All companies need to track the cost of doing business, part of which includes managing expenses. Employees must submit expense reports to be repaid for out-of-pocket purchases. Managers need to approve these expenses for reimbursement, track how much the company is spending on T&E (travel and expense) and document everything for tax purposes to help ensure the company can claim all appropriate deductions.

While larger companies have typically replaced paper reports, piles of receipts and spreadsheets with expense management software, smaller companies are more likely to hold on to inefficient manual processes and systems. This can have severe consequences: Small businesses lacking expense software risk employees purchasing something that isn’t allowed and frustration with cumbersome processes and reimbursement delays. They may experience hits to their cash flow when duplicate or fraudulent reports slip through the system, they can’t bill in a timely fashion for expenses incurred on a client’s behalf and inadvertent mistakes lead to tax penalties.

Why Is Expense Management Software Important?

Automated expense reporting software helps companies simplify T&E operations, increase productivity and boost the bottom line by improving the process in five areas:

Employees may submit expense reports and corresponding documentation, including photos or scans of receipts, directly into the software from their computers, tablets or smartphones, eliminating the need to fill out paper forms and hang on to sales slips. Reimbursement is expedited, putting cash back in employees’ bank accounts and eliminating the frustration that comes with delays.

Additionally, companies increasingly have geographically dispersed workforces, and as new and better collaboration tools enhance the experience of remote teams, the number of employees working from home is expected to increase for companies where that model is an option.

As a result, companies need an efficient way for employees to submit expenses and receive reimbursement at any time, whether they are at home or traveling.

The benefits also extend to finance teams.

T&E is usually an organization’s second-highest indirect expense, behind payroll, Mastercard reports, with accounting functions—expense processing, audit, compliance and management—representing up to 23% of the total cost of the program. Efforts to increase efficiency and keep those costs down are a top expense management trend right now. Here are four ways software helps:

Custom rules enforce policies, route expense reports for approval or even automatically approve recurring expenses and detect innocent mistakes as well as outright fraud. A report from the Association of Certified Fraud Examiners found that, in companies with more than 100 employees, 11% of fraud cases arose from expense reports(opens in new tab). Fake claims or duplicate entries siphon money away from the company and into a dishonest employee’s pocket.

Compliance with directives from the IRS and other tax agencies makes expense management software critical. Using software helps track which expenses businesses are entitled to deduct and provides easily accessible documentation should the company ever be audited.

Dashboards provide managers with unified expense data and present it in a visual format that makes it easier to understand and analyze. Real-time information provides insight into the current state of business operations. Also, having expense data in a single place can help finance teams establish future expense budgets.

Custom reports dive into details—who is spending, how much and in which categories. They also highlight trends, like how long it takes to approve an expense report, the status of reports and where they are in the approval cycle. This helps finance teams identify areas where they can gain efficiencies, tighten spending controls for cost savings and strengthen the bottom line.

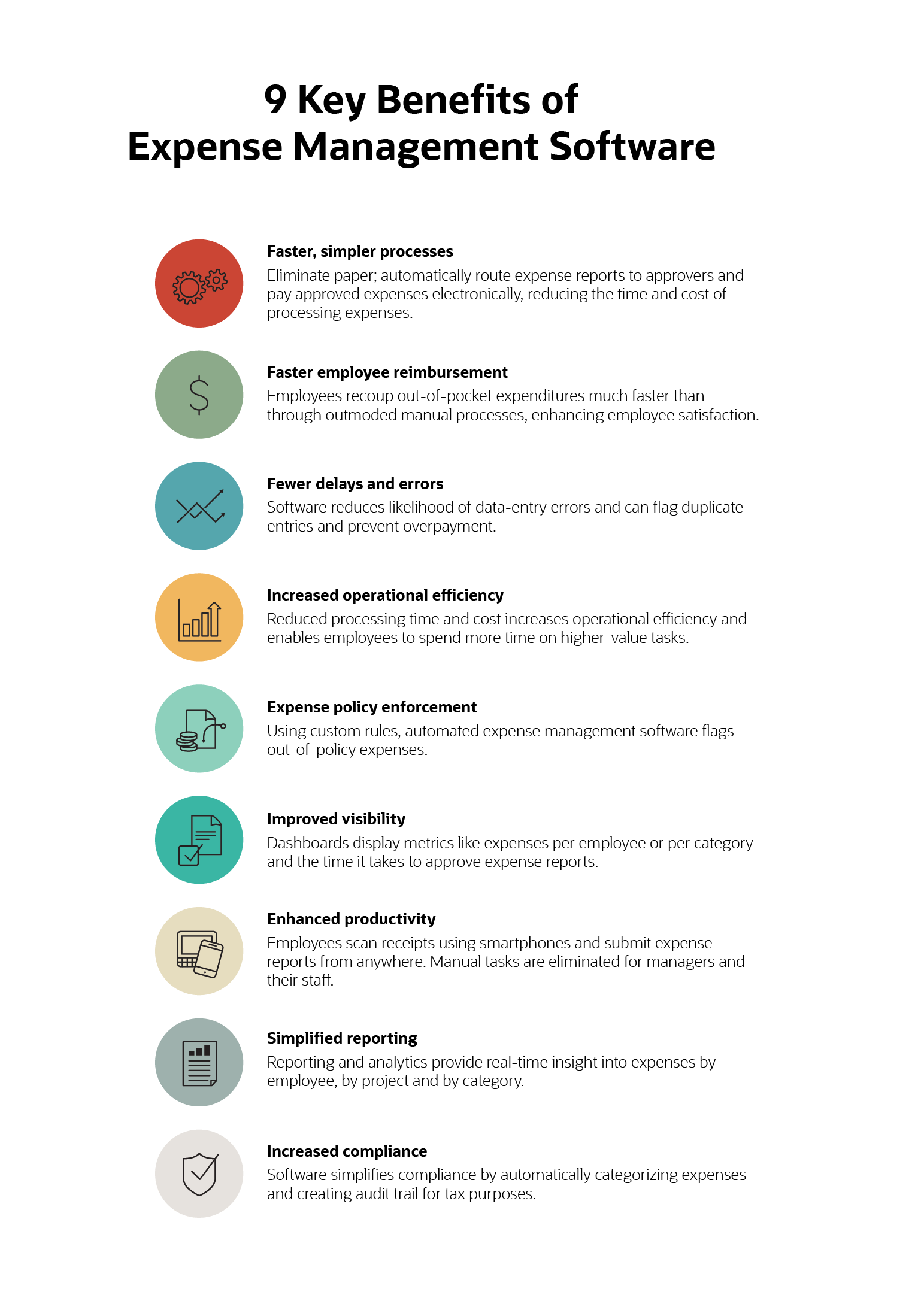

9 Benefits of Expense Management Software

Besides providing all of the above benefits, automated expense management software addresses many expense tracking and reporting challenges.

The benefits of automated processes are numerous: employee satisfaction, improved productivity, cost savings and better compliance. Enhanced reporting helps with financial planning and analysis as companies assess current spending and find ways to increase efficiency and trim costs.

Here’s what companies can expect when they implement expense management software:

1. Faster, simpler processes.

The old way of submitting expenses involved printing paper copies, attaching receipts and passing reports to managers, who would then either approve them or kick them back to the employee for adjustment. But with expense management software, the workflow is automated. Once the employee hits “submit,” the report is automatically routed to the appropriate person for approval. After approval, the amount to be reimbursed can be automatically submitted to payroll. If the manager who normally approves that employee’s reports is on leave, the report can be sent to a temporary approver.

The outcome of simplified processes is that companies:

- Cut processing costs. There are tangibles, like paper, that get eliminated. But companies also remove the costs associated with employees and managers alike contending with hard copies, searching for receipts or manually matching amounts. Many companies don’t even track how much it costs to process these reports, so introducing expense management software can help companies save money they didn’t even know they were wasting.

- Cut processing time. Because expense management software uses automation to send reports for approval, flag potentially out-of-policy expenses and submit approved reports for payment, companies decrease the time it takes to process reports. Accounting departments can run accounts payable reports on time instead of waiting for that last hard-copy expense report to be routed and approved.

2. Faster employee reimbursement.

With automated expense reimbursement, employees can submit expense reports and corresponding documentation without delay, and managers can quickly and easily review and approve claims as notifications come in. Thus, these tools put cash back in employees’ bank accounts more quickly and eliminate the frustration that comes with errors and delays—thereby enhancing employee satisfaction.

3. Fewer delays and errors.

In addition to reducing the time it takes to reimburse employees, the automation features in expense management software improve accounting accuracy. For example, with manual expense reports, employees might make data-entry errors that could be further compounded when finance staff transcribes the information into spreadsheets. Expense management software can flag errors and duplicate entries and prevent overpayment, or notify managers if the dollar figure seems too high. The software can also send alerts if a report or payment is overdue.

Solutions pull data directly from bank accounts and credit card statements and can be integrated with corporate travel management systems. Employees can capture receipts using their mobile devices and attach them to reports using app-enabled optical character recognition (OCR), eliminating potential errors from trying to type on a small screen.

4. Increased operational efficiency.

If you bill expenses directly to clients, employees’ reports must be timely and accurate to maximize cash flow. Ideally, expense management software is integrated with time tracking, project management, accounting and enterprise resource planning (ERP) software. When this process is simple for the employees who are tracking and the managers who are approving and reporting, your company could see improved cash flow.

And because all employees spend less time on mundane, error-prone and time-consuming manual expense reports, they’re not focused on the “input” portion of the input:output ratio. Instead, they can focus on the tasks and projects that bring value to the organization, whether that’s going on sales calls or preparing strategic budgets. This is one key reason that startups can benefit greatly from expense management software.

5. Expense policy enforcement.

Even the most meticulous manager may not be up-to-date on every new expense policy and tax change. By enforcing custom rules tailored to your business, automated expense management software flags out-of-policy travel expenses. For example, per diem meal allowances may have increased per federal guidelines, but employees are submitting expense reports based on the old amount. Or, an employee may be attempting to request reimbursement for a new addition to the policy, like an ergonomic keyboard, but is being denied.

5 Top Expense Fraud Clues

| Finance professionals should keep an eye out for these telltale signs. |

|---|

| Altered receipts: One potential downside of e-receipts is more potential for doctoring of image files. This argues for company-issued credit cards so that finance can cross-reference submissions to billing statements. |

| Date, time and location tags: A meal or parking/Uber expense on a weekend, late at night or in a town other than the employee's home or company HQ should trigger a follow-up, especially now that travel is rare. |

| Deviations from norms: Set your expense management system to trigger alerts if an expense claim is significantly higher than the historical benchmark. For example, if most home workers spend $80 per month on internet, a claim for $150 should raise a flag. |

| Cash payments: We're now in the era of contactless payments. With the exception of allowable tips, question why an expense was paid for in cash. |

| Split claims: If the company limits, for example, per-night hotel costs to $200, an employees might book a room for two nights at $350 and put in two separate claims to bypass the policy. |

6. Improved visibility.

Most expense management software includes a dashboard that compiles employee expense data and presents it in an easy-to-understand visual format using charts and other graphics. Managers can view metrics, like how much a company spends per employee or per category or the average time it takes to approve expense reports.

7. Enhanced fraud prevention.

That report from the Association of Certified Fraud Examiners says 20% of businesses with fewer than 100 employees and 13% of larger organizations have reported fraudulent expense reimbursements. It’s understandable that busy finance teams and managers might overlook well-camouflaged fake entries from trusted employees or contractors. Once that money has been paid, it’s difficult to get it back. And, if an auditor spots a questionable entry, that raises a big red flag and spurs more digging.

8. Simplified reporting.

Reporting and analytics provide real-time insight into company spend. Options for reporting expenses include by employee, by project and by category. Expense management software makes it possible to consolidate expenses into a single report. Additionally, companies can implement expense management best practices by:

- Identifying high-spending individuals, chronic policy violators and the expense trends of every employee over time.

- Suggesting which national hotel, car rental and even restaurant chains companies may want to approach for volume discounts.

- Encouraging employees to help save money connecting the dots between frugality and the ability to invest in growth.

These insights also help companies further identify areas where they need to clarify or better enforce spending policies.

9. Increased compliance.

Expense management software helps companies stay on the right side of compliance with local, state and federal tax agencies. Companies can place expenses into categories, like office, travel and mileage, and tag them appropriately; some expenses, such as most entertainment and dues to country, golf and athletic clubs, are now not tax deductible, so including them may draw the IRS’ attention. Expense management software also delivers easily accessible electronic copies of reports and receipts, which are invaluable if the organization is audited.

Choosing an Expense Management System

As with any software implementation project, follow best practices when purchasing an expense management solution, and keep a few pointers in mind:

- Start with a discovery and planning phase, which includes defining system requirements based on detailed expense management workflows and then researching and selecting a system. Will you choose on-premises or software-as-a-service (SaaS)?

- Ask providers about the cost structure for purchase, set up and customization, and look carefully into ongoing and indirect fees for upgrades, customer support, software license renewals and more.

- Make sure the solution can be customized to address your company’s workflows and policies without extensive developer resources. A better bet may be to see if your processes can be tweaked to fit the software, remembering that it’s been developed to meet the needs of hundreds or thousands of companies.

- Choose a system that’s easy to use for all employees—those who report, approve and analyze—with mobile capabilities, well-designed functionality and an intuitive interface that appeals to today’s multi-generational workforces.

- Allocate sufficient resources to provide training and technical support for all users.

- Don’t simply migrate all historical data to the new system; take time to delete obsolete customer accounts and look for inaccuracies.

- Deep integration with accounting and project costing solutions.