Leasing assets is a common practice for companies of all sizes and industries. Among their many advantages, leases increase businesses’ purchasing power, decrease maintenance costs (if the lessee isn’t responsible for maintenance), and help better manage cash flow.

Accounting for leases was overhauled in 2019 for publicly traded companies and in 2021 for private companies. Changes to rules were particularly extensive for lessees, even though the core principle of classifying leases based on how much they’re like an outright sale remains intact. The changes included big philosophical shifts along with many small adjustments, with the primary change being that lessees are now required to carry the operating leases on their balance sheets if they last more than 12 months; the idea is to give investors a better understanding of a company’s long-term liability.

Remaining compliant with the new rules has proved to be more difficult than anticipated, especially for companies without the right accounting systems in place.

What Is Lease Accounting?

Lease accounting refers to the treatment of lease-related revenues and expenses for financial recordkeeping and reporting. Accounting standards from several rule-setting organizations, including the Financial Accounting Standards Board (FASB) and Government Accounting Standards Board (GASB) in the US, and the International Accounting Standards Board (IASB), govern how leases are classified for accounting purposes.

Lease accounting aims to properly reflect the true nature of the underlying lease agreement for key considerations, including:

- Proper recognition of lease liability on a lessee’s balance sheet.

- Recording and properly valuing the asset at inception and as that value changes throughout the duration of the lease.

- Recognizing and valuing lease liability at inception and as that liability changes throughout the duration of the lease.

- Proper recognition of income statement aspects, such as lease revenue and expenses and profits and losses on leased assets.

What Is a Lease?

A lease is a contract between two parties for the temporary use of an asset in return for payment. Businesses use many types of leases, tailoring them to include details specific to each agreement. Leases can involve all kinds of assets, from property, such as office buildings, to equipment, such as computers, cars, trucks, and factory machinery. A lease contract documents key terms for each lease and is signed by both parties: the lessor and the lessee.

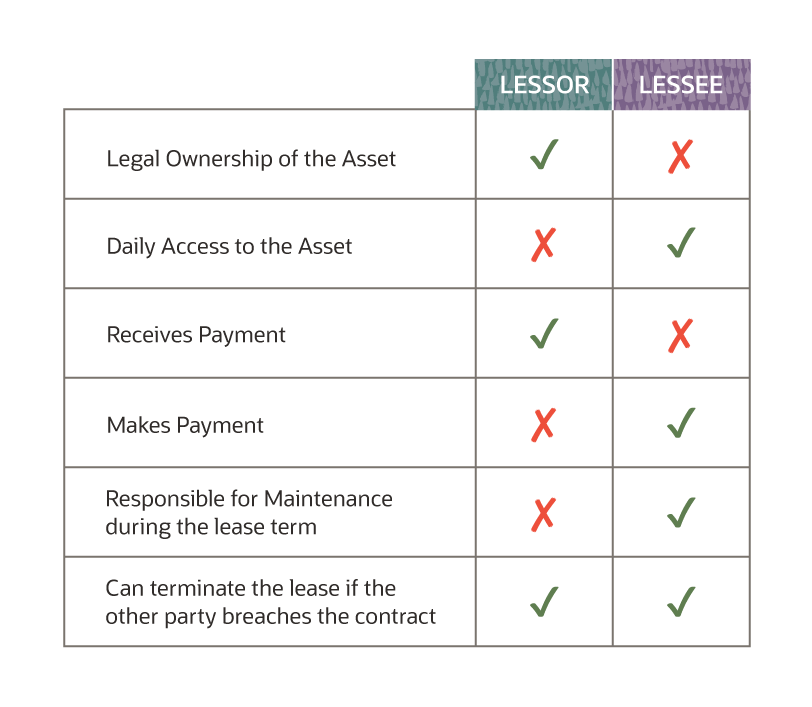

- What is a lessor? The lessor is the entity that owns the asset being leased. Lessors receive payment in return for giving up their right to use the asset during the lease term, although they maintain ownership.

- What is a lessee? The lessee is the entity that pays the lessor for use and day-to-day control over a leased asset during the lease term, in accordance with the lease agreement.

- Lessor vs. Lessee: The lease agreement describes the obligations of both lessor and lessee. Breaching these terms can cause early termination by either party. Typical lessor and lessee obligations are compared below:

Leases differ from rental agreements in many ways but the two most significant are duration and control. Rentals tend to be short-term—typically 30 days, max—while leases skew longer, often measured in years. Short-term leases have a duration of 12 months or less; while lease accounting rules do technically apply to them, as a practical matter, most lessees take advantage of an exception for short-term leases that do not include an option to purchase the underlying asset. Ultimate control of an asset, as in its maintenance or modification, remains with the asset owner for rentals, but leased assets are typically controlled and maintained by the lessee.

Key Takeaways

- Leasing is common among companies of all sizes and industries, offering access to resources they couldn’t otherwise afford, increasing their purchasing power, and assisting in managing cash flow.

- Current accounting standards aim to increase transparency of leasing activity on a lessee’s financial statements by eliminating prior “off balance sheet” treatment.

- Compliance with the updated standards increases accounting burdens, especially for international and public companies.

- The right lease accounting software saves time and minimizes the risk of errors, relieving the compliance burden for many companies.

Lease Accounting Explained

Five criteria for classifying a lease constitute an important part of the lease accounting standards. The objective of these criteria is to characterize the nature of the lessee business’s relationship with the underlying asset. The more akin to ownership control and an outright purchase, the more comprehensive the accounting will be for both lessor and lessee. The five criteria used to classify a lease are:

- Does ownership transfer at the end of the lease?

- Is there a “bargain purchase option”—i.e., a price significantly lower than the expected market value—for the leased asset that is reasonably certain to be exercised?

- Does the lease term cover the major part of the remaining economic life of the asset?

- Is the present value of the lease payments (plus any residual value guarantees) greater than or almost equal to the fair value of the asset?

- Is the asset very specialized, so can’t be used by the lessor at the end of the term?

The criteria are similar in nature to the old lease standards but eliminated specific thresholds (historically called “bright lines”) for numbers three and four. Instead, they now rely on professional judgement.

Lease Classifications or Types

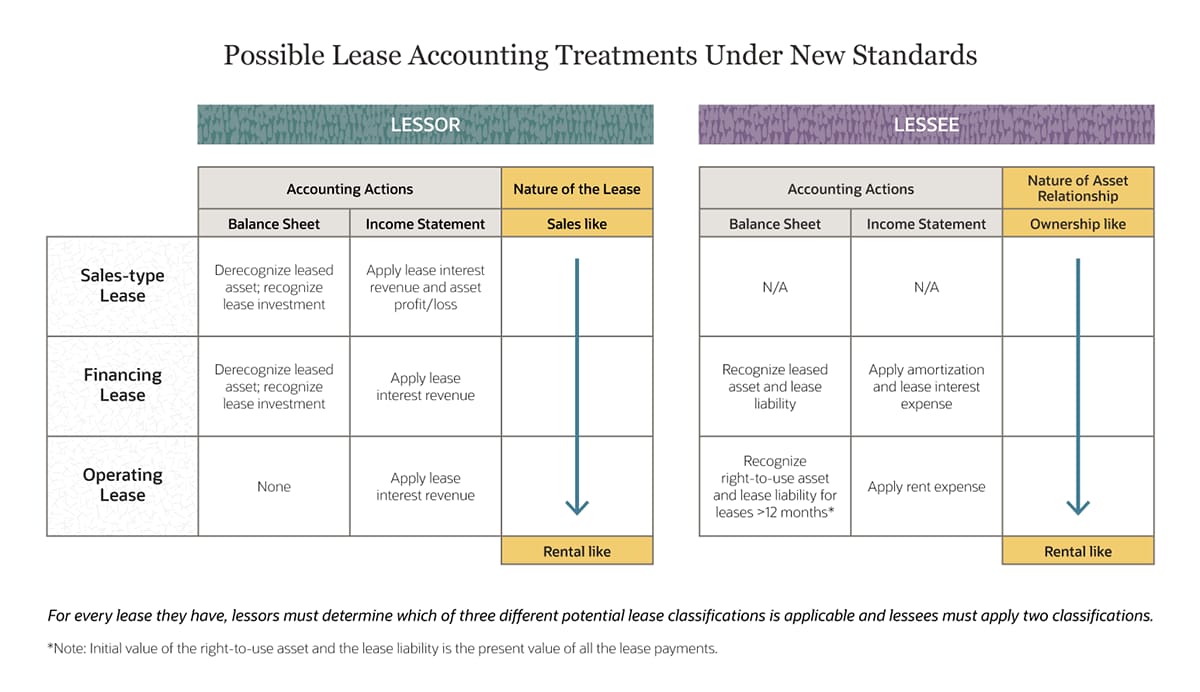

Classification of leases is important because the accounting treatment for both lessor and lessee is different for each classification. Using the five criteria explained in the prior section, leases are classified as follows:

- Sales-type: If a lease meets any one of the five criteria, it is a sales-type lease for the lessor and a finance lease for the lessee.

- Direct financing: If it doesn’t meet any of the five criteria, but the risks and rewards are similar to ownership transfer to the lessee and the value of the lease (including the residual) does not trigger profit to the lessor, it’s a direct finance lease for the lessor and a finance lease for the lessee. The technical fine print on measuring whether profit exists is similar to criterion number four, but instead of “greater than or almost equal to” the fair market value of the asset, the present value of the lease payments is “less than or equal to” that value and collectability of any residual value is probable.

- Operating lease: If a lease does not meet any of the criteria, it is an operating lease for both the lessor and the lessee.

- Operating lease vs capital lease: Evaluating whether a lease was operating or capital, a classic test question for accounting 101 students, is now outdated since the current standards no longer include capital leases, which have been replaced by finance leases.

Lessee vs Lessor Accounting

Lessors have three possible accounting treatments that may be applicable to a given lease while lessees have two. Selecting the appropriate lease accounting treatment begins with determining the classification of a lease, using the five criteria discussed earlier. Once the designation is determined, the lessor makes certain journal entries and disclosures while the lessee makes others.

Lessors classify leases as either sales-type leases, direct financing leases, or operating leases, based on the tests included in the standards. The more the lease resembles an outright asset sale, the more a lessor’s initial accounting mirrors that of a sale.

- For sales-type leases, which are, as you might guess, most like an outright sale, lessors “derecognize” the underlying asset—which simply means they remove it from their balance sheet—and add a new asset to their balance sheet in its place: an investment in the lease. Also, at this point, the lessor would recognize any profit or loss on the asset. Over the duration of a sales-type lease, the lessor records interest income and reduces the balance of the lease investment as it receives payments from the lessee. Sales-type leases are found often in the entertainment business, where movie theater technology is leased to independently owned theaters. Once the technology is installed in the theater, the lessor effectively transfers total control and responsibility for it to the lessee, usually for a 10- to 20-year lease term. At the end of the lease, the technology is likely to be obsolete, and therefore of no remaining value to the lessor. In reality, the lease is very much like a sale, which is why the movie-theater technology asset is removed from the balance sheet and replaced by the lease investment asset.

- For operating leases, which are the least sales-like, lessors retain the asset and related depreciation on their books and simply record lease income as the lessee makes payments. A straightforward example is a lease for office space in a high-rise building with multiple occupants. Since this is more like a rental than a sale, the lessor retains the building and related accounts, like a depreciation account, on its balance sheet.

- Direct financing leases can be thought of as in between sales-type leases and operating leases, although much closer to sales-type. With this type of lease, the lessor’s accounting works similarly to a sales-type lease but defers any profit or loss on the asset because it’s not quite an outright sale. This is the type of lease used by most financial institutions that acquire assets simply to make money from leasing them to customers.

Lessees can classify leases as either an operating lease or a finance lease, based on tests included in the standards. For lessees, the tests are meant to gauge the relationship with the underlying asset, determining how similar the lease is to true ownership. Under both classifications, lessees record a “right-of-use” (ROU) asset and a corresponding lease liability on the balance sheet, distinguishing leased assets from company-owned assets for financial reporting purposes. There are different accounting treatments for the two types of leases in the US standard, which is known as a “dual approach.”

- In a finance lease, the relationship is more like ownership—meaning, the risks and control of the asset lie mostly with the lessee. The lessee records an ROU asset, which is amortized, typically on a straight-line basis, over the shorter of the lease term or the asset’s useful life. The lessee also records a lease liability on its balance sheet and interest expense is recognized on the lease liability using the effective interest method. By design, this front-loaded expense pattern looks similar to depreciation plus interest on owned assets. An open-ended vehicle lease, where there is an obligation to purchase the car at the end of the lease, is an example of a finance lease.

- In an operating lease, the lessee records an ROU asset and a lease liability on their balance sheet. As lessees make payments over the lease term, they amortize the ROU asset and reduce the lease liability, recognizing the combined amounts as a single “lease expense” on their income statements. A closed-end vehicle lease, where the car must be returned to the lessor at the end of the lease, is an operating lease.

Why Were New Lease Accounting Standards Enacted?

One of the main reasons that lease accounting standards were changed was to eliminate off balance sheet treatment of operating leases. Under the old standards, a lessee’s liability for future amounts owed under operating lease contracts did not appear on its balance sheet. Rather, the liability was disclosed only in footnotes to financial statements. This treatment understated total liabilities on the financial statements, thus skewing some financial analyses, including debt covenants and certain key performance indicators (KPIs). Putting operating leases on the balance sheet increases the transparency of financial statements with regard to a company’s financial obligations (aka liabilities), as well as the property and equipment (aka assets) needed for company operations.

The benefit of transparency comes at a cost for lessees, especially those with operating leases. For lessees to comply with the current standards, they needed to take an inventory of all their operating leases, which was a major administrative undertaking. Then they completed numerous—and complicated—accounting calculations. Compliance changes were less dramatic for capital leases, though these are now called finance leases. The standards for lessors were largely unchanged.

Lease Accounting Standards

The current lease accounting standards are ASC 842 and GASB 87 in the US and IFRS 16 for international companies. The three standards are mostly consistent regarding lease definitions and various terminology. However, ASC 842 takes a dual approach to accounting treatment, while IFRS 16 and GASB 87 both use a single approach. There are other inconsistencies that a trained lease accountant can advise on, such as how to reflect leases on cash flow statements, how and when to revalue a lease for material changes in lease terms or impairment, and which fiscal periods on comparative financial statements may need to be restated. Conveniently, all three standards provide exemptions for short-term leases—those shorter than 12 months.

- ASC 842: This standard is from the FASB, which sets the rules for US Generally Accepted Accounting Principles (GAAP). ASC 842 establishes the three classifications of leases for lessors (sales-type, direct financing, and operating) and the two classifications for lessees (financing and operating). It also prescribes the dual accounting treatment described above. The goal of ASC 842 is to better account for leases that are, in effect, purchases. This standard went into effect for public companies in 2019 and became effective for private companies after Dec. 15, 2021. ASC 842 has since been amended to include guidance for a few extremely specific situations. The most broadly applicable amendment is ASU 2023-01 for common-control leases, which aims to clarify amortization of leasehold improvements (over their useful lives if control is expected to continue) and provide guidance on evaluating and accounting for related-party lease arrangements.

- IFRS 16: The IASB, which sets international financial reporting standards, issued IFRS 16 to specify a single accounting treatment for all leases similar to the way financing leases are handled in ASC 842. IFRS 16 is followed in jurisdictions around the world, and US companies with parents or subsidiaries abroad need to be aware of the differences between IFRS and GAAP. This standard became effective Jan. 1, 2019. A narrow-scope amendment, related to sales-and-leaseback transactions, went into effect in 2024.

- GASB 87: An equivalent organization to the FASB, the GASB defines GAAP rules for state and local governments. (Federal government GAAP rules come from the Federal Accounting Standards Advisory Board, or FASAB.) GASB 87 updated lease accounting standards for its constituents with a single treatment approach for all leases that is similar to the IFRS 16 approach. GASB 87 became effective on June 15, 2021, with no substantive amendments since.

Leasing Advantages

Leases are common because they provide many advantages to businesses. Lessees often think of leases as a “best of both worlds” scenario, where they get to use and control assets they need to run their business without the hassle and risk of ownership. Specifically, some advantages of leases are:

- Higher purchasing power: Leases typically require lower upfront costs than purchasing property outright. So, leases leave more money in the business’s pocket for other expenses. Upgrades to newer or better equipment are also easier under a lease, compared to purchases.

- Lower long-term maintenance costs: Lessees perform maintenance on leased assets only during the lease term. Carefully structuring the length of a lease relative to the life of an asset can avoid more costly upkeep for older assets.

- Better cash flow management: Negotiating leases with flexible payment schemes—think: no money down, accelerating/decelerating payments, or balloon payments—can improve a business’s cash flow. Once payment terms are set, the business can more reliably forecast its cash requirements.

- Simplified asset disposal: Lessees typically return the asset to the lessor when the lease term is complete, though a finance lease transfers asset ownership to the lessee. This is especially advantageous for businesses that need assets for a particular period only, such as certain heavy equipment needed for a multiyear construction project, and for assets that become obsolete quickly, such as computers.

Leasing Disadvantages

On the other hand, leases also can have significant disadvantages for a business, such as:

- Interest: Lease payments include an interest charge, which is an avoidable extra cost compared to outright purchasing with cash.

- Lost tax deductions: Businesses that purchase assets can claim depreciation to reduce taxable income. These deductions may be lost under certain leases. It’s important to consult a tax accountant for your specific situation and jurisdiction, especially given the updated lease standards.

- Lost residual value: The flip side to easy asset disposal at the end of an operating lease is that most times the lessee doesn’t own anything after making all the lease payments. Any salvage, or residual, value reverts back to the lessor.

- Lease administration: Even after initial adoption of ASC 842, maintaining compliance has proved resource-intensive. Companies now deal with tracking lease modifications, renewals, and common-control arrangements, while keeping ROU asset and liability balances current.

6 Lease Accounting Steps

For a typical business, there are six steps in accounting for a new lease.

- Determine whether a lease exists: Analyze the transaction to identify whether a lease, or multiple leases, exists in accordance with the lease standards. Each lease needs to be accounted for individually. Important exceptions are leases of intangible assets, inventory, assets under construction, biological assets, and assets related to certain environmental explorations (for example, oil and gas assets), all of which are covered by other standards.

- Remove non-lease components: Any non-lease components involved in the transaction should be removed from the lease value. For example, a lease contract for office space may also include perks such as free employee parking or landlord-paid improvements. This step requires estimates or appraisals to determine the value of the perks so that a portion of the total “lease” payments can be allocated to such non-lease components.

- Classify the lease: Classify the lease using the five criteria defined in the standards, enumerated above in the “Lease Accounting Explained” section.

- Measure the lease’s present value: For most leases with a term of 12 months or more, the lessee calculates the present value of the lease payments using either the lessor’s implicit interest rate or the lessee’s incremental borrowing rate. Present value is a financial concept that considers the time value of money, using certain assumed interest rates. Simply stated, present value recognizes that today’s dollars are worth more than future dollars, and so translates future cash inflows into today’s dollars. Incremental borrowing rate, commonly used for lease present value measurement, is the rate at which a lessee could borrow a similar amount from their lending institution. The measurements establish the value of the ROU asset and the related lease liability.

- Determine amortization: Based on the lease classification, the asset is systematically reduced using either a straight-line approach (reduced by the same amount each year, over the duration of the lease) or the effective interest method (an accelerated approach that yields more amortization sooner).

- Create journal entries: Using the appropriate accounting treatment for the lease category, create journal entries to record the initial lease and all recurring entries throughout the lease duration. Lease accounting should be part of every fiscal close.

The following graphic summarizes and compares key aspects involved in lease accounting, under current GAAP standards.

Lease Accounting Example

Since operating leases for lessees were the most affected by the adjusted guidance, here’s an example to illustrate how a typical three-year operating lease would be accounted for in a series of journal entries over the life of a lease. Consider ABC Inc.’s lease of a machine from XYZ Inc., the lessor.

Assumptions:

|

Calculations:

|

ABC leased a machine from XYZ for three years for $2,500 per month, a total of $90,000. Using ABC’s 6% incremental borrowing rate, the PV of ABC’s rental payments is $82,588. Since the PV of the lease is significantly less than the machine’s fair market value ($100,000), the lease is categorized as an operating lease. Under ASC 842, ABC reports the machine as an ROU asset with a corresponding lease liability on its balance sheet.

| ABC’s initial journal entries are: | ||

| Debit | Credit | |

| Right-of-use Lease Asset | $82,588 | |

| Machine Lease Obligation | $82,588 | |

| To establish the leased asset and to recognize the lease obligation. | ||

| At the end of the first year, ABC’s journal entries are: | ||

| Debit | Credit | |

| Amortization Expense | $25,899 | |

| Right-of-use Lease Asset | $25,899 | |

| To reduce the balance of the leased asset to reflect its PV at end of year 1 ($82,588 - $56,689). | ||

| Machine Lease Obligation | $25,899 | |

| Amortization Expense | $4,101 | |

| Cash | $30,000 | |

| To reduce the machine lease obligation to reflect its PV at end of year 1 ($82,588 - $56,689), reflect amortization expense based on imputed interest ($30,000 - $25,899) and recognize the cash paid to XYZ (12 x $2,500). | ||

| Together, these two journal entries add a total of $30,000 lease expense, comprising amortization of the ROU asset and interest on the lease liability, to ABC’s income statement. | ||

| At the end of the second year, ABC’s journal entries are: | ||

| Debit | Credit | |

| Amortization Expense | $27,496 | |

| Right-of-use Lease Asset | $27,496 | |

| To reduce the balance of the leased asset to reflect its PV at end of year 2 ($56,689 - $29,193). | ||

| Machine Lease Obligation | $27,496 | |

| Amortization Expense | $2,504 | |

| Cash | $30,000 | |

| To reduce the machine lease obligation to reflect its PV at end of year 2 ($56,689 - $29,193), reflect amortization expense based on imputed interest ($30,000 - $27,496) and recognize the cash paid to XYZ (12 x $2,500). | ||

| Together, these two journal entries add a total of $30,000 lease expense to ABC’s income statement. | ||

| At the end of the third year, ABC’s journal entries are: | ||

| Debit | Credit | |

| Amortization Expense | $29,193 | |

| Right-of-use Lease Asset | $29,193 | |

| To reduce the balance of the leased asset to zero (PV at end of year 3, $29,193). | ||

| Machine Lease Obligation | $29,193 | |

| Amortization Expense | $807 | |

| Cash | $30,000 | |

| To reduce the machine lease obligation to zero (PV at end of year 3 $29,193), reflect amortization expense based on imputed interest ($30,000 - $29,193) and recognize the cash paid to XYZ Inc. (12 x $2,500). | ||

Together, these two journal entries add a total of $30,000 lease expense, recognized on ABC’s income statement. At the end of the lease term, the ROU asset was fully amortized to zero since the asset was returned to the lessor. Similarly, the machine lease obligation is also fully written off, reflecting the satisfaction of the lease payments.

Improve Lease Accounting With Software

The current accounting standards for leases dramatically changed the accounting burden, especially for lessees, by forcing the adoption of new business processes, internal controls, and system requirements. Experiences from international companies and public companies that have already adopted the standards show that many organizations continue to refine their compliance processes and technology solutions to address lease modifications, renewals, and common-control arrangements. Using manual spreadsheets may be a viable option for only the smallest and least active businesses. Lease accounting software, such as that included in NetSuite Fixed Assets Management, captures key lease details, reflects payments, generates amortization schedules, and records journal entries for every account affected by the lease, over the duration of the lease, in a secure environment.

Determining whether leasing is right for your business requires thoughtful consideration of many variables. The current lease accounting standards, ASC 842, IFRS 16, and GASB 87, continue to impact how companies manage leased assets and financial reporting for them. Using the right automated lease accounting software can help clear away accounting burdens and allow business leaders to make better-informed decisions by staying focused on the unique pros and cons of leasing for their business.

Lease Accounting FAQs

What is ASC 842 lease accounting?

ASC 842 is a standard from the Financial Accounting Standards Board that establishes three classifications of leases for lessors (sales-type, direct financing and operating) and two classifications for lessees (financing and operating). It also prescribes different accounting treatments depending on the classification. The goal of ASC 842 is to better account for leases that are, in effect, purchases. This standard went into effect for public companies in 2019 and 2021 for private companies, with a few targeted amendments added through 2025.

How do you record a lease in accounting?

There are six steps to recording a lease in accounting. First, determine whether a lease exists. Second, remove non-lease components. Third, classify the lease using the five criteria included in ASC 842. Fourth, measure the lease. Fifth, determine the expense recognition method based on the lease type. Sixth, create journal entries using the appropriate accounting treatment for the lease category.

What is the new lease accounting standard?

“New” lease accounting standards became effective in 2019 and 2021, with the goal to eliminate “off balance sheet” treatment of operating leases. The lease accounting standards are ASC 842 (FASB), IFRS 16 (IASB) and GASB 87 (GASB). ASC 842 takes a dual approach to accounting treatment depending on the type of lease, while IFRS 16 and GASB 87 both use a single approach.

What is the accounting treatment for leases?

The first step in selecting the appropriate lease accounting treatment is determining the classification of the lease, using certain tests included in accounting standards. Once the designation is determined, the lessor makes certain journal entries and disclosures, and the lessee makes others. Lessors classify leases as sales-type leases, direct financing leases, or operating leases. Lessors derecognize the underlying asset (i.e., remove the actual asset from their balance sheets), recognize any profit or loss on the asset, and establish an investment in the lease that “replaces” the asset. Over the duration of a sales-type lease, the lessor records interest income and reduces the balance of the lease investment as cash payments are received. Lessor accounting for direct financing leases is similar but defers any profit/loss on the asset. For operating leases, which are the least sales-like, lessors retain the asset and related depreciation on their books and simply record lease income.

Lessees can classify leases as either an operating lease or a finance lease, based on certain tests included in the standards. In the case of finance leases, where the relationship is more like ownership, lessees record the right-to-use asset and a lease liability on their balance sheet. Each time a lessee makes a payment, they amortize the asset, reduce the lease liability, and recognize interest expense on the income statement. In an operating lease, which is more like a rental than ownership, the rules require the lessee to follow similar steps for recording the right-of-use asset and a lease liability on its balance sheet, but the expense is reflected as a single lease expense in the operating section on the income statement.

What are the accounting rules for a lessor?

Lessors classify leases as sales-type leases, direct financing leases, or operating leases. In sales-type and direct financing leases, lessors derecognize the underlying asset, recognize any profit or loss on the asset, and establish an investment in the lease. Over the duration of a sales-type lease, the lessor records interest income and reduces the balance of the lease investment as they receive cash payments. The lessor accounting for a direct financing lease, which is less like an outright sale, defers any profit/loss on the asset. And for operating leases, which are the least sales-like, lessors retain the asset and related depreciation on their books and simply record lease income.

What are lessor account statements?

The accounts used by lessors differ, depending on the category of lease. Lessors classify leases as sales-type leases, direct financing leases, or operating leases. Sales-type leases and financing leases impact both balance sheet and income statement accounts for lessors. Operating leases impact only a lessor’s income statement accounts.

How is a financing-related lease accounted for by lessor and lessee?

Lessors account for direct financing leases by recognizing an investment in the lease, any interest revenue, and derecognizing the underlying asset. During the lease, the lease investment balance increases for any interest income and declines as lease payments are received. Any selling profit or initial direct costs are deferred, but losses are recorded at the inception of the financing lease.

Under a finance lease, a lessee records the right-of-use asset and amortizes it over the life of the lease or the asset’s useful life, whichever is shorter. The lessee also records a lease liability. As lease payments are made, a portion of each payment reduces the lease liability and the rest increases interest expense.