With customer demands increasing, regulatory compliance growing more complex, and competition rising, accuracy and efficiency have never been more important for finance teams. Enter RPA. Robotic process automation (RPA) software can automate the time-consuming, error-prone manual tasks that plague finance operations, allowing teams to work smarter and devote more time to the high-value initiatives that drive business growth.

Businesses recognize RPA’s potential to overcome some of their biggest challenges, including governance, compliance, reconciliation, and strategic planning. That helps explain why the global RPA market is projected to grow from $13.9 billion in 2023 to $64.5 billion by 2032. And the possibilities are expanding, as RPA software is increasingly being combined with artificial intelligence (AI) capabilities to tackle more complicated workflows.

This article explores how RPA works, its benefits, and seven ways finance teams can use the technology to spruce up their operations.

What Is RPA in Finance?

RPA in finance involves the use of low-code software to perform repetitive financial management tasks that humans would otherwise have to complete manually. Typical finance use cases of RPA include customer onboarding, invoice processing, and fraud detection; in cases such as fraud detection, though, RPA’s role is the software equivalent of “clerical support” for the more sophisticated software that actually detects potential fraud.

RPA software bots interact with a company’s existing applications and systems in the same way that humans do—by reading information on a screen, entering and retrieving data, and issuing commands. A common example is when you deposit a check using your bank’s mobile app. An optical character recognition (OCR) bot reads the check amount and other details, then inputs the relevant information into your bank’s systems, eliminating the need for manual data entry.

These bots follow user-defined rules to automate basic finance processes, so they do not get smarter over time the way some AI software does. Combined with AI, however, this technology can help automate more intricate finance processes, such as forecasting and planning. RPA software can also be an integral part of a company’s enterprise resource planning (ERP) system.

Key Takeaways

- Because RPA bots make use of a system’s existing user interfaces, they offer a simple way to bring automation to all of the various systems and applications in a finance department.

- RPA software follows standard rules, performing the same task in the same way every time.

- RPA’s consistency helps avoid the errors that humans can introduce, such as typos and missed steps.

- AI can enhance RPA’s capabilities by analyzing the data a bot consumes, providing more informed outputs, identifying trends, and even predicting future outcomes.

How Does RPA Work in Finance?

RPA works in finance by processing structured data according to predefined, standardized rules and workflows. It interacts with the same applications that humans would use to perform these tasks manually. So, in accounts payable (AP), for example, RPA can read the items submitted in an employee’s expense report and cross-check them against the company’s policies to determine whether they conform. When partnered with AI capabilities, after it decides whether to approve the report, the RPA could even initiate reimbursement—a more advanced process that touches multiple finance systems.

Benefits of RPA in Finance

Finance teams deal with complex calculations, hard deadlines, large amounts of distributed data, and a variety of rules and regulations that change frequently. Technologies that can help them do this work better, faster, and more accurately are in high demand—and automation tops the list. Let’s take a look at how RPA improves financial operations and opens up new possibilities for business growth.

- Reduces errors: RPA follows standardized rules, so it always performs a task in the same way. This consistency helps avoid the errors that humans can introduce, such as typos and missed steps, when work is repetitive and tedious. Bots can also verify the accuracy of data from multiple sources, further reducing mistakes.

- Lowers risk: By processing and creating more accurate data, RPA shrinks a company’s risk of producing incorrect financial statements or making poor decisions based on inaccurate information. Additionally, bots leave a full audit trail for every task they perform, so finance teams can put together better, more complete compliance reports. Auditors can use RPA in combination with AI capabilities to help them make compliance determinations, including the identification and remediation of new potential risks.

- Improves efficiency: Think of all the finance and accounting processes involving multiple steps that rely on data from disparate systems. It takes a lot of time and effort to aggregate and manipulate that data manually. RPA can raise financial efficiency by automating many—or all—of these steps and completing them in a fraction of the time, with little to no human involvement.

- Scales operations: RPA’s efficiency, combined with the fact that bots run nonstop around the clock, greatly increases a finance team’s productivity. The robots can help a company keep up with even explosive growth in its financial transaction volume. At the same time, the humans who were previously performing these manual processes have more time to work on new tasks that contribute to the expanding the company, such as analyzing customer behavior to identify upsell opportunities.

7 Ways to Use RPA in Finance

RPA has the potential to benefit many aspects of a finance department. Because bots make use of existing user interfaces, they offer a simple way to bring automation to multiple systems and applications, thus streamlining many accounting processes. For example, many businesses use RPA to automate spreadsheet-based tasks, such as inputting and formatting data. Here are more ways to use RPA in finance.

1. Fraud Detection

Identity theft, banking fraud, money laundering, and other types of malfeasance are of major concern for finance teams across all industries. Fraud detection analysts spend the majority of their time on data collection and data entry, so they need tools that can handle the heavy lifting of these repetitive tasks—which is exactly RPA’s strength. In addition, as they’re collecting and/or entering data, RPA bots can also check the data for compliance with anti-money laundering regulations and examine transaction patterns to identify potentially fraudulent behavior.

In conjunction with AI, RPA can take more advanced actions. For example, AI can perform in-depth analysis of transactions to spot fraud based on emerging behaviors that a bot may not be programmed to see. Or AI could identify payment irregularities, such as fraudulent bank account numbers, that humans might miss. The bot can then alert a fraud analyst or take specific remediation actions, depending on its programming.

2. Customer Onboarding

Today’s customers demand a high level of service and support, starting with onboarding, a process that has many moving parts. RPA makes onboarding faster and more accurate, so companies can deliver a more satisfactory experience to their clients.

New customers must often fill out multiple forms—sometimes using pen and paper—and submit other documentation when they sign on with a new business. After customers submit their onboarding documentation, employees must manually verify its accuracy. An RPA bot, however, can use OCR and other technologies to extract data from those documents, verify it, enter it into the appropriate systems, and take other required actions. For example, at a software-as-a-service company, it could automatically create a new customer account, send a welcome email to the customer, and message the customer success team to initiate post-sales contact.

3. Reconciliation

Account reconciliation is one of the most important tasks in a finance department because it confirms that a company’s general ledger balances are accurate. Reconciliation involves cross-checking statements and other documents against actual bank account balances, which is a laborious process that requires access to multiple systems. And the risk of errors is high when someone is manually collecting and reviewing that data.

RPA helps finance teams more accurately and efficiently reconcile accounts by automatically completing many of the most tedious tasks, such as retrieving and verifying data and flagging discrepancies. With the added capabilities of AI, RPA bots can proactively reconcile accounts by analyzing and comparing bank account, transaction, and payment records in real time. They’re also able to intelligently route this information to the right humans for approvals or additional analyses.

4. Invoice Processing

Timely, accurate invoice processing is a cornerstone of an AP department because it allows finance teams to track how much money the company owes to vendors and to properly approve payments. RPA helps to automate AP processes by extracting the necessary information from invoices, standardizing the data, and entering it into the company’s accounting software. This eliminates the risk of errors arising from manually taking data from one system—or in some cases, a piece of paper—and entering it into another. Automatically coding invoices to the proper accounts and routing them for approval are other ways RPA makes invoice processing more efficient.

5. Accounts Receivable and Accounts Payable

RPA brings additional benefits to the AP and accounts receivable (AR) functions, which hold the keys to keeping a business’s cash flow healthy and its business relationships strong. When AR and AP rely on manual processes, however, they don’t always run as smoothly as companies would like. People sometimes fail to send invoices on time or forget to send them altogether, and bills don’t always accurately reflect how much a customer owes. Accounting automation addresses many of these challenges.

AR departments can use RPA bots to generate and send invoices based on purchase orders, collect and record payments, and send automatic payment reminders. By adding AI to the mix, finance teams can automatically analyze customer payment patterns and identify those at risk for nonpayment. AI can also unlock additional automation capabilities in AP, such as updating analytics dashboards to improve the visibility of a company’s cash flow.

6. Governance and Compliance

Companies should have strong governance in place to establish proper financial controls and accountability across all areas of the business. Many must also comply with industry-specific or government-imposed regulations that control how they store, process, and transmit financial data. RPA bots help businesses maintain solid governance and ensure compliance by automating these tasks and performing the work more accurately than humans.

RPA can also improve compliance and governance reporting. For example, it can aggregate financial data from multiple systems and create reports that demonstrate compliance to relevant stakeholders, such as the company’s board of directors or a government agency. Or, through AI capabilities, a bot could analyze financial transactions and flag any suspicious activity for compliance officers or auditors.

Finance teams may also use RPA to help with tax preparation, reducing the risk of noncompliance from filing inaccurate returns.

7. Forecasting and Planning

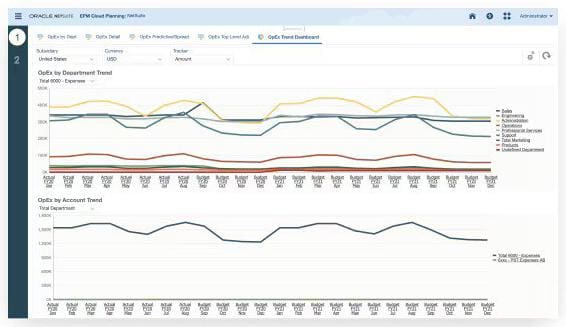

RPA enables better business decision-making and strategic planning in several ways. Automated variance reports that compare financial forecasts to actual results are one common use case that gives finance teams the ability to identify over- and underperforming initiatives in real time. Another example is automated trend analysis, which helps make future forecasts more accurate. Advanced bots can automate forecasting by providing in-depth analysis and data-backed insights when they’re needed—not just at the end of the month, quarter, or fiscal year. This enables businesses to respond to challenges quickly and stay ahead of the competition.

How Does Financial Management Software Benefit Automation Projects?

Automation has the potential to transform not only finance teams but their entire organization. Not all automation is created equal, however. And complications arise when trying to automate processes across disparate systems. NetSuite provides automation with embedded AI capabilities in a unified, cloud-based ERP system. Its financial management solution can simplify and automate AP, AR, customer onboarding, forecasting, and more—all in a secure, compliant way. Uncover new insights about your business, reduce your risk, and take control of your finances with NetSuite.

RPA in finance rationalizes operations, increases accuracy, and reduces costs, making it possible for organizations to expand their businesses and better serve their customers. Because they interact with existing user interfaces, RPA bots offer a relatively simple way to automate many of the repetitive, manual tasks that bog down finance teams. And advancements in AI are making these RPA solutions more powerful. Not only can they combine to automate more complex processes, they can also analyze data and even make forecasts. Finance teams that embrace RPA will be in an excellent position to innovate and grow in competitive markets.

RPA in Finance FAQs

How does RPA save money?

Robotic process automation (RPA) saves money by automatically performing repetitive tasks, freeing up humans to tackle more detailed work. It performs many tasks more efficiently than humans, which results in additional cost reductions. And when used in combination with AI, RPA can analyze data to identify savings opportunities, detect possible fraud, and more.

How does RPA help auditors?

Robotic process automation (RPA) helps auditors by accurately performing some tasks, such as reconciliations. Accurate finances make it easier to conduct an audit. Additionally, RPA quickly and accurately performs repetitive jobs, such as data collection and entry, giving auditors more time to spend on higher value work.

What are the biggest benefits of automation?

The biggest benefits of automation are fewer mistakes, higher efficiency, less risk, and greater scalability. Automation also enhances security, leaves clearer audit trails, encourages more collaboration and transparency across a company, makes it easier to access and analyze data, improves regulatory compliance, increases employee morale, enhances the customer experience, and enables better business decision-making.