Running a business costs money. And the bigger the business, the higher these costs are likely to be. But savvy business leaders don’t need to accept these costs without question. They can take steps to minimize expenses without sacrificing quality or the business’s competitive edge.

For most businesses, cutting direct costs can be challenging, because these expenses often depend on external factors, such as raw material prices and shipping rates. On the other hand, indirect costs — collectively known as overhead — include such expenses as salaries, office costs and insurance, which are often easier to control and manage through internal means. According to J.P. Morgan Chase’s 2023 Midyear Business Leaders Outlook report, 76% of respondents cited cutting discretionary expenses and overhead as a top response to an economic recession. How overhead costs are categorized, analyzed and managed can determine the difference between a lean, successful company and an inefficient operation struggling to meet demand. This article will explore the different types of overhead costs and provide practical strategies for effectively managing them.

What Is Overhead?

Businesses of any size must understand their overhead costs to maintain profitability, as overhead makes up a sizable portion of expenses. Overhead encompasses all the expenses a company incurs that don’t directly contribute to the production of goods or provision of services. For example, salaries for sales teams are considered overhead, whereas factory labor is not. Overhead costs vary greatly from industry to industry, but most businesses have some administrative expenses, such as office rent and insurance, that are included in overhead.

By carefully managing their overhead costs, business leaders can minimize expenses without impacting output quality or volume. But to effectively control these costs, analysts and decision-makers must understand exactly how resources are being used if they hope to find areas for improvement, increase margins and grow profitability.

Key Takeaways

Overhead costs are indirect expenses incurred during a business’s routine operations; they include salaries, office costs, insurance and more.

Overhead varies by category and industry, but it’s typically separated into three types: fixed, variable and semi-variable. These categories are based on how closely an expense is tied to production, output or the provision of services.

By tracking and analyzing overhead costs, financial professionals and decision-makers can better understand their operations and business metrics and create well-informed strategies to reduce costs.

Overhead Explained

Even though overhead costs aren’t directly linked to production or the provision of services, decision-makers must understand them to effectively plan prices, budgets and more. This is because overhead informs a key metric — operating profit. This measure, typically found on a company’s income statement, shows the profitability of a business’s core operations after all direct and indirect expenses are paid. Accountants calculate operating profit by subtracting overhead costs from gross profits — the profit left over after direct costs are paid. By tracking operating profits alongside overhead costs, financial teams can identify trends over time and adjust their plans to increase margins and reduce waste.

Managing overhead costs can be complex because these costs vary widely and can fluctuate between financial periods. Accountants need far-reaching data to effectively track expenses, evaluate their impact and identify areas for cost reduction throughout an organization. By continuously monitoring and managing overhead costs, often with the aid of accounting software integrated into a larger enterprise resource planning (ERP) system, financial teams can adopt strategies to identify inefficiencies and reduce overhead costs. These efforts aim to ultimately increase operating profit margins and, with them, the bottom line. For example, say a financial analyst finds that the sales office is paying a high utility rate, relative to other overhead costs. By investing in more energy-efficient appliances and adopting a hybrid work model throughout the week, the business can reduce its energy costs and increase its operating profit margins.

Types of Overhead Costs

There are three main types of overhead costs: fixed, variable and semi-variable. To determine a cost’s type, accountants consider how closely it’s tied to output and production. Understanding the differences among these three types of overhead costs helps financial teams better manage costs and enhances the accuracy of budgets and forecasts.

Fixed

Fixed overhead costs remain constant from one financial period to the next, regardless of business performance, output or services provisioned. These fixed costs include expenses such as rent, insurance and subscriptions. For example, a factory might run equipment 24/7 for an entire month or shut down operations; rent will remain the same, regardless. Because of this consistency, these costs are typically easier to budget and plan for.

Variable

Variable overhead costs fluctuate with the level of business activity, increasing when business is booming and decreasing when it’s not. For instance, sales teams’ commissions will increase as sales increase. Budgeters and financial teams can analyze forecasted sales and production schedules to plan for variable costs. However, these costs typically require some flexibility and adjustments as real sales come in and are compared to forecasted values. Additionally, it’s important to remember that variable costs that are directly related to the production of goods and provision of services, such as factory worker wages, are considered direct costs, not overhead.

Semi-variable

Semi-variable overhead costs have a fixed and variable component. For example, an electric utility company may charge a fixed base rate for delivery and a service contract, alongside variable costs that fluctuate with usage. Financial teams can track and analyze these costs by combining the fixed and variable strategies — the fixed component remains the same when budgeting, while the variable component typically requires ongoing monitoring and more detailed data to be accurately accounted for.

Types of Overhead Costs

| Type | Changes Over Time | Examples |

|---|---|---|

| Fixed | Remains constant from financial period to financial period | Rent, insurance, salaries |

| Variable | Fluctuates with business activities | Commissions, overtime, office supplies |

| Semi-variable | Has fixed and variable components | Utilities with base fees, commissions as well as base salaries |

Overhead Categories in Business

Overhead costs typically fall into four primary categories: production overhead, administrative overhead, selling overhead and financial overhead. Each category represents a different aspect of a business’s indirect costs and will likely include fixed, variable and semi-variable costs.

Production Overhead

Production overhead encompasses expenses essential for manufacturing operations but not directly connected to a single product or service. These costs include fixed expenses, such as rent and salaries for production managers, as well as variable or semi-variable costs, such as factory cleaning/maintenance and utilities for production facilities.

Administrative Overhead

Administrative overhead costs are associated with the general day-to-day running of the business, including office supplies, office worker wages and management salaries. Administrative overhead may also include costs for services the business uses, such as legal expenses and insurance policies.

Selling Overhead

Selling overhead includes expenses incurred during the marketing and selling of a company’s goods or services, including advertising; packaging costs for finished goods; and sales staff’s salaries, commissions and business travel. Wages for employees working with sales teams, such as marketing assistants, are also included. These costs may be semi-variable if they are tied to sales performance and/or volume.

Financial Overhead

Financial overhead refers to the costs associated with the management of a company’s finances. These costs include expenses, such as interest payments on loans, taxes, bank charges and investment costs. This category may also include financial services, such as those provided by accountants, contracted auditors or consultants.

Overhead Categories in Business

| Production Overhead | Selling Overhead | ||

|---|---|---|---|

| Essential manufacturing costs not directly connected to a single product or service | Expenses incurred during the marketing and selling of a business’s goods and services | ||

| Administrative Overhead | Financial Overhead | ||

| General day-to-day costs of running the business, including services used | Costs associated with managing a business’s finances, including financial payments and services | ||

Examples of Overhead

Overhead costs are as diverse as the businesses they impact, varying by industry, company size and even specific business process. By understanding the specific ways their business operates and incurs costs, decision-makers can create targeted strategies to increase efficiency and profitability. Here are some examples of common overhead costs.

- Salaries: Managerial salaries and other administrative personnel’s wages are considered overhead.

- Office equipment and supplies: Devices, such as computers and printers, and office supplies, including stationery, paper, light bulbs and more, fall under administrative overhead.

- Insurance: Overhead includes any insurance premiums for risk and liability coverage, as well as any other industry-relevant insurance policies, fees and expenses.

- External legal and audit fees: Payments to both staff and external experts, consultants and contractors are classified as overhead. These parties are tasked with maintaining legal and financial compliance with standards and regulations. Auditors may also be brought in to assess and improve business performance and efficiency.

- Company cars: The purchase of company cars used for business purposes falls under overhead. Fuel and maintenance are also included.

- Travel costs: In addition to company cars, other travel expenses, such as airfare, accommodations and meals, contribute to travel overhead.

- Technology expenses: Technology purchases, maintenance, upgrades and training are included in a business’s overhead expenses.

- Depreciation of assets and equipment: As assets lose value over time, depreciation is reflected in the income statement. Though some asset depreciation may be included in direct costs — such as manufacturing equipment — non-direct assets, including administrative computers, are classified as overhead.

- Property taxes on production facilities: Tax payments fall under overhead. These include property taxes for production facilities, as well as any other tax liabilities a business incurs.

- Rent: Overhead includes rent or mortgage payments for a business’s properties. These are typically fixed expenses.

- Utilities for factory: Energy, water, gas or any other utility a business relies on are typically categorized as overhead.

- Advertising: Marketing, advertising, sales teams and other expenses tied to the selling of goods and services fall under overhead. Indirect sales expenses, such as travel, are also included.

- Professional services: Fees and payments for accountants, consultants, contractors and other professional service professionals are considered overhead.

Accounting Applications of Business Overhead

Businesses use overhead analysis for more than just finding areas to cut costs. By calculating, tracking and studying overhead costs, accountants can run diverse analyses and generate financial statements that reveal important information about their business’s performance, finances and risks. However, this in-depth analysis requires robust data, typically collected and organized by accounting software and/or an ERP system. Accounting applications of business overhead include:

Break-Even Analysis

Accountants use break-even analysis to determine when a business sells enough to become profitable. This point, known as the break-even point, is where the sum of all costs, including overhead costs, are equal to the revenue earned by the business by selling its products or services. Analysts employ break-even analysis to set price and performance benchmarks that, when combined with forecasted sales and expenses, establish when the business will begin to generate profit. Decision-makers can then use this analysis to plan future investments. For startups, break-even analysis is especially important, as it helps stakeholders understand a startup’s initial overhead costs and compare them to potential revenue generation. This provides insight into the overhead costs necessary for the business to continue operations and turn a profit.

Shutdown Graph

A shutdown graph is a visual tool that shows the relationship between variable costs and revenue, specifically focusing on when a business’s costs exceed earned revenue. But beyond the break-even point, a shutdown graph includes the shutdown point — the threshold where a business is unable to cover its variable costs and is better off shutting down temporarily to minimize losses. Some businesses, particularly seasonal businesses, like agriculture and fishing companies, temporarily shut down during slow periods when they can’t cover operating costs. However, if revenue drops below the shutdown point, a business may want to consider exiting the industry completely, as it’s unlikely to survive. Accountants determine shutdown points using average variable costs over several financial periods to help decision-makers decide when temporary — or permanent — shutdowns are warranted to minimize losses.

Activity-Based Costing

Activity-based costing (ABC) is an accounting method that allocates overhead costs to specific processes. By allocating costs to each activity, ABC can provide a clearer picture of how resources are being used in the production process. To do this, financial professionals identify all activities connected with a product, such as the electricity that is used by factory workers to create goods. For example, if a company pays $75,000 for 2,500 labor hours while manufacturing a product, the average utility cost per hour is $30 ($75,000 / 2,500 hours). Using that information, accountants can allocate this cost to specific goods. Say a product takes 15 hours to build. Each product assembled would contribute $450 to the utility overhead ($30 x 15 hours). ABC can be a time-consuming process, but by assigning overhead costs to activities, decision-makers can set better prices, track activity costs and ensure profitable margins.

Balance Sheet

The balance sheet is a key financial statement that uses assets and liabilities to show a company’s financial position, up to a certain point in time. Most overhead costs are considered current liabilities, as they are short-term obligations that come due within a year. Accurately accounting for overhead, as well as for other liabilities, helps accountants determine a company’s equity. Equity is an important measure for business leaders, investors and lenders to use to assess the value and financial health of a business. By tracking the balance sheet over time, analysts can see how overhead has changed and identify areas where improvements can be made to decrease the business’s liabilities.

Factors Contributing to High Overhead

Business leaders must understand the factors that contribute to high overhead costs before they can take steps to reduce them and build a leaner and more efficient company. High costs directly influence pricing decisions and profitability, and can lead to reduced margins or the loss of customers to the competition. Here are four common areas to probe for high overhead costs when making improvements.

Fixed vs. Variable Costs

Fixed and variable costs must be regularly monitored because they can significantly contribute to high overhead over time. Fixed costs remain relatively constant but can accumulate over the long term, especially in high-cost areas or industries. Financial teams should regularly assess their fixed costs and make sure they’re worth keeping as business conditions evolve. For example, if a storage facility is vacant due to a long-term shift in inventory levels, its rent may be a wasted expense that can be trimmed without negatively impacting the business.

Variable costs, on the other hand, can escalate quickly with increased business activity, leading to high overhead during peak periods. When ramping up production or increasing sales, it’s important for businesses to monitor their variable costs and ensure that they’re scaling efficiently and not cutting into margins. When procuring a large order of office supplies, for example, managers might seek out vendors that offer bulk discounts to minimize overhead costs as their business grows.

Economies of Scale

The term “economies of scale” describes the benefits a company experiences when increasing output causes a decrease in costs per unit. Economies of scale are more common in large companies because they have the resources to invest in high-efficiency processes. But businesses of any size can benefit from scaling strategies, including state-of-the-art technology, a specialized labor force and bulk discounts on supplies and materials. This doesn’t necessarily mean that economies of scale translate to lower total overhead costs. Inefficiencies and waste can compound as output increases and a company grows, leading to higher overhead costs that can lead to shrinking margins, or even losses. Many businesses rely on accounting software to effectively track these metrics as they scale.

Unnecessary Expenses

Unnecessary expenses inflate a business’s overhead costs but often go unnoticed. Some expenses, such as redundant services and processes, may not be obvious until business leaders take a holistic look at their organization. This visibility is often achieved by using a cloud-based ERP platform with far-reaching data collection capabilities. To spot these areas, decision-makers should regularly review expenses to identify and eliminate costs that aren’t contributing to a business’s success. Even relatively small expenses, such as excessive office supplies or unused subscriptions, can add up, and small fixes, such as going paperless, can have a positive impact on profitability.

Inefficiencies and Wastage

Inefficiencies and wastage can constitute a significant portion of overhead costs. Examples range from small and simple waste (excess office supplies, for instance) to large and complex inefficiencies, such as a cluttered inventory management system with high carrying costs. Inefficiencies of any size can influence pricing strategy and reduce profitability, ultimately impacting a business’s competitive edge. To find improvements, decision-makers need a clear view of operations and strong data on resource allocation. Business leaders often achieve this visibility through automated, real-time data collection that’s integrated into a comprehensive business platform. By leveraging this technology, leaders can more effectively understand their overhead costs to become better informed about where they can reduce waste and build a leaner, more efficient operation.

5 Strategies to Reduce Overhead

Reducing overhead is a critical way for businesses to maintain or improve their margins, especially during periods of rising costs and economic uncertainty. Business leaders can use a mix of different cost control strategies, tailored to their needs, to improve operational efficiency. Here are five near-universal strategies to help reduce overhead costs and improve profit margins.

-

Streamline operations and processes.

Streamlining operations and processes requires a detailed view of workflows to effectively identify inefficiencies and redundancies. For example, if two separate offices are doing similar tasks, using a centralized data source or improving their communication could save time and energy. By simplifying these processes and eliminating unnecessary tasks, businesses can reduce the time and resources spent to accomplish goals, thereby reducing overhead relative to productivity. Businesses that successfully streamline their workflows can cut costs, improve overall efficiency and improve workforce morale by eliminating tedious and time-consuming tasks.

-

Embrace technology and automation.

Businesses that embrace modern technology can take advantage of various tools to automate processes, often within a larger business software platform. This automation limits the need for manual labor, speeds up tasks, minimizes costly errors and ultimately reduces overhead. For example, accountants can save time by using software to automate invoicing, payroll and bill payments. Built-in data validation tools also help businesses build confidence that their figures remain accurate and up to date, as they reduce costs and improve efficiency.

-

Regularly review and analyze overhead costs.

Regularly reviewing and analyzing overhead costs requires businesses to conduct periodic audits of their expenses. These audits, often performed by internal or external financial experts, aim to identify cost increases and potential savings. When conducting these reviews, it’s important for businesses to ensure that auditors have access to detailed financial data, not just surface figures. This allows them to go beyond just reviewing the numbers to analyzing them in the context of the business’s operations and goals. These audits typically involve looking at expenses over time to track key performance indicators and compare them with goals, prior performance and industry benchmarks. Auditors may also perform deeper analyses on specific expenses to calculate their returns on investment and to create actionable strategies that improve future performance.

-

Outsource non-core activities.

Non-core activities, while not directly contributing to a business’s primary services or products, are still necessary for effective operations. Some common non-core activities are payroll processing, IT services and janitorial services. By outsourcing these tasks to specialized third-party providers, businesses often spend less than they would if they were to manage these tasks themselves. These service providers can offer discounted prices by leveraging economies of scale and/or have established expertise that may not be available in-house. Additionally, outsourcing non-core activities allows businesses to free up internal resources and staff to focus on core processes and strategic initiatives.

-

Negotiate with vendors for better rates.

Some overhead costs are difficult to control in-house, including vendor rates and terms. Businesses that enjoy long-standing relationships with their suppliers and service providers can leverage their positive history to negotiate more favorable terms. These terms may include bulk or exclusivity discounts, extended credit terms, lower service rates and preferred status during scarcity periods. Business leaders should approach these negotiations with a clear understanding of their needs and a willingness to explore alternative vendors, if a better opportunity is available.

Manage Overhead With NetSuite Accounting Software

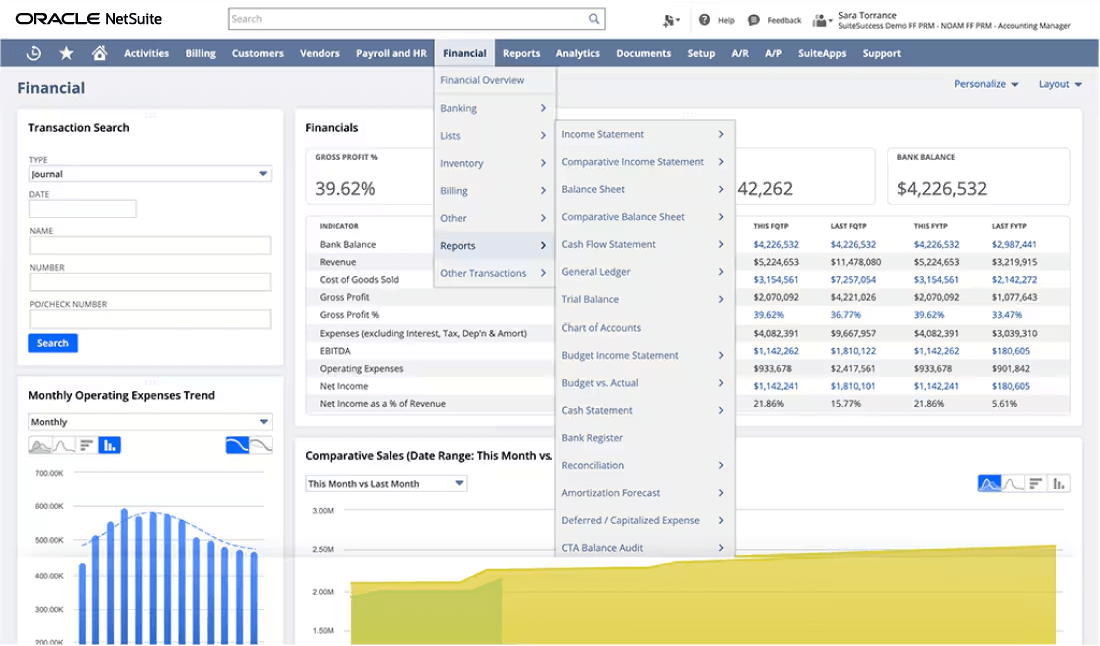

Effectively managing overhead costs is crucial for maintaining profitability in today’s competitive business environment. But businesses can only manage what they can see. With NetSuite cloud accounting software, business leaders can gain the necessary visibility to identify rising overhead costs and create strategies to increase efficiency, cut expenses and improve operations. NetSuite integrates core finance and accounting functions to quickly generate accurate reports and improve financial controls. This powerful combination enhances business performance, while reducing costs across the company.

NetSuite’s cloud accounting software automates tedious administrative tasks to minimize errors and streamline processes. Finance teams can leverage this sophisticated software to spend less time on manual bookkeeping and more time on strategic improvements. NetSuite also has built-in and customizable dashboards to provide a digestible visual representation of financial performance. This enables decision-makers at all levels to quickly identify high overhead and stay on task when cutting costs. And with NetSuite’s real-time data collection, business leaders can remain confident that they’re working with the most up-to-date and relevant information when planning their business’s future.

Strategic management of overhead costs is not just an incentive to increase margins — it’s a financial necessity in today’s highly competitive markets. To effectively manage these costs, decision-makers need a deep understanding of their business’s indirect expenses. And they must know how to reduce these costs without compromising their ability to satisfy customers. Businesses can leverage modern tools, such as cloud accounting software, to better control overhead costs. But reducing these expenses requires more than just technology; it demands deliberate and well-informed strategies. With careful planning, businesses can effectively minimize their overheads and build a leaner, more profitable organization.

Overhead FAQs

What is meant by overhead costs?

Overhead costs refer to the indirect expenses a company incurs during its routine operations. These costs are separate from the expenses that directly contribute to the production of goods or provision of services, known as direct costs. Overhead costs include office rent, insurance, administrative salaries and other indirect costs.

What does overhead mean in a business?

In a business context, overhead refers to all the expenses a company incurs that don’t directly contribute to the production of goods or provision of services. By effectively managing and reducing overhead costs, business leaders can maintain and expand profitability and facilitate growth.

What can be included in overhead costs?

Overhead costs include all expenses that aren’t directly tied to the production of goods or provision of services. These include fixed costs that remain relatively constant, as well as variable costs that fluctuate with business activity. There may also be semi-variable costs that feature elements of both categories. Some businesses further categorize these costs into production, administrative, selling and financial overhead to help decision-makers better track and analyze expenses.

What are overhead requirements?

Businesses must pay their overhead obligations to remain operational. Variable expenses, such as purchasing raw materials and office supplies, may be temporarily delayed or paused during slow periods. On the other hand, fixed costs, including rent, insurance premiums and taxes, typically need to be paid regularly, regardless of business activities.

What’s the difference between overhead and operating expenses?

Overhead expenses are indirect costs not specifically tied to the production of goods or provision of services. Overhead includes rent, insurance and office salaries. Operating expenses, meanwhile, are associated with day-to-day operations of a business. These expenses are directly related to the production and sales of a company’s products or services and include the cost of materials, equipment and inventory.

What industries typically have high overhead costs?

Industries that require highly skilled labor or expensive equipment typically have high overhead costs. The healthcare industry, for example, requires advanced — and expensive — technology, as well as highly skilled professionals who must be compensated accordingly. Those professionals include direct staff, such as doctors and nurses, as well as administrators, billing coordinators and other well-trained personnel.

What is overhead for a general contractor?

Overhead for a general contractor includes travel expenses, marketing, insurance, fuel, and vehicle and equipment maintenance. These costs aren’t directly tied to specific projects but are necessary for the contractor’s overall operations. For larger contractors, office costs and administrative salaries may also be included in overhead.