Young companies are often more focused on growing their business than maintaining tight control over expenses. But for any company, spend control is critical to maximizing and sustaining profitability. To manage spending effectively, companies need to define clear spending policies and processes. Software can effectively support spend control by providing visibility into expenditures, automating manual tasks and helping control how money is spent.

What Is Spend Control?

Spend control describes the policies, processes and technologies companies use to monitor and manage purchasing across the business. By carefully managing spending, companies can reduce unnecessary expenses, maximize operational efficiency and direct more of their hard-earned cash into activities that fuel business growth and deliver value to customers. Because it directly impacts profitability, spend control is a crucial discipline for any company.

Effective spend control isn’t possible unless a company has good visibility, ideally in real time, into all of its expenses — so it understands where its dollars are going. Those expenses include variable costs such as raw materials, travel and office supplies, as well as fixed costs such as payroll and rent.

Spend control vs cost control.

The term “cost control” commonly refers to a narrow focus on cutting costs in circumstances where a business downturn forces companies to rein in their spending. In contrast, spend control doesn’t necessarily imply reducing spending — it’s about making sure the company spends its money wisely in order to get the greatest return.

What Is Spend Management?

The terms “spend management” and “spend control” are often used to mean the same thing: the steps companies take to maintain or improve profitability by managing expenses. Businesses can use a variety of processes to control discretionary expenditures. At some companies, line managers approve purchases; at other companies, a dedicated procurement team or the finance department is responsible for approvals.

Purchase approvals may be manual or automated. With manual approvals, the approver typically has to click a button on a platform or app for each purchase. In an automated approval, an expense is approved instantly based on preexisting parameters, like the requester’s seniority or the dollar amount of the transaction.

Key Takeaways

- Spend control encompasses the policies, processes and technology businesses use to monitor and manage purchasing across the organization.

- Spend control plays a crucial role in maximizing profitability. By limiting nonessential and wasteful expenditures, it helps ensure that funds are available for the activities that drive growth and deliver value to customers.

- A lack of spend control can make financial planning and budgeting difficult, delay financial close processes and exacerbate other problems, such as maverick spending and fraud.

- Software that increases visibility and automates processes is one of the best weapons in a company’s spend control arsenal. Cloud-based software can help control spending by centralizing and automating procurement and employee expense management.

Spend Control Explained

Spend control is about strategically managing the company’s spending to gain the most benefit. Even when a business is doing extremely well, it should endeavor not to waste money. And when it’s not doing so well, effective spend control mechanisms can lessen the impact on the bottom line and help maintain financial stability.

Some discretionary spending is essential — and it can play a critical role in a company’s success. The right business trip or client gifts like tickets to sporting events can make the difference in closing a sale or in solidifying a customer relationship. Corporate training is another investment that can strengthen a company’s capabilities and increase its standing with customers. Companies can ensure that money is available for these activities by holding the line on less-important expenditures.

Why Is Spend Control Important?

Limited financial resources are a reality for every company. Spend control is about establishing methods to optimize the use of these financial resources.

Many companies weigh the value to the customer when deciding which expenditures to make. An expenditure that increases customer satisfaction or loyalty is more likely to be approved. If an expenditure doesn’t directly affect customers, companies may look for the least expensive way to meet a specific need.

As an example, consider how a company might deliberate about changing a supplier. If the company’s product quality is suffering due to an unreliable component, switching to a new, higher-quality components supplier might be worth the additional cost — it will reduce the number of defective products and increase customer satisfaction and repeat business. On the other hand, if the components from different suppliers all offer equal reliability, the company might choose the lowest-cost supplier.

Do Companies Need to Control Spending?

Spend control is on a short list of good financial practices for all companies. It’s important for a number of reasons, including:

- Increasing profits. Spend control is a crucial part of companies’ efforts to maximize their profitability. It helps ensure that funds are available for the activities and services that contribute to the company’s success.

- Developing long term advantage. Spend control can provide insights to management that can yield competitive strategic positioning.

- Planning and budgeting. Getting a good handle on the cash flowing out of company accounts is key to being able to accurately forecast revenue and profit. Without a good understanding of expenses, it may be difficult to confidently fund innovation and growth.

- Reducing financial risk. Uncontrolled spending exposes the company to additional risk due to problems such as maverick spending and even fraud.

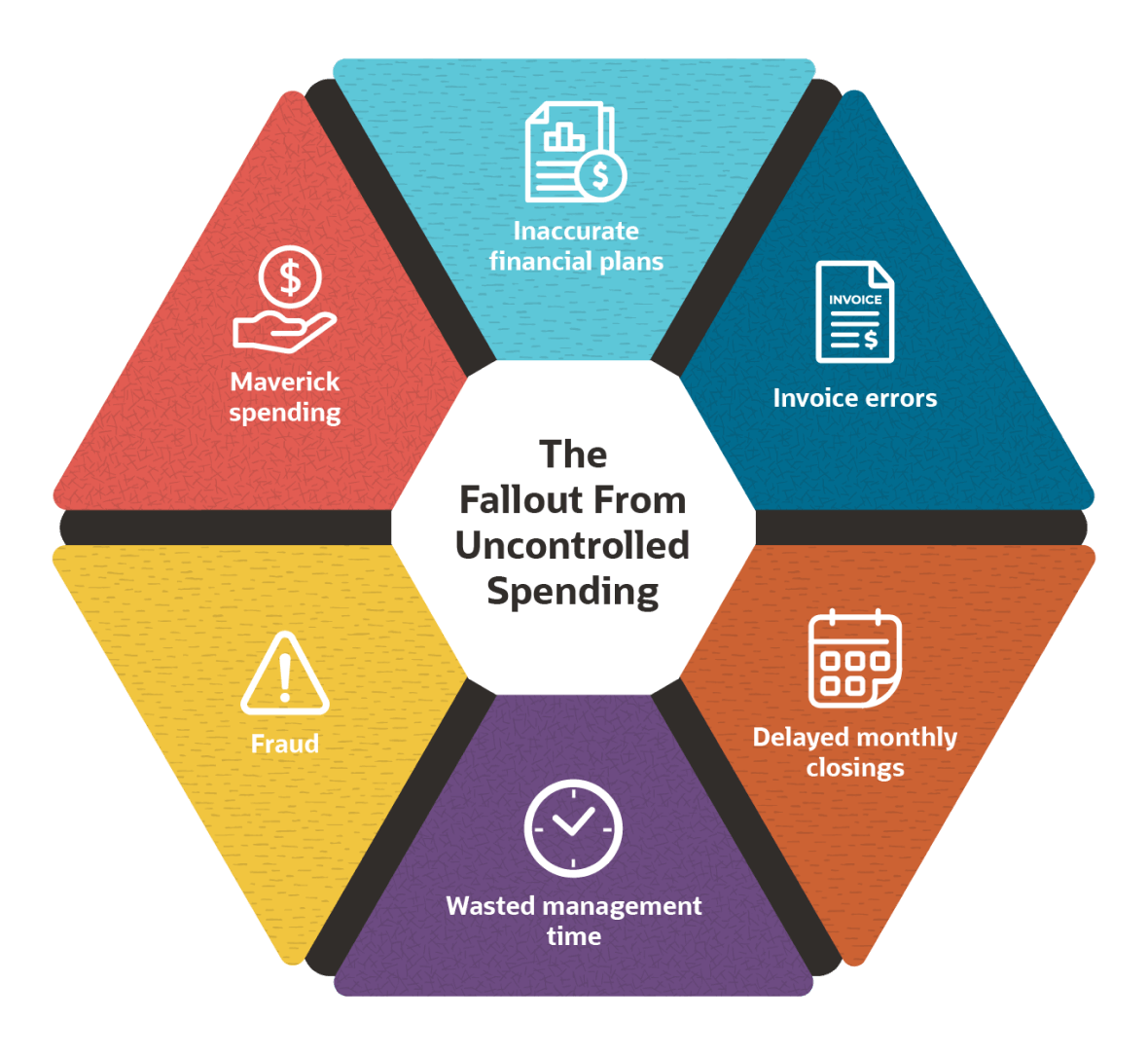

6 Impacts of Out-of-Control Company Spending

When companies lack spending visibility and control, the result can be financial problems that ripple across the business. Here are some of the worst consequences.

-

Poor financial performance and planning.

Companies that don’t have good spending insights and controls can run into serious financial problems. They may suffer from inconsistent cash flow or lack adequate reserves to handle unforeseen expenses. Without good visibility into expenses and profits, they may not set aside enough cash to cover their liabilities. The erratic financial performance can make it harder to attract funding from lenders and investors.

-

Costly errors.

Without good controls on spending, mistakes are much more likely. For instance, poor spend control can mean the company pays duplicate or incorrect invoices by mistake.

-

Delayed financial close.

Closing the books at the end of each accounting cycle requires categorizing and reconciling all expenses. Poor spending control and manual processes can cause serious delays. In one survey, companies that had to manually gather receipts took twice as long on average to complete a monthly close compared with companies with clear processes supported by automation.

-

Wasted time.

A lack of spending visibility and control means department managers and employees may have to take time away from higher-value activities to focus on administrative tasks, like tracking down purchasing records and fixing mistakes. No company wants to waste its managers’ time on discussions about how long employees took to resolve which items.

-

Maverick spending.

Maverick spending refers to purchases that run counter to company’s spending policies, such as buying supplies from non-approved vendors. This has many negative effects. Among them: an inability to take advantage of low negotiated rates and conflicts with vendors that have exclusive supply contracts. Maverick spending can also create the more insidious risk of becoming associated with an unvetted supplier that may have reputational issues.

-

Fraud.

No business can completely avoid the risk of problems caused by dishonesty. But the risk is much greater at companies that have poor spend controls and processes. The fallout from fraud can be significant, ranging from immediate financial losses to a longer-term lack of customer trust.

How Can Companies Control Spending?

It may not be possible for companies to eliminate every instance of noncompliant spending, but implementing the right processes, policies and technologies can greatly reduce the problem.

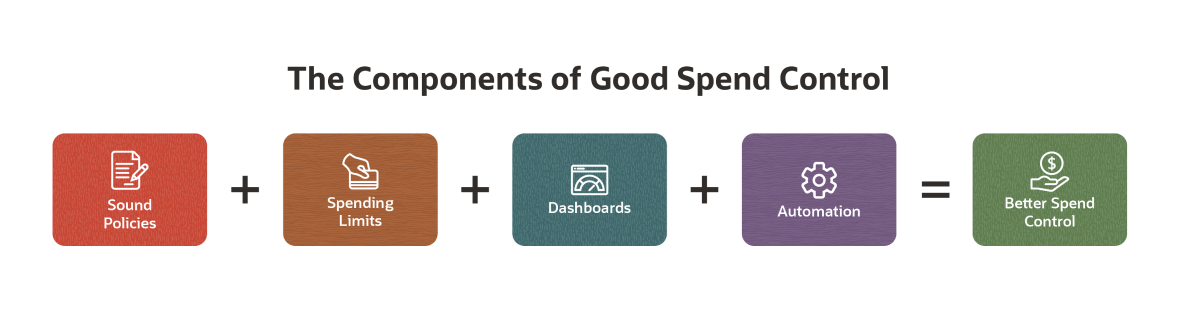

4 Best Practices to Control Company Spend

Best practices for spend control start with establishing and communicating clear policies, then applying technologies to support those policies and automate spending processes across the company.

-

Communicate clear policies.

Technology can help enforce spending controls, but it’s also essential to create clear policies and make sure people understand them. This might include, for instance, letting them know that items or services purchased using cash or non-approved payment systems won’t be reimbursed except through the specific approval of the CFO.

-

Embed spending limits and policies in purchasing systems.

Funneling all purchasing through a limited set of technology-based methods, including a corporate procurement system, can give a company an edge in controlling its expenditures. For smaller purchases, the company can issue credit cards that have financial limits or cannot be used for non-approved items such as alcohol. Limits can also be applied to mobile payment services.

-

Create a central platform or dashboard.

Mandating that employees direct spending via preapproved systems is a good start. The control gets even stronger, however, if the finance department can monitor purchases in real time on a centralized platform.

-

Automate immediate entry of receipts.

Capturing documentation at the time of purchase can reduce administrative effort and accelerate financial close processes. Some expense management systems let employees use mobile phone cameras to grab images of receipts. In addition to making the information immediately available, this is faster and easier for employees, especially if the system is smart enough to categorize different types of spending.

Benefits of Controlling Spend With Software

Software can be tremendously useful in a company’s efforts to get spending under control. It enables companies to capture all information about transactions, track spending trends, and centralize and automate purchasing. Key benefits include:

-

Increased visibility.

Visibility is a top benefit of using software to control spending. Software helps companies categorize spending and analyze how every dollar is spent. Anything that an executive or department manager needs to know is just a click away.

-

Access to real-time data.

Financial specialists and managers need immediate information in order to make fast decisions, set targets and take corrective actions. Leading software solutions include customizable dashboards that can track spending in real time.

-

Built-in controls.

A company that pushes all its purchasing through a central software system gains the advantage of a built-in spend control mechanism. The system helps channel purchases to approved suppliers so the company can capture contracted discounts. Centralizing purchases into a software system to which the finance department has access also makes employee fraud less likely. Leading solutions can automatically perform invoice-matching to identify discrepancies among purchase orders, the goods received and the amount billed.

-

Self-service.

At companies with manual purchase processes, uncertainty about the status of orders and invoices isn’t just an annoyance — it can also become a major waste of time. A cloud-based system that’s instantly updated can allow employees to check the status of their orders online.

-

Receipt and document organization.

Software can eliminate the amount of time spent chasing down paper receipts and manually categorizing expenses. Some solutions can capture the necessary detail about transactions at the instant they take place.

Take Control of Spending With NetSuite

NetSuite’s integrated suite of cloud-based applications helps companies save time and money, increase visibility into spending and eliminate time-consuming, error-prone manual tasks. Customizable dashboards provide real-time insights into spending, enabling managers and employees to track department-level spending, analyze vendor performance and drill down into individual transactions to investigate and take corrective action when necessary.

NetSuite procurement software centrally manages vendor relationships and transactions, helping businesses reduce cost by channeling purchases to approved vendors at previously negotiated prices. NetSuite accounts payable automates the review, approval and payment of supplier invoices, giving businesses greater control over the entire procurement process. Three-way matching automatically identifies differences among purchase orders, receiving records and billing statements. Expense management software automates and simplifies expense reporting, submission and approval by providing mobile support that lets employees use mobile devices to immediately enter expense reports and upload images of receipts.

Conclusion

Spend control is an important discipline for all businesses. A company that doesn’t effectively control costs can suffer problems such as declining profitability and increased financial risk. Good spend control policies and systems enable companies to gain better visibility into spending, optimize and centralize purchasing, automate manual tasks and reduce costly errors.

For comprehensive insights into how to optimize procurement to reduce costs, boost productivity and increase transparency, read the Ultimate Guide to Procurement Management for 2021.

Spend Control FAQs

What is a spend management system?

Several types of software systems can help manage different aspects of corporate spending. Procurement and accounts payable systems can help control and automate centralized purchasing processes, for example, while expense management software can simplify and automate submission, review and reimbursement of employee expenses.

How can a company control spending

Good expense control generally starts with sensible policies that are communicated clearly to all staff. On the technology side, spend control involves the use of various tools to track and report on individual and departmental expenditures. The tools can range from cloud-based procurement and expense management systems to business credit cards.

How do you keep expenses under control?

Companies use policies, spending limits and technology to control expenses. Visibility into spending, often made possible by software, helps reduce the amount of maverick spending, fraud and waste.

How do you manage your spending?

A combination of strong policies, streamlined processes and software automation is necessary to control spending for most companies. Software can automate the implementation of policies and processes, such as directing purchases to preapproved vendors. Although reaching the goal of strong spend control can take a while, it pays off in the long term in the form of higher predictability and profitability, fewer surprises, and a better-managed work environment.