Earning cash as a business is exciting. However, let’s pump the brakes before you immediately recognize that revenue. Has your business actually “earned” that revenue?

Revenue recognition has been a hot topic since the release of Accounting Standards Codification (ASC) 606 in 2014. Released by the Financial Accounting Standards Board (FASB) as a part of Generally Accepted Accounting Principles (GAAP) in the U.S., the new guidance—which went into effect in December 2017 for public entities and December 2018 for private entities—standardized how companies should recognize revenue, particularly in incidents when the nature, certainty, and timing of revenue might be complicated. The International Accounting Standards Board (IASB) then followed suit and released similar guidance as a part of the International Financial Reporting Standards (IFRS) to dictate when that revenue can be considered earned and the financial statement accurately updated.

Curious when your company should recognize its revenue? Our comprehensive guide breaks down what you need to know.

What Is Revenue Recognition?

Revenue recognition is an accounting principle that asserts that revenue must be recognized as it is earned. The focus is on recognizing revenue at the time goods or services are delivered to customers, as opposed to when payment is made. The principle is regulated by similar standards in both the U.S. and internationally.

The question becomes: When is revenue considered “earned” by a company? Revenue is generally recognized after a critical event occurs, like the product being delivered to the customer. The process involves identifying contracts, fulfilling performance obligations, determining transaction prices, and then recording revenue as these obligations are met. This method aims to promote consistency and transparency in reporting.

Key Takeaways

- Revenue recognition standards can vary based on a company’s accounting method, geographical location, whether they are a public or private entity, and other factors.

- The revenue recognition principle, a key feature of accrual-basis accounting, dictates that companies recognize revenue as it is earned, not when they receive payment.

- Accurate revenue recognition is essential because it directly affects the integrity and consistency of a company’s financial reporting.

- In order to standardize processes around revenue recognition, a five-step framework for recognizing revenue is relevant under both GAAP and IFRS.

Revenue Recognition Explained

In essence, revenue recognition looks to answer when a business has actually earned its money. Typically, revenue is recognized after the performance obligations are considered fulfilled, and the dollar amount is easily measurable to the company. A performance obligation is the promise to provide a “distinct” good or service to a customer, and are considered key components of a transaction. On the surface, it may seem simple, but determining what constitutes a transaction can require more time and analysis than one might expect. In order to accurately recognize revenue, companies must pay attention to the five steps and ensure they are interpreting them correctly. Fortunately, the FASB and IASB joined forces to outline the Five-Step Model—more on this later.

Accrual vs. Cash Accounting

The revenue recognition principle is a key component of accrual basis accounting. This accounting method recognizes revenue once it is considered earned, unlike the alternative cash-basis accounting, which recognizes revenue at the time cash is received. Here’s a more detailed explanation of the two:

- Accrual basis accounting: Revenue is recognized when it is earned, and expenses are recognized when they are incurred, regardless of when cash is received or paid. Income and related expenses are recorded in the same time period, even if cash hasn’t changed hands yet. Accrual basis accounting complies with GAAP, and because it involves more complex bookkeeping (e.g., tracking accounts payable and receivable), it offers a more realistic view of a company’s financial health. Larger businesses and public companies are required to use accrual basis accounting.

- Cash basis accounting: Revenue is recognized when payment is received, regardless of when goods or services are delivered, and expenses are typically recognized when they are paid. Cash accounting is simpler than accrual accounting in terms of record-keeping and cash flow tracking, but it may not accurately reflect a company’s financial position at any given time, especially for larger or more complex businesses. It’s typically used only by small businesses looking for a straightforward approach to accounting, but is not GAAP-compliant for most.

Why Is Revenue Recognition Important?

Proper revenue recognition is imperative because it relates directly to the integrity of a company’s financial reporting. The intent of the guidance around revenue recognition is to standardize the revenue policies used by companies. This standardization allows external entities—like analysts and investors—to easily compare the income statements of different companies in the same industry. Because revenue is one of the most important measures used by investors to assess a company’s performance, it is crucial that financial statements be consistent and credible.

Conditions for Revenue Recognition: Which Standard Does My Business Need to Follow?

Conditions for revenue recognition differ based on a company’s geography, business model, whether it is a public or private entity, its bank, investors, and numerous other factors. Public companies within the U.S. are required to follow GAAP standards. While private companies are not technically required to adhere to GAAP, they may find it necessary for financing and expansion opportunities.

For some international companies, IFRS comes into play as opposed to GAAP. Many companies voluntarily follow IFRS (opens in new tab) guidelines, but in some 140+ countries that have mandated IFRS (opens in new tab), these accounting practices are a legal requirement for financial institutions and public companies.

Revenue Recognition Requirements: Do All Businesses Need to Comply?

U.S.-based public companies must adhere to GAAP’s revenue recognition standards. Whether private companies are required to follow them is much more complicated.

From a strictly legal perspective, private companies are not required to comply with GAAP standards in the U.S. However, from a more de facto point of view, companies may need to comply with revenue recognition requirements for many reasons. Many banks and investors prefer or even require GAAP-compliant financial reporting, so many companies will find that they need to comply with revenue recognition standards to receive any financing. The IFRS follows a similar approach, where many regions require it for domestic public companies (less so in areas where the rules are still being implemented), but it is a popular option for many private companies as well.

IFRS Reporting Standards Criteria for Revenue Recognition

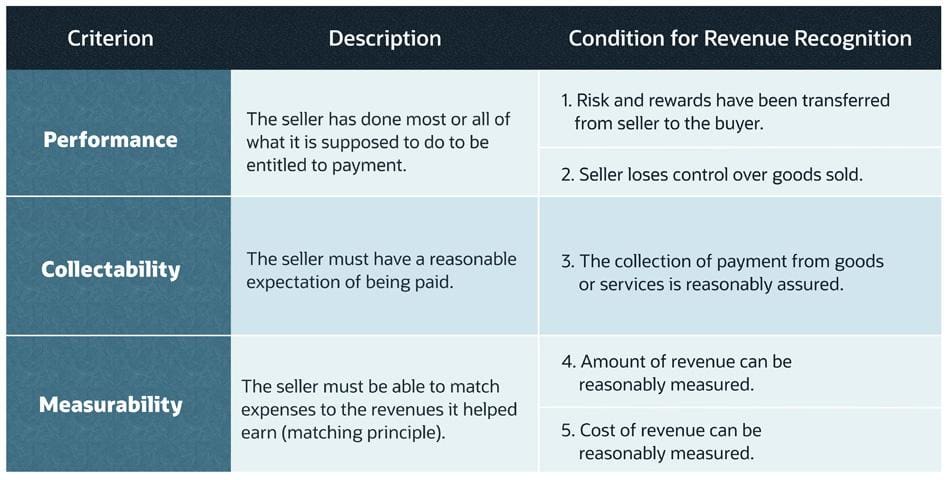

According to IFRS reporting standards, the following conditions must be satisfied for revenue to be recognized:

- Risk and rewards have been transferred from seller to the buyer.

- Seller loses control over goods sold.

- The collection of payment from goods or services is reasonably assured.

- Amount of revenue can be reasonably measured.

- Cost of revenue can be reasonably measured.

These conditions fall under three criteria that IFRS list as necessary for a contract to exist: performance, collectability, and measurability. The first two conditions listed are classified under “performance.” Performance is achieved when the seller has done most or all of what it is supposed to do to be entitled to payment. The third is a “collectability” condition, which means that the seller must have a reasonable expectation of being paid. The last two are considered “measurability” conditions because of the matching principle: the seller must be able to match expenses to the revenues it helped earn. Therefore, the amount of revenues and expenses should both be reasonably measurable.

GAAP Revenue Recognition Principles

The GAAP core principle for revenue recognition is that companies should recognize revenue when goods or services are transferred to customers, in an amount that reflects the consideration—the value promised in exchange for goods or services—that the company expects to receive. This is implemented through a five-step process (detailed later):

- Identify the contract with a customer.

- Identify the performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price to the performance obligations.

- Recognize revenue when (or as) the entity satisfies a performance obligation.

These principles help show the true financial impact of customer agreements and make it easier to compare financial reports across different types of businesses.

Accounting Standards Codification (ASC) 606

Guidance from the FASB is used to create GAAP principles. Thus, the revenue recognition principle dictated by the FASB ASC 606, a key feature of accrual-basis accounting, is an integral GAAP principle. It states:

“The core principle of Topic 606 is that an entity should recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.”

This principle ensures that companies in compliance with GAAP recognize their revenue when the service or product is delivered to the customer—not when the cash is received.

However, aside from this principle, previous U.S. GAAP guidance was immensely complicated. There were numerous and inconsistent requirements on how to recognize revenue, differing greatly across industries and geographies.

This led the FASB to release the update to ASC 606, which replaced GAAP’s 100 different industry and transaction-specific guidelines with a basic, five-step framework. Its intent is to provide more information on how to handle revenue recognition in contractual situations and offer an industry-neutral framework for improved comparability of financial statements.

The IASB soon followed suit and issued IFRS 15, Revenue from Contracts with Customers. These standards have essentially achieved convergence between the U.S. GAAP and the IFRS, with only some minor differences.

Five-Step Revenue Recognition Model

The five-step revenue recognition model is a cornerstone of modern accounting standards, providing a systematic approach to recognizing revenue under both GAAP and IFRS. It supports consistent and accurate revenue reporting across businesses of all sizes in various industries and with numerous transaction types. Here’s a look at each step in detail:

1. Identify Contract With Customer:

In order to complete this step, the parties must fulfill several criteria. All parties must first approve of the contract and be committed to fulfilling their obligations. The contract will outline each party’s rights as well as the payment terms regarding the goods or services to be transferred. It also must have “commercial substance.” This means that both sides expect the future cash flows of a business will change as a result of the transaction. Lastly, collectability must be probable. This means that payment is likely to be received (i.e., the customer’s credit risk should be evaluated at contract inception).

2. Identify Performance Obligation(s):

In this step, an entity must identify all distinct performance obligations. A performance obligation is a promise in a contract to transfer a good or service to the customer. There are two criteria for a good or service to be considered distinct, and both of those criteria must be met.

- A good or service is capable of being distinct if the customer can benefit from it on its own or with other resources that are readily available.

- A good or service must also be separately identifiable from other promises in the contract to be considered distinct—commonly referred to as being “distinct in the context of the contract.”

3. Determine Transaction Price:

This part of the process entails determining the amount of consideration the entity expects to be entitled to, in exchange for transferring promised goods or services to a customer (i.e. the transaction price). This does not include amounts collected on behalf of third parties, like sales tax. In many cases, this step is straightforward, as the seller will receive a fixed amount of cash simultaneously with the transferred goods or services. However, effects from several factors can complicate the determination:

- Variable considerations: When there is uncertainty around the amount of consideration, like in instances of discounts, rebates, refunds, credit s, incentives, and similar items.

- Constraining estimates of variable consideration: After estimating variable consideration, entities must assess the likelihood and magnitude of the potential revenue reversal (due to factors like market volatility).

- The existence of a significant financing component: When there is more than a year between receiving consideration and transferring goods or services, a contract may have a significant financing component. A financing component in the transaction price considers the time value of money.

- Non-cash considerations: When a consumer pays in the form of goods, services, stock or other non-cash consideration.

- Considerations payable to the customer: Instances where a company must also make a payment to a consumer like slotting fees, cooperative advertising, buydowns, price protection, coupons, and rebates.

4. Allocate Transaction to Performance Obligation(s):

If a contract has more than one performance obligation, a company will need to allocate the transaction price to each separate performance obligation based on its relative standalone selling price.

5. Recognize Revenue as Performance Obligation(s) is Satisfied:

The final step is to recognize revenue when or as the performance obligations in the contract are satisfied.

- Transfer of Control: When a customer obtains control over the asset, it is considered transferred and the company’s performance obligation is considered satisfied. The company can then recognize that revenue.

-

Performance Obligations Satisfied Over Time: As a company transfers control of a good or service over time, it satisfies the performance obligation and can recognize revenue over time if one of the following criteria is met:

- The customer receives and consumes the benefits provided by the entity’s performance as the entity performs.

- The entity’s performance creates or enhances an asset (for example, work in progress) that the customer controls as the asset is created or enhanced.

- The entity’s performance does not create an asset with an alternative use to the entity (see FASB ASC 606-10-25-28), and the entity has an enforceable right to payment for performance completed to date.

An example of performance obligations being satisfied over time would be a routine or recurring cleaning service. The customer will receive the benefit of the vendor’s cleaning service as it’s being performed simultaneously.

-

Performance Obligations Satisfied at a Point in Time: If a performance obligation is not satisfied over time, the performance obligation is satisfied at a point in time. To determine the point in time at which a customer obtains control of a promised asset and the company satisfies a performance obligation, it should consider guidance on control and the following indicators of the transfer of control:

- The company has a present right to payment for the asset.

- The customer has legal title to the asset.

- The company has transferred physical possession of the asset.

- The customer has the significant risks and rewards of ownership of the asset.

- The customer has accepted the asset.

For example, an online ecommerce store sends a shirt to a customer. That customer has 30 days after receipt to return the shirt if needed. The company will consider the performance obligation fulfilled and the 30 days has passed.

-

Measuring Progress Toward Complete Satisfaction of a Performance Obligation: For each performance

obligation satisfied over time, a company should recognize revenue over time by measuring the progress toward

complete satisfaction of that performance obligation. Methods for measuring progress include the following:

- Output Method: Outputs are goods or services finished and transferred to the customer. A company first estimates the amount of outputs needed to satisfy the contract. The entity then tracks the progress toward completion of the contract by measuring outputs to date relative to total estimated outputs needed to satisfy the performance obligation. Number of products produced or services delivered are both examples of output measures.

- Input Method: Inputs are measured by the amount of effort that has been put into satisfying a contract. The input method is implemented by first estimating the total inputs required to satisfy a performance obligation. The company then compares efforts to date with the estimated total needed to satisfy the performance obligation. For example, money, time and materials utilized are all input measures.

Revenue Recognition Examples

To better understand revenue recognition, let’s walk through two examples of companies with different business models.

-

Example: Subscription Service

The popularization of the subscription model presented some revenue recognition challenges. Instead of a one-time transaction, subscription models presented a variety of ways to pay–annual, quarterly, monthly, etc.

For example, a coffee subscription company charges $25 a month to send a sampling of ground coffees to its subscribers. It also charges a one-time $50 startup fee for the process of learning more about the consumer, creating a curated selection of coffees and sending a pour-over coffee maker as a part of the subscription program.

Once the initial process is complete (i.e., the consumer has completed the questionnaire, the company has created a curated plan and the pour-over coffee maker has been delivered), that $50 can be recognized. The recurring fee, however, is charged on the first of each month even though the coffee itself is not delivered until mid-month. The company cannot recognize that $25 recurring payment when they receive it, as the business has not technically earned it yet.

Account Debit Credit Account Receivable $75 Earned Revenue $50 Deferred Revenue $25 Because the startup process has been completed, that revenue can be recognized as earned. However, since the monthly service has not yet been delivered, the accounting ledger must reflect that. Thus, the revenue is deferred.

At the end of the month, when the business has delivered both the startup process and the monthly service, the ledger can be updated to reflect the newly recognized revenue.

Account Debit Credit Deferred Revenue $25 Earned Revenue $25 Let’s look at another relevant situation here. A current consumer decides to opt into the annual coffee subscription plan, meaning that they pay for 12 months of the service at a discounted upfront cost of $264 ($22/month). The coffee company cannot recognize that $264 upfront, as it has not delivered the service/product. Instead, the business will recognize the $22 each month after the consumer receives their coffee sampler.

-

Example: Independent Contractors

Independent contractors also face a perplexing accounting situation, because when they are paid often varies.

As an example, let’s say an independent digital design agency is hired by a startup. The startup agrees to pay the contractor for three performance obligations: website creation, logo design and digital ads ($12,000, $4,500 and $3,500, respectively). The agency will be paid after each product is delivered.

The digital design company’s ledger, because it has not earned the revenue yet, would first display as such:

Account Debit Credit Account Receivable $20,000 Deferred Revenue (liability) — Performance obligation A (Website) $12,000 Deferred Revenue (liability) — Performance obligation B (Logos) $4,500 Deferred Revenue (liability) — Performance obligation C (Digital ads) $3,500 The agency completes and delivers the website in the first month, leading to a ledger update—even if they have not been technically paid by the client yet. As soon as it’s delivered, the performance obligation is considered fulfilled.

Account Debit Credit Deferred Revenue (liability) — Performance obligation A (Website) $12,000 Earned Revenue — Performance obligation A (Website) $12,000 In the following month, it finishes and delivers the logo designs.

Account Debit Credit Deferred Revenue (liability) — Performance obligation B (Logos) $4,500 Earned Revenue — Performance obligation B (Logos) $4,500 Deferred Revenue (liability) — Performance obligation B (Logos) $4,500 Deferred Revenue (liability) — Performance obligation C (Digital ads) $3,500 In the third month, the digital ads are done and delivered, so the agency has fulfilled its performance obligations. Thus, the remaining revenue can be recognized. Again, this can be recognized even if the startup hasn’t technically paid them yet. The performance obligations have been fulfilled, meaning the revenue can be recognized.

Account Debit Credit Deferred Revenue (liability) — Performance obligation C (Digital ads) $3,500 Earned Revenue — Performance obligation C (Digital ads) $3,500

Streamline Your Revenue Recognition Process With NetSuite

Tailored to adapt to the complexities and regulations of modern financial environments, NetSuite’s Cloud Accounting Software automates and simplifies the revenue recognition process, ensuring compliance with USA and international standards. Whether your business deals with products, services, or a combination of both, across single or multiple milestones, NetSuite provides a rule-based event handling framework that meticulously schedules, calculates, and presents your revenue. This not only enhances the accuracy of your financial statements but also optimizes revenue forecasting, allocation, recognition, reclassification, and auditing. Elevate your business with NetSuite's accounting software and embrace a future of financial clarity and compliance. Discover how NetSuite can transform your revenue recognition practices and propel your business towards unprecedented growth and success.

For companies of all sizes, both public and private, understanding and applying the principles of revenue recognition is crucial for maintaining the integrity and consistency of a company's financial reporting. The establishment of ASC 606 and IFRS 15 standards has been a significant stride toward standardizing revenue recognition practices across the globe, ensuring transparency and comparability among businesses. As businesses navigate the complexities of revenue recognition, they must stay informed and compliant with these standards to accurately depict their financial health and performance. This guide serves as a comprehensive resource for mastering the intricacies of revenue recognition, aiding companies in their journey toward financial precision and reliability.

Revenue Recognition FAQs

Do small businesses need to understand revenue recognition?

Small businesses do need to understand revenue recognition and its associated principles. Even though many smaller companies are private and therefore not required to follow GAAP, many still adhere to the standard. From a financing perspective, GAAP financial statements are commonly understood by lenders and investors, providing credibility to the financial reporting and the company as a whole. Thus, having GAAP-compliant revenue recognition practices and financial statements can open up more financing options and sources, often at a lower cost — making it easier to build and expand a business.

For companies that are considering going public eventually, already adhering to GAAP can help ease the transition. When a private company goes public, the company will have a different ownership and capital structure, investors with varying investment strategies, generally more accounting resources and limited investor access to management. Therefore, the company must immediately meet the regulatory requirements in which it is filing, which may include submitting GAAP financial statements with the U.S. Securities and Exchange Commission (SEC).

How does revenue recognition help my business?

Revenue recognition isn’t just for compliance purposes — it is of benefit for companies to recognize revenue in a consistent manner, as well. Internally, companies can review and compare their current financials with past ones without qualm, knowing that their revenue recognition policies have remained consistent. Following the standards for revenue recognition also allows for easy external comparison so businesses can quickly and easily gauge how they are performing relative to their competitors.

What are the 4 elements of traditional revenue recognition?

While recent accounting standards like ASC 606 have introduced a more comprehensive five-step model for revenue recognition, these four elements form the foundation of traditional revenue recognition:

- Identification: Pinpoint the specific transaction or event that generates revenue.

- Measurability: The amount of revenue must be measurable with a reasonable degree of certainty.

- Collectability: There should be a reasonable assurance that the payment for the goods or services will be collected.

- Realization: The actual transfer of goods or services to the customer.