Depreciation is an accounting process that spreads the cost of a fixed asset, such as property and equipment, over the period of time it will likely be used. Doing so allows a business to match expense recognition with the revenue those expenses support, ultimately resulting in a more accurate picture of its profitability. As such, depreciation is less about asset valuation and more about cost allocation. There are many methods of depreciation that comply with Generally Accepted Accounting Principles (GAAP), though the most commonly used is the straight-line depreciation method, which offers the simplest, most straightforward way to calculate an asset's value over its time of use.

What Is Straight-Line Depreciation?

Straight-line depreciation spreads the cost of an asset evenly over the time it will be used, also known as its "useful life." It requires only three inputs to calculate: asset cost, useful life and estimated salvage value — meaning, how much the asset is likely to be worth at the end of its useful life. Another important term to understand is "depreciable base," which is the difference between the asset's cost and its salvage value. The depreciable base is divided by the number of years the asset is estimated to be useful, in order to calculate the annual depreciation expense. In each accounting period, this depreciation amount is uniformly charged, stepping down the asset's book value until it reaches its salvage value.

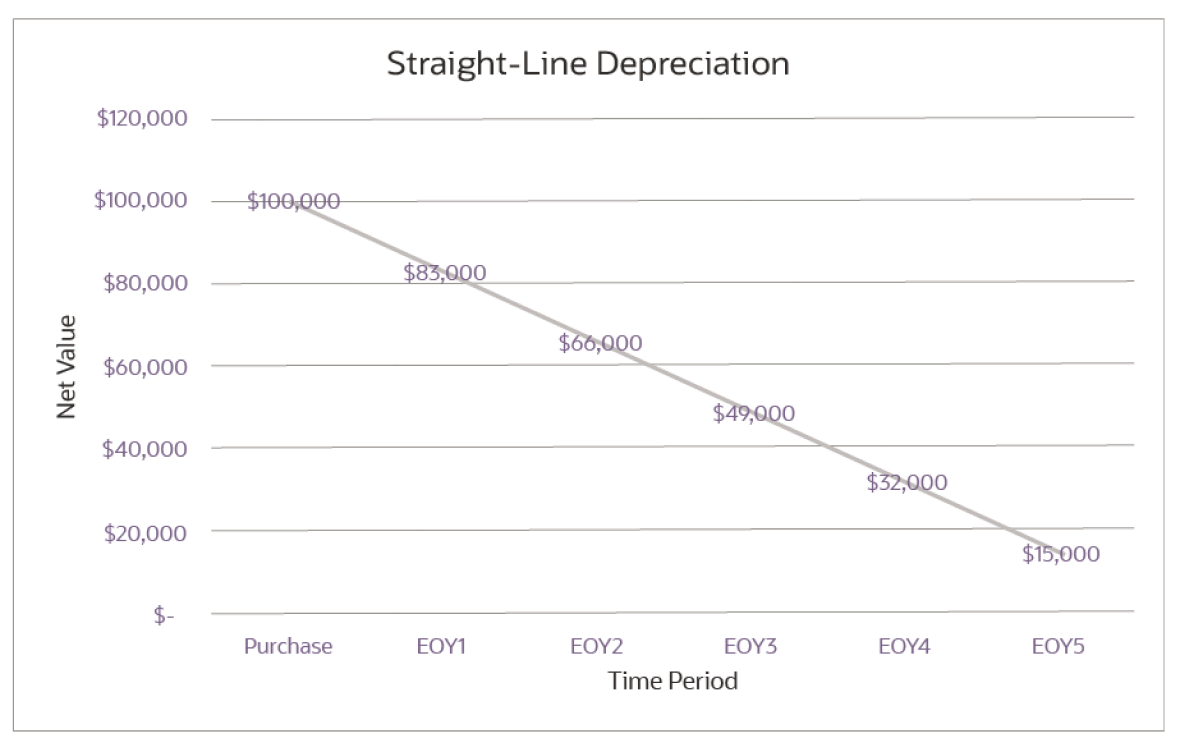

The chart below illustrates a typical straight-line depreciation scenario with a consistent reduction in net book value — that is, an asset's carrying value at a point in time — for a fixed asset over five accounting periods. (The chart uses the same figures as the free downloadable template found later in this article.)

Key Takeaways

- Straight-line depreciation is an accounting process that spreads the cost of a fixed asset over the period an organization expects to benefit from its use.

- Depreciation impacts a company's income statement, balance sheet, profitability and net assets, so it's important for it to be correct.

- The formula for straight-line accounting requires a mix of empirical data and reasonable estimates.

- Accounting software can reduce a company's burden of calculating and maintaining individual depreciation schedules for each of its fixed assets.

Straight-Line Depreciation Explained

Fixed assets, such as machinery, buildings and equipment, are assets that are expected to last more than one year, and usually several years. They are typically high-cost items, and depreciation is meant to smooth out their costs over the time they will be in service. This helps to avoid wild swings in cash balances and profitability on a company's financial statements that can be caused by expensing all at once. Straight-line depreciation is the simplest method for calculating depreciation because it assumes that the asset will decline in usefulness on a constant basis from period to period.

Bookkeeping for straight-line depreciation involves increasing the depreciation expense account on the company's income statement and increasing accumulated depreciation on the balance sheet. Accumulated depreciation is a contra asset account — the account balance is actually a credit balance — so it indirectly reduces the book value of a fixed asset when the asset and contra asset accounts are netted against each other.

Why Is Straight-Line Depreciation Important?

Depreciation is important because, by matching expenses with revenue, a company's overall profitability is determined more accurately. The straight-line method of depreciation, specifically, results in even, stable depreciation charges, so it makes budgeting and financial forecasting easier. Additionally, the consistent charges assist operating profitability and cash flow analysis, since they are easily identified and removed.

Other Depreciation Methods

Besides straight line, accountants may use several other depreciation methods. Activity-based methods, for example, yield variable depreciation charges, since they are based on an asset's usage rather than on the passage of time. Decreasing-charge methods accelerate the amount of depreciation in an asset's early years, operating under the assumption that the asset experiences the largest loss of service value at the beginning of its useful life. Some examples of these alternate depreciation methods include:

- Units-of-production method: This activity-based depreciation method quantifies an asset's useful life in terms of the amount of output it is expected to have. Depreciation charges are determined by the number of units produced in a particular time period as a percentage of the units expected to be produced over the entire useful life, which is then multiplied by the depreciable base.

- Sum-of-the years'-digits method: This is an accelerated depreciation method that results in lower depreciation charges in successive years by using a decreasing fraction of the depreciable base. The numerator in the fraction is the number of years left in an asset's useful life, and the denominator is the sum of the years' digits. For example, the denominator for an asset with a five-year life would be 5+4+3+2+1=15.

- Declining-balance method: This decreasing charge method applies a consistent depreciation rate to the declining net asset balance to yield higher depreciation charges in the earlier years of an asset's useful life and lower charges toward the end. Double-declining balance is another version of this method; as its name implies, it doubles the depreciation rate, resulting in very accelerated depreciation charges.

- Modified accelerated cost recovery system (MACRS): This depreciation method is required for U.S. tax purposes and, unlike GAAP-compliant methods, fully depreciates assets to a zero value rather than its salvage value. The IRS provides prescribed spans for useful lives, based on asset class.

When to Use Straight-Line Depreciation

Accountants try to select the method of depreciation that best corresponds with the nature of the fixed asset. A company can use different depreciation methods for different types of fixed assets, but they should use the same method consistently over time. Straight-line depreciation is a common default because of its practicality: It's easy to calculate, less of an administrative burden and less prone to error.

Simplicity aside, the nature of a fixed asset often makes straight-line depreciation the most fitting choice. When a fixed asset's obsolescence is simply the result of time passing, straight-line depreciation is an appropriate method. Furniture and fixtures are good examples of fixed assets that simply lose value as they age. Straight-line depreciation is also fitting in scenarios where the economic usefulness of an asset, such as a warehouse, is the same in each time period. Also, if revenue generated by the fixed asset is constant over the useful life, the straight-line method may be the best choice, such as for a building owned for rental by a landlord.

Straight-line amortization is a similar concept that is applied to intangible assets with definite useful lives, such as patents, trademarks and copyrights. Unlike straight-line depreciation, amortization usually assumes no salvage value and is calculated on the entire value of the intangible asset.

Advantages and Disadvantages of Straight-Line Depreciation

The advantages of straight-line depreciation support the method's popularity. Among them:

- Straight-line depreciation is easy to calculate and consistently applied.

- It has wide application to many fixed assets, especially when their obsolescence is simply due to passage of time.

- Straight-line amortization schedules are simple and reduce the amount of required record-keeping.

However, accountants often raise objections to using the straight-line method. Disadvantages noted are:

- Some assets are more correctly depreciated based on output, input or usage.

- It requires the use of MACRS recovery periods to be acceptable for U.S. tax purposes, prompting the need for additional calculations.

- Some assets experience accelerated obsolescence in their early years, such as computers and vehicles.

- Estimates for useful life and salvage value can be subjective and inconsistent among different companies.

What Numbers Are Included in Straight-Line Depreciation?

Each of the three data points used to calculate straight-line depreciation — asset cost, salvage value and useful life — comes with its own set of considerations. Estimates and judgment are required for the purpose of allocating costs in a systematic and rational manner.

- Purchase price: This data point is based on fact. The purchase price includes the cost of the asset plus any labor and material costs needed to put it into service, such as shipping, installation and customization.

- Salvage or scrap value: This is an estimate of how much money can be received when the asset is removed from service and sold or scrapped. Many companies will set this estimate at zero for lack of a more reasonable estimate. Other times, past experience or resale industry guides can be helpful.

- Useful life: This is another estimate, representing the number of years the asset is expected to be in service. Useful life is often different from physical life; the former represents the time an asset can perform its intended function in its intended way. Often, machinery still has physical life left, but the ongoing costs of repairs and maintenance or reduced operating efficiency reduce its useful life. Accountants typically use IRS tax tables, past experience or external sources to help determine the useful life of a fixed asset.

Straight-Line Depreciation Formula

The formula for straight-line depreciation yields a stable, consistent determination of annual depreciation expense for each period. The formula to calculate annual depreciation expense using the straight-line method is:

Annual depreciation expense = (cost – salvage value) / useful life

How to Calculate Straight-Line Depreciation

Calculating straight-line depreciation involves only three data points: asset cost, salvage value and useful life (described in steps 1–3). However, it's important to note that only one of the three is based on hard facts, while the other two are estimates.

These are the steps to follow:

- Determine the fixed asset's all-in cost, which includes the cost of the asset plus any costs to put it into service.

- Estimate the useful life of the asset, meaning, how long it is expected to be in service.

- Estimate the asset's salvage value, or how much it can be sold for at the end of the useful life.

- Use the standard straight-line depreciation formula, below, to calculate annual depreciation expense.

- Optional: Divide the annual depreciation expense by 12 to arrive at a monthly depreciation expense.

- Optional: Divide 1 by the useful life to arrive at an annual depreciation rate. For example, five years translates into 1/5, or 20% each year. Then multiply the annual depreciation rate by the depreciable base.

Examples of Straight-Line Depreciation

Consider the following example of straight-line depreciation. Company KMR Inc. has purchased a new delivery truck for an all-in purchase price of $100,000 (cost). It paid with cash and, based on its experience, estimates the truck will likely be in service for five years (useful life). Aided by data from a trusted guide for vehicle-pricing estimates, and estimating mileage and future condition, KMR estimates that the delivery truck will be sellable for about $15,000 (salvage value) at the end of five years.

Based on the formula (cost – salvage value) / useful life, KMR's annual depreciation expense based on the straight-line method is $17,000 [($100,000 – $15,000) / 5].

To see how this example plays out through asset retirement, see the chart near the top of this article and the template provided in the next section.

Free Straight-Line Depreciation Template

Use this template to calculate an asset's straight-line depreciation, as well as its impact on a company's balance sheet and income statement, by general ledger account.

The template has been preloaded with the example in the previous section but can be changed by updating the three input variables highlighted in yellow.

Calculate & Track Depreciation With NetSuite

While straight-line depreciation may be the simplest of depreciation methods, maintaining manual spreadsheets of depreciation tables for all of a company's depreciable assets can be complicated, time-consuming and prone to error. Adding to the difficulty, businesses may use different depreciation methods for its various categories of fixed assets, each with its own depreciation schedule. What's more, different depreciation schedules may be needed for book and tax purposes, as well. Robust automated accounting NetSuite Cloud Accounting Software, can take over this tedious process, reducing the potential for error and freeing employees to work on higher-value activities. Additionally, integration with NetSuite Fixed Assets Management can help ensure that depreciation and asset inventory are aligned, records are accurate and depreciation rules are applied consistently.

Conclusion

Straight-line depreciation is a popular method for allocating the cost of fixed assets over the duration of their useful lives. This method relies on the passage of time to calculate a consistent amount of depreciation charges in each accounting period. Because it is the simplest GAAP-compliant method, it is also the most commonly used in practice.

Straight-Line Depreciation FAQs

What are the other methods of depreciation?

Other methods of depreciation include units of production, sum of the years' digits, declining balance and modified accelerated cost recovery systems (MACRS). All of these methods are GAAP-compliant except for MACRS, which is required by the IRS for U.S. tax purposes.

How is straight-line depreciation different from other methods?

Straight-line depreciation is different from other methods because it is based solely on the passage of time.

How does straight-line depreciation factor into accounting?

When depreciation is calculated using the straight-line method, the current period's depreciation amount is debited to a depreciation expense account on the income statement and credited to an accumulated depreciation account on the balance sheet. This serves to increase expenses, which reduces income for the period. It also increases the contra asset account, which reduces the running balance of its related asset when netted together.

What are realistic assumptions in the straight-line method of depreciation?

Two of the three data points required in the formula for straight-line depreciation are estimates: the economic useful life of the asset and the estimated salvage value at the end of the life. The third data point, the asset's cost, is empirically quantified based on purchase price and costs incurred to put the asset into its intended service.

What is straight-line amortization?

Straight-line amortization is a similar concept to straight-line depreciation, but it is applied to intangible assets with definite useful lives, such as patents, trademarks and copyrights. Unlike straight-line depreciation, amortization usually assumes no salvage value and is calculated on the entire value of the intangible asset.

How do you calculate straight-line depreciation?

Straight-line depreciation is calculated by dividing a fixed asset's depreciable base by its useful life. The depreciable base is the difference between an asset's all-in costs and the estimated salvage value at the end of its useful life. The useful life is represented in terms of years the asset is expected to be of economic benefit.

What is a straight-line depreciation example?

Let's say a company purchases a new delivery truck for $100,000 (cost). The company pays with cash and, based on its experience, estimates the truck will be in service for five years (useful life). Aided by third-party data on vehicle-pricing estimates, and estimating mileage and future condition, the company estimates that the delivery truck will be sellable for about $15,000 (salvage value) at the end of five years. The formula to calculate annual depreciation using the straight-line method is (cost – salvage value) / useful life. Applied to this example, annual depreciation would be $17,000, or ($100,000 – $15,000) / 5.

What is the formula for depreciation

Using the straight-line method, the formula for annual depreciation expense is:

(cost – salvage value) / useful life = Annual depreciation expense

Why do we use straight-line depreciation?

Accountants use straight-line depreciation because it is easy to calculate, is less of an administrative burden and is less prone to error. It is also the most fitting choice for fixed assets that become obsolete as they age with the simple passage of time.