Like any industry, accounting comes with a long list of industry-specific terms that the rest of us may not use every day or even understand. And while many of the terms are common in most business settings, others are more specific to the accounting world.

If you want to know your big data from your generally accepted accounting principles (GAAP) from your general ledger, here’s a handy glossary of key accounts payable terms that will help you understand your finances and communicate with your accounting team.

42 Basic Accounts Payable (AP) Glossary Terms

Whether you’re introducing a new accounts payable (AP) strategy or recently joined the finance team, it’s important to understand all of the elements of accounting so that you can develop a strategy that works best for your organization.

Here are 42 basic accounts payable terms that will help everyone from non-accounting employees to entrepreneurs better understand the jargon that dictates accounts payable processes.

General Accounting Terms

Below are 13 of the basic accounting terms that can apply to a wide variety of different accounting processes:

- Accrual accounting: Also known as accrual basis accounting, the accrual method records revenue as it is earned and expenses as they are incurred, regardless of when cash is exchanged. This approach is required under GAAP and more accurately shows a company’s financial position than cash basis accounting, which reflects when cash comes into or leaves the business.

-

Cash flow: The total amount of cash and cash equivalents moving into

and out of a business at any given time. A cash flow statement shows how effective a

company is at managing its cash and indicates its ability to fulfill short-term

financial obligations. There are three sources of cash flow:

- Operating activities

- Investment activities

- Financing activities

- Certified Public Accountant (CPA): Anyone seeking to become a CPA must pass the Uniform Certified Public Accountant Examination created by the American Institute of Certified Public Accountants (AICPA) and administered by the National Association of State Boards of Accountancy. The CPA designation is granted by individual state boards. These professionals prepare financial statements, audits, and reports such as revenue forecasts and profit margin analysis to help inform investors and business leadership about the financial health of organizations. They can also provide individuals and families with valuable knowledge and advice on taxes and financial planning.

- Credit: In accrual accounting, a type of bookkeeping entry that decreases asset and expense accounts and increases liability, revenue, and equity accounts.

- Debit: In accrual accounting, a type of bookkeeping entry that increases asset and expense accounts and decreases liability, revenue, and equity accounts.

- Diversification: A strategy to stabilize and/or increase revenue by entering markets, industries, or product/service categories outside a company’s traditional area of focus, typically through the acquisition or development of new business competencies.

- ERP: Enterprise Resource Planning unifies accounting, inventory, and order management functions, providing a single solution that automates manual processes, centralizes business data, and improves visibility into daily performance across the entire organization. Some ERP systems also include customer relationship management (CRM) and human resources functions.

- Generally Accepted Accounting Principles (GAAP): Rules established by the Financial Accounting Standards Board (FASB) detailing its approved accounting methods and practices. Publicly traded companies are required to follow GAAP and to produce GAAP-compliant financial statements quarterly and annually.

- General ledger (GL): If accounting is the recordkeeping system for an organization’s financial data, the GL is a record itself for every financial transaction (e.g. assets, liabilities, revenue, equity, and expenses).

- Interest: The amount of money paid on a loan, line of credit, or other debt that exceeds the total repayment balance (i.e., “principal balance”). Interest is generally charged by lenders in exchange for borrowing money and paying them back over a period of time.

- Liquidity: Liquidity is how easily an asset, security, or other holding can be converted into cash.

- Present value: Represents the current value of a future sum and is based on a specific rate of return over time.

- Return on investment (ROI): A metric used to evaluate the value of an investment and is found by subtracting the cost of that investment from its current value, then dividing that by the cost of the investment. In most cases, ROI is expressed as a percentage. ROI can also be used to describe the time it takes for an investment to earn back the initial expense.

Balance Sheet Terms

The balance sheet is a key document produced by accountants that shows a company’s assets and liabilities. It can be a confusing place for non-accountants, so here are explanations of some of the most common balance sheet terms:

- Accounts Payable (AP): AP is the amount of money a business owes to its creditors and suppliers in the form of short-term obligations.

- Accounts receivable (AR): AR is the representation of the money that customers owe a company for goods or services purchased on credit.

- Assets: Includes all items or resources of value that an organization owns or controls. Short-term assets include cash and cash equivalents. Long-term assets are either tangible (e.g. real estate, equipment) or intangible (e.g. patents, trademarks). The value of short and long-term assets is recorded on an organization’s balance sheet.

- Balance sheet: A balance sheet is a financial statement that reports all company assets, liabilities, and shareholders’ equity for a specific point in time.

- Book value: The value of an asset as recorded in a company’s accounting books, reflecting the total acquisition cost minus depreciation or amortization. Also known as carrying value.

- Capital: The financial resources held or secured by a company to fund daily operations and fuel growth and non-financial assets, such as land, facilities, and equipment, used to support core business functions.

- Encumbrance: Financial obligations for specific goods or services that the business has committed to purchasing but has not yet received or paid for. Encumbrances reserve funds in the budget for when invoices arrive, preventing overspending or cash crunches for known upcoming expenses.

- Equity/owner’s equity: The value remaining in a business after subtracting total liabilities from total assets. Equity can be positive or negative.

- Liabilities: Monies owed by a business to other companies, organizations, or individuals for payment of debt, payroll, taxes, or other financial obligations.

- Overhead: Expenses that cannot be directly attributed to the cost of manufacturing products, acquiring goods for resale, or delivery of services. Overhead can include things like rent, insurance, and advertising expenses.

- Payroll: A general ledger account that includes all payments to employees in the form of salaries, wages, deductions, and bonuses. Payroll is entered as a liability on a company’s balance sheet.

Income Statement Terms

The income statement, which depicts revenue and expenses, comes with its own special set of jargon that isn’t always easy to decipher. Here are some basic definitions for the most popular income statement-related terms.

- Amortization: Amortization is the technique used to spread out business expenses over time, writing down the book value of an intangible asset or loan over a set period. In this way, expenses are broken down into smaller ones over a number of years instead of one large expense.

-

Cost of goods sold (COGS) or cost of sales: The combined value during a

given period of expenses directly related to the production of goods or acquisition of

products for resale. For services companies, it’s the cost of providing the services.

The formula for calculating cost of goods sold is:

COGS = starting inventory value + purchases for inventory – ending inventory value

Indirect expenses, such as sales and marketing, are excluded from COGS.

- Depreciation: An accounting process used to expense the purchase price of fixed assets over time, usually several years. Depreciation is seen as a better way to capture the value received from a fixed asset over its useful life. It also recognizes that the value of a fixed asset declines due to wear and tear and other factors.

- Expenses: The money that an organization spends in order to generate revenue. There are fixed expenses (constant and predictable), variable expenses (those that fluctuate), and accrued expenses (employee wages, utility bills, etc.).

- Gross margin: Gross margin is the percentage of revenue remaining after direct costs have been subtracted from net sales.

-

Gross profit: Gross profit is the amount of money a firm makes

once the cost of manufacturing/acquiring the products it sells or delivering the

services it provides has been deducted. The figure appears on the income statement and

is calculated by subtracting COGS from revenue (sales).

Gross profit = sales revenue – direct costs

Sales and marketing are not direct costs. Commissions are sometimes included in direct costs, but salaries are not.

- Net income: Also known as net profit, net income is calculated by subtracting total expenses from total revenue.

- Profit and loss statement (P&L): Also known as the income statement, this financial report provides a summary of a firm’s revenue, expenses, and profit/losses over a given period of time (i.e., a fiscal year or a quarter).

- Revenue: Any income that a business generates is revenue.

#1 Cloud

Accounting

Software

Accounts Payable Terms

You won’t stay in business for long if you don’t pay your suppliers, utility providers, and landlords on time. Here’s a quick primer on the top accounts payable terms that all companies should learn and know:

- AP aging: A report that categorizes unpaid invoices based on how long they’ve been outstanding, typically in 30-day increments (i.e., 0-30, 31-60, 61-90, and 91+ days). This report helps financial teams prioritize payments to manage cash flow, maintain good relationships and favorable payment terms with vendors, and avoid late fees.

- Days payable outstanding (DPO): The average amount of time it takes a company to pay for goods and services purchased on credit. Days payable outstanding helps investors and other stakeholders understand how a company is managing its cash. DPO only measures payment of direct expenses (i.e. COGS-related expenses), not selling, general, and administrative (SG&A) expenses like lease payments and utilities for office space. Utilities consumed as part of the manufacturing process would be included, however.

- Immediate payment: Indicates that payment is due upon delivery of a service or product.

- Invoice: A dated business document that’s produced by a seller and given to a buyer to indicate the amount to be paid for a product or service.

- Net 15, 30, 90: Credit terms on an invoice that indicate when full payment is due. Net means the amount to be paid includes any discounts, markdowns, or vendor credits that were applied to the purchase.

- Payment in advance (PIA): Payments made for goods or services before the items are delivered or the services are performed. For example, a buyer may be asked for an upfront deposit of 50% on a special order.

- Purchase Order: Also called a “PO,” this document is generated by a customer who, in turn, authorizes the purchase transaction. The PO becomes a binding contract once the seller accepts it.

- Recurring invoice: An invoice that’s sent to a customer on a regular schedule for a specific service or product.

- Terms of sale: Payment terms that a company and its customer have agreed to in advance of the sale. The terms can include price, delivery date, quantity, payment method, and payment terms.

AP Made Easy With NetSuite

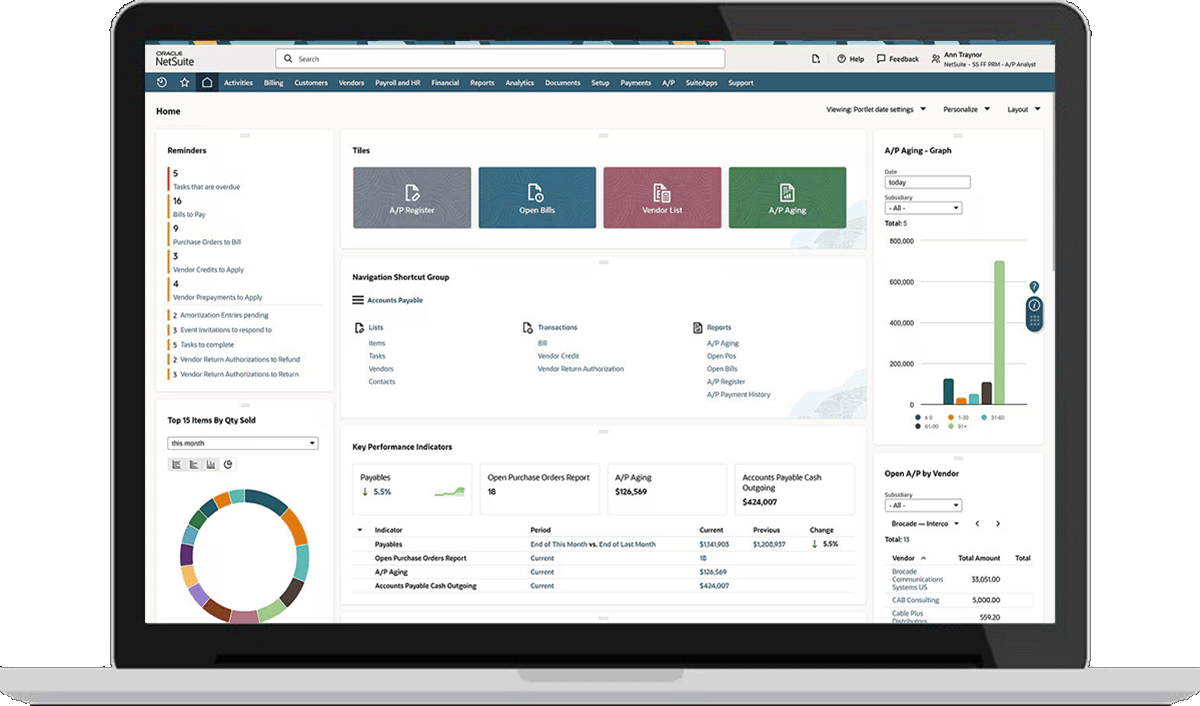

Managing accounts payable across multiple systems, tracking aging reports, and maintaining timely payments can overwhelm accounting and finance teams, leading to invoicing errors, payment delays, and mismanaged cash flow. NetSuite Accounts Payable software eliminates those costly issues through data centralization, automated invoice processing, real-time visibility into AP aging and cash positions, and automated approval workflows. The platform’s unified features minimizes manual data entry, giving finance teams comprehensive, role-based dashboards that provide insights into payment timing and cash flow. With features like automated purchase order creation, invoice capture, receipt matching, data validation, duplicate payment detection, and customizable payment terms, NetSuite turns routine AP processes into a strategic advantage that makes working capital go further while strengthening supplier relationships.

NetSuite’s Accounts Payable Dashboard

Understanding accounts payable terminology helps team members stay focused on the same goals when processing invoices, analyzing cash flow patterns, and deciding when to pay which vendors. With a strong foundation of AP knowledge, finance teams, vendors, and business leaders can work together to enhance their AP processes and maintain accurate financial records while taking steps to better manage expenses and cash flow. This common language also improves collaboration, helping team members spot opportunities to automate processes, minimize risks, and build stronger supplier partnerships through consistent, professional financial practices.