Business owners just starting out often take a hands-on approach to day-to-day account management. They often sign off on every outbound check and follow up on every billed customer. But customers don't always pay their bills on time, nor do suppliers always invoice correctly, and as a company grows, a manual approach can slow down accounting processes. Even a specialized team of accountants can get buried under endless stacks of invoices and receipts filling up their "to-do" boxes.

That's just a few reasons why modern, growing businesses use automated accounts payable (AP) and accounts receivable (AR) systems. From procurement to payment, automation can rid accounting staff of mundane work, allowing them the bandwidth to focus on business priorities while managing cash flow, enhancing the customer experience and reducing costly mistakes that often accompany manual data entry.

What Are AP and AR Automation?

Accounts payable and accounts receivable automation transform a company's traditional AP and AR functions into automated processes that simplify cash flow management, reduce errors and inefficiencies and improve customer/supplier relationships. Automation creates a digital workflow for routine steps like creating, sending, receiving, coding and routing invoices, as well as payment and reconciliation.

Despite advances in technology, manual processes are still commonplace at many organizations. A 2021 Levvel Research survey found a third of respondents still entering invoice information manually. It's not surprising, then, that a 2022 Guidant Financial Small Business Trends Survey of over 4,500 small businesses found about 32% reporting cash flow to be a top challenge. Common causes include difficulties in collecting payments from customers and inconsistent payments to their utilities/vendors. If a business is late paying its bills, it can accrue costly late fees and damage its relationship with its suppliers.

Key Takeaways

- Automation ensures bills are paid on time, while flagging potentially problematic accounts, like slow-paying customers or erroneous bills.

- Accounts payable automation issues automatic payments, matches purchase orders to vendor bills and sends payment reminders to customers, among other functions.

- Accounts receivable automation creates and sends invoices, reminds customers to pay and matches cash receipts and deposits to ensure accuracy of cash application, among other functions.

AP and AR Automation Explained

Picture a typical, manually driven AP project. A vendor bill comes in the mail. An accountant sorts the mail, puts the bill in a queue awaiting approval, eventually writes a check and then mails it to the vendor. That accountant spends valuable time entering all of the payment data into the company's spreadsheets, ledgers, etc., obtaining approval, and even tracking down postage. Every step is a delay that can make that payment late. Data entry mistakes happen, and a poorly placed morning coffee could make those paper bills and receipts unreadable. Even online payments' records can go missing if not properly cataloged.

Automated AP software can analyze the bills as they come in, alert necessary parties and pay the bill, involving that busy accountant only if there is a discrepancy, the amount exceeds a designated threshold, or any other reason human approval would be needed. Some businesses require a hands-on approach, where others automate predictable payments like rent. Automated AP can also match purchase orders to their corresponding invoices and delivery receipts to confirm accuracy before paying. On-time payments keep suppliers happy, and a good relationship with a vendor can lead to potential discounts or needed leeway in the future.

For AR, automation can increase customer satisfaction while decreasing days sales outstanding (DSO) — the average number of days it takes for a company to receive payment. The longer a customer invoice goes unpaid, the less likely it will ever be paid, leading to a financial loss or the headache of debt collection. Some customers that fall behind on payments can pay but simply forget, misplace or prioritize other, seemingly more pressing invoices. And if the invoice has any errors, most customers will want them rectified before paying. Repeat errors can lose customer confidence and push customers to a competitor.

Automated software can take over the role of sending emails and making phone calls every week to customers that haven't paid their invoices. Invoices can be generated and e-mailed accurately and automatically, reducing time between services rendered and customers invoiced. Automated AR can send custom notifications, to both customers and your team, when payments are 15, 30 or 45 days overdue, for example. If a customer is on a payment plan, automated AR software can send reminders every month before the due date. What's more, online payment options provide customers with added transparency, presenting their entire account history and letting them pay at their convenience, even after official business hours.

AP Automation

AP automation modernizes the way a business pays its vendor invoices. Staff at every level can quickly see which bills have been paid, which ones are due soon and any that might be overdue. Automation also reduces fraud and increases accuracy by cross-referencing invoice information to their purchase orders and delivery receipts, keeping outgoing payments transparent and accessible for effective oversight. When vendors are paid on time, a relationship builds that can reap business rewards, like early payment discounts and sales perks, for years to come.

Let's take a closer look at the capabilities of an automated AP system:

‘Reads' bills and invoices automatically.

Paper clutter can quickly lead to missed bills and jam-packed filing cabinets taking up storage space. AP automation can extract pertinent information from digital bills and upload them to the AP system. Even paper bills that require a person to scan them can have relevant data automatically extracted by means of optical character recognition (OCR) technology. Once uploaded, documents can be easily shared among necessary parties, keeping the business' cash flow reports accessible, up to date and safely stored. The digitization process also eliminates manual errors, such as duplicate data entry.

Matches POs to their invoices.

AP has three main elements: the purchase order (PO), the invoice and the shipping receipt that shows the order was delivered. Every purchase begins with a PO that should include the good/service specifics and cost. When the invoice for the purchase arrives for payment, the AP software automatically pulls the corresponding PO and matches it to the vendor bill (two-way matching) and, frequently, to proof of delivery (three-way matching). If the information is verified, the payment is either queued for approval, released to the vendor or scheduled for a future payment. For large or complex orders, it can be easy to miss a small item that wasn't delivered or a higher charge for a single item when matching manually. Automation can confirm that the charges were properly generated, paid and received.

Creates recurring payments.

Certain bills, like for utilities, loans or regular supplies, may have similar or identical payments every month. But they don't take any less work than most other bills when handled manually. Automation saves staff time by paying these predictable bills at the same designated time every month, often without official approval. Automated AP software equipped with machine learning (ML) can recognize outlier bills and notify staff. It might be as innocent as an extra-high AC bill in the office during a heat wave or a serious overcharge from a vendor that agreed to spread out payments but billed the full amount. Whatever the reason, automation can relieve staff of the mundane duties of paying regular bills.

Sets up payment reminders.

Automation can help prevent missed payments by sending reminders. If a business receives several bills with different due dates at once, the AP system can prioritize which ones to pay first, without dooming the far-off bills to a forgotten filing cabinet. Payment schedules and reminders can help maximize cash flow more effectively than a stack of sticky notes stuck to an accountant's computer. If a bill isn't due for six months, that cash can be used somewhere else, and a payment reminder ensures it gets paid before its deadline. Reminders and scheduled payments can be especially helpful if a business has peak seasons when its accounting staff is extra busy.

Automates payment approvals.

Automating payment approvals may seem risky, but it can be customized to whatever level your business needs. Routine vendor invoices that don't require the personal approval of the CFO can be automated to prevent bottlenecks and speed payment. With automation, companies can set a payment limit, above which requires explicit approval. The software, via artificial intelligence, can also flag unusual — and potentially fraudulent payments — that deviate from the norm and seek approval before releasing the funds.

Sends payment.

Whether the invoice is approved automatically or by an accountant/controller/CFO, the automated AP system sends the payment to the vendor, checking for accuracy and uploading proof of receipt. If the payment isn't immediately due, it can be scheduled more reliably than a handwritten note or online calendar reminder. With automated AP, businesses can be confident that payments are correct and made on time. In the event of a vendor discrepancy once payment is received, the AP system has created an audit trail that can simplify the resolution process.

AR Automation

The first step toward receiving a payment from a customer is to generate an invoice. But don't expect every customer to pay on time. It's not necessarily malicious — some customers just need reminders. But every minute your AR team is calling customers about overdue payments is a minute they aren't focusing on other important issues or projects. Accounts receivable (AR) automation can create and send invoices, handle routine reminders, process payments and help minimize losses from nonpaying customers.

Let's take a closer look at the capabilities of an automated AR system:

Creates and sends invoices.

Few customers will pay for a purchase without receiving an invoice. Any delay in the printing and notification process will prevent a customer from even seeing the balance, let alone paying it, and any possible errors will need to be rectified before the customer pays. Automated AR can create and send invoices to get the process started quickly and accurately, saving time from the very beginning of the AR process.

Matches invoices to payments and deposits.

The value of the matching capability is that AR records are updated once the payment or deposit is received; the invoice is marked paid and the customer record is current. This ensures accurate AR reports, showing only customers that still owe, mitigating time spent pursuing payment for invoices that have been paid but were missing invoice matching. This also provides an accurate picture of how much is owed or the company can expect to receive — overestimated and underestimated AR can lead to bad decisions made from incorrect assumptions.

Sets up reminders for client payments.

According to a PYMNTS.com survey of over 2,200 businesses, businesses that relied on manual processes to collect overdue payments took 67% longer compared with companies that used automated AR systems. The low-tech companies also had an average DSO of 52 days compared with just 40 days for moderate or highly automated AR firms. Automating the process of sending regular reminders and customizable notifications can keep customers aware of invoices coming due, saving the business time and money on collecting payments and helping to keep your DSO low.

Accepts online payment.

Online payments are a win-win for you and your customers. The more options to pay, the more likely customers will pay on time or early. An online payment, especially when integrated with automated AR software, means incoming cash that doesn't take a bookkeeper away from other duties. The software automatically syncs a payment to its invoice to make sure the proper accounts are credited and provides an intuitive platform for a customer to view its accounts at-a-glance.

Benefits of Automating Both AP and AR With Accounting Software

AP and AR automation are a boon to growing companies. Not only does automation reduce time spent on routine tasks and increase accuracy, but it also allows a smaller staff to scale and handle more strategic responsibilities. Backed by artificial intelligence and machine learning, automated software can relieve the accounting staff of many routine responsibilities and focus on what's important — business growth. Whether it's to shorten lag time between invoicing and payment, ease the burden on staff or stave off a new hire, automating AP and AR processes leads to efficiency gains, reduced costs and happy employees, vendors and customers.

Make AR/AP automation easy and efficient

Automate AP and AR Workflows With NetSuite

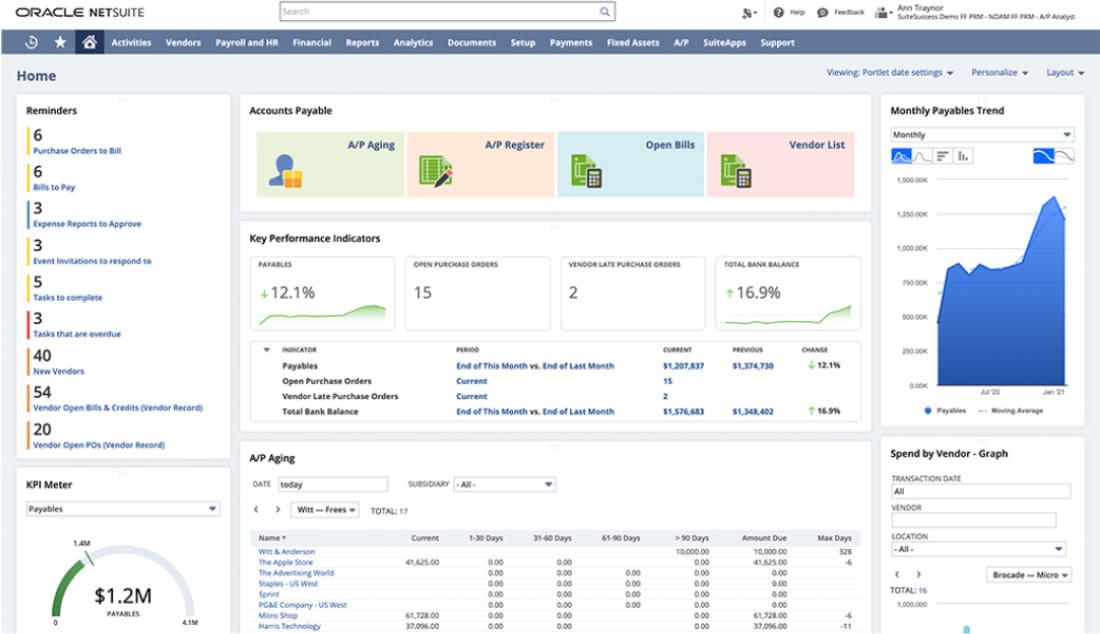

From procurement to payment, NetSuite Accounts Payable and NetSuite Accounts Receivable automate accounting processes and their associated workflows, minimizing the time and effort both critical functions require when handled manually. NetSuite Accounts Payable maintains detailed vendor records, captures and matches incoming invoices to their purchase orders and delivery receipts, and makes or schedules payments for bills that fall within predefined thresholds. User-configurable dashboards, alerts and notifications keep AP processes running smoothly, ensuring invoices are paid on time or even early.

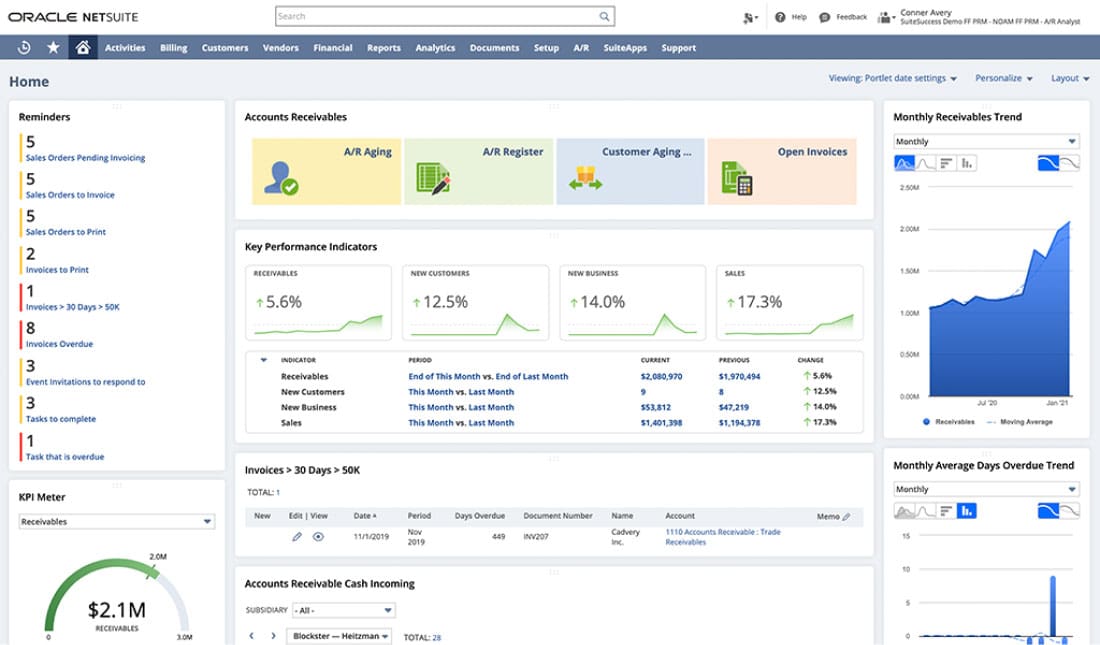

NetSuite Accounts Receivable enables easy invoice creation, tracks payments and manages collections, all while keeping real-time cash flow reports. The AR dashboard reporting capabilities provide customized, role-based insights and tools to help increase efficiency and improve cash flow management.

NetSuite's automated systems can integrate with a new or existing ERP platform, such as NetSuite ERP, to deliver even more reporting and business insights.

When a business grows beyond a handful of customers and vendors, the hands-on approach that begins when an invoice is generated and ends when payment is received becomes burdensome and, in turn, can negatively impact cash flow and customer and vendor satisfaction. Automated AP and AR systems can handle the day-to-day, routine workflows and keep staff involvement to a minimum. With the help of AI and ML, automated systems cross-reference invoices with their purchase orders and delivery receipts to ensure transaction accuracy. Automating AR and AP offers transparency and improved efficiencies for all parties' invoices, ensuring smooth processes that accurately manage cash flow.

AP and AR Automation FAQs

What is AR and AP processing?

AR processing refers to the steps involved when a company first generates an invoice through receipt of payment. AP processing refers to the steps involved when a company receives an invoice through payment.

What does AP and AR mean?

AP stands for accounts payable, the part of a business that receives and pays vendor bills. AR stands for accounts receivable, the part of a business that sends invoices and receives payments.

What is AR and AP in ERP?

AR and AP are a crucial part of any enterprise resource planning (ERP) system. Proper cash flow is crucial to run a business, and AR and AP show the cash coming in and going out of a business, respectively. Many ERPs integrate AR and AP software to ensure accurate data across a business.

What is the difference between accounts receivable AR and accounts payable AP?

Accounts receivable oversees the processes involved with payments coming into a business from its customers, while accounts payable handles payment of vendor invoices. Both can be automated to increase efficiency.

Why is AP and AR important for businesses?

AP and AR are important for businesses to properly manage their cash flow — the money flowing into a company from customers that are paying their bills and the money flowing out of a company that is making payments of its own. Without proper AP and AR management, businesses can fall behind in paying their bills, increasing the likelihood of incurring late fees, missing out on discounts and damaging valuable relationships.

What is AR reconciliation?

AR reconciliation is the process of comparing balance across two or more records. AR reconciliation typically happens at two levels: First, the detail in the AR subledger — or the AR aging — is compared to the balance in the AR account in the general ledger. Second, a specific customer's AR balance is compared to other source documents to verify all of the debits/credits. This ensures that all parties can see what is owed and what was provided.