Businesses calculate days sales outstanding (DSO) to track how quickly they're getting paid by customers. Businesses need to ensure that they're being paid within a reasonable amount of time so their cash flow remains healthy. If customers pay on time, companies will have the working capital necessary to buy additional inventory or to invest in their business. If customers don't pay on time, DSO will rise and the business may run short of cash.

What Is Days Sales Outstanding (DSO)?

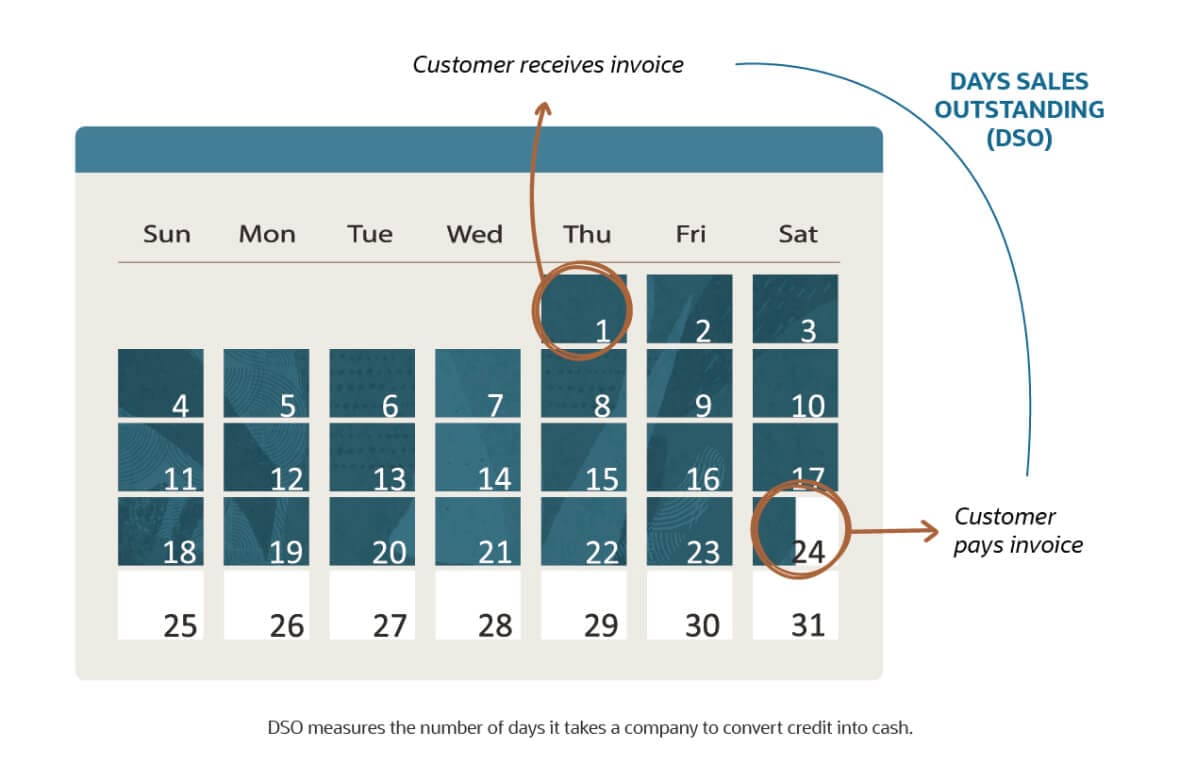

Days sales outstanding (DSO) is an accounting metric that measures the average number of days it takes a business to receive payment for goods and services purchased on credit. The lower the DSO, the faster payments are collected. The higher the DSO, the longer it takes the company to see its money.

DSO is one part of the order-to-cash cycle, which starts with a customer ordering an item or service and ends with the company's receipt of payment from the customer. Steps in between include order entry, fulfillment, shipping, invoicing, collections and payment processing. DSO is also part of the cash conversion cycle (CCC), which measures the length of time between when a company purchases inventory until it receives payment from customers who buy it.

DPO vs. DSO:

DPO stands for days payable outstanding. It measures the average number of days it takes for a company to pay what it owes to suppliers, vendors and financiers. On the flip side, DSO measures the average number of days it takes for the company to receive payment from its customers for their purchases. A knowledge of how both financial ratios are trending can help managers and potential investors understand the company's cash flow.

Key Takeaways

- DSO measures how long customers take to pay their bills.

- When DSO is high or rising, managers should look into the financial health of their customers and try to understand why they are taking longer to pay.

- A high or rising DSO may also indicate a need to improve the billing/AR/collections process.

- Maintaining a healthy DSO range is one way to keep a business's cash flow strong.

Days Sales Outstanding Explained

Businesses may extend credit to customers, allowing them to purchase a product today and pay for it within an agreed-upon time in the future. The amount a customer owes is an account receivable (AR) on the business's books. How long it takes the customer to pay what's owed is known as DSO. Cash sales are not included in the calculation since payment is received upon purchase. A low DSO implies customers are paying their bills quickly, yielding a quick conversion of credit sales to cash, which bolsters a company's cash flow and working capital. A DSO of 45 days or less is considered low.

Why Is DSO Important?

DSO and whether it's low or high provides insight about how long a company holds debt from customers, which impacts its cash flow — a leading indicator of a company's financial health and ability to repay its own obligations. DSO represents the speed at which payments are received after an invoice is issued, reflecting an efficient — or not — AR and collections process, customer satisfaction and potential issues, such as a customer having financial difficulties. Failure to collect money owed in accordance with an invoice's payment terms, typically net 30 days, can lower a business's liquidity and hurt its ability to grow, because funds are tied up in accounts receivable. Financial experts advise businesses to track DSO on a monthly basis.

Days Sales Outstanding Formula

DSO, also known as debtor days, measures the average number of days it takes a company to convert credit sales to cash. The formula for DSO relies on three variables: the average AR during a specific time period, the amount of sales made on credit during that same time period, and the number of days in the time period. The formula looks like this:

DSO = (Average AR in time period / credit sales made in time period) × number of days in time period

How to Calculate DSO for Your Business

To calculate DSO, first decide how long a time period you want to measure, be it monthly, quarterly or annually. For this explanation, let's use a quarterly time period of 90 days. Then follow these steps:

-

First calculate average AR. To do this, add together total AR at the beginning of the quarter and total AR at the end of the quarter and then divide by 2. For this example, let's say that beginning AR was $75,000 and ending AR was $25,000:

$75,000 + $25,000 = $100,000 / 2 = $50,000 average AR

-

Next we need to know the total value of sales made on credit. For this example, we'll use $280,000.

-

Now we know all of the variables and can plug them into the DSO formula:

(Average AR in time period / credit sales made in time period) × number of days in time period

So: ($50,000 / $280,000) × 90 = 16 days DSO

Note that sales that are paid by cash are not included in DSO calculations. If they were, companies that had many cash-paying customers would have a better DSO than companies that had few cash-paying customers. For comparative purposes, such as by a potential investor analyzing your company along with your competitors, including cash sales in the formula would artificially reduce DSO and possibly mask any problems a company might have with collecting what's owed. To that point, AR can be found on a company's balance sheet, though few disclose the portion of sales made on credit.

What Is High DSO or Low DSO? What Is Good or Bad DSO?

In general, a DSO under 45 is considered low. But that number should be considered in the context of billing terms. First off, it's best to compare DSOs of companies within the same industry because different industries will likely have different norms. Should there be a wide divergence of DSO within an industry, be sure to look at the DSO of companies that are considered the best operators. DSO should also be observed over time: A DSO of 48 may be considered an improvement if it's down from 50 last year and 53 the year before, whereas a DSO of 44 may be problematic if it was 40 last year and 38 the year before.

Also, the seasonality of a business's sales also affects DSO. A company that sells many holiday items may have a high DSO in the fourth quarter and low DSO in the first quarter. In that case, its DSO should be evaluated by comparing this year's first quarter to last year's first quarter. Another alternative is to compare DSO on an annual basis.

Companies with a DSO that is 25% more than the standard payment terms noted on their invoices may be considered high and warrant further inquiry.

Benefits of DSO

Tracking DSO is one way for managers to evaluate the business's relationship with customers and the efficiency of their collections department. Tracking DSO can:

-

Incentivize collections departments to proactively keep unpaid accounts receivable at appropriate levels.

A high DSO may indicate that a company's collection process needs to be reevaluated.

-

Flag customers that are not paying within the expected window of time.

Businesses may learn that delayed payments are due to a customer experiencing financial difficulties, or it may signal their unhappiness with your product or service. A single, large customer with overdue payments can cause DSO to appear unfavorable.

-

Indicate that the sales department has been extending credit to clients that aren't creditworthy in order to boost sales.

Salespeople may also be offering longer payment terms to customers for the same reason.

-

Ensure adequate cash flow.

If DSO starts rising, it could lead to a cash crunch that can harm a business's ability to buy materials or pay employees. The sooner a company knows it has a problem collecting receivables, the faster it can act to resolve the problem.

Limitations of DSO

As telling as DSO may be, there are situations where this accounting metric may not be as relevant, particularly when used for comparative purposes. The limitations of DSO include:

-

Comparing a company with many customers that buy on credit to another company with many customers that pay with cash.

Cash sales have a DSO value of 0, which would lower a company's DSO if it were included in the calculation. This is why it is important to factor for each company's business models and payment methods. If they're dissimilar, their DSOs are less useful for comparison.

-

When evaluating a company that just had a large spike or drop in sales to one with steady sales.

When sales suddenly spike, AR and DSO will likely follow suit, and vice versa. This applies to companies that experience seasonal spikes and troughs in sales, as well as cyclical companies whose sales are in lockstep with economic growth and slowdowns, such as travel and hospitality. Any immediate effect on DSO is not necessarily a reflection on a company's performance or that of its collection department.

-

When comparing companies in two different industries that have different DSOs.

Each industry has its own norms, so differences can be misleading. Looking at companies within the same industry provides a more apples-to-apples comparison.

| Benefits of DSO | Drawbacks of DSO |

|---|---|

| Helps companies stay on top of their cash flow/liquidity and know when to employ strategies to improve it. | Not useful when comparing companies with dissimilar business models and payment methods. |

| Prompts discussion with customers that aren't paying on time to determine and rectify their issues. | Not helpful when analyzing a company that has a spike in revenue. DSO may also spike, but not because customers are behind on payments. |

| Reveals when salespeople may be extending credit to risky customers or offering them longer payment terms. | Not effective when comparing companies in different industries or that respond differently to economic shifts. |

| Uncovers areas to improve the billing/AR/collections process. |

Days Sales Outstanding Examples

Let's consider Company A sells bicycles and tracks DSO on a quarterly basis. Last quarter, its average AR was $1.2 million and total credit sales were $3.2 million. As a reminder, the formula to calculate DSO is:

DSO = (Average AR in time period / credit sales in time period) × number of days in time period

Therefore, Company A's DSO equals 33.8 [($1.2 million ÷ $3.2 million) x 90 days].

For the same quarter, another bike retailer, Company B, had an average AR of $12.4 million and total credit sales of $15.7 million. Company B's sales might seem more impressive than Company A's, but its DSO is much higher, at 71.1 days [($12.4 million ÷ $15.7 million) x 90 days]. Put another way, Company B takes more than twice as long to collect cash from its sales than Company A.

This example illustrates why evaluating companies based solely on DSO could be misleading. Company B's DSO may reflect its willingness to extend credit to customers to achieve a higher sales volume — which could be either a smart business move or a risky proposition, if these buyers are financially unstable. DSO may also prompt questions about Company B's cash flow and collections process.

Applications of DSO

There are a number of steps a company can take to reduce its DSO, which in turn can improve its cash flow. It can, for example, identify customers whose payments are repeatedly late and, going forward, start requiring them to pay in cash at the time of sale. The company may also perform credit checks on customers before extending credit, to evaluate their ability to pay on time. Or the company might take advantage of an opportunity to forge a closer relationship with a typically reliable customer that hasn't paid due to extenuating circumstances, by offering a special payment plan.

Internal issues, such as a slow or inefficient invoice process, could be the culprit, too — many such issues arise when AR is handled manually, rather than automatically. Perhaps payment terms aren't clear, or invoices aren't going out in a timely manner. They may also contain errors — in amounts or other details, such as missing customer purchase order information — that delay payments. Better follow-up and more frequent reminders about unpaid invoices may be necessary. (One way to incentivize desirable behavior is to offer customers an early-payment discount.) It's also possible a company may need to make it easier for customers to pay their bills, such as by offering digital options via a payment portal or automatic withdrawals. The latter is particularly useful to companies that offer subscriptions or monthly memberships.

Bear in mind, a too-low DSO can be telling, too. For example, it may indicate that a company's credit terms are too tight and are impeding sales. In this instance, a company will want to reevaluate its credit policies to strike the right balance.

DSO is closely related to the AR turnover ratio, which measures the number of times AR is converted to cash during a certain period. Like DSO, AR turnover reflects a company's ability to collect money owed to it by customers, though in this case a high ratio is the end goal. Working together, a high receivables turnover and a low DSO means all receivables are returned on time. A low receivables turnover and high DSO means something isn't working properly and the collections process needs attention.

In addition, DSO can help a company make better projections. If a company has forecasted its revenue and DSO has been relatively steady, it can calculate what its AR will likely be. The formula is: (DSO / days in time period) x revenue forecast.

Free Days Sales Outstanding Template

Use our free DSO template to calculate your own DSO. The template is prepopulated with figures from an earlier example for a quarterly time period. Add your figures to the column on the right.

Gain Efficiencies, Ensure Compliance And Increase Your Accuracy With NetSuite Accounts Receivable

NetSuite's Accounts Receivables Software automates manual AR processes, which can help companies lower their DSO. The software quickly generates and sends more accurate invoices, defines credit terms and manages collections. It also automatically sends reminders to customers as their payment due dates near, as well as providing finance teams with visibility down to the individual customer and invoice. These robust capabilities can help companies improve their liquidity, fund growth, shorten the credit-to-cash cycle and seize new investment opportunities as they arise.

Conclusion

DSO is an important metric for measuring a company's financial health. The lower the DSO, the fewer days it takes the company to convert credit sales into cash and the freer its cash flow. The higher the DSO, the longer it takes the company to convert credit sales into cash, which slows cash flow. DSO can shed light on the effectiveness of the accounts receivable and collection processes or spotlight issues on the customer side of the equation. By monitoring DSO, the company can put strategies in place to bring it down, such as by offering an early payment discount.

Days Sales Outstanding FAQs

What does DSO tell you about your business?

DSO reveals how quickly customers are paying their bills. If DSO is high, then customers are taking longer to pay, which can hurt a company's cash flow. If DSO is low, then customers are paying their bills more quickly, which bodes well for cash flow.

What is the difference between DPO and DSO?

DPO stands for days payable outstanding. It measures the average number of days it takes a company to pay what it owes to suppliers, vendors and financiers. On the flip side, DSO measures the average number of days it takes for the company to receive payment from its customers for their purchases. Being aware of how both financial ratios are trending can help managers and potential investors understand a company's cash flow.

How do you calculate days sales outstanding?

The formula for DSO relies on three variables: the average AR during a specific time period, the amount of sales made on credit during that same time period and the number of days in the time period, such as 30, 90 or 365. To calculate DSO, divide the average accounts receivable for that period by the total value of sales made on credit during the same period. The result is then multiplied by the number of days in the period being measured.

What does DSO mean?

DSO stands for days sales outstanding. It's an accounting metric that measures how long it takes customers to pay for the services or products they purchased.

What is the "right" DSO ratio?

DSO looks at the relationship between a company's average accounts receivable and its sales made on credit during a certain time period. The "right" DSO depends on your business and industry.

Why is days sales outstanding important?

DSO and whether it's low or high provides insight into how long a company holds customer debt, which in turn impacts its cash flow, a leading indicator of a company's financial health and ability to repay its own obligations. DSO reveals how quickly payments are received after an invoice is issued, reflecting the efficiency — or not — of the company's AR and collections processes, level of customer satisfaction and potential issues, such as whether a customer is having financial difficulties.