Accrual-based accounting is the official accounting method required by public companies and the de facto method for many private firms. It is guided by several principles, two of which — the revenue recognition principle and the matching principle — dictate the timing of when revenue, and the expenses that support it, is recognized in a company’s books. In the real world, however, that timing doesn’t always line up neatly, such as when a company receives an advance payment for a product it has yet to provide. When that happens, accountants use a technique known as deferrals to delay the point at which the transaction is recognized. Doing so reflects (and communicates) a business’s financial activity more accurately.

What Is a Deferral in Accounting?

Deferrals are a type of “adjusting” entry in a company’s general ledger that delays the recognition of a transaction in the company’s accounting records until a future fiscal period or periods. Deferrals are used to put off revenue — meaning, the amount to be collected, and expenses, or the amount to be paid.

Revenue and expense deferral both stem from the same two accounting principles: revenue recognition and the matching principle. The revenue recognition principle, which is fundamental to accrual-based accounting, dictates that revenue should be recognized in the period in which it is earned — defined by the Financial Accounting Standards Board (FASB) as “when the selling company satisfies a performance obligation by transferring a promised good or service to a customer, giving the customer control of that good or service”.

The matching principle is the reason for expense deferrals. It calls for expenses to be reflected in a company’s books during the same accounting period as the revenue they support. For example, the cost of lumber used for a building in a multiyear construction contract would be deferred until the same time the revenue for that building is recognized. Not all expenses have a direct relationship to revenue, but for those that do, such as a salesperson’s commissions, they should be matched in timing with the revenue.

What is Deferred Revenue?

A revenue deferral is an adjusting entry that pushes a company’s recognition of revenue to a future fiscal period or periods. This is done when the company receives payment from a customer in advance of delivering the purchased goods or services.

What are Deferred Expenses?

An expense deferral is an adjusting entry that pushes the recognition of an expense to a future fiscal period or periods. This is done when payment has been made for a product or service prior to the recognition of the related revenue or to the customer’s receipt of the item.

Deferral vs. Accrual

Deferrals and accruals are types of adjusting journal entries that arise due to timing discrepancies between cash flow and accrual-based accounting principles. Both adjustments improve the accuracy of a company’s books and keep a company in compliance with Generally Accepted Accounting Principles (GAAP) by adhering to the revenue recognition and matching principles.

Key differences: The primary difference between deferrals and accruals is that they work in opposite directions. More specifically, deferrals push recognition of a transaction to future accounting periods, while accruals move transactions into the current period. Other differences are outlined in this comparison chart:

| Deferral | Accrual | |

|---|---|---|

| Accounting period | Pushes into the future. | Accelerates into current period. |

| Cash flow pattern: revenue | Payment comes in before goods or services are transferred to customer. | Payment comes in after goods or services are transferred to customer. |

| Cash flow pattern: expenses | Cash goes out for an expense incurred before related revenue is earned. | Cash goes out for an expense incurred after related revenue is earned. |

| Account affected: revenue | Increases liabilities. | Increases assets. |

| Account affected: expenses | Increases assets. | Increases liabilities. |

Key Takeaways

- Deferrals are adjusting entries that push the recognition of a transaction in a company’s accounting records to future periods.

- Both revenue deferrals and expense deferrals arise from the revenue recognition principle and the matching principle.

- Deferrals play a critical role in the accuracy of a company’s financial statements.

- Accruals accelerate recognition of a transaction in advance of cash flow.

- Manual accounting for deferrals can become unwieldy, inaccurate or overlooked without the right software.

Deferrals Explained

Deferrals are all about timing, within the context of earning revenue and matching expenses. They are used by companies of all sizes and industries to improve the accuracy of their financial statements. Anytime a customer pays in advance for goods or services to be delivered in the future, the supplying company is expected to book the payment as deferred revenue, sometimes called unearned revenue. Deferred revenue is a liability account, acknowledging that the supplying company owes a good or service to a customer.

Similarly, when a company makes a payment for goods or services in advance of receiving them, such as prepaying six months of insurance coverage, it would initially record a deferred expense for five months’ worth of payments. A deferred expense is an asset because it represents prepaid economic value.

Why Are Deferrals Important?

Deferrals are a useful mechanism to help a company’s books and records more accurately align the receipt of a product or service with its related revenue. They can have a significant impact on a company’s financial statements, which are used by internal and external stakeholders as the basis for many business decisions. A company that collects payment in advance of delivering its product should not reflect that payment as revenue until it satisfies its obligation.

In an extreme example, consider the faulty conclusions that could be drawn by looking at a wedding dress retailer that collects payment from hundreds of brides but never delivers a single gown. Without revenue deferrals, this retailer would appear to have a robust revenue line when, in fact, it doesn’t. Investors or lenders that are considering funding the retailer’s expansion to a second location would have no idea about the outstanding liabilities owed to customers and would possibly make an extremely risky decision.

How Deferrals Work

Deferrals help reconcile timing differences between cash flow and the income statement. A hypothetical example helps illustrate this point and how deferrals work, in general. This example is for deferred revenue.

On Oct. 1, 2022, a restaurant pays a linen supplier $10,000 for a one-year contract to supply clean tablecloths and napkins. The linen company records this transaction in its books as an increase to its cash account and an offsetting increase in its deferred revenue account. The linen company’s fiscal year ends on Dec. 31, 2022, at which point it will have earned only three months’ worth of the restaurant’s one-year payment, or $2,500 of the $10,000. The linen company’s 2022 income statement shows $2,500 as earned revenue. The remainder of the upfront payment, $7,500, cannot be recognized as revenue yet because the linen company owes the restaurant nine more months of services through Sept. 30, 2023, before it earns that cash. The amount remains in the deferred revenue liability account on Dec. 31, 2022.

At the end of each month in 2023, the deferred revenue account is reduced by one-ninth, or $833, and recognized as income as it is earned. The linen company’s 2023 income statement shows $7,500 as earned revenue, assuming the contract runs its term and is not renewed.

Without deferrals, the linen company’s revenue in 2022 would be overstated and its liabilities understated, distorting its financial health. Additionally, the deferrals give a better picture of 2023 operations, providing revenue to match the payroll and linen costs being incurred by the linen supply company.

Why Use Deferrals?

From a practical standpoint, revenue and expense deferrals are required for a company to comply with GAAP standards — a prerequisite for all public companies and most lenders. In addition, by establishing liabilities for unearned revenue and assets for prepaid expenses, the use of deferrals creates a better picture of a business’s financial health.

Why defer expenses and revenue?

The deferral of expenses and revenue into the proper fiscal periods helps management and external users of a company’s financial statements better understand the actual results of operations. Deferrals help smooth inconsistent swings in financial results from cash received or paid in advance of the goods and services being provided, as illustrated in the previous linen supply company example. It also helps properly value and acknowledge a company’s obligations to deliver an item to the customer. Deferrals help translate cash accounting, which records revenue and expenses when money changes hands, to accrual-based accounting, which recognizes revenue when earned and matches that timing to recognize expenses.

Examples of Deferrals in Accounting

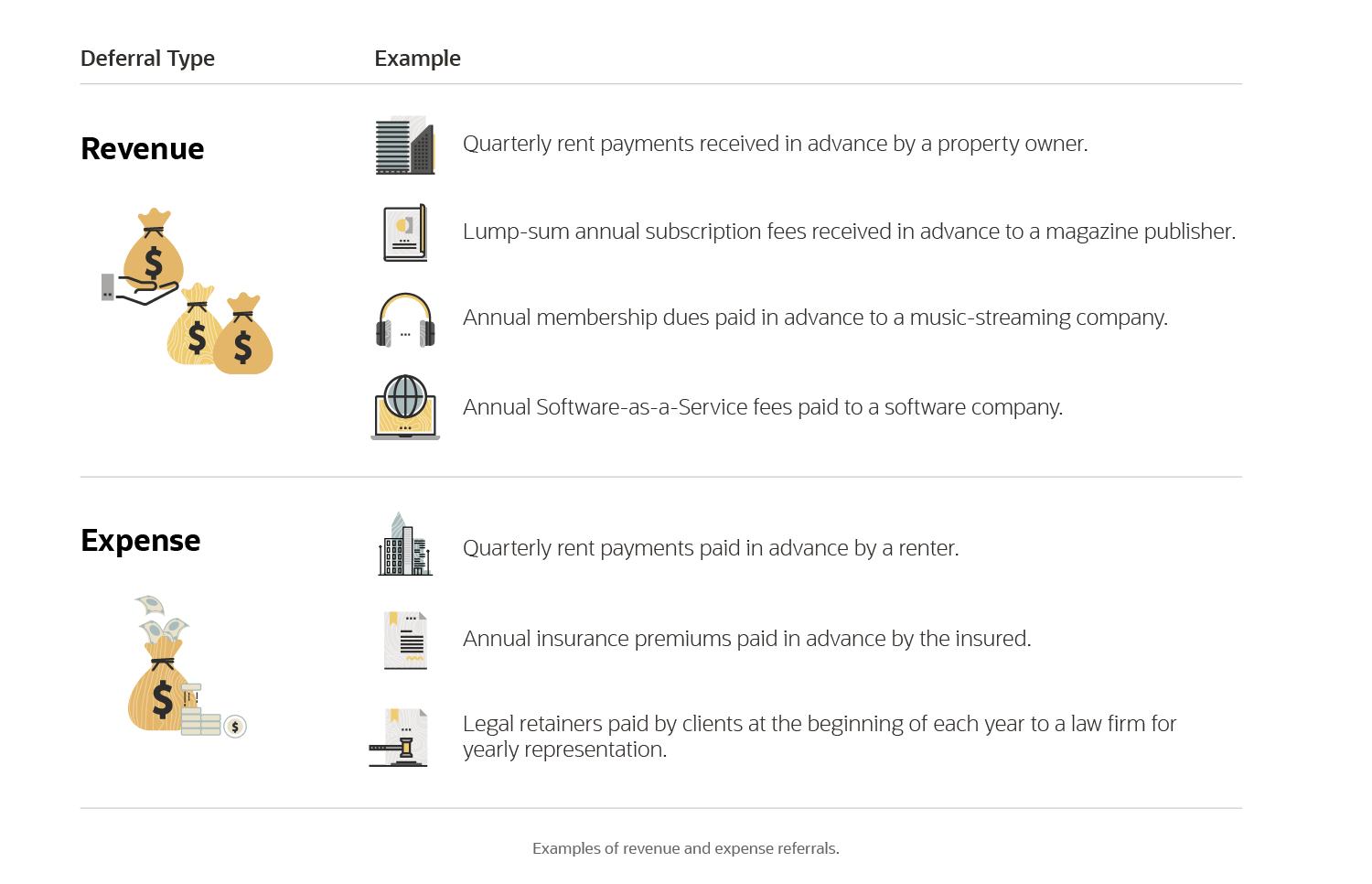

Many common business transactions give rise to deferrals. Some examples of deferred revenue and deferred expenses are:

Manage Deferrals With Accounting Software

Revenue deferrals and expense deferrals are important parts of a company’s accounting. Considering the examples above, the bookkeeping for deferrals might not appear to be too complex — until the volume of transactions is considered. For example, most magazine publishers have hundreds of thousands of subscribers. Layer in staggered subscription periods, different subscription prices and promotions that bake a few “free” months into the subscription price, and it’s easy to see how quickly this process can become unwieldy, inaccurate or overlooked without the right software for proper execution.

NetSuite SuiteBilling automates the revenue deferral process for all types of scenarios, including subscriptions, contracts and consumption-based revenue recognition, which is pertinent in many industries. Integrated with NetSuite Cloud Accounting Software, accounting for revenue and expense deferrals can become automated, more accurate and treated consistently, while also offering multidimensional data access and analysis, all built for scalability.

Deferrals are adjusting journal entries that help align the timing of cash flows with GAAP revenue recognition and expense matching. Deferred revenue arises from payments received before revenue is earned. Deferred expenses represent money paid in advance of receiving a good or service or before the related revenue is earned. Both are important for GAAP compliance and to more accurately represent a company’s results in its financial statements. Deferrals can become an accounting burden without the right software to help.

Deferral FAQs

Why would a business defer expenses or revenue?

A business would defer expenses or revenue for two reasons. First, from a practical standpoint, both revenue and expense deferrals are required in order to comply with GAAP guidelines. Second, by establishing liabilities for unearned revenue and assets for prepaid expenses, deferrals create a better picture of a business’s financial health.

Is deferred revenue a credit or debit?

Deferred revenue is a liability and has a natural credit balance, meaning that it increases with credits and decreases with debits.

What is an example of a deferral?

There are many common business transactions that give rise to deferrals, such as quarterly rent payments received in advance by a property owner (deferred revenue) and annual insurance premiums paid in advance by the insured (deferred expense).

Are accruals and deferrals the same thing in accounting?

Deferrals and accruals are adjusting journal entries that arise due to timing discrepancies between cash flow and accrual-based accounting principles. Both are tools that make a company’s books more accurate and GAAP-compliant by adhering to the revenue recognition and matching principles. The primary difference is that deferrals push recognition of a transaction to a future accounting period, while accruals bring them forward to the current period.

What is an example of a deferred expense?

An expense deferral is an adjusting entry that pushes the recognition of an expense to a future fiscal period because payment for the expense was made prior to the recognition of the related revenue or prior to receiving the item. An example is when a renter pays their quarterly rent payments in advance.

Is a deferral an asset or a liability?

A deferred expense is an asset because it represents prepaid economic value. It arises when an entity makes a payment for goods or services in advance of receiving them. Revenue deferrals are liabilities.