There are three core financial statements used in business accounting: the income statement, statement of cash flows and the balance sheet, also referred to as the statement of financial position. Creating and maintaining an accurate balance sheet is critical to understanding the company’s financial status and informing business leaders and investors.

What Is a Balance Sheet?

The balance sheet is one of your company’s most important financial statements. It provides a snapshot of the company’s financial position at a specific point in time. Managerial accountants, business managers and investors use balance sheets as a key source of information to better understand the company’s financial health.

Key Takeaways

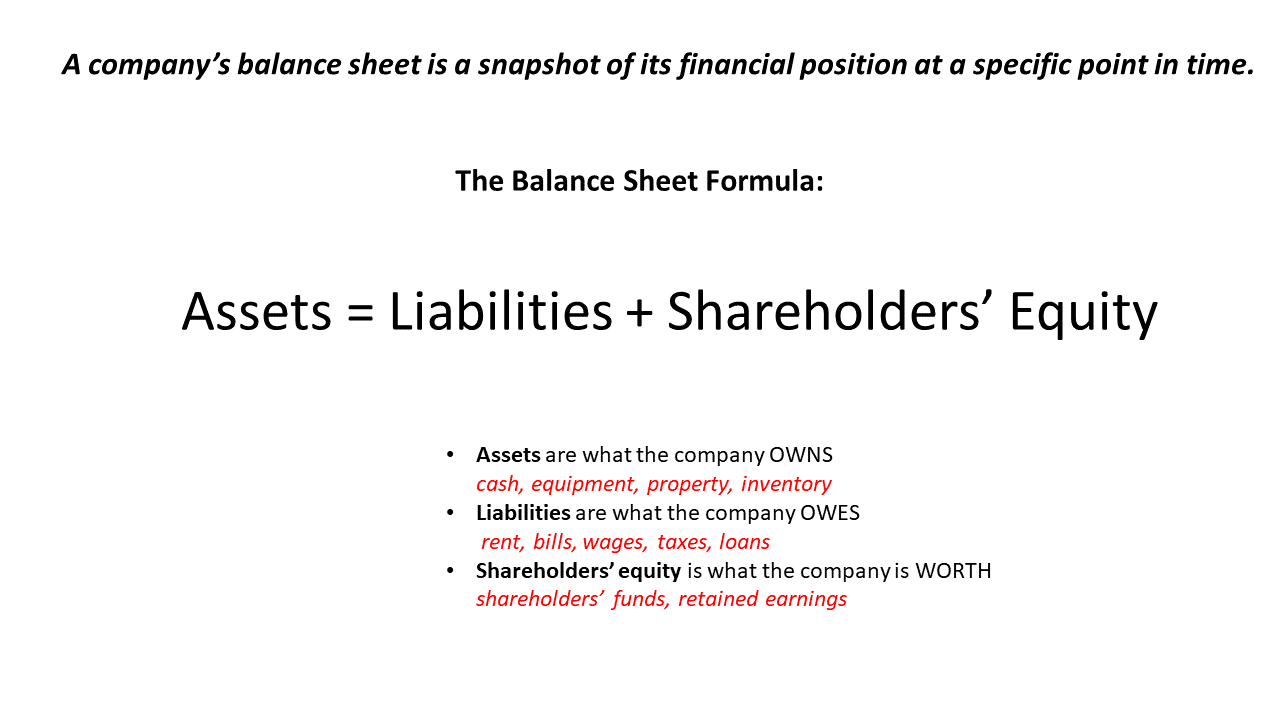

- A company’s balance sheet is a snapshot of its financial position at a specific point in time.

- The balance sheet lists everything that the company owns (its assets), everything that it owes (its liabilities), and shareholder equity.

- The difference between assets and liabilities is the equity in the company, which belongs to the owners. In a healthy company, this equity is a significant positive balance; if it’s negative, the company is technically insolvent.

- The balance sheet doesn’t provide information about the company’s revenue or cash flow, so it needs to be analyzed together with other financial data to gain a full picture of the company’s financial health.

- The information in the balance sheet can be used to help assess the company’s liquidity, operating efficiency and potential return on investment.

What Is Included on a Balance Sheet?

A company’s balance sheet includes everything that the company owns and everything that it owes—all of its assets and liabilities, in other words. It also shows the owners’ or shareholders’ equity in the company, which is equal to the difference between its assets and liabilities. For a privately-held company, the shareholders typically include the founders and any investors. For a public company, they include anyone who owns the company’s stock.

The balance sheet provides a snapshot of the company’s assets and liabilities on a specific date, such as the end of a fiscal quarter. Companies generally produce balance sheets at least once a year, and often quarterly and/or monthly as well.

The balance sheet reflects the cumulative effect of all the company’s transactions since the day the business started. For this reason, it is sometimes called the statement of financial position. It provides insights into the business’s overall financial health, including:

- Whether the company’s assets exceed its liabilities.

- How much money is currently invested in the business.

- Any profits retained in the business.

- How much debt the company carries, and how much of that debt is due in the short term.

- Whether the company is likely to be able to easily borrow money if it needs to.

Although the balance sheet contains a lot of useful financial information, it doesn’t show the company’s income, expenses or cash flow. To analyze those, you need to look at the company’s other two financial statements. Income and expenses can be found on the income statement, and changes to available cash are shown on the cash flow statement.

However, the company’s net profits in any specific reporting period are reflected in the balance sheet at the end of that period, where they appear as increases in shareholders’ equity.

Video: What Is a Balance Sheet?

Importance of a Balance Sheet

The balance sheet provides business managers and investors with the information they need to understand the company’s long-term financial soundness and resilience. In conjunction with other sources of information, it can also provide business managers and investors a picture of the company’s efficiency and rates of return on equity and assets.

Liquidity.

Because the balance sheet identifies current assets and liabilities separately from longer-term assets and liabilities, it can easily be used to calculate liquidity ratios such as the current ratio and the quick (“acid test”) ratio. These ratios show how easy it would be for the company to raise cash from the sale of short-term assets, which could be crucial for its survival in the event of a sudden business interruption or economic downturn.

Leverage.

The balance sheet can also be used to gain a view of how much debt the company has in relation to its assets. The balance sheet can be used to calculate three key ratios: the debt/assets ratio, the equity/assets ratio, and the debt/equity ratio. The formulas for these ratios are:

Debt to assets ratio = (Short-term debt + long-term debt) / Total assets

Equity to assets ratio = Shareholders’ equity / Total assets

Debt to equity ratio = Total liabilities / Shareholders’ equity

All of these ratios measure some aspect of the company’s “gearing.” Gearing is the extent to which a company’s activities are funded by debt rather than by its own funds. The higher the gearing, the more highly leveraged the company is and the more vulnerable it is to shocks such as economic downturns.

The balance sheet can also be used to calculate another widely used measure of financial leverage, net debt:

Net debt = Total liabilities – Cash and Cash equivalents

Net debt shows how much of the company’s overall indebtedness could be eliminated by liquidating current assets. A high net debt indicates that the company is highly leveraged and could be vulnerable to any financial setbacks.

Efficiency.

When combined with other business information, the balance sheet can provide insights into the company’s operating efficiency. It can be used to calculate key efficiency ratios including the inventory turnover ratio, asset turnover ratio and receivables turnover ratio.

The inventory turnover ratio shows how well the company manages its inventory, which can be a drain on capital if not managed efficiently. The higher the ratio, the more efficient the inventory management.

To calculate inventory turnover ratio, start by calculating the average inventory in a period by dividing the sum of the beginning and ending inventory by two:

Average inventory = (beginning inventory + ending inventory) / 2

You can use ending stock in place of average inventory if the business does not have seasonal fluctuations. More data points are better, though, so divide the monthly inventory by 12 and use the annual average inventory. Then apply the formula for inventory turnover:

Inventory Turnover Ratio = Cost of Goods Sold / Avg. Inventory

COGS can be found on the income statement. Average inventory can be calculated by adding together inventory on the current and previous balance sheets and dividing by two.

The asset turnover ratio shows how effectively the company generates sales revenue from its assets. The higher the ratio, the more efficiently the company is deploying its assets to generate sales. The formula is:

Asset turnover ratio = Net sales / Average total assets

To get the correct result, you need the average value of assets during the period, not the total value at the end of the period. Net sales can be found on the income statement and average total assets on the balance sheet.

The receivables turnover ratio shows how effective the company is at collecting money after extending credit to customers. The higher the ratio, the better the company is at managing its trade credit. The formula is:

Receivables turnover ratio = Net credit sales / Average accounts receivable

A business can find net credit sales by reviewing sales with the help of accounting software. Average accounts receivable can be calculated by adding together the accounts receivable from the current and previous balance sheets and dividing by two.

Rates of Return. Balance sheet information is used to calculate key rates of return for investors: return on equity (ROE), return on assets (ROA) and return on invested capital employed (ROIC).

Return on equity (ROE) shows how effectively the company generates income from its shareholders’ investment. ROE is the ratio of net income to shareholders’ equity:

ROE = Net income / Shareholders’ equity

Net income is the bottom line of the income statement, and shareholders’ equity comes from the balance sheet. Usually, ROE is calculated using average shareholders’ equity. To calculate average shareholders’ equity over a single year, add together the starting and closing equity positions for the year and divide by two.

Some companies report return on tangible equity (ROTE). ROTE is the ratio of net income to tangible equity, which is the portion of shareholders’ equity that supports the company’s tangible asset base. It is usually calculated as shareholders’ equity minus preferred stock, goodwill and other intangible assets.

Return on assets (ROA) shows the company’s ability to generate income from its assets. ROA is the ratio of net income to total assets:

ROA = Net income / Total assets at the end of the period or Average assets for the period

Net income is the bottom line of the income statement, and total assets come from the balance sheet. Sometimes, companies report return on tangible assets (ROTA), which excludes goodwill and other intangible assets.

Return on invested capital employed (ROIC) is a wider measure that demonstrates the efficiency of total capital invested in the business. ROIC is the ratio of net operating profit after tax (NOPAT) to capital invested in the business:

ROIC = NOPAT / Capital invested

NOPAT can be calculated by deducting taxes paid from operating profit: both figures can be found on the income statement. Capital invested is the sum of equity and debt after deducting non-operating assets and liabilities. These are assets that are not currently being used to support the company’s operations, such as undeveloped land, spare equipment, unallocated cash and investment securities, as well as any liabilities associated with these assets.

Basic Balance Sheet Formula

Assets

Assets are everything the company owns. Cash, securities, real estate, machinery and office equipment are all assets. So too are debts owed to your company by other companies or individuals. So, if you extend credit to your customers, the money they owe under those credit agreements is an asset. Advance payments toward future expenses are also assets.

Liabilities

Liabilities are what your company owes to other companies or individuals. For example, if you purchase supplies on 90-day credit terms, the money you owe to your suppliers under those agreements is a liability. So too is any money you have borrowed from banks or investors.

Shareholders’ equity

Shareholders’ equity is the difference between assets and liabilities. It’s also known as the company’s “net worth.” You can regard it as the money the company would have left if it settled all current and future claims. Ultimately, this money belongs to the company’s owners, which is why it is called “shareholders’ equity.”

In a healthy company, total assets are worth more than total liabilities, so shareholders’ equity is positive. But when a company’s total assets are worth less than its total liabilities, shareholders’ equity is negative. This situation is called balance sheet insolvency, and it can be a warning sign that the company may eventually be unable to pay its debts.

Structure of a Balance Sheet

A corporate balance sheet consists of three main sections, each of which corresponds to a term in the balance sheet formula:

- Assets

- Liabilities

- Shareholders’ equity

Assets

Assets are divided into two categories: current and non-current (or long-term). These categories are then subdivided to include things like:

- Accounts receivable

- Investments. These can be included under both current and non-current assets, depending on the nature and purpose of the investment.

- Property, plant and equipment (PP&E). PP&E is a subcategory of non-current assets and isn’t always used.

- Intangible assets

- Right of Use (ROU) assets

ROU Assets are leased assets, like office space, and under U.S. GAAP companies must account for these on their balance sheet (see ASC 842). Note: Companies must also record the unpaid portion of any leases as liabilities on the balance sheet.

The order in which these classifications appear on the balance sheet reflects their liquidity or the ease with which they can be converted to cash.

Current assets are liquid assets, meaning they can be converted into cash in one year or less. They include, in descending order of liquidity:

- Cash, and cash equivalents such as short-term certificates of deposit.

- Securities that can be readily traded for cash, usually on a regulated exchange.

- Accounts receivable, which is money owed to the company by its customers under credit agreements falling due within one year.

- Inventory

- Any expenses that the company has paid in advance. When taxes are paid in advance, or overpaid due to losses carried forward, the prepayment asset is called a “deferred tax asset” (DTA).

Again, there are two categories of assets (current and non-current) and multiple subcategories. Non-current or long-term assets are sometimes called Fixed Assets on the balance sheet, in which case, they include both tangible and intangible assets.

Intangible assets include:

- Goodwill, which is recorded when the company acquires another company or its assets and pays more than the fair market value of the acquired assets. Goodwill is the excess amount paid over and above the value of the assets.

- Patents, trademarks or other intellectual property acquired by the company from a third party.

Liabilities

Liabilities are divided into current liabilities and long-term/non-current liabilities. Current liabilities are shown on the balance sheet before long-term liabilities.

Current liabilities can include:

- Short-term debt, such as a line of credit.

- Accounts payable, which includes bills for any goods or services purchased by the company, including utility bills.

- Trade payables, which is money the company owes to its suppliers under trade credit agreements falling due within one year.

- Principle and interest payment on long-term debt (loans, bonds and notes) that is due to be repaid within one year.

- Customer prepayments

- Wages and benefits

- Short-term lease liability

- Pension contributions

- Federal and local taxes

Long-term liabilities include:

- Long-term debt (loans, bonds and notes) due in a year or more

- Long-term lease liabilities

- Long-term pension fund liabilities

- Deferred tax liabilities (taxes that have been accrued but will not fall due within one year)

Shareholders’ Equity

Shareholders’ equity is calculated as total assets minus total liabilities. It is the value of the company’s assets after all liabilities are settled. It is also known as net assets, net worth or book value. It usually consists of the following items:

- Share capital

- Retained earnings

Share capital is the capital contributed by shareholders through their purchases of company shares.

Retained earnings are net profits that are not returned to shareholders in the form of dividends but are retained in the business for future investment.

Example of a Balance Sheet

To better understand balance sheets, let’s walk through two quick examples.

Example 1: Small company

A typical small company balance sheet might look something like this:

| Balance Sheet | |

|---|---|

| Current assets | |

| Cash and cash equivalents | $50,000 |

| Accounts receivable | $100,000 |

| Inventory | $100,000 |

| Total current assets | $250,000 |

| Non-current assets | |

| Equipment | $250,000 |

| Total assets | $500,000 |

| Current liabilities | |

| Short-term debt | $10,000 |

| Accounts payable | $90,000 |

| Non-current liabilities | |

| Long-term loans | $250,000 |

| Total liabilities | $350,000 |

| Net assets | $150,000 |

| Shareholders’ (Owners’) equity | |

| Share capital | $100,000 |

| Retained earnings | $50,000 |

| Total equity | $150,000 |

Example 2: Large corporation

Large corporations usually have more complex balance sheets than small companies. Below is a typical large corporation balance sheet.

| Walgreen Boots Alliance, August 31, 2020 All amounts in $millions |

|

|---|---|

| Assets | |

| Current assets | |

| Cash and cash equivalents | 516 |

| Accounts receivable, net | 7,132 |

| Inventory | 9,451 |

| Other current assets | 974 |

| Total current assets | 18,073 |

| Non-current assets | |

| Property, plant and equipment, net | 13,342 |

| Operating lease right-of-use assets | 21,724 |

| Goodwill | 15,268 |

| Intangible assets, net | 10,753 |

| Equity method investments | 7,338 |

| Other non-current assets | 677 |

| Total non-current assets | 69,102 |

| Total assets | 87,175 |

| Liabilities and equity | |

| Current liabilities | |

| Short-term debt | 3,538 |

| Trade accounts payable | 14,458 |

| Operating lease obligation | 2,426 |

| Accrued expenses and other liabilities | 6,539 |

| Income taxes | 110 |

| Total current liabilities | 27,071 |

| Non-current liabilities | |

| Long-term debt | 12,203 |

| Operating lease obligation | 21,973 |

| Deferred income taxes | 1,498 |

| Other non-current liabilities | 3,294 |

| Total non-current liabilities | 38,968 |

| Total equity | 21,136 |

| Total liabilities and equity | 87,174 |

Limitations of Balance Sheets

Balance sheets are a powerful business tool, but they still have limitations that business leaders need to keep in mind. Key limitations include:

- The balance sheet doesn’t report the company’s current financial performance. It doesn’t include information about revenue or expenses, and it only reflects profit to the extent that it affects shareholders’ equity.

- The balance sheet doesn’t show cash movements in and out of the business during a trading period.

- A single balance sheet doesn’t tell you how a company’s financial position has changed over time, which can provide a better indication of the company’s future prospects. To determine that, you need to examine balance sheets from several different periods. Some companies facilitate this when they report their balance sheet by including comparisons with earlier balance sheets.

- Some items on a balance sheet, such as depreciation and goodwill, depend on the accounting policies adopted by the company and on managers’ own assessments. They could therefore be manipulated to provide a misleading picture of a company’s financial position. For example, if reducing the value of goodwill because of poor performance by an acquired subsidiary would render the parent company technically insolvent, management might decide to delay that impairment in the hope that the subsidiary’s performance improves.

To obtain a full picture of the company’s financial health, balance sheets must be analyzed in conjunction with the company’s income statement and cash flow statement, the notes to the accounts, and with other financial information.

How to Prepare Your Business’s Balance Sheet

It’s generally straightforward to prepare a company’s balance sheet. Here’s a guide to where to find the information for each line in a typical balance sheet (as shown in the downloadable template).

Assets

- Cash and cash equivalents: Add together the balances in the company’s checking and instant-access deposit accounts, petty cash and any checks from customers that haven’t been deposited yet.

- Accounts receivable: The total amount that your company has billed customers but hasn’t yet received.

- Inventory: The total value at market price of all the products you currently have available for sale, plus raw materials and work in progress.

Add together items 1-3 to determine your Current Assets.

- Equipment: The total purchase cost of the items minus any depreciation

or amortization.

Item 4 represents your tangible non-current assets. If you have purchased patents or trademarks, create item 5, “Intangible assets” and enter the total cost of acquiring them or their amortized value, if it differs from their acquisition cost. The value of intangible assets is amortized in much the same way as tangible assets are depreciated.

Total Assets are the sum of items 1-4, or 1-5 if you have intangible assets.

Liabilities

- Short-term debt: Add together your company’s current bank overdraft, the balances outstanding on any business credit cards, and the total amount of all loans due for repayment within a year.

- Accounts payable: The total amount of any supplier invoices that you haven’t yet paid.

Add together items 5-6 to give your Current Liabilities.

- Long-term debt: The total amount of loans, from any source, due for repayment in more than one year.

The sum of items 5-7 is your Total Liabilities.

To calculate your Net Assets, subtract Total Liabilities from Total Assets.

- Owners’ equity: The total amount that the company’s owners have invested in the company.

- Retained earnings: You can calculate this using this formula:

Retained earnings = Total assets – (Total liabilities + owners’ equity)

The sum of items 8-9 is your Total Equity. It should be the same as your Net Assets.

How to Create Balance Sheets

You can create balance sheets manually via spreadsheets or with accounting software.

Manually: Creating a balance sheet manually can sound daunting, but the days of quill pens and physical ledgers are long gone. Today, you can create a basic balance sheet with a standard spreadsheet-based template, as long as your business isn’t too complicated. You’ll need to gather the following documents to find the required information:

- Bank statements

- Records of accounts payable and accounts receivable

- Statements for any outstanding loans

- Receipts for asset purchases or other documentation of asset value

- A complete current inventory record

Software: Although it may not be complicated to create a balance sheet manually, it is definitely time-consuming—and you’ll have to reenter much of the information every time you go through the process. So as your business grows and you get even busier, you might decide it’s best to use accounting software, which will record all your company’s financial transactions and automatically generate financial reports from them. This can make it much faster and easier to produce a balance sheet, and it can increase accuracy since no one is manually inputting data (and potentially missing a zero or decimal point).

Free Balance Sheet Template

You can start creating your own balance sheets today with this downloadable balance sheet template.

The balance sheet is one of the company’s most important financial statements. It provides a snapshot of a company’s financial position by showing its assets, liabilities and shareholders’ equity. However, it doesn’t show the company’s income, expenses or cash flow, and it doesn’t show how the company’s financial position has changed over time. To get a more complete view of a company’s financial health, you need to analyze the current balance sheet alongside other documents like the income statement, cash flow statement and balance sheets from earlier periods.