“Asset” is one of those words that has both a casual meaning and a specific definition. As part of everyday speech, asset is used favorably: “He’s a real asset to the community.” But in the business accounting sense, what do finance professionals mean by assets? In that context, an asset is something of value that a company expects will provide future benefit.

Assets are a key component of a company’s net worth. Lenders may also factor in a company’s assets when issuing loans. As a note, this article only addresses company-owned assets, not right-of-use assets (i.e., leased assets).

What Are Assets?

Assets are resources “controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise,” as defined by the International Financial Reporting Standards (IFRS). Put another way, assets are valuable because they can generate revenue or be converted into cash.

Assets can be physical items, such as machinery, or intangible things, such as intellectual property. Assets are reported on a company’s balance sheet, one of its key financial statements. A business cannot operate effectively or sustain itself without assets; they are critical to producing and marketing goods or services, which, in turn, is essential for generating revenue and profit.

Key Takeaways

- Assets, which can be tangible or intangible, are resources that provide economic benefit to a business.

- They are categorized based on their characteristics, such as how easily they can be converted into cash, their physical existence, and their purpose.

- Properly classifying assets is essential to accurately calculating key financial metrics, like working capital and cash flow.

- Which asset valuation method a company decides to use will depend on the nature of the business, type of asset, and purpose of valuation.

- Valuing assets is crucial to financial reporting and business planning and helps determine a company’s solvency and risk profile.

Assets Explained

Assets are a broad category of tangible and intangible items that play a critical role in any business. They can include everything from industrial equipment and inventory, which enable production and sales and, therefore, revenue generation; to real estate and patents, which impact a company’s overall valuation; to vehicles and printers, which enable day-to-day operations.

Simply put, a business cannot operate effectively without assets. Assets sit on the plus side of a balance sheet, thereby increasing the attractiveness of a business to lenders or investors; in many cases, they can be used as collateral for financing to support expansion or existing operations. Assets also contribute to the net worth of a company and, as a result, are important in assessing the financial health of a firm. (After all, they can often be sold or leveraged when needed). Physical assets, like production equipment or office printers, are essential for daily operations. Intangible assets, like trademarks, and certain unique or high-quality assets can fuel competitive advantage and boost brand value.

What’s more, assets are important to informed decision-making. Knowing which assets a business has and their condition can drive choices around upgrades, investments, resource allocation, and strategic planning. Finally, asset management is key to transparent financial reporting and regulatory compliance, keeping a company on the right side of key stakeholders who have a vested interest in its financial stance.

Assets vs. Liabilities

A company lists its assets, liabilities, and equity on its balance sheet. Assets are resources a business either owns or controls that are expected to result in future economic value. Liabilities are what a company owes to others—for example, outstanding bills to suppliers, wages, and benefits due to employees, as well as lease payments, mortgages, taxes and loans.

As a note, for public companies, leased property and equipment is listed on the balance sheet as both an asset (right of use) and a liability (the present value of future lease payments). Private companies will soon be required to do the same under US GAAP.

Equity is the company’s net worth—the value that would be returned to the owners or shareholders if all assets were sold and all debts were settled. The relationship between assets, liabilities, and equity is defined in the “accounting equation,” one of the basic principles of accounting:

Assets = Liabilities + Shareholders’ equity

A business with more assets than liabilities is considered to have positive equity or shareholder value. If assets are less than liabilities, a company has negative equity or owes more than it is worth.

How Assets Work

Assets underpin a company’s ability to produce cash and grow. They are categorized based on specific characteristics, such as how easily they can be converted into cash (for company-owned assets) and their business purpose. They help accountants assess a company’s solvency and risk, and they assist lenders in determining whether to loan money to a company.

Types of Assets

Assets can be classified based on a number of criteria. For companies, the correct classification is critical to financial reporting and evaluating the business’s financial health. Typically, assets are valued by the expected future cash flows they represent in their current condition, according to the IFRS.

-

Personal:

Soft personal assets, such as intellect, wit, or a winning smile, are different than personal financial assets, which contribute to an individual’s or household’s net worth. Examples of personal financial assets include cash and bank accounts; real estate personal property, such as furniture and vehicles; and investments, such as stocks, mutual funds, and retirement plans.

-

Business:

Business assets deliver value to a company because they can be used to produce goods, fund operations, and drive growth. Assets include physical items, such as machinery, property, raw materials, and inventory, as well as intangible items, like patents, royalties, and other intellectual property. Companies account for their assets on their balance sheets and categorize them based on a set of criteria that reflect their liquidity—or how readily they can be converted to cash—as well as whether they are physical or nonphysical assets and how they’re used to derive value.

-

Current:

Current assets are short-term assets that a company can sell, convert to cash, or use up within one year or within its operating cycle, whichever one is longer. Because these assets are more readily liquid, they might be used to fund day-to-day operations and meet other immediate financial obligations. While any asset can be converted into cash within 12 months if the price is sufficiently discounted, current assets include only those that are expected to be converted into cash or used up within that time frame. Some examples of current assets include cash and cash equivalents, inventory, marketable securities, and accounts receivable (AR).

-

Noncurrent:

At the other end of the spectrum, noncurrent assets are those that may not be readily converted to cash within a year. Also known as fixed or long-term assets, these are used for longer-term operational purposes, typically providing value over several years. Some examples of noncurrent assets include land, buildings, machinery, and equipment—referred to as property, plant, and equipment (PP&E) on a balance sheet— intangible assets, like trademarks and patents, and long-term investments.

-

Tangible:

Assets that have a physical existence are called tangible assets. They include cash, PP&E, inventory, raw materials, tools, and office supplies.

-

Intangible:

Intangible assets, as the name implies, lack a physical presence. Examples of intangible assets include right-of-use assets, patents, copyrights, and trademarks, the value of which can sometimes be difficult to quantify.

-

Long-lived:

Long-lived assets are tangible and intangible assets that are expected to provide an economic benefit beyond the current year. They include manufacturing equipment or buildings.

-

Wasting:

Other tangible and intangible assets that decline in value over a limited lifespan are referred to as wasting assets. Tangible assets that qualify as wasting assets include manufacturing equipment and vehicles, which wear down or become obsolete over time. Intangible assets, such as patents, also qualify as wasting assets because they have a limited lifespan before they expire. To reflect wasting assets’ reduction in value over time, accountants reduce the assets’ value on the balance sheet by applying depreciation (for tangible assets) or amortization (for intangible assets).

-

Operating assets:

If an asset is required for the company’s core business activities and revenue generation, it is called an operating asset. This asset category includes tangible or intangible items, such as inventory, AR, intellectual property, and PP&E. For a mining company, heavy equipment qualifies as an operating asset, as does a manufacturer’s production equipment.

-

Non-operating assets:

Non-operating assets are items that a company owns but are not necessary for funding or performing day-to-day business operations. However, they may still generate income or be held for investment purposes. Examples of non-operating assets include short-term investments and marketable securities (unless they’re part of the company’s core business, as in some financial services firms), interest from deposits, vacant land or unused buildings, and idle or outdated machinery and equipment. These items are considered dispensable and may be sold to raise capital if necessary.

Examples of Assets

There are a wide variety of assets that businesses might need to perform at their highest level. They include:

- Cash and cash equivalents

- AR

- Marketable securities

- Trademarks

- Patents

- Product designs

- Distribution rights

- Buildings

- Land

- Mineral rights

- Equipment

- Inventory

- Software

- Computers

- Furniture and fixtures

Three Key Properties of Assets

For something to be considered an asset, it must have three properties:

- Ownership: First, a company must own and control the asset. This allows the company to convert the asset into cash or a cash equivalent and limits others’ control over the item. Note: Right-of-use assets aren’t always convertible. Lease agreements often stipulate that the lease cannot be transferred or sold. The ownership property is important when considering an asset’s informal meaning versus its technical meaning. For example, companies often say their employees are their “greatest asset,” but in terms of accounting, companies don’t have true control over them—employees can easily leave for a new job.

- Economic value: Second, an asset must also provide economic value. All assets can be sold or otherwise converted to cash, except for some right-of-use assets, such as lease agreements. In that way, assets can be used to support production and business growth.

- Resource: Finally, an asset must be a resource, which means it has or can be used to generate future economic value. This generally means that the asset can create future positive cash inflows.

Importance of Asset Classification

Properly classifying assets is important for company leaders to have an accurate picture of key financial metrics such as working capital and cash flow. Asset classification can also help a business qualify for loans (it gives the bank a clearer picture of the risk it’s taking on), work through bankruptcy, and calculate tax liabilities.

Distinguishing operating assets from non-operating assets also helps organizations see how each asset type drives overall revenue.

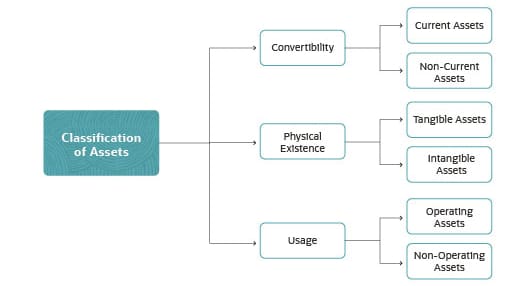

Three Classifications of Assets

Classifying assets helps businesses to assess liquidity, manage risk, validate compliance with accounting standards, and optimize resource allocation. This ultimately leads to better management, business planning, and financial health.

Companies can categorize their assets in a number of ways. At a high level, however, these categories can typically be divided into three different overarching classifications:

- Convertibility: Convertibility describes how easily assets can be converted to cash, which is crucial for managing liquidity and meeting short-term obligations. Assets are typically divided into current (liquid) assets and noncurrent (fixed) assets. Current assets can generally be converted to cash quickly to support day-to-day operations and working capital needs. Noncurrent assets require more time and effort to sell or convert into cash but are important to long-term growth. A marketable stock is very liquid and can quickly be sold for cash, whereas a commercial building might not readily be liquidated.

- Physical existence: Physical existence describes whether an asset physically exists (tangible) or does not (intangible). Distinguishing between the two is essential for asset valuation, depreciation, and understanding how assets contribute to business value. There are all sorts of examples of tangible assets, from laptop computers to construction cranes. Other assets, like intellectual property, have no physical presence.

- Usage: Usage describes the purpose of an object as it relates to business operations. A company might categorize its assets based on whether they are used in daily business operations (operating assets) or not (nonoperating assets). This classification helps companies better analyze which assets drive revenue and operational efficiency and, in turn, make more informed strategic decisions. Operating assets include cash, inventory, AR, and machinery. Nonoperating assets include investments, vacant land, or surplus equipment.

Asset Valuation Methods

Selecting the right asset valuation method helps ensure relevant, accurate, and defensible valuations—which are important for financial reporting, transactions, and strategic decision-making purposes. Determining the right method can be tricky, as it will depend on the type of business, the categories of assets involved, the availability and reliability of market data, and the purpose of the valuation. It’s important that skilled financial professionals with experience in asset valuation evaluate these factors to determine the best approach.

-

Market Value Method

The market value approach involves determining the value of a business asset by comparing it to similar assets that have recently been sold on the open market. This method makes the most sense when an active market for the asset and sufficient comparable transactions are available. Because this approach incorporates current market conditions, it can offer a realistic, up-to-date valuation. However, it will not be a good choice if there isn’t enough comparable sales data or if the asset is unique.

-

Book Value Method

This method looks internally at the company’s books, rather than externally, for valuation. It calculates the value of an asset based on its recorded value on the company’s balance sheet, subtracting any accumulated depreciation. This approach offers an objective, accounting-based measure of asset value and is typically used for internal reporting or regulatory purposes. It’s also straightforward. However, it may understate or overstate the true economic value of the asset, particularly if conditions have changed since the asset was acquired.

-

Cost Method

This approach uses an asset’s original purchase price or the amount required to replace it with a similar new asset, adjusted for depreciation or obsolescence, to determine its value. It is a simple, practical approach and can work well for tangible assets. However, it does not incorporate or consider changes in market value or an asset’s income-generating potential. Therefore, companies typically turn to this method only when market data is unavailable or unreliable.

-

Liquidation Value

This method estimates the net cash that would be generated if the business asset were sold off quickly (and any liabilities were immediately paid off). Liquidation value tends to result in a lower valuation than other methods because assets must often be sold at a lower price for a prompt sale. This approach—more commonly used for entire businesses or divisions—comes into play for bankruptcy, restructuring, or distressed sale scenarios.

How Do Assets Affect Accounting?

Understanding and properly valuing assets is integral to accurate accounting, business planning, and financial reporting. And, in the case of public companies, accurately accounting for leased assets is required by law. Classifying and valuing assets is critical to understanding a company’s cash flow and working capital. Accountants have to properly classify assets for purposes such as securing credit and obtaining insurance. They also have to effectively value assets in order to calculate depreciation and amortization for tax purposes and to enable the company to sell them if necessary.

Automate Asset Management With NetSuite Solutions

Keeping track of assets can be challenging given the number and diversity of assets a company may own. Automated asset management solutions offer a way to inventory, categorize, and track assets in order to understand their value and plan operations efficiently. They can also help track and plan the operational life cycle of an asset from acquisition to disposal, including operating and maintaining the asset. In addition, automated asset management systems can help a company comply with shifting government or industry regulations.

NetSuite’s accounting software, for example, incorporates fixed asset management functionality that makes it easier to manage and control depreciating and nondepreciating assets across their full lifecycle, from creation to disposal. Eliminating unwieldy and labor-intensive spreadsheet calculations, NetSuite empowers companies to more easily track assets across multiple facilities with a fully integrated fixed-asset accounting solution.

Assets include almost everything owned and controlled by a company that’s of monetary value and will provide future benefits. Assets are classified by how quickly they can be converted to cash, whether they are tangible or intangible, and how a business uses them. Assets are a key component of a company’s net worth and an important factor in its overall financial health.

Asset FAQs

How can a business tell if something is an asset?

An asset is anything that has current or future economic value to a business. Essentially, for businesses, assets include everything controlled and owned by the company that’s currently valuable or could provide monetary benefit in the future. Examples include patents, machinery, and investments.

What are intangible assets?

Intangible assets are non-physical assets that provide value to a company but don’t exist in physical form. Non-physical assets include things like goodwill, reputation, patents, trademarks, royalties, brand equity, and contractual obligations.

Does labor count as an asset?

Labor is not an asset. In most cases, labor is an expense. Wages payable count as a current liability to hold salaries that are due to employees at the end of the month or whenever payday is.

What’s the difference between current and fixed assets?

Current assets are generally used up within a year and are therefore short-term. They are involved in the daily processes of running a business. Fixed assets are those that have a longer lifespan – generally over one year.