In today’s fast-paced and globally connected business environment, companies must navigate increasingly complex supply chains to deliver products and services to their customers. Supply chain disruptions, rapidly evolving consumer demands and intensifying competition have made inventory and production management critical to achieving and maintaining success. However, businesses must balance their on-hand inventory stock and all of the associated costs — including raw materials, labor, shipping and carrying costs — with other business strategies, such as investing in new equipment or growth initiatives. To find that balance, modern businesses need visibility into operations to identify and remove bottlenecks and inefficiencies in their workflows.

But inventory management is about more than just counting finished goods on shelves; it’s an ongoing process that begins with raw materials and follows products as they move through the entire production cycle. That’s because goods that have already begun that process but have yet to be completed, commonly known as works in process, still require resources, attention and space on the factory floor. And how companies track and monitor these “in-between” goods can have a major impact on overall performance and the bottom line.

What Is Work in Process?

Work in process refers to partially completed goods that are in the midst of the manufacturing or production process. While work in process is more commonly used by manufacturers, even businesses that sell only finished goods may still have “in process” inventory between placing supplier orders and receiving goods that are ready to sell to customers.

Costs associated with WIP goods include the supplies, labor and overhead associated with production that are required to transform raw materials into finished products. These costs are often expressed as a fraction of total costs based on the good’s production status. However, for companies with large or complex manufacturing systems, businesses can estimate WIP for a given financial period by using formulas that rely on starting and ending WIP inventory levels and production costs. This formula will be covered in more detail later in this article.

Accountants and financial teams typically list the value of WIP inventory on their company’s balance sheet as a current asset under the inventory category, distinct from raw materials and finished goods inventory. Accurate WIP reporting ensures that lenders, creditors and regulatory agencies understand a company’s true value when making decisions and calculating debt or tax obligations. Internal analysts, on the other hand, can track and manage WIP over time to identify bottlenecks and improvable areas. By addressing inefficiencies, companies can better serve their customers, while reducing waste and expenses.

-

Work in Process in Supply Chain Management

Supply chain managers compare WIP measurements to material and finished good levels over time to develop strategies that ensure that their business will have enough raw materials on hand to meet production demands without tying up too many resources in in-process goods or storage costs. According to St. Louis Fed data, manufacturers’ average inventory levels have risen over the last 30 years, making it imperative for them to determine optimal inventory levels to remain competitive without overextending their resources. This makes effective tracking and valuation of WIP as a percentage of overall inventory especially important.

By monitoring WIP, companies can better plan production schedules and align operations with overall business strategies that reduce waste and improve supply chain performance, such as just-in-time or lean manufacturing initiatives. For example, a company with high inventory levels relative to WIP may want to slow down production until sales can catch up, minimizing carrying and material costs in the meantime. On the other hand, if WIP goods are outpacing raw materials, the business might want to increase supply orders or look for ways to speed up procurement before stockouts occur.

-

Work in Process in Accounting

For accountants, WIP represents the total costs of all the unfinished goods remaining at the end of an accounting period. These costs, which are accumulated in the WIP account, include materials, labor and manufacturing overhead and are listed as a current asset on the balance sheet. Once the goods are completed, the costs are then transferred from WIP to the finished goods inventory account. Then, when the finished products are sold, the costs are recognized as cost of goods sold (COGS) on the income statement. Through this meticulous reporting, businesses can track their costs and determine how quickly they can turn inventory investments into sales and profit.

Key Takeaways

- Work in process refers to all partially completed goods in the manufacturing or production process and their associated costs, including raw materials, labor and overhead expenses.

- Businesses calculate and analyze WIP over time to identify bottlenecks, optimize inventory and better allocate resources. WIP is typically listed as a current asset on the balance sheet, a key financial document.

- While work in process and work in progress may both be labeled “WIP,” they can mean different things, depending on the context and industry. Typically, work in process refers to short-term operations, while work in progress is more commonly used to describe long-term capital projects.

Work in Process Explained

Businesses use WIP data to gain visibility into their manufacturing and production operations. By understanding the value of the goods currently in production and comparing that value to other key metrics, including finished inventory and forecasted demand, companies can make better decisions about resource allocation, production scheduling and inventory management.

For example, say a manager has been tracking WIP over the last six months and notices a steady increase without a proportional increase in finished goods. Upon further analysis, the manager sees that materials are consistently getting stuck at one assembly process, creating a bottleneck that slows down the entire operation. By taking steps to address this bottleneck, the manager is able to improve the overall efficiency of the operation, ultimately reducing carrying costs and clutter from surplus unfinished goods waiting for their next step. Additionally, by tracking WIP over time, decision-makers can spot trends to better plan for future production needs and adjust inventory levels accordingly.

WIP also impacts other financial metrics and key performance indicators (KPIs), such as COGS and gross profit margins. Together, these financial metrics paint a more detailed and accurate picture of a company’s financial health, rather than “all-in” metrics like net profit. Not every business tracks WIP, however, as goods with short production cycles may not spend enough time or incur enough costs between raw materials and final goods to justify a standalone KPI calculation. Efficient management of WIP helps improve inventory turnover rates, indicating better production efficiency and inventory management. For these businesses, tracking both supplies and sellable inventory over time reveals similar insights into production efficiency and risk of overstocking or understocking.

Work in Process Inventory Formula

Accurately calculating work in process inventory allows businesses to determine the amount of costs tied up in partially completed goods at any given time. This prevents overstating or understating other financial metrics, including COGS on the income statement, when generating financial statements or calculating tax obligations. And by continually recalculating WIP over time, businesses can identify issues early, such as a consistently increasing WIP level without any increase in demand.

The work in process inventory formula is:

WIP inventory = Beginning WIP inventory + Manufacturing costs - Cost of finished goods

The elements that compose this formula are:

-

Beginning WIP inventory: The starting value for WIP goods, carried over from the previous financial period.

-

Manufacturing costs: Raw materials used, direct labor expenses and overhead costs incurred during the period, such as utilities or equipment costs. These overhead costs can be allocated in different ways, depending on the chosen accounting method, such as per good or per hour.

-

The cost of finished goods: The manufacturing expenses that went toward goods that were completed during the financial period, including goods that were part of the beginning WIP inventory and goods that were started and completed during the given time. Keep in mind that this isn’t the amount that the goods will be sold for but, rather, the costs associated with producing them.

For example, let’s say a furniture manufacturer had a beginning WIP inventory of $50,000 and incurred $200,000 in manufacturing costs ($75,000 for materials, $100,000 for labor and $25,000 in overhead costs) during the period. During that time, it completed $180,000 in furniture and sent that inventory to stores.

This manufacturer’s WIP calculation would be:

WIP inventory = $50,000 + $200,000 - $180,000 = $70,000

That $70,000 would then be reported on the balance sheet as a current asset, titled work in process inventory.

Work in Process vs. Work in Progress

While the terms “work in process” and “work in progress” are occasionally used interchangeably, there are some key differences between the two concepts. Work in process generally refers to partially completed goods with relatively short production cycles. These goods are typically considered “normal” business operations and follow general, day-to-day workflows. In contrast, work in progress usually encompasses larger projects or long-term capital investments, often spanning multiple accounting periods and involving more complex activities beyond just physical production, such as building a new factory.

The chart below highlights how work in process and work in progress diverge in key areas.

| Work in Process Work in Progress | Work in Progress | |

|---|---|---|

| Scope of work | Scope of work Specific tasks related to the transformation of raw materials into finished products. All tasks and activities needed to complete a project or product; not limited to physical goods. | All tasks and activities needed to complete a project or product; not limited to physical goods. |

| Industries | Industries Predominantly used in manufacturing and industrial sectors. Broadly used across various sectors, including construction, software and creative industries. | Broadly used across various sectors, including construction, software and creative industries. |

| Financial statements | Appears as a current asset on the balance sheet. | Placement varies; can be a current asset or a long-term asset, depending on the project’s duration. |

| Accounting treatment | Considered an inventory asset; includes cost of raw materials, labor and overhead until the product is completed. | Accounting practices vary by industry; may include costs associated with the project until completion. |

| Asset liquidity | Less liquid, as it involves physical inventory that needs to be completed and sold. | Liquidity varies, based on industry and asset. |

| Typical time periods | Usually short-term, aligning with production cycles. | Time periods can vary widely, from short-term projects to multiyear constructions. |

| Industry applications | Manufacturing of goods, assembly lines, production plants. | Construction projects, software development, creative projects, such as film or book writing. |

| Measurement | Production units, cost accumulation at specific production stages. | Progress stages, milestones or percentage of completion, not necessarily in financial terms. |

| Management focus | Optimizing production processes, reducing cycle time, improving inventory management. | Achieving project milestones, adhering to deadlines, maintaining overall progress. |

Work in Process Examples

Bertha’s Bakery is a hypothetical commercial bakery that produces a variety of baked goods. Its production process involves multiple stages — mixing ingredients, baking, cooling, decorating/finishing and packaging — with some complex goods requiring days or even weeks to fully bake, package and ship to customers. At the start of an accounting period (one month), the bakery had $25,000 worth of partially baked goods and ingredients in its WIP inventory from the prior period. During the month, it spent $60,000 on ingredients, $75,000 on wages for bakers, decorators and packagers and $45,000 on overhead costs (utilities, equipment maintenance and other expenses). Through these expenses, the bakery created $155,000 in finished and sellable goods.

Using the WIP inventory formula, the bakery’s WIP inventory would be:

WIP inventory = Beginning WIP ($25,000) + Manufacturing costs ($60,000 + $75,000 + $45,000) - Cost of goods manufactured ($155,000) = $50,000

The bakery can now see that its WIP inventory is increasing. While a one-time increase is not necessarily indicative of a larger trend, the business is concerned that overstocking goods would be a costly mistake, as perishable goods have a short shelf life before they become unsellable. Bertha’s Bakery decides to take proactive steps to prevent waste by slowing down production until sales increase enough to justify a larger inventory investment.

Hypothetical clothing manufacturer Cassidy’s Clothing has a manufacturing workflow that relies on skilled artisans carefully crafting high-quality garments. This detail-oriented and hands-on production process frequently leads to high WIP inventory to effectively meet demand and minimize business interruptions. The company began the financial period with $32,000 worth of unfinished clothing in various stages of completion. Over the period, it spent $95,000 on fabrics and supplies, $80,000 on labor and $50,000 on manufacturing overhead and produced $240,000 in sellable clothing.

Cassidy’s Clothing’s WIP inventory calculation would look like this:

WIP inventory = Beginning WIP ($32,000) + Manufacturing costs ($95,000 + $80,000 + $50,000) - Cost of goods manufactured ($240,000) = $17,000

The $17,000 remaining WIP inventory is significantly lower than the $32,000 that Cassidy’s Clothes started with. If this trend continues and sales keep pace with finished inventory, the business’s sales may outpace production, leading to stockouts, frustrated customers and lost revenue. To counter this, Cassidy’s Clothes increases its production schedule to meet rising demand.

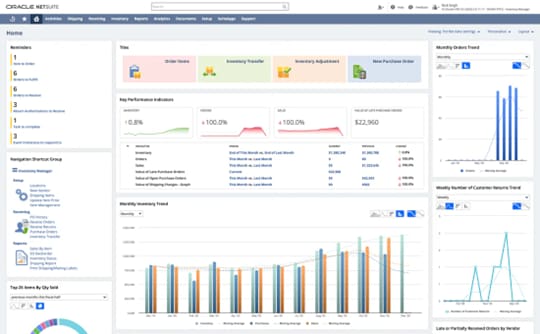

Manage Your Work in Process Inventory and Accounting With NetSuite

Effectively tracking and managing WIP inventory is critical for manufacturers hoping to optimize production, control costs and ensure accurate financial reporting. However, many companies still rely on manual processes or disconnected systems that lack the visibility needed to see exactly what’s happening between procuring raw materials and finalizing goods. With NetSuite Inventory Management, managers and decision-makers can monitor and control inventory levels across all production stages and locations from a centralized platform. NetSuite’s cloud-based solution enables users to securely access all the relevant data they need through intuitive and customizable dashboards, wherever and whenever they need to.

NetSuite’s comprehensive financial capabilities allow businesses to monitor goods as they move through the manufacturing cycle, providing real-time updates on work in process inventory and its associated costs. By leveraging this data, business leaders can proactively identify bottlenecks, improve production scheduling and better allocate working capital. And NetSuite’s built-in advanced inventory controls help businesses ensure quality and compliance at every step of production, enhancing customer service while increasing profitability.

NetSuite’s Customizable Solution

Businesses leverage work in process inventory data to develop more effective strategies that balance raw materials and finished inventory levels with production schedules and resource requirements. This data also gives leaders more detailed visibility into manufacturing workflows by monitoring where goods are and the costs they have incurred as they move closer to their final destination, the customer. Through ongoing WIP trend analysis, businesses of any size can more closely align their inventory levels with other key metrics, including sales and demand, to minimize waste and delays without impacting sales or customer satisfaction.

Work in Process FAQs

What is included in work in process inventory?

Work in process (WIP) inventory includes all partially completed goods that are currently in the manufacturing or production process. WIP accounting lists these interim goods as a separate and distinct category.

How do I account for work in process inventory?

Work in process (WIP) inventory is typically listed as a current asset on the balance sheet. As goods are completed, the costs accumulated under WIP are transferred to finished goods inventory. Then, after finished goods are sold, these costs are converted to cost of goods sold and listed on the income statement.

What is the meaning of work in process?

Work in process refers to goods that are currently in the manufacturing process and will be transformed into finished products over a relatively short period of time. This measure typically includes associated costs, such as raw materials used, direct labor costs and overhead expenses incurred up to that point in the production cycle.

What is the meaning of work under process?

Work under process is another term for work in process. Like work in process, it refers to the inventory and associated costs for goods that are partway through the manufacturing cycle.

Is it work in progress or process?

Both work in progress and work in process are used to describe partially completed projects, though their usage may vary in different business contexts. Work in process typically refers to manufacturing environments and short-term inventory creation, while work in progress typically encompasses broader projects and long-term investments.

Is it correct to say work in process?

Yes, work in process is a commonly used accounting and operations term when referring to partially produced goods and their costs. It’s most commonly used in a manufacturing context, but other industries also use it to describe goods that are in between raw materials and sellable products.