Running a business can be expensive, especially during periods of increasing costs and economic uncertainty. But rising prices affect more than just direct costs, such as workers’ wages and raw materials. Businesses must also carefully track their spending on the indirect expenses that keep everything running, such as insurance, administrative costs, office supplies and more. These costs are collectively known as overhead.

Managing overhead costs plays a pivotal role in assessing profitability, setting prices and making informed decisions. But many businesses have complex overhead costs that can be time-consuming to calculate accurately. This complexity, coupled with the potential for errors, poses significant challenges for growing companies, especially small and midsize businesses. This article explains how to calculate overhead costs and allocate them to various business metrics. It also discusses how business leaders can address common challenges and ensure that their overhead calculations are timely and accurate.

Key Takeaways

- Overhead includes all the costs not directly connected to producing goods or provisioning services. This includes insurance, administration, rent and more.

- Businesses can use overhead calculations to assess profitability, allocate costs to different business metrics and calculate the overhead rate as a percentage of income.

- Overhead calculations help business leaders develop pricing strategies, find areas for improvement and enhance decision-making, budgeting and forecasting.

How to Calculate Overhead

To calculate overhead, financial professionals require a deep understanding of their company’s operations and the expenses those operations incur. To calculate different overhead rates, financial teams also will likely need comprehensive sales and/or labor data to effectively allocate costs to various metrics. These calculations place overhead costs within a larger business context to give decision-makers deeper insights into improvable areas. The six major steps to calculate overhead are:

-

Identify and List All Overhead Expenses

The first step in calculating overhead is to identify and list all overhead expenses. Overhead costs aren’t directly tied to the production of goods or provisioning of services, but they’re nonetheless necessary for day-to-day business operations. These costs include office rent and supplies, utilities, administrative salaries, insurance and more. By identifying and listing these expenses, financial teams gain a clearer picture of the costs that, while not directly contributing to revenue, still impact profits and efficiency. Tracking these expenses over time and regularly updating these lists can help companies identify trends in rising expenses early and take steps to reduce costs and improve profitability.

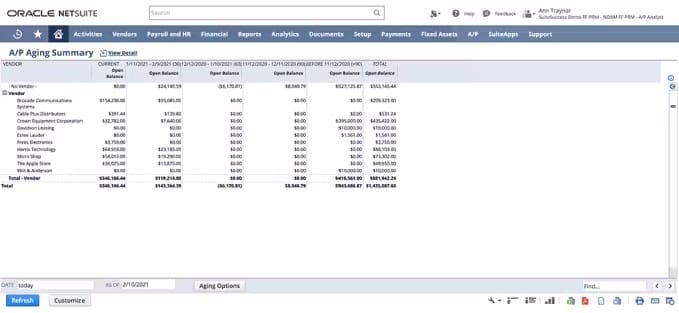

A Sample Accounts Payable Summary

A list of expenses helps accountants categorize and analyze the costs incurred as part of normal business operations. -

Categorize Expenses

Once all overhead expenses are identified, categorizing them helps accountants gain a more holistic view of expenses and understand where the money is going. Categorization involves grouping similar costs together, based on a company’s structure. For example, utilities, rent and supplies for managerial offices can be categorized as building costs, while administrative salaries and benefits can be classified as administrative costs. By organizing these expenses, businesses can simplify overhead cost calculations. This categorization also provides valuable insights into where money is going, how effectively it’s being spent and how these categories change over time. This helps businesses identify areas where costs can be reduced or additional investments may be required to build long-term success.

-

Sum Up Costs

Once all expenses are properly categorized, businesses can combine them into larger sums, often by department, category, as an overall total or by any other metric that suits their needs. This step provides analysts with a numerical value for each overhead category, which will be used to compare costs and for future calculations and analyses. These sums can be as general or specific as a business requires. For example, a small business that only sells one product may not benefit from detailed breakdowns of every overhead cost. On the other hand, a business with several diverse product lines can use that granular detail to plan future endeavors and allocate resources.

-

Determine the Allocation Base

If a business aims to assign overhead costs to specific products or services, choosing an appropriate allocation base is essential. The allocation base is the measure or factor used to distribute indirect costs across products or services, based on the most relevant driver for those costs. Businesses should choose allocation bases that reflect how they actually incur overhead costs. For example, if a primary driver of overhead costs is manufacturing, then machine hours might be a suitable allocation base. Once they choose an appropriate allocation base, businesses can then fairly distribute overhead costs across different products or services, providing a more accurate picture of product cost and profitability. This can inform pricing strategies and future manufacturing schedules. Not every business allocates its overhead costs, however, as it can be a time-consuming and complex process, depending on the nature of the business.

-

Calculate Overhead Rate

It’s now time to calculate the overhead rate. The overhead rate is a ratio that businesses use to determine how much is spent on overhead, relative to a chosen allocation base, as shown in the formula section below. Accountants and decision-makers can use this rate to determine the profit margins for goods and services and ensure profitability for new and existing business endeavors. There’s no perfect measure of what a “good” overhead rate is, as it varies by industry and business model, so it’s important for companies to track rate changes over time and compare performance to benchmarks and industry standards.

-

Compare Overhead Rate to Sales and/or Labor Costs

After calculating the overhead rate, businesses often compare this rate to their sales and/or labor costs. Through these comparisons, decision-makers can gain a clearer understanding of how overhead costs relate to the revenue generated and the labor used during a financial period. For instance, if the overhead rate is high compared with sales, this might indicate that the business isn’t generating enough revenue to efficiently cover its indirect costs and it may want to cut back on production or pivot to a new marketing strategy. Similarly, a high overhead rate relative to direct labor costs may suggest that the business is spending too much on indirect costs, such as sales teams or marketing, relative to direct operations. The company may benefit from reallocating some of those resources into direct production. Decision-makers use these comparisons to identify potential inefficiencies and develop targeted strategies to better manage costs.

Overhead Cost Formula

The formula to calculate the overhead rate is:

Overhead rate = [Total indirect costs (overhead) / Allocation base] x 100

If the allocation base is total income, for example, the overhead rate can tell a business what percentage of revenue is going toward paying overhead costs. Say a company typically spends $70,000 in overhead and brings in $350,000 in revenue over a typical month. The overhead rate calculation for this company would be:

Overhead rate = [$70,000 / $350,000] x 100 = 20%

This shows that for every dollar of revenue the company earns, $.20 goes to cover overhead.

Indirect Costs vs. Direct Costs

A company’s direct costs are what it spends to produce its goods or provision its services. Indirect costs, on the other hand, are expenses that a company incurs simply by operating, even though they’re not directly tied to the production process. A manufacturing company, for example, will have both direct and indirect costs. The direct costs would include the raw materials and labor used in production. The indirect costs would include marketing costs and administrative salaries. Reducing direct costs can be challenging without negatively affecting the quality or quantity of goods, as these costs often depend on fixed factors, such as vendor rates for materials or established labor contracts. Indirect costs, however, typically offer more opportunities for cost savings, as they don’t directly impact the output or production cycles for goods and services. By understanding the difference between these two types of costs, businesses can make targeted cuts to reduce expenses without negatively affecting their ability to meet demand and satisfy customers.

Indirect Costs vs. Direct Costs

| Indirect Costs | Direct Costs | |

|---|---|---|

| Definition | Tasks and expenses that aren’t connected to the production of goods or provisioning of services | Tasks and expenses that create goods and services that will be sold to customers |

| Included in overhead? | Yes | No |

| Examples | Administrative salaries, marketing and commissions | Raw materials, factory labor and manufacturing supplies |

How to Calculate Overhead Absorption Rate

Absorption rates are metrics that show overhead costs as a percentage allocated to specific business functions. These rates are most often employed when generating financial reports and statements, which are used by regulatory bodies, lenders and investors to assess a company’s financial performance and ensure compliance with accounting standards.

Absorption rates can take several forms and follow this general formula:

Absorption rate = (Overhead costs / Chosen allocation base) x 100

For example, if $50,000 in overhead is “absorbed” by $200,000 in labor costs, this calculation would allocate overhead into wages, as a percentage. Businesses can use this rate to calculate the real cost of their direct labor, like so:

Direct labor absorption rate = ($50,000 / $200,000) x 100 = 25%

This 25% represents the $.25 that is spent in overhead for every $1 spent on direct wages. Businesses can use this rate to set wages and budget expenses more effectively. Some other common absorption rates include direct material costs, machine hours and sales price and are calculated with the same formula, but with a different divisor.

How to Calculate Overhead Rate per Employee

Overhead can be allocated per employee, a critical measure for service-based companies projecting future costs and profits. This measure can be evenly spread out for all employees by dividing total overhead costs by the number of employees. However, it’s more common for analysts to divide by total billable hours instead. This figure can then be multiplied by the total hours worked by each employee to create a more accurate measure of costs, rather than one overall average. By using this method, businesses can allocate these costs appropriately to both full-time and part-time employees. The formula is:

Overhead rate per employee = [Overhead costs / Number of total billable hours] x Hours worked by employee

Let’s say a software development company is calculating overhead per employee for a project. This project incurred $10,000 in overhead costs. It required four full-time workers to each spend 40 hours and two part-time testers to each spend 20 hours completing the project. The overhead rate per employee would be calculated by first finding the rate per billable hour, as follows:

Rate per billable hour = $10,000 / 200 hours (40 x 4 + 20 x 2) = $50 per billable hour

Then, the overhead rate for each employee can be found by multiplying that $50 per billable hour rate by the total hours worked by each employee. With this figure, project managers can see that the four full-time employees each incurred $2,000 (50 x 40) in overhead, and the two part-timers each incurred $1,000 (50 x 20). This also shows that for every hour billed for this project, the company must pay $50 in overhead. This figure can be used to show the real labor cost for future projects, ultimately creating more accurate budgets and better-informed pricing strategies. The overhead rate per employee can also be calculated per labor cost, rather than labor hours, following a similar formula but dividing overhead by total labor costs. Businesses can use this method to determine the overhead cost relative to wages.

Common Mistakes in Calculating Overhead

As businesses grow, their overhead costs often grow with them — in both size and complexity. And if businesses can’t accurately track these rising costs, they may end up with skewed budgets, inaccurate reports and distorted forecasts. These inaccuracies can echo throughout a company and significantly impact profitability and future pricing. Here are four of the most common mistakes made in calculating overhead and strategies to avoid them.

Confusing Direct and Indirect Costs

How accountants categorize costs can vary depending on the nature of the business. For example, in a manufacturing business, office workers’ salaries are typically considered indirect costs. But for service businesses, those wages may be considered direct costs if they’re directly involved with providing services to customers. Misclassifying costs can lead to inaccurate reporting, misinformed strategies and legal and financial consequences. Businesses with complex costs can consult relevant accounting guidelines, such as those provided by the IRS, to distinguish between direct and indirect costs properly. By identifying inconsistencies, accountants can make adjustments as errors are found or standards change. Regular analysis also helps businesses adjust pricing and quickly adapt to evolving market conditions.

Overlooking Certain Expenses

As a business’s list of overhead costs grows, accountants are more apt to overlook some of them. This oversight can lead to a distorted view of expenses, resulting in business leaders’ basing decisions on an incomplete or inaccurate view of the company’s finances. Subtle financial costs, such as depreciation and amortization, should be included in the comprehensive list of expenses to ensure that every cost — small and large — is properly accounted for. If a company doesn’t have a team of financial experts, it can bring in independent auditors to check that accountants are keeping accurate books.

Not Regularly Updating or Reviewing Overhead Costs

Businesses that regularly review their overhead can quickly identify rising costs and adjust operations before these costs cut into profit margins. Regular review also helps distinguish between relevant and irrelevant indirect expenses. As businesses grow and become increasingly complex, decision-makers may be able to excise some redundant or outdated expenses without affecting productivity or output. This streamlining can increase profit margins and help businesses build a more resilient operation. A proactive approach also helps business leaders explore opportunities for potential savings, such as switching to more affordable vendors or renegotiating contracts. Additionally, updating and reviewing overhead costs can help align existing operations with nonfinancial business goals, such as increasing sustainability or energy efficiency.

Using Incorrect Allocation Bases

Analysts allocate overhead to gain a more realistic view of costs relative to overall business operations. However, not all allocation strategies are equally effective. Therefore, financial teams should carefully choose their allocation bases to focus only on metrics that can provide appropriate and usable insights. Incorrectly allocating costs can lead to incorrect conclusions and poorly implemented cost-reduction strategies. For example, say a manufacturing company allocates overhead costs only by the number of units produced and ignores machine hours. This can skew the picture of overhead costs, as it ignores expenses incurred during periods of machine downtime or maintenance. Underestimating or misallocating overhead costs in this way can lead to potential financial losses and misguided pricing strategies. To avoid this, businesses should carefully study their cost drivers and choose allocation bases that reflect the actual operations of the business. This ensures realistic cost analysis and a more precise picture of financial health.

Why Should Businesses Calculate Overhead?

According to the J.P. Morgan Chase 2023 Midyear Business Leaders Outlook report, 76% of business leaders plan to cut discretionary expenses and overhead if the economy experiences a recession. But businesses can’t improve what they can’t see, and overhead is no exception. Through robust data collection and analysis, financial managers can reduce overhead costs. This is often done with the aid of accounting software and/or an enterprise resource planning (ERP) system and ultimately allows businesses to increase their profitability and find new competitive advantages. Here are five specific ways that businesses can benefit from calculating overhead.

Pricing Products or Services Appropriately

An accurate view of overhead helps businesses understand the true cost of their products and services. For example, if a furniture manufacturer spends $100 in direct costs to produce a table, a $125 selling price may seem high enough to cover expenses and generate a profit. However, after allocating overhead to the products sold over the financial period, the manufacturer can determine the true cost of the table — significantly higher than $100 — and set prices accordingly. In this example, the initial discrepancy arose from not accounting for indirect expenses, such as office rent, managerial salaries, marketing and more. By considering these overhead costs, businesses ensure that they have enough remaining capital to pay bills, create a safety net for unexpected costs and reinvest surplus revenue into growth.

Assessing the Profitability of Projects or Products

When assessing profitability, analysts often overlook the overhead costs indirectly associated with the project or product they’re assessing. For instance, say a business launches a product without tracking overhead costs, such as sales commissions and storage. Based on direct costs and sales alone, decision-makers might initially see the product as highly profitable. But when those overhead costs start to pile up, profits can suffer, and the product may even end up incurring a loss. To accurately assess profitability, businesses need to understand and manage all costs, not just direct ones. This empowers decision-makers to locate accurate break-even points and truly gauge the profitability of new or existing business endeavors.

Identifying Areas for Cost Savings or Efficiency Improvements

To keep up with ever-changing markets and customer demands, business leaders must identify inefficiencies and implement modern strategies. To do this, they must regularly assess and review their overhead costs to spot unnecessary spending and find potential savings. If a supplier has raised its rates over the last year, for example, a business could benefit from switching to a vendor with better rates or investing in new, more efficient equipment. Through a combination of targeted downsizing, outsourcing and streamlining redundant or inefficient operations, businesses can minimize their overhead and ensure that they’re using up-to-date best practices and optimizing operations to maintain high margins and stay competitive.

Budgeting and Forecasting

Creating accurate budgets and forecasts requires overhead calculations, as these costs directly contribute to a business’s spending and ability to reach financial goals. For many businesses, manually budgeting for every overhead cost can be challenging without the aid of automated data collection and validation tools. To overcome this challenge, many accountants rely on accounting software to speed up and improve the budgeting process. This also helps businesses create dynamic budgets that can be easily adjusted as conditions change. Through more robust budgeting and forecasting processes, businesses can ensure that they have enough cash on hand to meet obligations, cover overhead and keep operations running smoothly, even when conditions change and unexpected costs arise.

Decision-Making for Expansion, Contraction or Diversification

Costs often change during phases of business expansion, contraction or diversification. When companies go through major changes, financial teams may overlook new or altered cost factors. Even well-informed, proactive strategies can fall short in predicting how these factors will impact overhead costs. To effectively track fluctuating overhead costs, businesses can use a centralized financial system as part of a larger ERP system to create a single source of data and ensure transparency. These systems often come with automated alerts and customizable financial reports to ensure that relevant users can identify every cost for analysis and improvement.

Automate Your Overhead Calculations With NetSuite Accounting Software

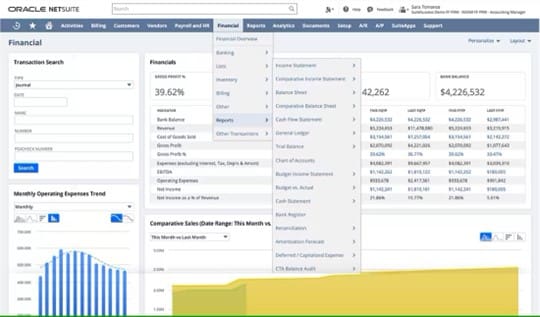

Businesses of all sizes likely have some inefficiencies and expenses that can be improved. But knowing where to look and how much can be cut before it affects customer satisfaction can be challenging. With NetSuite cloud accounting software, businesses can streamline and automate overhead cost calculations to gain a more complete view of financial performance. NetSuite eliminates redundant data entry to enhance accounting accuracy and speed up financial processes. Key features also include real-time metrics and customizable dashboards that allow decision-makers to monitor overhead costs as they occur.

NetSuite cloud accounting software automatically applies specific rules and schedules to ensure compliance with all relevant standards and enhance the reliability of overhead calculations. Business leaders can leverage NetSuite’s sophisticated software to quickly get the exact information they’re looking for, whether it’s broad, companywide financial data or a detailed, granular report on a specific process. And with NetSuite’s cloud-based platform, users can securely access everything they need to improve their financial visibility and controls wherever and whenever they need to. With NetSuite, businesses can focus on increasing profitability and growth, rather than studying spreadsheets and crunching numbers.

NetSuite Cloud Accounting Software Dashboard

Understanding overhead costs is a critical aspect of running a successful business. By effectively managing these indirect expenses, including costs related to insurance, administration and office supplies, business leaders and decision-makers can more effectively assess profitability, set prices and make informed decisions. However, the process of calculating overhead can be complex and time-consuming, especially for small and midsize businesses or those undergoing major changes. But with a systematic approach aided by accounting software, businesses can analyze their overhead to gain a clearer picture of their financial health, make improvements and create a more efficient and resilient operation.

Calculating Overhead FAQs

What is a typical overhead rate?

There is no typical overhead rate, as acceptable values vary by industry, product, business model and priorities. Generally, however, most businesses try to keep their overhead rate under 35%. Higher overhead spending rates can cut into margins and reduce overall profitability.

How do you calculate overhead and profit?

Overhead is the sum of all indirect expenses. To calculate the overhead rate, divide overhead by total income over the same period, often monthly. Then, multiply that figure by 100 to convert the rate into a percentage. Profit is calculated by subtracting total expenses (both direct and indirect) from total revenue.

How do you calculate overhead elements of cost?

Overhead cost elements include anything that isn’t directly connected to the production of a good or the provision of a service, but are still essential to the business’s day-to-day operations. These costs include rent, administrative salaries, insurance and other indirect expenses. By adding up all these expenses, businesses can calculate their total overhead costs. These expenses are often tracked and calculated with the aid of accounting software and/or an enterprise resource planning (ERP) system.