Wouldn’t it be great if customers paid their bills early — or at least on time? Think of all the time saved in chasing them down, reissuing invoices or sending them to collections. Think of how predictable your cash flow would be and how much healthier your balance sheet would look. One way to encourage this desired behavior is to offer certain customers a percentage off the total amount of their bills if they pay them before they’re due. Early payment discounts come in several forms and can be a win-win for businesses and customers alike, provided they’re applied strategically so as not to cut into profit margins.

What Is an Early Payment Discount (EPD)?

An early payment discount (EPD) reduces the dollar amount of an invoice as an incentive to get customers to pay their bills ahead of the payment terms. Typical discounts fall in the 1% to 2% range. For example, a 2/10 EPD indicates a 2% discount if the invoice is paid within 10 days. The customer benefit is clear, but businesses also benefit by getting their hands on cash that otherwise would be tied up in accounts receivable — money that might be used to bridge a cash-flow gap or for business growth. In addition, early payments decrease a cash-flow metric known as days sales outstanding (DSO), which measures the amount of time it takes for an invoice to be paid. A lower DSO reflects well on a company’s financial processes and overall financial health.

Key Takeaways

- An early payment discount is an incentive that reduces the dollar amount of an invoice if the customer pays it in advance of the due date.

- Early payment discounts provide businesses with more control over their cash flow, can improve their competitiveness and even boost customer loyalty.

- Early payment discounts can cut into profit margins if not strategically applied.

- Discounts come in several forms: static, dynamic or sliding scale.

Early Payment Discount Explained

Many businesses struggle with cash flow. A growing business may have record sales, but until actual payment is received, it still bears all costs related to the product or service sold. The business also relies on the cashflow from payments received to pay its own bills, produce more products and pursue other means of growth. Suffice it to say, an extended lag between billing and receiving can lead to cash-flow problems. EPDs, also called prompt payment discounts, aim to shrink the lag by offering customers a cash discount in exchange for paying their bills early. When properly implemented, the business’s loss from the discount will be smaller than any interest it would have to pay to borrow money from a lender. If a business is in need of cash, EPDs can be a quicker and more affordable way to turn assets into capital than a traditional loan.

How Do Early Payment Discounts Work?

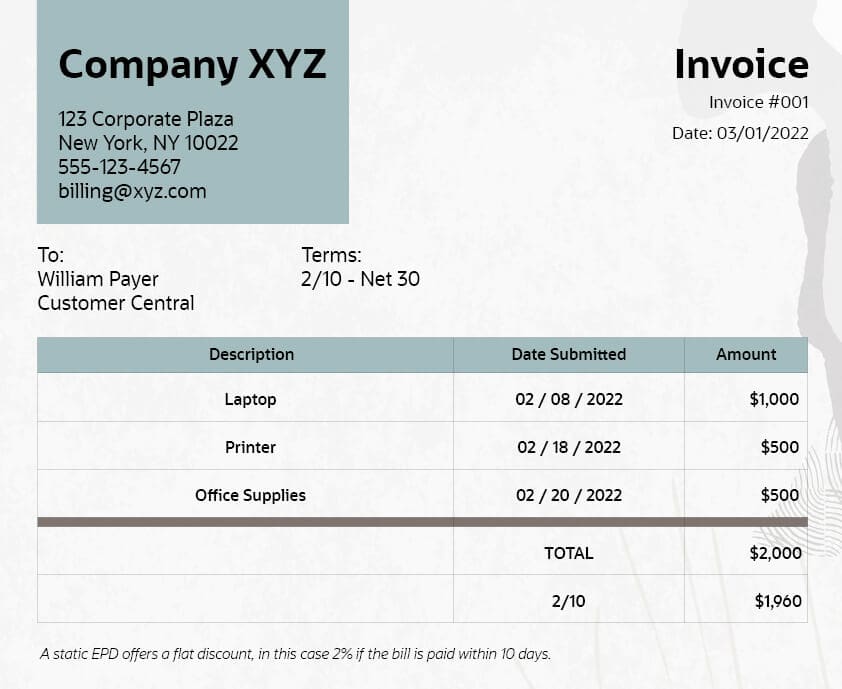

What constitutes an “early” payment varies from one business to the next. Many businesses state EPD terms right on the invoice, usually written in a “%/early date - net final date” format. For example, if an invoice includes 1/15 - net 30 listed under terms, the 1 is the percent of discount offered, the 15 is how many days the customer has to pay the bill to receive the discount, and the net 30 is the final due date for the full amount to be paid. Under these terms for a $1,000 invoice, the payer has 15 days to pay the bill at the discounted rate of $990 ($1,000 - $10, or 1%). Otherwise the full balance is due within 30 days.

It’s important to note that payment terms must be clear and explicit to avoid any misunderstanding that could create friction between the vendor and customer. For example, a business may consider “day 1” to be the date the invoice is printed, while the customer may consider the clock to be starting when they receive the bill. Customers tend to appreciate discounts — but not confusing terms that cause them to miss out.

Types of Early Payment Discounts

EPDs generally come in three options — static, sliding scale or dynamic — and each one ranges in flexibility. A business may choose to use one or more models across its customer base.

Static: A static EPD discount provides a predetermined discount for an invoice paid in a set number of days. It’s the least flexible, but most straightforward, of EPD types and may be leveraged in specific cases, for example, to bolster a quarterly financial report, for which there is a specific deadline. For example, a 2/10 - net 30 EPD on a $2,000 invoice means the customer has 10 days to pay to save 2%, or $40, off the total amount. Otherwise, they have 30 days to pay the full amount.

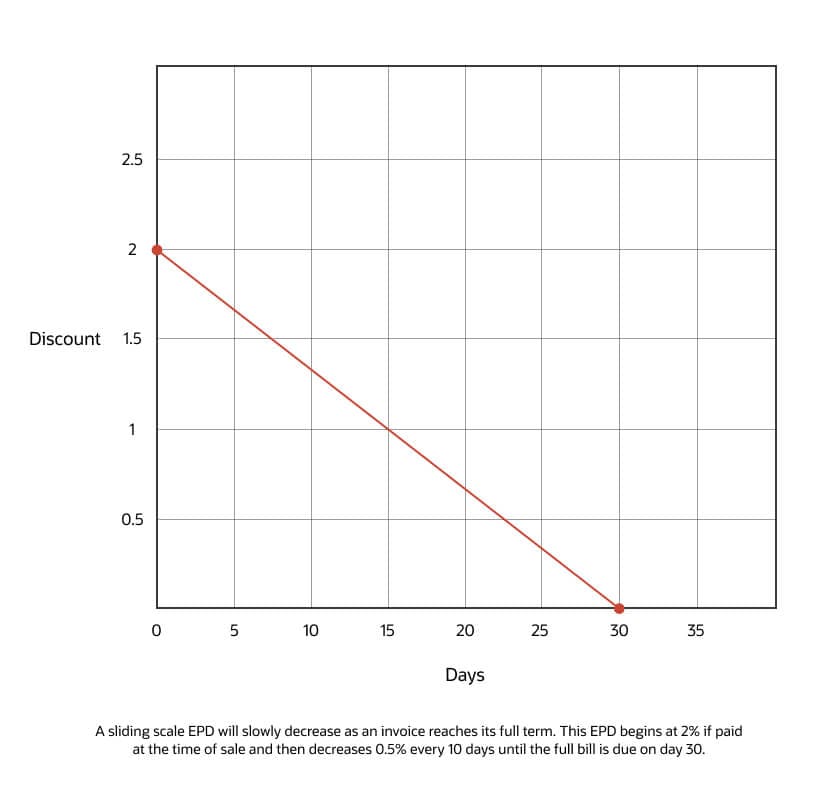

Sliding scale: A sliding scale EPD adjusts the discount based on when the invoice is paid; the longer it takes, the lower the discount. This is often used to reduce DSO or late payments throughout the year. For example, that same $2,000 invoice could come with a 2% discount if paid upon purchase (day 0), 0.4% reduction every 6 days. So day 10 would have a 1.33% discount, day 15 would have 1%, and day 20 would have 0.67%.

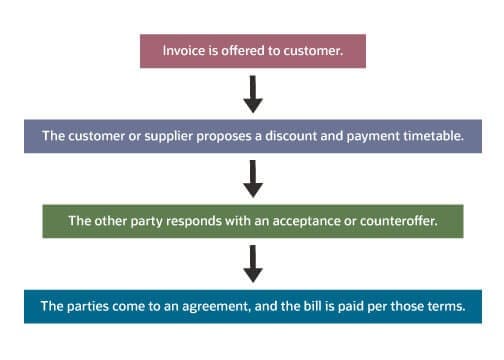

Dynamic: Dynamic discounting allows for the negotiation of terms between the buyer and seller. This method may take more time but can be informed by supply and demand. For example, the customer may request a 1.5% discount on that $2,000 invoice. The supplier can agree but stipulate payment must be made within 15 days of the original invoice date.

Benefits of Early Payment Discounts

EPDs can be a win-win option both for businesses that are able to offer them and for customers that are able to take advantage of them, not only due to the associated monetary savings and boosts in cash flow, but also in the form of stronger business relationships. Each party retains a sense of control, too. The business decides whether to offer an EPD and the customer chooses whether to take advantage of it or hang onto their money for the invoice’s full term. Let’s take a closer look at the benefits from each perspective.

Benefits for vendors: Lowering the amount a buyer owes to a business might not seem beneficial to the seller at first glance, but there are several reasons why EPDs can be a good idea.

- Quicker payments. Few things motivate a buyer to buy — and also to pay early — more than a discount. EPDs can also decrease the time (and costs) that goes into sending out payment reminders and chasing down late customers.

- Increased cash flow. Whether it’s money for growth, to cover expenses, to close a quarterly report or the many other reasons a business may need extra cash on hand, EPDs can improve the business’s cash flow, yielding funds that then can be put to use for innovation and growth.

- Increased customer loyalty. Offering more payment options and discount levels than competitors can keep customers feeling appreciated and coming back.

- Potential savings. Turning invoices into capital early may be a cheaper alternative to financing a loan — despite the loss from the discounts. The business sets the terms and rates, not a lender.

Benefits for customers: In addition to pure monetary savings, there are some subtle reasons why a customer might want to take advantage of EPDs.

- Increased options. Customers like to be in control of their finances. Offering them some agency as to how they can pay their bills contributes to a sense of proactivity.

- Rewards for “good” behavior. Positive reinforcement is a known motivator for coaxing a desired behavior. A discount for early payment is one such example. What’s more, customers will feel good about saving a few bucks (or more) if they’re able to do so.

- Building business credit. By establishing a history of early payments, customers can build their business credit, which in turn may lead to better invoicing and lending terms.

Drawbacks of Early Payment Discounts

EPDs aren’t without a few issues. If not properly managed, the downsides of an EPD can outweigh its benefits. Consider the following:

- Less money per order. If a business already has tight margins, a 1% or 2% discount can shrink them more or even lead to loss. If a $1,000 order nets a profit of $200, a 2% discount (resulting in a profit of $180) translates to a 10% decrease in profit.

- Discounts given to customers already paying early. If a customer typically pays early, do they really need an incentive?

- Still a bit unpredictable. Even though customers are incentivized to pay early, they may opt not to. For those that do, exactly when the payment will come in within the discount terms is still variable.

- Potential monetary loss. If a business needs cash and qualifies for low-interest financing, it may be more cost-effective to take out a loan and not discount prices. It’s important to compare rates before deciding where to get the quick capital. (More on that soon.)

How to Calculate Early Payment Discounts

No matter the type of EPD (static, sliding scale or dynamic) used, the discounts are all calculated the same way. Let’s say you own a hardware store and received an invoice from a supplier for $15,000 worth of merchandise, with 1/10 - net 30 EPD terms. Here is how to calculate the discounted price:

- Locate the original invoice amount and the discount rate. In this case, that’s $15,000 and 1%, respectively.

- Convert the discount percentage to a decimal by dividing it by 100: 1/100 = 0.01.

- Multiply the original amount by the discount rate subtracted from 1: $15,000 x (1 - 0.01).

- The answer is your new discounted total. If you pay your supplier within 10 days, the balance is $14,850. Otherwise you have 30 days to pay the full $15,000.

- This formula can be expressed as: Discounted price = original invoice amount x (1 - discount %).

- Alternatively, start with the first step and go directly to this formula: Discounted price = original invoice amount - (original invoice amount x discount %). So, $15,000 - 1% = $14,850.

Now let’s say you’re on the other end of that invoice: You’re the supplier in need of cash and debating whether to offer the hardware store an EPD or finance a loan through more traditional means.

This involves understanding the annual percentage rate (APR) of the EPD and then comparing it to loan rates. Since the discounts are calculated for small periods of time — 10 days in this example — the annual rate is not always obvious and can be higher than it seems until it’s calculated for its daily rate. To find the APR of the discount, follow these steps:

- Locate the discount percent (1%), the full length of the invoice (30 days) and how long the discount is active (10 days).

- Convert the discount percentage to a decimal by dividing by 100: 1 / 100 = 0.01.

- Divide the discount by 1 minus the discount: 0.01 / (1 - 0.01) = 0.010101.

- Calculate the difference between the full invoice length and the length of the discount, then divide the answer into 360 (or 365, depending on the lender): 360 / (30 - 10) = 18.

- Multiply the results of steps 3 and 4 to calculate the APR of the discount: 0.010101 x 18 = 18.18%.

- This formula can be expressed as: APR = [discount % / (1 - discount %)] x [360 / (full days to pay - discount days).

- Compare the discount APR to a loan APR to determine which option is better.

The APR calculation that comes second is important to the buyer too — not just the vendor. Yes, the vendor would want to calculate the APR to determine if it’s more beneficial to raise capital by offering EPDs or if it’s better off borrowing from a different source. The buyer would also want to calculate APR to determine whether to take the discount offered and pay early. The best example would be if the buyer had to decide whether to borrow the $14,850 on day 10 to pay the invoice and secure the discount or to wait until it has enough cash on day 30.

Or, say the $14,850 is earning high interest and the buyer needs to decide if it’s better to keep it earning interest for the full 30 days or if it’s better to sacrifice those last 20 days of earning potential to secure the discount. In both of those cases, the buyer would want to compare those interest rates to the APR of the discount to determine which course of action would suit them best. If they can borrow from a line of credit for anything less than 18.18%, then they would be better off paying the invoice on day 10 with borrowed funds and pay back the borrowed funds on day 30. In another example, if they’re earning less than 18.18%, then it would be more beneficial to use the funds they already have, even if it means sacrificing the 20 days of unearned interest, because they would save more than they could earn.

Examples of Early Payment Discounts

Many industries can benefit from offering EPDs. Let’s say a restaurant supplier usually sets a 60-day deadline on its invoices. But this quarter, it needs access to cash and decides to offer an EPD to its longtime customers. One in particular has bought $5,000 worth of plastic cutlery, cups and paper goods. Some EPD scenarios could be:

- A static EPD of 1/25 - net 60. This bill would be lowered to $4,950 ($5,000 less 1%) if it’s paid within 25 days. Otherwise the customer will owe the full amount, due within 60 days.

- A sliding scale EPD of 2/15, 1.5/30, 1/45 - net 60. This bill would cost $4,900 ($5,000 less 2%) if paid within 15 days, $4,925 ($5,000 less 1.5%) if paid within 30 days and $4,950 ($5,000 less 1%) if paid within 45 days. After that the full $5,000 is due by day 60.

- A dynamic EPD. The restaurant supplier proposes a 1% discount for payment made in 30 days. The customer counters with a 2% discount for the same term. They meet in the middle and agree on a 1.5% discount ($4,925) on net 30 days.

Early Payment Discount Alternatives

EPDs can be modified to fit the needs of any size company trying to improve its cash flow. However, offering a discount for early payment isn’t the only way to do so, and it may not always be your best option, either. Alternatives to EPDs include:

- Invoice factoring. Unpaid invoices can be sold to a third-party financing company, known as a factor, for a percentage of the original value, generally around 80%. The majority of the invoice’s value is paid within a few days, and the remainder when the financing company is paid. This is a case where calculating APR to compare options would be wise — APR on factoring is typically very high.

- Invoice financing. Like invoice factoring, invoice financing lets a company borrow against its unpaid invoices, though the company retains control of the accounts. In other words, the invoices become collateral. This EPS alternative is also called sales-ledger financing.

- Taking out a loan. If a lender is offering competitive interest rates that fit your budget, it might be worth considering keeping invoices at full price and borrowing instead.

Make It Easy. Automate Early Payment Discounts

Manually managing accounts payables and receivables is both time-consuming and resource-intensive for businesses of all sizes. One small mistake, such as the incorrect placement of a decimal point when calculating an early payment discount, can chip away at profit margins. NetSuite Cloud Accounting Software eliminates the potential for error by automating many different accounting processes. For example, the cloud-based software lets business managers schedule payments based on invoice due dates; apply custom rules to capture early payment discounts; and schedule and approve recurring invoices, such as utilities or subscriptions, that fall within predefined thresholds. Businesses can be confident in the accuracy of their accounting, while lowering DSO and improving cash flow.

A business’s financial health can be derived from its cash flow, which to a large extent is dependent on customers paying their bills on time — or, better yet, early. One way to encourage this behavior is by offering select customers an early payment discount (EPD), such as 2% off an invoice’s total amount if it’s paid within 15 days, rather than 30. The sooner a business sees its cash, the more likely it can pay its own bills (maybe take advantage of an EPD, as well) and use the funds for growth opportunities. EPDs can also help businesses build better relationships with their customers, who are likely to appreciate the choice of payment options, feel good about saving some money and return to buy again.

Early Payment Discount FAQs

Which type of discount encourages the debtor to pay early?

An early payment discount encourages customers to pay their bills before they’re due. If an invoice includes 1/15 - net 30 as part of its terms, the 1 is the percent discount offered, the 15 represents how many days the customer has to pay the bill and receive the discount, and the net 30 is the final due date for the full amount to be paid.

How do you incentivize early payments from customers?

Offering a discount for early payment can incentivize customers to pay their bills before they’re due. Early payment discounts (EPDs) generally come in three options — static, sliding scale or dynamic. A static EPD discount provides a predetermined discount for an invoice paid in a set number of days. A sliding scale EPD adjusts the discount based on when the invoice is paid; the longer it takes, the lower the discount. Dynamic discounting allows for negotiation of terms between the buyer and seller.

How do I record an early payment discount?

There are two methods for recording an early payment discount: net and gross. The net method records unclaimed discount amounts, which provides a business with visibility into where they can cut expenses. The gross method records only those discounts taken.

Should you offer early payment discounts?

That depends on the business and its goals, as well as a comparison of APRs. EPDs can be a win-win option for both businesses and customers, not only due to the associated monetary savings and boosts in cash flow, but also in the form of stronger business relationships. Each party retains a sense of control, too. The business decides whether to offer an EPD, and the customer chooses whether to take advantage of it or hang onto their money for the invoice’s full term.