Job costing is an accounting method designed to help you track the cost of individual projects and jobs. It involves looking at direct and indirect costs, and it’s usually broken into three specific categories: labor, materials, and overhead. Understanding costs for a job at this level will help you better budget and plan for similar projects in the future, and you may discover some ways to cut costs or find items that should be billed to the customer.

What Is Job Costing?

Job costing is a precise accounting method of tracking all the costs and revenue associated with a particular project. Companies use job costing to determine the true profitability of their projects and identify cost overruns before they spiral out of control, informing data-driven pricing decisions for both current and future work.

Job costing projects include one-off customer undertakings, manufacturing new products, or delivering multiple products that will be developed at the same time. Job costs are typically broken down into labor, materials and overhead—though each of these elements can be broken down further. For instance, labor costs might include both employee wages and third-party vendor fees. Material costs can include both direct raw materials that appear in a finished product and the indirect materials used to create the product, like tools or adhesives. Companies must carefully account for and plan around each of these elements to deliver their projects successfully and on time.

Video: What Is Job Costing?

Key Takeaways

- Job costing tracks labor, materials, and overhead to reveal project profitability and flag overruns before they hurt margins.

- Construction companies, marketing agencies, custom manufacturers, and other businesses with unique projects use job costing to price work accurately and maximize profitability.

- Accurate job costing uncovers inefficiencies and improves pricing decisions by comparing actual costs against estimates throughout project phases.

- Modern accounting software provides real-time cost visibility by integrating with systems such as inventory, payroll, and project management.

Job Costing Explained

Job costing has a few primary goals:

- Understand profit or loss of each job. Job costing looks at each element involved in a specific project so you can track profitability of each one.

- Compare to estimates. By analyzing how successfully you manage estimates, you can better price jobs in the future. The purpose of job costing is to ascertain the profit or loss made on each job.

- Uncover inefficiencies and excess costs. Things like repetitive work that could be automated or poorly allocated employee resources can be addressed in future projects.

Take the example of a construction company hired to build a high-rise for a real-estate developer. The construction company will estimate every cost and then track every charge involved in delivering the project, including material and equipment costs, team and subcontractor salaries, and administrative expenses. Depending on the terms of the contract, the builder may share these details with clients so they can see the breakdown of costs. Additionally, in the future, the construction company can better quote and plan for similar projects armed with specific, real-world examples.

Why Is Accurate Job Costing Important?

One of the most impactful decisions a business makes is what to charge for a product, project, or service. In service industries, where the payroll costs are often the largest line item, it can be especially important to incorporate job costing. It’s one of the most important accounting practices for small businesses to reach gross profit margin goals. Accurate job costing can improve profitability, help you better manage employee scheduling, and be a key component of prompt financial reporting. Proper job costing leads to better profitability, project estimating, management decisions, and timely financial reporting.

Accurate job costing helps businesses strike a balance between revenue and costs on any given project by carefully analyzing each step of the job and using historical data to better inform future projects. Meticulous job costing reduces the likelihood of unexpected costs during the project life cycle, which can quickly eat into profit margins and lead to disputes with customers.

Accountants and finance departments rely on job costing for back-office processes and tax filing. For example, itemized costs help accounting teams accurately analyze how project expenses can fit into the company’s overall financial picture.

Job Costing vs. Process Costing

While related, it’s important to make the distinction between job costing and process costing. In simplest terms, job costing is a means of quantifying all of the individual costs required to deliver a unique project output like a small-scale manufacturing run. Process costing, on the other hand, breaks down costs over a given time frame, which is particularly useful when the cost of individual units or job outputs can’t easily be differentiated.

These two cost allocation methods are suited for different types of production.

- Job costing: Primarily used for unique or custom projects where costs vary by job, such as construction projects, custom manufacturing runs, professional services, and client-specific work.

- Process costing: Best for continuous, standardized production runs where identical processes are used and costs are averaged across units, like mass-produced chemicals, beverages, textiles, or electronics.

What Is Process Costing?

Process costing is an accounting practice by which companies assign costs to a collection of products or project outputs generated, usually within the course of a month, and use that to calculate a unit cost. Process costing is most often used by companies mass producing many identical or near-identical products at once.

For example, a manufacturer of white label rubber gaskets regularly fills orders for thousands of gaskets at once, perhaps on a recurring contract for a kitchen appliance manufacturer. Given that production costs do not vary between individual products—all of the same gaskets cost the same to produce—the gasket company can accumulate manufacturing costs over a fixed time and divide the overall figure by the number of units produced to determine a unit price.

What’s the Difference Between Job and Process Costing?

Job costing requires a company to quantify all the material, labor, and overhead costs required to manufacture a single job output, such as the previously mentioned construction job or a limited run of a custom item. Process costing requires businesses add all operating costs for consistent, large-scale production of similar items over time, such as white label rubber gaskets, paper straws, or smartphones.

| Job Costing | Process Costing | |

|---|---|---|

| How it works | Assign costs to the delivery of individual jobs, products, or services. | Assign costs for projects that deliver many units of the same output. |

| How it's calculated | The total labor, material, and overhead costs for a specific job. | Per unit cost of labor, material, and output, based on the total cost of delivering many units over a given time frame. |

| When it's used | Generally used in projects involving multiple workstreams with different outputs and stakeholders. | Helpful on projects that consistently deliver the same products at scale, where there is opportunity for continuous improvement. |

Who Uses Job Costing?

Almost any type of business that provides products or services to clients stands to benefit from job costing. The process can help you better understand your own costs for things like products, parts, and even how to manage your payroll more efficiently. The practice is often associated with construction companies, as they work with a rolodex of third-party contractors and each job is different. However, job costing is gaining traction in other industries, including:

- Marketing and advertising agencies: Marketing and advertising agencies must factor both direct costs and period expenses into their job costing. Period expenses refer to costs that grow over time, like rent, office supplies, and utilities.

- Construction companies: With complex projects that involve an enormous volume and range of materials, as well as partnerships with multiple subcontractors, construction companies rely heavily on job costing to deliver on budget and remain profitable.

- Consulting firms: Working on retainer requires businesses to calculate their monthly operating and material expenses so they can clearly justify their own costs to customers. Large consultancies with tactical project teams are especially dependent on job costing to scope out their projects.

- Energy utilities: Delivering energy to a city or region incurs many costs, including for staff, delivery, mechanisms, materials, overhead, and the energy itself. Job costing is the key to staying profitable in this low-margin sector.

- Engineering offices: Engineering projects frequently vary in scope and length, from one-off building designs in the case of residential engineering to multiyear consultancy and site-supervision work in the case of public construction and civil works. In all of these cases, a detailed breakdown of labor and overhead costs is crucial to accurate project scoping.

- Manufacturers: In the manufacturing sector, profit margins are often defined by scale. Smaller jobs tend to require manufacturers to break even or remain profitable, even if it requires minimum order quantities to do so. Larger jobs can be priced more aggressively as profits add up when delivering many units. Job costing can help manufacturers evaluate their costs accurately and account for labor and overhead costs, not just materials.

- Retailers: Retail companies increasingly sell their products online, which requires a major warehouse and inventory management operation. Added to this are the cost of building, running, and constantly improving their websites, money spent on advertising, and partnership with fulfillment and delivery partners. Job costing is ideally suited to managing this broad mix of variables and staying profitable.

- Transportation and logistics providers: Logistics networks are complex and require a rigorous, accurate process to accurately cost operations. From the labor costs of drivers, to variations in delivery speed depending on the shelf-life of parcels, job costing allows these organizations to factor in all the nuances of their operations to help shape their pricing and contractual terms.

- Health care and life sciences organizations: Health care institutions have a broad range of costs, such as for medical devices and equipment maintenance, salaries for physicians, nurses, and support staff, and vendor costs, like cafeteria and food providers.

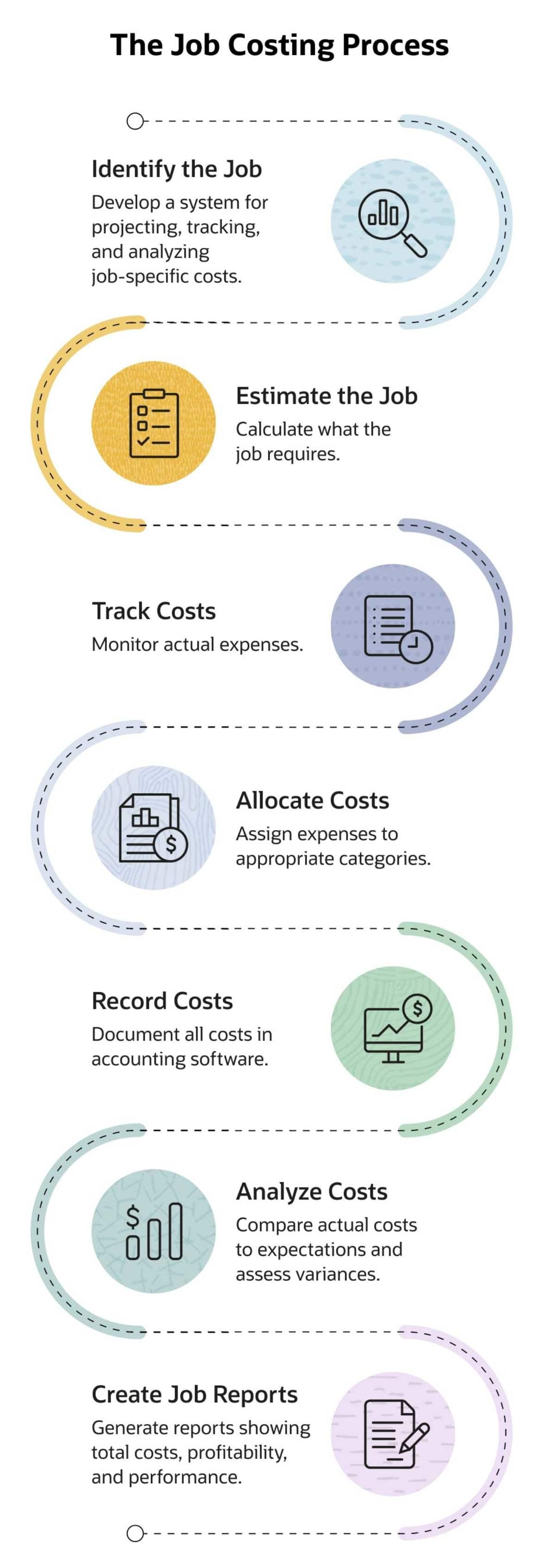

The Job Costing Process

To be effective, job costing must go beyond tracking expenses and focus on turning project data into useful financial insights. From the beginning of the job through final reporting and analysis, each of the seven steps below builds on the previous ones to paint a detailed picture of a project’s costs and profitability.

- Identify the job: Define the project’s scope, deliverables, and timeline. Assign a unique job number or code (e.g., JOB-2026-01 or ClientName-001) so every expense can be tied back to that project. Labor hours, material purchases, subcontractor invoices, even allocated overhead, for instance, should reference this code in timesheets, purchase orders, and accounting entries. These early efforts make it easier to organize costs from the start and prevent misattribution later.

- Estimate the job: Calculate projected labor, material, and overhead costs using past project data, current market rates, and the current project’s specific requirements. Estimate each major cost component separately, such as labor hours and hourly rate, material quantities and unit price, and fixed overhead costs like equipment rental. Breaking down estimates makes it easier to see later whether overruns come from labor, materials, or overhead, instead of just comparing one lump-sum total.

- Track costs: Monitor actual expenses as the project progresses by recording receipts, timesheets, invoices, and purchase orders, always tagging them with the job’s unique code. Ongoing documentation prevents unexpected cost overruns and allows for mid-project budget (or scope) adjustments.

- Allocate costs: Assign expenses to appropriate categories, such as direct labor, direct materials, indirect costs, subcontractors, or overhead. Use clear criteria: for instance, if a cost is directly tied to one project, it’s direct; if it supports multiple projects, it’s overhead. Proper allocation supports accurate profitability projections and improves future job cost estimates.

- Record costs: Document allocated costs in the accounting system, again making sure each one is tied to the correct job code. This could mean coding timesheets to a job, tagging purchase orders, or entering vendor invoices with the project reference. Recording this way creates a clear, detailed audit trail and integrates project costs with financial records.

- Analyze Costs: During each project phase, compare actual expenses to the original estimates to identify variances, calculate profit margins, and reveal inefficiencies. For example, check if labor hours are higher than planned or if material prices have increased. Ongoing analysis gives managers the chance to take corrective actions before costs balloon.

- Create job reports: Generate reports that summarize each project’s total costs, profitability, and key performance metrics. Share these with stakeholders to show results and use them internally to refine pricing strategies. Well-structured reports also create a reference library that makes it easier to benchmark new projects against past performance.

How to Calculate Job Costing

Rather than simply analyze performance from financial documents, such as income statements and balance sheets, after a job is complete, job costing helps you dig deeper into more granular costs associated with specific projects or jobs. The basic formula includes adding together the costs of labor, material, and overhead. But to calculate the cost of a job accurately, it takes meticulous analysis of each step and component of these three areas.

-

Calculate Labor Costs

This is the cost of paying all the employees involved on a particular project, including third parties and subcontractors. To calculate labor costs, multiply each employee’s payroll daily rate by the number of days spent working on a specific job.

Labor costs = (Number of working days x daily pay rate x number of workers)

This calculation assumes all workers will work the same number of days and receive the same daily pay. But the formula can be performed for as many individuals or groups as needed to accommodate different pay and hours worked, and then the costs can be summed at the end.

-

Calculate Material Costs

This includes both direct material costs (materials that comprise the finished product) and indirect material costs (materials that are required to finish the job but aren’t part of the final product). Direct costs typically include raw materials, whereas indirect costs might include things like the tools or machinery used to manufacture goods or office supplies. To calculate material costs, add all direct and indirect costs.

-

Calculate Overhead

Overhead costs can be some of the most challenging to accurately estimate, as they require managers to break down the company’s daily operating costs and attribute the right proportion to their project. Their goal is to account for the total overhead needed to complete a project, including rent on a company’s office spaces and manufacturing facilities, electricity, internet, and other business expenses. Given the difficulty, businesses sometimes apply a blanket overhead fee to each project, such as 10% per job.

Job Costing Example

Consider a luggage company that has assigned 10 employees with the task of manufacturing 20,000 new backpacks in time for the new school year. The team has four working weeks (20 business days) to complete the order. The project manager expects to work full time during that period, at a rate of $500 per day. Two warehouse managers and two supply chain managers will each work three days per week (12 days total), at a rate of $350 per day. Five plant employees will work full time to manufacture the backpacks themselves, at a rate of $200 per day.

For labor, (20 days x $500 x 1 person) + (12 days x $350 x 4 people) + (20 days x $200 x 5 people) = $46,800

Added to this are direct material costs of $20,000 for the polyester, zippers, and additional fabrics used in the bags themselves, as well as indirect costs of new machinery and office supplies, which also add up to $20,000. Added together, total material cost is $40,000.

Finally, overhead costs for the four weeks are estimated at an additional $10,000. Add that to $46,800 in labor and $40,000 in materials, and altogether our project cost equals $96,800.

Benefits of Accounting Software for Job Costing

Project accounting software makes job costing easier in multiple ways, most notably by allowing businesses to break down labor costs for large and complex projects using a simple, user-friendly interface. Additionally, job costing helps automate revenue recognition and monitor and report on profitability.

Additional benefits of accounting software for job costing include the following.

-

Timely estimations:

Accounting software helps make the job costing easier and speeds up the process. From viewing historical costs of similar jobs to prices of materials you’ve ordered, the software helps you categorize estimated expenses and view detailed costs for each step of a job, as well as the complete picture. And when the software is part of larger enterprise resource planning (ERP) software, you have even more information at your fingertips. ERP platforms bring together modules from across the business so data, such as information from human resources, inventory management, and supply chain management, all live in one digital space.

-

Accurate job pricing:

Job costing software can automatically assign costs to specific projects based on precise, predefined business rules, unlocking consistency and accuracy in the way they are broken down. So, for example, you could distinguish between expenses for certain marketing or sales campaigns.

-

Reduce customer conflict:

By accurately reporting costs, companies can make better pricing estimates and set realistic expectations for their customers. Costs can also be updated throughout the project so you can share expense details with clients as they come in and projects progress.

-

Real-time reporting:

Real-time cost information is a difference-maker for businesses working on high-stakes projects. With immediate insight into labor, material, and overhead costs, you can perform job costing not just after the fact, but also throughout the project so you can see how it’s meeting estimates and make adjustments as needed.

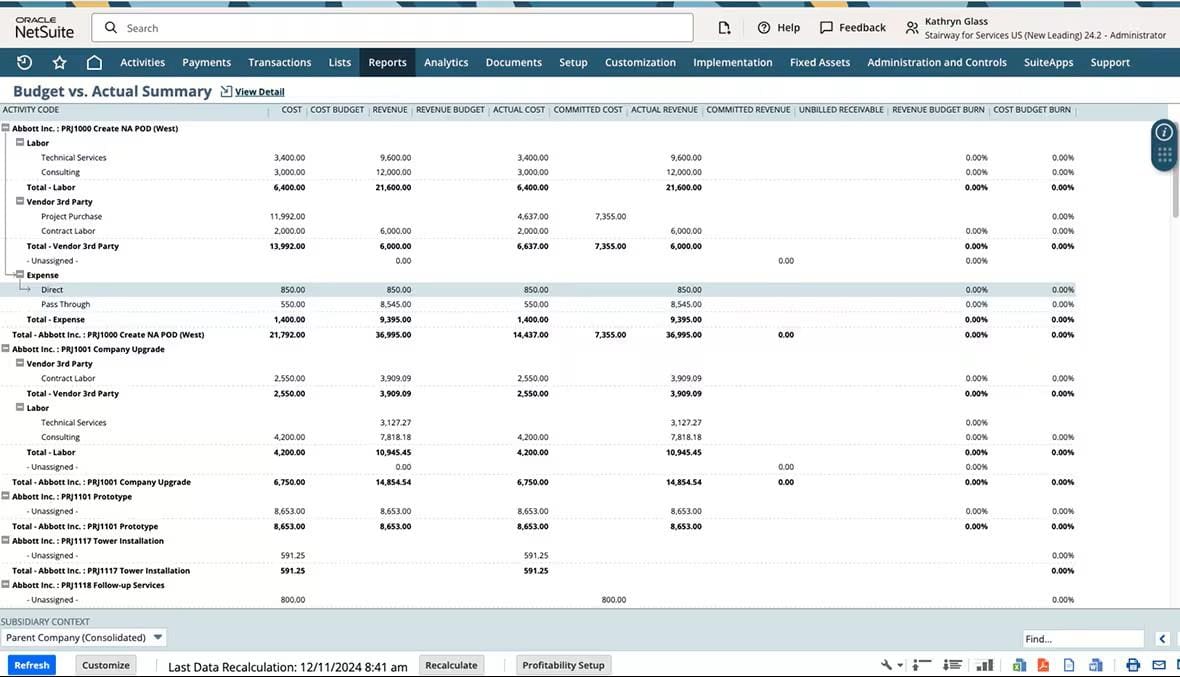

Manage Job Costing With Accounting Software

Job costing is not a standalone process. It delivers the most value when project accounting software for professional services is integrated with other modules as part of a comprehensive ERP solution. These modules can include human resources, inventory planning, customer relationship management, and more. Integrated software solutions make steps in the job costing process simpler with capabilities like automatically attributing employee expenses to the appropriate cost center for better and more accurate tracking. Together in one digital space, these solutions deliver more comprehensive visibility and control over projects across the business, in real time.

An integrated approach helps businesses make better use of their resources, deliver projects on time, simplify invoicing and discover ways to reduce overhead, in addition to maintaining healthy customer relationships. The latest accounting software is also highly scalable. From startups delivering niche products to enterprise players running multiple lines of business, users can more accurately run estimates and keep project costs in check. This empowers teams to focus on improving productivity, efficiency, and profits.

NetSuite’s Project Accounting Dashboard

The expression “time is money” is especially relevant in the context of job costing. Increased competition, tighter project timelines, and a volatile customer base have put pressure on businesses to fight for every second and every penny they can save. The first step to cost each job accurately—a task made easier with an accounting software solution.

#1 Cloud

Accounting

Software

Job Costing FAQs

What is an example of job costing?

Construction companies regularly rely on job costing to evaluate their projects. For instance, a construction project manager will evaluate materials costs (e.g., concrete, steel, and heavy machinery needed to complete the job), labor costs (e.g., the daily rate of on-site workers), and overhead costs (e.g., rent for a temporary office on-site) to create an overall project estimate.

What are job costing systems?

Job costing systems are specialized software solutions that help companies accurately estimate the costs involved in a multifaceted project. They simplify the process so that project managers can drill down into costs at the individual level and create real-time reports that can inform their future strategies.

Who uses job costing?

Companies in virtually every industry can use job costing, from construction companies to marketing and advertising agencies. By developing accurate estimates of their material, labor, and overhead costs, businesses can position themselves to deliver projects on budget and on time.

What is the importance of job costing?

The fundamental aim of any business is to make a profit. Job costing helps businesses break down the relationship between revenue and costs to discover where improvements can be made. Job costing also helps provide cost estimates for customers or clients.