll miscalculations, can undermine employees’ financial independence and erode trust in their employers. Effective payroll reconciliation makes it possible to pay employees in a timely and accurate manner, increasing employee confidence, fostering a positive work environment and demonstrating the business’s respect for its employees’ financial well-being.

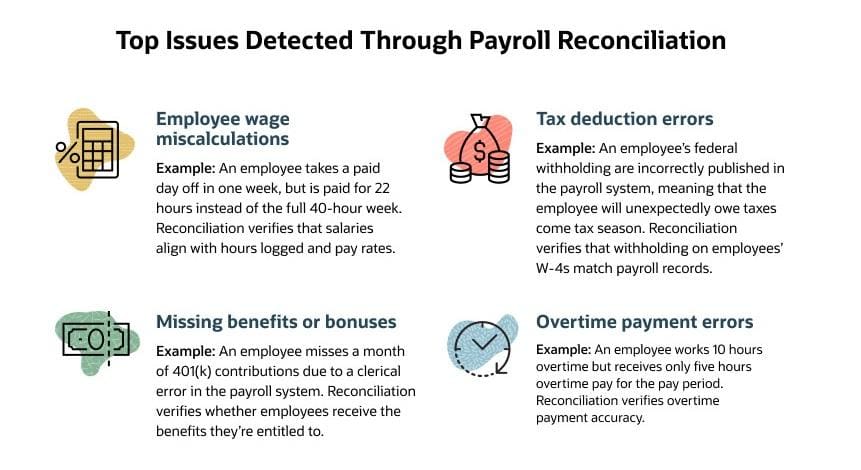

Top Issues Detected Through Payroll Reconciliation

Payroll reconciliation is instrumental in identifying and rectifying common payroll issues, such as wage miscalculations, incorrect tax deductions, omissions in bonuses or benefits, and overtime discrepancies. The process supports not only payment accuracy but also legal compliance and employee morale.

Miscalculations in Employee Wages

Miscalculations in employee wages, whether due to underpayments or overpayments, are a frequent payroll concern. Payroll reconciliation methodically reviews wage calculations and compares them with actual hours worked, examining entries like paid versus unpaid time off and regular hours versus overtime, to identify and rectify such discrepancies. Detecting and correcting these errors is important not only for financial accuracy, but also because, legally, employees must receive their rightful earnings.

Consider an employee who takes one paid sick day but is mistakenly paid for 32 hours, instead of the full 40-hour week. This error temporarily reduces their income, which can undermine trust in the company’s payroll process. Additionally, it creates extra work for the payroll department, which must now issue back pay and adjust the employee’s sick leave balance.

By confirming calculations for pay rates and hours worked, payroll reconciliation verifies that salaries align with hours logged and agreed-upon pay rates, thereby promoting fairness and accuracy in wage distribution.

Incorrect Tax Deductions

Incorrect tax deductions represent a significant financial and legal risk for businesses, but calculating payroll tax is no straightforward feat. Payroll reconciliation helps detect errors in tax withholdings and contributions, helping a business comply with tax laws. This process prevents legal ramifications and penalties, and it also safeguards the company’s reputation by upholding responsible financial practices.

For instance, say an employee’s state income tax is miscalculated, due to an error in applying the correct state tax rate. This mistake could occur in businesses with employees working in different states, especially if payroll systems or spreadsheets aren’t updated with the latest tax rates. As a result, the employee might end up either underpaying or overpaying their taxes, leading to potential problems at the end of the tax year. For the employer, underpayment errors can lead to compliance issues with state tax authorities, resulting in fines and additional administrative burdens. Payroll reconciliation helps identify these discrepancies early by validating deduction calculations with regard to current tax codes and rates. This, in turn, makes it easier to deliver accurate and timely tax payments, which can positively contribute to the overall financial health of the business.

Omission of Employee Bonuses or Benefits

Accidentally omitting employee bonuses or benefits can lead to dissatisfaction, a perception of workplace unfairness and even potential legal issues. For example, an employee could be overlooked for a year-end bonus because of a clerical error or an oversight in the payroll system. Or, an employee might be mistakenly excluded from enrolling in the company’s healthcare plan, due to an incorrect classification in the payroll system. These types of errors can have a substantial impact on employee morale and trust in the company — and, in the latter example, could present a real issue should an employee face an urgent health issue.

Through payroll reconciliation, these oversights can be proactively identified and corrected so that employees receive what they’re entitled to, be it 401(k) contributions, healthcare insurance, paid time off or other benefits. Guaranteeing that employees receive what they’re entitled to is crucial to maintaining a positive and equitable work environment.

Discrepancies in Overtime Payments

Overtime payment discrepancies caused by overpayments or underpayments are particularly common for hourly workers, due to their varying work hours. Some weeks, a worker might work 40 hours or less, other weeks, more. Data-entry errors can lead to situations where, for example, workers who put in 10 hours of overtime are incorrectly paid for only five hours. Payroll reconciliation can help companies identify such inconsistencies before payday by comparing recorded hours against the actual number of hours worked.

The legal ramifications of incorrect overtime payment can be significant. Failing to pay overtime correctly can result in violations of labor laws, such as the U.S. Fair Labor Standards Act. This can lead to penalties, legal disputes and potential damage to the company’s reputation. Regular payroll reconciliation is essential for upholding these legal standards, ensuring fair labor practices and accurate compensation for employees, and protecting the company from potential legal and financial repercussions.

11 Steps to Perform Payroll Reconciliation

Performing payroll reconciliation is a detailed process that requires scrupulous attention to detail. Following these 11 steps can result in a thorough and effective process.

1. Set Up a Regular Reconciliation Schedule

Payroll reconciliation isn’t a process that should be performed only on occasion or on an as-needed basis. Rather, businesses should aim to set up a multitiered reconciliation schedule. For each pay period, conduct reconciliation at least two days before payday. This will ensure that paychecks are accurate in terms of number of hours worked, wage or salary, necessary deductions and contributions. Remember, it’s easier to fix errors before paying employees than after.

Every quarter, align one scheduled reconciliation with your quarterly tax return — i.e., before submitting IRS Form 941. This will confirm that federal tax withholdings and payments will match payroll records. Additionally, plan to perform an annual reconciliation at the end of the fiscal year, before filing annual taxes, to make sure payroll data reflects the information on each employee’s W-2.

A structured approach like this can help businesses stay on top of various payroll features to support accuracy and legal compliance throughout the year.

2. Gather Payroll Records and Bank Statements

Comprehensive and accurate payroll documentation is the foundation of effective reconciliation. Begin with the payroll register, an essential document that provides detailed employee information, such as name, birthdate, Social Security number and employee number. It also logs payroll activity for each pay period, including each employee’s number of hours worked, pay rate, bonuses, benefits and other deductions.

Compare the payroll register with individual employee time cards or sheets, which are necessary for verifying hours worked and making wage calculations. Then, collect the general ledger, which records wages, deductions and other important financial transactions. Make sure the payroll-related entries in your general ledger, including dates and figures, match what’s in your payroll register.

Finally, obtain corresponding bank statements to cross-verify the actual cash flow from payroll disbursements. Together, these various records and statements create a comprehensive snapshot of the payroll process; their consistent alignment is key to a successful reconciliation.

3. Verify Employee and Payroll Details

Confirm each employee’s personal information both on the payroll register and in your payroll system. Verify data, such as their name, birthdate, Social Security number and employee number. Pay particular attention to hours worked (both regular and overtime), pay dates and current pay rates. For example, if an employee recently received a raise, verify that the updated salary is accurately reflected on pay stubs, the payroll register and your payroll software.

It’s also important to double-check deductions, including employee withholding status, federal/state/local income taxes, FICA contributions, health insurance premiums, wage garnishments and retirement plan contributions. Discrepancies in these areas can cause complications for employees during tax season and also give the business trouble if they’ve been underpaying or under-contributing.

Don’t forget to differentiate between employees and non-employee workers, such as freelancers or independent contractors. Mistakenly categorizing independent contractors as employees, for instance, can lead to issues at tax time (for both the business and the worker), as well as affecting net pay calculations.

4. Calculate Total Gross Pay for Each Employee

Calculate each employee’s total gross pay, which is the amount earned before any deductions or withholdings. For hourly employees, this involves multiplying their hourly rate by the total hours worked in the pay period, including overtime. For salaried employees, divide the annual salary by the number of pay periods in the year.

Check that all components contributing to gross pay, including regular and overtime hours, bonuses, commissions and any other earnings, are accurately factored into the calculation. Precise calculation is important, as it sets the foundation for subsequent deduction calculations.

5. Compare Calculated Total Gross Pay With Total Gross Pay Recorded

Carefully match the calculated gross pay figures for each employee with those recorded in the payroll register. This can help uncover discrepancies that might stem from data-entry errors, miscalculations in overtime or bonuses, or inaccuracies in recorded work hours. Use a systematic approach to verify each entry by, for example, cross-referencing timekeeping records with departmental payroll summaries. Then, add up the total gross pay for each employee and compare it with the total gross pay recorded in the payroll register for that pay period.

Accuracy is especially important here, as mismatches can lead to payroll inaccuracies that affect not only financial and legal compliance, but also employee satisfaction. If possible, consider using an automated payroll system, which can speed up the process and make it less error-prone.

6. Review and Validate Employee Deductions

Thoroughly examine all employee deductions, including Social Security, Medicare, federal income taxes, state income taxes (if applicable), local taxes, health insurance premiums, retirement plan contributions, workers’ compensation insurance and wage garnishments. Make sure that each deduction is accurately calculated and distinctly recorded in the payroll register, not presented as an aggregate sum. This meticulous approach aids in accurate business tax filings and eases the task of cross-checking figures, line by line. Additionally, each deduction should be verified against the withholding amounts stipulated on an employee’s Form W-4.

Such rigorous review and validation of employee deductions is essential to maintaining compliance with tax laws and benefit policies — as well as to maintaining accurate and transparent payroll processes. Failure to accurately review and validate these deductions can lead to errors in business tax liabilities and employee net pay, potentially eroding the business’s legal standing and employee trust in the payroll system.

7. Compare Total Net Pay With Total Amount Debited

Total net pay from payroll records represents the amount that employees are expected to receive, whereas the total amount debited from the company account indicates the actual amount paid out. Match the total net pay from payroll records to the total debited from the company’s bank account. Each employee’s pay should align with actual disbursements, and the total debited figure should match the total net pay for that period. Pay close attention to potential mismatches, which could indicate errors, unprocessed adjustments or changes in payroll that have yet to be reflected in bank transactions, like a last-minute salary modification or correction of a previous error. Any unprocessed adjustment or error should be noted, as it can incur consequences for both the company’s financial standing and employee morale.

For example, if ledger records indicate a total net pay of $50,000 for a pay period, but the bank account shows a debit of $48,000, this discrepancy could point to a possible payroll miscalculation. Errors could be due to incorrect hours logged or erroneous tax withholdings, among other reasons.

8. Investigate Causes of Discrepancies

When discrepancies arise, begin a thorough investigation to pinpoint the underlying causes. Have you added any employees? Are any on leave? Have any employees recently received a raise or pay cut? These changes can affect payroll, and if the changes aren’t reflected in the payroll system and records, discrepancies may crop up.

Patterns indicating deeper issues, such as recurring errors in time-tracking or systematic data-entry mistakes, need special attention. They may reflect procedural weaknesses or system inadequacies that require more significant corrective measures. For instance, frequent miscalculations of overtime pay could point to a systemic problem in how overtime hours are recorded or processed. Therefore, it may be worthwhile to offer additional staff training or to update time-tracking and payroll software solutions.

9. Correct Payroll Mistakes

Promptly address payroll errors as soon as they’re identified. If they’re not minor errors that can be resolved before payday, prepare to issue additional payments for underpayments or to adjust future payroll for overpayments. When corrections impact employee wages, be sure to establish a clear communication plan.

Inform affected employees as soon as possible, explaining the nature of the error and how it will be rectified. For example, if an overpayment is to be adjusted in the next cycle, make sure impacted employees understand how it will appear on their upcoming paychecks. Use clear, empathetic language and provide an opportunity for employees to ask questions or express concerns. This approach maintains transparency and trust, while managing expectations — all of which can benefit the employer-employee relationship.

10. Identify and Remediate Errors in Payroll Process

Use specific examples of past errors as learning opportunities to refine your payroll process. For example, if incorrect time entries are a recurring issue, consider implementing a more robust time-tracking system or retraining staff in accurate timekeeping. It’s also important to proactively identify areas prone to errors, such as manual data entry or complex overtime calculations. Exploring software solutions that leverage automation or incorporating additional manual checks and balances can help address existing issues while preventing future errors.

In addition to identifying and addressing individual errors, use these findings to evaluate and strengthen overall payroll processes. As part of this evaluation, incorporate feedback from employees and payroll staff, as they often have practical insights into areas in need of improvement. Use these findings to strengthen the payroll process, whether by revising protocols, implementing new payroll systems or conducting regular training sessions for staff involved in payroll preparation. A proactive approach to addressing these discrepancies not only resolves immediate issues but also helps build a more robust and error-resistant payroll system in the long term.

11. Document the Reconciliation Process

Develop a comprehensive documentation protocol for each payroll reconciliation, whether it’s for a regular pay period or a quarterly or annual review. Documentation should include a detailed record of all steps taken, discrepancies identified and corrective actions implemented. This official record will ensure that everyone involved in the payroll management process knows why such a change was made. That said, the log should be straightforward, easy to interpret and include clear annotations.

Detailed logs can become particularly valuable, both for immediate reference and also during internal or external audits. Logs provide auditors with a transparent view of the payroll process’s integrity and compliance history, serving as an official account of all changes made. It’s also useful to maintain a repository of these logs for historical reference, which can be invaluable in identifying patterns over time, improving long-term payroll accuracy and aiding in future process improvements.

Payroll Reconciliation Example

Let’s consider a scenario at CodeBloom Labs, a hypothetical tech startup that rapidly expanded its workforce from 30 to 120 employees, creating payroll management complexities. During a routine weekly payroll reconciliation, CodeBloom’s payroll management team uncovered a major discrepancy: Six new employees were being paid based on outdated, lower starting pay rates for their respective positions.

CodeBloom promptly realized the outdated pay rates were due to hiring an influx of new employees faster than it could update its payroll system. The company revised the affected employees’ pay rates, ensuring that everyone would receive the correct salary on their next paycheck, plus back pay.

To avoid similar future troubles, CodeBloom upgraded to an automated payroll system suitable for its larger workforce. It also planned additional training for the payroll team, emphasizing strict standard operating procedures when new employees are hired and demonstrating how to update the system regarding employee status, tax laws and wages.

All told, CodeBloom’s routine weekly payroll reconciliation process resolved immediate discrepancies, and it also highlighted areas for improvement. This proactive approach put the company in a better position for growth into a midsize enterprise.

CodeBloom Payroll Reconciliation for Pay Period 11/6/23 – 11/12/23

| Employee ID | Employee Name | Initial Pay Rate | Correct Pay Rate | Hours Worked | Gross Pay Calculated | Total Deductions | Net Pay Calculated | Net Pay Disbursed | Discrepancy |

|---|---|---|---|---|---|---|---|---|---|

| E0045 | Matt | $30/hr | $30/hr | 40 | $1,200 | $325 | $875 | $875 | $0.00 |

| E0046 | Jonathan | $25/hr | $30/hr | 39 | $1,170 | $300 | $870 | $675 | $195 |

| E0047 | Yukio | $25/hr | $30/hr | 40 | $1,200 | $325 | $875 | $675 | $200 |

| E0048 | Timothy | $25/hr | $30/hr | 38.5 | $1,155.00 | $285 | $870 | $677.50 | $192.50 |

| E0092 | Maya | $30/hr | $35/hr | 40 | $1,400 | $380 | $1,020 | $820 | $200 |

| E0093 | Roger | $30/hr | $35/hr | 40 | $1,400 | $380 | $1,020 | $820 | $200 |

| E0094 | Quinn | $30/hr | $35/hr | 40 | $1,400 | $380 | $1,020 | $820 | $200 |

| E0095 | Angel | $35/hr | $35/hr | 40 | $1,400 | $380 | $1,020 | $1,020 | $0.00 |

Payroll Reconciliation Best Practices

Effective payroll reconciliation is at the heart of financial accuracy and compliance, but it can be a challenging and time-consuming task, especially when handled manually. To support a smooth, error-free process, it’s wise to heed the following best practices.

Regularly Schedule Reconciliations

Create a reconciliation schedule and stick to it. Businesses should aim to reconcile payroll at least every pay period — ideally, two or more days before issuing paychecks — to catch and rectify issues early. Making a pre-payday reconciliation part of the typical payroll cycle can minimize the risk of post-payment complications, such as issuing back pay or making adjustments with benefits providers.

It’s also wise to conduct additional reconciliation periods at lengthier intervals, such as monthly, quarterly and/or annually. This can help the payroll management team spot and fix any discrepancies that went unnoticed during more routine reconciliations or emerged during quarterly tax payments or annual tax filings.

Having a clearly defined reconciliation rhythm is key to transforming this task into a standardized and manageable part of both payroll and financial operations. After all, it’s easier to stay on top of errors before they become problematic or get lost in the mix.

Maintain Transparent Communication With the Finance Department

Payroll reconciliation may be a payroll management process, but it’s also deeply intertwined with financial management. Therefore, effective payroll reconciliation relies on transparent, ongoing communication between the payroll and finance departments. For instance, they need to keep each other apprised of updates on payroll changes, tax law modifications or any identified discrepancies. Doing so can help prevent unnecessary errors and discrepancies and ensure consistency across departments.

Similarly, don’t assume just because the payroll team spotted an error or made a change that the finance team will also be aware. Each team should feel a sense of shared responsibility for the financial integrity of the organization. Establish regular meetings or communication channels to discuss payroll and financial matters. This type of close collaboration can help companies get ahead of potential issues, making for a smoother reconciliation process, while fostering an environment that values teamwork.

Implement a Double-Check System

Although payroll reconciliation is essentially a system of double-checking in and of itself, one top payroll tip is to implement additional checks and balances. For example, after reconciling a pay period, quarterly or annual total, have all payroll entries and reconciliation results reviewed by another team member. This additional layer of scrutiny can lower the risk of overlooking errors, thereby enhancing the accuracy and reliability of the overall process.

Such a system can be particularly valuable in environments with complex or voluminous payroll data, where the likelihood of subtle errors may be greater. Just be sure that any employee who is involved is well-trained in the reconciliation process and has a strong knowledge of payroll.

Train Employees on the Importance of Accurate Timekeeping

Payroll accuracy is, in part, contingent on employees’ ability to accurately track their time. In fact, the 2022 EY report notes that missing/incorrect time punches are the most common payroll error.

It’s important to make sure employees understand the direct effect of their time entries on payroll calculations and encourage them to be diligent about recording their hours, including any overtime. Regular training sessions can emphasize this importance and how it can help minimize errors at the source, thus alleviating the reconciliation workload — and ensuring that employees get paid the right amount and on time.

Such training can be even more valuable in workplaces with flexible scheduling. For instance, if a company allows employees to work any eight hours between 6 a.m. and 7 p.m., employees may work in nontraditional patterns or split shifts. This flexibility necessitates reliable methods of tracking hours worked. Be sure to provide clear guidelines and tools for consistent and accurate time recording.

Ensure Proper Documentation for Future Audits

Reconciling payroll is one thing. Documenting it is another, to ensure compliance with tax regulations and labor laws. Each step of the reconciliation, from the initial gathering of payroll records to the final identification and remediation of errors, should be meticulously documented to create a clear audit trail.

Documentation should include details, such as reconciliation dates, which payroll records were reviewed, what discrepancies were identified, any corrective actions that were taken and evidence of communications with employees or tax authorities. This information should be organized and accessible, to demonstrate the company’s commitment to identifying, rectifying and preventing future payroll errors.

What to Do if You Find Payroll Discrepancies

One of the top questions smaller businesses ask about payroll is, “What happens if I make a mistake?” A structured approach to resolution works, not only to spot and resolve payroll discrepancies in a timely and transparent manner, but also to find root causes and implement changes to prevent future problems.

Set Up a Resolution Team or Individual

The first step in handling payroll discrepancies is to identify who’s going to tackle the issue. Depending on your organization and the type of discrepancy, this might be a whole team or an individual who coordinates investigations, conducts thorough analyses and oversees the resolution process. This team or individual should be organized; able to communicate clearly with various stakeholders, including employees, business leaders and finance teams; and have tact: This isn’t the time to point fingers — it’s time to solve problems.

A dedicated team or individual is also necessary to be sure that discrepancies receive focused attention, streamlining the resolution process and minimizing the impact on the overall payroll function, allowing other team members to continue their regular activities without disruption.

Investigate the Root Cause

Effective resolution hinges on identifying the root cause of discrepancies. Simple errors, like incorrect overtime calculations, will need to be rectified, but it’s also imperative to find out why the discrepancy happened in the first place to prevent it from happening again. Was it human error? A system glitch? A flaw in the timekeeping or payroll procedure? Investigation should involve a detailed review of payroll records, timesheets and related financial documents to figure out the root cause, apply the right corrective action and prevent recurrence. Don’t forgo looking into external factors, such as changes in tax regulations or banking errors.

Communicate With Affected Employees

Payroll discrepancies may not always affect employees, but if and when they do, effective communication is vital. Employees should be notified in a timely, transparent and empathetic manner. To help maintain trust, alleviate concerns and reduce the chances of misunderstandings, it’s important to promptly and clearly tell affected employees about the discrepancy, its impact and what steps are being taken to resolve it. It’s also wise to provide employees with a point of contact for any questions or concerns. This approach can reinforce the company’s commitment to fairness and transparency, helping to preserve employee morale and trust.

Implement Measures to Prevent Future Errors

After resolving payroll discrepancies, however minor, it’s worth taking the time to implement measures that will prevent similar errors from occurring in the future. This might mean reviewing and refining payroll processes, enhancing training for payroll staff, updating payroll software or systems, or developing a deeper relationship with the finance team. Other options, such as introducing additional checks and balances or automating certain aspects of payroll, can also reduce the likelihood of future discrepancies, while regular audits and employee feedback can help pinpoint internal weaknesses.

Combined, these measures help support the long-term accuracy and efficiency of your payroll system while fostering a culture of continuous improvement and attention to detail.

How Accounting Software Can Help With Payroll Reconciliation

It’s easy to think of payroll reconciliation as a function of payroll management and human resources, but the process is closely related to accounting, too. Automated accounting software can effortlessly import time-tracking data, calculate pay and flag discrepancies, reducing errors and the manual effort otherwise required to reconcile payroll. Similarly, software with real-time data processing capabilities can help teams immediately identify — and correct — discrepancies, further streamlining the reconciliation process.

Top-tier accounting software provides invaluable compliance support by automatically updating to reflect current tax laws and regulations. This feature can help businesses stay on top of compliance requirements and avoid legal and financial penalties associated with payroll errors. And, accounting software that integrates with payroll software can automatically double-check payroll register data against the general ledger to confirm consistency across financial records, adding an additional layer of speed and reliability to reconciliation.

Streamline Your Payroll and Reduce Errors With NetSuite

It’s clear that payroll and accounting departments must uphold a certain kinship to effectively manage payroll reconciliation. Detailed employee payment records must align with the general ledger and financial statements, for instance, and each team is affected by ever-changing tax regulations. In addition, a company’s financial integrity relies, in part, on accurate payroll. One way to help ease this process, making life easier for payroll and finance teams alike, is to use a payroll solution that easily integrates with other business software, such as an accounting system.

NetSuite SuitePeople Payroll System, for example, automates complex calculations that encompass everything from gross compensation to tax deductions and withholdings. Automation extends to remitting funds to relevant tax and benefits agencies, as well as disbursing net pay to employees, further simplifying the payroll process and reducing the likelihood of errors. SuitePeople also natively integrates with NetSuite’s accounting system. Payroll data flows directly into the company’s general ledger, eliminating the need for manual data uploads and facilitating real-time monitoring and management. What’s more, NetSuite’s cloud-based nature ensures secure and compliant storage of payroll records, adding an extra layer of security and accessibility for organizations of all sizes.

Effective payroll reconciliation is more than a routine task; it’s a vital component of a business’s financial integrity and compliance requirements. From establishing a regular reconciliation schedule to adapting to ever-changing tax laws, the steps of the payroll reconciliation process work together to not only identify and rectify immediate discrepancies, but also pave the way for continuous improvement and growth. For businesses looking to simplify their payroll and payroll reconciliation processes, it’s worth considering an automated payroll software solution that seamlessly integrates with accounting and financial management tools. Such technology can ease the burden of manual reconciliation, reduce human error and make it easier to stay on top of regulatory changes.

Payroll Reconciliation FAQs

Why is payroll reconciliation important?

Payroll reconciliation ensures that employees are paid accurately and in compliance with tax regulations. It helps identify and correct payroll errors, prevent fraud and maintain financial integrity by matching payroll records with bank statements and accounting data.

How do you prepare a payroll reconciliation?

To prepare for payroll reconciliation, gather payroll records, bank statements and the general ledger. Verify employee details, calculate gross pay, review and validate deductions and compare net pay against bank debits. Investigate discrepancies and document the process thoroughly.

How often should companies perform payroll reconciliation?

Companies should perform payroll reconciliation regularly. Ideally, reconcile payroll every pay period before payday, plus quarterly in alignment with Form 941 submissions and annually to ensure accuracy in W-2 forms.

How do I reconcile my 941 to payroll?

To reconcile Form 941 to payroll, compare the total taxes reported on 941 with your payroll records for the same period. Ensure that federal income tax, Social Security and Medicare taxes withheld from employees align with the reported amount.

What are the 3 types of reconciliation?

In the context of payroll reconciliation, three types of reconciliation may refer to:

- Payroll reconciliation: Ensures that payroll records (hours worked, pay rate, deductions) match financial statements and bank records.

- Account reconciliation: Matches the company’s general ledger accounts with other financial records, like bank statements, to ensure consistency in reporting.

- Tax reconciliation: Verifies that the taxes withheld and reported (such as in Form 941) align with payroll records and tax payments made.

Businesses typically engage in other types of financial reconciliation as well, including bank reconciliation (matching the cash balance on financial statements to the bank statement), customer reconciliation (ensuring that customer records align with sales and payment records) and vendor reconciliation (matching a company’s records of transactions to a vendor’s invoice).

What is HR reconciliation?

The term “HR reconciliation” is not a standard term in payroll or human resources (HR) processes. In payroll and HR contexts, reconciliation typically refers to verifying the accuracy of payroll records and ensuring that they align with financial statements and bank transactions — i.e., payroll reconciliation. This includes verifying that employee details, hours worked and deductions are correct and properly recorded. HR tasks may involve verifying or cross-checking employee-related information, such as benefits administration, but such tasks are not commonly referred to as “HR reconciliation.”