Executives and compliance professionals face growing pressure to manage dynamic programs that keep pace with evolving regulations. Covering areas like financial reporting, sustainability, food safety, and labor laws, these rules are increasingly complex and constantly changing due to political, economic, and market shifts.

Poor compliance management can disrupt operations, damage reputations, and hurt profitability. Digital compliance strategies, leveraging data and AI, help businesses stay ahead of regulatory changes and integrate compliance seamlessly into daily operations. This article explores practical steps for using technology to build resilient compliance programs.

What Is a Compliance Standard?

Compliance standards are intended to codify the public interest, whether it’s a question of safeguarding consumers or investors; promoting a well-functioning market according to principles such as fair competition, or advancing broader societal concerns, such as human rights or environmental protection. The standards encourage companies to operate ethically, responsibly, and transparently, while also mitigating risks and protecting their stakeholders’ interests.

Yet standards are not set in stone, given the gray areas they cover, the influence of powerful interest groups, and the pace of change in business and society. This leaves regulations subject to expansion, revision, and reversal—not to mention reinterpretation by the court system and new presidential administrations.

Noteworthy compliance standards include the Health Insurance Portability and Accountability Act (HIPAA) in healthcare and the Occupational Safety and Health Administration requirements established for workplace safety. These standards must be managed along with other significant compliance obligations, such as licensing, taxes, and tariffs. To give a sense of the scope of regulation, the Federal Register published 90,402 pages of proposed and finalized rules, executive orders, and other federal notices in 2023 alone. But that’s just part of the picture. Regulatory bodies and jurisdictions are many and include local, state, federal, and international bodies, as well as industry-run self-regulatory organizations that focus on distinct sectors and issues.

Key Takeaways

- Companies face complex, shifting regulatory challenges, creating risk and uncertainty in business.

- At stake are business efficiency, regulatory penalties, and reputation.

- Companies can surmount obstacles by automating and integrating compliance into daily business operations to avoid costly disruptions, delays, and regulatory repercussions.

Regulations and Compliance Explained

Businesses must embed regulatory compliance into both new product development and ongoing operations to minimize disruption and risk. Seamless integration reduces friction in processes, enhances customer experience, and lowers the likelihood of fines, legal challenges, or forced business adjustments. For example, a real estate agency must comply with state licensing laws, the Fair Housing Act, and ethical codes, while a manufacturer must meet environmental, workplace safety, tax, and product labeling regulations. Proactively managing these obligations helps businesses operate smoothly while avoiding compliance pitfalls.

Many companies, especially small businesses, operate with understaffed compliance teams, sometimes relying on a single employee managing multiple roles. As a result, nearly one-third of senior compliance managers lack confidence in their programs, according to a RegASK survey. Additionally, 41% worry about discovering relevant regulations too late, while a Gartner study found that 87% of compliance professionals have recently faced situations where they were unsure how to comply. These gaps highlight the growing challenges of navigating regulatory requirements effectively.

Cloud-based technologies, such as enterprise resource planning (ERP) systems, as well as dedicated compliance management software and AI, can help ease the burden on compliance teams. For instance, emerging AI use cases include drafting company policy and process controls, automating the monitoring of rule changes, conversing with chatbots about compliance, and summarizing regulatory requirements within a company’s specific context.

Why Is Regulatory Compliance Important?

Regulatory compliance makes headlines only when it fails big, carrying consequences such as forced divestitures, product recalls, fines, and tarnished reputations. Yet the impacts of regulation are pervasive in day-to-day business activities, such as product development or customer service, even when they don’t attract regulators’ attention.

Consider the scenario of a product development team that identifies compliance issues late in its design of a consumer electronics device—and then has to do a costly redesign that delays product launch. Or a mortgage company that poorly integrates federally mandated anti-fraud controls in its lending process, causing confusion and frustrating delays for potential home buyers. Avoiding operational hitches and inefficiencies like these involves the development of business processes that inherently meet compliance obligations without adding unnecessary costs or steps.

In these and other ways, compliance can either help drive or hinder business growth.

- Downsides of noncompliance: Surveys show that three out of 10 companies have lost new business because they were missing a compliance certification; nearly half have delayed or canceled product launches; and one-third have suffered slowdowns in innovation. Potential mergers are often abandoned when due diligence uncovers slack compliance within the company targeted for acquisition. When companies approach a bank for financing, a weak compliance track record can lead to stricter loan terms or even denial. Another major cost of a violation is the redoubled scrutiny a noncompliant company then faces from regulators for the foreseeable future.

- Upsides of compliance: Maintaining regulatory compliance can reduce business risks, accelerate the product development and sales cycles, establish competitive differentiation as an upstanding business partner, and avoid closures, recalls, fines, penalties, and legal settlement costs.

Risks of Noncompliance

Consider these actual events: A leading ride-sharing company had to pay more than $300 million in fines after moving personal data about drivers from Europe to the U.S. without adequate safeguards. Sixteen investment firms were fined a combined $81 million by the Securities and Exchange Commission (SEC) when they failed to preserve electronic communications for financial reporting. Two credit repair companies filed for bankruptcy after a financial regulator found they charged illegal advance fees and engaged in bait-and-switch advertising. An Ohio industrial manufacturer was assessed over $300,000 in penalties and given 15 business days to address its lack of adequate safeguards and safety training.

The risks of noncompliance vary significantly, but they all carry consequences if not addressed, many of which are described below.

- Disruptions to business operations: Compliance controls that are poorly integrated into workflows create extra steps and potential bottlenecks. This can decrease productivity and cause last-minute issues. For example, international orders might be held up while necessary export documentation is found and tariff compliance checks are performed. Worse yet, failure to comply can have more serious consequences, including fines, lawsuits, and even license revocations that could temporarily or permanently halt operations.

- Third-party risk: More than eight in 10 compliance professionals surveyed by Gartner say their relationships with third parties, such as vendors and contractors, exposed them to noncompliance. Typical third-party vulnerabilities include data breaches and failure to uphold environmental standards.

- Financial penalties: In 2024, a number of large companies were issued massive fines, reaching billions of dollars, for serious violations, including money laundering, environmental breaches, and anti-competitive practices. These cases, however, are outliers. Consider that the SEC brought 583 enforcement actions in 2024, resulting in a total of $8.2 billion in penalties. Still, for small to midsize companies that typically face lower penalties than their larger peers, the impact of regulatory fines can be no less significant to their bottom lines.

- Lawsuits and litigation: Individuals can sue companies for harm caused by lax regulatory compliance. These lawsuits often seek compensation for damages resulting from defective products, environmental pollution, data breaches, or other issues. Government agencies, on the other hand, typically address regulatory violations through administrative actions, such as investigations, hearings, and negotiated settlements—though government cases sometimes end up in court. In all, companies can face civil penalties and individual damages, substantial legal costs, and protracted distraction from their businesses.

- Privacy violations: Data privacy rules continue to proliferate, often following the model set by the European General Data Protection Regulation (GDPR) privacy and security standard enacted in 2016 (described more fully later on). Some 20 U.S. states have comprehensive data privacy laws already in place or that will soon be in effect. For example, California imposes fines on companies of up to $2,500 on each consumer impacted by unintentional violations, meaning that a data breach affecting thousands of customers could cost millions in fines. Privacy is also mandated under sector-specific standards, such as HIPAA. Meanwhile, cyber risk remains stubbornly high, with six out of 10 North American cybersecurity professionals reporting a severe to moderate impact from an incident in the past year, according to the Computing Technology Industry Association.

- Loss of licenses and credentials: Most businesses need federal, state, and/or municipal licenses for various aspects of their operations, any of which can be revoked for reasons ranging from unpaid taxes to failed inspections. Key employees may also have to complete annual coursework to maintain professional credentials—for example, to keep working in healthcare or financial services. Companies must track necessary licenses, certifications, renewals, and related requirements, such as taxes, and be ever alert to changes that arise due to the passage of time, the launch of new products and services, or an expansion into different jurisdictions.

- Reputational risks: Publicity compounds the damage to a business when it is fined by regulators, issued a warning, or temporarily closed to fix problems identified by government inspectors. Everything from short-term sales to business partnerships, investor confidence, brand equity, employee retention, and the company’s long-term viability is at risk.

- Loss of customer confidence: Negative sentiment travels fast, especially on social media, and customers lose trust when learning of a violation of data privacy, product safety, or environmental standards. Over half of Americans have avoided buying certain brands or types of food because of a safety recall or advisory, according to a Gallup poll.

- Reduction in employee morale: Lax compliance can make it harder to attract and retain staff. Another Gallup poll found that employees who are aware of unethical behavior in their organization are 45% more likely to be looking for another job.

Examples of Compliance Frameworks

Any single compliance framework may track a large number of potential violations. For instance, HIPAA violation cases have included impermissible uses of personal health information, lack of notice of privacy practices, workforce training failures, noncompliance with audit control standards, lack of contingency planning, and failure to protect information shared with third parties. HIPAA fines are based on the motivation and seriousness of the violation. If a rule is violated due to a lack of knowledge, for example, the civil penalty could range from over $100 to tens of thousands of dollars. If it’s due to neglect and not rectified within 30 days, it could run over $2 million.

Here are brief descriptions of five major compliance frameworks.

- Health Insurance Portability and Accountability Act of 1996 (HIPAA): Healthcare providers, insurers, and billing companies must uphold the privacy and security of patients’ information, disclosing it only for treatment, payment, or other permitted purposes or with the patient’s authorization.

- General Data Protection Regulation (GDPR): This framework sets strict rules for companies that handle Europeans’ personal information. Businesses must be transparent about their data collection and use, obtain consent for it, limit collection to what’s necessary, ensure data security, and give individuals rights to access, correct, or delete their data under certain circumstances. Implemented in the European Union in 2016, GDPR has become a model for data protection business practices and laws globally, including the California Consumer Privacy Act.

- Sarbanes-Oxley Act of 2002 (SOX): To protect investors from fraudulent financial reporting by public corporations, SOX compels CEOs to personally certify the accuracy of their company’s financial statements, subject to independent audit. It also requires internal controls to prevent the manipulation or misrepresentation of financial data and to keep it secure.

- Family Educational Rights and Privacy Act of 1974 (FERPA): Schools must protect the privacy of student education records under FERPA, disclosing information only in specified circumstances or with the written consent of parents and students. At the same time, parents and students can review and request corrections to inaccurate records.

- Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010: To curb risky lending practices, the Dodd-Frank Act increased the number of financial services regulators by creating such agencies as the Consumer Financial Protection Bureau (CFPB) and enhancing the oversight of existing ones. The law also requires measures, such as stress tests on large banks, as well as requirements to hold more capital in reserve, limit speculative trading, and take other precautions to avoid systemic bank sector failures, such as the global financial crisis that occurred in 2008. For smaller financial services companies, the CFPB’s regulation of a wide range of financial products includes requirements such as greater transparency, fair lending practices, and responsible debt collection.

Steps to Enable Regulatory Compliance

A company’s compliance management strategy should sync with its business strategy and get the board of directors’ endorsement to elevate its importance among all staff. Fortified by technology, the compliance strategy should implement controls that align government regulations, enterprise risk management, and internal corporate policy. Here are eight steps to include in the strategy.

1. Identify Which Regulations Are Important to Your Business

Each jurisdiction, industry sector, and type of business structure can impose different obligations on a company. For example, a small business with employees in multiple states must comply with the minimum wage laws in each state. A chemical manufacturing plant will face different environmental compliance rules from a restaurant. A sole proprietorship may have fewer reporting requirements than a publicly traded corporation.

Identifying relevant regulations can require consulting a combination of resources. Government agencies often publish compendiums of regulations, such as the Environmental Protection Agency’s sector-specific web pages, the Small Business Administration’s compliance guide, or a state government’s tutorial on starting a local business. Depending on the size of the business and its compliance team, a company may rely on lawyers, accountants, consultants, or regulatory tracking services to fill in the compliance picture. Compliance management software can also provide a repository of regulatory information that’s routinely updated.

2. Conduct an Audit to Assess Whether Your Business Is Meeting Compliance Standards

An initial compliance audit provides a baseline for ensuring adherence to all relevant laws and regulations. It begins by defining the audit scope, including specific regulations, objectives, and a time frame. Then, the audit team is assembled to gather information through document reviews, interviews, observations, and data analyses. Any audit should also cover the compliance needs of third parties, such as vendors and suppliers, which can pose significant regulatory risks.

The audit should compare the company’s practices to identified requirements, pinpoint gaps, and assess risks. These documented findings should accompany recommendations and a compliance road map.

3. Create a Compliance Road Map

Based on the compliance audit, this action plan lists all of the activities necessary to move from the current state of compliance to the ideal, or target, state. A typical compliance road map might include:

- Applicable regulations, based on jurisdiction, industry, and business structure

- Business processes, which may need to integrate compliance into their workflows

- Compliance goals, such as reducing risk or improving data security

- A timeline, prioritized by level of risk

- Roles and responsibilities, at all levels of the organization

- A budget, including technology

4. Prioritize and Scope Your Efforts

Specific, measurable objectives should be put in writing, accompanied by compliance controls that are prioritized based on the most elevated risks, level of regulatory oversight and enforcement, and, above all, the potential business impact.

Taking a phased approach addresses the resource limitations under which many compliance teams operate. The scope of compliance activities should then be expanded as more resources become available.

5. Document Compliance Procedures and Processes

Documentation of compliance procedures and processes serves many purposes. Unsurprisingly, the documents help avoid confusion and keep everyone on the same page. They delineate clear roles and responsibilities, and then serve as training materials for employees. Regulators consider such documents to be evidence of a credible compliance program.

Compliance documentation should be clear, concise, and centrally available on a compliance management platform or other repository. For example, a data breach response procedure would outline steps to be taken in compliance with regulatory requirements, such as notifying the authorities. Also included would be assignments for all responsible staff—from the IT security team, which must confirm the nature and extent of the breach, to the communications department, which may have to inform customers. Other documented processes would try to capture “lessons learned” from the incident.

6. Roll Out Compliance Road Map and Train Employees

The compliance road map should be extensively socialized across the company, accompanied by an explanation of its importance to the company and its individual employees. Internal communications efforts might include companywide meetings, as well as email announcements and other types of communication channels, with opportunities for questions and feedback.

Training should also come in a variety of formats from short videos to in-person workshops. Importantly, all resources should be made easy for employees to access via a centralized platform. Companies can use generative AI for training, setting up an always-on, conversational resource to answer employees’ compliance questions as they arise.

7. Monitor for Noncompliance

Regulatory change is a constant. Profit-driven business unit leaders may lose focus on compliance, or new business initiatives may expose a company to unanticipated regulatory risk. So, monitoring for noncompliance should be a continuous process, best supported by compliance management software, regulatory tracking services, and other tools.

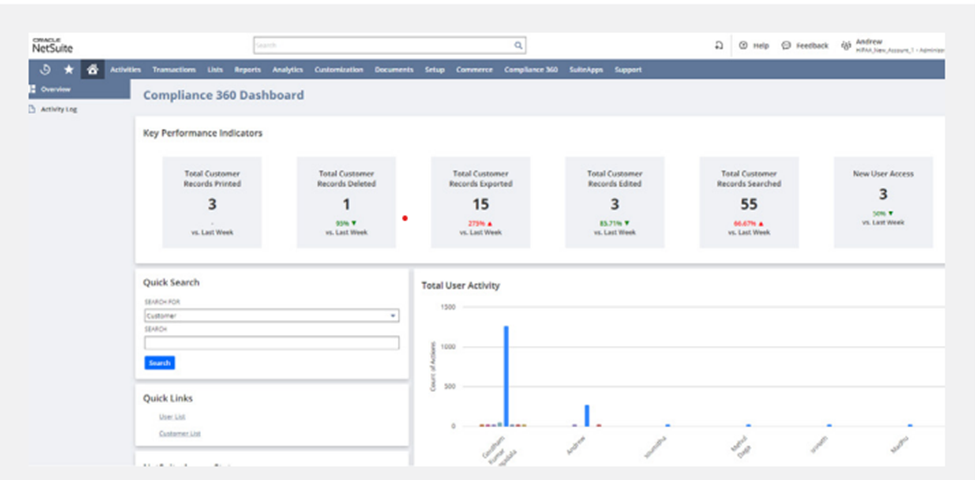

Compliance management software automates the tracking of regulatory changes, monitors such key performance indicators as compliance rate and mean time to issue discovery, and posts alerts for potential issues. Data analytics identify patterns and anomalies in various data sources that may indicate noncompliance. And employee monitoring systems track employee activity, such as who accesses sensitive customer data or what a financial adviser discusses with a customer. With technologies available, such as data analytics and AI, compliance monitoring can become predictive instead of strictly reactive.

8. Maintain Continuous Improvement

Many companies have a long way to go to automate compliance and integrate it into their day-to-day business activities. In a 2024 KPMG survey of large businesses, only 24% of compliance professionals say they were mapping regulations to business controls, though 56% plan to prioritize this step in the next two years. Survey respondents describe a similar state of play in key areas, such as third-party management and regulatory change management. Small and midsize companies are likely to be even further behind.

Compliance team leaders need to engage their board members and their peers in senior management about the business value of digitally transforming their compliance function in today’s climate of regulatory complexity and change.

Best Practices for Enhancing Compliance Adherence

Companies comply best by instilling a culture of compliance across the organization, bolstered by high-quality standards in the design of policies, training, communications, and tools. In this environment, automation, audits, and ongoing vigilance are considered best practices.

- Coordinate compliance efforts with corporate culture: Compliance needs to be integrated into the company’s overarching business culture, strategy, and workflows to ensure greatest adherence. Otherwise, requirements can be viewed as work disruptions and impediments to business performance.

- Increase the visibility of compliance performance: Employees can be encouraged to make ethical decisions and avoid risk when given vocal leadership from top managers, as well as recognition, rewards, and other positive reinforcement. Measurable success can drive engagement at the highest levels of the company. Nearly two-thirds of compliance leaders have prioritized improving their measurement of compliance program effectiveness in 2025, according to Gartner.

- Make compliance training accessible to employees: Compliance training should be offered via multiple media by interactively engaging employees in online courses, short videos, quizzes, and infographics, as well as in-person sessions. Centralized resources, such as FAQs, knowledge bases, support hotlines—and, increasingly, AI chatbots—can support staff as they do their work on an ongoing basis.

- Periodically audit for internal compliance adherence: Even as compliance management software systems continually monitor for gaps and trends in regulatory adherence, companies should periodically conduct audits to review and revise policies, procedures, and practices in their different departments. Though annual audits are common, some companies prefer to conduct them biannually or quarterly, depending on their level of regulation and risk.

- Prepare in advance for compliance audits: Internal compliance audits help companies find potential gaps or violations before their regulators do. Regulators may also conduct routine inspections, random audits, or other activities triggered by customer complaints. In all cases, a successful outcome depends on advance preparation, such as by gathering all documentation on policies, procedures, training records, and performance metrics.

- Appoint an officer or stakeholder to oversee compliance initiatives: Having a dedicated compliance officer demonstrates a commitment to conducting business ethically and in compliance with established rules and regulations. In addition to bringing subject-matter expertise and strong integrity to the task, a compliance officer also needs to have strong communication and interpersonal skills to effectively convey the importance of compliance and build relationships across departments and with regulators.

- Stay up to date on compliance standards: With continual changes occurring in complex regulations across multiple jurisdictions, companies can be hard-pressed to keep abreast of all obligations. To avoid risking noncompliance, compliance teams rely on a combination of resources, such as government agency publications, expert advice from lawyers or consultants, and specialized regulatory tracking software and services.

- Automate processes where possible: Cloud-based software can streamline tasks that might otherwise be time-consuming and error-prone. For example, compliance management software can automate workflows, monitor for violations, track deadlines, and provide updates on regulatory changes in order to support policy management, risk assessment, and employee training.

- Leverage software to reduce compliance headaches: As an integrated suite of business and compliance applications, ERP systems act as a bridge to integrate business and compliance strategies, workflows, and performance monitoring. Lately, AI enhancements have added pattern recognition and gap analysis capabilities that elevate compliance to a more predictive and proactive function.

Software That Takes the Guesswork Out of Compliance

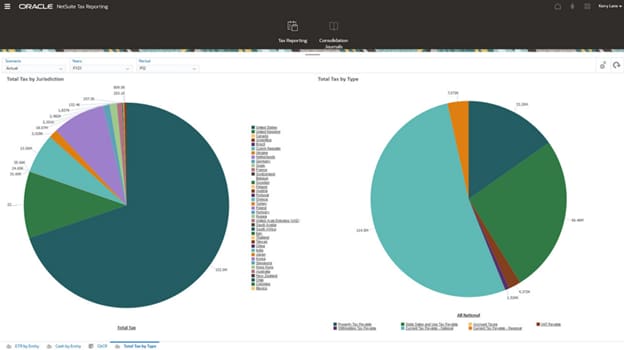

NetSuite’s leading cloud ERP system offers a comprehensive suite of governance, risk, and compliance tools to help businesses effectively manage compliance processes and mitigate operational and financial risks. The system’s capabilities help companies establish and monitor compliance controls, ensuring alignment with business strategy and processes while managing risk. Through automation, NetSuite streamlines compliance tasks, enhances efficiency, and reduces risk even though companies across myriad industries face increasingly complex regulatory challenges.

Companies of all sizes face complex, shifting regulatory obligations, and navigating the resulting uncertainty and potential risks presents an ongoing challenge. But by taking a proactive, technology-driven approach that embeds compliance into business processes, companies can avoid inefficiencies and disruptions, while also mitigating risks, avoiding costly penalties, and protecting their reputations. Implementing the eight steps outlined in this article, combined with best practices in automation and continuous monitoring, can help businesses build a robust compliance program. Ultimately, prioritizing compliance fosters a culture of ethical conduct, strengthens stakeholder trust, and contributes to long-term business success.

Regulatory Compliance FAQs

How do you make compliance training more engaging?

Compliance training can be more engaging when it incorporates interactive elements, such as quizzes, games, and even humor, through videos, animations, and other media. In addition to catering to different learning styles, compliance leaders should make training relevant by connecting compliance concepts to employees’ everyday work experiences. Many providers offer libraries of compliance training resources that can be tailored to specific needs.

How do you increase compliance awareness?

Building compliance awareness requires constant effort, with top executives reinforcing its importance in routine communications and meetings. Setting the tone at the top can compound the impact of the basic building blocks of compliance training, as well as providing easily accessible information resources and detailing clear roles and responsibilities. Ideally, awareness-building efforts work to foster a culture of compliance where ethical behavior is recognized and rewarded, and open communication about compliance concerns is encouraged.

How do you maintain compliance with regulations?

Compliance works best when it is integrated into a company’s overall business strategy and processes. Otherwise, it can be perceived as an additional, disruptive step that impedes business performance. In this context, a robust compliance program should set clear policies, procedures, and training to guide employee behavior, using automation and expert advice to keep abreast of ever-changing regulatory requirements.