Remember when expense reports focused on reimbursing employees for travel expenditures? While the COVID-19 pandemic put the kibosh on most trips, it didn’t eliminate the need for T&E reporting. With the shift to remote work, companies increasingly use their T&E systems as a tool for reimbursing a new bucket of expenses, such as purchases to set up home offices, faster internet, even food delivery.

Though managing reports and the accompanying documentation has traditionally been a labor-intensive and relatively expensive process, best practices combined with automation can simplify the task and cut costs while improving compliance with spending policies.

What Does T&E Mean?

T&E is short for “travel and expense” or “travel and entertainment.” The term is applied to business expenses that employees pay out of pocket or with a company card; the business subsequently reimburses employees for those expenses or pays the credit card bill once the employee submits the appropriate paperwork.

T&E covers a wide variety of business expenses, from dinner with clients to mobile phone services. Typically, it includes items such as air travel, lodging, meals, incidentals and local transportation. When businesses look to cut costs, they may zero in on T&E and look for ways to tighten reimbursement policies and improve compliance with them.

For example, Mastercard reports that T&E costs are usually an organization’s second-highest indirect expense, behind labor. That report also states that accounting functions, like expense processing, audit, compliance and program management, on average, range from 11% to 23% of the total cost of the program.

What Is a T&E Expense Report and What Does It Contain?

Companies require employees to submit T&E expense reports to document out-of-pocket expenses for reimbursement. T&E expense reports typically contain information about each expense item, such as:

- The date the expense was incurred.

- Where the expense was incurred, such as Joe’s Restaurant, Acme Computer Supply.

- The client or project for which the item was purchased, if applicable.

- The client or project account for which to bill the expense, if applicable.

- The cost of the item.

- Any additional notes: “Dinner with Jane Doe to discuss expanding scope of work.”

These fields vary based on the type of expense. For example, employees requesting reimbursement for home internet service may not include the client/project or account number on T&E reports.

Why Is It Important to Report T&E Expenses?

Companies that effectively track T&E expenses tend to more easily catch policy violations and fraud, avoid audit grief, control costs and stay compliant with IRS rules.

With the right expense management strategy, finance teams can closely track how much they’re spending on items from travel and entertaining clients to home office purchases, and then use that information to create or refine spending policies and identify areas where they can cut costs.

But controlling cash outflows isn’t the only reason to master T&E.

T&E and Taxes

T&E expense reporting is very important for tax purposes. The IRS recognizes many business expenses as tax deductible as long as they’re “ordinary and necessary”—that is, common and accepted within your industry or trade, and helpful or appropriate to the business.

However, while travel-related business expenses such as flights, lodging, meals and mileage are generally deductible, companies must be able to show documentation categorizing these expenses and stating their purpose.

It’s also important to note that since the 2017 Tax Cuts & Jobs Act (TCJA), most entertainment expenses are no longer tax deductible. CFOs must be able to prove that an entertainment expense qualifies as an exception if the company is audited by the IRS. Exceptions include recreational expenses for employees, such as holiday parties and expenses related to attending business meetings or conferences.

How Can You Report T&E Expenses?

There are many ways to handle travel and expense reports. Traditionally, companies required their employees to fill out paper reports, attach physical receipts and drop off the completed forms to the accounting department.

Today, most companies use technology—ranging from spreadsheets to automated expense management software—to manage expenses. With expense reporting software, employees fill out expense forms online and attach images of receipts. The software may also check expenses for compliance with company policy and automatically approve or deny them accordingly.

How Can I Automate T&E Report Management?

The easiest way to automate travel & expense report management is to choose a solution that provides the ability to set custom business rules, create expense reports with the least possible friction for employees, easily upload the proper documentation and then track reports throughout their lifecycles. You can also automate approval workflows, direct integration with accounts payable and electronic payments.

Ideally, the solution will include a mobile app with a straightforward, intuitive interface to facilitate documentation submissions from employees—from home for now but eventually while on the road.

Benefits of T&E Expense Reporting Automation

Automating T&E expense reports doesn’t just benefit employees. It can help finance teams save staff time, mitigate fraud and create more complete audit trails.

The costs of manually processing travel and expense reports can add up quickly—think about the time that employees spend entering data, reviewing reports for errors and/or noncompliance and tracking approval of T&E forms. Easier policies and expense software and processes also means there’s less work on the part of finance teams by improving productivity, enabling better tracking and compliance, maximizing the accuracy and timeliness of expense reporting and enhancing the overall experience.

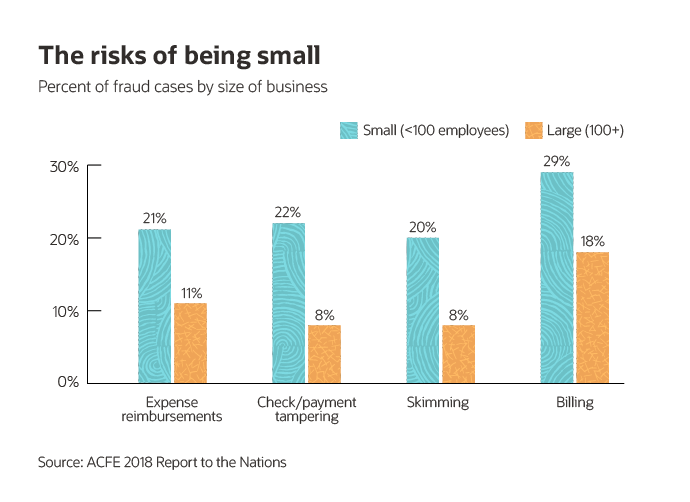

Expense reporting automation can also help companies spot fraud. A study by the Association of Certified Fraud Examiners found that expense reimbursements accounted for 21% percent of fraud in businesses with fewer than 100 employees. This could include doctored expense reports, duplicate entries or fake expenses being added into reports. Expense reporting automation solutions enable companies to set policies for allowable expenses, automatically scan for anomalies and flag expenses that don’t conform to those policies.

Maybe that’s why T&E fraud drops to 11% among companies with more than 100 employees, which are more likely to have automated than smaller firms—despite the benefits of well-managed expense management for smaller businesses.

T&E expense automation solutions also make it easier for employees to submit their expense reports from home or while on the road. For example, automated T&E expense report systems often include the ability to scan or photograph paper receipts with a mobile device.

Automation can also minimize data errors. In larger companies, travel and expense reports come in from a variety of departments, for a plethora of projects. With all that data, manually entering and approving T&E reports can introduce inconsistencies. Using an automated solution lets companies save money by catching errors before they propagate throughout the system.

T&E Reporting Best Practices

When executed correctly, travel and expense reporting helps companies stay compliant with IRS mandates and better allocate their budgets. But to do that, it’s important to follow best practices for T&E reports. Here are some of the most important:

Make travel and expense reporting easy for employees. This can’t be overstated: If the system is difficult for employees to use, they’ll put reporting off to the last possible moment or try to find workarounds. So it’s no surprise that a main driver for many companies implementing T&E software is to simplify the reporting process for employees and managers.

Many CFOs are then pleasantly surprised by the payoff for finance teams.

Include mobile capabilities. Most employees have mobile phones, so it makes sense for them to use their devices to scan receipts or otherwise track expenses. Some apps even automatically calculate foreign-exchange rates using the dates on receipts and add local taxes based on where expenses were incurred and where employees reside.

Create and communicate clear policies. To simplify T&E reporting, it helps to have clearly defined expense policies. For example, the company might have a set per diem for meal reimbursements when employees travel to conferences. The challenge is to communicate those policies to employees. Get HR colleagues involved in this effort during policy development.

Define a workflow. An expense management workflow clearly outlines the route that a receipt takes from the time it’s entered into the company’s expense management system until the employee is reimbursed or the charge is paid by the business. An effective workflow is a critical element of automation.

Automate as much as possible. Automation simplifies and cuts the cost of what has traditionally been a labor-intensive manual process. It can also improve compliance.

T&E Policy Best Practices

It’s important to set expectations for how reports are submitted, what can be reimbursed and how the chain of approval will be set up. For example, at what dollar amount is a report escalated from a first-line manager?

Again, HR professionals and managers can help explain and reinforce the rules using unambiguous language, as employees are more likely to comply with a policy they understand.

For example, companies need to specify how employees book travel (such as the websites, travel agency or other methods they can use) and specify the preferred class of hotels, rental car guidelines and meal allowances. Companies may also want to define rules for adding personal time to a trip, like whether they’ll still pay for flights or extended hotel stays.

The work from home trend and concerns about extending the cash runway have added even more complexity.

Policies should include specific criteria for approving or rejecting expenses and how employees will be reimbursed. Define when travel requests need to be submitted, and what the deadlines are for submitting travel and expense reports.

The “why” also needs to be part of the policy. For example, including IRS requirements for reporting may help improve compliance because employees will understand the rationale for what they’re being asked to do.

Finally, T&E policies can’t be set in stone. Revisit at least once a year, or more often in case of major changes, like an acquisition. Don’t just look at the T&E policy; review reports from your expense management system to identify where you’re spending more than expected. Maybe you can save money, such as by adding a new travel booking site or expanding the list of acceptable hotels to include properties from a lower-cost chain.

5 Tips for T&E Expense Management

Effective travel and expense reporting can be boiled down to five main tips:

- Make it as easy as possible for employees to report their T&E

- Define clear policies for T&E expense reporting.

- Keep abreast of new tax laws to ensure compliance.

- Separate T&E expenses by category in case of an audit.

- Automate as much as possible to facilitate the process and help prevent fraud.

Finally, start early. Even startups need T&E policies and best practices. By putting rules in place from the get-go you can head off bad habits, like allowing per diem spending beyond what the IRS will allow the company to deduct.