For businesses, financial risks are everywhere, from volatile markets and regulatory changes to inefficient processes and unexpected cash crunches. To protect their livelihood and prevent costly missteps, businesses must fully understand and carefully navigate all the risks they face. Addressing and mitigating these threats require business leaders to take a hard look at their operations and processes. Through detailed data and analysis, companies can focus their risk management strategies on the areas where they’ll have the biggest impact, taking into account the unique risks faced by their industry, business type and customer base.

This article explores how businesses can better manage their financial risks to reap the benefits that robust and comprehensive financial risk management processes can bring.

What Is Financial Risk Management?

Financial risk management allows businesses to safeguard their economic value against the risks associated with internal weaknesses and external pressures, including operational inefficiencies and market fluctuations. To competently manage their risks, businesses must first identify financial threats and measure or forecast their impacts. Then, they can take steps to minimize potential damages, if not avoid them entirely. Just about every investment carries some level of risk, so understanding and implementing financial risk management strategies are crucial steps when deciding which potential returns are worth their associated risks. Businesses can use these strategies to protect their assets and investments while supporting long-term sustainability and growth.

With sound financial risk management, businesses can prevent losses, improve their financial performance and maintain their competitive advantage. While this is important for businesses of all types and sizes, it’s especially important for smaller enterprises with limited resources, as even relatively small setbacks can inflict far-reaching financial consequences. Well-planned and robust financial risk management policies can help business leaders make informed decisions, allocate resources appropriately and navigate their finances with confidence, even given today’s fast-paced and ever-changing market.

Key Takeaways

- Financial risk management allows businesses to safeguard their financial position against internal weaknesses and external pressures, which helps leaders fine-tune performance as they secure competitive advantages.

- The financial risk management process is systematic. It includes identifying, analyzing, prioritizing, mitigating and monitoring risks to facilitate constant improvement and the ability to adapt to new challenges as market conditions evolve.

- Effective financial risk management not only minimizes potential losses, but it can also heighten profitability by fostering cross-functional collaboration, improving internal limitations and strengthening financial reporting.

Financial Risk Management Explained

Financial risk management encompasses a broad spectrum of activities that aim to minimize the negative impacts of financial uncertainties. Financial risk management strategies typically focus on five major categories: market risk, credit risk, liquidity risk, operational risk and legal and regulatory risk, all of which will be explored later in this article. By embracing comprehensive financial risk management plans that address all of these categories, businesses can identify the risks most pertinent to their operations and take steps to limit the business’s potential exposure. Although there are some near-universal strategies for limiting risks, such as diversification, the approach a business pursues will likely vary based on their industry, type of risk, available resources and other factors.

For many companies, financial risk management serves a dual purpose: protecting the business from potential losses and empowering leaders to seize growth opportunities that align with their risk tolerance and business goals. For example, a manufacturer might analyze market trends and loan terms from several banks to decide when and how it borrows funds to buy new equipment. In this way, the business can minimize its debt and risk of default without missing opportunities to expand operations and increase output or launch new product lines.

Financial Risk Management Applications

Financial risk management isn’t just a concept reserved for large banks and investment firms. By analyzing and expanding their financial management strategies, businesses can gain insights into those areas where they’re succeeding and where they’re falling short of expectations. Financial risks can arise across different parts of a business, so it’s important for companies to create detailed management strategies for every aspect of their finances. Here, we look at the financial risk management strategies preferred by banking, corporate finance and investment management companies, and explore how they might be applied to any business to provide a roadmap for financial success.

-

Banking

Banking-related financial risk management goes beyond managing accounts to include minimizing risks associated with credit, interest rates and loans. Many businesses have a working relationship with bankers or banking institutions that they rely on for advice and consultation, but it may be beneficial to periodically conduct market research or bring in external financial experts to assess the risks of major decisions, such as taking out a new loan. Through this due diligence, businesses can secure loans at favorable rates that fit with overall financial forecasts to optimize their cash flow and maintain creditworthiness, liquidity and stability, even during periods of uncertainty.

-

Corporate Finance

Financial risk management plays a crucial role for leaders weighing their investment options. By applying corporate finance risk management principles, business owners can decide where to invest, as well as how to structure their capital and protect their assets, including big-picture moves, such as mergers and acquisitions. Even if a business doesn’t have a dedicated chief financial officer or team of financial analysts, it can still benefit from the same due diligence, detailed financial reporting and risk analysis that larger companies rely on before making these decisions. Much like large investment firms and corporate financiers, small and medium-sized businesses can diversify their investment portfolios to spread responsibility and hedge against external risks, such as currency and interest rate fluctuations. Additionally, businesses should track key financial metrics over time, such as the working capital (current assets minus current liabilities) and debt-to-equity ratio (total liabilities divided by total shareholders’ equity), because this can help decision-makers maintain a healthy balance between debt and equity and ensure financial stability.

-

Investment Management

While investing in risky ventures can sometimes harm financial health, businesses playing it too safe can miss promising opportunities. If a business is sitting on surplus cash, reinvesting it into growth can often do more long-term good than leaving it in an account, especially if the business already maintains a cash reserve for safety during slow periods. Financial risk management strategies help business owners assess the potential returns and risks for various investment options, including stocks, bonds and other securities. These options should be weighed against long-term business plans, as some options have specific rules regarding when and how their returns are realized. For example, during inflationary periods, some businesses invest in U.S. Treasury Bonds, such as Series I savings bonds whose returns are based on inflation. These bonds earn interest for up to 30 years but draw penalties if cashed in before five years. By carefully choosing which investments to make and when, businesses can make sound decisions that align with their long-term financial goals.

Types of Financial Risk to Manage

Every business faces its own unique risks and should cater its management strategies to its specific circumstances. However, most financial risks fit into one of the five categories described in detail below, along with strategies that minimize these risks.

- Market risk: Market risk pertains to the potential losses a business might face due to changes in market rates and prices. These include interest rates that affect loan repayments and supply chain issues that disrupt the cost and speed of procuring raw materials. According to Goldman Sachs’ May 2023 10,000 Small Business Voices survey, 77% of small businesses surveyed are concerned about their ability to access capital when dealing with high interest rates and tighter lending conditions. By diversifying funding sources and suppliers, closely monitoring market trends and gradually adjusting prices as needed, businesses can minimize the impact of these external pressures and maintain their profitability.

- Credit risk: Credit risk stems from a borrower’s failure to repay a loan or meet contractual obligations. This category of risk includes customers delaying payments for goods or services purchased on credit, as well as penalties arising when businesses miss loan payments to creditors. To reduce the risk of unpaid customer invoices, businesses can run credit checks, reduce the length of repayment terms, implement more robust accounts receivable practices and track their revenue streams to be sure that no single client represents a large portion of total revenue. To track outgoing payments, on the other hand, many businesses rely on software that automates accounts payable functions, such as automatic payments and alerts, to ensure that payments are made on time to avoid penalties or additional fees, as well as to maintain cash flow.

- Liquidity risk: Liquidity is a measure of a business’s ability to meet its short-term financial obligations. When businesses are unable to quickly convert assets, such as inventory, into cash, they can be at risk of missing loan repayments, wages and other expenses. This is especially true for small businesses, since unexpected expenses or slow business periods can rapidly drain their limited resources and leave them unable to meet their obligations. However, businesses can plan for cash crunches by carefully tracking their cash flow statement, a key financial document. Through detailed cash flow analyses, businesses can minimize liquidity risks by creating appropriately sized cash reserves or opening lines of credit that they can tap into as needed.

- Operational risk: Operational risk is associated with failures in internal processes, equipment, people and systems that can lead to direct or indirect losses. According to the U.S. Federal Reserve Bank’s 2024 Report on Employer Firms, 91% of companies experienced one or more operational challenges and 93% faced some type of financial challenges in the year leading up to the survey. To manage operational risk, businesses can strengthen their internal controls, improve staff training and closely monitor their day-to-day workflows. In today’s data-driven business environment, many leaders implement sophisticated business software, such as an enterprise resource planning (ERP) system, to collect and organize data that provides insights into inefficiencies throughout the organization, as well as actionable strategies to make improvements.

- Legal and regulatory risk: Noncompliance with laws and regulations can result in financial penalties, legal consequences and reputational harm. In addition to close adherence to relevant standards, businesses must carefully monitor upcoming changes to regulations, as adjustments to processes may be needed to meet evolving benchmarks, including carbon emissions, energy usage or safety standards. Many businesses rely on both internal and external experts, auditors, consultants and/or legal counsel to monitor legislation and regulatory standards and assess compliance. Legal and regulatory risks also include any penalties that arise from inaccurate tax reporting and payments.

Benefits of Financial Risk Management

Through effective financial risk management, businesses can stabilize their operations and secure their financial future. But beyond minimizing losses, proactive risk management strategies also let companies boost their profitability and overall business performance. This section examines six potential benefits businesses could reap when establishing or improving their financial risk management policies. These benefits are illustrated through a running example of a hypothetical clothing manufacturer and retailer called Easy Shorts that’s establishing its first comprehensive set of financial risk management policies.

- Encourages a cross-functional approach: A business’s financial risks can be affected by many diverse factors and often require a collaborative approach to address them. Through risk management, businesses often pull data from various departments, integrating insights from finance, operations, marketing and more. With this kind of cross-functional approach, risks are evaluated from multiple perspectives, leading to comprehensive data-sharing and communication throughout the organization. Easy Shorts begins its risk management overhaul by bringing in managers from the marketing, accounting and warehousing departments to identify potential financial risks. Through this collaborative brainstorming, the retailer recognizes that a major financial risk to next year’s profits lies in volatile material prices that might potentially strike at margins and the bottom line.

- Optimizes processes: By identifying financial inefficiencies, businesses can eliminate redundancies and ease bottlenecks, often by leveraging automation and other productivity-enhancing technologies that streamline processes and minimize waste. Easy Shorts, for example, chooses to invest in automated robotic arms to guarantee accuracy when cutting fabric, avoid wasting material and minimize other supply costs.

- Reduces risk likelihood and impact: Proactively addressing financial risks through a bona fide risk management process helps businesses minimize their potential impact before they affect cash flow or ability to meet customer demand. Easy Shorts, by closely monitoring customer trends and preferences through market research and direct feedback, expects a dip in sales — and therefore incoming cash — during an upcoming slow season. To maintain its liquidity, the retailer locks in a low-interest credit line early on and offers a 5% discount to any customers with outstanding invoices if they pay within the coming month.

- Boosts confidence in financial reporting: To effectively manage financial risks, businesses need a clear and detailed picture of their financial strength, typically gleaned through financial reports, such as the income statement, balance sheet and cash flow statement. While large and public companies are required to generate these statements, small, private companies can also benefit from accurate and reliable financial reporting, as it imbues stakeholders with confidence and a clearer sense of a company’s financial standing. Returning to Easy Shorts, as part of its financial risk management plan, it decides to implement accounting software to generate financial statements quickly and accurately for regular review, giving decision-makers clear insights into where income is going, how the company is leveraging its debt and more. Additionally, these detailed reports demonstrate Easy Short’s creditworthiness to lenders and creditors, potentially leading to better terms for future borrowing.

- Facilitates risk treatment and mitigation: A well-structured financial risk management framework helps identify the best strategies for treating and mitigating risks. This allows decision-makers to prioritize risk mitigation strategies that create a road map for future investments and operational improvements. Easy Shorts, for example, notices losses from currency fluctuations at its overseas suppliers, so it explores hedging options, eventually securing a stable pricing contract to protect future profit margins.

- Fosters continuous improvement: Today’s financial risks won’t necessarily match tomorrow’s, and businesses must constantly monitor their risks and improve their management tactics. By regularly reviewing and updating its risk management policies, Easy Shorts identifies potential liability from upcoming changes to government energy policies. To minimize the risk of legal and financial penalties, the company invests in energy-efficient equipment now, rather than fight competitors over high-demand equipment as the deadline nears. This new investment has the added benefit of reducing utility costs and marks Easy Shorts as an eco-friendly company, an important distinction for many modern consumers.

Financial Risk Management Techniques

The financial risk management strategies employed by investors and corporations can be relevant and worthwhile for any business, empowering leaders to make well-informed investment decisions that align with their long-term strategic goals. Let’s review several common financial risk management techniques and the lessons that can be applied at the enterprise level.

-

Diversification

While diversification is often thought of in relation to a business’s investment portfolio, it can also refer to a business’s operations. For example, a business that relies on a small number of products or a niche customer base is at risk of major revenue losses if a supply chain disruption slams production or demand unexpectedly shifts. By expanding product lines, entering new markets and marketing to previously untapped customers, businesses can diversify and limit their dependence on a single source of revenue. This helps mitigate losses if one source becomes less profitable or dries up entirely.

-

Hedging

Hedging offsets potential losses and protects against unfavorable or unexpected fluctuations in a business’s financial interests, such as currency exchange rates, interest rates and commodity prices. Hedging often includes financial derivatives, such as futures, options and swaps, but also extends to other practices, including securing fixed-rate loans to guard against interest rate hikes, borrowing from more flexible credit facilities over traditional lenders or entering into forward contracts for variable processes, such as utilities. By locking terms like these early, businesses trade future savings for predictability, increasing the reliability of financial plans and budgets.

-

Quantitative Measures

Businesses use statistical models, key performance indicators (KPIs) and other quantitative measures to calculate financial metrics, allowing analysts and decision-makers to assess and manage their exposure to different risks. When managing risks, businesses should choose metrics that address their specific needs, as KPIs can cover a broad range of financial data, including profitability, liquidity, efficiency, valuation and leverage. Through targeted, deliberate and ongoing quantitative analyses, businesses can identify critical risk factors, predict and mitigate potential impacts and prioritize steps that will minimize exposure and bolster the bottom line. For example, a business facing liquidity risks can track its operating cash flow ratio by dividing operating cash flow by current liabilities to assess whether it will be able to pay short-term liabilities from revenue earned through core operations.

-

Corporate Governance

Effective corporate governance is pivotal for businesses managing their financial risk. It involves establishing clear policies, ethical standards and practices that guide operations and inform decisions. This includes implementing internal controls, complying with regulatory and labor guidelines and fostering a company culture based on risk awareness and ethical behavior. Furthermore, businesses can segregate financial duties to prevent fraud, minimize errors and establish checks and balances for financial decisions and processes. In addition to these direct financial governance policies, indirect policies, such as HR sensitivity training and stakeholder engagement, can help businesses ensure accountability and minimize operational, legal and reputational risks to build a more sustainable company culture.

Financial Risk Management Process

Due to the complexity of financial risks, businesses should take a systematic approach to managing them. By following the six steps below, decision-makers can create a management process that identifies all potential risks and underpins ongoing improvement strategies so that their businesses can maintain financial stability as market forces evolve.

-

Risk Identification

A business can only manage the risks it can see. Identifying risks involves a thorough examination of a company’s operations and financial transactions, as well as market factors that could threaten a business’s financial strength. Modern businesses often leverage digital tools, such as accounting software built into a larger ERP system, to collect, organize and report financial data in real time. These tools help businesses quickly uncover both obvious and hidden financial risks before they begin to affect the business’s overall health. All risks should be cataloged and considered, as even relatively small risks can compound over time to become major problems if not addressed early.

-

Risk Analysis

Next, businesses should evaluate the identified risks to understand their root causes and predict any potential impacts they may have. Businesses can use both qualitative and quantitative methods to determine whether the return is worth the risk. One common method is to calculate expected loss using this formula:

Probability of the risk × Impact of the potential risk = Expected loss

For example, if an investment has a 20% chance of causing a $75,000 loss, the expected loss would be $15,000 (.20 x $75,000). This quantitative analysis helps businesses estimate the magnitude of each risk and contextualize it within their own risk tolerance before making financial decisions.

-

Risk Prioritization

Once risks have been analyzed and their estimated gains and losses are calculated, businesses can prioritize them based on possible impact and the likelihood of occurrence. High-impact, high-probability risks are typically given precedence over those with lower impact and probability, as they can have a more lasting influence on a business’s financial health. This prioritization helps organizations properly allocate their resources and attention, minimizing the most pressing and potentially damaging risks first before moving on to smaller, less-urgent weaknesses.

-

Risk Mitigation

Prioritizing risks may give businesses a road map to follow, but decision-makers must still follow through with actions to reduce, transfer or eliminate the identified risks. By diversifying, hedging, taking out insurance policies and updating internal controls, businesses can minimize the adverse effects of their financial risks. The best mitigation strategy for each risk will depend on the risk’s nature and potential impact, and the business’s available resources and risk tolerance.

-

Risk Monitoring and Reporting

As a business’s risks change over time, so must its management strategies. By monitoring risks and reporting on progress, or the lack thereof, businesses can ensure that their management strategies are working as intended or adjust them when necessary. This ongoing cycle of monitoring and reporting allows businesses to continually track risks, catch any changes in root causes or underlying conditions that created these risks, and report findings to relevant stakeholders.

-

Plan Review and Revision

Once risk management plans have been enacted and results have been recorded, businesses can analyze the records and make adjustments as needed. Some revisions may be simple, while others may require companies to reassess their financial risks from step one. For example, suppose a manufacturer concluded that it was failing to deliver goods to customers in a timely manner and determined this was due to an unreliable supplier; however, after diversifying its supply chain, these delays did not improve. By reassessing its risks, the business realized it was facing more than just a supplier issue; there was internal inefficiency, as well — in this case, a delay between the factory’s request for additional raw materials and placement of the order with suppliers. After making some operational improvements, the manufacturer was able to decrease its order fulfillment time, allowing it to closely match production schedules with demand and minimize the risk of overstocks and stockouts. This type of continuous improvement enables businesses to remain resilient and adaptable as new risks are identified and addressed.

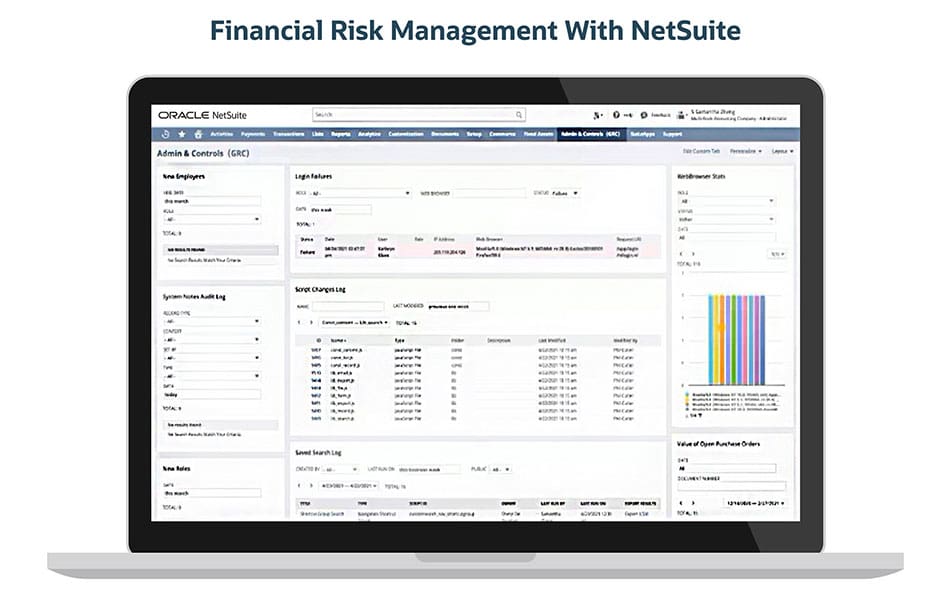

Mitigate Financial Risks With NetSuite Financial Management Software

To create comprehensive financial risk management practices, businesses must have high visibility into their operations and finances. NetSuite’s Financial Management solution gives companies real-time visibility into financial data and a framework for enhancing financial risk management practices. NetSuite’s platform integrates core financial operations, such as accounting, revenue management and reporting, to enable businesses to identify, assess and respond to their financial risks efficiently and proactively. Additionally, the platform can be seamlessly integrated with other systems, including customer relationship management and inventory, to ensure that risk management is a cohesive part of the entire operational strategy.

With a range of features — such as automated financial consolidation, advanced billing and subscription management, detailed financial planning, budgeting and compliance capabilities — NetSuite Financial Management equips business leaders with the tools they need to make informed decisions that align risk management strategies with overall financial objectives. With NetSuite’s comprehensive, cloud-based solution, businesses can improve their financial stability and seize opportunities for new growth in order to build long-term success and develop an organization better positioned to overcome risks and challenges.

Financial risk management is key for businesses navigating the complexities of today’s highly competitive market. By understanding and implementing a strong financial risk management process, companies can identify, analyze, prioritize and address their unique financial risks to ensure operational stability and promote sustainable growth. This strategic approach safeguards against potential financial setbacks and allows business leaders to seize growth opportunities. With the right tools and deliberate, focused strategies in place, companies can enhance their risk management capabilities, improve their financial performance and maintain their competitive advantage.

Financial Risk Management FAQs

What is meant by financial risk management?

Financial risk management is the process of identifying, analyzing and mitigating risks that could negatively impact a company’s financial health. Proactive financial risk management helps businesses minimize business losses and maximize investment returns.

What are the methods of financial risk management?

Financial risk management methods vary according to the business’s funding and revenue sources, industry, market forces and other pressures. But some common financial risk management methods include diversification, hedging, insurance and strict internal controls. These strategies help businesses minimize potential losses by spreading risk, offsetting losses and creating contingency plans should investments fail to yield expected returns.

What is a real example of financial risk management?

A real example of financial risk management is an airline using fuel hedging to minimize the uncertainty surrounding future fuel costs. By locking in fuel prices at a predetermined rate through a contract with its supplier, the airline can stabilize its fuel costs — a significant part of its operating expenses — to create more accurate budgets and expense forecasts for the upcoming year.

Why should financial risk be managed?

Business leaders manage their financial risks to stabilize their cash flow, protect their assets and ensure the long-term viability of their business. Effective risk management helps companies avoid significant losses, seize opportunities and maintain financial stability, even when faced with market volatility and economic uncertainty.

What are the five financial risks?

The five main types of financial risks are:

- Market risk: Includes financial losses from external market changes, such as interest rates and currency fluctuations.

- Credit risk: Stems from both customers and businesses not paying their bills on time.

- Liquidity risk: Arises when a business doesn’t have sufficient funds to meet its obligations on time.

- Operational risk: Stems from inefficiencies, failures and errors in day-to-day business operations.

- Legal and regulatory risk: Occurs when companies fail to comply with rules and laws regulating their industry and business practices.

What is the difference between risk management and financial management?

Risk management is just one aspect of financial management; it focuses on identifying, assessing and minimizing potential losses. Financial management, by contrast, is broader and involves managing the entirety of a company’s finances through budgeting, investments and resource allocation to achieve financial goals. Both risk and financial management are important priorities for maintaining a company’s financial position and building long-term success.