Many small businesses struggle to stay on top of their business expenses. Indeed, paying operating expenses was the most common financial challenge uncovered by the Federal Reserve Small Business Credit Survey, and 47% of business owners said they would be forced to use their personal funds if revenue disappeared for two months.

Tracking, recording and analyzing expenses is a basic component of financial management, and when done properly, it can dramatically increase the chance of a business avoiding such financial issues. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business expenses—such as payroll—are always met.

Business expenses are “ordinary and necessary” costs incurred to operate your business, such as inventory, payroll costs and rent. Also referred to as deductions, business expenses are the costs of operating a business. They’re recorded on the income statement—these expenses will be subtracted from business revenue to show a company’s net profit or loss and taxable income.

Why Should I Track Expenses?

The U.S. Small Business Administration (SBA) says that financial management covers bookkeeping, projections, financial statements and financing. Basic financial management practices include creating a budget, finding credit sources (and always having some credit available) and having a separate bank account to pay employees.

The Federal Reserve Banks of Chicago and San Francisco found a direct correlation between sound financial management and the financial health of small businesses. Businesses with above average or excellent financial health had four things in common: knowledge and experience with credit products, a higher level of unused credit balances, budgets that they revisited regularly and cash set aside cash for payroll.

Tracking business expenses helps a business:

- Create a budget. A budget is a list of all monthly or yearly expenses, organized by category. To budget properly, the business needs to know how much money it has, what it will likely spend and track budgeted expenses against actual ones.

- Take advantage of tax deductions. The IRS says to be deductible, business expenses must be both ordinary and necessary. An ordinary expense is common and accepted in the particular trade or business. A necessary expense is one that is helpful and appropriate for the trade or business. Most business expenses can either be fully or partially written-off as long as they are substantiated with documentary evidence (receipts and statements). This reduces an organization’s taxable business income.

- Manage and optimize cash flow. Tracking and regularly logging expenses according to the company’s accounting method of choice ensures there is enough cash on hand to pay for them. This also helps the business plan responsible use of credit cards, lines of credit or loans to cover shortfalls. It also helps a business maximize favorable payment terms with suppliers to take advantage of discounts and hold onto cash longer.

- Spot outliers and identify cost savings. Charting and regularly reviewing expenses help business leaders quickly spot unplanned increases in costs, determine whether they are legitimate and address them. That’s a simple way to cut unnecessary costs.

- Benchmark against other industries. The U.S. Census Bureau provides data by industry, state and region to help businesses determine whether their expenses are in line with others in their industry. If the business tracks expenses, it can regularly benchmark that data against others in its industry and geography to ensure its costs are reasonable and look for opportunities to cut them down.

- Ensure PPP loan forgiveness. Many small businesses received Paycheck Protection Program (PPP) loans to cover slowdowns during the coronavirus pandemic, and that debt will be forgiven by the federal government if it was used to cover certain business expenses. Eligible business expenses include payroll and specific costs related to business mortgage interest, rent and leases and utilities.

Video: How to Track Business Expenses

What Is the Best Way to Track Small Business Expenses?

To accurately track expenses, all small businesses need to engage in bookkeeping, which the SBA defines as the organized method of monitoring all income and expense transactions.

Done manually, tracking expenses for a small business can look something like this: as the business owner goes through the week, she collects all documents related to expenses—such as invoices, receipts, credit receipts, etc. The bookkeeper takes all those documents and enters them into an Excel template to make sure cash coming in is accounted for and expenses are being paid on time. Those numbers are put together to produce several reports completed on at least a monthly basis, including the income statement, balance sheet, cash flow statement, accounts payable report, accounts receivable report and inventory report. The business owner reviews those reports, pinpoints what doesn’t make sense or could be improved and makes changes accordingly.

Even entry-level small business accounting software can automate most of the process outlined above. This software may make this process easier by letting business users capture receipts with a smartphone camera and match them to predefined expense categories through optical character recognition (OCR) technology.

Depending on the complexity of the business and how much revenue it generates, it may choose from a variety of accounting solutions that have differing capabilities that simplify and automate accounting and financial management processes. But there are basic steps small businesses starting out need to follow to make sure the data going into the system and the processes around it are dependable.

#1 Cloud

Accounting Software

7 Steps to Track Small Business Expenses

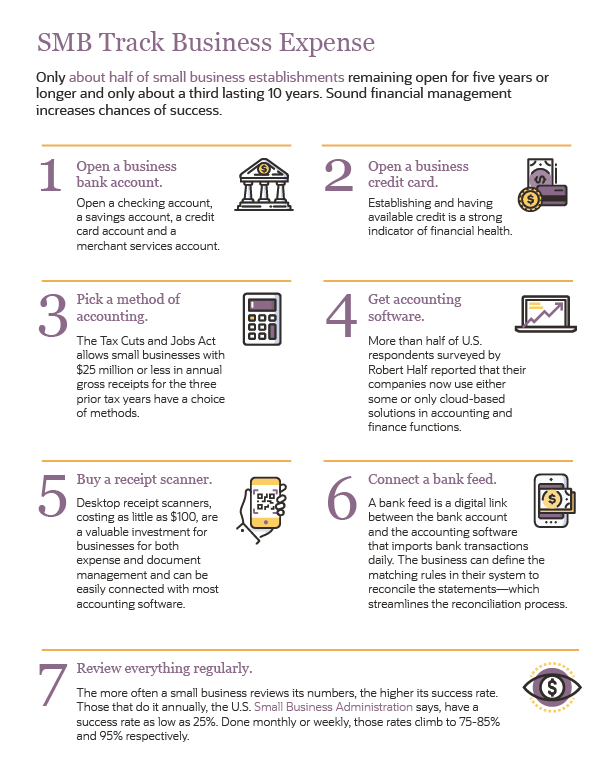

To effectively track and manage expenses, small business leaders should take these steps:

1. Open a business bank account. The Federal Reserve study reported that more than 60% of companies with excellent financial health created a budget and a separate bank account for payroll. Meanwhile, less than 5% of businesses with poor financial health completed these two basic steps.

Establishing a separate bank account for business expenses makes it easier to track them and later claim them as tax deductions. The SBA notes business bank accounts also offer personal liability protection by keeping business funds separate from personal funds. In addition, business bank accounts typically come with the option for a line of credit that can be used to cover cash flow shortfalls.

Businesses should open a checking account, savings account, credit card account and a merchant services account. The latter allows the business to accept credit and debit card transactions from customers. The business will need its federal employment identification number (EIN) to open a business bank account. A sole proprietor can use his or her social security number.

2. Use a dedicated business credit card. With a dedicated business credit card, the business canestablish a credit history to receive financing (and optimal financing terms) when it’s needed. Having credit also gives the company a way to make big purchases when it’s just starting out. Not surprisingly, available credit is an indicator of overall financial health—65% of businesses in poor financial health reported that they had no available credit on their credit cards, but 87% and 95% of businesses with above-average and excellent financial health, respectively, had credit available, per the Federal Reserve study. The SBA says credit cards help businesses negotiate favorable agreements with suppliers and can help protect businesses against identity theft. Credit cards offer perks for the business, as well, such as business rewards or travel rewards.

3. Choose cash or accrual accounting. Every small business must pick a set of rules for determining when to report income and expenses. This provides a consistent accounting method for tax purposes. In general, small businesses with $25 million or less in annual gross receipts for the three prior tax years can use either accrual accounting or cash basis accounting (the previous limit was $5 million).

However, because accrual accounting is the recognized accounting method under generally accepted accounting principles (GAAP), most private companies—with some limited exceptions—require this approach for financial reporting.

Cash basis accounting can be a more straightforward approach and easier to manage for small businesses because it records the transaction when the payment is received. Expenses are deducted in the tax year they are paid. Accrual basis accounting records the transaction on the books upon completing the sale and allows for businesses to deduct it in the tax year in which it was incurred, regardless of when the payment is made. Accrual accounting requires double-entry bookkeeping and paints a more accurate and complete financial picture because it takes a long-term view of the business.

4. Choose accounting software to automate record keeping and track expenses in one spot. Fifty-eight percent of U.S. respondents surveyed by Robert Half reported their companies now use either some or only cloud-based solutions in accounting and finance functions. These solutions make it simple to monitor, organize and pay expenses, whether invoices from a supplier, a rent payment or payroll. They can reduce the work required to track expenses and increase the accuracy of this information. Additionally, accounting software has reporting tools that can reveal money spent on each category or provide year-over-year comparisons.

5. Digitize receipts with a receipt scanner. Certain accounting software either includes or supports mobile apps that enable employees or business owners to scan receipts with the camera on their smartphone. Software in each uses OCR technology, which turns text into machine-readable code. But buying a separate receipt scanner allows organizations to scan a document, review it and categorize it—either automatically mapping the contents to defined fields in the accounting software or providing the ability to do so manually. Desktop receipt scanners, costing as little as $100, are a valuable investment for businesses for both expense and document management, and they easily connect with most accounting software systems.

6. Connect your bank account to your accounting software to import transactions. There are different levels of integration that a small business can enable with its bank depending upon the software it chooses. Businesses can download credit card and bank statements and manually import them as CSV (Excel) files into the system. Most accounting software offers a connectivity plug-in that will give you a bank feed. This digital link between the bank account and accounting software imports bank transactions daily, along with statements. The business can define the matching rules in its system to reconcile the statements, which makes the reconciliation process more efficient.

There is some accounting software that offers a direct integration to the bank, so the business owner can manage and complete all banking in the accounting system without also logging into the bank account portal.

7. Review and categorize expenses regularly. The more often a small business reviews its numbers, and the better it understands them, the more likely it is to survive and grow. Business leaders need to grasp the current- and near-term financial health of their organization and looking at expenses and related metrics frequently is a crucial part of that.

Small businesses face tough odds. Even before the pandemic, only about half of small business establishments remained open for five years or longer and just about a third lasted 10 years. But their role in the health of the national economy is enormous and essential. Businesses with less than 500 employees account for nearly half of the private sector workforce, and the SBA’s Office of Advocacy credits them with 44% of U.S. economic activity.

Tracking business expenses is a critical first step toward having the data needed for not only better day-to-day or month-to-month management, but improved long-term decision-making that will benefit employees, customers and the entire economy.