Overdue reimbursement checks, poor visibility into how much employees are spending and kludgy spreadsheet-based tracking systems are just some of the travel expense management challenges organizations face today.

That second one might be the most painful: Companies need to know where their money’s going and whether employees are following spending rules. And small businesses may feel travel and expense (T&E) inefficiency most acutely: Many lack automated systems to quickly and inexpensively process reports, and their finance teams are often stretched thin.

A better bet for all-size companies: Identify and address T&E management challenges before inefficiency and errors drive up costs—or shorten your runway.

Top 11 Challenges of Travel and Expense Management

When employees travel for business, the cost of airfare, lodging, ground transportation and meals can add up quickly. Even those working at home or locally rack up expenses, like office supplies and mileage for customer visits.

These expenses must be processed, approved and reimbursed in a timely and cost-effective manner. However, 46% percent of companies don’t even track how much they spend processing expense reports, according to Tallie’s 2019 Travel & Expense Management Trends Report.

That lack of visibility is just one of the travel and expense (T&E) management challenges that companies should be aware of.

1. Poor data visibility

Managing financials is impossible when a company doesn’t know how its money is being spent by employees in the field. This lack of visibility also leads finance teams to miss errors, duplicate reports, miss receipts, even potential fraud.

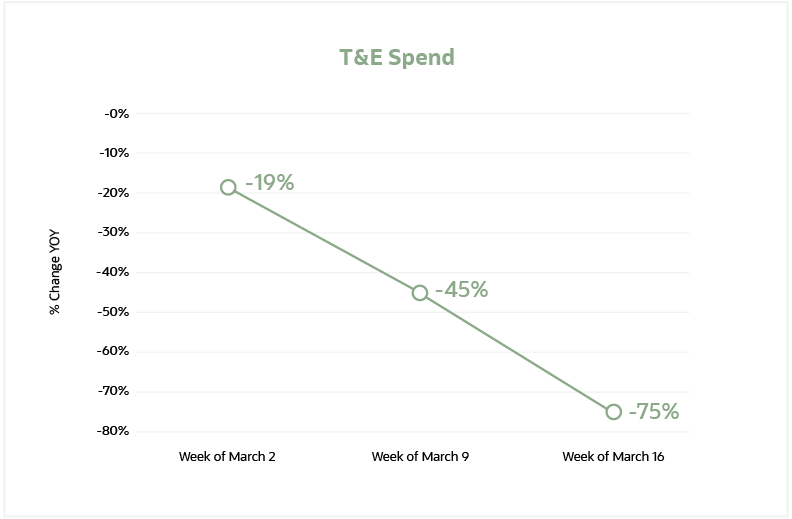

Some companies had a pretty good handle on travel patterns and could perform “educated guesstimates” on monthly spend. But COVID-19 shook all that up. Dataconomy reports that the pandemic dropped the bottom out of T&E spending and upended categories. In March 2020, hotels represented 51% of spending. That dropped by 31% in just a month, to 20%. Meanwhile, spending on business services jumped from 10% to 27%.

It’s safe to assume there will be more, and lasting, changes. So much for estimates.

The answer is centralized expense management software that collects and categorizes all receipts and documents in a centralized database that can be reviewed at any time. Besides tracking employee spending, T&E management systems determine how the organization will reimburse employees. And because it reduces the need for manual data entry, this software also helps prevent errors and speed up the T&E process.

2. Inefficient processes

Because they involve a lot of paper, email and spreadsheets, manual expense management processes are time-consuming and error-prone. They also introduce major inefficiencies and bottlenecks. With 43% of companies still using manual processes to manage expense reports, per the Tallie survey, and 46% not tracking the cost associated with this work, moving to an automated expense management system would benefit a wide range of companies.

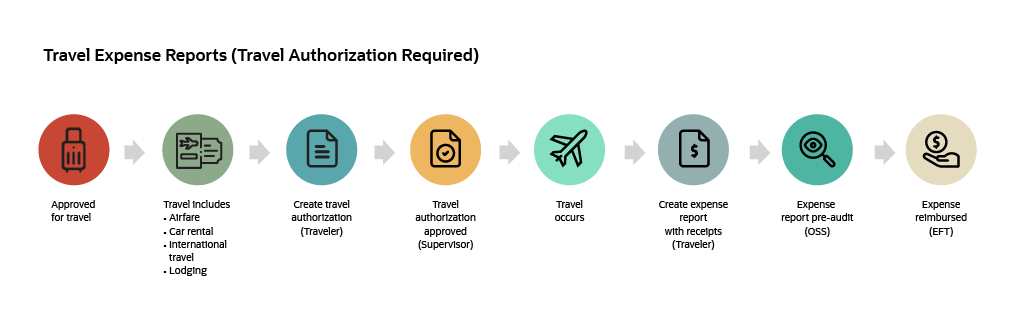

It’s not a stretch to see how working from home could add even more bottlenecks to an already cumbersome process, especially in organizations that require T&E authorizations and audits.

One tip for startups that are just formulating an expense management process—and that are keen to keep employee satisfaction high—is to focus on a pleasant and efficient user experience when evaluating software. Look for mobile payment capabilities, for example. More on mobility later.

3. High-cost solutions (both in time and money)

When evaluating expense management, don’t focus only on the one-time (for on-premises) or monthly (for SaaS/cloud) software cost. Disparate systems that don’t “talk” to one another add more delay and cost to the reporting process. And employees who have to shop around online for the best flight and hotel deals waste valuable time.

To estimate the true cost of adding expense management software, adapt this worksheet:

Calculating T&E Costs

| Current Manual Process, Employees | |

|---|---|

| Average time spent per expense report per employee | |

| Average hourly salary | |

| Number of employees generating T&E | |

| Number of reports created monthly | |

| With T&E Software in Place, Estimated | |

| Average time spent per expense report per employee | |

| Average hourly salary | |

| Number of employees generating T&E | |

| Number of reports created monthly | |

| Current Manual Process, Finance | |

|---|---|

| Average time spent per expense report per finance employee | |

| Average hourly salary of finance employee | |

| Number of reports processed monthly | |

| Average time spent addressing errors in reports | |

| With T&E Software in Place, Estimated | |

| Average time spent per expense report per finance employee | |

| Average hourly salary of finance employee | |

| Number of reports processed monthly | |

| Average time spent addressing errors in reports | |

4. Outdated systems/technology

Everyone agrees that manual systems are cumbersome and error-prone, yet companies continue to cobble together spreadsheets, emails, point solutions and paper receipts in hopes of winding up with a cohesive approach.

As time goes on, ad-hoc systems tend to become a major burden for both the finance team and employees. Only 27% of companies, for example, have systems that automatically flag out-of-policy expenses, per Tallie. That means either accounting is manually reviewing reports, or disallowed items are slipping by.

One bright spot for firms with older technology is that they can leapfrog peers and take advantage of some hot expense management industry trends, like mobility, improved integration, and expanded use of AI, automation and machine learning.

5. Increased spend in T+E

Companies that aren’t tracking T&E spending trends over time are missing out on opportunities to both make better decisions about policies and intervene early to address out-of-policy or potentially fraudulent activity.

For instance, if an employee who usually spends about $500 a month visiting customers at their locations is suddenly spending $750 with no prior approval or explanation, the spreadsheet approach to T&E management won’t pick that up.

Companies with travel and expense software that utilizes that machine learning we mentioned, however, can intervene early. An ML system that’s been properly tuned can flag anomalies, like that $250 per month spending increase, that might indicate fraud or human error.

Service-based companies that deliver projects to their customers face even more challenges with a manual approach to expense management. For these companies, they must reimburse their employee but also pass on the expense to their customer and neatly account for it each month to balance the books and understand project profitability.

Larger companies facing spiraling costs may also consider a corporate travel management team that will address all functions associated with supporting business travel for employees, customers, vendors and business partners, including containing costs and enforcing policies.

6. Lack of policy enforcement

One top expense management best practice is to create a policy that everyone in the organization must follow. Your policy should outline exactly what is and isn’t an approvable expense based on up-to-date IRS regulations governing reimbursements and your company’s culture and budget reality.

A formal policy that clearly outlines exactly what is and isn’t an approvable expense also helps the accounting department and/or approvers quickly and equitably decide whether an expense is allowable or not. Employees know when they can expect to be reimbursed and what recourse they have if an expense is rejected.

No policy to enforce? SHRM provides travel expense policy templates, as do other industry groups, so companies don’t need to start from scratch.

7. Late report submission

When expense reports come in late, you may incur fees on corporate cards, which could affect the employee’s credit score in cases of joint liability. Lateness also presents accounting challenges as the finance team scrambles to gather documentation and get expenses approved before monthly or quarterly closes.

To avoid this issue, your expense policy should include firm deadlines—for example, “submit all expense reports by the last day of the month following the month in which they were incurred”—and managers must be automatically alerted in time to encourage their staffers to get reports in on schedule.

8. Slow employee reimbursements

There’s nothing worse than hustling to get a report in, then waiting months after an expense outlay to get reimbursed—particularly for an employee who paid out-of-pocket for a pricey product or service. This can lead to frustration on the worker’s part and even impact productivity and morale. With effective expense management processes and software, however, companies can automate the approval and reimbursement process and ensure that employees get repaid in a timely manner.

9. Inefficient receipt management

For the T&E management process to go smoothly, employees need an easy way to submit receipts along with their expense reports. On accounting’s end, to comply with IRS records retention rules, the digital or hard copy versions of receipts for most expenditures above $75 must be retained for at least three years.

The answer for most companies is to ensure employees can use a receipt management smartphone app, ideally with GPS and OCR technology, to easily capture and upload receipts to a central repository. Then, when it’s time to file an expense report, there’s no need to dig around for paper, and finance teams have searchable records.

10. Lack of system integrations

When business systems can’t communicate directly with one another without human intervention, processes like T&E management become time-consuming, expensive and error-prone. By consolidating a range of activities, and by automatically inputting the resultant data into a company’s enterprise resource planning (ERP), general ledger or other accounting system, an integrated expense management solution can vastly improve an otherwise cumbersome, expensive process.

And in fact, better integration is another top expense management industry trend. When considering T&E management software, employees will appreciate the ability to track their reports from filing to payment. The finance team will benefit from a consolidated view of financial data.

Look for built-in integrations compatible with your accounting system and the ability to granularly report on T&E spending. That’s critical for those charged with financial planning and analysis for your company, because financial planning and accounting (FP&A) requires data, and lots of it. Yet FP&A teams spend 75% of their time simply gathering and processing data, per an Association for Financial Professionals survey, in part because they lack access to source systems.

11. Lack of reporting

Business analytics have come a long way over the last decade, but a company that’s still using spreadsheets and manual processes to manage expenses can’t take advantage of these advancements.

Related to the FP&A discussion, finance teams with no centralized system from which they can pull reports will find it impossible to understand T&E spend over time. That hinders everything from financial projections to cash flow analysis to vendor negotiations.

Bottom line on challenges: Leaders need insights into how departments are allocating their T&E budgets on a monthly basis, how spending is trending and where savings could be found. Finance teams need automation to cut down on the amount of time they spend on tedious, manual processes and the ability to spot errors and anomalies. And employees need apps to easily wrangle receipts and a way to track the progress of their reports.

These problems can be solved with a unified software platform that not only automates the expense management process, but also integrates with other finance systems to create accurate, timely reports.