The break-even point is all about equilibrium. It’s the point at which there is financial balance—where revenue exactly covers costs, meaning there’s no profit or loss. The break-even point isn’t as much an operational goal as it is an informative starting point or tool for decision-making. Most businesses and investors aim to journey beyond the break-even point into profitability. Understanding the tipping point can help businesses achieve that goal.

What Is Break-Even Point (BEP)?

The break-even point (BEP) is reached when a business’s total revenue and total expenses are equal; the business is neither profitable nor in the red. The break-even point can be measured in several ways: Sometimes it’s expressed in terms of volume, other times in sales dollars, and still other times as a target price. In addition, BEP has specific definitions for accounting, finance, and investments (more about this in the next section). But regardless of how it’s measured or where it’s applied, the underlying premise is the same for all: The amount of revenue exactly covers costs—and not a penny more.

Accounting Break-Even Point vs. Financial Break-Even Point

The accounting version of the break-even point is often expressed in units and defined as the volume of activity at which a company’s revenue and expenses are equal. For example, this could be the exact number of cars a manufacturer needs to sell in order to cover all of its variable and fixed costs. Sometimes, the break-even point is calculated as dollars of revenue needed to cover all costs, such as a carmaker producing $100,000,000 worth of cars sales to cover its variable and fixed costs.

Financial break-even point puts a different spin on the same underlying concept. Financial break-even point occurs when a company’s earnings, before interest and taxes, would result in zero earnings per share. In calculating the financial break-even point, a company can determine how much overall profit is needed before it begins meeting shareholder obligations.

A third type of break-even point is used by traders, brokers, and savvy individual investors when managing their financial investments. This version refers to the market price of a financial instrument, such as a share of common stock, needed to recoup the price paid for that instrument, plus any fees associated with the purchase and sale transactions.

Financial equilibrium is a constant thread in these break-even point versions. The balance of this discussion relates to the accounting break-even point.

Key Takeaways

- The break-even point is the point at which a company’s revenue and expenses are equal—meaning, no profit but no loss.

- The break-even point is an important management metric for startups and established businesses alike, especially for making strategic decisions.

- The formulas involved in calculating the break-even point are relatively straightforward, but obtaining the requisite accurate data can be a challenge.

- Multidimensional software that simplifies revenue- and expense-tagging can help keep break-even analysis accurate and current.

Break-Even Point Explained

Businesses of all sizes and at all stages in their life cycles should analyze their break-even points. Indeed, this is critical for any organization seeking to understand what production levels it needs to recoup its variable costs and pay for its fixed costs.

- Variable costs are those directly tied to a company’s activity. As production increases, so do variable costs. A few examples of variable costs are costs for raw materials used to produce a finished product, sales commissions, and hourly direct labor.

- Fixed costs do not change in proportion with activity. Examples of fixed costs include rent, property taxes, and insurance costs.

| Variable Costs | Fixed Costs |

|---|---|

| Raw materials and inventory | Rent or mortgage payments |

| Production supplies | Property taxes |

| Shipping and freight charges | Insurance premiums |

| Hourly wages and sales commissions | Salaries for permanent staff |

| Utilities and fuel | Loan and lease payments |

| Maintenance costs and supplies | Subscriptions and licenses |

Let’s distinguish between the two types of expenses with an extreme example: If a company completely stopped production, would this expense exist? If so, then it’s likely a fixed cost. If not, it’s likely a variable cost. As a practical matter, assigning costs to the right general ledger account helps facilitate identification of variable versus fixed costs.

While the break-even point identifies the level of production and sales needed to precisely cover both sets of expenses, for a business to be profitable, revenue must exceed its variable and fixed costs. Production levels above the break-even point result in profit; production levels below the break-even point result in company losses. Understanding this tipping point is an essential component in determining product pricing, forecasting financial status, and monitoring other business-planning goals.

Why Is Break-Even Point Important?

The break-even point is an important data point that helps inform many business decisions. It also provides a better understanding of the variable and fixed costs involved in the company’s operations. For example, once a break-even point has been calculated, the company can more accurately determine how much it needs to produce and sell to break even. A manufacturer would want to make sure it has the production capacity or labor force necessary to scale above the break-even point, for instance.

The break-even point is also important because it helps the company assess how much time and capital it might need to cover losses incurred until it can ramp production up to and beyond the break-even point. Additionally, the break-even point helps external stakeholders, such as investors and lenders, decide whether to engage with a given company, based on their desired return on investment or how much credit risk they can tolerate.

How Is Break-Even Point Used?

The break-even point is helpful by itself, but it’s also a key data point for planning various business scenarios. For example, cost-volume-profit (CVP) analysis uses break-even points to show how potential changes in a company’s sales volume may affect its costs, revenue, and profits. Let’s dive into five other common business situations that can benefit from break-even point analysis.

- Starting a new business: Entrepreneurs use break-even analysis to determine initial funding requirements and to estimate how long they’ll need to operate before covering all costs. This is a key part of creating a realistic business plan, setting appropriate funding targets, and pitching the business to investors and lenders.

- Launching a new product: Companies use break-even points to determine initial production volumes and pricing strategies for new goods and services. By comparing these figures with demand forecasts, businesses can evaluate whether projected sales will realistically cover development and production costs and earn enough profit to justify new offerings.

- Setting or changing prices: Break-even points allow businesses to estimate how different pricing levels will affect the number of units that must be sold to cover costs. This assessment helps companies make well-informed decisions when balancing competitive pricing with profitability requirements and revenue goals.

- Risk evaluation: Break-even analysis shows how changes in costs and strategic pivots will impact profitability so businesses can assess risks and make data-driven adjustment, investment, and expansion decisions.

- Evaluating cost changes: When costs change due to market fluctuations or operational changes, companies can use break-even points to maintain profitability by determining optimal price increases and how best to adjust production volumes or efficiency targets.

How to Calculate Break-Even Point

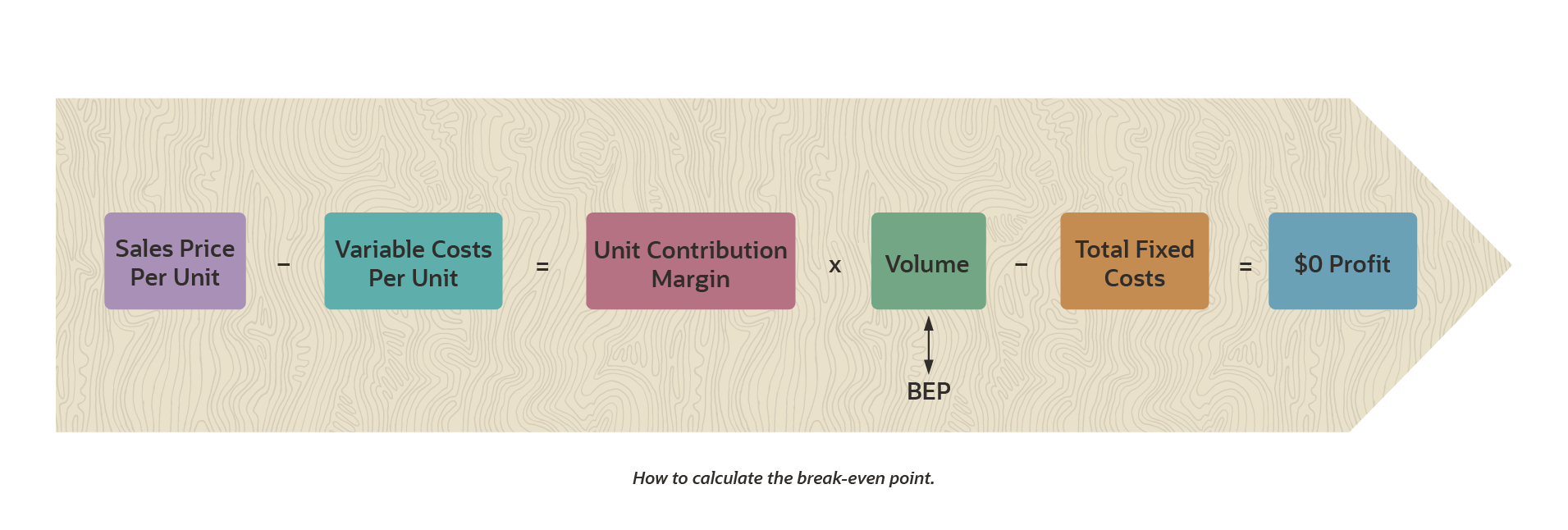

The break-even point can be calculated in one of two ways: via the contribution margin (CM) approach or the equation approach, with CM serving as the fundamental concept in both approaches. (Note: “CM” is both a calculation approach and a component of the formulas for calculating break-even point.) The contribution margin is the amount of revenue available to cover fixed expenses after all variable expenses are covered; CM can be thought of as the amount that can be “contributed” toward fixed costs.

Calculating the Contribution Margin

Before you can calculate the break-even point using either approach, you must start by calculating the CM (in total dollars when using the equation approach) or unit CM (for just a single item when using the CM approach). The preliminary steps are:

-

Calculate the contribution margin in currency. The CM in total dollars is the starting point for the break-even point equation approach. For example, if a car company has total sales revenue of $10,000,000 and total variable expenses of $8,000,000, the CM is $2,000,000, which can be used to pay fixed costs. The formula is:

CM = Total sales revenue – Total variable expenses

-

Calculate the unit contribution margin. The unit CM is part of the break-even point formula in the CM approach. An example for unit CM is a car that sells for $25,000 but costs $20,000 in variable expenses to produce. Its unit CM of $5,000 can go toward covering fixed expenses. The formula is:

Unit CM = Sales price per unit – Variable expenses per unit

Break-Even Point Formula

The break-even point formulas for the equation and CM approaches are derivatives of each other. The equation approach uses this formula:

At the break-even point: Sales revenue – Variable expenses – Fixed expenses = $0

or: CM – Fixed expenses = $0

Calculating Break-Even Points Based on Units

The CM approach uses the following formula to determine the break-even point in terms of volume:

Break-even point = Fixed expenses / Unit CM

or: BEP = fixed expenses / (sales price per unit – variable expenses per unit)

Calculating Break-Even Points Based on Sales Dollars

One option to determine the break-even point is to multiply the result of the formula above by the unit sale price. Another way to determine it in terms of overall sales dollars is to adjust the formula to:

Break-even point = Fixed expenses / (Unit CM/Unit sales price)

or: BEP = Fixed expenses / [(Sales price per unit – Variable expenses per unit) / Unit sales price]

This is the contribution margin ratio, which provides important information, such as for every unit sold how much contribution margin is produced in a percentage, which allows you to easily see how “profitable” one product is or could be compared to another.

An Example of Break-Even Point

Consider this break-even point example. A local entrepreneur is interested in buying a bed and breakfast (B&B) on Long Island that has been closed for many years. The B&B can accommodate 10 guests per night and will provide a country breakfast. The nightly rate for other B&Bs in the area is about $100, and the variable costs per guest are estimated to be about $40, which includes the costs of breakfast and house-cleaning services.

The entrepreneur estimates that her annual fixed costs will be about $84,000 per year, based on insurance estimates, projected real estate taxes, landscaping fees, and mortgage rates. She plans on offering single occupancy and allowing 10 days per year of scheduled closing for the innkeeper’s vacations and seasonal deep cleaning. Based on this data, she determines that the total rentable guest nights per year is 3,550 (10 guests x 355 days).

What level of occupancy does the entrepreneur need to break even? First, she needs to determine the B&B’s unit CM, calculated like this:

Unit CM = Sales price per unit – Variable expenses per unit

Unit CM = $100 – $40 = $60

This means that for every guest night sold, $60 can be used to cover the B&B’s fixed costs.

Next, the B&B’s break-even point in terms of units is calculated like this:

Break-even point = Fixed expenses / Unit CM

Break-even point = $84,000 / $60 = 1,400

This means that the revenue from 1,400 guest nights will pay all variable costs and fixed costs, without any money left over. Therefore, to break even for the year, the B&B needs to have a 40% occupancy rate (1,400 guest nights sold / 3,550 total rentable nights per year).

To find the break-even point in terms of total sales dollars instead of units, the entrepreneur can use this formula:

Break-even point = Fixed expenses / (Unit CM / Unit sales price)

Break-even point = $84,000 / ($60 / $100) = $140,000

Therefore, the B&B will start making profits after $140,000 in rental sales. At that point, $56,000 will go towards variable costs ($40 per room for housekeeping and food x 1,400 rooms sold), and $84,000 will cover fixed expenses.

What Increases Break-Even Points?

The break-even point formula comprises many moving parts—sales prices, variable costs, and fixed costs, for example. It’s not surprising, then, that the following fluctuations could increase the break-even point, raising the number of units that will be necessary to cover all costs without going over:

- A reduction in unit contribution margin will require a higher volume of production to reach the break-even point.

- Lower sales prices will decrease the contribution margin per unit and cause the break-even point in unit sales to increase. Lower sales prices can be the result of aggressive discounts or weak demand.

- Higher variable costs will reduce the unit CM and cause the break-even point to increase. Higher variable costs can result from macroeconomic factors such as inflation, supply chain issues, or shortages of any variable input, such as materials or labor. Additionally, changes in the production process or the way costs are categorized can increase variable costs.

- Increases in fixed costs will raise the break-even point, assuming all else remains the same. A few examples of increased fixed costs include rising real estate taxes, higher insurance premiums, and increased salaries.

How to Reduce Break-Even Points

Understanding the components of variable and fixed costs can help a company lower its break-even point, making profitability easier to achieve. Some ways to reduce the break-even point include:

- Increasing the unit CM so that it requires a lower volume of production to reach the break-even point.

- Raising sales prices to increase the unit CM, which causes the break-even point to drop. Many sales and marketing strategies can be effective for raising the sales price of an item, including elimination or reduction of discounts.

- Lowering variable costs to increase the unit CM and cause the break-even point to go down. Any reduction in variable costs should be done strategically to avoid a potential reduction in product quality that may hurt sales.

- Trimming an organization’s fixed costs to decrease the break-even point. Reduced fixed costs represent a lower financial hurdle that needs to be cleared. Fixed costs are common targets for cost-cutting measures, such as office space consolidation, reducing ancillary costs such as office supplies, or restructuring staffing.

Benefits of a Break-Even Analysis

Break-even analysis, as part of CVP, shows how revenue and costs are impacted by changes in activity levels, which are useful tools for running—and growing—a business. Such analyses:

- Help determine startup funding and resourcing requirements: Understanding the break-even point can help new businesses model how long it will take to achieve that level of production, and how much funding they may need to get to that point.

- Demonstrate the impact of changes in pricing strategies: Changing prices will affect unit CM, which can increase or decrease the break-even point and the path to profitability.

- Help set revenue targets, budgets and salesperson goals: Companies pursuing profits should set goals above the break-even point.

- Guide decisions about new products, investments, and process changes: When determining whether to launch a new product, make investments, or change processes, the change in the break-even point can help determine whether these decisions make sense or if they are even achievable.

- Play an important part in cost-volume-profit (CVP) analysis, which can model “what if” scenarios.

How Break-Even Analysis Works

Break-even analysis shows the relationship between costs, profit, and volume and the point at which financial equilibrium—where total revenue equals total costs—is achieved. This break-even point is a hypothetical line in the sand, where one side is profit and the other is loss. The formulas for CM and unit CM rely on accurate data about sales revenue and variable costs. The identification and aggregation of fixed costs is also critical when determining the break-even point.

Accurate expense tracking is paramount for all of this. As the saying goes, garbage in equals garbage out. Most companies can crunch the numbers, but challenges abound in the tracking and categorization of revenue and expenses—many of which can be mitigated by advanced accounting software. The formulas are straightforward, but assembling the data may not be. Further, continually monitoring revenue and expenses is another key challenge in break-even analysis. Companies often find that the financial metrics they use are outdated or have changed. Consider the B&B example, where a revised break-even point should be recalculated each year as real estate taxes and insurance premiums rise.

Free Break-Even Point Template

This break-even point template can guide you through computing the break-even point in terms of units. It includes fields where you can input any data you wish, with embedded formulas to yield the result. The B&B example, from above, has been loaded to help follow along.

Manage and Analyze Break-Even Point With NetSuite

Calculating the break-even point for a specific product or multiple product lines can be tricky when the data needed is not available or clean. An automated enterprise resource planning (ERP) system can provide the most accurate results because it links production information with accounting information. NetSuite ERP is a multidimensional tool that allows for data tagging, which improves the accuracy of variables in the break-even point formula. Together with business intelligence tools, the break-even point and its underlying components can be easily monitored and better managed to help companies stay on the profit side of the break-even point.

Business managers regularly make decisions that are enhanced by understanding the break-even point. The break-even point represents the point of equilibrium between revenue and expenses, where there is no profit or loss. This is a key metric for startup businesses as well as established companies that are deciding whether to expand, invest, divest, cut costs, or model the potential impact on profit from changes in selling price, service fees, income taxes, and product mix. The formulas aren’t complicated, but the underlying data may be hard to rely on without the right software and processes in place.

Break-Even Point FAQ

What happens to my break-even point if sales change?

The break-even point does not change when sales change. It remains the point at which revenue covers variable and fixed costs without any profit or loss. A company experiences a profit if sales surpass the break-even point and a loss if sales drop below it.

How would cutting costs affect my break-even point?

Lowering variable costs will increase the unit contribution margin and cause the break-even point to be lower. Additionally, cutting an organization’s fixed costs would also reduce the break-even point.

What is the formula to calculate break-even point?

In order to calculate the break-even point in terms of dollars, first calculate the unit contribution margin (CM) using this formula:

Unit CM = Sales price per unit – Variable expenses per unit

Then use the following formula to determine the break-even point in terms of overall sales dollars:

Break-even point = Fixed expenses / (Unit CM/Unit sales price)

What is a break-even point example?

Consider this break-even point example: A local entrepreneur is buying a bed and breakfast (B&B), which can accommodate 10 guests per night. The nightly rate is $100, and the variable costs per guest are $40, which includes the costs for breakfast and house-cleaning services. The entrepreneur approximates that her annual fixed costs will be about $84,000 per year. Based on single occupancy and 10 days per year of scheduled closing, the number of total rentable guest nights per year is 3,550 (10 guests x 355 days). To determine the level of occupancy the entrepreneur needs to break even, she first computes the B&B’s unit contribution margin (CM), which is calculated as sales price per unit ($100) minus variable expenses per unit ($40). Therefore, the unit CM equals $60. Next, she determines the B&B’s break-even point in terms of units, which is calculated as fixed expenses ($84,000) divided by unit CM ($60). Therefore, break-even point in terms of units equals $1,400. Now the entrepreneur can determine the occupancy rate she needs to break even: She divides unit CM by fixed costs (1,400 / 3,550). The answer is 40%.