The Essential Concepts, Formulas and Advice You Need to Succeed

This accrual accounting guide teaches business owners what they need to understand and how to use accrual accounting effectively. Accounting experts share basic definitions and concepts, formulas, examples, sample journal entries, and advice to help best account for revenue.

Included on This Page:

- How to Enter Accruals in Journal Entries

- How Accrual Basis Accounting Differs from Cash Basis Accounting

- Which Accounting Method Will Give You Real-Time Insight to Grow Your Business

What Is Accrual Basis of Accounting?

Accrual basis of accounting is the standard method accountants use to rectify financial events by matching revenues with expenses. With accrual basis, a business’s financial position is more realistic because it combines the current and expected future cash inflows and outflows.Because the accrual basis method records a transaction before any money changes hands, the time of transactions is not a computational factor. For example, a utility company provides services to its customers and bills them once a month. The utility company records the expenses for providing the monthly service. It records the revenue when it posts the customer bill at the end of the month, even though the customer hasn’t submitted a payment. Therefore, for that month of service, the accountant records the expenses and accrues revenue on the balance sheet even if the customer has not yet submitted payment.

Accrual basis accounts for sales returns, bad debts or reduced product value, known as obsolescence, by ensuring there is enough allowance, or reserve money, set aside to cover all these costs.

Accruals are adjustments, and companies often make these adjustments before they issue their financial statements, such as their statements of cash flow. Small businesses do not usually perform accrual accounting because the method can pose a financial risk. When using accrual accounting, companies often end up paying expenses before the associated cash is received (for example, paying the sales tax before they receive their cash for the sale).

Accrual basis of accounting provides a company with the best real-time financial picture available because the method takes into account expenses incurred and paid as well as revenue received and earned. The IRS generally requires that businesses with inventory use accrual basis accounting because inventory is an asset. Companies often buy inventory on credit and pay for it later. In other words, they record the purchase when they execute the purchase contract and adjust their books accordingly.

For example, a company that uses accrual basis accounting records a sale as soon as it sends an invoice to a customer. Technix Limited, a software company, has total monthly sales of $10,000. About 60% of these sales are in cash, while the rest is on credit. Under accrual accounting, accountants treat the credit transactions as sales; the profit these sales generate include both cash and credit sales, both of which deduct expenses and the cost of goods sold.

Logan Allec, founder and CPA of Money Done Right, says,

“Sometimes it takes time for people to wrap their heads around accrual accounting. They ask questions about how well their business did last year and think that the answer lies in looking at their bank account. They think that the amount they made and spent (the cash basis) is the reality, but the cash basis does not indicate how well the business is doing. Looking at what one makes and spends may work for very basic, small businesses, but anything more complex than a lemonade stand should consider using accrual accounting.”

Small Business Cash Basis vs. Accrual Basis Accounting

The difference between accrual and cash accounting is how companies account for sales and purchases. Accrual basis accounting matches revenue with expenses when incurred. Cash basis accounting records expenses or income only when a payment is made or cash is received.

When comparing the two different accounting methods, accrual accounting is superior to cash basis accounting when gauging the genuine state of a company’s financial position.

The Difference Between Cash Basis and Accrual Basis Accounting

Allec says that accrual accounting “portrays a company’s economic reality. There is more research that goes into accrual accounting books, especially when compared with cash basis accounting.”

In principle, cash basis accounting cannot accurately represent a company’s financial position at any point in time, because it does not assume that the customer will pay the bill. The accrual accounting method assumes payment, since the company has already rendered services. It is important to note that when using a cash basis accounting system, revenues are not matched with expenses in a timely manner which can lead to inaccurate assumptions and decisions that may not be in the best interest of the company.

This framework differs from the accrual method, which generates financial statements that show the full extent of operations, as well as the company’s financial position at any point in time. However, when employing accrual basis accounting, it is important to continually monitor accounts receivable to ensure that collections can be made. Where they cannot, estimates should be recorded to reflect uncollectable amounts.

Worldwide, two standards govern these accounting methods: the Financial Accounting Standards Board (FASB) dictates generally accepted accounting principles (GAAP), and the International Financial Reporting Standards (IFRS) dictate transparency, consistency and comparability. GAAP is for the United States, and IFRS is an international set of accounting standards. Both dictate the differences between accrued revenues and expenses and how to account for them.

Accrual Accounting Method

The accrual accounting method provides a more accurate picture of a company’s profitability, growth and overall financial health at any point in time. This standard accounting practice has no delay in expenses or cash exchange. However, without the right accounting system some businesses may find the accounting method too complex.

Businesses show their choice of accounting method in their financial statements. These statements are summary-level reports that generally include a balance sheet, an income statement and any supplementary notes. Auditors can only certify these statements if a company uses the accrual basis of accounting, although they can compile both types. However, one of the drawbacks of the accrual basis of accounting is that it does not provide a clear picture of the business cash flow on a profit and loss statement. Therefore, it is important for businesses to produce a statement of cash flows reconciling the accrual profit and loss statement to the business cash on hand.

Accrual accounting adds another layer to a company’s accounting information, and it changes the way that accountants or small business owners record their financial information. It can lower business volatility by deciphering any ambiguity around revenues and expenses. With accrual accounting, a business can be nimbler by anticipating expenses and revenues in real-time. It can also monitor profitability and identify opportunities and potential problems in a more timely and accurate manner.

What Accounting Framework Is Most Appropriate for Your Business?

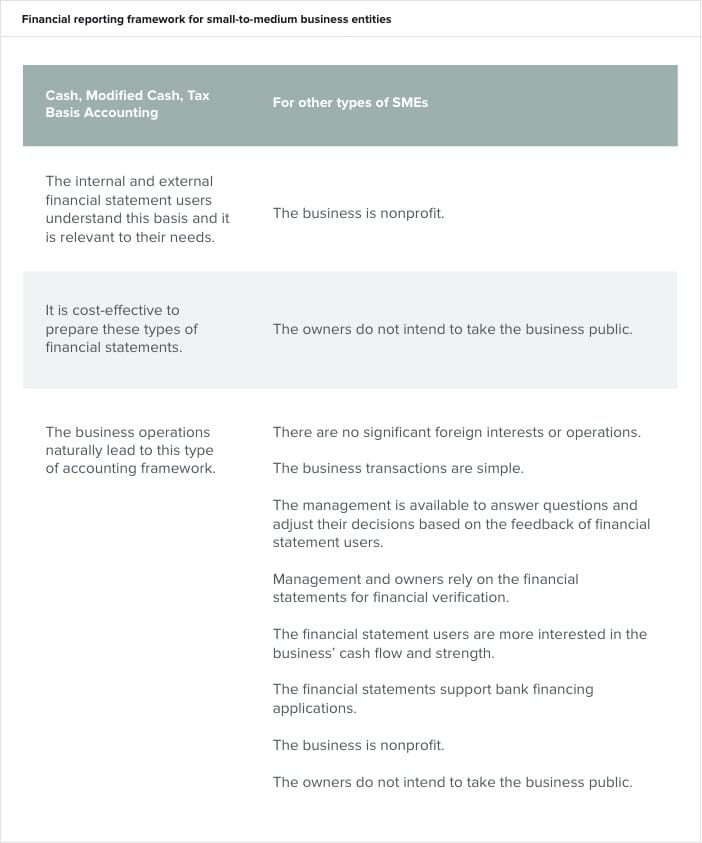

An accounting framework is the set of rules and processes that govern financial statement information. These include GAAP and special purpose frameworks (SPFs). The most appropriate framework depends on the business structure and the needs of the people reading the financial statement.

Accountants offer each framework for a different purpose. For example, SPFs can include non-GAAP bases of accounting, a cash basis, modified cash basis, tax basis, regulatory basis and contractual basis of accounting. The choice of accounting framework ultimately resides with the owners of private companies, since they alone assume all of a company’s reporting risk. Some businesses, however, choose based on the advice of their trusted CPA.

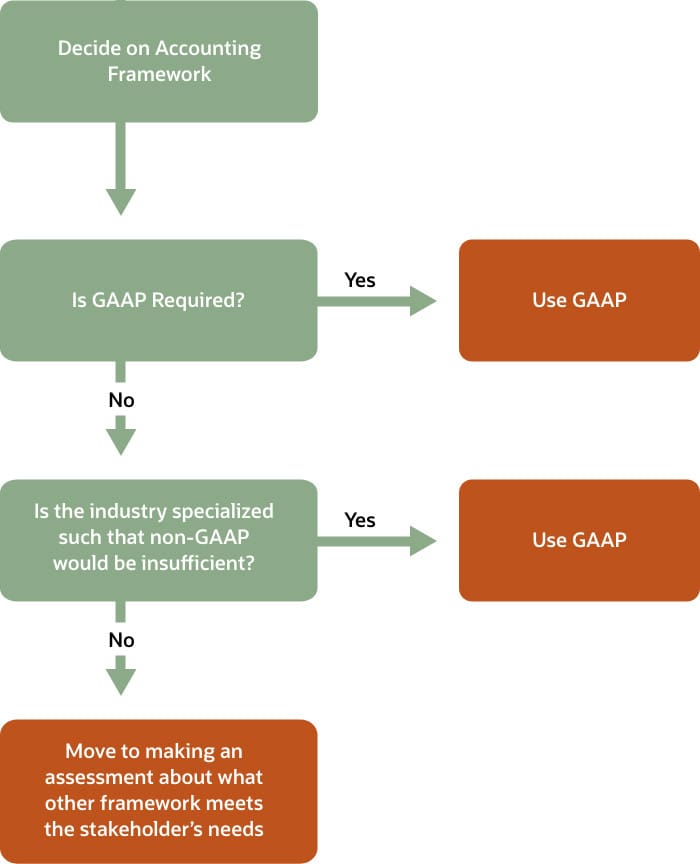

Most large companies go with an accrual basis accounting framework because of IRS requirements and because it forms the best basis for determining a company’s economic reality. Overall, most companies adhere to a GAAP reporting framework to ensure accuracy and comparability and meet the various requirements of key stakeholders such as investors or a bank. The IFRS also offer international GAAP for small- to medium-sized businesses, called IFRS for SMEs. To start the decision-making process regarding methods, use the flowchart below.

Flowchart to Rule Out GAAP Accounting Framework

If the flowchart leads you to assess which other accounting frameworks might better fit, you should consider the following to determine whether to use one of the three other common frameworks (cash, modified cash or tax basis accounting) or another financial reporting framework for small-to-medium business entities.

Most large businesses use GAAP-based accrual accounting to ensure a framework that presents its financial position on a real-time basis matching revenues and expenses when they occur, not when cash is received or when expenses are paid out. When a company structures itself as a corporation and its revenues exceed $25 million for the past three years, the Internal Revenue Service no longer considers it a small business, necessitating the use of accrual accounting.

The Two Types of Accrual Accounting

There are two types of accrual-based accounting principles.

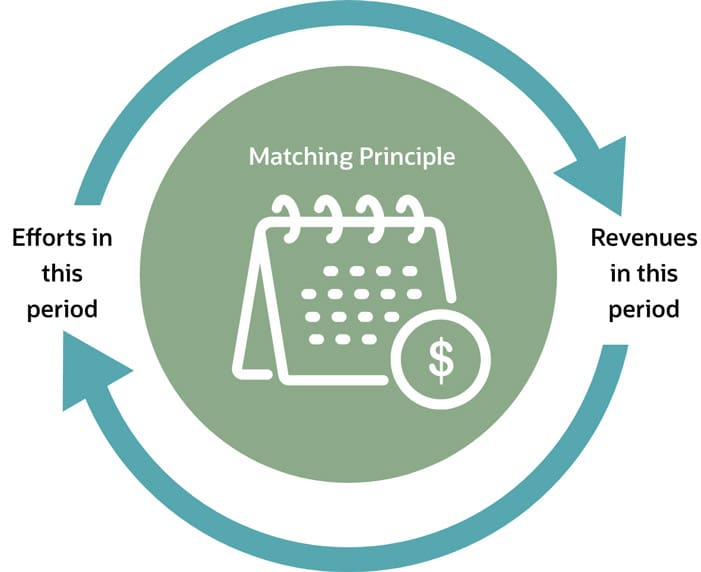

- Matching principle. Using this principle, accountants record all revenue and expenses in the same reporting period, matching them and designating profits and losses for that period. When companies use the matching principle, they must book the expense during the period they incurred it, not necessarily when they happened.

- The second principle is the revenue recognition principle, which falls under GAAP in standardized accounting. It refers to the period and manner in which a company realizes its income and it provides auditors with an apples-to-apples comparison of a company’s financial picture that is more transparent across industries. This principle is fully documented in the International Financial Reporting Standard (IFRS) 15 and Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606), (ASC 606).

Why Is Accrual Accounting Important?

Accrual accounting gives companies an accurate financial picture at any point in time. Accrual-based financial statements reflect the relevant work and activities without having the burden of making the invoices, bills and cash line up in the same month or time period.

The key benefit of accrual accounting is that the expenses and revenues automatically line up, so a business can account for both expenses and revenues for a given period. If companies only record their transactions when cash changes hands, they do not have an accurate portrayal of their outstanding expenses and how much their customers owe them at a given time. With accrual accounting, they can make business decisions with current, accurate financial information.

Accrual Accounting Entries

Accrual accounting entries are journal entries that recognize revenues and expenses a company earned or incurred, respectively. Accruals are necessary adjustments that accountants make to their company’s financial statements before they issue them. These include revenues and assets, such as incoming payments and inventory, as well as expenses, losses and liabilities, such as outgoing payments, vacation time, sick leave and taxes.

To record accruals, accountants use accrual accounting principles in order to enter, adjust and track both expenses and revenues. The accrued assets should appear on the balance sheet and the income statement of the financial statements, and the recording procedure must adhere to double entry. Accountants make all entries in an accrual basis accounting system in double, or as reversing entries.

The accounts usually affected in accrual accounting are revenue, accounts payable, liabilities, non-cash-based assets, goodwill, future tax liabilities and future interest expenses. One thing to note is that accounts receivable and accounts payable only show up on the balance sheet when accrual accounting methods are employed. Further, it is vital to put a process in place, especially in large companies, for staff to turn in their invoices or other forms that form the basis for recording accruals and recognizing expenses in a timely manner. This way, the company has the most up-to-date information and its financial statements are presented fairly for the reporting period.

Accrued Revenue

Accrued revenues are income or assets that the company has received or income or assets that are due to the company, but that it has not yet received. IFRS 15 and ASC 606 specify how and when companies recognize revenue.

IFRS 15 and ASC 606 expect that companies recognize revenue proportionate to the rate they expect payment. These regulations include five steps to decide when companies should recognize revenue:

- Identify customer contracts.

- Identify contract performance obligations.

- Identify the transaction price.

- Allocate the transaction price to the contract performance obligations.

- As the company satisfies each performance obligation, recognize the revenue.

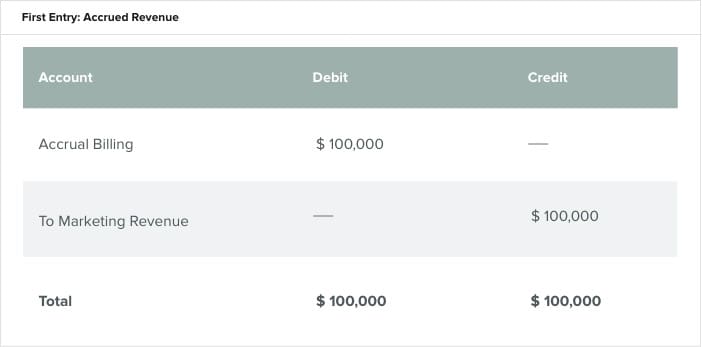

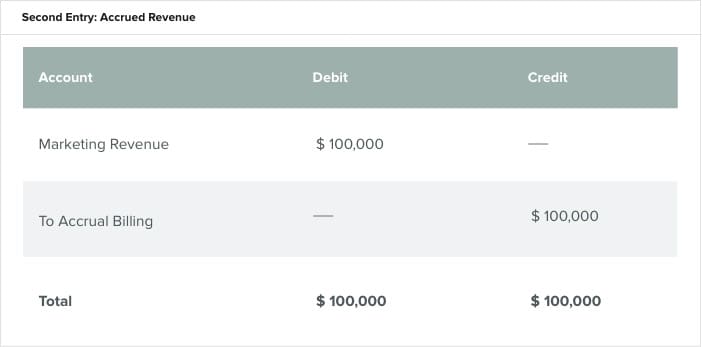

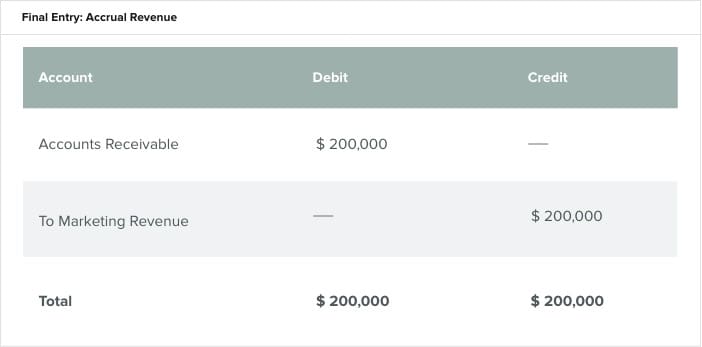

An example that looks at recording accrued revenue is a marketing company that takes a new contract with an overseas company, Venture Outsourcing, to develop its marketing campaign. The two parties agree that Venture Outsourcing will pay the marketing company $100,000 when it meets each milestone in the contract. The total contract is for $200,000, so there should be an interim entry after the first milestone. The journal entries would look as follows.

The first journal entry is the bill out to Venture Outsourcing and in to the marketing revenue account. After the company meets the second milestone, the accountant makes two entries. One reverses the initial accrual. The other bills the client.

Accrued Revenue Journal Entries

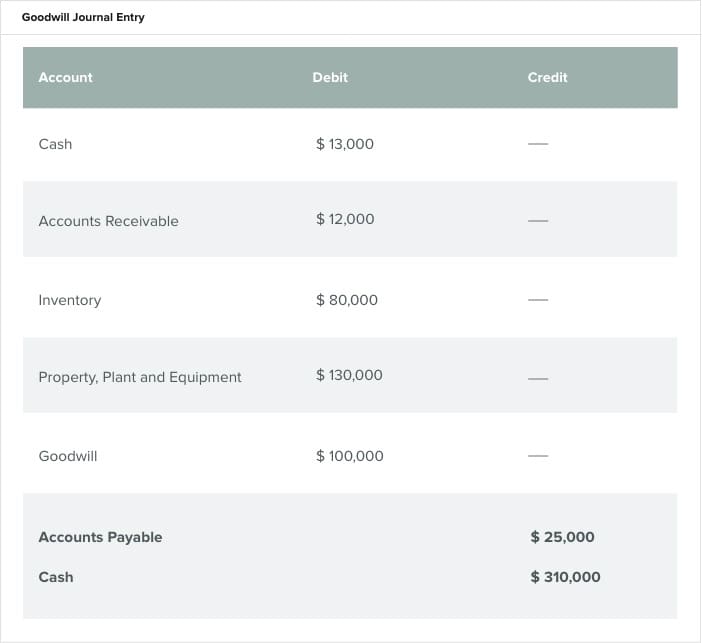

Goodwill

Goodwill is an intangible asset usually coming from the purchase of another company for more than the market value of its assets and minus the liabilities. The stock of many companies is often worth more than the value of their holdings due to things like their brand name, customer base or proprietary information or technology. On the balance sheet, accountants record goodwill as a noncurrent or long-term asset.

To calculate goodwill, add the fair market values of the assets and liabilities and subtract them from the company’s purchase price. Not all accountants agree on this calculation of goodwill, however, because the data is not always present. Goodwill plays a more significant role in private companies.

For example, a national auto parts company wants to purchase a local small auto parts store. The store’s identifiable assets are worth $210,000, and the purchase price is $310,000. The identifiable assets include cash, receivables, inventory and equipment. The total value is the identifiable assets minus expenses, found under accounts payable. The goodwill for this company is $100,000 and represents the brand awareness, customer base and potential revenue.

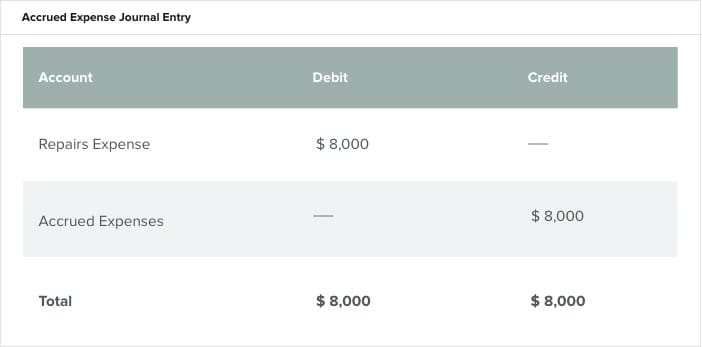

Accrued Expense Journal Entries

An accrued expense is an acknowledgment by a company of its financial responsibilities. Without recognizing an expense when it is incurred, the company does not recognize the liability, and it will have a higher reported profit in that period by not accruing the expense. Common accrued expenses are interest expense accruals, suppliers’ accruals or wage or salary accruals.

For example, a manufacturing company makes a large repair on one of its machines in December. Using a calendar period, it pays the bill when it arrives on the following month, January. For the current year’s financial statements to be accurate, it must make sure it reports the repair expense liability in the same month/year when it was incurred. To record an accrued expense in a journal, accountants make adjusting entries that debit the repairs expense and credit the accrued expenses payable.

One different type of expense is the prepaid expense in accrued basis accounting. A prepaid expense refers to when a company pays up front for a service or product. As opposed to the normal accrued expense, this type of expense ties up capital before the service or product is received.

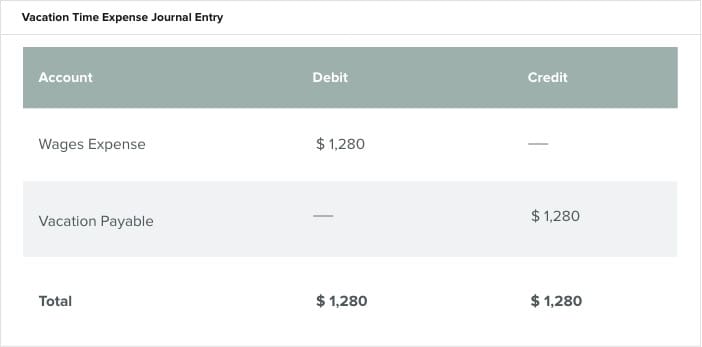

Another type of expense is the vacation accrual, also known as the PTO accrual (paid time off). This refers to the time off that employees earn, as per the company vacation or PTO policy. The IRS requires some employers to calculate vacation accrual and record it in their financial statements. Many companies offer a “use it or lose it” policy for vacation to avoid having to carry large PTO reserves. Nonetheless, the company is still responsible for accruing PTO that the employee has earned but not yet taken whether there is a carry-over policy or not. Companies should review these policies and accruals annually to ensure they are accurate. To calculate the total vacation accrual, add up the number of vacation hours earned, subtract the number used by the employee and multiply the number of accrued hours by the employee’s hourly rate.

For example, an employee accrues 40 hours and makes $32 per hour. The total vacation accrual is $1,280 (40 hours x $32). See the journal entry in accrual accounting below.

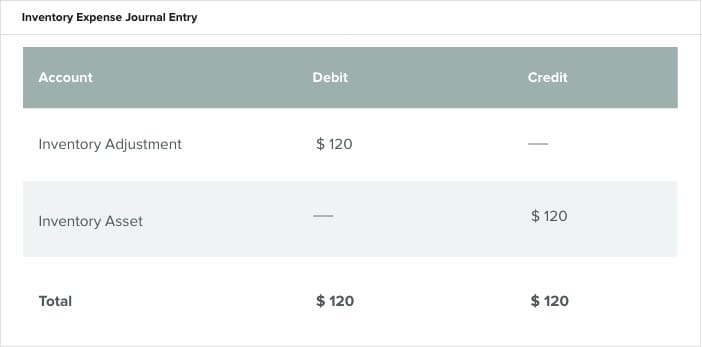

Inventory expenses work in a similar fashion. For instance, accrual accounting often makes adjustments for changes in inventory, such as when a warehouse has inventory shortages or has broken and/or obsolete inventory.

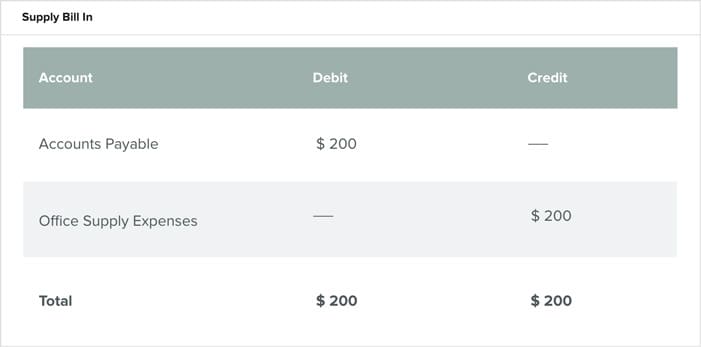

Accounts payables, or payables, are short-term obligations or debt that the company pays for material bought on credit. Accounting for $200 worth of office supplies bought on credit would be accounted for as follows:

Accounts Payable Journal Entries

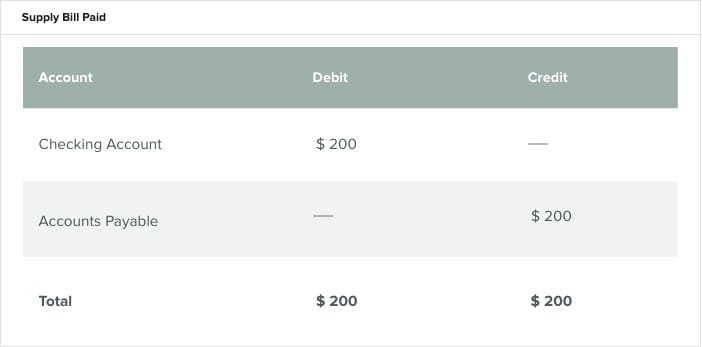

Then, once the credit card is paid, a $200 debit is recorded to the checking account, and a $200 credit to accounts payable is made. In this way, accounts payable acts as a running category that keeps the company’s balance of money that it owes its vendors and short-term lenders.

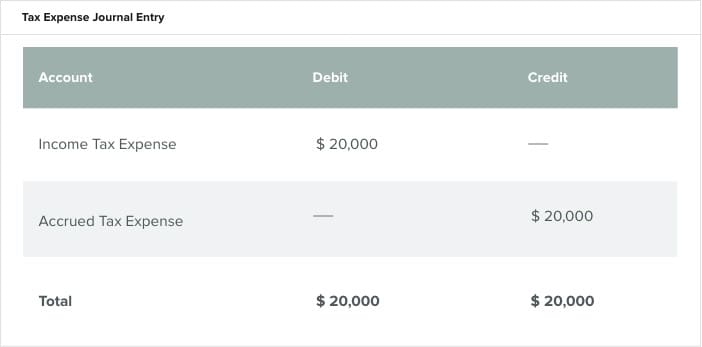

Taxes incurred are an example of a commonly accrued expense. They are taxes that a company has not yet paid to a government entity but has incurred from the income earned. Companies retain these taxes as accrued expenses until they pay for them. The journal entry for a tax expense appears below.

Accrual Accounting Rate of Return Formula

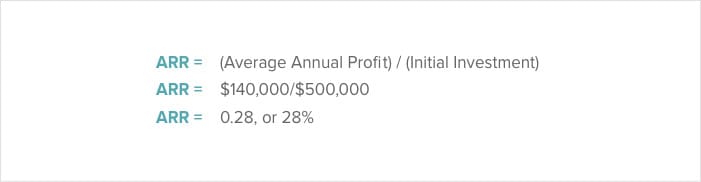

The accrual accounting rate of return (ARR) formula is the average annual accounting profit divided by the initial investment. Managers use ARR to determine if they should proceed with an investment. They’ll continue with a project if the ARR is above their hurdle rate.

The hurdle rate is the minimum amount a company expects to earn when investing in a project. Here is an example ARR calculation for a project whose initial investment is $500,000. Accountants expect the project to generate an annual revenue of $140,000 for five years.

If this rate is above the company’s hurdle rate, or required rate of return (RRR), then company can comfortably pursue funding. Companies have different RRRs, based on their tolerance of financial risk. This calculation is also helpful in choosing between projects, but it does not differentiate between investments that have different cash flows over their lifetimes. Further, it does not account for the time value of money (TVM) or the earning capacity in the future.

To illustrate this concept, imagine that there are two projects, one that yields more revenue in its early years and one that yields more revenue in its later years. The project that generates the revenue earlier would not have a higher value, even though it could reinvest its profits sooner.

Advantages of Accrual Accounting

An accrual accounting system produces a more accurate picture of a company’s financial health. Other benefits of an accrual basis accounting system are that it gives a company a better basis to form key decisions including:

- Performance Management:

In an accrual system, companies get immediate feedback on their true cash position and what they can expect to see in the future. - Accuracy:

An accrual system also provides a more accurate depiction of what a company owes and what they expect in future cash flows. With this information, businesses can better manage financial peaks and valleys. - Future Planning:

Done in real time, accrual accounting provides a clearer picture of the future so managers can work on ways to improve their outlook and identify areas for improvement.

When Should Revenues Be Recognized Under Accrual Accounting?

Under accrual basis accounting, revenue is recognized when it is earned and payment is assured, and the accounting should occur within the same financial reporting period.

This guarantee of recognition occurs when the buyer and seller enter into an agreement to transfer goods and/or services, basing payment on the matching principle, relative to the accounting period. Another crucial principle of the accrual basis of accounting is periodicity. Periodicity is an assumption under which accountants adjust their entries. This assumption posits that there are discrete intervals in accounting, such as months, quarters and years. These intervals, or periods, are pivotal in determining the income of a company for a specified time period. Without these intervals, there would be no way to gauge a company’s financial progress, much less to perceive trends. The IRS allows years to be either calendar (January 1 - December 31) or fiscal (any consecutive 12 months not ending in December) when filing taxes.

Retail provides an excellent example of revenue recognition under accrual accounting. Fashion companies sell their clothing through their retail outlets. If a customer buys an outfit on November 15 with their credit card, the business processes the credit card at the time of purchase but does not receive the cash payment until December. The company treats the credit card like cash because it is a claim to money. The accountant records the revenue in November when the store realizes and earns it.

Usually, accountants must recognize revenue at the point of sale when selling from inventory. However, there are exceptions to this rule, including the method of calculating the percentage of completion. For those purchases normally recognized at the point of sale, the exceptions are buyback agreements and returns.

Buyback agreements are contracts where the seller agrees to buy back the product after they sell it to a customer. One example is when a seller-builder agrees to buyback a development property if an occupant-buyer’s company transfers them to a new location in their first year of ownership. It is better for the seller-builder to buy back this property and resell it as it continues to develop and sell other properties to keep the investment attractive. Accountants deal with this by not showing a sale on the company’s books.

Returns are when the buyer brings back the purchased item and receives a refund. Many companies cannot reasonably estimate their amount of future returns, so they should put a maximum period on the item’s return policy. Accountants handle this by estimating and deducting a future return rate for each period.

When Should Expenses Be Recognized Under Accrual Accounting?

Accountants recognize expenses under accrual accounting when a business incurs the liability. When a company pays the expense is irrelevant as the expense must be recognized in the period in which it was incurred.

If this was not the case, businesses could recognize expenses that predate or follow the period in which they recognize the revenue. This could be misleading when considering a company’s financial health at any point in time. This is especially true in the timing of income taxes. Without the appropriate expense-revenue matching, the income taxes they pay could be too high in one month and too low in another.

When it’s difficult to correlate expenses or match them to revenue, accountants generally designate them as period cost. Examples of these types of cost are rent, utilities and administrative salaries. Accountants generally expense these costs during the associated period or consider them as incurred.

This time during which expenses and revenues are matched is the basis of accrual accounting and illustrates the primary difference between it and cash basis accounting. Without matching the expenses to the revenues, as one would under the accrual basis of accounting, accountants cannot render an opinion on financial statements.

Retail shops also offer good examples of expense recognition under accrual accounting. A garden nursery store owner spends $80,000 on soaker hoses. After being stored for three months, those hoses sell for $170,000. The shop recognizes and records the expense of purchasing and storing the hoses during the period in which it sells them via its cost of goods sold. The company can match the $80,000 expense in the same period as the $170,000 sale.

If there is no clear connection between the expense and the revenue, business owners can use one of two classifications in their ledgers, the systematic and rational allocation or the immediate allocation. The systematic and rational allocation assigns costs over the expense’s useful lifetime. For example, if a garden nursery business bought new hosing to water its stock, it would be unable to match the purchase with a specific sales transaction. However, the owner knows that the system will be in good working condition for about five years and they will not be able to resell it. The company would allocate a depreciation expense over those five years. Doing this allows the store to spread any revenue resulting from the watering system—such as labor hours saved—over the hose’s useful lifespan, while still matching and recognizing the initial cost.

The immediate allocation classification occurs when a company cannot determine the future cost benefit of an expense. These types of expenses can include selling costs, interest, administrative costs and commissions. An accountant immediately records these expenses in the financial statements during the period in which the company incurs them.

Accrual Method of Tax Accounting

In the accrual method of accounting, businesses report their income tax in the year they recognize the revenue, regardless of when they receive payment. And they deduct their expenses in the tax year they incur them, regardless of when they make payments.

The term tax accrual defines the tax liability or obligation that companies owe to the IRS. Businesses pay this, for example, when they have collected sales and use tax. For example, if a company sells products or services, the IRS requires it to collect taxes based on the valuation of those products or services and pass those taxes on to the revenue agency. Also, owning assets incurs additional tax liability. For example, owning property or vehicles will add a tax that the company must pay.

The differences between an accrual basis and a cash basis accounting system are especially relevant concerning the payment of taxes. The IRS allows companies to choose any permitted accounting method when they file their first tax return. To change their accounting method later, however, companies must receive approval from the IRS by using its Form 3115 ahead of filing or attaching the form to the company income tax form for the year of change.

The tax laws that went into effect for 2018, the Tax Cuts and Jobs Act (TCJA), allow more businesses to use cash basis accounting, even those with inventory. The laws used to specify that businesses with gross receipts or inventory of more than $5 million must use an accrual basis of accounting. Under the new provisions, only businesses with more than $25 million in annual revenue must use the accrual basis accounting method. This means that businesses that earn less than $25 million annually can recognize both sales and expenses earlier.

The method businesses choose will not determine their profit; it only determines when they record a transaction. Although the choice of accounting may affect the amount of taxes they pay in one year, the following year’s taxes will most likely offset those savings.

For example, a small manufacturing firm chooses a cash basis accounting method for its first year in business. The advantage of this method is that it allows the company to control when it recognizes income and deductible expenses. The firm can defer its income to the following tax year by delaying its invoices or by shifting its deductions to the following year so that it can speed up the payment of expenses. To defer income using the accrual basis accounting method, it would have to put off shipping its products.

Frequently Asked Questions

For most of us, when we hear the term “accrual accounting,” we just want to take cover. That’s why we’ve made it easy. Below are the most frequently asked questions (FAQs) concerning accrual accounting, as well as the concise, clear answers you’re seeking. Now, you can put your accounting plans in effect today.

Do I Need an Accountant to Do Accrual Accounting?

No. Any business can use accrual accounting.

Do I Need to Use Fancy Accounting Software If I Switch to Accrual Accounting?

No. you have many options, particularly if you want to use software, which runs the gamut from simple to highly complex. You also have the option of using no software at all.

What Forms Do I Need to Complete Accrual Reversals?

Some businesses require forms to complete reverse accruals. Others possess accounting software that has the ability to automate reversals.

Should a Startup Use Accrual Basis Accounting?

This depends on whether the startup plans to exist independently for the long term or pursue entry into the public market. To get an accurate picture of the business, use accrual accounting.

Streamline Your Accrual Accounting in the Cloud With NetSuite’s Cloud-Based ERP

Business owners and leaders recognize that understanding the many facets of accrual accounting could be the difference between success and failure. See how Cayman Islands Department of Tourism reaped significant gains using NetSuite to help their move to accrual accounting.

They also understand that they need tools to achieve this goal. NetSuite’s financial management solution expedites financial transactions and provides real-time visibility into a company’s performance. The suite of products includes unified order management, inventory, CRM and ecommerce.

Learn more about how you can use NetSuite to manage your company’s finances and ensure compliance.