Accounting is a broad discipline that focuses on the current state of an organization’s financial activities. But today’s accountants are a far cry from the stereotypical “numbers person” who’s more comfortable with a spreadsheet than a strategic business plan. In fact, the insights produced by accountants—and finance teams overall—inform and shape strategy for all corners of the business.

Accountants work closely with stakeholders, including executives, investors, and boards, as well as human resources, IT, and sales and marketing teams, and act as liaisons between their companies and government, tax, and regulatory agencies.

Startups, nonprofits, and small companies may work with fractional CFOs—an experienced CFO who works on a contract or part-time basis—or accounting partners, but whether internal or outsourced, the accounting function is vital to success.

What Is Accounting?

Accounting is the process of recording and categorizing a company’s transactions, and then summarizing, analyzing, and reporting on these activities. The resulting information—in the form of the balance sheet, income and cash flow statement, forecasts, and other reports—is used to inform business leaders as they:

- Evaluate staffing and payroll

- Balance or assess inventory levels

- Investigate new business opportunities

- Maximize profitability

- Manage cash flow

- Analyze the financial health of the business

The reports and other information that accountants produce are also used outside of the company, by lenders, investors, auditors, and, in the case of public companies, investors.

Key Takeaways

- Accounting encompasses a broad set of activities, from basic bookkeeping to analyzing the company’s financial health, forecasting revenue, preparing taxes, and following legal compliance.

- Businesses use five main types of accounting: managerial, cost, project, tax, and financial accounting.

- US public companies must use Generally Accepted Accounting Principles (GAAP).

Accounting Explained

Accounting establishes a structured system for recording and monitoring a business’s financials. More than simple record-keeping, accounting creates consistent metrics and language so stakeholders can better understand their company’s economic activities and make well-informed financial decisions based on objective data, rather than assumptions or estimates. Accounting reports and statements also serve as the baseline for external parties, such as lenders or creditors, to assess a company’s financial stability.

Businesses also rely on accounting to maintain transparency with external parties when meeting legal obligations, complying with financial reporting regulations, and fulfilling tax requirements. Furthermore, by adhering to predetermined accounting standards, financial teams give managers crucial information to evaluate different aspects of business performance, such as product-specific profit margins or liquidity benchmarks. This visibility and clarity help decision-makers at all levels understand the business’ financial health and what changes need to be made to reach their profitability and growth goals, as well as monitor progress toward those goals over time.

How Does Accounting Work?

Every business needs some form of accounting function. Deciding when to hire an in-house accountant is a major decision for entrepreneurs. For small businesses, a single person may perform all accounting tasks and act as the CFO. Alternatively, hiring an outside accountant may make sense, especially for tax purposes. Many small businesses use software to keep track of income and expenses and then send that information to an outsourced accountant for review.

Regardless of whether the company uses outside accounting partners or in-house employees, the accounting functions include recording, categorizing, analyzing, and reporting financial activities. Internally focused reports help managers allocate funds and make business decisions, such as how much to charge for products. Other reports are used for compliance, taxes, attracting investors, and applying for loans.

What Are the Types of Accounting Practices?

There are many accounting specialties. Businesses use five main types: managerial, cost, tax, project, and financial accounting.

Managerial Accounting

Managerial accounting provides the reporting, analysis, and interpretation of financial data that decision-makers need to create and refine business strategy. Managerial accountants support planning by performing cost-volume-profit analysis, weigh in on organizational structure, and analyze variances.

Cost Accounting

Cost accounting, a specialty within managerial accounting, is focused on how much a business spends to create its products, including labor and supply costs. The information gleaned from cost accounting is used to optimize operations—to value inventory, set selling prices for products, and create budgets for similar projects.

Tax Accounting

Tax accounting, which is governed by the US Internal Revenue Code, deals with preparing tax returns and making tax payments. Accountants help companies comply with complex and changing laws.

Project Accounting

Professionals, such as project managers and accountants, use project accounting to integrate key financial tasks on a project-by-project basis and report their progress and success to management. Project managers rely on project accounting to inform them of the status of direct costs, overhead costs, and any revenues associated with a specific project. Project accountants generate these figures in financial reports. A project manager uses these reports to determine if they need to adjust the project’s budget and work breakdown structure.

Financial Accounting

This discipline focuses on providing information to outside parties interested in the business. A financial accountant typically prepares balance sheets, income statements, and cash flow statements to help investors understand the company’s performance or to make a case to a bank to loan money to the business.

Why Is Accounting Important?

Accounting supports several critical business functions. At a basic level, it helps the business track revenue, expenses, assets, liabilities, and shareholder equity; manage cash flow; know whether customers have paid; and know whether the company has paid its bills.

Accounting provides a business with insights that can help it plan for the future. For example, managers can use inventory accounting methods to learn whether the cost to produce a product has increased and adjust the price or change suppliers accordingly. They can examine sales data to inform decisions on what new products to add and which customers should get more attention.

Accountants also help their companies secure financing and find investors. Most lenders, whether they’re loaning money to small businesses or large corporations, need to see proof that the business is viable. Investors also want to assess the potential return they’ll get on their investments.

Finally, accounting helps with taxes and compliance. Producing accurate financial statements is necessary to report income to the IRS for public companies, while both private and public companies are required to provide quarterly tax estimates and a yearly tax return. If reports are incorrect, a company could be under-reporting and subject to an audit or fines from the government; or, conversely, over-reporting and paying more than it should. Other compliance issues include reporting for loan covenants and for US Securities and Exchange Commission (SEC) reporting regulations for public companies.

History of Accounting

Accounting has existed since ancient civilizations first began trading goods. The earliest evidence of accounting is found on clay tablets dating as far back as 3,300 BCE in Egypt and Mesopotamia.

Some of today’s accounting concepts emerged in Medieval Europe. Merchant Benedetto Cotrugli is credited with inventing the debit/credit accounting system in 1458. However, Italian mathematician and Franciscan monk Luca Bartolomes Pacioli is commonly known as the father of accounting and bookkeeping. He described double-entry bookkeeping in his 1494 book Summa de Arithmetica, Geometria, Proportioni et Proportionalita—“The Collected Knowledge of Arithmetic, Geometry, Proportion, and Proportionality”—a work that has influenced the teaching and practice of accounting to this day.

The Accounting Profession

Suffice it to say, the accounting profession has come a very long way since those days of ancient civilization and early accounting books. Today it’s considered one of the best business jobs (11th), according to US News & World Report’s “2025 Best Business Jobs.”

What Does an Accountant Do?

An accountant generally performs a variety of financial duties. The most common include reviewing financial information, analyzing accounts, providing insights about the company’s finances, and preparing budgets and reports. Accountants at small businesses may also be tasked with bookkeeping, in which case they may maintain the general ledger, pay bills, handle payroll, and reconcile accounts.

A certified public accountant (CPA) is an accountant licensed by a state board of accountancy. Obtaining a CPA license requires a candidate to complete an appropriate education, obtain real-world experience, and pass a CPA exam. CPAs typically provide business and tax advice and help create financial strategies that help businesses maximize profits.

Roles & Titles

| As a business grows, so too will its needs for a larger finance team to accurately manage its financial resources. Specific roles and responsibilities include the following positions: |

|---|

| CFO: A chief financial officer reports directly to the CEO and the board of directors. CFOs aren’t just about closing the books—they serve as reality checkers, strategists, and risk mitigators for their companies. The CFO typically supervises a diverse finance/accounting team and is responsible for the overall financial health of the business. CFOs in publicly traded companies formally attest to the accuracy of financial statements and shareholder reports. |

| VP of finance: The VP of finance typically has a deep accounting background—essentially, a CPA with leadership skills—and understands in-depth the current and historical financial data of the company. Generally paid less than a CFO, VPs of finance may also be promoted into the CFO role. |

| Controller: The controller is a CPA and, often, holds an MBA. Controllers are senior accounting experts that oversee a company’s cash flow and accounts receivable/accounts payable (AR/AP). In smaller companies, they may help with financial planning & analysis, though generally FP&A is a finance function versus accounting. |

|

Accountant: These professionals hold CPAs and may be in-house or contractors who work with a number of companies, sometimes within one industry. They prepare audited financial statements and oversee financial records, such as tax returns, balance sheets, employee expenses, and cash flow and income statements. Forensic accountant: These investigators analyze and interpret financial records to spot fraud, embezzlement, or other misconduct by identifying suspicious patterns. Many also work alongside law enforcement or legal teams during investigations and litigation. Tax accountant: Companies rely on tax experts to assess their tax obligation based on local, state, and federal tax regulations. They prepare tax returns, provide advice, and help businesses minimize their tax liabilities through legal methods, such as deductions and credits. |

| Bookkeeper: This position is your first financial hire and, again, may be a contractor or an in-house staffer. These professionals have accounting backgrounds and they are responsible for putting together monthly income statements and balance sheets for the company. |

| Other staff roles: Within the finance team, companies may have specialists who focus on auditing, FP&A, human resources, bookkeeping, taxation, budget analysis, AR/AP, and inventory or other operational aspects. |

Accounting Areas of Expertise

Corporate finance encompasses several areas of accounting expertise. Larger companies may hire accountants who specialize in one or more of these areas:

- Payroll: Pay employees accurately and on time and withhold the appropriate deductions, like taxes and health insurance premiums, from their paychecks.

- Cost: Value inventory, set selling prices for products, and create budgets using historical data.

- Accounts receivable/accounts payable: Focus on sending invoices, collecting payments, and paying bills.

- Bookkeeping: Record transactions and balance the books.

- Collections: Track whether customers pay on time and take steps to obtain payment if they don’t.

- Tax: Helps the business pay applicable taxes and maximize the deductions to which it’s entitled.

Accounting vs. Bookkeeping

Although the terms “accounting” and “bookkeeping” are sometimes used interchangeably, bookkeeping is just one function within the broad discipline of accounting:

- Bookkeeping involves maintaining systematic records of financial transactions in the appropriate accounts, or ledgers. These records are ultimately reflected in the company’s general ledger, a master accounting document containing a complete record of the company’s transactions.

- Accounting encompasses much more than bookkeeping. It includes advanced functions, such as summarizing, analyzing, and communicating data; preparing taxes; and following legal compliance. For example, a senior accountant in a business would manage the general ledger, prepare financial statements, and work with external auditors.

Bookkeeping vs. Accounting

| Bookkeeping | Accounting | |

|---|---|---|

| Overall function | Keep accurate up-to-date records of all financial transactions. | Use the information provided by bookkeeping to determine a company's financial position. |

| Purpose | Maintain a systematic and chronological record of all financial activities and transactions. | Analyze and interpret data, make financial forecasts, and advise business owners on financial decisions. |

| Result | Provide necessary information and data for the accounting process. | Prepare and analyze financial statements used to make informed decisions. |

| Key skills | Be accurate and knowledgeable about bookkeeping; work is reviewed by internal or external accountant. | Understand more complex financial matters and interpret data for business owners. |

| Typical tasks | Post journal entries, send invoices, record payments, manage payroll, and reconcile accounts. | Prepare adjusting entries, analyze costs, perform audits, prepare and file tax returns, provide tax planning, and advise business owners. |

Steps of the Accounting Cycle

The accounting cycle consists of eight main steps during each accounting period. Accounting software can automate most of these tasks:

- Identify and categorize transactions: For example, an accountant would categorize sales orders as income.

- Record journal entries: Individual transactions are entered in the appropriate accounts.

- Post journal entries in the general ledger: This task must be performed in accordance with the rules of double-entry accounting.

- Prepare an unadjusted trial balance: This report includes all the business’s accounts and their balances, comparing debits and credits. Debits and credits must balance.

- Adjust accounting entries: At the end of an accounting period, an accountant will add any entries that haven’t been recorded previously, such as interest from bank accounts.

- Prepare an adjusted trial balance: This report includes the adjustments made in the previous step.

- Prepare financial statements: Use the account balances from Step 6 to create financial statements, including an income statement, balance sheet, and cash flow statement.

- Close the books: Prepare for the next accounting period.

Accounting Standards

While companies may follow different accounting practices, there are established frameworks and rules for recording transactions and preparing financial statements. Official standards, often required for public companies, differ with the business’s region, type, and industry, but all have the same objective—consistent, transparent, and comparable financial records that help leaders, investors, creditors, and other stakeholders stay informed and synchronized when making decisions.

What Is IFRS (International Financial Reporting Standards)?

IFRS is a set of accounting rules developed by the International Accounting Standards Board for worldwide public companies. IFRS replaced the International Accounting Standards in 2001 and aims to provide an international standard that companies can use to conduct business across the globe. As of 2025, IFRS has complete profiles for 169 jurisdictions and periodically updates its standards to meet evolving global business practices and accounting needs. However, the United States follows its own rules, discussed below.

What Is the FASB (Financial Accounting Standards Board)?

The FASB (opens in new tab) is an independent, nonprofit organization formed in 1973 that maintains the financial accounting and reporting standards for US-based companies, known as Generally Accepted Accounting Principles (GAAP). The SEC, as well as state accounting boards and the American Institute of Certified Public Accountants, recognize the FASB as the organization tasked with setting accounting standards for public companies.

What Is GAAP (Generally Accepted Accounting Principles)?

GAAP is a set of US accounting guidelines and standards issued by the FASB. Public companies must comply with GAAP in their accounting practices, including when preparing financial statements. This helps investors and authorities assess and compare financial statements from different companies. Privately held companies don’t need to comply with GAAP, but these businesses often choose to do so—especially if they plan to go public in the future.

Are There Industry-Specific Accounting Standards?

Beyond the general frameworks provided by GAAP and IFRS, many industries have developed specialized standards to address their unique financial activities. Some common examples are:

- The banking sector follows specific finance guidance, such as maintaining fund reserves for potential loan defaults and registering additional equity securities with regulatory agencies, including the Federal Deposit Insurance Corporation.

- Insurance companies disclose additional details about their liabilities and follow different rules for short- and long-term contracts based on their risk and terms.

- Healthcare organizations rely on a variety of unique payment and receivable models to manage complex accounts. These complications often stem from multiparty payer mixes and credit balances from payments that were later reimbursed by insurance companies.

- Real estate companies have specialized guidelines for valuing property, recognizing revenue on development projects, and accounting for complex leasing transactions.

These granular accounting standards allow businesses to create financial statements that provide analysts and stakeholders relevant information that reflects the strengths and challenges of their industry.

Accounting for Small Business vs. Enterprise

While many principles of accounting are the same for a small business and a large enterprise, there are a few key practical differences—the biggest being the volume of financial activities. A small business may have only a few hundred transactions per month, while an enterprise may handle many thousands or even millions.

Another common difference is the method of recording transactions. There are two primary methods: cash basis accounting and accrual basis accounting. Smaller businesses often use cash basis accounting, which is simpler. With this method, revenue and expenses are recorded when cash changes hands.

Businesses that need to comply with GAAP, such as public companies, must use accrual basis accounting. Accrual basis accounting is more complex but generally gives a more accurate picture of a company’s financial position. With accrual basis accounting, a company records income when it’s earned and expenses when they’re incurred, regardless of when money changes hands. For example, a company that’s paid in advance for a multiyear contract would record a portion of the revenue in each year.

Accounting Example

Accountants use the double-entry bookkeeping method to record transactions. Each transaction is recorded as a journal entry, with a credit to one account and a corresponding debit to another. These entries must balance each other. This method helps accountants record each transaction in the appropriate amount and check that the five major account types—revenue, expenses, assets, liabilities, and equity—all balance.

Here’s an example of double-entry bookkeeping in accounting: A business sends an invoice to a customer. Using the double-entry method, the accountant records a debit to accounts receivable. The balancing credit is recorded in the sales revenue account.

When the customer pays the invoice, the accountant credits the accounts receivable account and debits the cash report.

The bookkeeping journal entries for this event are:

| To record sales revenue: | ||

| Debit | Credit | |

| Accounts receivable | $1,500 | |

| Revenue | $1,500 | |

| To record cash received and eliminate the amount owed by the customer: | ||

| Cash | $1,500 | |

| Accounts receivable | $1,500 | |

Emerging Technologies in Accounting

Accounting has evolved significantly from the days of leather-bound ledgers, and new technologies continue to transform how businesses manage their finances. Automating routine tasks, such as entering data and categorizing transactions, isn’t new, but recent advancements in AI and machine learning have further enhanced automation in ways beyond standard accounting software’s capabilities. These tools allow accountants to quickly analyze large data sets and identify patterns often too subtle to be discovered by traditional methods. This allows staff to focus more on acting on these insights, rather than mundane tasks, surface-level analysis, and number crunching.

Cloud-based accounting systems have also become more accessible, providing businesses of all sizes with real-time financial visibility and remote collaboration among teams. These systems often come with built-in data analytics tools and automated reporting features to help accountants identify trends, anomalies, and opportunities for financial improvements across their organization. Furthermore, cloud vendors typically update these systems as new technologies and best practices arise, giving businesses a scalable solution that automatically adapts to evolving accounting standards.

Managing an Accounting System

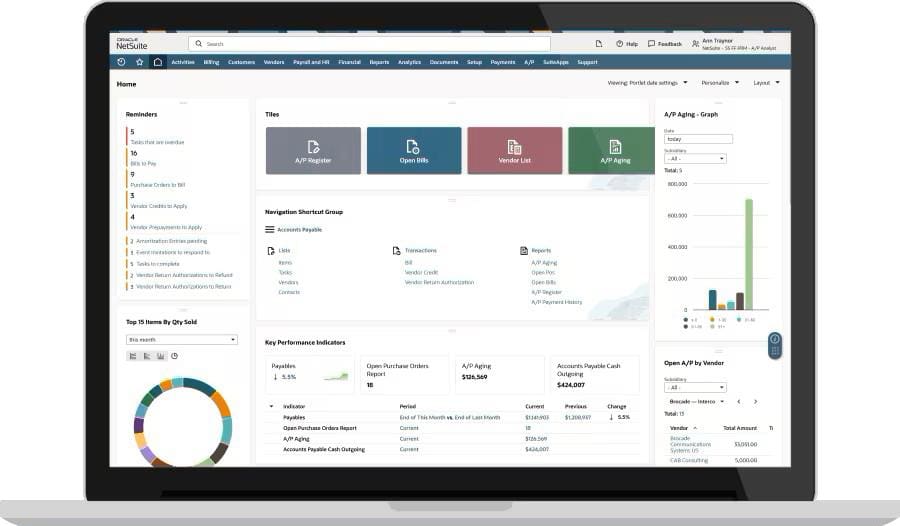

An accounting system, such as NetSuite financial management solutions, helps businesses automate many routine accounting tasks, including paying bills and running reports. The software can eliminate a lot of manual work, especially if the system is integrated with other business applications. That automation saves businesses money and reduces errors. Typically, the finance department will play a key role in setting up the system, particularly when it comes to creating custom reports and approval workflows.

The work involved in maintaining and updating accounting software depends on the type of system you choose. Companies generally have a choice between on-premises or cloud-based accounting software. On-premises software typically requires IT expertise to install and manage on-site software and hardware. Cloud-based software or software-as-a-service systems are easier to manage because the provider updates the software automatically and users access the system over the internet using a browser.

NetSuite’s Accounting Dashboard

No matter whether your business uses in-house skills or hires an independent provider, accountants provide expertise that’s essential to managing everyday financial activities, complying with tax and regulatory requirements, and generating insights into the company’s performance.

Accounting FAQs

What is the basic definition of accounting?

Accounting is the process of recording, organizing, and reporting financial transactions. It creates a systematic record of a company’s financial activities and turns raw data into digestible reports that help both internal stakeholders (managers, budgeters, forecasters) and external parties (lenders, creditors, regulators) understand the business’s financial position when making decisions.

What are the skills needed for an accountant?

Accountants typically need both technical knowledge of accounting principles and analytical skills to interpret data and identify trends relevant to the business’s goals. Other common skills include attention to detail, adaptability to changing regulations and standards, problem-solving abilities, software proficiency, ethical judgment, and communication skills to demonstrate complex concepts to non-financial stakeholders.

What is the role of accounting in a business?

Accounting provides the financial infrastructure that businesses use to track their performance, comply with regulations, and make informed decisions in line with overall financial goals. This is achieved through processes such as preparing financial statements, complying with tax rules, and supporting audits.

Who does accounting report to in a business?

For small businesses, accounting staff typically report directly to the owner or CEO, while larger organizations may have dedicated financial leaders, such as controller, finance director, or chief financial officer. These parties then report to the CEO or present financial information directly to the board of directors and external stakeholders through targeted financial metrics, key performance indicators, and analysis.