As a consumer, you’ve undoubtedly been in this situation: There’s a product you like online or in a store, but it’s out of stock in your size so you move on to another item or a different store. In business and accounting, that item you like is known as a finished good — and if its manufacturer had properly managed its finished goods inventory, the item would not have run out. Understanding, calculating and effectively managing finished goods inventory provide the necessary insight for many important business decisions.

What Are Finished Goods?

Finished goods are products that have passed through all the stages of manufacturing and are ready for sale. Think of finished goods as what you see on the shelves in stores — i.e., the “merchandise” — though finished goods may also be found in warehouses and distribution centers.

Key Takeaways

- Knowing the amount and value of finished goods inventory helps a company understand its profit and determine future budgeting needs.

- Proper management of finished goods inventory helps a business satisfy demand for its products and reduce the likelihood of missed sales (stockouts) and lost revenue.

- A good grasp on finished goods inventory can help a company reduce wasteful spending on raw materials and storage space.

- Finished goods inventory is included in the current asset section of a company’s balance sheet.

- Tracking finished goods inventory by item or stock keeping unit (SKU) is important and labor-intensive.

Finished Goods Inventory Defined

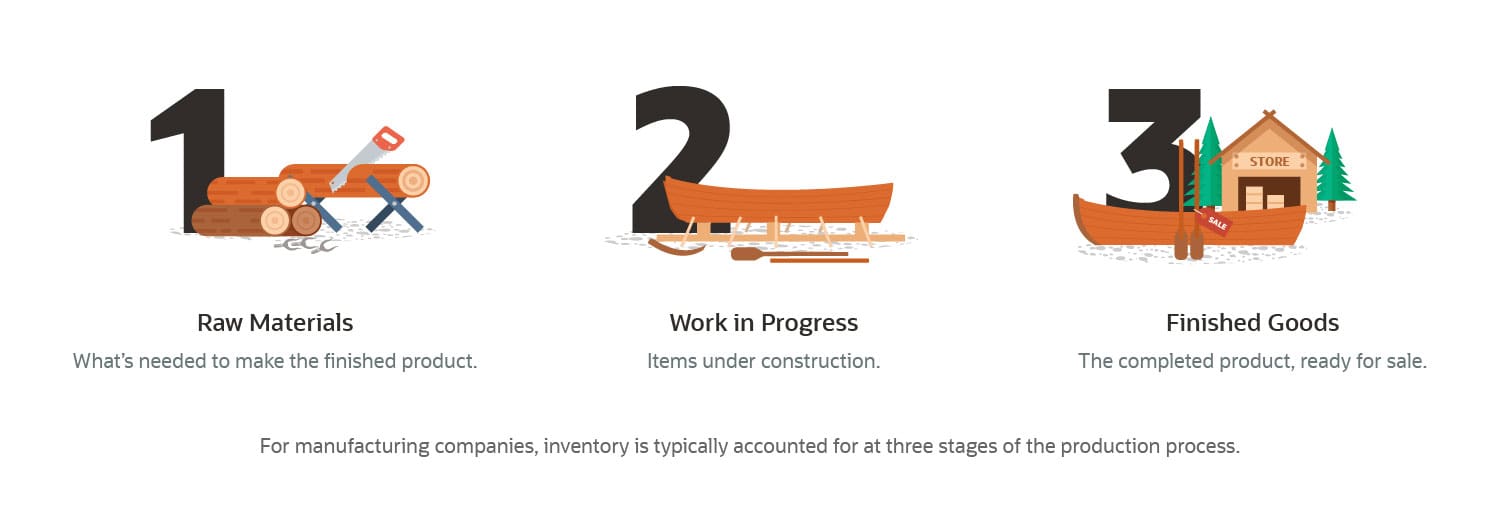

Finished goods inventory is the third and final classification of inventory that is used for accounting purposes by manufacturing companies, the items that are sold to the customer. Manufactured products begin as raw materials and then move into the work-in-progress (WIP) stage as they are being produced. End products ready for distribution and sales constitute the finished goods inventory.

Accounting for inventory follows that production workflow. Inventory value moves from raw materials to WIP and, ultimately, to finished goods through entries in the business’s different general ledger accounts. The process of moving inventory values from one account to the next allows the manufacturer to see how much inventory it has at any of the three stages. Some businesses, such as retailers that buy completed products from wholesalers to sell directly to consumers, might skip the first two classifications and only carry finished goods inventory.

It’s important to note that, as an element of business accounting, finished goods inventory is expressed in terms of the dollar value of the inventory, not the number of items. Finished goods are considered a short-term asset because they are expected to sell within 12 months; finished goods therefore appears as a current asset on a company’s balance sheet.

Why Is Finished Goods Inventory Important?

Well-managed finished goods inventory is important to the success of a manufacturing company or a retail store. By tracking it, a company better understands the inventory it has in stock for sale, helping to gauge how large an order it could accept at a specific point in time. For example, if a parent called an electronics store to see if it has the gaming console their child wants for their birthday, an effective finished goods inventory system could easily answer that question, as well as identify other stores that may have it and how many are still in stock.

Studying the history of this inventory also can help a business plan by revealing trends in seasonality or other sales fluctuations, leading to a deeper understanding of the goods that sell quickly and the ones that do not; this, in turn, feeds into analyses of the company’s cash flow and how much cash has been allocated to inventory. Inventory turnover is an important inventory management key performance indicator (KPI) that tells a company how many days it would take to sell out its current finished goods inventory and, therefore, whether it has too much or not enough cash tied up in inventory. The longer items remain in finished goods inventory, the less profitable the company is likely to be because of added storage fees, damage, obsolescence or the unrecovered expenses of making the finished goods.

3 Steps to Becoming Finished Goods

For a manufacturing product to be considered finished goods, it must go through three accounting stages that reflect its production process. To illustrate those steps, consider the hypothetical rowboat manufacturing firm, Oar Master Inc. (OMI).

- Raw materials: These are the objects needed to create the product. For OMI, that means wood, oarlocks and carbon-fiber plastic to make the shell of the boat, to name a few. For each product, it’s important for OMI to keep the correct level of stock of raw materials inventory on hand to feed the production process and generate the right quantity of finished goods.

- Work in progress: Items in the various stages of production are considered WIP inventory. They’re not yet ready for distribution or retail. The outer shell of a rowboat without the seating inside it or the oarlocks in place is, obviously, a WIP. WIP inventory value includes materials, labor and direct overhead costs.

- Finished goods: The fully manufactured and painted rowboat, outfitted with seating and oarlocks, represents the finished goods in this example. That boat is now ready to be shipped to its distribution destination.

Finished Goods Examples

Everything people buy is a finished good, including the device on which you’re reading this article. The items you bought the last time you went food shopping are finished goods. The car you drove to get to the supermarket is a finished good. The wallet that held your cash and credit cards is a finished good.

Depending on the type of company, it also is feasible for the finished goods of one business to be the raw materials of another. For example, a manufacturing company may make nuts and bolts, nails, screws and washers, which are all finished goods that become the raw materials for a different company that needs them to make its finished goods — a child’s backyard swing set, a backup power generator, a rowboat.

Finished Goods Terminology

When it comes to understanding finished goods inventory and how to determine its value, it’s important to be familiar with the key components that go into its calculation.

-

COGS — Cost of Goods Sold: COGS represents all of the direct costs a company incurred to create the finished goods it sold in a given period — such as a month, a quarter or a year. It includes the costs of materials and labor but excludes indirect expenses, such as distribution and sales costs. For example, if you run a printing business, COGS would include the paper, ink, binding materials and labor needed to produce printed materials, but not the shipping costs to deliver the finished goods to the destination point. COGS calculations reflect several different expense accounts and are shown as a subtotal on an income statement. Because COGS shows a business the true cost of the products it sells, it is crucial input for setting customer prices that ensure an adequate profit margin.

-

COGM — Cost of Goods Manufactured: COGM is similar to COGS, but it calculates the cost of all the finished goods a company produced during a specific time period, regardless of how much has actually been sold. It includes the direct costs of the materials required to make the finished goods, the labor involved and the manufacturing overhead. Also included is the value of WIP inventory at both the beginning and the end of the period in question.

COGS and COGM are similar concepts, with the primary difference being the specific items included. COGS is the direct costs of the items that were sold during a given fiscal period. COGM is the costs of the items being manufactured, which may be different than those being sold. An extreme example is that a car company may incur COGS related to pickup trucks sold out of inventory during a month in which its factory was closed and, therefore, the company had zero COGM.

-

WIP — Work in Progress: This is the inventory of items being processed but not yet ready for distribution or sale. You may also see it referred to as work in process, and the terms typically are used interchangeably. WIP is the stage between raw materials and finished goods. Such inventory can include items awaiting packaging or quality control checks, as well as packaged items. For example, a crayon manufacturing company could call both unwrapped crayons and wrapped-but-unboxed crayons WIP inventory.

-

Finished Goods: This is the inventory that’s ready to sell and to generate revenue for the company. That box of crackers in your grocery cart, or that jacket you try on at the mall, or that toy you buy for your children — they are all finished goods.

Why It’s Important to Calculate Finished Goods Value

Proper management of finished goods inventory is impossible without accurately calculating the value of finished goods for a given period. Accurate knowledge of finished goods inventory ensures that a business can satisfy demand for its products, and reduces the likelihood of missed sales (stockouts) and lost revenue — all of which leads to increased profitability. So, a finished goods inventory calculation can provide insights into a company’s gross profit, since it is often the biggest expense for a manufacturer.

In addition, regularly calculating finished goods inventory helps set product pricing, increases the accuracy of future budgets and tells you how much raw materials to order, and when, which can lessen wasteful spending and reduce inventory storage costs.

How to Calculate Finished Goods Inventory

Finished goods generally have a higher value than items in previous inventory stages because materials and labor have been added. Calculating finished goods inventory value by item is important because it helps company management set product prices that are competitive and profitable by factoring in costs for direct materials, direct labor and overhead.

Finished goods formula: The formula to determine the value of finished goods is:

Beginning finished goods inventory (dollar value) + COGM - COGS = ending finished goods inventory

Follow these three steps to use the formula to determine the value of finished goods inventory at the end of a given fiscal period:

- Determine the ending finished goods inventory value for the period before the one you’re calculating. This becomes the beginning finished goods inventory value for the current period.

- Add the COGM for the current period.

- Subtract the COGS for the current period to obtain the ending finished goods value of the period.

To illustrate these steps, let’s say that our rowboat maker, Oar Master Inc., closed out its first fiscal quarter with $100,000 in finished goods inventory. Its COGM in the second quarter was $90,000, and its COGS for the period was $70,000. Plugging those numbers into the formula, we get $100,000 + $90,000 - $70,000 = $120,000. OMI ended its second fiscal quarter with $120,000 in finished goods inventory, which is 20% more than its prior period. In a vacuum, that increase might be a cause for concern, especially if historical records show a long-term rising trend. If sales are also rising, of course, the increased finished goods inventory may be perfectly reasonable.

Finished Goods in Accounting

From an accounting perspective, finished goods are considered short-term assets since the company expects to sell them within the next year. They usually get combined with raw materials and WIP on one inventory line for the balance sheet. Businesses use the cost of finished goods to help set prices to consumers. The difference between the cost to make the goods and their retail price, commonly referred to as a markup, is the main source of a company’s profit and is used to fund indirect costs, like executive compensation. Markups can differ by industry, company and product, as well as over time.

It’s also worth noting that there are several accounting methods to determine the inventory values used when calculating COGS and, by extension, finished goods inventory. First-in, first-out (FIFO), last-in, first-out (LIFO) and specific identification are three GAAP-compliant ways to determine variables that go into the COGS calculation. These methods can yield very different values, especially during periods when material and labor costs fluctuate. They should be consistently applied from one fiscal period to another, so it’s important to select wisely. In addition, the U.S. Internal Revenue Service has its own set of rules for calculating COGS, separate from those mandated by GAAP (i.e., generally accepted accounting principles, the standards established by the Federal Accounting Standards Board).

Managing Finished Goods With Inventory Management Software

Knowing and managing the value of finished goods on hand at any point in time is essential to the financial success of many companies, especially those in manufacturing and retail. To do that, you need an effective inventory management solution. It must be precise; it must track purchase and production costs; it must automate COGS and COGM calculations to help determine the value of inventory on hand; it must be applicable down to the item (or SKU) level; and it must do all this in accordance with the inventory valuation method(s) most appropriate to your business.

Cloud-based NetSuite Inventory Management can do all of this, and for companies of any size. In addition to supporting the complex accounting issues, NetSuite software can track finished goods in multiple locations, helping to prevent stockouts and optimize inventory. In turn, it can make order fulfillment faster and more efficient. It also helps forecast inventory requirements and trends, based on time of year.

Conclusion

Finished goods are the last stage of product manufacturing, and the wellspring that generates revenue for manufacturing and retail companies. Properly accounting for the value of finished goods inventory and using that knowledge to inform business decisions can ensure that companies don’t run out of inventory before meeting customer demand. Evaluating finished goods inventory can help determine product prices, make materials procurement more efficient, and squeeze cost out of inventory processes. In short, the value of finished goods inventory is indispensable to manufacturing and retail companies’ profitable growth.

Finished Goods FAQs

What are the examples of finished goods?

Finished goods are products that are ready for distribution and sale, be they sold in stores, online or through B2B channels. Food and drink at the supermarket are considered finished goods. Gaming consoles, clothing, toys, furniture, pencils, laptops, smartphones and sporting equipment are all additional examples of finished goods.

What is included in finished goods?

Finished goods include a number of expenses, from raw materials through work in progress to the final product. Direct labor, direct materials and direct overhead factor in, as do storage costs for finished goods held in inventory.

Which one of the following is an example of finished good?

Let’s say you’re an ice cream shop owner who makes all ice cream on premises. The milk, sugar, cream, eggs and other such ingredients would be the raw materials. The finished good is the tub of completed ice cream, ready for customers to enjoy.

What are non-finished goods?

Non-finished goods can include both the raw materials used to produce finished goods, as well as work-in-progress inventory. They are the items not yet ready for distribution or sale.