Capital — the funds available to a business — is the lifeblood of any successful venture. It can be contributed by owners and investors, borrowed from lenders or generated internally through operations. Sufficient capital is essential to stay in business, avoid bankruptcy and feed growth. But maintaining adequate capital balances can be a challenge, especially for new and small businesses. When a business’s capital balances are insufficient, it is said to be undercapitalized. Operating in an undercapitalized state is not ideal, but it’s not always fatal. As such, it is important to understand the causes and effects of undercapitalization, as well as how to address it, even for business owners who think their personal assets are safe from creditors because the company is incorporated.

What Is Undercapitalization?

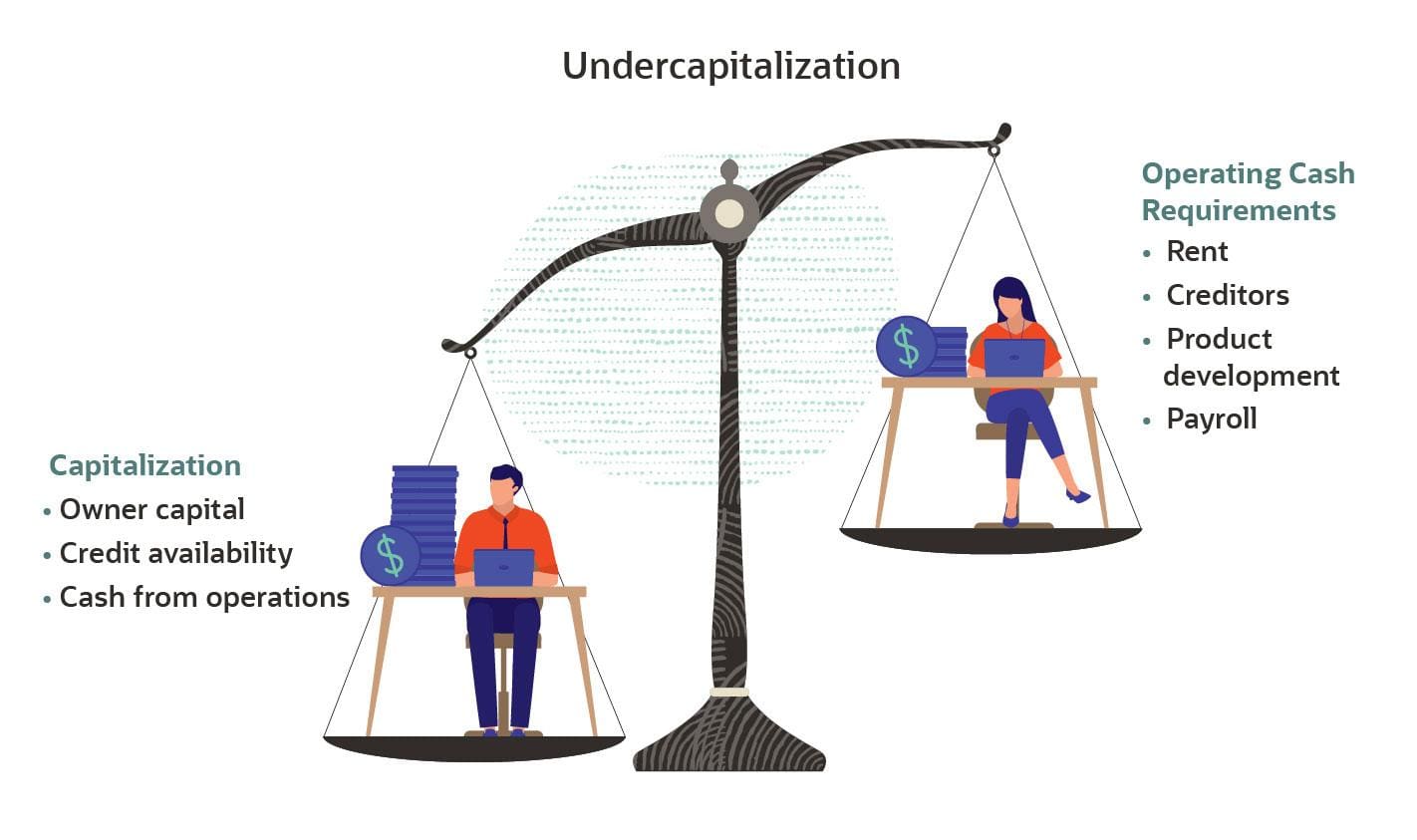

Undercapitalization occurs when a business doesn’t have enough cash to maintain operations and pay creditors. The emphasis on cash is what makes capitalization different from the accrual accounting definition of “profitability”, which is a company’s ability to use its resources to generate revenues in excess of its expenses. A company that is profitable “on paper” can still be undercapitalized in real life. Undercapitalization can be caused by imbalanced cash inflows and outflows, which can become problematic over time. In other cases, undercapitalization describes a situation where a company simply needs more funds than it has or can access in order to grow.

Key Takeaways

- Businesses that are undercapitalized don’t have enough money to maintain operations, pay creditors and fund growth, leading to missed opportunities and even insolvency.

- Undercapitalization can be devastating for new, small and growing businesses.

- Causes of undercapitalization include declining cash flow, being underinsured and not having access to adequate credit.

- Solutions to avoid undercapitalization include careful planning and management of the three sources of capital — internally generated, debt and equity — though each has its pros and cons.

Undercapitalization Explained

When a company is undercapitalized, it is unable to pay for its obligations, such as rent, supplies, payroll and debt. Said another way, undercapitalization creates a liquidity problem. A business may become insolvent if its cost structure is larger than its ability to generate profits and it lacks access to external sources of capital, such as loans or owner contributions.

Even profitable, liquid companies may experience undercapitalization. If a company doesn’t have the capital to invest in additional manufacturing equipment or hire staff in order to capture increasing demand, undercapitalization can create missed opportunities. Similarly, undercapitalization can limit a company’s ability to expand into new markets or develop new products, creating additional opportunity cost.

Without proper financial management, new and small businesses are especially susceptible to undercapitalization, although it can happen to companies of all sizes and in all industries, as well as to business units within larger companies. Funding a new venture requires accurately quantifying the amount of capital necessary to start up the business and to support operations until it ramps up and becomes self-sustaining. Developing these financial plans and projections is particularly challenging since it requires estimating both initial outlays, such as licenses, equipment and deposits, and ongoing operating expenses, including rent, payroll and inventory purchases. Underestimating can cause startup funding to be too low, leading to undercapitalization, as can overspending an accurate budget. Further complicating matters, a new business without credit history may not be able to borrow to bridge a temporary gap in capital.

Undercapitalization can be a significant challenge for small businesses if they haven’t prepared for contingencies that impact cash flow, such as market downturns, litigation or natural disasters. Preparations include establishing a rainy-day capital fund and setting up access to credit or additional investment. However, small business owners may be limited in their ability to make additional investments in the business, and credit limits for borrowing may be inadequate. For this reason, undercapitalization can also mean that funds aren’t available for growth or expansion.

Causes of Undercapitalization

Undercapitalization, or not having enough funds to sustain business operations, can be caused by any number of internal or external factors. It’s important to recognize the reasons undercapitalization occurs since it’s a leading cause of failure for small businesses. In fact, one analysis indicates that lack of adequate capital caused almost 40% of a sample of more than 100 recent startups to fail. Common causes of undercapitalization include:

- Underestimating required costs, which can lead to failure to raise adequate startup or expansion capital.

- Declining cash flow from reduced product sales or depressed economic conditions.

- Unavailability of credit, either due to lack of/poor credit ratings or limited credit lines.

- The use of short-term loans — debt due in a year or less — rather than permanent funding from long-term loans or open-ended equity investments, which creates a cyclical under-resourcing of capital.

Intentional underfunding is a less common cause of undercapitalization that can lead to significant legal consequences. Some entrepreneurs opt to intentionally minimize the amount of capital they contribute to a business with the expectation of shielding personal assets in the event the business fails or is sued. This can lead to undercapitalization if the amount of contributed capital is less than the business needs to reasonably operate and pay its debts. However, this strategy has been challenged in courts, even for businesses that are organized as corporations or limited liability corporations. The courts have established a precedent of “piercing the corporate veil,” holding the entrepreneur personally liable for intentionally undercapitalizing the business.

Effects of Undercapitalization

Businesses that are undercapitalized and experiencing liquidity problems are in a precarious situation. The worst-case scenario is business failure, but that is not an inevitable result. Sometimes undercapitalization simply constrains future growth. In other cases, it makes a business more susceptible to risk. Some of the effects of undercapitalization include:

- Business failure due to insolvency, which is the most dire effect of undercapitalization.

- Lack of payment or recurring delinquent payment, which can cause supply-chain issues.

- The inability to produce inventory and make sales due to these supply-chain issues, which perpetuates a downward spiral for cash inflows.

- The inability to hire the necessary employees to keep operations running.

- Inflexibility to weather any negative changes in cash flow, which significantly increases the risk of insolvency.

- Corporate owners possibly being held personally liable in cases where personal and corporate assets are commingled, the corporation does not keep adequate records or corporate owners intentionally defraud their creditors.

Undercapitalization can be deceptive for investors in the short run. When analyzing a business that is still operating but has an unusually low amount of capital, certain investment metrics can be misleading. For example, the return on equity percentage will look higher than comparable but more amply capitalized businesses because the value of the equity in the calculation’s denominator is smaller. Similarly, shareholders of an undercapitalized public company may receive higher dividends than an adequately capitalized company would return because the undercapitalized company is not properly reinvesting in the business. In turn, the higher dividends and return ratios inflate the share price in the short term, giving shareholders unsustainable appreciation in the share price. In all cases, a company that is undercapitalized and unable to fund its operations and pay its bills faces insolvency in the medium to long term.

How Businesses Raise Capital

Capital comes from three sources: internally generated cash from operations, debt and equity. These three sources have different benefits and challenges; key among them is cost of capital. Before a business can turn a profit, it must at least generate sufficient income to cover the cost of the capital it uses to fund its operations. The availability and amount of each of these sources of capital play a primary role in a business’s ability to avoid being undercapitalized.

- Cash generated internally from operations — or retained earnings — has the lowest cost of capital. It is also the most sensitive because it is affected by the very nature of the business — its sales, expenses, cash flow policies and efficiency.

- Debt is an external source of capital that comes from lenders. There are many variations of debt financing, including secured and unsecured short- and long-term loans, credit cards, factoring and personal loans taken by a small business owner. Interest charges and borrowing fees increase the cost of debt-sourced capital.

- “Selling” equity in the form of taking on additional partners, issuing additional shares or accepting private equity, angel or venture capital investment is another way a business can raise capital. Equity financing is considered to have the highest cost of capital among the three sources because it dilutes the earnings distributions to the owners.

Other options to raise capital include grants from government agencies, debt and equity crowdfunding and loans from alternative lenders, such as online or peer-to-peer lenders. These options may be helpful for small and new businesses that need capital but don’t have an established track record. The cost of capital for these options varies, as do the amounts made available.

Solutions to Undercapitalization

Undercapitalization is a primary reason that new and small businesses fail, but it doesn’t have to be the case. There are several things a business can do to help prevent undercapitalization, as well as approaches to help monitor capital levels for early detection of issues. At the same time, it’s important to do some contingency planning. More specifically, the following solutions may be helpful in avoiding undercapitalization.

- Create a detailed business plan early in the process that can be used to attract investors and lenders and serve as a guide for creating the organization, standing up product development and achieving financial success.

- Take a holistic approach to develop startup or expansion capital needs, being as thorough and inclusive as possible. Consider engaging experts or using resources like the Small Business Administration guides for help.

- Use a conservative mindset when estimating capital needs, skewing to the high end for costs and the low end for projected cash inflows. Add in 5% to 10% extra as a reserve.

- Set up credit lines in advance of needing them so that agreements are in place and capital is standing by.

- Establish a history of making payments on time with a lender, which may make it easier to obtain funding from that lender down the road if needed.

- Develop a strong connection with customers to ensure healthy operating capital. Strong customer service, product differentiation and well-trained employees can help achieve this goal.

- Develop a budget aligned with the business plan that can be used to manage cash inflows and spending. Regularly monitor and analyze any deviations from the budget.

Undercapitalization Examples

Undercapitalization is a common issue for new, small and growing businesses. Underestimating the level of startup capital needed for a new business is a common mistake. Similarly, it’s easy to imagine a thinly profitable small business without external investors or credit lines getting into a situation where it can’t pay its bills and has nowhere to turn for additional capital. Less intuitive are the cases of undercapitalization for growing businesses because growth might infer financial strength.

Here’s an example of undercapitalization in a growing, small business: Hypothetical business KMR Bakery specializes in gluten-free delicacies. Its sole owner has created a stable business with long-term, allergen-trained employees, a loyal customer base and steady positive cash flow that is used to maintain a constant supply chain and support the owner’s family. When another specialty bakery unexpectedly closes in the neighboring county, KMR experiences an influx of customers, and demand exceeds supply. This causes stockouts and frustrates the owner and the employees, who turn new and regular customers away from empty shelves. The owner would like to expand her operations to capture the demand and serve the community but never had the need to establish a bank credit line. She also doesn’t have the amount of personal funds needed to build more space, buy equipment and increase her inventory of supplies. KMR is an example of a liquid business that is undercapitalized.

Improve Planning and Budgeting With NetSuite

Ensuring that a business has enough capital to meet its current needs and capture growth is a primary challenge for all businesses, but it’s especially critical for new, small and growing businesses. Undercapitalization is problematic, resulting in lost opportunity (at best) and possible insolvency (at worst).

Two key ways to avoid undercapitalization involve creating comprehensive, accurate business plans and monitoring actual results against a budget. The planning and budgeting features of NetSuite Financial Management software can help businesses do exactly that. And its prebuilt synchronization gives companies real-time visibility into their available capital, so they can make more informed decisions on a daily basis and act before the level of undercapitalization becomes dire.

An undercapitalized business doesn’t have enough money to meet its needs. Regardless of whether the undercapitalization is caused by imbalanced cash inflows and outflows or lack of access to funds needed to grow the business, it is a primary challenge for new, small and growing businesses. Managing the three sources of capital — internally generated cash from operations, debt and equity — is critical to avoid undercapitalization. Other forms of preparation, such as pre-establishing lines of credit and shoring up operating priorities, can also help.

Undercapitalization FAQs

Does undercapitalization affect dividends

Yes. Undercapitalized public companies may pay higher dividends than an adequately capitalized company would return because it is not properly reinvesting in the business.

How does undercapitalization affect shares

Shareholders of undercapitalized public companies may receive higher dividends than an adequately capitalized company would return. The higher dividends and return ratios may inflate the share price in the short term, providing shareholders with unsustainable appreciation. However, in the medium to long term, a company that is undercapitalized and unable to fund its operations and pay its bills faces insolvency, which will cause shares to lose their value.

What are the advantages of undercapitalization?

An advantage — or more like a silver lining — of undercapitalization is that, up to a point, it promotes entrepreneurs to start or grow new businesses by lowering the cost of entry or expansion.

What are the disadvantages of undercapitalization?

When undercapitalization becomes problematic and a business no longer has enough money to operate, it can result in lost opportunity and possible insolvency. Undercapitalized businesses are also at a disadvantage in capturing innovation and growth opportunities.

How do you solve undercapitalization?

Solving undercapitalization takes a three-pronged approach. First, creating a detailed business plan using a holistic and conservative approach can help prevent initial undercapitalization. Second, monitoring capital levels, analyzing deviations from the budget and maintaining a strong connection with customers facilitate early detection of potential capital issues. Third, it’s important to do some contingency planning, such as establishing a history of making payments on time with a lender and setting up credit lines in advance of needing them. That way agreements are in place and capital is standing by.

What is overcapitalization?

A business that is overcapitalized has more capital than it needs. The amount of its debt and equity exceeds the value of its assets. Overcapitalization is a sign that a business is not using its capital effectively, whereas a business that is undercapitalized doesn’t have enough money to maintain operations, pay creditors and fund growth, leading to missed opportunities or even insolvency.