Bank reconciliation is the process that companies use to make sure that the cash balances they show on their books matches the actual cash they have in the bank. With companies’ increasing use of other entities to make and receive payments, it’s probably wise to think of bank reconciliation as also applying to the cash that passes through these other entities, including online payment systems. But banks still hold the overwhelming majority of business accounts and companies can use the same basic process they use in bank reconciliation to pinpoint their cash positions elsewhere.

What Is Bank Reconciliation?

Bank reconciliation is a process of comparing a company’s bank statement with its own cash records (often called its “cash books”) to make sure the balances and transactions match. During reconciliation, the company looks for discrepancies and brings the two cash amounts into alignment by adjusting for as-yet unrecorded transactions, such as deposits that have not yet cleared the banking system or new bank fees.

Bank reconciliations are an important accounting tool because they maintain accurate financial record-keeping, good cash-flow management, fraud or error detection, and effective compliance and tax reporting. The process is handled by an accounting department or business owner and traditionally performed monthly. However, with modern accounting software, companies can implement weekly or even daily reconciliations. The difficulty of reconciliation work depends upon the volume and complexity of transactions and whether the process is performed manually or in an automated fashion.

Key Takeaways

- The cash balance on a company’s books almost never matches the bank statement balances at the end of the month.

- Bank reconciliation is used to identify, justify, and align these mismatches and provide the most accurate possible picture of cash flow.

- The reconciliation process requires business owners to understand some key accounting concepts, such as NSF checks and deposits in transit.

- Bank reconciliations should be done on a regular basis so that conflicting items don’t pile up, becoming more confusing and harder to fix.

- Software can help companies automate certain parts of the reconciliation process.

Bank Reconciliation Explained

The cash balance shown on a company’s internal balance sheet almost never matches the actual cash balance it has in its bank or other payment services. These discrepancies have a variety of causes, from timing issues in the course of normal business operations, to errors and even fraud, and can vary in size from very small to quite large. Bank reconciliation has to do with identifying and settling these discrepancies in order to get an accurate picture of the business’s available cash. It is an integral part of effective cash-flow management and internal controls.

Why Is Bank Reconciliation Important?

A business’s investments in marketing, R&D, and technology all depend on it having the necessary level of cash. Bank reconciliation is one of the processes that tells a company, at any given point in time, whether it’s in a position to fund something new or should hold back.

4 Reasons Bank Reconciliations Matter

Bank reconciliations are particularly important because they:

- Pinpoint cash flow: A business needs to understand the amount of money that is coming into its accounts as well as the amounts going out. That understanding is crucial both for small financial decisions—such as when to release payment to a vendor—and for bigger decisions—like whether to pay a special dividend to shareholders. A bank reconciliation provides a definitive picture of your business’s available cash.

- Foster business confidence: Incomplete or old data can lead to ill-informed business decisions, such as a company paying a bill that it doesn’t have the funds to cover, and the relationship damage that such moves may cause. If the cash view is flawed in the other direction—if it doesn’t account for, say, a big payment that’s about to come in—the company may be overly cautious about investing and may fail, for instance, to fill a critical open position or not buy an attractive asset that is available at a bargain price.

- Highlight potentially fraudulent activity: An item-by-item bank reconciliation reveals fraudulent activity quickly. Suppose a company has written a check for $440 to a heating-repair company. If the company sees a debit on its bank statement of $490 for that transaction, it immediately triggers a question about whether someone had changed the amount.

- Draw attention to accounts receivable problems: When done regularly, bank reconciliation can help identify issues with receivables—for example, unpaid invoices—and allow a company to take corrective action.

Who Should Oversee Bank Reconciliations?

Someone in a financial position—like a company’s controller or an accounting manager—is usually responsible for overseeing the bank reconciliation process. A staff accountant typically does the actual reconciling of the company’s accounting records and bank statements, in accordance with segregation of duties best practices.

At a big company, there would typically be several people within the accounting department to handle different account reconciliations. It’s common for the owner to do the bank reconciliation at a smaller company.

Bank Reconciliation Process Flow

Understanding the bank reconciliation process is vital to maintaining a company’s financial integrity. Specifics of the bank reconciliation process will vary based on company size, transaction volume, industry, and technology used. Some companies may reconcile monthly while others do so daily. Small businesses may perform reconciliation manually while large companies automate much of the process. In addition, the amount of oversight may differ, with companies in higher-risk situations or with more complex operations requiring multiple levels of review.

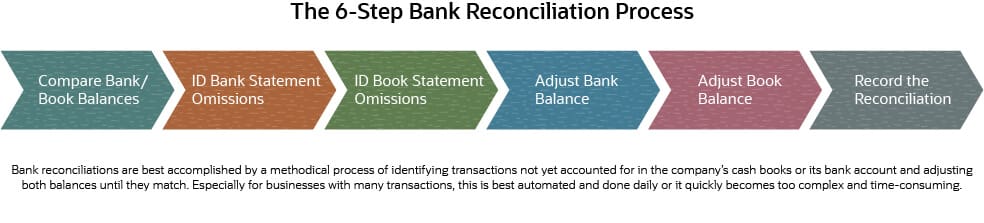

The overarching process flow, however, remains consistent across most organizations. The bank reconciliation process has three basic steps.

- Compare: The first step is comparing the cash balances and transactions on the company’s books to the cash balances and transactions listed on an external bank statement. Because of things like electronic transfer fees, outstanding checks and deposits, and different cut-off periods, the two rarely match.

- Adjust: In the second step you adjust both balances. Both the amount of cash in the bank account and the amount of cash on the company’s books often change in this step as you account for transactions reflected on the one but not the other.

- Reconcile: In the third step you record the reconciliation. Basically, what you’re doing here is recording a change to the cash accounts in your general ledger. The bank account balance will adjust naturally as the transactions you identified in the second step move through the banking system.

Important Terms to Know for Bank Reconciliation

There are many things that account for the differences between a company’s bank statement and its accounting records. Several of them have evolved into common terms you may encounter at various stages of a bank reconciliation:

- Book balance: The cash amount recorded in a company’s general ledger before any reconciliation adjustments. It indicates the company’s internal record of cash transactions and is updated as transactions are recorded internally.

- Bank balance: The cash amount reported by the bank on the company’s bank statement on a specific date. Incorporates all transactions the bank has processed. Bank balance may differ from book balance because it may not include recent transactions that have not yet cleared.

- Outstanding check: A check a company has received but hasn’t yet deposited in the bank, or a deposited check that hasn’t yet been cleared through the banking system. It can also be a check a company issued but that hasn’t been deposited by the recipient.

- NSF check: Non-sufficient funds (NSF) is banker parlance for a “bounced” check. If a company tries to deposit a check from a customer that doesn’t have the funds on account to cover the payment, the transaction fails. The money doesn’t end up in the check recipient’s account, and the payer is usually charged a fee for bouncing a check. Sometimes the recipient is charged, too.

- Deposit in transit: A payment that a company has received and recorded in its books but that has not yet been processed and reflected in the bank account balance. This commonly occurs when deposits are made near the end of a business day or when there are processing delays, causing the funds to appear in the company's records before they show up on the bank statement.

- General ledger: The master accounting record of a business. It integrates all financial transactions and balances across various business accounts, such as cash, accounts receivable, and accounts payable. It serves as the foundation for creating financial statements like the balance sheet and income statement. During bank reconciliation, the cash account in the general ledger is compared to the bank statement to correct any discrepancies.

- Adjusted cash balance: The final reconciled cash amount determined after accounting for all reconciling items identified during the bank reconciliation process. This balance incorporates adjustments for deposits in transit, outstanding checks, bank fees, and any errors, and should match between the company’s records and the bank statement.

- Bank errors: Mistakes made by the bank in processing a company’s transactions, such as recording incorrect deposit amounts or processing transactions that belong to other accounts. These errors are identified during the bank reconciliation process and are reported to the bank for correction.

- Cleared transactions: Transactions that have been processed and posted by the bank and appear on both the bank statement and the company’s general ledger. Making sure that these match is a core aspect of the reconciliation process.

- Uncleared transactions: Transactions that are recorded in the company’s books but not have not yet been processed by the bank. They might include checks that have been written but not yet cashed or deposits that have been sent to a bank but have not yet posted. Uncleared items can cause temporal differences between book and bank balances.

Benefits of Bank Reconciliation

Bank reconciliation is such a fundamental part of corporate accounting that the only real question for most companies is who does it and with what tools—not whether to do it in the first place. Among its biggest benefits, bank reconciliation:

- Verifies customer payments have been made: Fulfilling an order or completing a project is only part of running a business successfully. Businesses also need to know that the payment is now available as cash in the bank. A bank reconciliation is how you make sure of this.

-

Simplifies accounting: As they grow, most companies opt for the accrual method of accounting, in which revenue and expenses are recorded when the relevant activities occur, versus when the cash comes in or goes out. The accrual method, required by GAAP, is seen by many accountants as providing the most realistic picture of a company’s financial position, and is usually required by the IRS for companies that hold inventories. Bank reconciliation is indispensable to accrual accounting.

Companies that use cash accounting—recording transactions at the same time the bank does—still need bank reconciliation. For example, take a company that pays its employees through paper checks instead of automatic deposits. The time it takes checks to clear, or employees to deposit those checks, means that on paydays there will be a mismatch between the company’s books and its bank account.

- Catches errors: Bank reconciliation helps companies spot bank errors as well as those made by internal staff on the general ledger. Although bank account errors are not common, they do happen. On the general ledger side, there tend to be far more errors in organizations that use more manual business accounting processes.

- Draws attention to cash-flow problems: A company that takes a disciplined approach to bank reconciliations—and that does them on a set schedule—often has an advantage in spotting cash-flow issues. With this early view of a potential problem, a company can take steps to minimize any disruption to its business.

Challenges With Bank Reconciliations

In trying to resolve the mismatches between their books and their bank statements, accountants tend to look for a few different causes. The most common are:

- Uncleared checks: These are payments that have been sent out but have not yet cleared through the banking system. Accountants adjust for them during reconciliation. Similarly, customer checks received and applied by the business may not yet have cleared the banking system.

- Voided checks clearing: If a check your company voided subsequently clears the bank, the charge must be recorded. This is not a common occurrence but does happen. It’s something you would catch and adjust as part of a bank reconciliation.

- Returned deposited checks: This refers to a payment that cannot be processed by the banking system. The cause can lie with a customer making a payment, for example, if the customer has insufficient funds in its account, has put a stop order on the payment, or has made a mistake such as failing to sign the check. It can also lie with a recipient company if, for instance, the company has neglected to deposit the check until it’s more than six months old. Whatever the cause, returned deposited checks require adjustments during the bank reconciliation process.

- Bank service fees: Many bank services carry a fee, including for various account services and for electronic or expedited payments. The precise level of these fees sometimes isn’t known until they appear in companies’ bank statements, at which point they require an adjustment to a company’s books.

- Interest income: This is another number that isn’t always clear before it shows up on a company’s bank statement. The amount is added to the company’s books during reconciliation.

How to Do Bank Reconciliations Step by Step

Companies can assign different people to handle different parts of a bank reconciliation and can complete reconciliations in a number of different ways. The basic sequence, however, consists of the following six steps.

- Compare the bank account balance to the cash balance on your books: The first step in a bank reconciliation is to look at the bank account statement and bookkeeping record side by side. For most businesses, the cash balances are not going to be the same. The difference could be a few hundred dollars, a few thousand dollars, or more depending on the size of the business and the type and magnitude of any unreconciled transactions.

- Scrutinize your bank statement: In this step, you are looking for the line items on the bank statement that aren’t reflected in the bookkeeping of the company’s cash accounts. Bank fees are an example of an item on the bank statement that may not be in the accounting records.

- Scrutinize your cash book: Next you want to figure out the cash-in or cash-out transactions that are on the company’s books but not listed on the bank statement. This may include deposits or payments recorded or made on the first or last day of the period that have not yet cleared. It may also include checks written that haven’t reached their recipients, or that the recipients haven’t deposited.

- Adjust the balance of your bank account: After identifying transactions in the general ledger that haven’t yet been processed by the bank, you can figure out how the balance in your bank account is expected to change in the next few days or as those transactions are recorded by the bank. Outstanding deposits will increase the amount of cash. Outstanding withdrawals decrease the cash in your bank account.

- Adjust the balance of your books: This is similar to step four, but here you manually adjust the company’s book balance for any unmatched transactions listed on the bank statement. Some of the transactions listed in the bank account, such as interest payments, will increase the balance on your books. Other transactions, like bank fees, will decrease the cash shown on your books.

- Record the reconciliation: There are two ways to record a reconciliation, both of which apply only to the company’s books, not its bank account. The first is to put a simple note at the bottom of the cash book categorizing each discrepancy and showing the aggregate discrepancy in each category. The second is to compile a bank reconciliation statement. This is a more detailed document that shows the reason for each discrepancy from the bank balance. Where a cash book note might only show there was $100 worth of NSF checks in a given month, the bank reconciliation statement would break down the bounced checks by date, amount, and payer.

Example of a Bank Reconciliation

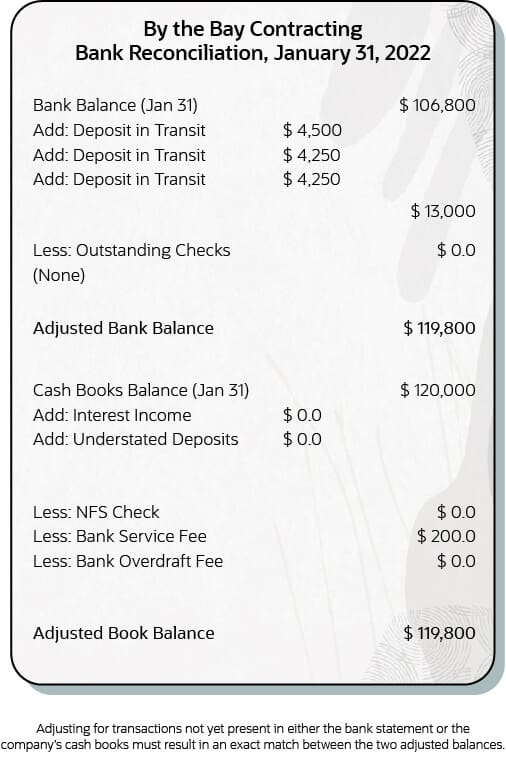

A hypothetical San Francisco home contractor, By the Bay Contracting, is doing a reconciliation at the end of January. By the Bay’s bank account shows $106,800 but there is $120,000 in cash on the company’s books. The company’s accountant sets about reconciling the discrepancy. She notices $200 worth of bank fees that aren’t reflected on the company’s books and $13,000 worth of deposits in transit—checks from three separate home renovation clients that were received earlier in the week but that have not been deposited at the bank.

The accountant calculates that the bank account balance is going to end up at $119,800 once it includes the $13,000 of deposits in transit. At the same time, the cash balance of $120,000 on the company’s books will go down by the $200 in bank fees. She creates a bank reconciliation statement that itemizes both the $200 in unrecorded bank fees and the $13,000 in outstanding deposits.

Bank Reconciliation Statement

A bank reconciliation statement is a document that outlines the differences between a company’s bank statement and its own accounting records. It’s used to identify and explain any discrepancies and to confirm that the adjusted balances on both sides match.

The statement helps confirm financial reporting accuracy and can uncover errors, missing transactions, or unauthorized activity. It also serves as a useful audit trail, showing how cash records were reviewed and adjusted.

Here’s an example of what By the Bay Contracting’s bank reconciliation statement could look like.

Why Are Bank Reconciliation Statements Prepared?

Bank reconciliation statements serve as a bridge between a company’s internal accounting records and the transactions reported by the bank. They’re typically prepared on a regular basis, often monthly, and are presented as detailed reports to be reviewed by the accounting team, financial managers, and sometimes the company’s executives or board of directors, depending on the size and structure of the organization. They may also be presented to auditors as part of the financial review process. As such, preparing these statements should be looked at as more than just a routine accounting task. Rather, they’re fundamental to sound financial management and informed decision-making.

Here are the main reasons why businesses should regularly invest time and resources into preparing bank reconciliation statements:

- Error detection: Bank reconciliation statements present a side-by-side comparison of a company’s internal accounting records and its bank statement. Regular review of these statements allows companies to detect and investigate errors such as data entry mistakes, missed transactions, or redundant postings. This facilitates early error correction and can prevent bigger problems down the road.

- Decision-making: By providing an accurate reconciliation between bank records and internal accounts, these statements contribute to a more reliable financial picture. This verified information supports better-informed decisions regarding expenditures, investments, and strategic planning. Regularly reviewing reliable statements underpins everything from daily cash management to long-term expansion strategies.

- Expense monitoring: Bank reconciliation statements contribute to an accurate view of a company’s cash outflows by verifying and correcting discrepancies between bank records and internal accounts. This verified information allows business leaders to track and analyze spending more reliably, supporting effective budget management. Regular review can also help spot unauthorized or unnecessary payments to support more efficient resource allocation.

- Fraud detection: Regularly reviewing bank reconciliation statements can reveal unusual patterns or unexpected entries that warrant further investigation. While the statements themselves don’t directly expose fraud, they serve as a crucial tool in the broader fraud detection process by helping companies spot possible problems early.

- Accurate financial statements: By providing a clear record of reconciled bank accounts, bank reconciliation statements support the accuracy of broader financial reporting so that other financial statements (such as the balance sheet and cash flow statement) reflect the company’s true financial position. This accuracy is important not only for internal reporting but also for maintaining trust with investors, regulators, and other key stakeholders.

- Audit and regulatory compliance: Bank reconciliation statements provide tangible evidence of consistent account reconciliation, which demonstrates good financial stewardship and supports compliance with accounting standards and legal requirements. Bank reconciliation statements are particularly important for highly regulated industries and companies preparing for external audits.

Tips for Successful Bank Reconciliations

Best practices in bank reconciliation vary from business to business, especially as a company grows and its operations become more complex. The following tips, however, can be applied to any organization’s bank reconciliations.

- Do bank reconciliations on a set schedule: Reconciliations are time-consuming and confusing if not done regularly. A delay in reconciling can wipe out some of the benefits bank reconciliations offer, such as spotting cash-flow problems in a timely way. As a result, smart businesses do monthly or even weekly bank reconciliations. A high-volume business such as a retail store or restaurant may well do bank reconciliations daily, a feature supported by some accounting software that can automatically link to and download information from banks in real time.

- Consolidate accounts: If there is so little activity in an account that there is sometimes nothing to reconcile, consider closing the account and moving the funds to a more active account. This will make your bank reconciliation process more efficient.

- Take advantage of technology: As businesses grow, so do the volume and complexity of their transactions—making manual bank reconciliations impractical. Modern tools powered by AI, machine learning, and robotic process automation (RPA) can streamline routine tasks, quickly flag anomalies, and help teams improve and improve the accuracy of transaction matching and error detection over time. Cloud-based accounting platforms offer scalability and remote access, while advanced analytics reveal deeper insights into financial trends and discrepancies. Some companies are also exploring the potential of blockchain-based reconciliation solutions, which promise real-time processing and enhanced security.

Free Bank Reconciliation Template

One way to become familiar with the process of bank reconciliation is to work through a basic example. Download our free Excel bank reconciliation template and try it out. As downloaded, it will reflect the reconciliation numbers described in the By the Bay Contracting example described above, but with additional rows for further adjustments. You can change the numbers to reflect examples from your organization’s statements and books, and add rows as needed (but don’t forget to adjust the provided formulas).

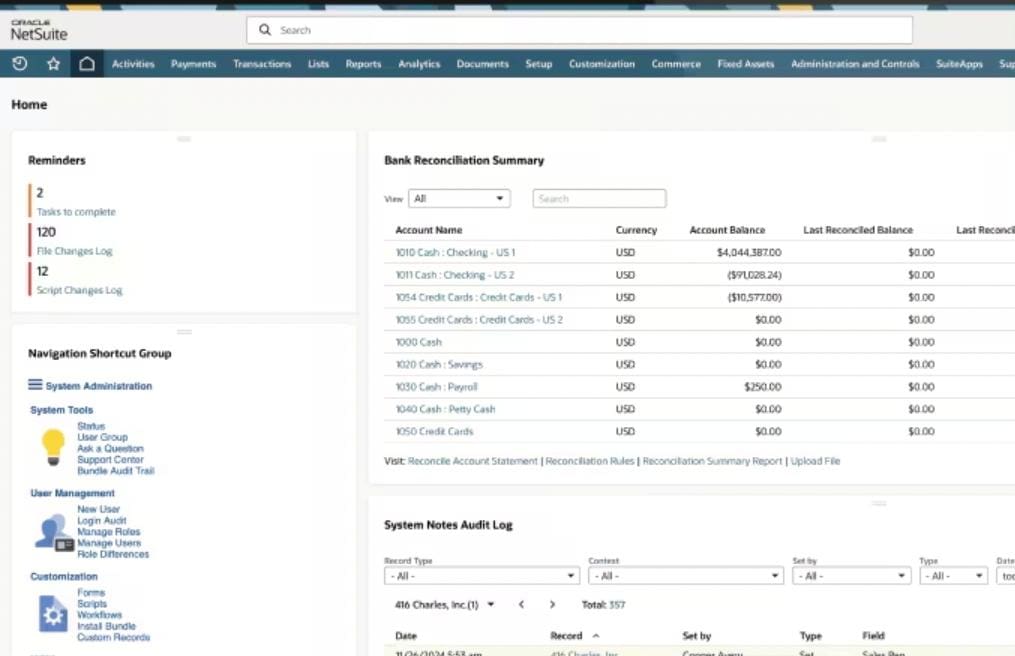

Manage Bank Reconciliations With NetSuite

For companies with high transaction volumes, multiple bank accounts or multiple currencies, bank reconciliation can be a time-consuming process. NetSuite Cash Management can automate a crucial part of this process—the manual comparison of bank data with companies’ accounting system data. NetSuite users can automatically import bank data, saving time and improving accuracy. For instance, the MD Restaurant Group, a chain based in Illinois, is using NetSuite’s bank reconciliation functionality to compare financials from 19 different entities.

NetSuite Automated Reconciliation

Bank reconciliation aligns the cash balances on a company’s bank statements with the cash balances it has on its books. It is an essential part of corporate accounting. Among the benefits of bank reconciliation are better cash-flow management, better management of accounts receivable and a better ability to spot fraud. The right steps and technologies can help companies increase the speed and efficiency of their bank reconciliation processes, regaining time for other activities.

Bank Reconciliation FAQs

What do you mean by bank reconciliation?

Bank reconciliation starts by comparing the cash a company has on its books to the cash it has on its bank statement. Adjustments are made to each so that the two figures match, and the company has an accurate picture of its cash position and all cash transactions for the period. Examples of adjustments include deposits that have been made but haven’t yet been cleared at the bank and so aren’t included in the bank statement, bank service fees, and returned checks that haven’t yet been accounted for in the company’s books.

What are the 6 steps for bank reconciliation?

The first step is for a company to compare its bank account statement with its bookkeeping record. The two figures are rarely the same when a reconciliation starts. Step two is to adjust the bank account balance and step three is to adjust the balance on the company’s books. The final step is recording the reconciliation.

What are the three methods of a bank reconciliation?

Reconciliations can be done manually, using paper. A second method is to do them with spreadsheet software. The third method is to do reconciliations with the help of cloud-based accounting software.

What is a bank reconciliation statement?

A bank reconciliation statement is a document that itemizes adjustments to a company’s bank balance and its accounting books so that the two numbers match.

What are some tips for a successful bank reconciliation?

First, do your reconciliation on a regular basis so the effort doesn’t get too complicated. Two other tips are to automate those aspects of bank reconciliation that you can, and to close bank accounts that don’t have a lot of activity, so you aren’t doing small reconciliations.