After payroll and benefits, corporate travel and entertainment (T&E) is the second-largest controllable employee expense for most companies. Because it makes up such a large chunk of a company’s financial outflow, travel expenses shouldn’t be managed using paper records, crumpled receipts, and Excel spreadsheets.

By automating the expense management process, companies can save considerable time, improve accuracy, and reduce the time it takes to reimburse employees for their expenses.

What Is Expense Management Automation?

Expense management automation involves using technology to accomplish many of the processes associated with employee expense reporting, policy vetting, approval, and reimbursement. Key areas to automate include manual tasks like paper receipt collection, data entry, and checking expenses against company rules before routing reports to managers. Employees will generally submit expenses through a mobile apps or web portal, and managers can quickly approve or reject reports.

Companies benefiting from expense management automation use software to manage the process of paying for reimbursable expenses incurred by employees. This software also helps assure that the company isn’t overspending on approved—or unapproved—expense areas.

Expense management automation implies use of analytical tools to make smarter spending decisions and help organizations maintain compliance and accountability by accurately tracking and reporting on all expenses. Automated systems can also integrate with accounting software, simplifying reimbursements and financial reporting.

Key Takeaways

- Expense management tools automate the reporting, routing, approval, and reimbursement of business expenses incurred by employees.

- Such automation benefits finance teams, employees, managers/approvers, and the company as a whole.

- Automating expense management saves time and money, reduces error and fraud, increases compliance and control, and provides greater visibility into expenditures.

- A solid implementation plan can help overcome common challenges and simplify processes.

Why Automate Expense Management?

Because manual expense management requires a lot of paper and spreadsheets, the process tends to be inefficient, time-consuming and error-prone. It’s also expensive: One survey of almost 600 finance professionals showed that 43% of companies use manual processes to manage expense reports, and 46% don’t track the costs associated with that work. Of those that do, 25% say it costs more than $11 per record; for 8%, that figure rises to $31—or even more.

Still, cost isn’t the only compelling driver for automation. According to the 82% of companies that have either invested in or are planning to invest in technology to improve expense management, simplifying the expense reporting process for employees and managers is a key reason for the move. Yet one 2024 survey of more than 200 finance and accounting professionals showed that use of expense management software has been stuck between 39% and 47% since 2021, while nearly half of respondents continue to single out excessive time spent filling out expense reports as a top challenge.

Other motivations include gaining access to real-time insights for visibility into spending trends and a desire to have all the company’s expense data on a single platform—versus scattered across spreadsheets and paper-based systems.

Which Roles Benefit from Automated Expense Management?

Finance is certainly one of the most obvious beneficiaries of automated expense management. But it’s not the only function or role that benefits. The C-suite, employees, managers, business owners, and even IT teams enjoy the advantages of automation.

- Finance: Automated expense management reduces the burden of manually gathering and reconciling expense reports, a process prone to errors and delays—especially during high-pressure closing periods. Automation not only makes this work easier, it flags missing documentation, helps prevent fraud, identifies spending patterns, and improves compliance with company policies.

- Employees: Workers benefit from the relative ease of filling out or scanning and submitting expenses in a purpose-built system rather than doing it all by hand. Automated systems check expense forms for missing documentation and other issues, resulting in faster reimbursement and fewer delays.

- Managers: Managers and other approvers gain access to clear workflows and a direct line of sight into the expenses they need to review. In fact, some expense management software can categorize expenditures based on predefined rules relevant to the business. Better visibility into budget adherence and centralized communication are additional benefits, as is a clear record of both expenses and interactions that can be referred to if issues arise.

- IT: Expense management software that is integrated with accounting, finance, and other enterprise systems negates the need for manual data transfers, reducing errors and minimizing IT support needs.

- C-suite: Executives gain deeper insight into companywide spending, enabling greater financial control. Integrated automated expense management systems also provide access to real-time spending data that supports decision-making. This can lead to cost savings and increased profitability.

- Business owners: For owners of small and midsize businesses, expense management automation can reduce administrative overhead, freeing up time for strategic tasks. As with the C-suite, improved visibility into spending patterns may uncover opportunities to cut costs, increase budget compliance, or even renegotiate vendor contracts. Automation can also help minimize errors and prevent fraud, reducing financial losses while improving cash flow and profitability.

Traditional Expense Management Process

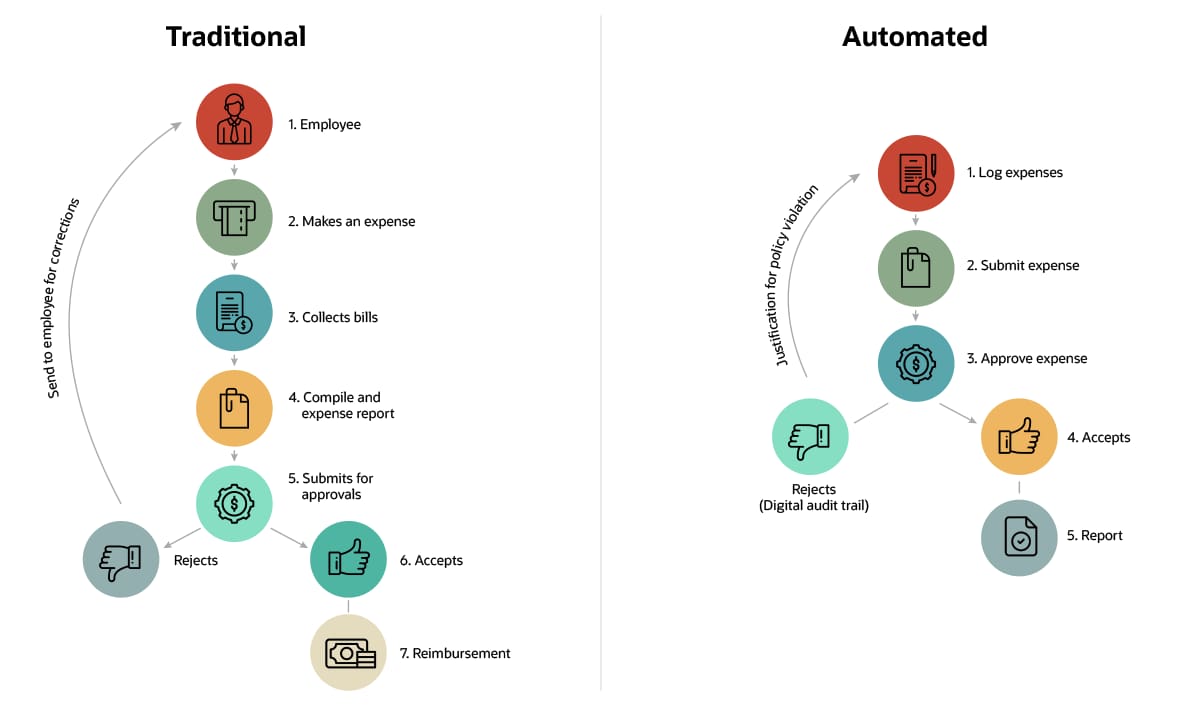

Traditional expense management processes that rely on manual data entry, paper receipts, and cumbersome approval workflows introduce inefficiencies and vulnerabilities. These workflows are time-consuming and increase the risk of financial errors and non-compliance. Furthermore, the lack of real-time visibility into spending patterns makes effective budget management and cost control much more difficult. Let’s walk through a typical process.

11 Steps to Processing an Employee Expense Report

- Employees gather paper receipts as they accumulate expenses.

- On a monthly or quarterly basis, they take those receipts and record them in a spreadsheet-based expense report.

- The report is reviewed by the accounting or finance team and the employee’s direct supervisor.

- The report is sent to the appropriate approvers—managers, senior executives—for review.

- The expense report is approved in whole or in part, with any unapproved expenses sent back to the accounting team and, subsequently, the employee for review and revision.

- The report is sent to the accounts payable coordinator to be posted and set for payment.

- All submitted receipts are verified as legitimate.

- The receipts are entered into the file for tax and accounting purposes.

- The accounting team enters the correct tax codes into the expense report.

- The expense report is posted in the company’s accounting or enterprise resource planning (ERP) system for auditing and accounting purposes.

- The reimbursement payment is authorized and issued to the employee or credit card company, as applicable.

Manual vs. Automated Means to Expense Management

Expense management, whether manual or automated, is the process of tracking, categorizing, approving, and reimbursing business expenses incurred by employees on behalf of the company. These expenses often include travel, accommodations, meals, and work-from-home purchases such as office supplies or computer hardware.

Even in small companies, expense management requires collecting, tracking, analyzing, and reporting on significant amounts of data. It also requires coordination among multiple parties, including the employees reporting the expenses, approvers, finance teams, and business owners or executives.

Expenses can be managed manually, often via spreadsheets, or they can be automated with expense management software—the latter route improves efficiency and accuracy and benefits all stakeholders involved.

Manual Expense Management

Traditional, manual expense management relies on paper- or spreadsheet-based systems to process, pay, and audit expenses. This approach is cumbersome, time-consuming, and error prone, leading to challenges that include but aren’t limited to:

- Inaccuracies in financial reporting.

- Increased risk of fraud or theft.

- Difficulty analyzing spending patterns or identifying noncompliance with company policies.

Automated Expense Management

Automated expense management systems replace nearly all the manual workload with software. These tools handle receipt capture, expense categorization, approval routing, and reimbursement with limited manual data entry, if any. Benefits include:

- Time savings for employees, approvers, and finance teams.

- Reduced errors and fraud risks.

- Enhanced ability to analyze spending and ensure compliance with policies.

Benefits of Automated Expense Management

Companies can gain significant benefits by automating their expense management processes. On average, it takes 20 minutes and costs $58 to manually process a single expense report, according to the Global Business Travel Association. If errors are found in the report, one correction can add 18 minutes of time and $52 in costs to the process. That’s a high price to pay for what might be a simple paperwork error.

The GBTA says companies process an average of 51,000 expense reports each year; that translates to about $2,650,000 in costs. The association says 19% of those reports contain errors, adding an additional $562,000 and 3,000 hours to the effort.

By automating the expense reporting process, companies can reduce the amount of time spent gathering records, getting those records approved, and then fixing mistakes. This, in turn, dramatically reduces the costs involved.

But those are not the only advantages of automated expense management. Additional benefits include:

-

Enhanced productivity:

Expense management automation makes workflows much faster than manual and paper-based processes. Employees save time by scanning and submitting expenses digitally, allowing them to focus on their core responsibilities instead of tedious administrative tasks. Those in finance and accounts payable can offload repetitive work, such as reviewing expense reports, chasing employees for missing receipts, and categorizing expenses. This shift frees them to concentrate on higher value work, such as financial planning, strategy, and analysis. Approvers and company leaders also benefit, as automated workflows ensure expenses move along with less manual oversight. Executives gain instant insight into company spending, which can readily reveal its impact on the company’s top and bottom lines.

-

Improved accuracy:

The less manual data entry, the greater the precision of expense management. Many automated systems use capabilities like optical character recognition to lift data from receipts, minimizing human error. Artificial intelligence (AI) or rules-based automation can more effectively categorize expenses, leading to more accurate financial reporting data and informed decision-making. And when automated expense management software integrates directly with existing ERP systems, data can seamlessly flow to and from other enterprise modules without redundancy or latency.

-

Quicker reimbursements:

Expense management automation greatly accelerates the reimbursement process. Rather than manually filling out forms, attaching physical receipts, and submitting reports for review, employees can log expenses or upload receipts directly into the system, which then automatically categorizes and records the information and, ideally, integrates directly with the company’s accounting systems. Expenses are then routed straight to approvers, who can quickly assess and approve reports for timely reimbursement.

-

Better visibility and accountability:

Automated expense management systems gather companywide expenses—from sales teams to procurement—into one system. These systems also tend to include built-in analytical capabilities that reveal valuable intelligence about employee spending patterns. This can help business leaders better strategize about budgets and cost-saving measures. Because these systems are always collecting and updating expense data in real time, they allow for more timely interventions regarding spending and budget utilization.

-

Improved control:

Expense management automation tools, particularly when integrated with enterprise accounting and finance systems, greatly enhance financial controls. They streamline accounting processes and financial reconciliation, enabling more robust oversight. They also empower finance teams and company leaders to implement tighter controls over cash flow management and enforce expense policies more effectively.

-

Enhanced compliance:

Expense management automation technologies can use both programmed rules and AI capabilities to enforce company spending policies effectively. These systems automatically flag noncompliant expenses, spot apparent errors, and detect anomalies that may indicate fraudulent claims. For example, they can identify expenses exceeding preset limits, unauthorized upgrades, or unusual spending patterns deviating from an employee’s typical behavior. Expense management automation also helps improve compliance with relevant financial regulations by automatically categorizing expenses, generating audit-ready reports, and creating comprehensive digital audit trails.

-

Improved employee experience:

Manual expense reporting processes are often cumbersome, leading to poor user experiences for employees. This frustration is exacerbated by delays in reimbursement for out-of-pocket business expenses. Automated systems address these issues by offering user-friendly expense reporting, often featuring integration with corporate credit cards to automatically import transactions. This integration, combined with faster approval processes, expedites reimbursements and leaves employees more satisfied with the process.

Features of Automated Expense Management Solutions

Automated expense management solutions help accounting teams track expenses, obtain fast approvals on employee expense reports and reimburse associates on time. They also help eliminate errors and fraud and provide accurate spending data that results in better decision-making.

The key features of these systems include but aren’t limited to:

- An easy way for employees to submit and manage their expenses.

- A process for submitting expenses from anywhere via a web browser or mobile device.

- Automatic data extraction of, for example, costs, tips, taxes, and seller information, to simplify the filing process.

- Real-time verification of corporate expense policies and immediate notifications of any that are violated.

- Integration with corporate credit card reporting systems.

- A dashboard that administrators and approvers can use to view and approve expense reports.

- Multiple levels of authorization for approvers, as required.

- Direct integration into the company’s ERP or other central financial and accounting systems.

- Documented proof of all receipts, interactions, acceptances and rejections in case of an audit.

- Data reports and insights that help companies track spending and control their budgets.

How to Automate Your Expense Management Process

Automating the expense management process may involve a significant shake-up in the status quo, and it requires forethought and planning to do it well. Following are some steps companies can take to increase the likelihood of successfully introducing expense management automation.

Step 1: Research Potential Expense Management Solutions

With a variety of expense management solutions on the market, it’s important to first explore the options to determine which ones align with your organization’s goals. Some features that can be particularly valuable include automated data extraction, receipt scanning, expense policy compliance and enforcement, and integration with other enterprise systems, such as accounting. Many companies find it beneficial to invest in an ERP platform with advanced expense management capabilities baked in.

It’s critical that the system is user-friendly, making it more likely to be adopted. Scalability is also key, as the solution should be able to expand alongside the needs of the business.

Step 2: Choose Your Expense Management Software

After assessing the options and performing vendor due diligence, it’s time to decide on the expense management system that best meets your company’s requirements and goals. Ideally, you’ll select a tool that integrates with your company’s existing systems to ensure a seamless data exchange, while offering a user-friendly experience for team members who will use the technology. Many companies will want to select a cloud-based system with built-in AI-enabled analytics and mobile options.

Be sure to consider the vendor’s reputation, quality of support services, and long-term viability. A vendor with a strong track record, responsive customer support, and a clear roadmap for future developments can add value while minimizing implementation challenges.

Step 3: Link with Your Accounting Software

One of the biggest benefits of automating expense management is the elimination of manual data entry and the errors that go along with it. For greatest efficacy, expense management tools must seamlessly integrate with other existing financial systems; the goal is to facilitate the exchange of data between the expense management system and accounting tools, thereby eliminating the need for manual data reentry. Companies that opt for an ERP solution with built-in expense management capabilities are one step ahead in this regard.

Step 4: Upload and Configure Your Expense Policies

Expense management software can fortify a company’s spending policies by automatically checking reported charges against company guidelines. But first the company needs to upload its expense policies to the system in order to configure rules regarding approved expense categories, spending limits, and required documentation. Then the software can review expense reports and line items against company policies and spending thresholds, flagging reports with noncompliant expenses, lack of documentation, and potential fraud and errors for further review.

Step 5: Incorporate Your Corporate Cards

Companies that issue corporate cards to their employees are at an advantage when it comes to automated expense reporting. By incorporating these credit cards into the expense management software, transactions can be automatically imported, simplifying the whole process for employees. This approach also creates a continuously updated digital expense report, limiting the likelihood of reporting errors or omissions.

Step 6: Create Your Automated Expense Approval Workflows

Most expense management software offers customization options to align with a company’s approval workflows. To take advantage of this, companies should input their expense approval hierarchy into the system so that it can automatically route expenses to the appropriate manager, department head, or someone else for review. There should also be a way to set up automatic notifications to keep appropriate parties informed of the status of expense reports throughout their life cycles.

Step 7: Identify and Implement Compliance Checks

To reap the full benefits of automated expense management, it’s essential to implement automatic compliance checks within the system. These checks verify that submitted expenses fall within company policies, detect duplicate submissions, and make sure all necessary documentation is in place. By integrating these verification processes, companies can safeguard financial integrity and reduce the risks associated with inflated expenses, fund misuse, or fraudulent claims.

Step 8: Train Personnel

This may be the most important step. If employees are unable or unwilling to use the expense management software due to inadequate understanding, the automation effort won’t deliver any benefits. The company should offer comprehensive training to three groups: those submitting expenses, those responsible for approving expenses, and those performing analysis or reviews of expenditures.

Focus training on features relevant to certain users, such as mobile receipt capture and digital expense report creation for those submitting expenses, and analytics and reporting for those in finance and accounting. It’s also a good idea to offer learning opportunities in a variety of formats, such as classroom sessions, on-demand videos or webinars, and on-the-job training.

It pays not to scrimp on training, since this investment increases the likelihood of full adoption of the system and all its features. This way the organization and its employees can get the expected range of benefits

Troubleshooting Common Expense Management Automation Challenges

Benefits aside, implementing and using expense management automation is not without its challenges. Integration issues, resistance to change, data-entry troubles, and compliance hurdles are all possible. Here’s a look at each of these issues and the potential solutions.

Integration Issues

It’s essential that any new expense management software integrate with other business systems, but companies often struggle to connect expense management tools with existing accounting software, ERP systems, or other financial tools. This can be particularly complex when dealing with older, on-premises software.

Solutions

- Invest in integration-friendly solutions: To make integration easier, select expense management software with prebuilt connectors or application programming interfaces (APIs) that plug into existing financial systems.

- Opt for integrated expense management: Another option is to invest in accounting software, finance software, or an ERP system with built-in expense management capabilities—circumventing the need for integration.

- Upgrade legacy systems: Compared with on-premises systems that often rely on outdated technology and closed architectures, modern cloud-based enterprise systems are easier to integrate with a multitude of newer tools, including expense management software, thanks to their open APIs, standardized data formats, and built-in integration capabilities.

Change Management Obstacles

Internal resistance to new processes or tools can thwart the benefits of even the most well-thought-out expense management automation plan. Because the new expense management approach will require changes in behaviors and perhaps even roles, change management must be a top consideration.

Solutions

- Invest in a robust change management plan: This should include a communications strategy with clear explanations of benefits for the business as a whole and for each user group.

- Develop a comprehensive training program: Make sure it addresses the needs of different user groups—those submitting expenses, those approving them, and those analyzing them—and is offered in various formats on a frequent basis. This includes regular refresher courses.

- Set up a dedicated help desk: User support will be invaluable during the transition, as well as for future new hires and users. Self-service resources that provide quick answers to common questions, step-by-step guides, and troubleshooting tips are also advisable. These could include FAQs, video tutorials, and a searchable knowledge base.

Data-Entry Errors

While expense management automation eliminates many sources of manual data-entry errors, there will still be chances for mistakes. From poorly scanned receipts to employee data-entry errors, such errors can lead to inaccurate reimbursements, skewed financial reports, and potential compliance issues.

Solutions

- Use data validation tools: These automated and often AI-driven technologies are built to identify and correct errors in real time. They can flag discrepancies between receipt amounts and entered data, detect duplicate submissions, or identify out-of-policy expenses. If corrections aren’t apparent, the issues will be flagged for human review.

- Create multilevel approval workflows: Establish a tiered approval process where expenses are reviewed by immediate supervisors and then by finance personnel. This multistep approach decreases the likelihood of errors moving downstream.

Compliance Challenges

Automating expense management can boost compliance with company expense policies and financial regulations. But making sure the system incorporates and remains up to date with company policies, government regulations, and industry standards takes effort.

Solutions

- Properly configure the system: Take the time to set up the software so that it aligns with and enforces relevant policies, rules, and regulations.

- Regularly scan for changes in rules and regulations: Make sure any new policies, laws, or standards are incorporated into the software before they go into effect.

- Select an adaptable system: Look for expense management software that’s easy to update—or, better yet, automatically updates itself—as new regulations or policy changes emerge.

Choosing the Right Automated Expense Management Software

When shopping for automated expense management software, you’ll quickly learn that not all systems are the same. Look for a solution that eliminates paper, enables better tracking and compliance, maximizes the accuracy and timeliness of expense reporting and enhances the overall user experience for everyone.

You’ll also want to make sure the solution offers the right level of functionality, can accommodate your company’s specific needs, and comes with the necessary after-sale support. Most importantly, find a solution that integrates directly with your ERP or other financial systems. This will help eliminate manual data entry, reentry, and associated errors.

For businesses that rely on employees’ abilities to make purchases, expense management automation is a must. It makes the process of tracking, classifying, approving, reimbursing, and reporting expenses faster, while providing real-time insights into spending. In turn, companies can save time and money as they dig into the data needed to make more informed financial decisions. Benefits aside, implementation can lead to integration challenges, not to mention internal resistance to change. Investing in integration-friendly solutions and creating a clear change management plan with thorough training can make all the difference.

Expense Management Automation FAQs

What is the difference between manual and automated expense management?

Expense management is the process of tracking, classifying, approving, reimbursing, and reporting employee business expenses. Manual expense management typically relies on paper-based or spreadsheet-driven processes. Automated expense management uses software to streamline these processes, with features such as digital receipt capture, automated expense entry and routing, error and fraud detection, and workflow management.

While automated systems require initial investment in software and training, they can lead to time and cost savings, increased accuracy and productivity, better spending control and compliance, and improved visibility and accountability.

What is the difference between spend management and expense management?

Spend management and expense management are related but distinct finance processes. Spend management is broader in scope, covers the entire procurement cycle, and includes strategic sourcing, supplier negotiations, contract management, purchasing, and payment. Expense management is narrower in focus, covering employee-initiated expenses on travel, meals, and other job-related purchases. It involves processes for submitting, reviewing, reimbursing, and auditing these expenses.

What are the disadvantages of manual expense management?

Compared to automated expense management, manual expense management is time- and labor-intensive, has a higher likelihood of errors, makes it harder to detect fraud, and requires increased effort to ensure policy compliance. It also doesn’t provide the same level of real-time visibility into companywide expenses, which makes it harder to analyze expense patterns.