Generally Accepted Accounting Principles (GAAP) are the guidelines and standards U.S. public companies must follow in preparing their financial statements and supporting disclosures. They standardize reporting so all public companies share their financial activities in a consistent and accurate way. Private companies aren’t required to comply with GAAP—but some firms decide to do so anyway, especially if they are considering going public in the future or they’re seeking additional financing.

What Are Generally Accepted Accounting Principles (GAAP)?

Created and managed by the Financial Accounting Standards Board (FASB), GAAP provides consistent approaches to a wide range of financial accounting issues. These include:

- Revenue recognition

- Expense recognition

- Financial and non-financial assets

- Taxes and other liabilities

- Leases

- The use of derivatives and hedging

- Accounting for mergers and acquisitions

While GAAP leaves room for interpretation, it provides a common financial accounting framework that helps companies, investors and other stakeholders reliably understand the economic condition of a business and compare it with other businesses. Accounting software makes it easier for companies to incorporate this framework in their business and helps ensure they remain compliant with GAAP and other accounting standards. By automating accounting processes, financial software also improves efficiency and helps companies produce timelier financial reports.

History of GAAP

In the wake of the 1929 financial crash and the Great Depression, policymakers sought stronger control over the financial markets and the activities of publicly traded companies. The Securities and Exchange Commission, established in 1934, was tasked with setting new standards designed to ensure more accurate and complete corporate financial accounting.

Who Created GAAP?

To develop these financial accounting standards, the SEC turned to the American Institute of Accountants (AIA). The AIA’s Committee on Accounting Procedure (CAP) began issuing standards, influenced by the SEC and occasionally by Congress. The AIA was the first body to use the term generally accepted accounting principles. Later, much of this responsibility moved to the American Institute of Certified Public Accountants’ Accounting Principles Board (APB).

Financial Accounting Standards Board

In 1973, the APB was replaced by the independent Financial Accounting Standards Board (FASB), which took over responsibility for managing GAAP. The FASB, which has its own staff, is overseen by the private nonprofit Financial Accounting Foundation (FAF). The FASB manages and updates GAAP.

Congress formally allowed the SEC to recognize the FASB’s role, and established fees that public companies must pay to support it. The FAF and FASB also earn revenue by publishing standards and educational documents designed to help companies successfully implement the standards.

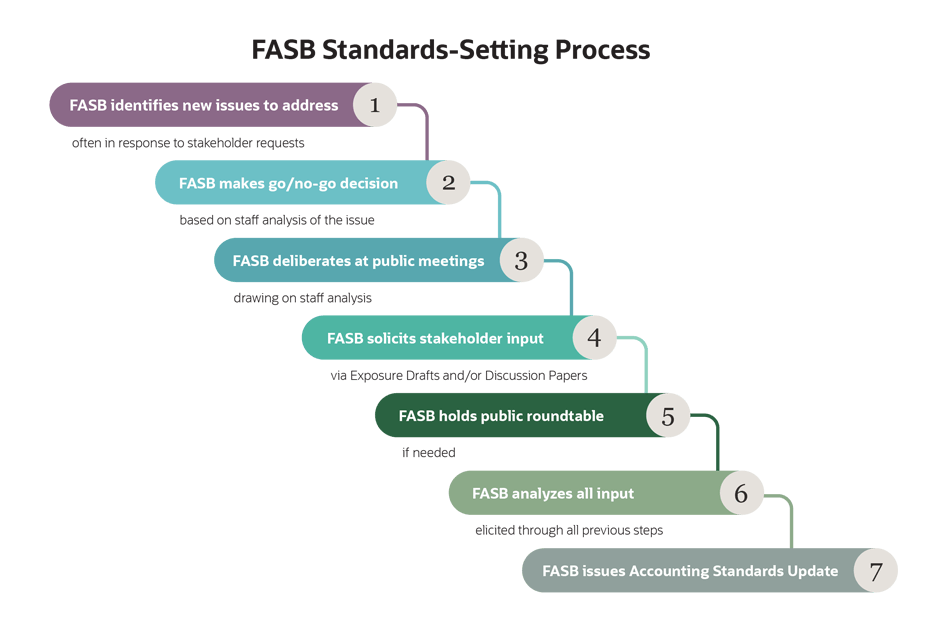

FASB Standards Setting Process

The FASB has defined a complete process for building and revising GAAP standards based on input from stakeholders. Those stakeholders include CFOs and corporate accountants who prepare financial statements, as well as members of accounting firms, academics and industry organizations.

Governmental Accounting Standards Board

The FAF also controls the similar Governmental Accounting Standards Board (GASB) which creates financial standards for government accounting.

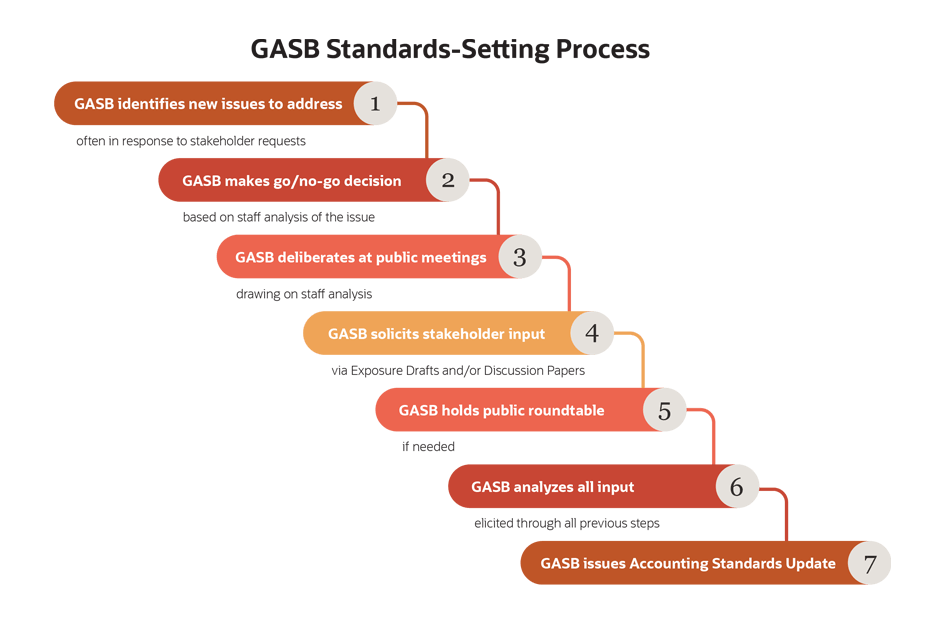

GASB Standards-Setting Process

The GASB process for building and revising GAAP standards that apply to state and local government accounting is similar to the FASB process. The steps include research, stakeholder participation, board consideration and standards issuance.

10 Basic Tenets of Generally Accepted Accounting Principles

GAAP is built atop a set of core financial accounting principles and assumptions. These include:

- Regularity: Accountants should follow GAAP rules.

- Consistency: Accountants should apply the same rules consistently throughout all financial reporting and across all time periods. If they do make changes to reporting methods, these should be fully disclosed and explained.

- Sincerity: Accountants should be accurate and impartial.

- Permanence of methods: Consistent procedures should be used for all financial reports so observers can make comparisons more easily.

- Non-compensation: Accountants should be transparent about the existence of debts or costs and not hide them within assets or revenue.

- Prudence: Accountants should report only facts; no speculative assumptions.

- Continuity: Asset valuations are based on the assumption that the company’s operations are expected to continue.

- Periodicity: The company provides financial reports on a regular basis, such as quarterly.

- Materiality: All financial information that would be significant to an investor should be disclosed.

- Utmost good faith: The honesty of all parties is assumed and expected.

What is IFRS?

The international equivalent of GAAP is the International Financial Reporting Standards (IFRS).They are the official financial accounting standard in the European Union and more than 165 jurisdictions worldwide. Foreign companies registered in the U.S. can now substitute IFRS reporting for GAAP if they choose.

Some attempts have been made to converge IFRS and GAAP standards over the past two decades in areas such as revenue recognition, lease accounting, and mergers and acquisitions. While the two standards appear unlikely to fully converge, the FASB is now a member of the Accounting Standards Advisory Forum (ASAF) that advises on new IFRS standards.

Increasingly, companies with foreign stakeholders, investors or potential acquirers may need to prepare some or all of their financial information utilizing IFRS. Certain small-to-mid-sized enterprises may be able to use a simplified version known as “IFRS for SMEs.”

GAAP vs IFRS

Meaningful differences between IFRS and GAAP still exist in areas ranging from employee compensation to accounting for assets such as intangible assets, plant, property and equipment (PP&E) and inventory. For instance, IFRS prohibits the use of last-in-first-out (LIFO) inventory costing, which is allowed under GAAP. Both IFRS and GAAP allow other methods of valuing inventory, such as first-in-first-out (FIFO) and weighted average cost.

GAAP vs Non-GAAP

GAAP standards help investors compare companies on an apples-to-apples basis, knowing that each company is following the same rules to report its information in similar ways. However, some companies prefer to report additional non-GAAP metrics to add nuance and show more information about their performance.

For instance, GAAP requires companies to subtract depreciation expense from operating revenue when reporting earnings. Some business leaders feel reductions like these unfairly diminish company performance and can cause investors to view results negatively, so they also report non-GAAP earnings.

One common non-GAAP metric is earnings before interest, taxes, depreciation and amortization (EBITDA). As its name suggests, EBITDA is an earnings measure that excludes depreciation and amortization costs, as well as interest expense related to loans or other debt. EBITDA is often preferred in capital-intensive industries like telecommunications where companies tend to borrow heavily to invest in assets and have correspondingly high depreciation and interest costs as a result. Using EBITDA enables these companies to show better results than they can with net income alone.

The SEC requires public companies to show how GAAP earnings were adjusted to arrive at EBITDA or any other non-GAAP measures they report.

Producing GAAP-compliant financial statements and tracking non-GAAP metrics are both easier with business accounting software. Even small businesses and startups can benefit from a financial management solution because it allows them to record financial transactions, consistently, reduces data errors and accelerates the financial closes process, helping them meet internal and external reporting requirements. Cloud-based solutions also offer real-time visibility into day-to-day financial performance from anywhere with an internet connection, making it possible to manage a business without being tied to an office.

Limitations of GAAP

In the U.S., GAAP is only required for public companies, and though some countries have their own versions of GAAP, foreign public companies typically use IFRS instead.

GAAP doesn’t cover every aspect of financial reporting, and it has been deliberately designed to leave room for professional judgment by accountants and auditors. Even so, companies also use a wide variety of non-GAAP metrics to provide what they consider to be a more accurate view of business performance. In addition to EBITDA, other common metrics include earnings before interest and taxes (EBIT), free cash flow, funds from operations (FFO) and core earnings, to name a few.

Public companies using non-GAAP measures should carefully follow current SEC guidelines for doing so. And investors should carefully review non-GAAP performance to make their own judgments, especially if companies change the way they present these results over time.

GAAP requires public companies to report their financial activities in a consistent way, so stakeholders can get a clearer view of a business’s financial health. Though private companies don’t need to use GAAP, it may be helpful for firms that are considering going public in the future or aiming to obtain additional funding.

Business accounting software simplifies generating reports and sharing information with internal and external stakeholders. With financial management software, you can accurately track and report both GAAP and non-GAAP metrics, helping ensure compliance with accounting standards and giving potential investors more confidence in your company’s performance.