Economic theory refutes the notion of "having it all" when resources are limited. The simple truth is, no matter how advantageous the outcome of any business decision may be, rejection of competing options—including doing nothing—implies other benefits were sacrificed. The value of those other benefits is called opportunity cost, and its assessment plays an important part in the overall decision-making process.

What Is Opportunity Cost?

Opportunity cost is the value a company sacrifices when choosing one option over another. In other words, it’s the profit, time, or resources the company misses out on from the option it didn’t choose.

Because businesses operate with finite resources, opportunity cost is central to decision making. Every allocation of capital, time, or personnel means those resources can’t be used elsewhere. Evaluating these trade-offs helps managers see not just the cost of an option, but also what they give up by not choosing an alternative.

Key Takeaways

- Opportunity cost is money or benefits lost by not selecting a particular option during the decision-making process.

- Opportunity cost is composed of a business’s explicit and implicit costs.

- Opportunity cost helps businesses understand how one decision over another may affect profitability

Opportunity Cost Explained

Opportunity costs help managers weigh trade-offs and allocate resources effectively. By comparing potential gains from one choice against alternatives, businesses can identify which investments offer the greatest returns to support smarter strategic decisions. This analysis becomes particularly important for smaller businesses making major investments or directional pivots.

Consider an e-commerce retailer whose order volume has surpassed its in-house shipping capacity. The company faces a choice: hire additional warehouse staff or outsource fulfillment to a third-party logistics provider. While outsourcing costs more per shipment, it frees employees to focus on product development and customer service, potentially growing long-term revenue. The opportunity cost of keeping shipping in-house includes not just the direct costs of new wages and expanded warehouse space but also lost revenue from delayed product launches and missed market opportunities. By weighing these factors against growth projections and demand forecasts, the business can determine which path best supports its objectives.

Why Is Opportunity Cost Important?

Opportunity cost analysis reveals what’s usually overlooked by examining the road not taken and helps businesses clarify the potential impact of each decision. By quantifying what’s sacrificed, companies can strengthen their decisions with evidence-based analysis of resources, investments, and strategy. A few key benefits of opportunity cost analysis:

- Informs resource management: Understanding opportunity costs can help managers direct limited resources toward activities that generate the highest returns. This can maximize the value extracted from every dollar, tool, hour, and employee.

- Enhances decision-making: Weighing the benefits of one option against realistic alternatives helps leaders avoid short-term bias and align choices with long-term goals.

- Identifies potential costs: Many business moves involve costs that don’t show up on financial statements—like forgone revenue, lost time, or missed market opportunities. Opportunity cost analysis brings these hidden factors to light and quantifies their impact.

How to Calculate Opportunity Cost

Opportunity cost is calculated as part of the cost-benefit analysis (CBA) process businesses use to evaluate competing priorities and support decision making. The most time-consuming aspect of calculating opportunity cost is gathering the various inputs needed to gauge potential returns if the business doesn’t use software to record its financials. But once that information is in hand, the calculation is just a matter of subtraction:

Opportunity cost = return on option not chosen – return on option chosen

As a simple example, if our previously mentioned growing ecommerce business is deciding whether to lease a nearby 5,000-square-foot warehouse for $6,000 per month vs. the same size facility 20 miles away for $5,000 per month, the opportunity cost for selecting the more expensive option would be $1,000 per month. And that's just for the space alone. But opportunity costs also come in the form of the time spent commuting to the farther location, money spent on gasoline, and vehicle wear and tear. Over time, the seemingly more expensive decision may prove to be less expensive after all.

Opportunity Cost vs. Opportunity Benefit

These ideas are like two sides of the same coin, helping to weigh the pros and cons of any decision. Opportunity cost is about the advantages that an individual or business gives up when opting for one choice over another. It basically represents the value of the alternative that is not chosen in the final decision. In economics, it serves to guide decision making processes, underscoring that every decision comes with a price even if it’s not immediately obvious.

On the opposite side, opportunity benefit refers to the profit or advantage gained from selecting one option over others. While opportunity cost focuses on what’s forfeited by not selecting the best alternative, opportunity benefit highlights the positive result or value obtained from choosing a specific course of action. Although it’s not as widely used as opportunity cost, it plays a role in evaluating opportunity costs.

What Opportunity Cost Tells Businesses

Every business decision represents benefits gained and lost. By understanding what is given up by not choosing a particular option, a business can better compare the value—i.e., the opportunity cost—of one decision over the other.

For example, the decision to purchase a new construction vehicle can be viewed as a comparison between what the business will gain by buying one versus what it will cost it by not buying one. For example, a comparison can be starting a new project in parallel to an ongoing project versus passing on that new project and forgoing its resulting profit. Opportunity cost informs the business about what it will miss out on by not selecting an option or, conversely, the opportunity realized from its selection.

Weighing Opportunity Cost

Opportunity cost is the sum of two specific types of costs: explicit and implicit, the former being more easily calculated than the latter.

Explicit Costs

Explicit costs, also referred to as accounting costs and explicit expenses, are typical business expenses a company incurs and records in its general ledger. They have an actual, tangible dollar amount and directly affect cash flow and profitability. Examples of explicit costs include typical business expenses that can be quickly obtained from an enterprise resource planning (ERP) system that centralizes the data, such as rent, payroll, equipment, utilities, and advertising, from different parts of the business.

Implicit Costs

Unlike explicit costs, implicit costs typically don't have a fixed monetary value that a company can track. Rather, they reflect the indirect, intangible costs of using already owned assets and resources. Implicit costs—also referred to as implied, imputed, or notional costs—aren't recorded for accounting purposes and reflect a loss in income, not profit. For example, the time spent by a procurement team member to research and compare different construction vehicles is an implicit cost; the explicit cost is the vehicle's purchase price.

Implicit costs are considered an opportunity cost, in and of themselves. The time spent by the procurement employee tasked with assessing construction vehicles represents a loss of what that person could have been working on otherwise.

Explicit vs. Implicit Costs

| Explicit Costs | Implicit Costs | |

|---|---|---|

| Definition | Typical business expenses a company incurs | Intangible costs of already owned assets and resources |

| Alternate names | Accounting costs and explicit expenses | Implied, imputed, and notional costs |

| How are they measured? | Dollar amounts in receipts and ledgers | Estimated value of staff effort that could have gone elsewhere |

| Appears in financial documents? | Yes, in the general ledger | No |

| Examples | Rent, payroll, equipment, utilities, and advertising | Time spent researching options before making purchases |

Opportunity Cost and Profits

Ultimately, opportunity cost can be framed as profit made or missed as the result of a business decision. Just as there are two types of costs, there are also two types of profit: accounting and economic.

Accounting Profit

Accounting profit is a business's net income, also known as the bottom line because it can be found at the end of the income statement. Accounting profit is calculated by subtracting the business's total explicit costs from total revenue, revealing how well the company is performing financially. Investors and lenders also look at accounting profit to help determine whether they want to work with the business.

Economic Profit

Economic profit equals total revenue minus explicit and implicit costs, and can often be very different than accounting profit. Also, keep in mind that economic profit is theoretical in nature because it accounts for opportunity costs, meaning the value of actions not taken. Economic profit reflects how efficiently a business is operating and allocating its resources.

How to Evaluate Opportunity Cost

Evaluating opportunity cost requires systematic comparison of available options and their potential returns. Some costs may not be immediately comparable—short-term profit and long-term growth, for example—and will require deeper analysis before weighing them against each other.

Start by listing all viable alternatives, then estimate the expected value of each option in both monetary returns and strategic benefits, such as market position or operational efficiency. Factor in the timeline for each option and compare it to overall business goals. Short-term gains may carry different opportunity costs than long-term investments depending on other factors, such as upcoming seasonal shifts in demand or available capital.

Account for both explicit, quantifiable costs and harder-to-measure implicit costs, such as management time or administrative complexity. Consider using scenario modeling tools to test how different assumptions might change the relative value of each option, such as potential sales for a new product or efficiency gains from new equipment. For complex decisions, assign probabilities to uncertain outcomes and calculate expected values. The unchosen option with the highest expected return represents the opportunity cost.

Opportunity Cost Examples

There are as many examples of opportunity costs as there are decisions made, even if the final decision is to not make a decision. But every decision has a value associated with the path not taken. Here are some examples of opportunity cost:

- A company decides to spend $50,000 to launch a new product. The opportunity cost is the value of the $50,000 that can't be spent elsewhere.

- An employee is contemplating going back to school full time to earn a master's degree. The opportunity cost of this decision is the salary they won't make for two years.

- An investor is debating whether to sell $8,000 worth of shares in a company. The stock price is expected to increase in three months, but they need the money now for a down payment to lease office space. In this example, the opportunity cost can't be determined until three months later, when the difference between the new stock price can be subtracted from its current price.

- A company notices sales have slowed down for a hot-selling product; it still has $10,000 worth left in inventory. Its annual carrying cost for holding the inventory is 20% of the products' value, or $2,000. The company is considering discounting the products 15%, losing out on $1,500 worth of revenue in an effort to sell the rest, clear inventory and save on carrying costs.

- A business has a $500,000 surplus that it can use to upgrade its manufacturing plant or invest in the stock market. If it expects the renovations to generate a 9% return in the first year and the investment to generate 12% for the same time period, then the opportunity cost of going with the first option is 3%. Investing in stock would be the better choice because the return is expected to be much higher.

Calculate Opportunity Cost With Accounting Software

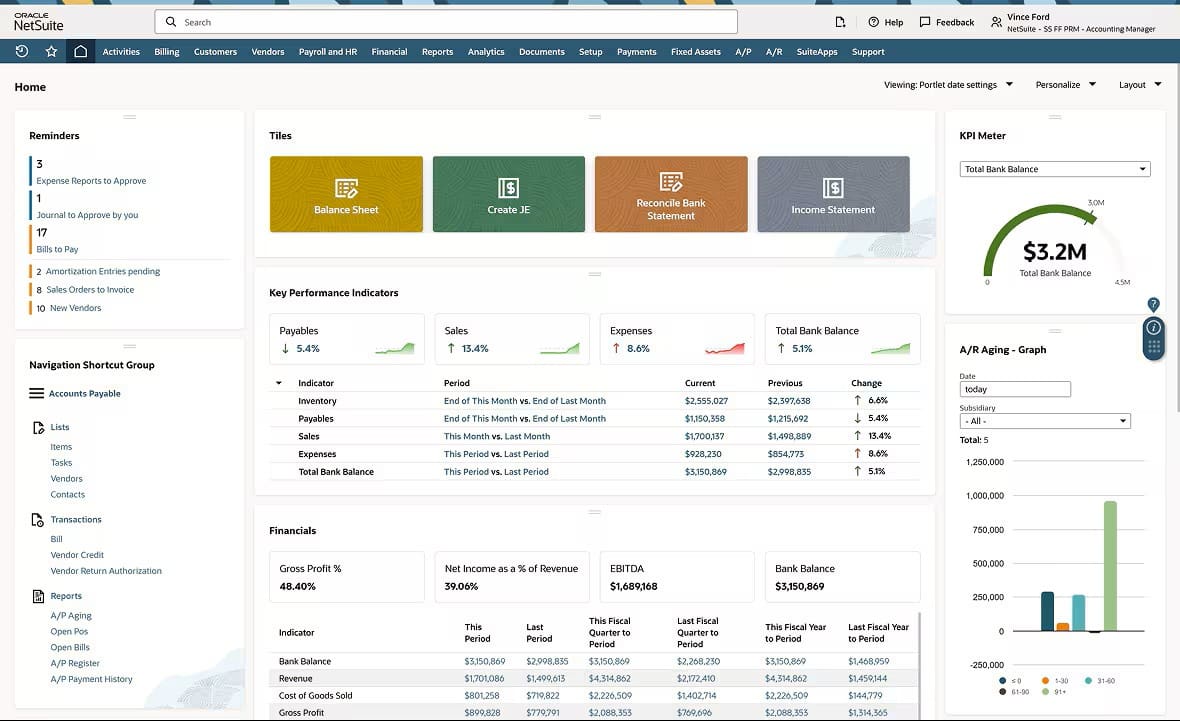

NetSuite Cloud Accounting Software powers organizations to calculate opportunity cost using real-time transactional and financial data The cloud-based solution automates the data collection process, empowering decision-makers to estimate returns on various scenarios more quickly than having to manually track down needed information. NetSuite's accounting software also provides businesses with a comprehensive view of their cash flow and financial performance and automates time-consuming accounting tasks, such as updating journal entries, account reconciliations, accounts payables and receivables processing, and closing the books.

NetSuite’s Accounting Dashboard

As a business grows, so does the need for automated software to manage other operational activities, such as supply chain, inventory, and order management. NetSuite ERP integrates a company's separate functionalities in a single database, providing a holistic view and leading to more-informed decision-making that positively impacts profitability.

Successful businesses rely on data to help decide where to allocate their finite resources, be it capital, time, or energy. Part of their due diligence is factoring in opportunity cost—an economics term that describes the value and benefits lost by not choosing a particular option. By calculating opportunity cost, which adds together both implicit and explicit costs, businesses can best determine the path to higher returns and, in turn, greater profitability.

Opportunity Cost FAQs

What is opportunity cost in business and example?

An opportunity cost is the value of the option not taken when a business makes a decision. For example, if the business is deciding whether to purchase two new tractors, the opportunity cost of not doing so would be the potential revenue and profitability lost by not being able to take on another project.

What has an opportunity cost?

Any decision a company is weighing has an opportunity cost associated with it. Understanding the opportunity cost of not choosing one option or the other can help the company make a more informed decision.

What is the difference between opportunity cost and sunk cost?

Sunk cost is money a business has already spent on something. Opportunity cost is the potential return lost by choosing one option instead of another.

Why does opportunity cost matter?

Opportunity cost helps businesses better understand the many factors that can impact their profitability. That includes the decision not to select an alternative option.

When should businesses not use opportunity cost?

At the heart of any decision lie two or more choices. Therefore, it is always wise to calculate opportunity cost before making a decision.

What’s the difference between opportunity cost and risk?

Risk refers to the possibility of loss or adverse outcomes — the chance that results will fall short of expectations, often due to uncertainty or external factors beyond a company’s control. Opportunity cost, on the other hand, is about trade-offs, or the estimated value of the next best alternative not pursued.

What’s the difference between opportunity cost and a trade-off?

A trade-off is the compromise of giving up one thing to gain another, while opportunity cost is the value of what’s sacrificed when that choice is made.

Is opportunity cost good or bad?

Opportunity cost is neither good nor bad; it simply exists as a natural part of making choices with limited resources. Understanding opportunity costs helps businesses make more informed decisions by evaluating the potential value given up with every choice.