A business should always strive to stay solvent by meeting its financial obligations. But cash flow troubles can arise, potentially resulting in insolvency. Though often temporary, insolvency can lead to severe consequences, even bankruptcy if left unchecked. Recognizing early warning signs and understanding recovery options can be the difference between a setback or business failure. Fortunately, smart cash management practices can help companies stay solvent, even in the face of rising prices or declining sales.

What Is Insolvency?

Insolvency is the inability to pay debts. Businesses and individuals alike can become insolvent, often due to issues like a reduction in monthly cash flow, increased expenses, or poor cash management.

Insolvency is often temporary. For example, if a business’s customers don’t remit payments due quickly enough for the business to keep up with short-term supplier debts, the business could become insolvent. Such situations can usually be resolved by tapping into a credit card, line of credit, or short-term loan. But if cash flow management issues persist, insolvency can lead to legal action and/or bankruptcy.

Key Takeaways

- Insolvency refers to a financial state in which a business can’t afford to pay its debts.

- There are two types of insolvency: balance sheet insolvency and cash flow insolvency.

- A business can be insolvent without being bankrupt, but not the other way around.

- Debt restructuring gives businesses a way to avoid bankruptcy by negotiating with creditors to get better payment terms or to trade equity for debt forgiveness.

Insolvency Explained

Insolvency refers to a financial state of distress in which a business lacks the cash to meet financial obligations, such as utility bills, rent, supplier invoices, loan payments, credit card bills, and even employee wages. Although insolvency can lead to bankruptcy or other legal proceedings, it doesn’t have to. A business can typically get out of insolvency—and, therefore, become solvent—by carefully managing its finances.

Increasing income, reducing expenses, and utilizing better cash management methods are all examples of effective strategies a company can use to recover its financial position. Debt restructuring, which can lead to more favorable repayment terms, can also help companies get a handle on past-due obligations.

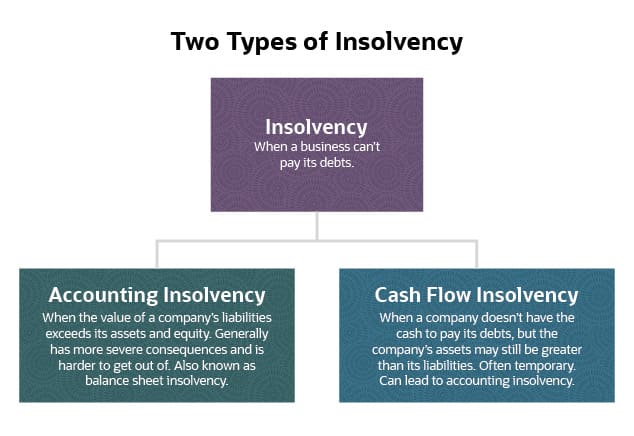

Types of Insolvency

There are two types of insolvency: balance sheet insolvency (also known as accounting insolvency) and cash flow insolvency. They both mean that a business can’t meet its financial obligations when they come due. However, there are differences in determining each type of insolvency—and one can inflict more severe consequences than the other.

Balance Sheet Insolvency

Balance sheet insolvency, also called accounting insolvency, refers to a situation when a business is insolvent “on the books.” In other words, the value of the business’s assets listed on its balance sheet is less than its liabilities. This means the business owes more than it owns, and therefore can’t meet its financial obligations when they come due. Operations may be ongoing, but the financial pressure is mounting.

Short-term fixes, such as lowering prices to spur sales, divesting assets, or selling unpaid receivables to a third-party invoice factoring company, can sometimes get cash in-house faster. Or the owners may come to the rescue by contributing enough capital to keep the business running. But while these circumstances can help a business stay afloat in the short term, they’re unsustainable long-term.

Cash Flow Insolvency

Cash flow insolvency occurs when a business is unable to make scheduled payments to creditors, such as lenders, vendors, suppliers, utility companies, and landlords. According to its financial records, a company’s assets might be greater than its liabilities, yet the company can still be cash flow insolvent because it doesn’t have enough cash to cover expenses.

Generally speaking, cash flow insolvency is less serious than balance sheet solvency. Cash flow insolvency is frequently just a matter of “bad timing” that can be fixed relatively quickly, usually by finding ways to boost cash reserves. But when cash outflows persistently outpace cash inflows, there can be a domino effect: Suppliers stop supplying, revenue withers due to lack of inventory, and cash inflows shrink further. Cash flow forecasting and similar strategies can help a business avoid insolvency by providing a way to make more accurate predictions and budget accordingly.

Insolvency According to the Uniform Commercial Code

The Uniform Commercial Code (UCC) is a set of federal business laws that regulate commercial transactions. In section 1-201(23) (opens in new tab), UCC defines the term “insolvent” as:

- Having generally ceased to pay debts in the ordinary course of business, other than as a result of bona fide disputes,

- Being unable to pay debts as they become due, or

- Being insolvent within the meaning of federal bankruptcy law.

If a business meets any of these three definitions, UCC provides creditors with remedies they can pursue to recoup the money owed to them by the insolvent debtor. For example, under § 2-702 (opens in new tab), if a seller of goods discovers that a buyer that has placed an order is insolvent, the seller may refuse to deliver the goods unless the buyer pays for the entire order in cash up front.

It’s worth noting that the UCC definition of insolvency differs from that of the IRS (opens in new tab), which says “a taxpayer is insolvent when his or her total liabilities exceed his or her total assets.” UCC’s definition encompasses both accounting/balance sheet and cash flow insolvency, whereas the IRS’s version only addresses accounting insolvency.

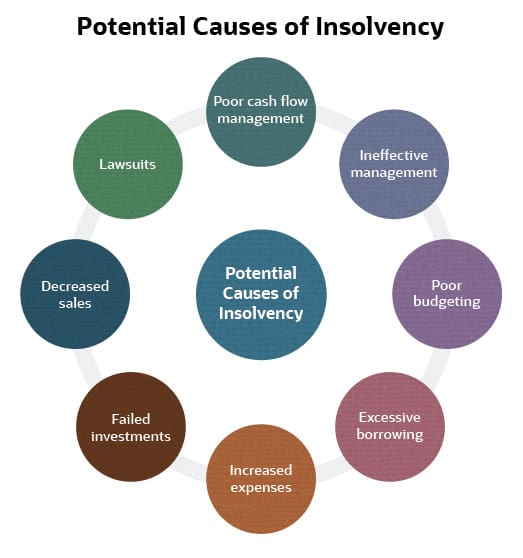

What Contributes to Insolvency?

Many factors contribute to insolvency, though most relate to poor financial management. Businesses should pay heed to the factors outlined below, using them as warnings to rectify circumstances as quickly as possible. Doing so can help a company stay solvent and avoid potential court proceedings—or, worse, declaring bankruptcy.

- Poor cash flow management: If a company fails to pay attention to its cash inflows and outflows, it could lead to a shortfall—a key contributor to insolvency. For example, if a business loads up on new inventory but is unable to sell those items quickly, it could lead to a cash shortage.

- Poor oversight: If a company fails to pay bills on time, it could incur late fees and have difficulty negotiating with suppliers, leading to higher operating costs, therefore, contributing to insolvency. Such issues can be caused by poor hiring practices or HR shortfalls—perhaps an unqualified worker was hired for a job. Other times, poor accounts payable processes lead to late payments because supplier invoices go missing or delayed approvals.

- Excessive debt: Most businesses will need to borrow money from time to time, whether to grow or simply maintain operations. But when a business takes on too much debt—especially when it involves high monthly payments and a high interest rate—the amount of capital funneled into servicing that debt means less cash is available for other things, potentially contributing to insolvency.

- Rising costs: Sometimes, a company can’t foresee the increased cost it takes to run a business. If labor or raw materials costs go up, for example, a business may need to increase revenue and/or quickly find ways to cut expenses in order to avoid insolvency.

- Failed investments: Bad investments or acquisitions are a frequent cause of insolvency—an unfortunate reality for many businesses. When risking business assets, it may be prudent to opt for safer investments over riskier ones.

- Declining sales: Sales can rise and fall depending on a variety of factors that affect purchasing decisions, like seasonality, as well as economic, social, or other factors. Not only will a business need to effectively manage cash flow in response to changing conditions, it must recognize other issues or trends that could affect its ability to generate sales.

- Lawsuits: If a business has been sued by its customers, employees, competitors, government agencies, or others, the associated monetary losses can lead to insolvency. It can be expensive to defend lawsuits, and the business may have to pay out large sums of money in damages or settlement payments, impacting its ability to operate solvently.

It’s important to note that the above factors are often interrelated and may not always occur in isolation. For example, if a business isn’t careful, decreased sales or increased expenses could lead to poor budgeting and cash flow management decisions. On the flip side, effective budgeting and cash flow management practices can mitigate the effects of revenue shortfalls and increased costs, helping a business remain solvent.

Insolvency Warning Signs

The sooner a company recognizes the warning signs of insolvency, the more likely it may be able to stay solvent. Having the right indicators in place—and monitoring them regularly—facilitates prompt intervention, helping to reduce potential business disruption. Seven common warning signs include:

- Cash flow issues: If cash outflows are consistently exceeding inflows, it’s a sign that there are fundamental issues with a business model or business processes. Perhaps prices need to be increased to better cover costs, or the timing of cash collections should be shortened with tighter customer payment terms. While temporary cash shortfalls can be endured, regularly over drafting bank accounts or relying on credit lines for day-to-day operating expenses is often unsustainable.

- Missed payments: Consistently missing payments to suppliers, lenders, or employees is a key indicator of a liquidity issue. Not only does this potentially incur extra costs from penalties, but it can also cause reputational harm and begin a waterfall of deterioration. Days payables outstanding (DPO) is a KPI that measures lengthening payment times, which can be a precursor to missed payments.

- Increasing debt: If accounts payable balances or credit line balances are involuntarily growing, it may indicate that the company is struggling to meet its financial obligations through normal operations and is relying more heavily on credit to sustain its activities. This can be particularly problematic because as debt levels rise, so do the risk of default and additional interest expenses.

- Reduced lender confidence: Lenders have a keen sensibility of credit risk. Tightening credit terms lets a company know that its lenders have concerns about being repaid. This can manifest in lower available credit, higher interest rates, or increased collateral requirements.

- Too much inventory: Mounting stock ties up capital that could be used to pay other obligations. It also adds storage costs and increases the potential for loss from damage, theft, or obsolescence. In more dire situations, overstock may suggest weak sales or softening customer demand.

- Revenue losses: Revenue monitoring uncovers the underlying reasons for revenue losses so that they can be corrected. Losses of major customers can quickly lead to insolvency, while a steady slowdown in sales volume or average purchase amounts should be investigated.

- Legal threats: Lawsuits can be costly to defend, and settlements or adverse judgements significantly strain cash flow. An uptick in legal issues, whether from creditors or customers, may signal underlying problems. This suggests that management should proactively explore alternative funding sources for day-to-day operations, as existing cash flow may soon be diverted to cover mounting legal obligations.

Insolvency vs. Bankruptcy: What’s the Difference?

The words “insolvent” and “bankrupt” are often used interchangeably when describing a business that can’t afford to pay its debts. But the two words actually mean different things.

Cash flow insolvency refers to the state of financial distress that occurs when a business doesn’t have the cash to meet its financial obligations. Balance sheet insolvency is when the value of a company’s total assets (both short-term and long-term) is less than the value of its liabilities. Insolvency can be temporary and does not necessarily have a negative impact on the business’s credit scores or viability. A business may be able to get out of insolvency without court intervention, sometimes by selling off assets, obtaining credit, or factoring invoices to boost short-term cash flow, and/or by working with creditors to restructure debt while making business changes that increase cash flow. They often start by focusing on their collections efforts to reduce days sales outstanding (DSO). A business can be insolvent without being bankrupt.

Bankruptcy, on the other hand, is the legal process that ensues when an insolvent entity goes to court and declares itself as bankrupt. Depending on the type of bankruptcy filed, a company may decide to liquidate (Chapter 7) or restructure its debt (Chapter 11). Declaring bankruptcy doesn’t always force a company out of business, but it negatively affects its credit rating and, possibly, damages relationships with customers and suppliers, and hurts the management team’s credibility with investors.

- Chapter 7 Bankruptcy Procedure: A business filing for Chapter 7 bankruptcy is likely past the stage of being able to restructure its debt and, therefore, must either liquidate or cease operations after selling off its assets to pay back creditors. After the company’s assets are sold, remaining debts are usually written off by the debt holder.

- Chapter 11 Bankruptcy Procedure: A business can still operate if it files for Chapter 11 bankruptcy, and debts are restructured under the supervision of a court-appointed trustee. Debts must still be paid back, but this option gives companies the chance to rectify their financial struggles and reach a state of solvency.

Note: There is also Chapter 13 bankruptcy, which is essentially the same as Chapter 11 in that it allows the filer to restructure debt. But Chapter 13 bankruptcy is available only to individuals and sole proprietorships.

Insolvency vs. Bankruptcy

| Insolvency | Bankruptcy |

|---|---|

| Can lead to bankruptcy. | A result of insolvency. |

| Can be temporary. | Goes on permanent record. |

| May not impact credit. | Negatively impacts credit. |

What Happens If a Business Becomes Insolvent?

If a business becomes insolvent, a number of things can happen. For one, the company will likely be able to maintain normal operations for a while as it attempts to resolve its financial issues. Many times, businesses can address financial issues before they become insurmountable. For example, if the situation doesn’t seem dire, a business might be able to regain solvency by improving its financial planning and cash management processes.

If cash flow struggles seem unlikely to let up anytime soon, the business might be able to proactively restructure its debt by contacting creditors and negotiating more affordable payment terms. Generally, creditors don’t want a business to default on payment obligations—after all, the creditors also need to get paid to stay in operation—so they may be willing to work out a new, more manageable repayment schedule. It’s important to communicate any financial hardship sooner rather than later.

Or, in cases of minor cash flow insolvency, the issue may resolve on its own. For example, if a customer delays payment for a large order, it could negatively impact the business’s short-term cash flow, causing a temporary state of insolvency. But once the customer makes its payment, the business should be able to get back on track immediately.

If cash flow problems persist, regardless of the cause, and the business cannot meet its financial obligations, it may have to declare bankruptcy—either to liquidate its assets or to obtain legal assistance with debt restructuring. Bankruptcy is generally a last resort.

What Recovery Options Exist for Insolvent Companies?

If a company becomes insolvent, there are several recovery options that may help stabilize operations and avoid liquidation. These strategies vary in complexity and formality, and the right approach depends on the company’s specific situation. Each option comes with its own risks and implications. Companies in financial distress can engage specialized financial advisors to help figure out the best path to recovery.

Common recovery options include:

- Informal restructuring: A non-legal, flexible approach to resolving distress, informal restructuring involves voluntary efforts by a company to stabilize its finances in good faith. This may include negotiating with creditors to revise payment terms, reduce operational costs, sell non-core assets for cash, or seek new investment.

- Formal debt restructuring: A structured, often court-supervised process to renegotiate existing debt terms to improve financial stability. Common measures include extending repayment periods, lowering interest rates, or converting debt into equity to alleviate the pressure of meeting debt obligations.

- Turnaround management: Companies may bring in external turnaround experts to help develop and implement strategic and operational changes aimed at restoring profitability and cash flow. These changes can range from subtle cost reductions to a complete overhaul of the business model.

- Debt-for-equity swap: Creditors agree to exchange debt for shares in the company, reducing debt levels and eliminating the related interest expense. In doing so, creditors become owners with a vested interest in moving the company forward, while existing owners give up a portion of their stake.

- Mergers and acquisitions: A financially stronger company may acquire or merge with an insolvent business, providing access to capital and operational support.

- Pre-package chapter 11 bankruptcy: The negotiation of a comprehensive reorganization plan with key creditors before formally filing for Chapter 11. This approach can significantly shorten the bankruptcy process and reduce business disruption.

- Chapter 11 bankruptcy: This form of bankruptcy provides legal protection from creditors while the business restructures under court supervision. Unlike Chapter 7, the goal is to rescue the business rather than shut it down.

- Section 363 sale: This process enables the company to quickly sell assets under the protection of Chapter 11. It’s commonly used to preserve value in distressed scenarios, either through a full business sale or by selling off specific parts.

- Liquidation: When recovery isn’t an option, liquidation involves selling all assets and distributing the proceeds to creditors. It marks the formal end of the company’s operations.

Debt Restructuring and Insolvency

Debt restructuring occurs when an insolvent business contacts its creditors to renegotiate payment terms. The idea is to make it easier for the insolvent company to pay off outstanding debts. For example, if a business is struggling to make loan payments, it could attempt to refinance at a lower interest rate or extend the term of the loan to decrease the monthly payment amount.

An insolvent business can also consult with a debt restructuring professional for assistance. Debt restructuring companies help the insolvent business identify the best way to climb out of insolvency. Some companies might offer debt refinancing options, such as loan consolidation, where outstanding loan balances are paid off and a new loan issued by the consolidator for the total amount. The individual loans are paid off, as far as the original creditors are concerned, and the business instead makes its “new” payments to the new lender.

In certain situations, a creditor may be willing to convert a company’s debt into equity in the business. Called a debt-for-equity swap, this option is attractive to lenders that want to avoid writing off a debt. If a business has the option to restructure debt, it’s generally a good alternative to declaring bankruptcy. Although Chapter 11 bankruptcy also allows a business to restructure debt, the company still gets hit with the reputation and credit-damaging bankruptcy label.

Know Exactly Where Your Business Financials Stand With NetSuite

For the most part, businesses can prevent insolvency by maintaining good financial management practices, particularly with financial management software. NetSuite Financial Management enhances a business’s ability to monitor financial transactions, develop budgets, and generate forecasts. Real-time data, flexible reporting, and KPI tracking make it easy to quickly assess financial health and spot potential cash flow problems before they arise, helping prevent insolvency.

An insolvent business can’t fulfill its financial obligations. This state is often temporary, but if the conditions that led to insolvency remain unaddressed, the business can wind up in bankruptcy. Many of the factors that lead to insolvency are within the business’s control; for example, a keenly aware company can avoid poor cash management decisions, helping it stay solvent. Meanwhile, the right finance and accounting software can help companies monitor their financial performance in real-time, making it easier to prevent insolvency.

Insolvency FAQs

What does insolvency mean?

Insolvency refers to the state of financial distress in which a business doesn’t have enough cash to pay its bills when they come due or when the value of all assets is less than that of outstanding debt. There are two main types of insolvency: cash flow insolvency and balance sheet insolvency (also known as accounting insolvency). Cash flow insolvency occurs when a company can’t pay its debts, but its liabilities aren’t necessarily greater than its assets. Accounting insolvency occurs when a company’s liabilities are greater than its total assets.

Both types of insolvency can be temporary but, if left unchecked, either can lead to bankruptcy. Bankruptcy is a legal declaration that says the insolvent business can’t pay its creditors. It results in a permanent impact on the insolvent company’s credit history and can result in liquidation of all assets. A company can be insolvent and not bankrupt, but not the other way around.

What is the difference between insolvency and solvency?

Solvency means a business is able to meet its financial obligations. If a business is insolvent, it means it cannot pay its financial obligations when they come due.

What is an example of insolvency?

Insolvency occurs when a business can’t fulfill its financial obligations. This can result from a temporary cash shortfall or because the value of a business’s assets are less than its liabilities. For example, if a company issues debt to fund an acquisition, but fails to hit revenue targets, it could contribute to insolvency.

What does it mean when a company liquidates?

When a company is liquidated, all of its assets—such as inventory, machinery, and office equipment—are sold and the funds used to pay creditors. The company usually goes out of business after liquidation.

What is the difference between insolvency and liquidation?

Insolvency refers to a financial state in which an entity has insufficient assets to meet its liabilities as they come due. Liquidation refers to a process in which noncash assets are sold or written off. The proceeds can then be used to pay back creditors. In some cases, insolvency can lead to liquidation, either voluntarily or after declaring Chapter 7 bankruptcy, for example.

What happens in cases of insolvency?

When a business is insolvent, it can’t meet its financial obligations. To recover from cash flow insolvency, companies may need to evaluate their cash management strategy, find ways to boost collections, and/or cut costs. Businesses can also contact creditors to restructure debt. If insolvency persists, a business may need to declare bankruptcy.