“The beginning of wisdom is the definition of terms.” —Socrates

As you prepare to meet ASC 842/IFRS 16, the new lease accounting standards, is your head spinning to understand the terms? As you plan to book your right of use asset, is it properly calculated with the correct IBR (internal borrowing rate), and have you taken the right expedients during the transition? By the way, are you doing a full retrospective or modified retrospective transition anyway? A great place to start is with understanding the definitions of the new items in the standard. Read on as we explore the most important concepts and terms you must know to understand the new leasing standards.

I’ve been there, both with the lease terms and trying to make sense of a new language. The first time I attended a technical session, I heard about parsing the JSON so you could write a script to call out the https of something. It was like a time in college when I went to a hypnosis show and people in the audience were hypnotized into speaking gibberish. It was funny then, but when the show ended we went back to speaking English.

1. Lease

ASC 842-10-15-3 states: “A contract is or contains a lease if the contract conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration. A period of time may be described in terms of the amount of use of an identified asset (for example, the number of production units that an item of equipment will be used to produce).” It needs to be physically distinct.

This means that ASC 842/IFRS 16 does not include:

- Intangible assets (ASC 350)

- Minerals & biological assets including timber (ASC 930, 932)

- Inventory (ASC 330)

- Assets under construction (Covered under ASC 360)

The graphic below explains the relationship between lessors and lessees:

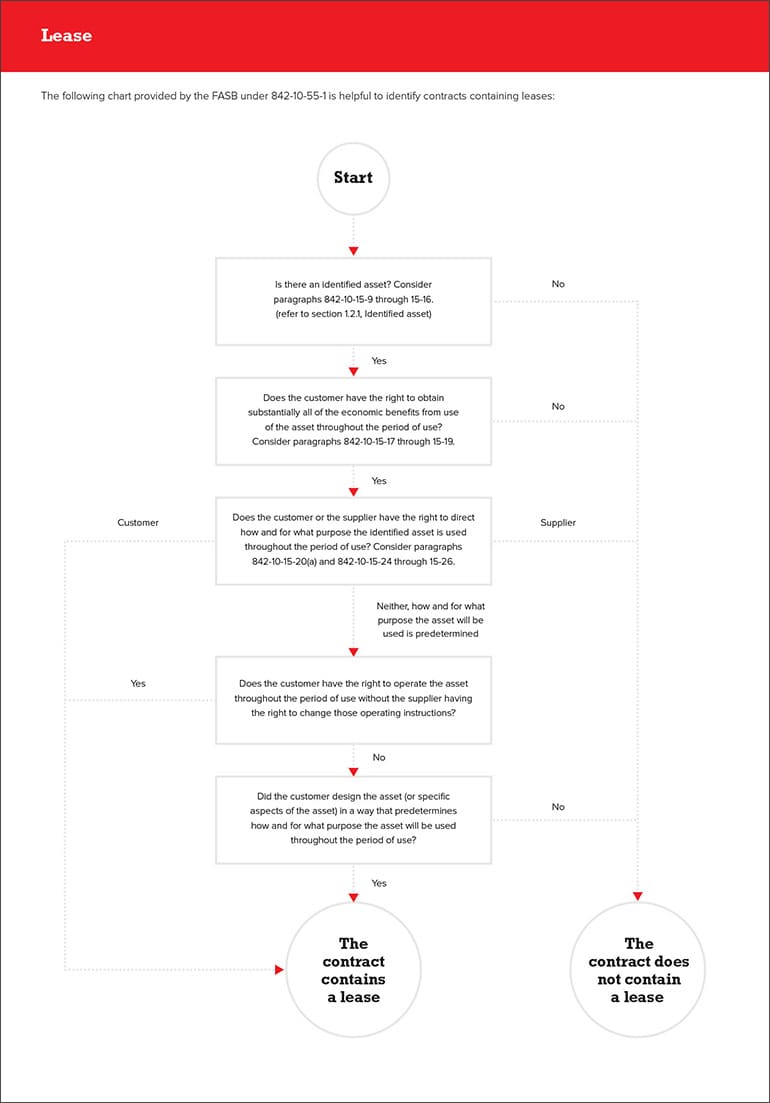

The following chart provided by the FASB under 842-10-55-1 is helpful to identify contracts containing leases:

2. Contract Components

Once it is determined that a contract contains a lease, ASC 842-10-15-28 requires the entity to separate the contract into the various lease components. Separate lease component exists if:

- The lessee can benefit from the right of use on its own, or together with other resources that are readily available to the lessee. Readily available resources are goods or services that are sold or leased separately (by the lessor or other suppliers) or resources that the lessee already has (from the lessor or from other transactions or events).

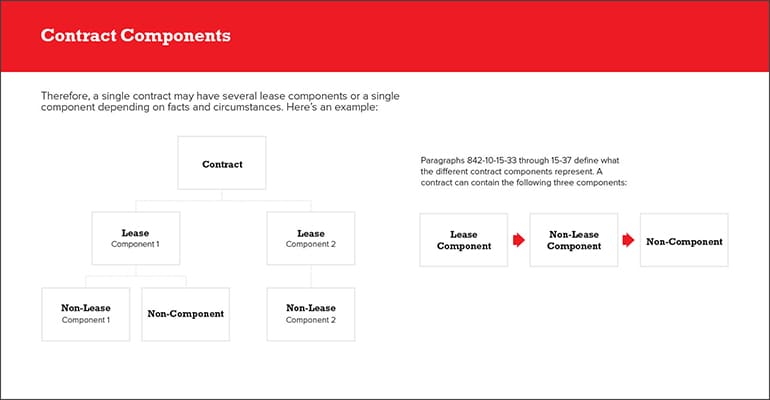

- The right of use is neither highly dependent on nor highly interrelated with the other right(s) to use underlying assets in the contract. Therefore, a single contract may have several lease components or a single component depending on facts and circumstances. Here’s an example:

Paragraphs 842-10-15-33 through 15-37 define what the different contract components represent. A contract can contain the following three components:

- Lease Component – The right to use an underlying asset. For example, this could be the rent for the right to use office space.

- Nonlease Component – An activity that transfers a good or service to the lessee. Building from the office example, this would be common area maintenance charges on office space. 842-10-15-31 also states that nonlease components are not accounted for under lease accounting. Recognizing these costs/revenues are accounted for under different standards.

- Noncomponent – Costs that are incurred regardless of whether a lease exists. For instance, property taxes on the lease would qualify as a noncomponent.

3. Commencement Date of Lease

The commencement date of a lease is the “date on which the lessor makes an asset available for use by a lessee.” This is not the same as the date of the lease contract, and they can be different. The lease inception is “the date of the lease agreement or commitment, if earlier.” At this point, the commitment should be in writing, signed and have all principal provisions agreed upon. For example, when a retail space begins with a rent holiday, the date the space is available is the commencement date, not the date of the first payment. See paragraphs 842-10-55-19 through 55-21 for implementation guidance on the commencement date.

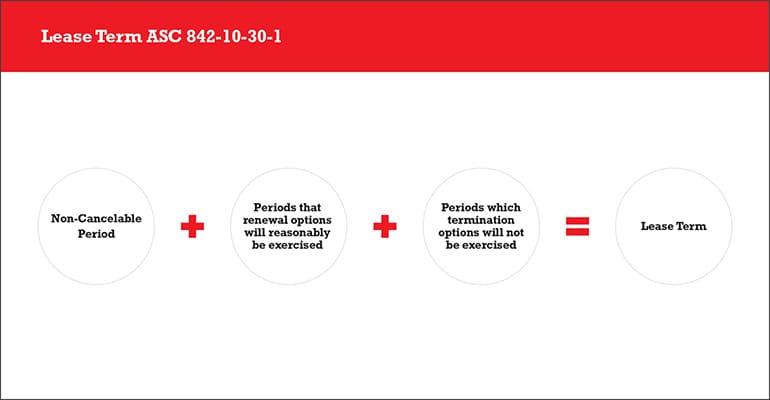

4. Lease Term ASC 842-10-30-1

ASC 842-10-30-1 defines the lease term as the non-cancellable period during which a lessee obtains the right to use an underlying asset, combined with the following:

- Periods covered by an option of lease extension if the lessee is reasonably certain to exercise that ability.

- Periods covered by an option of lease termination if the lessee is reasonably certain not to exercise their ability to terminate.

- Periods covered by an option of lease extension (or not to terminate) in which the option to exercise is controlled by the lessor.

5. Incremental Borrowing Rate (IBR)

The discount rate for the lease initially used to determine the present value of the lease payments for a lessee is calculated based on information available at the commencement date.

When determining incremental borrowing rates the following rules apply:

- A lessee should use the rate implicit in the lease in instances where that rate is readily determinable.

- If the rate implicit in the lease is not readily determinable, a lessee should use its internal incremental borrowing rate.

- A lessee that is a private business is allowed to use a risk-free discount rate for the lease. This rate is determined by using a period comparable with the lease term as an accounting policy election for all leases.

- Obtaining the discount rate in a lease transaction is frequently difficult, so many entities will rely on the incremental borrowing rate.

The incremental borrowing rate is the interest rate that a lessee would be required to pay when borrowing over a similar term, and with a similar security, the necessary funds to obtain an asset with a similar value.

The lessee will take its internal cost of funds and make adjustments based on the asset quality, the amount of funds borrowed and the term.

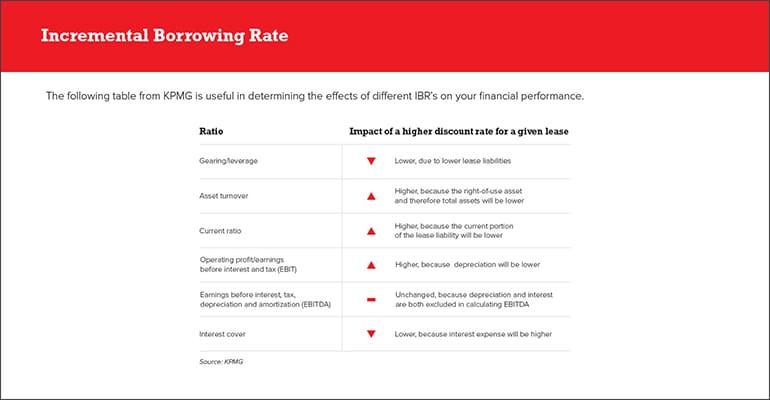

The following table from KPMG is useful in determining the effects of different IBRs on your financial performance.

If you are not a public entity, you can elect the IBR to be the risk-free rate in place at the time of the lease commencement.

6. Short Term Lease Exemption

A short-term lease is one that has a term of 12 months or less (from the commencement date) and does not include a purchase option that the lessee is reasonably certain to exercise.

As an accounting policy, a lessee may elect to not apply the recognition requirements to short-term leases. Instead, a lessee may recognize the lease payments in profit or loss on a straight-line basis over the term of the lease and variable lease payments in the period the obligation for those payments is incurred (842-20-55-1 through 55-2). The accounting policy elected for short-term leases is determined by the class of the underlying asset.

In other words, you can account for short-term leases in the same manner as previous lease guidance.

7. Initial Measurement Lease Liability

The lease liability represents the present value of all outstanding lease payments that are not yet paid. It is discounted by using the IBR or the implicit rate in the lease and calculated using an NPV (net present value) of all known payments that are unpaid.

8. Right of Use Asset (ROU)

The right of use asset is a new feature of the lease guidance. It represents the unused value of the leased asset remaining over the lease term.

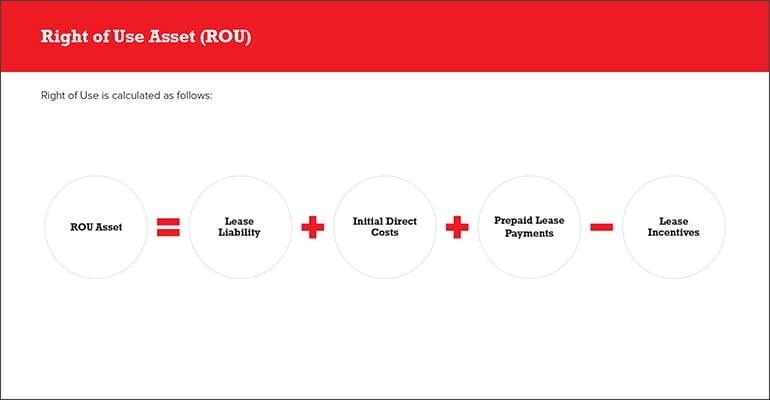

It’s measured by taking the lease liability and adding the initial direct costs and the prepaid lease payments, then subtracting any lease incentives offered (see definitions further below).

The ROU is amortized linearly over the life of the lease.

Depending on the lease type, it can be amortization or ROU or rent expense.

Right of Use is calculated as follows:

- Lease Liability – Liability initially measured at the present value of the lease payments.

- Initial Direct Costs – Costs directly attributable to negotiating and arranging the lease that would not have been incurred without the execution of the lease. For instance, commissions paid and payments made to an existing tenant to terminate its lease are considered initial direct costs (842-10-30-9 &10).

- Prepaid Lease Payments – Lease payments made to the lessor before or at the commencement of the lease.

- Lease Incentives – Payments made by the lessor to or on behalf of the lessee and any losses incurred by the lessor from assuming a lessee’s preexisting lease with a third party.

9. Lease Classification - Finance & Operating Leases

ASC 842 diverges from IFRS 16 with respect to lease classifications. Under IFRS, all leases are classified as finance leases. Under US GAAP, there are two lease classifications: finance leases and operating leases.

In sections 842-10-25-1 thru 25-3, a lease is classified as a finance lease if any of the following criteria are met:

- The lease transfers ownership of the underlying asset to the lessee by the end of the term outlined in the lease.

- The lease allows the lessee the ability to purchase the underlying asset, and the lessee is reasonably certain to exercise that option.

- The lease term represents the majority of the remaining economic life of the underlying asset. However, if the commencement date falls at or near the end of the economic life of the asset, this should not be used for purposes of classifying the lease.

- The present value of total lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments equals or exceeds substantially all of the fair value of the underlying asset.

- The underlying asset is so specialized that it is not expected to have an alternative use to the lessor at the end of the lease term.

If none of the above criteria are met, then the lease should be classified as an operating lease. Note that the majority of real estate leases tend to be classified as an operating lease.

#1 Cloud

Accounting

Software

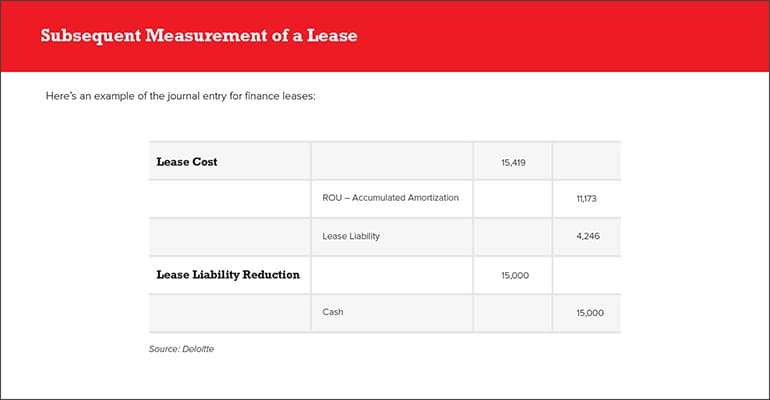

10. Subsequent Measurement of a Lease

Under the new standard, finance leases and operating leases are measured differently.

When measuring a finance lease, lease costs are recognized using the following pattern:

- The Right of Use (ROU) is amortized on a straight-line basis.

- The lease liability is amortized using the effective interest.

- The lease liability is increased by the interest incurred in the period, and the carrying amount is reduced by the lease payment.

This process is very similar to how a mortgage works; it uses the effective interest method to reduce the lease liability.

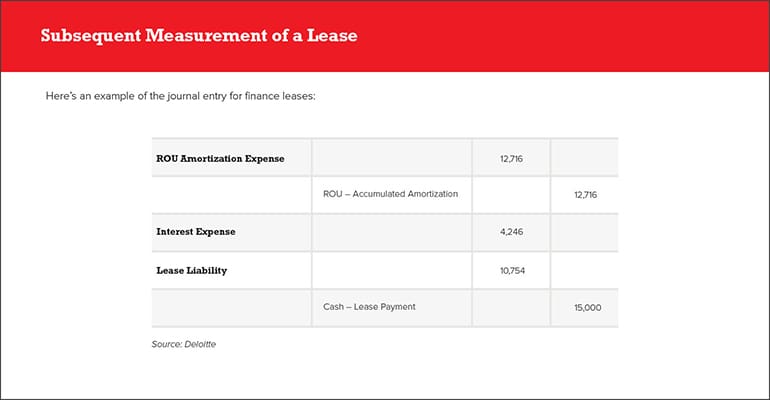

Here’s an example of the journal entry for finance leases:

When measuring an operating lease, lease costs are recognized using the following pattern:

- A single lease cost calculated so the remaining cost of the lease is allocated over the remaining lease term on a straight-line basis unless another rational and systematic approach is more representative of the pattern of expected benefit from the right to use the underlying asset (842-20-25-8).

- This cost will include the interest charge and right of use (ROU) amortization into a single expense recognized on a straight-line basis.

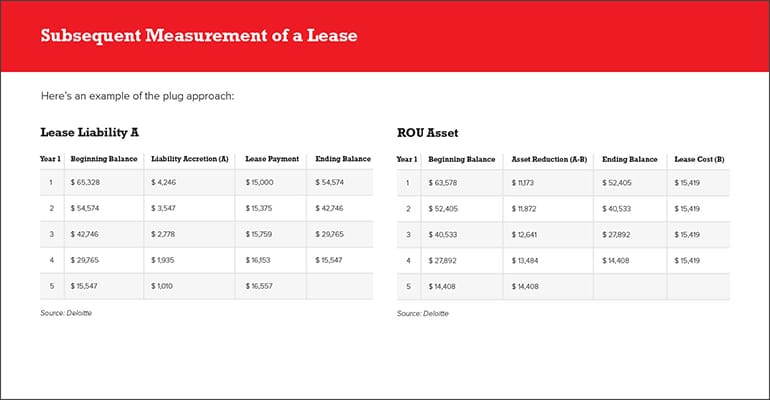

- The amortization of the ROU is determined by the plug method.

- The straight-line lease expense is calculated by dividing the undiscounted payments by the lease term.

Here’s an example of the plug approach:

This is what the subsequent journal entry would look like for operating leases:

11. Remeasurement

At times, the lease liability may need to be remeasured during the life of the lease. This will change each of the subsequent lease accounting entries. There are three situations where the lease liability will require remeasurement:

- There is a change in the lease term or purchase options are exercised.

- There are changes in amounts owed under a residual guarantee.

- Variable payments become lease payments because of a contingency resolution.

After the lease liability is remeasured, an offset is required to adjust the remaining ROU asset. The ROU asset can’t go below zero, and any remaining balance would be included in net income (842-20-35-4).