Financial statements help businesses effectively manage their revenue and expenses. The insight they provide into financial performance is especially important for manufacturing companies, which need to contend with unprecedented levels of volatility in the price of labor and raw materials. With their unit cost of labor rising nearly 5% in the second quarter of 2023 alone, manufacturers must constantly adjust their pricing models to ensure that they continue to generate profits.

When done accurately, manufacturing financial statements provide managers with a valuable starting point to analyze their business’s performance and set accurate budgets for the future. Though not always the case, manufacturing financial statements related to inventory may also be audited for tax and governance purposes, making accuracy even more important.

This article outlines the role and importance of financial statements for manufacturers, breaks down the nuances of each type of financial statement and explains how technology speeds up the preparation of manufacturing financial statements while reducing the risk of error.

What Are Manufacturing Financial Statements?

Manufacturing financial statements are reports that provide stakeholders both within and outside a manufacturing company with up-to-date information on the business’s financial performance. Internal stakeholders, including accountants and managers, use financial statements to benchmark their business’s financial performance, manage budgets and create accurate forecasts for the future. External stakeholders, such as investors and lenders, rely on financial statements for information on a manufacturer’s profitability, net worth, liquidity and solvency so they can make sound investment decisions.

Compiling manufacturing financial statements can be a painstaking process when done manually. What’s more, errors when calculating the costs of raw materials or compiling cash flow statements can lead to inaccurate budgeting, forecasting and planning. These errors, in turn, can eat into revenue and cause reputational damage — neither of which manufacturers can afford as they operate on increasingly thin margins to keep the price of their goods competitive in a volatile economy.

Key Takeaways

- Manufacturing financial statements are reports that provide manufacturing companies with valuable insights into their financial performance.

- Unlike retail and other merchandising businesses, manufacturers produce their own goods, which adds complexity to the way they track and cost for inventory.

- Accurate financial statements are essential to inform sound business decision-making, which is why many manufacturers rely on financial management software to accelerate and eliminate human error from the process.

Manufacturing Financial Statements Explained

Manufacturing financial statements are records of a manufacturing company’s activities and financial performance. They serve as a reference for internal stakeholders, who use them to assess the business’s performance and adjust their strategies accordingly; and for investors, whose contributions will depend on the business’s current financial performance and future prospects.

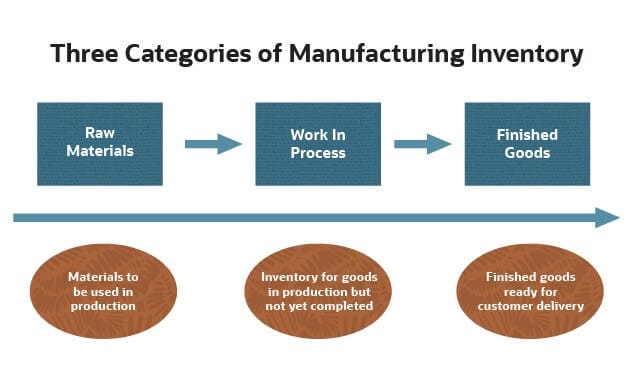

In addition to their fixed assets, such as the facilities they occupy and machinery they use to produce their goods, manufacturers typically include three types of inventories in their financial statements: raw materials, work in process and finished goods.

While general accounting statements reflect the overall financial performance of an organization, manufacturing financial statements measure the financial performance of a production facility or collection of production facilities in companies that manufacture their products in multiple locations. Manufacturing financial statements are typically used by management and external investors to inform decision-making, and inventory and sales data may also be subject to regulatory scrutiny.

What Makes Manufacturing Financial Statements Different?

The biggest difference between manufacturers’ financial statements and those of companies in other industries is that manufacturers produce their own goods, which adds a layer of complexity to their financial statements because they are required to track every cost, from raw materials to production to the point of sale. In practice, the distinction between manufacturers and, say, retail or merchandising businesses is that manufacturing inventory falls into the following three distinct categories:

- Raw materials: Raw materials refer to materials or components that will ultimately be included in a manufacturer’s finished products but have not yet been used. For instance, the schedule of raw materials for a smartphone manufacturer might include LCD screens and nickel batteries, among other components. To calculate raw material costs over a given period, manufacturers need to know the quantity that was used in production during that period.

- Work in process: Work-in-process inventory accounts for the cost of manufactured goods that are still being produced, but not those that are already complete. The cost of work-in-process inventory includes the direct cost of raw materials, direct labor costs and direct overhead costs. Overhead costs refer to the cost of running a manufacturing operation outside of monies spent on production and sales — energy and utilities, for example. For simplicity, some manufacturers combine their schedules of raw materials and work-in-process inventory into a single document, known as the schedule of cost of goods manufactured.

- Finished goods: Finished goods refer to all products that a manufacturer has produced over a given period that are now ready to be sold to customers. Manufacturing companies track these costs in a schedule of finished goods. Accounting for the costs of finished goods is more complex than accounting for typical retail merchandise, which retailers simply purchase from their external suppliers at a set price.

4 Main Manufacturing Financial Statements

Manufacturing companies assess their performance based on four main financial statements: the statement of cost of goods manufactured, the income statement, the balance sheet and the cash flow statement. This is another distinction between manufacturers and merchandising businesses, which typically develop only an income statement, balance sheet and cash flow statement. To better understand the particulars of manufacturing financial statements, it’s useful to walk through the four main types and break down how each of these reports comes together to paint a complete picture of a manufacturer’s financial standing.

1. Statement of Cost of Goods Manufactured

The statement of cost of goods manufactured summarizes the total production costs incurred by a manufacturing company during a specific accounting period. It typically includes costs related to raw materials, labor and overhead, showing the total cost of goods that were completed and transferred to finished goods inventory on a manufacturer’s balance sheet.

Below is an example of the statement of cost of goods manufactured for fictitious business ABC Manufacturing. Note the differentiation between direct costs, such as materials and labor, overhead costs and manufacturing costs.

ABC Manufacturing

Statement of Cost of Goods Manufactured

For the year ending December 31, 2022

| Direct Materials | ||

|---|---|---|

| Beginning Raw Materials Inventory | $50,000.00 | |

| Inventory Purchases | $20,000.00 | |

| Inventory Available for Use | $70,000.00 | |

| Less Raw Material Ending Inventory | $10,000.00 | |

| Total Direct Materials Used | $60,000.00 | |

| Direct Labor | $30,000.00 | |

| Factory Overhead | ||

| Energy and Utilities | $5,000.00 | |

| Equipment Repairs | $1,500.00 | |

| Total Factory Overhead | $6,500.00 | |

| Total Manufacturing Costs | $96,500.00 | |

| Plus Beginning Work in Process Inventory | $20,000.00 | |

| Total Cost of Work in Process Inventory | $116,500.00 | |

| Less Ending Work in Process Inventory | $30,000.00 | |

| Total Cost of Goods Manufactured | $86,500.00 | |

2. Income Statement

A manufacturer’s income statement records the business’s profits and losses over a set period, which can be as short as a month or as long as a year. To complete the income statement, manufacturers must first establish their sales over a given period and subtract the cost of goods sold (COGS), which is the total cost incurred by the manufacturer to produce the goods for that period. From that value, they must then subtract operating expenses, such as the cost of selling finished goods and fixed manufacturing overhead, among others. The final value will either show a net gain or net loss.

While income statements can be very complex, the example below illustrates the basic principles manufacturers must follow to create this crucial document.

ABC Manufacturing

Income Statement

For the year ending December 31, 2022

| Sales | $50,000,00 | |

|---|---|---|

| Cost of Goods Sold | $20,000,00 | |

| Gross Profit | $30,000.00 | |

| Operating Expenses | ||

| Selling | $10,000.00 | |

| General Administration | $1,500.00 | |

| Fixed manufacturing Overhead | $8,500.00 | |

| Total Expenses | $20,000.00 | |

| Net Income | $10,000.00 | |

3. Balance Sheet

A manufacturer’s balance sheet is an essential financial statement that provides stakeholders and investors with a snapshot of the business’s financial performance at a given moment in time. Accountants and managers use this information to assess their company’s performance and adjust their strategies accordingly. External investors, meanwhile, use the balance sheet as an indication of a manufacturer’s operational efficiency and liquidity, which helps them determine their potential return on investment.

The balance sheet itself tallies what a manufacturer owns (its assets) and what it owes (its liabilities). Assets include short-term assets, such as raw materials, work-in-process inventory and finished goods inventory, and long-term assets, such as production equipment. Manufacturers also include fixed assets on their balance sheets. Fixed assets are those that are difficult to move — the land and facilities where goods are produced, for example.

Liabilities include short- and long-term liabilities, as well as stakeholder equity. Short-term liabilities might include the financing a manufacturer has received to pay for its raw materials, whereas long-term liabilities might be recurring costs, such as a manufacturer’s mortgage and equipment loans.

Note the example of a balance sheet, below, which shows the total assets and total liabilities and shareholder equity for ABC Manufacturing. The ideal scenario for a manufacturer is to finish the designated period with more assets than liabilities, though this ratio will vary, based on the business’s priorities. For example, a manufacturer that has just taken out a major loan to overhaul its factory operations will shift this balance to liabilities until it pays off the loan.

ABC Manufacturing

Balance Sheet

For the year ending December 31, 2022

| Assets | ||

|---|---|---|

| Current Assets | $20,000,00 | |

| Fixed Assets | $15,000,00 | |

| Total Assets | $35,000.00 | |

| Liabilities | ||

| Short-Term Liabilities | $10,000.00 | |

| Long-Term Liabilities | $5,000.00 | |

| Total Liabilities | $15,000.00 | |

| Shareholder Equity | ||

| Common Stock | $5,000.00 | |

| Total Liabilities and Equity | $15,000.00 | |

4. Cash Flow Statement

The cash flow statement tells manufacturers how much money is coming in to their company versus how much money is going out — a ratio known as liquidity, which is commonly determined by dividing current assets by current liabilities. This information tells manufacturers if they have enough cash to both cover their operating expenses and pay off their debts during a given amount of time.

Cash flow statements also allow investors to assess the financial performance of multiple companies using the same criteria, regardless of which bookkeeping method each uses to do its internal accounting. With an objective view of each manufacturer’s liquidity, investors are better positioned to make sound investment decisions.

Note the following illustration, in which cash flow is broken into three categories: cash flow from operating activities, cash flow from investing activities and cash flow from financing activities. To calculate the total cash-on-hand that a manufacturer has at the end of the reporting period, the sum of these values is added to the cash-on-hand value from the previous reporting period. It’s worth noting that, unlike merchandising companies, manufacturers don’t treat all their costs as business expenses. Much of their direct material, labor and overhead costs are treated as inventory. In fact, the Financial Accounting Standards Board mandates specific reporting rules for the allocation of production overhead to inventory as part of its mission to improve Generally Accepted Accounting Principles (GAAP) among American businesses.

ABC Manufacturing

Statement of Cash Flow

For the quarter ending December 31, 2022

| Cash Flow from Operating Activities | ||

|---|---|---|

| Net Ssales Income | $40,000,00 | |

| Increase in Inventory | $10,000,00 | |

| $50,000.00 | ||

| Cash Flow from Investing Activities | ||

| Net Cash from Investing Activities | $5,000.00 | |

| Less Equipment Purchases | -$10,000.00 | |

| -$5,000.00 | ||

| Cash Flow from Investing Activities | ||

| Mortgage Payments | -$12,000.00 | |

| Share Dividends Paid to Investors | -$15,000.00 | |

| -$27,000.00 | ||

| Beginning Cash On hand | $20,000.00 | |

| Ending Cash On hand | $38,000.00 | |

Importance of Accurate Manufacturing Financial Statements

Manufacturing companies have many moving parts to track, manage and optimize. For instance, to produce goods, a manufacturer needs to juggle raw materials, inventory in various stages of development, equipment and employees. That makes business processes, such as planning, budgeting and performance management, particularly complex, which is why many manufacturers rely on financial statements to analyze and optimize their operations.

Manufacturers also depend on accurate financial statements to be able to adapt their strategies and pricing models to stay in line with variable market conditions. For example, a rise in the cost of copper from China might drive an electronics manufacturer to source copper for its wires from another major producer, like Chile. This, in turn, might impact the price at which the manufacturer sells its finished products. Striking a balance between profit and fair market price is no easy task, especially in today’s uncertain economy. Accurate insights into financial performance allow manufacturers to make decisions based on granular performance data.

While precise financial statements can show manufacturers where they are performing well and where they must adjust their operations to optimize profits, inaccurate financial statements can have the opposite effect. Manufacturers that make major financial decisions based on incorrect impressions of their financial performance risk putting their vitality and reputation at stake.

Mistakes in Manufacturing Financial Statements

Internal and external stakeholders alike rely on the accuracy of manufacturing financial statements to make informed management and investment decisions. Not surprisingly, then, errors in manufacturing financial statements can have major consequences, ranging from poor budgeting to inaccurate inventory valuations. These errors skew a manufacturer’s perception of its costs and revenue, which can lead to poor decision-making and financial loss. For instance, a manufacturer of PVC piping that has chosen a high-volume, low-margin sales strategy that was based on a cash flow calculation error may actually lose money on every sale. Given the stakes, manufacturers should do everything they can to avoid the following common errors in their financial statements.

- Over- or under-allocation of overhead: The over- and under-allocation of overhead costs is relatively common among manufacturers. Over-allocation occurs when a company’s actual overhead costs are lower than their allocated costs. Conversely, under-allocation occurs when a manufacturer’s true overhead costs are higher than their allocated figures. Both scenarios lead to inaccurate financial reporting, which can throw off important decisions involving budgeting, forecasting and pricing.

- Incorrect inventory valuation: Inventory management is a core manufacturing process, but accuracy is difficult to achieve for companies with limited time and employee resources. Indeed, despite advances in the way manufacturers track and monitor goods as the goods move through their organization, average global inventories on hand still grew by 30 days' worth between 2004 and 2022 (opens in a new tab). With three kinds of inventory to track, manufacturers face the added challenge of complex inventory calculations that are especially prone to error. Incorrect inventory valuations can lead to poor planning, inaccurate orders, inventory stockouts, dissatisfied customers, financial loss and, in extreme cases, reputational damage.

- Not accounting for work in process properly: The difficulty of calculating work in process is that, unlike finished goods, “work” is not an objective output. That said, work in process is a critical component of a manufacturer’s balance sheet, providing stakeholders and investors with a complete picture of the company’s performance and productivity levels. At the logistical level, inaccurate work-in-process calculations can cause confusion for procurement teams, which rely on these figures to determine how much or how little inventory to order.

Manage All Your Financial Statements in NetSuite

NetSuite cloud accounting software provides manufacturers with a complete view of their financial performance. Real-time access to financial data makes it easy for businesses to generate financial statements, dig deeper into the details of their financial performance and comply with regulatory requirements, such as GAAP. What’s more, by automating repetitive tasks, including the creation of journal entries and reconciliation of financial statements, NetSuite cloud accounting software eliminates the need for manufacturers to collect and normalize data from multiple teams to complete these operations. In turn, this saves their finance teams hours each month, which they can refocus on trends analysis and process optimization.

Checking the Pulse of Your Operations Has Never Been Easier

Manufacturing companies need the insight that timely, accurate financial statements provide. NetSuite can help. Get your free product tour today to get started.

Manufacturing financial statements are, collectively, a powerful tool that allows manufacturers to regularly check the pulse of their operations and finances so they can effectively manage their inventory, overhead and employees. By empowering manufacturing decision-makers to accurately track their costs and revenue in one place and in real time, cloud-based accounting software takes the complexity out of compiling financial statements, putting manufacturers in the best position to meet customer demand, build investor confidence and generate profits.

Manufacturing Financial Statements FAQs

How do manufacturing companies prepare financial statements?

Manufacturing companies prepare financial statements by collecting and analyzing data on their costs and revenue. More specifically, manufacturers analyze and compare sales and income with costs, including fixed assets, inventory and overhead.

What are manufacturing statements?

The four main financial statements used by manufacturers are the schedule of cost of goods manufactured, the balance sheet, the income statement and the cash flow statement.

What are income statements for manufacturing companies?

An income statement for a manufacturer is a financial statement that provides a detailed summary of a manufacturing company’s revenue, costs and profitability over a specific accounting period, typically a fiscal quarter or year. This statement is a crucial component of a manufacturer’s financial reporting and valuable insights into the financial performance of its core manufacturing operations.