If you’ve set your sights on becoming a licensed certified public accountant (CPA), you first must pass the Uniform CPA Exam. It’s not an easy undertaking. This standardized test comprises four sections, each of which you have four hours to complete: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Business Environment and Concepts (BEC) and Regulations (REG). To pass, you must score 75 points on each of the four sections and do so within 18 months. Some test-takers take one section at a time, while others prefer to tackle two, three or all four sections within a single testing window.

Regardless of your path, passing the CPA exam means a lot of studying. But never fear: Proper planning, the right tools and the following 12 tips can help you achieve your goals. I know because I’ve been in your shoes.

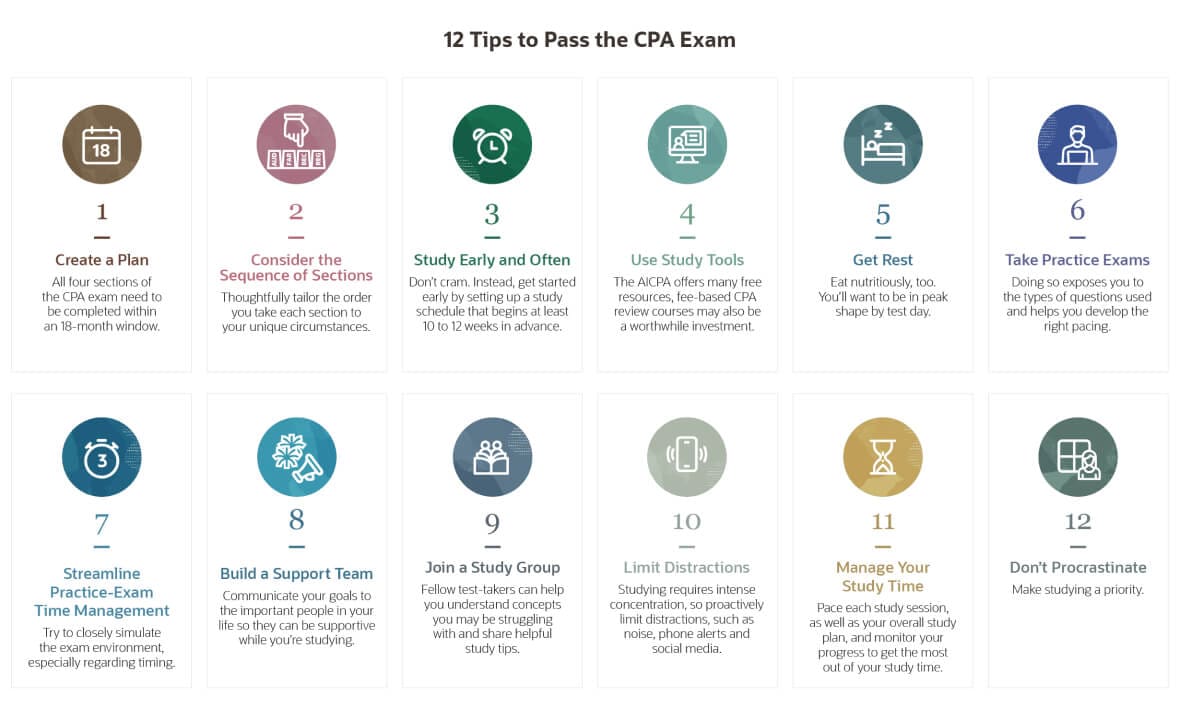

12 Tips to Pass the CPA Exam

The CPA exam tests your knowledge of an enormous volume of information and how to apply it. It’s a rigorous exam that includes multiple choice questions, task-based simulations and short writing assignments. To pass, you’ll need to score 75 points on each of the four sections, but since each question has a different point value depending on its level of difficulty, you may not need to answer 75% of the questions correctly. Roughly half of all test-takers pass their attempted test section(s), according to American Institute of Certified Public Accountants (AICPA) statistics — but among those attempting to complete all four sections at once, the passing rate drops to 20%. Only a very few, 0.1% in 2020, go on to earn the Elijah Sells Award, presented to those with an average composite score of over 95.5 for all four sections of the CPA exam, taken in a single sitting.

Industry sources recommend 100 hours of studying per section. To help make that huge time investment more effective, consider the following 12 exam tips, compiled from several industry sources and interviews with licensed CPAs, including a Sells Award winner.

-

Create a plan.

All four sections of the CPA exam need to be completed within an 18-month window. It’s important to create a plan for getting them done on time, since the exam is offered only four times per year. The clock starts ticking once you pass your first section. It would be unfortunate if a passing section were lost and needed to be retaken simply because the 18-month window had expired. When creating a plan, consider work schedules and upcoming life events, as well as allowing some time for the unexpected.

-

Consider the sequence of sections.

The “best” sequence to take the test sections is the subject of much debate among CPAs. To some, it makes sense to take each section as close to the related college course as possible so the information is fresh in your mind. Other CPA veterans suggest tackling the AUD section after being employed as an auditor. Still others recommend saving the easiest for last, which may be the BEC section since it has the highest passing rate. Conversely, you may want to start the 18-month clock only after passing the section with the lowest passing rate, FAR. And many test-takers attempt multiple sections at once, in any number of combinations. The point of this tip is that there is no magic sequence, so thoughtfully tailor yours to your unique circumstances.

-

Study early and often.

The CPA exam is rigorous and requires a significant amount of preparation. Don’t cram. Instead, get started early by setting up a study schedule that begins at least 10 to 12 weeks in advance of the exam. The schedule should be realistic and tailored to your lifestyle. Whenever possible, try to schedule short study blocks, such as 60 to 90 minutes, rather than marathon sessions, since studies show that cognition is less effective over longer study periods for many people.

A corollary to this tip might be to study in the morning. It’s commonly believed that the hours of 10 a.m. to 2 p.m. are a prime time for optimal learning, although there are also studies that show a high level of recall when studying late in the evening. Be self-aware and schedule studying at the time of day that works best for you. Be consistent, though, to reduce the likelihood of procrastination and skipped sessions. Frequent, bite-sized study bursts can help reinforce concepts reviewed during longer study sessions. For example, many CPA candidates keep flashcards with them at all times, taking quick hits whenever they have a few minutes of downtime, such as when they’re waiting for a bus or standing on a supermarket line.

-

Use study tools.

Evaluate the plethora of available study tools that fit your budget. The AICPA offers many free resources on its website, such as CPA Exam Blueprints, sample tests and advance access to its research database. Blueprints show the content topics that are and are not tested in each section, helping to focus your study. Currently, the blueprints are especially important, since the AICPA is in the process of changing some of the content covered, adding emphasis to some topics and removing others, as part of its project to revamp the exam by 2024. The sample tests can be a good diagnostic tool to identify your strengths and weaknesses, which can in turn inform your study plans. Advance access to the research database helps test-takers become familiar with this tool before they need to use it on a real test. Beyond the free study tools, there are many fee-based CPA review courses that provide a study framework and content. Carefully select the one that best fits your learning style — auditory, visual, online, in-person, instructive or self-study — since these courses can get pricey.

-

Get rest.

Studying for the CPA exam can take a toll on the body, so it’s important to keep an eye on your health. Get plenty of rest, eat nutritiously and take breaks. An overstressed body can hinder the effectiveness of studying, and an illness on the day of the exam can be problematic. You’ll want to be in peak shape by test day, not exhausted and spent.

-

Take practice exams.

The AICPA database of past test questions can be helpful to determine content proficiency. Take a bunch after studying one topic before moving on to the next. It’s also important to become familiar with the format of the tests themselves. Taking practice tests exposes you to the three distinct types of questions used: multiple choice, task-based simulations and essays. Taking practice tests is the best way to develop the right pacing, which is essential because every testlet within every section is timed. Together with tutorial videos, practice exams can also increase familiarity with the tools and functions of the testing software.

-

Streamline practice-exam time management.

When doing practice tests, try to closely simulate the exam environment, especially regarding timing. Professional review courses suggest allocating no more than three minutes per multiple-choice question and less than 15 minutes per task-based simulation. BEC is the only section that uses written essays, which should take no more than 12 to 15 minutes per prompt.

-

Build a support team.

Communicate your goals to the important people in your life so they can be supportive while you’re studying for the CPA exam. Your support team will likely be willing to provide small accommodations, like a quiet study space, as well as larger compromises that may result from your shifting priorities. Whenever possible, reach out to colleagues, mentors and licensed CPAs to supplement your support team and provide insight and advice. Additionally, reach out to employers — it’s likely in their best interests to help you succeed in becoming licensed.

-

Join a study group.

About 100,000 people take the CPA exam each year, so finding a study group should be relatively easy and helpful if you like working in groups. Exchanging ideas with other test-takers might yield helpful study tips and be a resource to help you understand concepts you may be struggling with.

-

Limit distractions.

Studying for the CPA exam requires a high degree of concentration, so it’s a good idea to proactively limit those distractions that you can control. Noise, phone alerts, social media, friends and family tend to knock studiers out of “the zone.” Take these distractions into account when crafting study plans, opting for more distraction-free locations and times. At the same time, acknowledge that certain distractions are out of your control, such as work or school schedules, and plan accordingly.

-

Manage your study time.

Most of us don’t have hundreds of hours of free time in our lives, so it’s critical to practice excellent time management when studying for the CPA exam. Sticking to a study plan can be hard, especially when there are so many ways to become distracted (see tip 10). You’ll want to pace each study session, as well as your overall study plan, and monitor your progress. To get the most out of your study time, consider setting timers for breaks or unavoidable distractions, like eating dinner. In fact, research shows that taking breaks boosts productivity, energy level and focus.

-

Don’t procrastinate.

In order to reach your goal of passing the CPA exam, you’ll need to make studying a priority. Avoid accepting other demands on your time that might infringe on your study plans. By starting your studying early, you can build in flexibility to absorb unanticipated kinks in your overall plan and still stay within the 18-month window.

Conclusion

If you’d like to be among the 40,000 newly minted CPAs each year, you’ll need to pass the CPA exam. It’s a significant undertaking that requires a lot of time, energy and focus. These 12 CPA exam tips can help you get the best results.

CPA Exam FAQs

How should I study for the CPA exam effectively?

Studying for the CPA exam requires a measured, thoughtful study plan that progresses over 10 to 12 weeks. Studying is facilitated with free and paid tools, as well as study groups. Do not cram.

Is the CPA exam really that hard?

The CPA exam is a rigorous standardized test that is meant to assess knowledge on a wide range of accounting topics and how to apply that knowledge in real-world situations. The exam consists of four four-hour sections; the passing rate is roughly 50%.

How many hours should I study for the CPA exam?

Professionals commonly use 100 hours of study per CPA exam section as a rule of thumb. And remember, there are four sections.

How can I pass CPA quickly?

All four sections of the CPA exam must be completed within an 18-month window. Taking multiple sections of the CPA exam close together may help you pass it more quickly.