Efficient cash-flow management plays a vital role in the success of any business. Days payable outstanding (DPO) — the average number of days an organization takes to pay suppliers’ invoices — is an important financial metric for tracking and optimizing cash outflows. Maintaining a high DPO can free up more cash to pay for everyday operating expenses and short-term investments. However, an extremely high DPO can also be a sign that the company is having difficulty paying its bills and may be endangering its supplier relationships. Here’s everything you need to know about how to calculate DPO and use it to improve cash flow, including the advantages, limitations and real-world examples.

What Is Days Payable Outstanding (DPO)?

Days Payable Outstanding or DPO is the average number of days between the time the company receives an invoice and when the invoice is paid. DPO is typically calculated on a quarterly or annual basis. If a company has a DPO of 23 for its most recent quarter, that means it took 23 days on average to pay its suppliers during that time.

DPO is a key cash-flow metric that indicates how well a company manages its cash outflows. A high DPO is often desirable because if a company takes longer to pay creditors, it has more cash available in the short term to use for other purposes.

DPO vs. DSO:

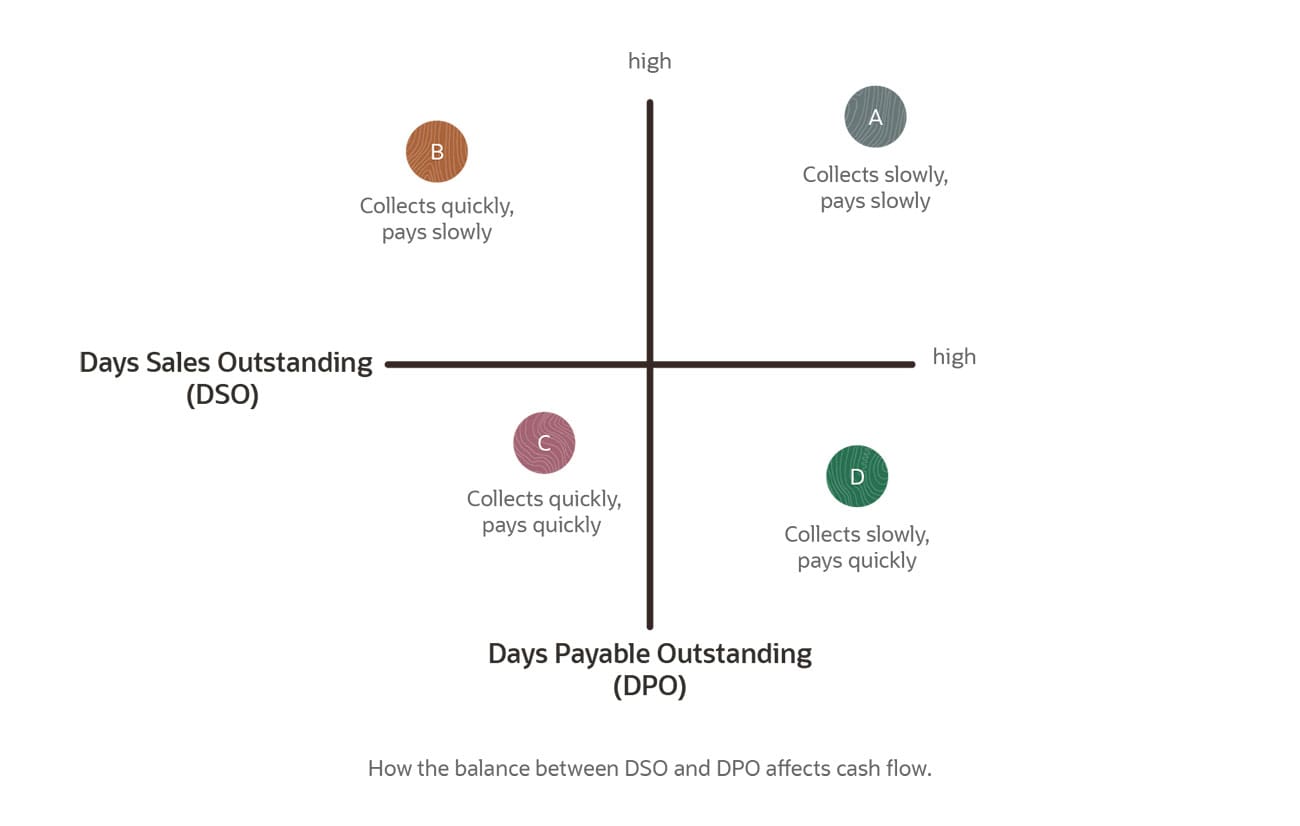

While DPO is an important measure of cash outflows, days sales outstanding (DSO) is the corresponding metric for cash inflows. DSO is the average number of days it takes a company to receive payment for the outstanding invoices it has issued to customers. A healthy company may aim for a very low DSO, which indicates that it collects revenue quickly, together with a high DPO, which indicates it pays its bills more slowly. The combination of low DSO and high DPO increases the amount of cash available at any time.

Key Takeaways

- Days payable outstanding (DPO) is the average number of days a company takes to pay invoices for goods and services obtained on credit.

- DPO is a key financial metric for tracking and managing cash flow.

- A high DPO is generally favorable because it means more cash is available to fund operations.

- However, reducing DPO may be advantageous if it means the company qualifies for vendor discounts or other incentives.

Days Payable Outstanding Explained

Companies generally obtain goods and services on credit, paying for them only after they receive invoices from suppliers. A high DPO means that the company waits longer to pay those bills. Because the company holds on to its money for a longer period, a high DPO generally helps to improve the company’s cash position — more cash is available to fund everyday operations and make short-term investments. But it’s important to balance the advantages of better cash availability against the potential impact on vendor relationships. Vendors prefer customers that pay their bills faster. Those that do may qualify for discounts and enjoy a better overall relationship with their vendors.

Why Is Days Payable Outstanding Important?

Companies generally aim to optimize cash flow and manage cash efficiently. Increasing DPO contributes to these goals.

DPO is one of three metrics used to calculate the cash conversion cycle (CCC), which measures how long it takes a company to convert its investments in inventory into cash. The other two metrics are DSO, which is the average number of days it takes to collect payment from customers, and days inventory outstanding (DIO), which is the average number of days the company holds inventory before it is sold. The formula for calculating CCC, in days, is CCC = DSO + DIO - DPO.

A low CCC is generally advantageous because it indicates that the company can rapidly turn its resources into cash. One way to reduce CCC is to pay vendors more slowly (increasing DPO). Companies can also reduce CCC by collecting money from customers faster (reducing DSO) and by selling inventory more quickly (reducing DIO).

High DPO vs. Low DPO

In most situations, a high DPO is considered to be beneficial. It implies that the company is getting better credit terms from its suppliers and that it’s taking full advantage of those terms. As a result, the company is able to free up more cash that it can use to pay operating expenses. A low DPO means the company pays its bills faster, which can be an indication that it’s not able to negotiate extended payment terms from its vendors. However, a low DPO isn’t always a bad sign. A company may choose to pay quickly in order to improve vendor relationships and qualify for early-payment incentives.

Days Payable Outstanding Formula

The formula for calculating DPO takes into account three factors: the accounts payable (AP) balance, the number of days in the relevant accounting period, and the costs incurred to produce the company’s products and services, known as the cost of goods sold (COGS) or cost of sales.

There are two ways to calculate DPO:

DPO = AP x days in accounting period /

COGS

or

DPO = AP / (COGS / days in accounting

period)

How to Calculate DPO For Your Business

Calculating DPO involves three steps:

- Calculate accounts payable. This is the sum of all amounts owed to creditors. Some companies determine DPO based on the AP balance at the end of the period, while others use the average balance during the period.

- Determine COGS. COGS is calculated by adding the costs of materials, labor and other expenses directly attributable to the creation of the company’s products and services during the period.

- Count the number of days in the accounting period. DPO is typically calculated for a period of a full fiscal year or a quarter.

Let’s say a company wants to determine its DPO for the most recent fiscal year. Its AP at the end of the year is $30,000, and it has calculated COGS at $500,000.

DPO = 30,000 x 365 days / 500,000 = 21.9 days

We can see that on average in the past year the company took 21-22 days to complete payment on invoices received.

Benefits of DPO

Actively managing DPO as part of a broader cash-flow management strategy can provide several benefits:

-

Increased cash availability.

Maintaining a high DPO can free up cash for short-term use. If a company waits until the last minute to pay its bills, it can use the cash in the meantime on other programs. For example, the company may be able to use cash to pay other business expenses instead of borrowing money, thus avoiding interest costs.

-

Supplier incentives.

Maintaining a low DPO, on the other hand, can enable the company to win early-payment incentives from its suppliers. It’s the responsibility of the finance team to ascertain whether the discount outweighs the benefit of paying later and using the cash for other purposes until the invoice is due.

-

Investor appeal.

Investors look favorably on companies with high DPO. A high DPO suggests that a company has better cash flow, along with a correspondingly greater ability to use cash for short-term investments and to weather any temporary business downturns.

Limitations of DPO

Although maintaining a high DPO can improve cash flow, it also has potential drawbacks:

-

Strained vendor relationships.

Paying as late as possible can jeopardize a company’s relationship with its vendors. If the company’s DPO is too high, a vendor may decide to take its business elsewhere. Delaying payment can even cause financial problems for smaller suppliers that rely on the company’s business for much of their revenue, potentially hampering their future ability to supply what the company needs.

-

Lost supplier discounts.

Maintaining a high DPO can mean losing out on supplier discounts — and if the company delays payment beyond the due date, it may incur late-payment penalties.

| Effect of High DPO | Effect of Low DPO | |

|---|---|---|

| Cash-Flow Management | Greater cash availability | Less cash |

| Vendor Incentives | Lose discounts | More likely to win discounts |

| Investors’ View | Favorable | Unfavorable |

Days Payable Outstanding Examples

The average DPO among the largest U.S. companies rose 7.6% in 2020 to more than 62 days; however, DPO varies widely by industry and by company. It’s sometimes possible to calculate DPO for public companies from data included in their financial statements. Take Walmart, as an example. The retail giant reported accounts payable of approximately $55.3 billion and COGS of $429 billion for the fiscal year ending Jan. 31, 2022. Using the DPO formula (AP x days in accounting period / COGS), Walmart’s DPO for the fiscal year was approximately 47 days ($55.3 billion x 365 days / $429 billion).

Here’s another example: Aerospace company Boeing reported accounts payable of approximately $9.3 billion for the year ending Dec. 31, 2021. The combined cost of goods and services sold was approximately $59.2 billion. Based on the formula above, its DPO was approximately 57 days (9.3 billion x 365 / 59.2 billion).

How to Interpret DPO

A high DPO is a key element in an effective cash-flow management strategy. It indicates that the company is maximizing the amount of free cash available. That’s particularly the case if the company has a high DPO combined with a low DSO because that means the company collects cash from its customers faster than it pays its suppliers.

Generally speaking, a company with a high DPO is also viewed as having more leverage in the marketplace. It’s an indication that the company is important enough to its suppliers that they are willing to accept longer payment terms in return for doing business. A low DPO, in contrast, could indicate that a company is not able to get the best terms from its suppliers or is not fully exploiting the extended payment terms that are available. But it could also indicate that the company is paying early and getting discounts for quick payment from suppliers.

Application of DPO

DPO is used primarily as an internal financial metric. Finance leaders view the metric as a bellwether of their success at meeting the company’s strategic cash-flow requirements. If the company is tight on cash, it will look to the finance team to extend DPO as long as possible. DPO is a key factor in the company’s cash conversion cycle, which measures its ability to quickly convert resources into cash.

DPO also has applicability in the investment community. Investors scrutinize DPO as a measure of the company’s liquidity and efficiency in managing cash.

6 Ways to Improve Days Payable Outstanding

Companies can take a variety of steps to improve DPO, depending on factors such as their goals and the industry in which they operate. Those steps include analyzing invoice processing methods, negotiating terms and automating accounts payable processes.

-

Determine your goals.

Although it’s generally in the company’s best interest to increase DPO, a company needs to weigh doing so against its market needs. There may be only a few vendors that can provide the materials the company needs, and therefore paying those vendors promptly to cement the customer-supplier relationship is to the company’s advantage. That’s particularly true if those suppliers offer incentives for early payments.

-

Check that you’re paying as late as possible.

Check your suppliers’ payment terms to determine whether you’re paying as late as possible before the due date. If not, you may be able to delay payment while still maintaining a good relationship with suppliers.

-

Review terms against industry data.

It’s useful to gather data to assess how quickly other companies in the same industry pay their invoices. You may discover that you’re paying faster than your competitors, which puts your company at a disadvantage in terms of cash flow.

-

Negotiate better terms.

Understanding the average DPO for your industry may put you in a good position to negotiate longer payment terms with your suppliers. Large companies and other businesses that are particularly important to their suppliers are typically well placed to ask for more favorable terms.

-

Create a preferred vendor list.

Directing the company’s spending to a smaller set of companies gives the business more leverage to negotiate payment terms. It also makes it easier to track and agree to terms for all suppliers.

-

Improve invoice processing systems.

Decentralized, ad-hoc invoice processing methods can suffer from lack of control over how invoices get paid. By centralizing and automating invoice processing, the company can implement consistent and standardized payments in compliance with vendor terms. Comprehensive financial systems also make it much easier to track DPO and other financial metrics, so the company can monitor trends and adjust operations accordingly.

Free Days Payable Outstanding Template

Use this free DPO template to calculate DPO for your own company and compare it with other businesses. The template includes both a spreadsheet and a comparative bar chart. To compare DPO with other businesses, you will need their accounts payable balances and cost of goods sold. For public companies, that information can be obtained from their published financial statements.

Better Cash Flow Insights With NetSuite

NetSuite Cloud Accounting Software enables companies to centralize, automate and track financial information for improved cash-flow management. It helps businesses automate the capture of vendor invoices, approvals, payments, reconciliations and more. Find all your business bills, receipts and contracts in a single place and eliminate manual data entry errors. Real-time insights into financial metrics such as days payable outstanding (DPO) help companies track business performance and respond quickly to trends.

Conclusion

Focusing on tracking and optimizing DPO helps a company better manage all-important cash flow. Increasing the number of days taken to pay vendor invoices helps the finance team ensure more cash is available to fund operations. On the other hand, reducing DPO can be advantageous if it means the company wins greater supplier discounts.

Days Payable Outstanding FAQs

What does DPO tell you about your business?

Days payable outstanding (DPO) shows the average number of days your company takes to pay its vendors. The value of a high DPO is improved cash flow — the company has more cash available for other uses. However, it’s important to strike the right balance between efficient cash management and vendor relations. Rapid payments can earn supplier discounts, while companies that pay too slowly may incur late-payment penalties or even be unable to work with some suppliers.

How do you calculate days payable outstanding?

Days payable outstanding (DPO) is calculated by multiplying the average accounts payable balance by the number of days in an accounting period and then dividing the result by the costs of goods sold (COGS). The formula is:

DPO = AP balance x days in accounting period / COGS

Is days payable outstanding good?

A high days payable outstanding (DPO) is often desirable because a company that takes longer to pay its bills has more cash available for other purposes. On the other hand, a company that pays its bills quickly (low DPO) may improve its relationships with its vendors.

What is a good days payable outstanding ratio?

The definition of a good DPO depends on many factors and differs by industry. Generally speaking, a good DPO is one that allows a company to improve cash availability while also keeping its vendors satisfied. DPO is also a sign of how much power a company has in the marketplace. Companies with large market share will represent higher potential revenue to vendors, so they may have additional leverage to pay more slowly.