Companies don’t always do as good a job of actually collecting revenue as they do of selling their products and services. Unearned discounts, billing mistakes and penalties that customers have been told about but that get waived mean that a dollar’s worth of sales doesn’t always end up as a dollar’s worth of revenue. And when the problem happens over dozens of SKUs, hundreds of customers and thousands or tens of thousands of transactions, the losses can add up quickly.

Such revenue leakage occurs across many types of industries. In fact, 45% of executives see revenue leakage as a systematic problem for their companies, according to a 2020 survey by Boston Consulting Group.

The ways companies can combat revenue leakage include rethinking outmoded processes, reducing use of bad or inaccurate data and turning to smarter software and better technology. Companies that take steps such as these can add as much as 5% back to their bottom lines, per BCG.

What Is Revenue Leakage?

Revenue leakage refers to money that has been earned but not collected, generally because of a lack of awareness on the part of the business. It usually results from manual — and often faulty — finance and accounting processes, such as pricing errors, the use of incompatible invoicing systems, relying on spreadsheets and unbilled or underbilled services. Some types of revenue leakage are industry-specific; others tend to happen across industries. Revenue leakage is much more common in transactions that involve contracts or ongoing customer relationships. Cash transactions — in which buyers walk away with goods they have just paid for — are less prone to revenue leakage.

Key Takeaways

- Revenue leakage isn’t an issue just for small or poorly organized companies; about half of executives across all industries see it as a pervasive problem for their business’s revenue management.

- A well-run revenue assurance effort starts by laying out the areas of revenue leakage that are occurring and ranking them by economic value.

- The two basic causes of revenue leakage are faulty processes and bad data. Among the most frequent problems are lax discounting policies and manual invoicing.

- Software tools can help companies get better control of both the processes and the data that lead to revenue leakage.

- A company that effectively manages its revenue-leak issues can see its earnings go up by as much as 5%. This is because revenue that hasn’t previously been collected — and suddenly is — tends to fall directly to the bottom line.

Revenue Leakage Explained

Revenue leakage is a function of organizational and sales complexity. Any company with multiple salespeople or products is vulnerable to the problem of not collecting some of the revenue it has earned. If discount policies and contracts aren’t centrally managed, salespeople may offer discounts that aren’t necessary to get or keep customers, or may throw in extra services that are only supposed to be available for a fee.

Revenue leakage can affect services as well. For example, relying on manually inputting information into spreadsheets, transferring data from spreadsheets to billing and time tracking platforms, and then ensuring the accuracy of time creates administrative work — and these costs may not be accounted for when billing.

Product variations can also create confusion, and a product that should have one price may be sold at a lower one. New products are especially prone to revenue leakage because of introductory pricing that doesn’t always end after the promotion is over.

Why Is Revenue Leakage Important?

Small and medium businesses’ cash flows fuel everything they do — from providing high-quality customer service to enabling growth, and from fostering innovation to helping them successfully compete for talent. Without revenue, there is no profit. This is why some companies have celebratory rituals for closing on new business, like sounding a gong in a central area when a significant new contract is signed. The gong is a reminder of how important revenue generation is — new and follow-on sales are the enabler of everything.

Collecting revenues that have been earned but — because of some operational glitch — not realized is obviously not a glamorous activity. But it is a discipline that every small and medium enterprise should become expert at. A company that doesn’t master it will eventually not be able to do some of the things it wants to do.

What Is the Impact of Revenue Leakage?

The financial impact of revenue leakage varies, depending on the industry and the circumstances. A rule of thumb, however, is that companies struggling with revenue leakage have earnings that are 1% to 5% lower as a result. Thinking of the impact in terms of earnings, as many experts do, is a reminder that when companies bring in revenue that hasn’t previously been collected it tends to fall directly to the bottom line.

Complex industries can feel a significantly greater impact. For instance, the complex reimbursement structures, number of parties involved and extent of unpaid bills that are prevalent in the health-care industry create unique challenges for health-care companies, in terms of collecting earned revenues. As much as 15 cents on every dollar earned by health care companies and hospitals goes uncollected, according to consulting firm McKinsey.

A company whose revenue leaks are high compared to its peers may be at a disadvantage in developing new products or boosting its business. Such a company might also have other problems associated with non-optimized cash flow, such as higher borrowing rates.

What Causes Revenue Leakage?

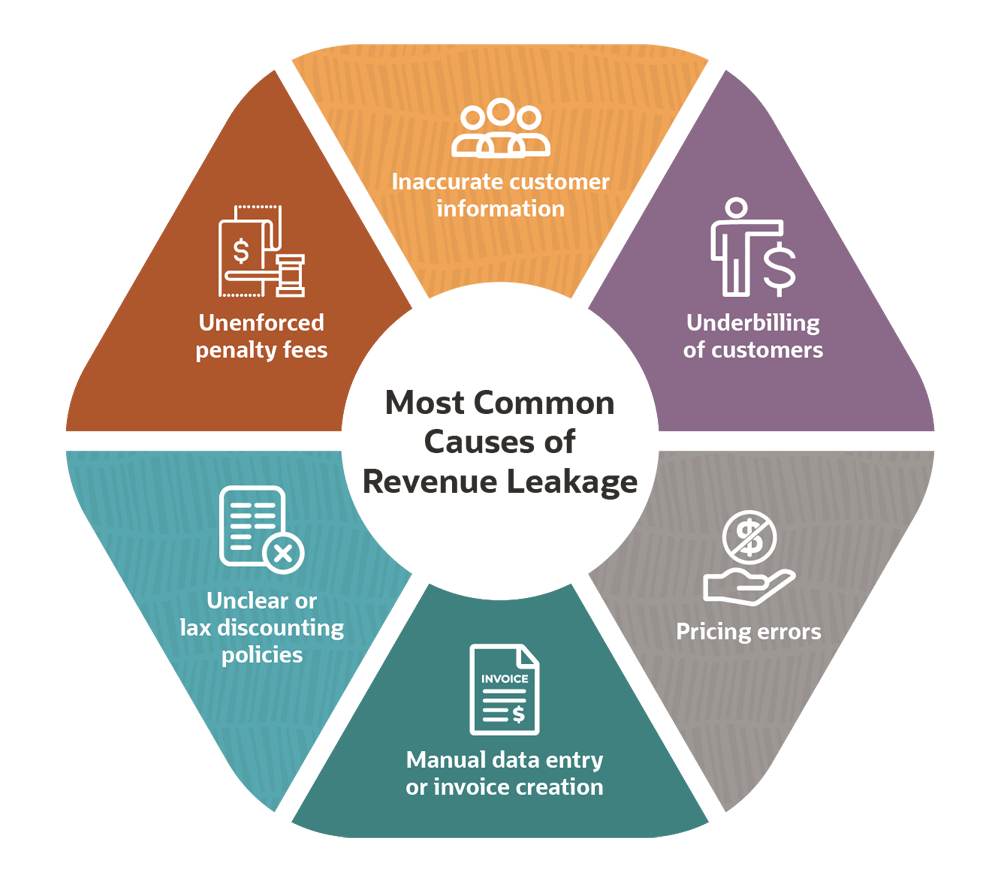

A company digging into any instance of revenue leakage will typically find either a faulty process or bad data — often both. Here are the most common causes:

- Manual processes prone to mistakes and inefficiencies. Manual invoicing is a particularly big problem. It means that invoices aren’t created at the same time that sales are closed. When the creation of an invoice is delayed, add-on services are sometimes omitted, or the time entered for them is underestimated. Manual invoicing is particularly problematic for subscription-based and software-based businesses, which should use automated renewals as their default process.

- Spreadsheets. This is a variation on the first problem, pertaining to a lack of automation. The data on spreadsheets is typically entered manually and sometimes contains mistakes or omissions. The time a person spends on a project could be underestimated and entered incorrectly, resulting in underbilling. Moreover, the information in most spreadsheets must be integrated with a billing system. This may mean further inefficiencies because of incompatible technology.

- Inaccurate or outdated customer information. If data is uncoordinated or has to be pieced together from different systems, a seller may not have accurate data about how much volume it is doing with a particular customer. This is equally possible whether we’re talking about a product manufacturer or someone selling digital goods. To be supporting a customer with, say, 100 mobile phones or 100 digital subscriptions — but only charging for 85 of them — is to leave money on the table. Credit cards that have expired are another form of bad data that can lead to nonpayment or delayed payment.

- Unclear or inaccessible policy information. In certain kinds of businesses, the sales function is highly dynamic, and salespeople must have immediate information at their fingertips. If the information is not available on demand, a salesperson might charge too low a rate or not realize that a particular service they’re including is actually an extra that should be invoiced.

- Underbilling. Underbilling can be a problem when a business has a high percentage of service revenues. With an inefficient information flow, service personnel may not realize that a service they’re performing at a customer site is billable. Discussions or work done back in the office to respond to a particular client request likewise may not be properly billed.

- Pricing errors. This is another issue brought about by bad data. Pricing errors can take the form of promotional pricing that continues even after an introductory period ends. Another kind of pricing error that leads to leakage is when an existing customer falls below the threshold required for a volume discount but continues to get the discount anyway.

- Unenforced policies, including penalty fees. Many businesses have penalties that must be paid in the event of certain customer actions — like the early termination of a contract or a request for a new membership or identification card. When these penalties aren’t enforced, it leads to revenue leakage.

How to Identify Revenue Leakage

A company’s executives — often a CEO or a finance officer — usually have a sense of when their businesses aren’t collecting all of the revenue they’re due. To act, however, companies must have more information. Three steps can help with this.

-

Form a hypothesis about where the leaks are. The first place companies might think to look for leaks is on their top accounts. Sometimes, indeed, that’s where the leaks are. But quite often the largest leaks happen not on the biggest accounts but on those that have the most complicated contractual terms. The hypothesis about where the worst leaks are coming from should be generated not just through executive hunches — though such hunches are important — but also by those closest to the revenue-generation and revenue-collection functions.

-

Rank the different leak “types” by economic value. Not every revenue leak is of equal magnitude. It makes sense for companies to start with the leaks that are having the biggest impact. For this reason, it’s important to prioritize the different leaks based on the dollars lost or uncollected.

-

Test the hypothesis. Companies should verify their hypotheses regarding revenue leaks. This can be done through an audit by the finance department, with help from those responsible for revenue generation. The audit would look at problems with data and processes, and it might include the re-creation of steps related to specific revenue moments.

To illustrate these three steps, consider a paint manufacturer that realizes it is under-collecting on sales to contractors. The manufacturer’s first hypothesis is that contractors are getting prices below what’s in their contracts; its second hypothesis is that contractors often aren’t being billed for all the services they get. Through an audit, the manufacturer might realize that the unearned discounts are the bigger problem. The improvement program it would put in place (which might include centralized price quotes and the elimination of paper contracts) would focus on fixing the bigger problem first. Ensuring that all services are billed would be a second-phase undertaking.

6 Ways to Stop and Prevent Revenue Leakage

Reversing revenue leakage shouldn’t be considered a side project; it is a core part of operational excellence. Companies that already have the crucial qualities of discipline and self-analysis — and that incorporate technology to advance their businesses — can use those things to collect previously unrealized revenue.

The following six ideas may be particularly helpful.

-

Pinpoint the problem. An accurate diagnosis is the first step. Companies can start by getting a sense of where revenue leaks tend to happen in their industries. They should also ask employees who are in revenue-generating positions if they have any ideas about how and where revenue is leaking out. As noted in the “How to Identify Revenue Leakage” section, the problems are not always where one would expect.

-

Fix workflows around leaked revenue. Most workflow issues can be addressed. Whether it’s a confusing mix of price sheets or an organizational structure that enables excessive discounting, there’s generally a fix. Small and medium enterprises might not fill up a conference room whiteboard with process maps and yellow stickies as they work their way through workflow issues, but they can often come up with solutions to workflow problems quickly because of the speed at which they move. For instance, if there’s evidence that service reps aren’t billing for everything they do at customer sites, a company could use an average-time-per-service estimate to spot potential instances of unbilled or underbilled services. That increased scrutiny alone — a small change — would likely result in the recapture of some previously leaked revenue.

-

Replace manual processes with good software. Technology can address many of the issues that lead to revenue leaks, and good software is available to assist or automate virtually any manual business process. A good software program will make it possible for service staff to fill out a timesheet on a mobile device within minutes of having completed their work, which typically reduces billing errors. Software can also put knowledge management systems at the fingertips of anyone selling services, allowing quotes to be quickly and accurately generated. And software can help automate the creation of certain invoices, reducing the problem of late billing or underbilling.

-

Hold the line on pricing. Salespeople with broad autonomy to offer discounts can impede the end goal of revenue maximization. Another thing that doesn’t help is lax enforcement of contract terms. Companies must have clear, effective rules to begin with, and they must enforce those rules — another thing they can sometimes do systematically through software.

-

Task a single individual with revenue assurance. It’s relatively uncommon for companies to assign full-time staff to revenue assurance: 59% of companies don’t do this, according to the Boston Consulting Group survey. The proportion of small and medium enterprises with no full-time revenue assurance staff is likely even higher. However, even at smaller companies that don’t have a budget for billing analysts, it may be useful to make revenue assurance part of the brief of a senior executive. Someone in finance may have the right mix of authority and expertise to perform this role.

-

Centralize timesheets. This is especially important for service companies, where revenues earned are often dependent on billable hours. To increase the odds of getting accurate and timely information, companies can program their billing systems to send automated reminders.

Prevent Revenue Leakage With NetSuite

The revenue leakage that is caused by manual processes and incompatible systems is easiest to address through software. This is an area where NetSuite’s Invoice and Billing Management functionality can help. NetSuite SuiteBilling can streamline billing operations and eliminate the need to manually track customer subscription changes. It also allows for automated renewals, reducing an important cause of revenue leakage in the many businesses that are subscription-based or software-based.

Conclusion

Revenue leakage affects companies of all sizes and types. It’s generally heaviest in situations that involve ongoing customer relationships, or where contract terms are complex or involve data that is not well tracked. Revenue leaks are also a function of poor billing processes and undisciplined discounting. Improved workflows, better discipline and new, more capable software tools can help companies recapture the vast majority of revenues that they are leaking. Earned but unrealized revenue tends to drop directly to the bottom line when the leaks are plugged, and could mean a profit improvement of as much as 5% for some companies that upgrade their practices.

Revenue Leakage FAQs

How can revenue leakage be stopped?

For most companies, the first step is figuring out why revenue has been earned but isn’t coming into their coffers. Those insights may come from salespeople, or they may come from people in financial roles. The solution depends on the specifics of the situation. Long-term solutions generally involve a change in workflow processes, a move to better technology and the creation of more disciplined policies. Improvement often depends on several of these steps taken together.

What is revenue leakage in project management?

Companies in project management engagements sometimes fail to record all of their time or do not charge for time spent by part-time personnel brought in to advise on the project. This is a form of revenue leakage. It can be avoided by setting clear expectations with clients and establishing — and following — explicitly detailed processes for timesheet entries.

How do you track revenue leakage?

Revenue leakage has to do with financial flows and is thus best tracked through some sort of audit process. The audit could be financial or could be a workflow process, like the steps used to create an invoice or determine whether a client has earned a volume discount.